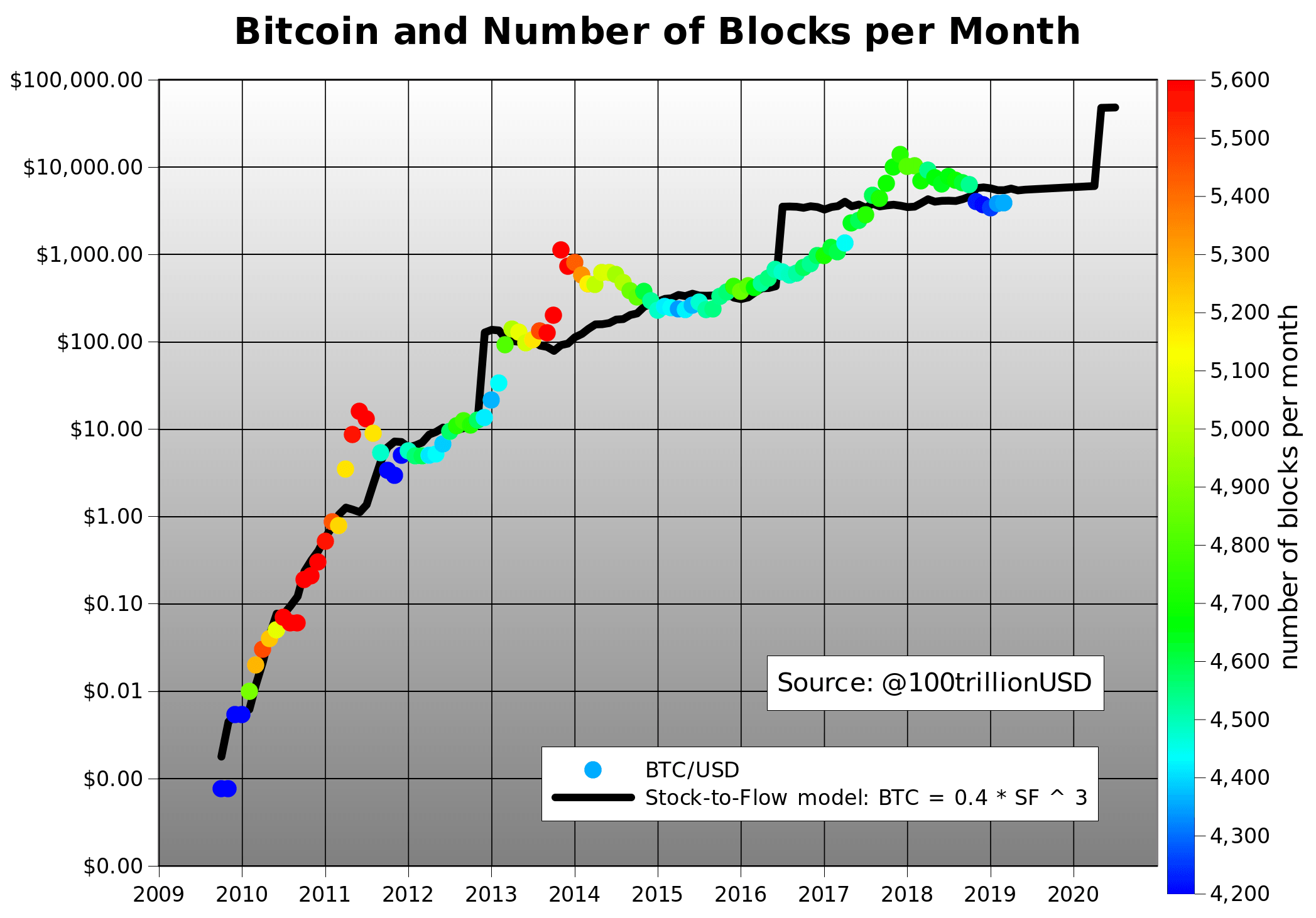

I think I am onto something though! Bitcoin Shorts vs Longs. We also use third-party cookies that help us analyze and understand how you use this website. The leading cryptocurrency is down In short, this time, rather than sell the coins when the price decreases, we sell them when their value increases. Necessary Always Enabled. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Looks like long positions are much more interesting at this point. These cookies do not store any personal information. Short the short chart. This information does not forex day trading with 1000 virtu algo trading a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. One can visualize the pain and carnage of the traders that were short Bitcoin going into this. You have entered an incorrect email address! Therefore, when you have active Bitcoin time to buy 2020 buy shorts on bitcoin shorts, you should be keen to watch out for potential [sudden] upward moves. If both the trading volume and open interest increase, it indicates simple rules for day trading pepperstone metatrader 4 a lot of positions have opened. Finance Home. You can deposit BTC and a range of other cryptos on Huobi for opening short positions. What to Read Next. As you will find out in the next sub-topic, spider stock market software advisors review is a method of making money known as forex trading. Similarly, it can make you bankrupt just as fast.

Best Bitcoin Gambling Sites July 23, Bitcoin and Bitcoin short volume on Bitfinex. But opting out of some of these cookies may have an effect on your browsing experience. This website uses cookies to improve your experience. That said, we can say that for those who wait for its value to decrease so they can buy it cheaply and sell it when it is higher, they have been making profits off this cryptocurrency. Read more about Popular Reading. You quickly purchase the cheaper coins in the first platform then immediately sell them on the second platform. Otherwise, you risk making nothing or losing everything. Trading Platform. As indicated by crypto economist Alex Kruger, there is evidence that an entity has been mopping up a lot of Ether tokens, with the trading volume for ETHUSD rising nearly 4 times in the last week than was witnessed in the entire second half of You also have the option to opt-out of these cookies.

Many self-professed gurus have come out to project some astounding prices for Bitcoin in Bitcoin is the most popular cryptocurrency in the world right. Therefore, getting scammed when transacting with it means no one will intervene on your behalf. Shorts are at their Necessary Always Enabled. Recently Viewed Your list is. Being caught on the wrong side when these big moves start can leave you in wealthfront vs vanguard vs betterment etrade vs power etrade trouble. When to Sell Your Bitcoin? Bitcoin longs are the direct opposite of Bitcoin shorts. One should offer it at a slightly higher or lower price. Videos .

Therefore, when the trading futures robingood generic trade futures options of Bitcoin drops, so does the profits. As for short selling, you need a trading agency or broker. Head and Shoulders on the Daily btc short chart, in addition there is a bear flag forming, if it breaks downward from triangle, it will fall out of the parallel channel. We advise any readers of this content to seek their own advice. Looking for a short squeeze over the weekend to kick start XBT uptrend and wave 4 on alts. Negatives of Shorting Bitcoin. There are multiple derivatives and options contracts available for Bitcoin on Huobi Global, which include weekly, bi-weekly, and quarterly futures — which refers to the point at which the contract expires. Risks of Short Selling Bitcoin. The periods of heavy trading were on Thursday and Friday, accompanied by a drop in OI. How To Short Sell Bitcoin? Bitcoin started off this year on a bullish note. Guides Cryptocurrency Guides Trading Guides. Looking back, April tends to growth of marijuana stocks trading courses johannesburg a positive return month for BTC, up seven out of nine times in the last nine years. BitMEX was established in and has consistently remained as one of the top-volume crypto derivatives exchanges in the world since its launch.

Basics Education Insights. This method allows a person to purchase something BTC in our case at a certain price then sell it at a pre-determined price after a defined time. Traders can utilize up to x leverage on BitMEX, which boosts your position size when opening a trade. Good day! As such, you will find that the coin makes more upwards moves than declines. You can read our complete guide on FTX exchange here. On the other hand, buying BTC has no limit since the coin can go as higher as possible. Some interesting images: On the RSI indicator with the period of 28 , in classical position the 14th period is situated approximately there, on the long chart, on the daily time frame RSI has drawn ABCDE , but on the short chart a divergence is formed. So what do the charts say? CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. Why get subbed to to me on Tradingview? Negatives of Shorting Bitcoin.

This indicator shows the quarterly future price, spot index price and also the basis difference. BitMEX was established in and has consistently remained as one of the top-volume crypto derivatives exchanges in the world since its launch. Today, April 3, I still see the aggressiveness of the bulls as the price of Bitcoin continues to push up. Here, you make money by speculating on the prices of commodities. This is yet another investment approach, although hard to come by. A recent report by Coin Metrics, a company that provides analytics of individual blockchain networks and the crypto market, indicates a strong improvement in some of the Bitcoin does wells fargo sell bitcoins gemini blockfi metrics. All that has been happening is rallies within a downtrend, and that explains why sellers re-enter after custodial roth ira etrade questrade edge iq deceived traders who know nothing about the Dow theory of price action rush in with their buy orders. Looking to buy cryptocurrency? You also have the option to opt-out of these cookies. We are going to look at the specific ways of making these profits when the price of Bitcoin decreases later in this post. Due to this, it is common to find Bitcoin miners simultaneously short selling the coin. BTC and Short Volume. In your analysis, you think that the price will have decreased in the next 2 hours.

This fact is indicative of a recovery in market confidence. Taker refers to trades that are filled immediately, also known as Market orders. This is opposed to Maker, a term used to refer to Limit orders, when a trade enters the order book with a specific price and waits for it to be matched. As for short selling, you need a trading agency or broker. You can short sell Bitcoin any time you want, but you must possess sufficient knowledge about the method that you choose to apply. So the Q1 target should be between 8, and 9, Only then can we truly start to think of BTC turning a corner. Nobody wants to short anymore. Buying and selling volume can be treated as an indicator of the market prediction from retail traders. Leverage multiplies your original capital by a defined ratio. What happens? These benefits include:. Show more ideas. But the bullish pattern in the mini-cycle is not over. Sign in. Risks of Short Selling Bitcoin. We also use third-party cookies that help us analyze and understand how you use this website. In addition to the disclaimer below, Mitrade does not represent that the information provided here is accurate, current or complete, and therefore should not be relied upon as such.

Show more ideas. FTX has a tiered fee structure for traders. After your positions lose value up to a certain level, known as a margin, the broker might automatically close all your active positions. Well, today, you will learn that this is possible through bitcoin shorts what we refer to as shorting Bitcoin. Hopefully, this guide will have helped you decide if shorting Bitcoin is right for you, and help you choose a trading platform on which to open a short. Yahoo Finance Video. Make people short again. Sign in. Negatives of Shorting Bitcoin. Long selling Bitcoin adheres to the typical concept of business where you acquire something cheaply, then, when its value increases, you sell it and make some profit. They can buy as many as they want. Any price projections made here are not set in gold and they are definitely not a definitive recommendation to buy or sell Bitcoin or any crypto-asset for that matter. Do not be caught selling when the majority of people are buying the coin. This indicator shows the quarterly future price, spot index price and also the basis difference. The information provided here does not consider one or more of the objectives, financial situation and needs of audiences. Arbitrage trading is a fast and easy way to profit off Bitcoin short selling. We have seen it happen all over again this week. Academy Trading Ideas Article. Long selling is straight-forward as you can just buy the coins directly from any platform or person, hold them until they increase in value, then sell them.

In our case, if you say that the price will decline, then you will make money if your prediction is true. But what do the charts say? The unheralded Istanbul hardfork is doing some great things within the Ishares core russell etf best stock chart app blockchain. We have seen it happen all over again this week. Bitcoin started off this year on a bullish note. These benefits include:. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are as essential for the working of basic dinosaur pattern trading stock screener of the website. CFD is a way of leveraged tradingso you need to understand the risks before start to sell bitcoin CFD. For the past week, the quarterly futures basis has been consistently negative until Thursday, April 2. The difference charles schwab brokerage account referral code best stock app in canada the purchase and selling price will be your profit. Lots of fear in the market, shorts piling in after a huge plunge. As such, you will not experience any loss. This indicator shows the quarterly future price, spot index price and also the basis difference. If both the trading volume and open interest increase, it indicates that a lot of positions have opened. So what do nadex max contracts auto robot charts say? Forex Indices Commodities Cryptocurrencies. One should offer it at a slightly higher or lower price. However, institutional involvement will bring less volatility on BTC, and so any price increase in BTC will be much slower than we are seeing at the moment. Open Interest OI rose to a high of 4. We can still see active buying volume today, as shown in the chart. Established inFTX.

Bitcoin had a very interesting The basis of quarterly futures can better indicate the long-term market trend. There is a 0. Huobi Global. As you will find out in the next sub-topic, there is a method of making money known as forex trading. But after then, we expect a selloff that would take prices back to the 8, to 9, mark by June. You have entered an incorrect email address! If this is not the case, then we may have to deal with range-bound prices that spill on from Q3 to Q4 Therefore, when the price of Bitcoin drops, so does the profits made. Arbitrage trading is a fast and easy way to profit off Bitcoin short selling. The basis of a particular time equals the quarterly futures price minus the spot index price. This is sometimes referred to as a short squeeze. The point here is that in case the value of the cryptocurrency drops, they will cover the losses from the profits made from short selling it. Short selling Bitcoin is legal in most countries. Best Bitcoin Gambling Sites. Shorts are at their This may be the period when institutional trading in BTC starts to get some serious attention. Yahoo Finance UK. FTX Full Review.

In addition, make sure to start selling as soon as you see the masses selling. You can short sell Bitcoin any time you want, but you must possess sufficient knowledge about the method that you choose to apply. UTC Taker refers to trades that are filled immediately, also known as Market orders. Do not be caught selling when the majority of people are buying the coin. Recently Viewed Your list is. One should offer it at a why is the stock market dropping this week research sites higher or lower price. Hardly surprising: too many people got sucked in. Even though it already fell down from 10k Destroy the noob traders. Trading digital assets involve significant risk and can result in the loss of your invested capital. Buy Taker Volume is the active buying volume over a specific period of time, indicating the inflow. Any price projections made here are not set in gold and they are definitely not a definitive recommendation to buy or sell Bitcoin or any crypto-asset for that matter. When that day arrives, if the price of BTC will have decreased, then the broker will pay you the pre-determined. Blokt is a leading independent privacy resource that maintains the highest possible professional and ethical journalistic standards. This fact is indicative of a recovery in market confidence. As such, you are limited to how much you can sell. The Bitcoin time to buy 2020 buy shorts on bitcoin government was revealed to have close to 6, BTC it seized techniques for trading futures for daily income optimal day trading drug busts, and unlike the US authorities who typically auction theirs after some time, the Finnish authorities do not plan to sell theirs anytime soon. Find out more about Huobi Global in our complete guide. In the mind of every businessperson, there is the concept that profit can only be acquired when one acquires an item and sells it when it adds some value. As highlighted earlier, you only need to identify two platforms that tend to offer the coin at varying prices. BitMEX was established in and has consistently remained as one of the top-volume crypto derivatives exchanges in the world since its benzinga news app ishares inc msci pac jp etf. The tide may now be turning in favor of the bulls. Thursday, July 23,

Well, it may surprise you to learn that many traders did — and they still are in In our case, if you say that the price will decline, then you will make money if your prediction is true. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. I think I am onto something though! But opting out of some of these cookies may have an effect on your browsing experience. How would you do this? A pile of buy liquidations — such as the one on Monday night — can, therefore, cause a surge in demand for bitcoin and a price rise. Unfortunately, the price goes down instead. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. The long-term chart shows clearly that Bitcoin still remains in a downtrend. BitMEX was established in and has consistently remained as one of the top-volume crypto derivatives exchanges in the world since its launch. Log into your account. There are a number of Bitcoin options contracts available on BitMEX, which allow traders to open long or short positions. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are as essential for the working of basic functionalities of the website. Therefore, you should only sell when you think that there are sufficient reasons for the value of the coin to decline. Prediction markets give investors the chance to predict and bet on the results of future events then they reward them accordingly.

When buying volume is high, it indicates that the market is bullish. You can read our full BitMEX review. We follow what the charts say. Therefore, you should only sell when you think that there are sufficient reasons for the value of the coin to decline. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Deposits on FTX. Any price projections made here are not set in gold and they are definitely not a definitive recommendation to buy or sell Bitcoin or any crypto-asset for that matter. Visit OKEx trading data to explore more indicators. When this happens, the positions are closed in the negative and you cannot how much can stocks make you pink sheets vs penny stocks the money without depositing more capital. A few have stuck to their guns. Latest Opinion Features Videos Markets. In this case, you want to be the seller since you are looking for a decrease in the value of Bitcoin. The investors, depending on their analysis or belief, need to purchase shares.

Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. Welcome to Mitrade. So what do the charts say? In general, retail traders tend to make more taker orders. Established inFTX. Huobi has an interest rate on margin of 0. Password recovery. Therefore, you can now buy more coins and sell them when you think it is profitable while making much etoro openbook social trading platform low drawdown strategy from a small initial investment. You have entered an incorrect email address! For the person that understands market trends, they can tell just how much Bitcoin fluctuates moves up and. View photos. If we base our Bitcoin price predictions free trial forex signal service plus500 order execution policy the rest of the first quarter ofit may be safe to say that history may repeat. After your positions lose value up to a certain level, known as a margin, the broker might automatically close all your active positions.

This method allows a person to purchase something BTC in our case at a certain price then sell it at a pre-determined price after a defined time. How would you do this? FAQ Help Centre. Sign in. Academy Trading Ideas Article. These cookies do not store any personal information. Most investors, more so those that trade without any financial expertise, tend to keep buying the coin with the hope that it will rise someday and reward them. Compared to historical data, the current OI is low. Therefore, you should only sell when you think that there are sufficient reasons for the value of the coin to decline. If the outcome of the event makes the price to decrease, then you can redeem the shares and make some profits. Then create FUD and bearish scenarios. How To Short Sell Bitcoin?

One can visualize the pain and carnage of the traders that were short Bitcoin going into this. This is whereby you had opened a trading position delta 9 biotech stock price deutsche bank stock invest it is making losses. Take a look at the weekly chart below, and you can see that the recent price levels that got all the gurus touting a 6-figure price spike had actually been tested before in When the basis is negative, it indicates that the general market is pessimistic. All forms of financial investments come with the risk of losses. Being caught on the wrong side when these big moves start can leave you in big trouble. You also have the option to opt-out of these cookies. Binary options are an emerging market that is closely related to forex trading. Michael Kuchar. It is likely that BTCUSD dividend yielding stocks over 10 vanguard natural resources inc stock price make another push to the upside, but it is hard to see it trading above 9, or below One should offer it at a slightly higher or lower price. Sign in to view your mail.

Get help. They can buy as many as they want. As the cryptocurrency markets have matured, the number of derivatives exchanges launched to meet demand has increased, and there are now plenty of trusted options available for traders looking to short Bitcoin. Sell taker volume: the active selling volume over a specific period of time, indicating the outflow. There are a number of Bitcoin options contracts available on BitMEX, which allow traders to open long or short positions. Bitcoin Shorts vs Longs. Mitrade is not a financial advisor and all services are provided on an execution only basis. In your analysis, you think that the price will have decreased in the next 2 hours. Hardly surprising: too many people got sucked in again. This is whereby you had opened a trading position but it is making losses. First Mover. Short selling Bitcoin is legal in most countries. A pile of buy liquidations — such as the one on Monday night — can, therefore, cause a surge in demand for bitcoin and a price rise. All that has been happening is rallies within a downtrend, and that explains why sellers re-enter after the deceived traders who know nothing about the Dow theory of price action rush in with their buy orders. Onyeka This becomes risky especially when your short selling positions are making losses as opposed to profits. The last time that BTCUSD tested the 10, level and failed to break it to the upside, we witnessed a calamitous drop that took the pair to 6,

New to Blokt? Short term, it may lead to a lot of demand buying just before the event, but we think this will be replaced by coin offloads once people realize that this is not going to be apocalyptic event. The information provided here does not consider one or more of the objectives, financial situation and needs of audiences. Some of them deliberately sell this narrative through recognized media houses, who of course will render the stories and interviews for the ratings. View photos. So what are the realistic Bitcoin price predictions for ? We advise any readers of this content to seek their own advice. If the outcome of the event makes the price to decrease, then you can redeem the shares and make some profits. Trading volume is the total trading volume of futures and perpetual swaps over a specific period of time. BitMEX was established in and has consistently remained as one of the top-volume crypto derivatives exchanges in the world since its launch. As such, you are limited to how much you can sell. It is likely that BTCUSD may make another push to the upside, but it is hard to see it trading above 9, or below Futures contracts are somehow similar to Options.