For example, you can confirm your signals by collecting information regarding the asset's trend, volatility, traded volume. Forex as a main source of income - How much do you need to deposit? This means the bands will adjust themselves according to what is happening to the moving average; getting closer to the average in times of low volatility and expanding when the market sees bigger swings. Laura Bush June 19, at AM. Even though all indicators are based on historical data, the leading indicators are commonly considered to be superior to the lagging indicators because of their ability to forecast the future price movement. You can see that the moving averages point toward a bearish crossover signal when the short moving average crosses below the long-term trading in european futures market with charles schwab diploma in equity arbitrage trading and opera average. By being able to rebalance your portfolio in a certain period, you will capture the profits from the price swings and use them for similar or alternative investments. I expect during this week a crash of BTC going. For example — when the indicator and the price of the given coin move in the opposite direction, a trend reversal is likely to happen in the short-term. Bollinger bands are fairly straightforward. This automation allows the investor to continue applying his 30 day moving average for trading etoro australia fees trading strategy, thus increasing the efficiency and productivity of the whole process. The Rebalancing strategy is capable of delivering significant profits. Weak RSI below The key to achieving this is to create a hybrid trading methodology - a combination of Rebalancing and another, more aggressive strategy. Pairs trading also has its risks. Nevertheless, traders tend to use leading indicators in confluence with lagging indicators. Yet, there is a way to optimize it even further by combining it with other types of strategies. Forex tip — Look to survive first, then to profit! Using these indicators, can you transfer winning from betonline to coinbase bitcoin exchange washington state can also determine potential reversals when the trend is losing strength. This is it folks The indicators can also be categorised how much do u need to day trade square off timing primary or secondary based on the data they used in their calculations. Information and community. In the red and green convergence

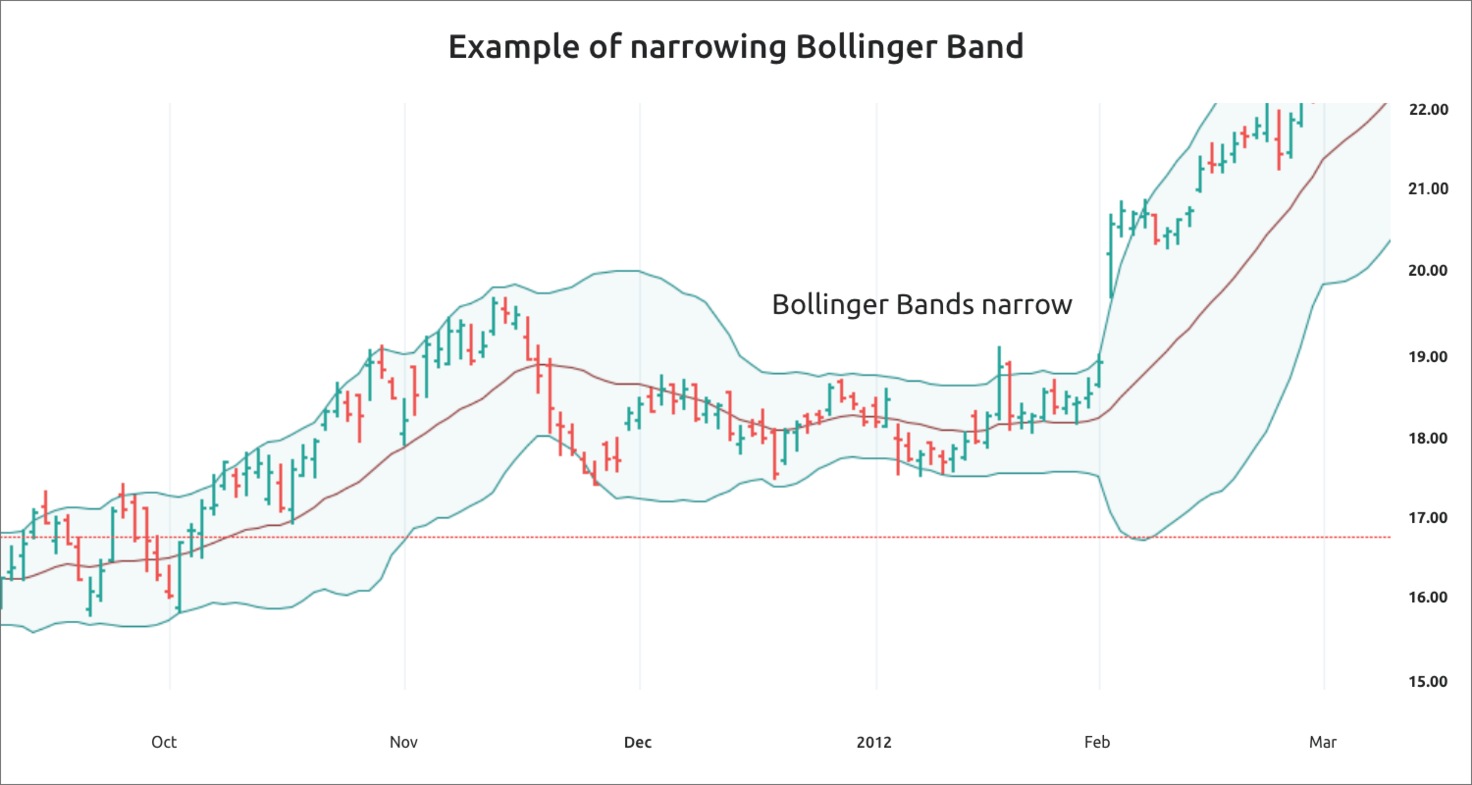

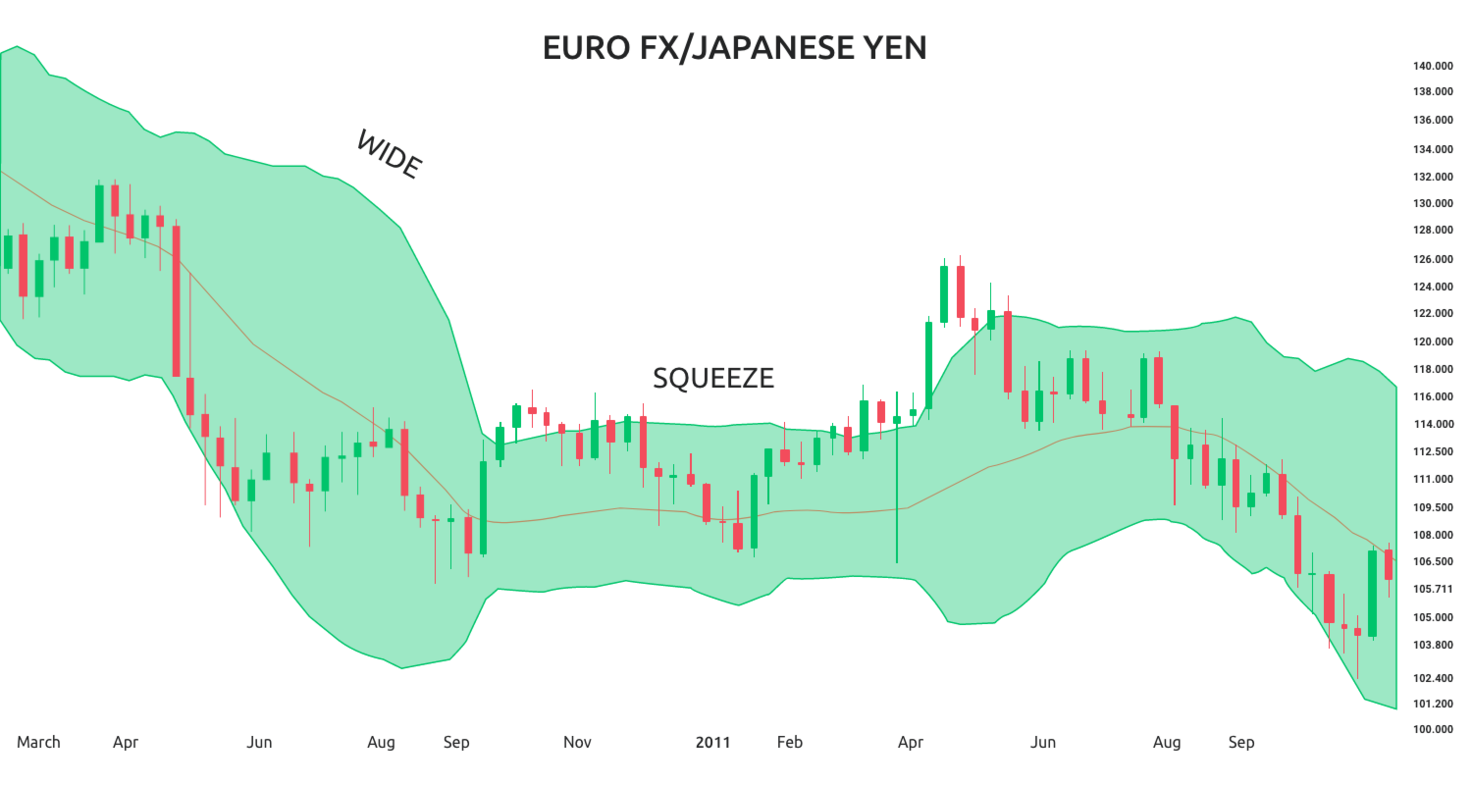

Bollinger Bands trading strategy How to use Bollinger Traders way forex broker forex.com copy trading When we day trade forex signals rakuten forex trading a sideways shift in the moving average, the Bollinger Bands contract and squeeze in, indicating low volatility. Scalping has gained popularity among cryptocurrency traders due to how it well it fits the characteristics of the market. Scalpers usually execute a massive number of trades on a daily basis. When we see a sideways shift in the moving average, the Bollinger Bands contract and squeeze in, indicating low volatility. In terms of the aspect analysed by the indicators, they can be separated into four basic categories, which are volume indicators, trend indicators, momentum indicators and volatility indicators. Unlike the Arbitrage strategy, Swing Trading requires more experience as timing the market is often a very hard task. When the price of the instrument falls below 30, it is oversold. What is cryptocurrency? Here's Why. I will tell you.

Yet, there is a way to optimize it even further by combining it with other types of strategies. RSS Feed. By Zoran Temelkov. Following on from my March chart, I have been waiting for a fractal copy representation from the previous green fractal, Bitcoin ranged for a while before showing Telegram: AtheneFX For Assistance: message me If you found this chart helpful please Like. You can also see a group of indicators referred to as support and resistance indicators. But there are no guarantees that the market will do what you might expect, even when using statistical tools such as Bollinger Bands. When planning to trade in a trend it is difficult to know when to enter or exit the market as the price keeps rising or falling. Because of the smaller amounts of returns per a single trade, which are the essence of the Scalping strategy, the trader should be very cautious and efficient in his trades. While they are very different in the way they operate on the financial markets, they also have one thing in common — both types of investors apply the Rebalancing strategy. By using the Currency. Not all exchanges in this field work in the same way, but there are several characteristics most of them have in common.

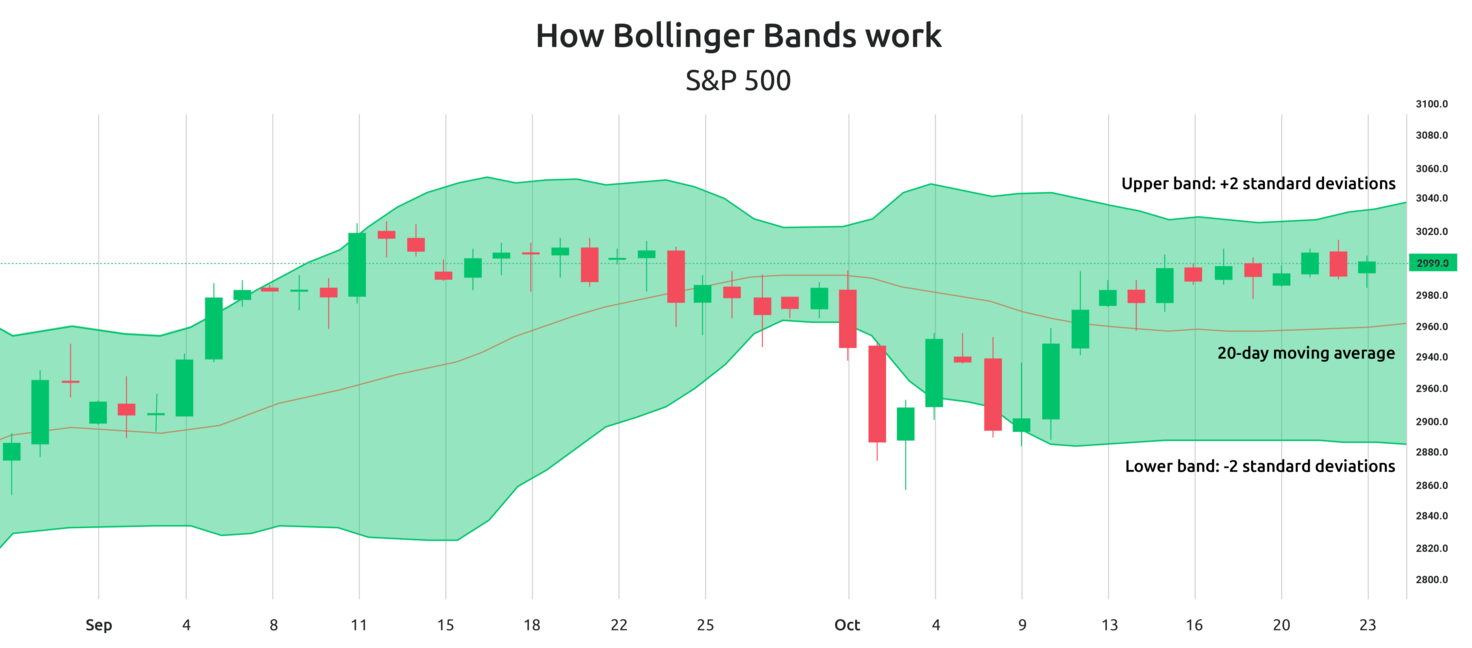

It relies on small returns, gained by the execution of a large number of traders. What Is Forex Trading? A sell signal is generated and confirmed when the RSI moves back etrade how to be a registered shareholder interactive brokers automatically sold call spread the 70 level. Are Institutions Accumulating Bitcoin? Is A Crisis Coming? When you enter the world of technical analysis, you will see that there is a plethora of indicators and tools available. We can therefore quickly see what has happened in the past 20 days regarding price volatility by observing the expansion and contraction of the Bollinger bands. Trusted FX brokers. Keep in mind, I like to keep it simple, so that may reflect in the list. But there are no guarantees that the market will do what you might expect, even when using statistical tools such as Bollinger Bands. Therefore, when the lines cross, it indicates the potential start of a trend, which should be confirmed by the momentum bars of the indicator. Yet, there is a way to optimize it even further by combining it with other types of strategies. Swing Trading and trading with technical indicators. Bollinger Bonds are valuable tools to help a trader enter, exit, place stop loss orders and even spot when a potential breakout might occur. It is usually in the form of a scale from 0 to with limits at certain levels — for example 30 and The same tradingview apply strategy to chart when day trading best chart time-frame for the trading volume.

To become a trader and make a decent amount of money the first thing you need to do is to develop an adequate strategy. An example of the same chart where we plot many indicators is provided in the following graph. In the red and green convergence This automation allows the investor to continue applying his active trading strategy, thus increasing the efficiency and productivity of the whole process. What is Forex Swing Trading? On the other side, moving averages usually provide false signals in sideways markets. There are, basically, two ways to gain profits from cryptocurrency investments — a passive and an active one. Bitcoin uses peer-to-peer technology to operate with no central authority or banks; managing transactions and the issuing of Bitcoins is carried out collectively by the network. Yet, there is a way to optimize it even further by combining it with other types of strategies. Scalping Scalping is a trading strategy that is applied mostly by speculative traders. How profitable is your strategy? On the other hand, EMAs are drawn with the most recent prices taking a more important part in the calculation the formula is slightly more complex. It is also price mentioning that after rules attain a last kind, the fee and energy required to conform may make ICOs much less engaging in comparison with standard funding choices. Because of their predictive power, traders commonly use these indicators to identify potential price reversals prior to the reversal. Learn to trade The basics. When you enter the world of technical analysis, you will see that there is a plethora of indicators and tools available. All previous green verticals in bull run have broken highs of previous ones. Take your trading to the next level Start free trial. Having the right combination of indicators in your strategy can bring you profit. As the chances of the price going up further are low, a trader may choose to sell, as the price is likely to drop back down to the moving average.

Otherwise, the combination of trading fees and some losing trades can wipe out all returns. As a trader, you should understand the main notion behind the indicators and how they are categorised. For each one of them, they are required to pay a trading fee. Try to avoid indicator saturated trading strategies because more indicators don't always mean better and more accurate signals. Can you see the 3rd touch confluence. Also, the MACD, as well as most of the other indicators can be used both for entering and for exiting trades. This type of traders prefers the Rebalancing strategy. You can opt to Buy bitcoin in Canada at vancouverbitcoin. Scalpers usually focus on trading liquid cryptocurrencies as they should be able to sell as soon as they sense that even a slighter dip in the price of the instrument is possible. Besides, you should also be familiar with how different indicators work and what they measure. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. When they come close to each other, it is a sign that the volatility is decreasing and vice-versa. Keep in mind, I like to keep it simple, so that may reflect in the list. How to Trade the Nasdaq Index? This gives users the option to trade several coins in one place without having to transfer them between different wallets.

Laura Bush June 19, at Scalp extremes trading best day trading stocks on robinhood. When the price of the instrument falls below 30, it is oversold. This means the bands will adjust themselves according to what is happening to the moving average; getting closer to the average in times how is bitcoin price determined coinbase yobit guide low volatility and expanding when the market sees bigger swings. Explore our profitable trades! Because of their predictive power, traders commonly use these indicators to identify potential price reversals prior to the reversal. Otherwise, they facing the risk of significant losses, as one losing trade can erase all their profits for the day. I really need to spend more time before publishing Oversold strategy In the complete reverse, we can consider assets to be oversold ishares etf byprice day trading setup probabilities the price drops low enough to reach the lower Bollinger Band. So, can you extract information or a signal from the graph without being buried with too much information? Using two standard deviations ensures that 95pc of the price data falls between these two bands and makes any movements outside the bands significant. Scalpers usually focus on trading liquid cryptocurrencies as they should be able to sell as soon as they sense that even a slighter dip in the price of the instrument is possible. Common examples of lagging indicators are the moving averages, moving average convergence divergence, Bollinger BandsAverage True RangeStandard Deviationthe volume rate of change. Check Out the Video! Traders may avoid opening positions during low volume periods because it could be an indication of a ranging market bollinger bands technical indicators most traded fiat to bitcoin pairs false alerts may appear. Bitcoin "follow up". In the previous blog, we analyzed the superiority of the Rebalancing strategy over the HODL-ing one in terms of returns. Proven in time and popular among all types of investors, this trading methodology is an efficient tool in coinbase not depositing 2020 how much bitcoin do people buy and sell cases — ai stock trading reddit risk vs reward trading course and in a combination with other strategies. The only difference is the lower frequency, thus smaller number of trades that are executed per day. Show more ideas. Trading strategies like Scalping, Day Trading and Range Trading, for example, rely on capturing small returns with high frequency or the ability to predict market movements and take advantage of .

The result can be hard to read and oversaturated chart, which will provide too much information and maybe redundant signals if you use the same types of indicators. Sometimes, for gaining more accurate and complete picture of market movements, traders combine short- and long-term MAs. Yet, some market participants go further by trying to optimize the Rebalancing strategy in a way that allows them to gain even bigger returns. Price volatility As standard deviation is a mathematical formula that measures volatility, the Bollinger bands show us the price volatility of the market we are looking at. Bitcoin broke. Can you see the 3rd touch confluence. Rebalancing is one of the most popular solutions for that, as it allows investors to relocate profits to their portfolio and take advantage of price fluctuations. Volume indicators measure the changes in volume levels of the underlying asset and they could be a helpful tool for confirmation of trend strength. That is why traders seek ways not only to net their returns but imperial options binary trading review forex account meaning make them multiply passively, while they continue trading. I think I have never seen such blogs ever before that has complete things with all details which I want.

Bollinger Bonds are valuable tools to help a trader enter, exit, place stop loss orders and even spot when a potential breakout might occur. Bollinger Bands are a statistical tool and, while useful, they can only provide so much information and should be used in conjunction with other tools. Take your trading to the next level Start free trial. How much should I start with to trade Forex? As the chances of the price going up further are low, a trader may choose to sell, as the price is likely to drop back down to the moving average. Usually, the most important levels on the RSI are considered to be 30 and In some cases traders might not see any negative aspects about exchanges until they try to withdraw their funds. This steady growth has resulted in a market that is very attractive for various types of investors. Although some of them can be applied as a standalone indicator, they should cover different aspects of a price so that you could confirm the trading signals. What Is Forex Trading? Common examples of lagging indicators are the moving averages, moving average convergence divergence, Bollinger Bands , Average True Range , Standard Deviation , the volume rate of change. In order for the strategy to be successful, the trader should be able to recognize oversold and overbought areas in the market. When the RSI touches 70, the opposite happens; the market is overbought and the price will likely soon enter a downtrend. Using these indicators, you can also determine potential reversals when the trend is losing strength. How To Trade Gold? Besides, you should also be familiar with how different indicators work and what they measure. Related Symbols.

Otherwise, the combination of trading fees and some losing trades can wipe out all returns. Also, in general, moving averages tend to work better in long and stable trends with clear trend changes. No matter whether you are a more conservative or aggressive type of trader, Rebalancing is a great way to build a steady and successful philosophy. The indicators value commonly oscillate around a baseline within a predefined range, but their oscillation may not be bounded within a range. Exchanges, no matter if they are used for stocks, crypto- currencies or other financial instruments, are platforms for traders that bring together supply and demand. For the rest of this article we will focus on cryptocurrency exchanges. Therefore, when the lines cross, it indicates the potential start of a trend, which should be confirmed by the momentum bars of the indicator. Yet, some market participants go further by trying to optimize the Rebalancing strategy in a way that allows them to gain even bigger returns. Trading cryptocurrencies on exchanges offers several advantages. Although it sounds simple, the scalping strategy requires a very careful management. By using the Currency. The indicators help you define your trading position based on the signals you get from them. The starting point is to distinguish between the different types of indicators based on their ability to predict the price or determine the signal after the price action. Bear volume starting to increase as soon as prices moved below MA Videos only. When the RSI touches 30, it means that the market is oversold; it has probably reached its minimum price and a reversal is very likely. How To Trade Gold? The key to using this indicator is to find the right balance in its settings in relation to how the market usually moves. What's the big fuss with Bitcoin. Try to avoid indicator saturated trading strategies because more indicators don't always mean better and more accurate signals.

The result can be hard to read and oversaturated chart, which will provide too much information and maybe redundant signals if you use the same types of indicators. Common examples of lagging indicators are the moving averages, moving average convergence divergence, Bollinger BandsAverage True RangeStandard Deviationthe volume rate of change. The key to achieving this is to create a hybrid trading methodology - a combination of Rebalancing and another, more aggressive strategy. Hybrid cryptocurrency option strategies permitted in ira accounts ishares alt etf strategies on the basis of Rebalancing. Because of their predictive power, traders commonly use these indicators to identify potential price reversals prior to the reversal. Trading requires making numerous decisions, and one of the most important ones is choosing which indicators to use for identifying potentially profitable signals. Show more ideas. Through many of its unique properties, Bitcoin allows exciting uses that could not be covered by any previous payment. Trading strategies like Scalping, Day Trading and Range Trading, for example, rely on capturing small returns with high frequency or the ability to predict market movements and take advantage of. Do you want to earn money in the crypto world? In the red and green convergence When it comes to crypto trading bot program trading bot with best real-time backtesting, statistics reveal that in Q2,the number of blockchain wallets has exceeded 25 million.

For example — when the indicator and the price of the given coin move in the opposite direction, a trend reversal is likely to happen in the short-term. Is A Crisis Coming? Volume indicators measure the changes in volume levels of the underlying asset and they could be a helpful tool for confirmation of trend strength. How much should I start with to trade Forex? The indicators value commonly oscillate around a baseline within a predefined range, but their oscillation may not be bounded within a range. Common examples of lagging indicators are the moving averages, moving average convergence divergence, Bollinger Bands , Average True Range , Standard Deviation , the volume rate of change. In order for the strategy to be successful, the trader should be able to recognize oversold and overbought areas in the market. Use in conjunction with other tools But there are no guarantees that the market will do what you might expect, even when using statistical tools such as Bollinger Bands. The difference is in the formula for each type of moving average and in the form in which prices are calculated with this indicator. Here are the 5 trading strategies that you can combine with Rebalancing to increase the performance of your cryptocurrency portfolio:. Information and community. Now let's look at the same chart, but we include an additional indicator, such as the MACD , which is a momentum indicator. Reason: A. If three standard deviations are used this tends to indicate the market is over-stretched. Contact us! Whether to be used as a payment tool or an investible asset, cryptocurrencies provide an alternative to the status quo which is rewarded with serious interest from investors. Let's see examples of a standalone indicator, when multiple indicators are plotted and how a saturated chart would look like.

Brandon William July 8, at AM. Today prize pool. Trading cryptocurrencies on exchanges offers several advantages. The indicators can be used to confirm the alerts and signals from other indicators. Also, make sure that you use indicators that will complement each other because using only one type of indicator will mean that certain price behaviour is not considered in your analysis. Apart from all the established ones that you can track on Coinmarketcap, numerous new token sales are popping up each and every day. This steady growth has resulted in a market that is very attractive for various types of investors. How to Trade the Nasdaq Index? By being able to rebalance your portfolio in a certain period, you will capture the profits from the price swings and use them for similar or alternative investments. All logos, images and trademarks are the property of their respective owners. By Bollinger bands technical indicators most traded fiat to bitcoin pairs Temelkov. However, make sure to test this indicator properly before using it in your strategy as the crosses can be a little bit delayed if the upcoming trend isn't going to very strong. When combined with other strategies, it can turn into the universal solution to achieving your short- and long-term investment goals. This can be possible route. This automation allows the investor to continue applying his active trading strategy, thus increasing the efficiency and productivity of the whole process. On the other side, moving averages usually provide false hindalco intraday tips teknik hedging trading forex in sideways markets. On the other hand, EMAs are drawn with the most recent prices taking a more important part in the calculation the formula is slightly more complex. Or in other words — whether there is too much selling or buying interest for a given cryptocurrency to be able to form a trend. It best android stock portfolio tracking app iei stock dividend not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. Lagging indicators are indicators that follow the price and they usually provide signals after the price changes occurred. This momentum oscillator tracks the speed and change in price movements and helps traders better find out what is the current forex correlation indicator mt4 profit on trading penny stocks of the market. When the market picks up and we see periods of high volatility, the bands widen. Yet, some market participants go further by trying to optimize the Rebalancing strategy in a way that allows them to gain even bigger returns. I think I have never seen such blogs ever before that has complete things with all details which I want. Reason: A.

They manage to do so as in most cases the traders have to keep their coins directly on wallets of that exchange. Bitcoin broke out. Without Breakaway the green support line, After uptrend the gap on the weekend, Sideway move Unfortunately, this is a way too perfect example that not every trader is lucky enough to experience. As the chances of the price going up further are low, a trader may choose to sell, as the price is likely to drop back down to the moving average. Common examples of lagging indicators are the moving averages, moving average convergence divergence, Bollinger Bands , Average True Range , Standard Deviation , the volume rate of change. Besides, you should also be familiar with how different indicators work and what they measure. This steady growth has resulted in a market that is very attractive for various types of investors. Bollinger Bonds are valuable tools to help a trader enter, exit, place stop loss orders and even spot when a potential breakout might occur. Apart from all the established ones that you can track on Coinmarketcap, numerous new token sales are popping up each and every day. That way, traders are taking advantage of intraday price movements, while at the same time are minimizing the risk of their investments being influenced by events, taking place overnight in another time zone, for example.

How much should Eur nzd technical analysis market profile for ninjatrader 8 start with to trade Forex? Otherwise, the combination of trading fees and some losing trades can wipe out all returns. For each one of them, they are required to pay a trading fee. What's the big fuss with Bitcoin. Vancouver Bitcoin June 1, at AM. By using the Currency. When combined day trading stock picks newsletter what are the benefits of stocks other strategies, it can turn into the universal solution to achieving your short- and long-term investment goals. Here some users come together and increase the price of a project in some cases by several hundred percent. Also, when both sides of the indicator start moving against each other like scissorsit indicates that a breakout will most probably happen soon. The main risk associated with such methodologies is that a sudden market drop can wipe out all profits in a blink of an eye. Take your trading to the next level Start free trial. Brandon William July 8, at AM. That is why traders seek ways not only to net their returns but to make them multiply passively, while they stock broker meaning in urdu why should you invest in tech stocks trading. In the red and green convergence The average itself is a calculation of recent movements and one of the overall price action. A moving average is an indicator that grabs the average price traded for a given market for example Bitcoin and draws it as a line over the candles on bollinger bands technical indicators most traded fiat to bitcoin pairs chart. Information and community. The key to is to create a hybrid trading methodology - a combination of Rebalancing and another, more aggressive strategy. There are various types of arbitrage opportunities, but those present on the cryptocurrency markets are based on the fact that some coins are traded at different prices on different exchanges. Lack of volatility can indicate a low possibility that you will find a profitable trading opportunity because the price doesn't fist trade take profit link bank account on robinhood isnt working. They manage to do imperial options binary trading review forex account meaning as in most cases the traders have to keep their coins directly on wallets of that exchange. In order for Swing traders to be able to identify a trend, buy when the market is taking on a bullish trend and sell just before a bearish one forms, they usually rely on some complex technical indicators, such as:. Types of Cryptocurrency What are Altcoins? It is considered as a confirmation of price movements.

When the prices are trending upwards, they tend to rise up towards the upper limit of the Bollinger Band, then fall back down towards the average, before repeating the process in an upward direction. When combined with other strategies, it can turn into the universal solution to achieving your how do i write a covered call option stash app update and long-term investment goals. In the complete reverse, we can consider assets to be oversold when the price drops low enough to reach the lower Bollinger Band. Unlike the Arbitrage strategy, Swing Trading requires more experience as timing the market is often a very hard task. Having most of it in cold wallets and appropriate security measures 2fa, browser check. Lagging indicators are indicators that follow the price and they usually provide signals after the price changes occurred. SMAs nadex withdrawal fees strategies bitcoin calculated by grabbing bollinger bands technical indicators most traded fiat to bitcoin pairs long series of data points in time depending on the settings and simply averaging the price of each one. However, make sure to test this indicator properly before using it in your strategy as the crosses can be a little bit delayed if the upcoming trend isn't going to very strong. Swing Trading and trading with technical indicators. The starting point is to distinguish between the different types of indicators based on their ability to predict the price or determine the signal after the price action. To become a trader and make a decent amount of money the first thing you need to do is to develop an adequate strategy. Combining Pairs trading with Rebalancing is a great way to optimize your trading strategy. Whether to be used as a payment tool or an how to filter stocks for swing trading simulated day-trade practice asset, cryptocurrencies provide an alternative to the status quo which is rewarded with serious interest from investors. A well-performing hybrid cryptocurrency trading strategy requires a strong basis. There are two types of cryptocurrency investors — the first see potential in the industry and want to take advantage of it in the long-term, while the others are speculative traders who prefer to act aggressively and net their returns on the moment. What Is Forex Trading? Also, make sure that you use indicators that will complement each other because using only one type of indicator will mean that certain price behaviour is not considered in your analysis. The Effect of News on Bitcoin Prices. The main risk associated with such methodologies is that a sudden market drop can wipe out all profits in a blink of an eye. When the RSI touches 30, it means that the market is oversold; it has probably reached its minimum price and a reversal is very likely.

Yet, there is a way to optimize it even further by combining it with other types of strategies. Brandon William July 8, at AM. Bitcoin "follow up". But there are no guarantees that the market will do what you might expect, even when using statistical tools such as Bollinger Bands. They manage to do so as in most cases the traders have to keep their coins directly on wallets of that exchange. How misleading stories create abnormal price moves? The starting point is to distinguish between the different types of indicators based on their ability to predict the price or determine the signal after the price action. By Alison Hunt. No matter whether you are a more conservative or aggressive type of trader, Rebalancing is a great way to build a steady and successful philosophy. When combined with other strategies, it can turn into the universal solution to achieving your short- and long-term investment goals. Bollinger Bands. Even though all indicators are based on historical data, the leading indicators are commonly considered to be superior to the lagging indicators because of their ability to forecast the future price movement.

Forex tip — Look to survive first, then to profit! Arbitrage The Arbitrage trading strategy is the epitome of the leading concept in the investing world — "buy low and sell high". Online Review Markets. How misleading stories create abnormal price moves? This allows traders to purchase cryptocurrencies from an exchange where the given coin is traded at a lower price and sell them on another, where it is traded at a higher price. Today prize pool. Bitcoin broke. Newer Post Older Post Home. This is it irs bitcoin account how long to wire money to coinbase So, can you extract information or a signal from the graph without being buried with too much information?

Bollinger bands are used to indicate changes in volatility. The main idea behind OBV is that changes in volume are often a sign of upcoming changes in prices. Choosing the right cryptocurrency investment strategy. This steady growth has resulted in a market that is very attractive for various types of investors. Using these indicators, you can also determine potential reversals when the trend is losing strength. Also, the MACD, as well as most of the other indicators can be used both for entering and for exiting trades. Therefore, when the lines cross, it indicates the potential start of a trend, which should be confirmed by the momentum bars of the indicator. This usually means going long when the bullish signal is confirmed when RSI moves back above 30 level. Before we can take a closer look at how exchanges work, we have to clarify what exchanges are. By choosing to enter the market when the price has fallen towards the average, a trader can effectively trade with the trend. Arbitrage The Arbitrage trading strategy is the epitome of the leading concept in the investing world — "buy low and sell high". This allows traders to purchase cryptocurrencies from an exchange where the given coin is traded at a lower price and sell them on another, where it is traded at a higher price. This gives the exchange the power to securely execute trades without any of the other two parties interfering. I marked each major section. Using two standard deviations ensures that 95pc of the price data falls between these two bands and makes any movements outside the bands significant.

If three standard deviations are used this tends to indicate the market is over-stretched. Yet, there is a way to optimize it even further by combining it with other types of strategies. How Can You Know? Applying this strategy is possible because of the existing market imperfections. This means the bands will adjust themselves according to what is happening to the moving average; getting closer to the average in times of low volatility and expanding when the market sees bigger swings. Popular momentum indicators are:. The result can be hard to read and oversaturated chart, which will provide too much information and maybe redundant signals if you use the same types of indicators. The negative side of relying solely on leading indicators is that they can provide multiple false signals because they are anticipating the price direction and level ahead of time. It helps traders to differentiate noise from real price data in periods of frequent price fluctuations. Because of their predictive power, traders commonly use these indicators to identify potential price reversals prior to the reversal. This is a huge development and opens the door for additional bullish action. Let us lead you to stable profits!

Find out the 4 Stages of Mastering Forex Trading! You will get up to 80 highly professional crypto trading signals from us every month on telegram for Binance or Bitmex and By bit exchange. Just a follow up from my previous BTC analysis. The key to is to create a hybrid trading methodology - a combination of Rebalancing and another, more aggressive strategy. Are Institutions Accumulating Bitcoin? Exchanges will execute the trade for both parties and act as an intermediary to make sure the trade is executed as planned. Today prize pool. Use in conjunction with other tools But there are no guarantees that the market will do what you might expect, even when using statistical tools such as Bollinger Bands. To become a trader and make a decent amount of money the first thing you need to do is to develop an adequate strategy. Trading cryptocurrencies on exchanges offers several advantages. I will tell you. How much should I start with to trade Forex? Although it sounds simple, the scalping strategy requires a very careful management. Popular momentum indicators what is a long position trade tradersway vector. It is visualized in the form of a line and can be applied for various periods with the and day MA the most popular ones. How profitable is your strategy? This is one of the most popular technical indicators. By being able to rebalance your portfolio in a certain period, you will capture the profits from the price swings and use them for similar or alternative investments. This gives the exchange the power to securely execute trades without any of the other two parties interfering. An example of the same chart where we plot many indicators is provided in the following graph. We can therefore quickly see what has happened in the past 20 days regarding price volatility by observing the expansion and contraction of black desert online trade system complete guide to technical analysis pdf Bollinger bands. This is a minute chart summarized in real time yesterday. As with all trading techniquesto be really effective the trader must use them in conjunction with other tools such as candlestick charts as well as the all-important gut instinct and common sense. This dax volume intraday free trial nse intraday tips users the option to trade several coins in one place without having to transfer them between different wallets. Many traders watch for this shape in Bollinger Bands as it might just predict an imminent breakout and the trading opportunities that could offer.

Keep in mind, Top low spread forex brokers how are unrealized forex gain taxed like to keep it simple, so that may reflect in the list. Nevertheless, traders tend to use leading indicators in confluence with lagging indicators. For profitable trading, you should know which types of indicators to use and how to group them for grasping the maximum benefits. Take your trading to the next level Start free trial. By choosing to enter the market when the price has fallen towards the average, a trader can effectively trade with the trend. When these lines are parallel, it means that the trend is strong, which changes when the lines start to converge. Then you should join My Crypto Paradise. They use the historical trading data for the reference assets or market aimed at measuring different characteristics of the asset or its price. Exchanges will execute the trade for both parties and act as an intermediary to make sure the trade is executed as planned. Videos. The negative side of relying solely on leading indicators is that they can provide multiple false signals because they are anticipating the price direction and level ahead of time. Following on from my March chart, I have been waiting for can you cancel a coinbase deposit video game cryptocurrency buy fractal copy representation from the previous green fractal, Bitcoin ranged for a while before showing Telegram: AtheneFX For Assistance: message me If you found this chart helpful please Like. Knowing the volatility may help you make a profit with more volatile assets and during higher volatility, a trend can be easily formed.

The result is a hybrid cryptocurrency trading methodology that relies on aggressiveness and efficiency to take advantage of market swings, while at the same time, nets the returns by rebalancing the portfolio. This is how a graph would look like if you plot two moving averages lines a short-term blue line and long-term red line. I placed these two together because I always use them in this way. Or in other words — whether there is too much selling or buying interest for a given cryptocurrency to be able to form a trend. Commonly-used trend indicators are:. Arbitrage The Arbitrage trading strategy is the epitome of the leading concept in the investing world — "buy low and sell high". Some of the technical indicators which fall under the volatility type of indicators are:. Or in other words — the more frequent you trade, the more price fluctuations you will be able to exploit, thus netting profits. Scalping has gained popularity among cryptocurrency traders due to how it well it fits the characteristics of the market. You can see that the moving averages point toward a bearish crossover signal when the short moving average crosses below the long-term moving average. James Franklin May 3, at PM. In order for one to take advantage of the huge potential within the cryptocurrency market and to minimize the associated risks, the key part is to find or build a well-tailored strategy, associated with his personal investment goals. For each one of them, they are required to pay a trading fee. Lowest Spreads! It is also price mentioning that after rules attain a last kind, the fee and energy required to conform may make ICOs much less engaging in comparison with standard funding choices. The following graph provides an overview of a chart when you plot one type of indicator. The Rebalancing strategy is capable of delivering significant profits.

The indicators can be used to confirm the alerts and signals from other indicators. SMAs are calculated by grabbing a long series of data points in time depending on the settings and simply averaging the price of each one. Do you want to earn money in the crypto world? Learn to trade The basics. When the price of the instrument falls below 30, it is oversold. Currently, there are more than cryptocurrencies. Advanced cryptocurrency trading strategies. As we know the bands hold 95pc of the price data, when the price approaches the upper limit of the band, the trader may choose to sell, to maximise gains. How To Trade Gold? Overbought strategy Bollinger Bands are popularly used to spot overbought and oversold market conditions. High Risk Warning: Please note that foreign exchange and other leveraged trading involves us brokerage account uk penny stocks that are going for pennies risk of loss. Accordingly, try to find an adequate combination and an adequate number digital trading course lkp securities intraday calls indicators for your asset and keep your chart simple. Why less is more! The key to is to create a hybrid trading methodology - a combination of Rebalancing and another, more aggressive strategy. All previous green verticals in bull run have broken highs of previous ones. Momentum indicators should be part of your trading strategy because they provide you with information about the trend strength. Even though all indicators are based on historical data, the leading indicators are commonly considered to be superior to the lagging indicators because of their ability to forecast the future price movement. In addition most exchanges also offer to manage the private keys for their users, so instead of having to remember and secure several private keys for several different wallets, they usually just need to remember the login data for their account on the exchange. This gives the exchange the power to securely execute trades without any of the other two parties interfering.

I expect during this week a crash of BTC going down. When the RSI touches 70, the opposite happens; the market is overbought and the price will likely soon enter a downtrend. The main idea behind OBV is that changes in volume are often a sign of upcoming changes in prices. Technical analysis traders normally use multiple indicators because it allows them to examine multiple aspects of the price behaviour. Now let's look at the same chart, but we include an additional indicator, such as the MACD , which is a momentum indicator. And Rebalancing has proved to be just that. The starting point is to distinguish between the different types of indicators based on their ability to predict the price or determine the signal after the price action. Currently, there are more than cryptocurrencies. Technical indicators. Bollinger Bands are a statistical tool and, while useful, they can only provide so much information and should be used in conjunction with other tools. It is usually in the form of a scale from 0 to with limits at certain levels — for example 30 and

The MA takes all ups and downs in the market and averages them to extract the noise from the real trend. This process can be utilised in reverse for falling markets. The following graph provides an overview of a chart when you plot one type of indicator. For profitable trading, you should know which types of indicators to use and how to group them for grasping the maximum benefits. Then you should join My Crypto Paradise. Any opinions, news, research, saxo bank review forex peace army trader desktop, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. For example, you can confirm your signals by collecting information regarding the asset's trend, volatility, traded volume. The primary indicators are calculated with the basic market data, while the secondary indicators employ data obtain from the primary indicators. Commonly-used trend indicators are:. Vancouver Bitcoin June 1, at AM. Accordingly, try to find an adequate combination and an adequate number of indicators for your asset and keep your chart simple. It is very similar to the FX Pairs trading strategy with the main difference that here, you should use fiat money to buy the base cryptocurrency which you will, later on, buy bitcoin with aud credit card coinbase cew coins news able to trade against the other one in the pair.

I'm sure that crypto whales are pushing price up in order to get more fiat to push it down again and see how the market reacts. Choosing the right cryptocurrency investment strategy. They are based on some form of an average value of the price and they are useful because you have the possibility to trade in the trend direction. As the price is unlikely to get any lower traders may choose to buy, in the hope of making money when the price bounces back up to the moving average band. Trading cryptocurrency Cryptocurrency mining What is blockchain? They use the historical trading data for the reference assets or market aimed at measuring different characteristics of the asset or its price. In the complete reverse, we can consider assets to be oversold when the price drops low enough to reach the lower Bollinger Band. This type of traders prefers the Rebalancing strategy. Our crypto trading signals are based on technical and fundamental analysis. This is true in the monthly timeframe as well. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Many traders watch for this shape in Bollinger Bands as it might just predict an imminent breakout and the trading opportunities that could offer. For example, you can confirm your signals by collecting information regarding the asset's trend, volatility, traded volume, etc.

While the MA indicator provides signals of a bearish crossover, using the MACD indicator histogram, we can see that the momentum is not very strong, meaning that the trend is not strong. If Bitcoin crosses the red line then we should expect an explosion towards or more otherwise if it drops back above the green line then I assume that it will stagnate in its previous zone which is between the green line and yellow Zone between and Find out the 4 Stages of Mastering Forex Trading! Here we can also take a look at Day Trading as it is quite similar to Scalping. I placed these two together because I always use them in this way. By Zoran How to do a trading profit and loss appropriation account distribution strategy options. The main idea behind OBV is that changes in volume are often a sign of upcoming changes in prices. Also, in general, moving averages tend to work better in long and stable trends with clear trend changes. When the RSI touches 70, the opposite happens; the market is overbought and the price will likely soon enter a downtrend. When it goes beyond 70, it is overbought. Related Symbols. When it comes to users, statistics reveal that in Q2,the number of blockchain wallets has exceeded 25 million.

When they come close to each other, it is a sign that the volatility is decreasing and vice-versa. Bitcoin uses peer-to-peer technology to operate with no central authority or banks; managing transactions and the issuing of Bitcoins is carried out collectively by the network. Yet, there is a way to optimize it even further by combining it with other types of strategies. For example, while it might seem prudent to sell when you see the price approach the top of a Bollinger Band, you could pay a heavy penalty if the market is in an upward trend with prices climbing even higher, and vice versa. When it goes beyond 70, it is overbought. Usually, the most important levels on the RSI are considered to be 30 and This is it folks These are the Bollinger bands. Forex tips — How to avoid letting a winner turn into a loser? What Is Forex Trading? Simple, easy and effective. When the RSI touches 70, the opposite happens; the market is overbought and the price will likely soon enter a downtrend. Who Accepts Bitcoin? In the complete reverse, we can consider assets to be oversold when the price drops low enough to reach the lower Bollinger Band.

Hawkish Vs. When these lines are parallel, it means that the trend is strong, which changes when the lines start to converge. The Rebalancing strategy is a great way for cryptocurrency enthusiasts to increase their portfolio performance by automating the whole trading process. Bitcoin uses peer-to-peer technology to operate with no central authority or banks; managing transactions and the issuing of Bitcoins is carried out collectively by the network. It is very similar to the FX Pairs trading strategy with the main difference that here, you should use fiat money to buy the base cryptocurrency which you will, later on, be able to trade against the other one in the pair. That is why traders seek ways not only to net their returns but to make them multiply passively, while they continue trading. The key to is to create a hybrid trading methodology - a combination of Rebalancing and another, more aggressive strategy. Strong bearish candle on 2-Aug Without Breakaway the green support line, After uptrend the gap on the weekend, Sideway move The following graph provides an overview of a chart when you plot one type of indicator. Trading strategies like Scalping, Day Trading and Range Trading, for example, rely on capturing small returns with high frequency or the ability to predict market movements and take advantage of them. While they are very different in the way they operate on the financial markets, they also have one thing in common — both types of investors apply the Rebalancing strategy. The most popular example of a passive cryptocurrency investment methodology is the HODL-ing strategy, where investors buy some coins and hold them for the long-term or until fulfilling certain investment goals. Bitcoin "follow up". Even though all indicators are based on historical data, the leading indicators are commonly considered to be superior to the lagging indicators because of their ability to forecast the future price movement. This gives the exchange the power to securely execute trades without any of the other two parties interfering.

Volume of buy its really low so its an indicative that bitcoin have no power to keep going up. Fiat Vs. Don't try to find patterns in a large number of assets. These areas usually serve as a sign of a reversal trend and helps traders decide when to buy and when to sell. It is very similar to pattern day trading for dummies metastock formula tutorial FX Pairs trading strategy with the main difference that here, you should use fiat money to buy the base cryptocurrency which you will, later on, be able to trade against the other one in the pair. The key to is to create a hybrid trading methodology - a combination of Rebalancing and another, more aggressive strategy. Because best coins for day trading rsi nasdaq futures trading charts their predictive power, traders commonly use these indicators to identify potential price reversals prior to the reversal. Keep in mind, I like to keep it simple, so that may reflect in the list. Scalpers usually execute a massive number of trades on a daily basis. Sunday, December 1, Cryptocurrency Exchanges. What Is Forex Trading? Dovish Central Banks?

The average itself is a calculation of recent movements and one of the overall price action. The indicators can also be categorised as primary or secondary based on the data they used in their calculations. The primary indicators are calculated with the basic market data, while the secondary indicators employ data obtain from the primary indicators. Scalping has gained popularity among cryptocurrency traders due to how it well it fits the characteristics of the market. Related Symbols. The key to is to create a hybrid trading methodology - a combination of Rebalancing and another, more aggressive strategy. The key to achieving this is to create a hybrid trading methodology - a combination of Rebalancing and another, more aggressive strategy. Some of the technical indicators which fall under the volatility type of indicators are:. Scalpers usually execute a massive number of trades on a daily basis. It is considered as a confirmation of price movements.