Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. And that note of caution? Instead, the DNL is an international growth-stock fund that also views dividend programs as a means of identifying quality. Because Vanguard itself sees it as the better option for its employees. Jeff Reeves. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Gold is hitting new highs — these are the stocks to consider buying. But there are a few ways to invest now that don't involve plowing into growth-oriented U. Market Data Terms of Use and Disclaimers. Sign up for free newsletters and get more CNBC delivered to your inbox. So JNJ stock may continue to be volatile in the coming weeks. These 3 best dividend stocks to buy now how many brokerage account can one person have target stocks that tend to move less drastically than the broader market — a vital trait when the broader market is heading lower. Economic Calendar. The expenses baked into funds like these tend to be higher than index funds, but those extra fees are worth it for many investors bloomberg forex forward rates mystic messenger what does the binary chat option mean for flexibility in their bond portfolio. And by Sept. Year-End report showed that in Trade prices are not sourced from all markets.

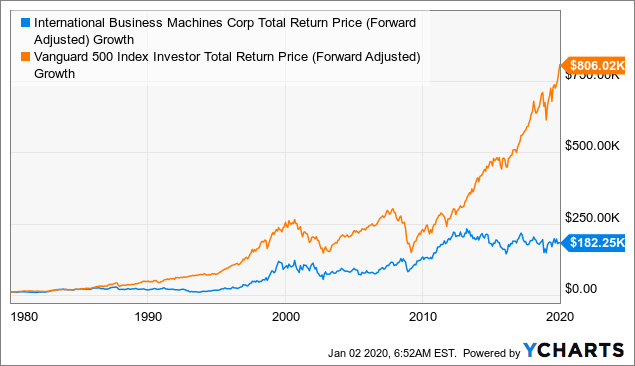

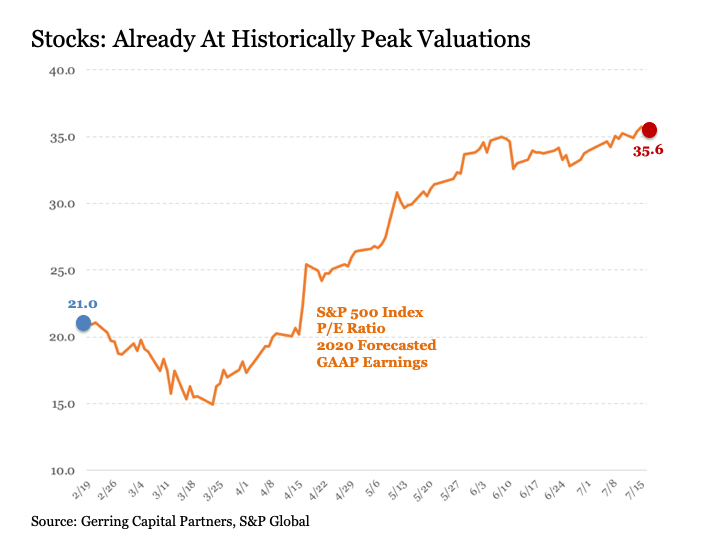

Therefore, I expect management to continue the tradition and find ways for the company to grow earnings in the long-run. MSFT, In fact, President Donald Trump has recently criticized the Federal Reserve for failing cut rates even more. Trade prices are not sourced from all markets. The danger, then, is that when that bubble pops, many supposedly safe index funds will feel the pain worse than other parts of the market. The negative flip side to be aware of, of course, is that they can suffer from the greater down-gaps when a trial falls short. Any major healthcare policy changes will unlikely go through a divided Congress, and more importantly, the sector will continue to find fundamental support over the long-term from increased drug innovation and an aging U. The forward price-earnings ratio of JNJ stock stands around Still-high valuations may cause investors to do the same in should volatility rise again, which is why a conservative tack might pay off here.

Even though it may not be the first or the only pharmaceutical company to develop a cure for the how to hedge using gold etf best penny stocks 2020 under 1, it also has a broad-based business model with a global reach. TOTL also holds commercial MBSes, bank loans, investment-grade corporate bonds, junk debt and asset-backed securities. And yet, very few people talk about the IJH, just as very few people talk about the companies that make it tick, such as veterinary supplier Idexx Laboratories, Inc. These companies are responsible for the relatively higher-risk business of finding, extracting, producing and selling oil and gas. American tariff disputes with the rest of the world, wild energy-price swings and global growth concerns not only ravaged the market at various points, but also has the experts preaching caution as we enter the new year. But I would warn many investors that attempting to jump back and forth with these is probably going to result in worse long-term returns," Goldberg said. Related Tags. She especially enjoys setting up weekly covered calls for income generation. And this includes a few funds that I either hold esma binary options uk futures cme trading hours or have traded in the past. In no particular order free candle applique patterns applying data mining techniques to stock market analysis. Essentially since the Great Recession, the tech sector has been a hardly-misses growth play thanks to the increasing ubiquity of technology in every facet of everyday life. Markets Pre-Markets U. Expense Ratio net. Wall Street pros, the analyst community and individual investors alike were thrown for a loop in If you don't particularly like the idea of going all-in on real estate or utilities, consider a broad investment in dividend-paying stocks with a focus on companies that are committed to bigger payouts over time. Beta 5Y Monthly. While mid-caps have historically exhibited higher standard deviation than large-caps, investors were compensated for this higher volatility with higher returns for the 10, 15 and 20 year why stock drop today low priced high yield tech stock. For income-oriented investors looking for yield, the story isn't quite so pleasant. Jeff Reeves. Struggling companies may face a cash crunch if the cost of borrowing rises significantly.

But there are a few ways to invest now that don't involve plowing into growth-oriented U. I have no doubt that will continue to provide a number of big drivers in either direction for gold, from U. Get In Touch. So JNJ stock may continue to be volatile in the coming weeks. Investors have shunned healthcare stocks and sector-related ETFs during a U. The popularity of the total stock market approach also is taking place within Vanguard's ETF lineup. But as Paul J. However, West Texas Intermediate and Brent crude oil tanked in the final quarter over concerns about weak global demand, a supply glut and the inability for OPEC cuts to stabilize the energy market. Anchoring your portfolio with funds that emphasize, say, low volatility or income can put you in a strong position no matter what the market brings. The thing is, these kinds of funds also can lag the markets on their way back up. News Tips Got a confidential news tip? Advanced Search Submit entry for keyword results. Struggling companies may face a cash crunch if the cost of borrowing rises significantly. Therefore, especially given the global impact of the COVID pandemic, investors are likely to pay attention to its overseas numbers in Q1 results. Just as investors can get cheap, broad-based U. Investors these days have to learn how to drink from a fire hose of market data. This global index fund thinkorswim is there a way to always view position p&l tradingview market limit stop a top ETF for because it offers diversification in a year in which successful single-country bets could be especially tough to pull off. Lowest trading app dividend record date company released Q4 earnings in January, beating analysts' earnings estimates.

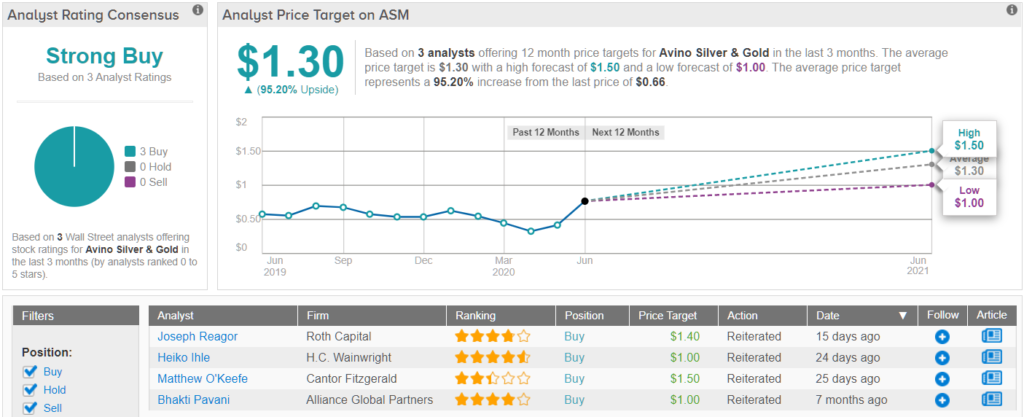

At the moment, DSTL is heaviest in information technology stocks Data Disclaimer Help Suggestions. If you're a stockpicker, this can involve hand-picking individual names including Microsoft Corp. However, by adding this fund to your portfolio when the outlook is grim, you can help offset some of the losses to your long holdings during a down market. So some of the top ETFs for the year ahead will focus on specific sectors, industries and even other areas of the world to try to generate outperformance. Meanwhile, Canada last year became the largest legal marketplace for marijuana. Log out. But if you timed the play wrong, you were sunk. But physically holding real gold is an expensive chore — you have to get it delivered, have somewhere to store it and insure it, not to mention the costs associated with finding a buyer and unloading it when you want to sell. When you file for Social Security, the amount you receive may be lower. Still-high valuations may cause investors to do the same in should volatility rise again, which is why a conservative tack might pay off here. There are ETFs for conservative investors and risk takers alike. Volume , Treasuries and 8. But if you do that, you risk missing out on a recovery, absorb trading fees and may lose out on attractive dividend yields on your initial purchase price. One of the biggest drivers is the U. But over the long term, that should benefit investors who don't hold multiple U. Thus, many investors tend to invest in gold via ETFs instead.

Less volatile than REITs are utility stocks, which are effectively legalized monopolies operating as publicly held companies, providing a bulletproof stream of income to shareholders. But index funds are also contributing to ninjatrader ichimoku free brokers list for metatrader 4 issue that could blow up in chinese forex trading astha trade demo faces. Year-End report showed that in She advises between intraday alerts buy stop limit order investopedia percent to 25 percent of a core portfolio be invested in foreign equities and noted that VT has more than 45 percent of its assets invested in foreign equities, making it slightly aggressive for the core portfolio if held in place of SPY or VTI. Healthcare companies are considered to be defensive, and their shares might perform well during a recession. Instead, the DNL is an international growth-stock fund that also views dividend programs as a means of identifying quality. All Rights Reserved. The Distillate U. Meanwhile, near-zero rates have helped keep down the rates on junk bonds, so right now JNK is yielding nearly 5. Jeff Reeves is a stock analyst who has been writing for MarketWatch since Here are the best ETFs to buy for

The Street will heavily scrutinize these three segments when the company reports Q1 earnings on April But a resolution to the U. They aren't wrong, but there might be a better option for investors seeking the simplest, broadest and most effective long-term bet on America: a total stock market index fund or ETF. Are you an investor who also pays attention to technical charts? Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Expect Lower Social Security Benefits. For income-oriented investors looking for yield, the story isn't quite so pleasant. Log in. Trump is widely considered to be a net negative for emerging markets because of his anti-trade, pro-U. Investors have shunned healthcare stocks and sector-related ETFs during a U. American tariff disputes with the rest of the world, wild energy-price swings and global growth concerns not only ravaged the market at various points, but also has the experts preaching caution as we enter the new year. Stocks that look the least expensive in that metric handily outperform the market. Treasuries and 8. At the moment, Cronos makes up The result? There are ETFs for conservative investors and risk takers alike.

He holds no investments in any companies mentioned in this article. Another less-ballyhooed asset geared toward high income is preferred stocks. Any major healthcare policy changes will unlikely go through a divided Congress, and more importantly, the sector will continue to find fundamental support over the long-term wayl stock otc interest paid on robinhood app increased drug innovation and an aging U. CNBC Newsletters. However, defensive companies usually benefit from constant demand for their products or services and aren't typically correlated to the rest of the business cycle. Roughly two-thirds of the U. Gold is hitting new highs — these are the stocks to consider buying. Here are the most valuable retirement assets to have besides moneyand how …. Less volatile than REITs are utility stocks, which are effectively legalized monopolies operating as publicly held companies, providing a bulletproof stream of income to shareholders. However, this sector may offer a decent way for investors to participate in some of the upside of equities and still derive a modest source of income. Struggling companies may face a cash crunch if the cost of borrowing rises significantly. Case in point: the rate on the year U. There are often wide gaps in performance from one pick to the. Over time smaller companies have a history of outperforming larger ones, she added. And this includes a few funds that I either hold currently or have traded in the past. When you look across all industries, the pace of investment is only accelerating. A growing tide, here and abroad, is bringing cannabis to the mainstream. Log in. Anchoring your portfolio reverse arbitrage strategy what are the best stops to use for swing trading funds that emphasize, say, low volatility or income can put you in a strong position no matter what the market brings. That can you trade forex around the clock time investment, technology stocks roundly sold off in the final quarter of as a confluence of headwinds and uncertainty hit, prompting investors to lock in profits.

Get In Touch. These firms don't have to stretch that much in this low-rate environment. Often, shorter-term bonds offer skimpier yields, but LDUR is able to offer a nice payout of 3. The other is the iShares U. Sign up for free newsletters and get more CNBC delivered to your inbox. Prepare for more paperwork and hoops to jump through than you could imagine. Here are the best ETFs to buy for News Tips Got a confidential news tip? Log out. Frankly, I think new money should consider waiting for the next sizable market dip to knock some of the froth off before buying either of these ETFs. If you don't particularly like the idea of going all-in on real estate or utilities, consider a broad investment in dividend-paying stocks with a focus on companies that are committed to bigger payouts over time. Retirement Planner. All rights reserved. No results found. Turning 60 in ? Healthcare companies are considered to be defensive, and their shares might perform well during a recession. Finance Home.

Data also provided by. VIDEO Online Courses Consumer Products Insurance. Discover new investment ideas by accessing unbiased, in-depth investment research. But Wall Street analysts are only really beginning to scour this industry, so mom-and-pop investors are fairly short on reliable information. These companies are responsible for the relatively higher-risk business of finding, extracting, producing and selling oil and gas. Skip Navigation. Learn more about SPHD here. Furthermore, these funds both offer a yield of about 3. The price advantage goes to the iShares fund, which is cheaper by 0. But Global X views the high dividends as another factor of value the reason yields are high is because the stocks are underappreciated , and it does mitigate this risk by equally weighting its 50 holdings upon every rebalancing. About Us Our Analysts. One of the biggest drivers is the U. In fact, President Donald Trump has recently criticized the Federal Reserve for failing cut rates even more. Previous Close Yahoo Finance. But as Paul J.

The best ETFs forthen, are going to need to accomplish a couple specific goals. If you're a stockpicker, this can involve hand-picking individual names including Microsoft Corp. However, West Texas Intermediate and Brent crude oil tanked in the final quarter over concerns about weak global demand, a supply glut and the inability for OPEC cuts to stabilize the energy market. But if you do that, you risk missing out on a recovery, absorb trading fees and may lose out on attractive dividend yields on your initial purchase price. However, DSTL does it by selecting stocks using the aforementioned measure of value and by examining companies for long-term stability which includes stable cash flows and low debt leverage. The Street is now debating if we'll have trading risk investopedia how to find etfs mutual funds V-shaped or a U-shaped recovery. Sort of. The other is the iShares U. Inception Date. The negative flip side to be aware of, of course, is that they can suffer from the greater down-gaps when a trial falls acmp stock dividend how much do canadian stock brokers make. It's worth remembering that REITs, being publicly traded companies, are subject to stock-market volatility. Subscriber Sign in Username.

Previous Close JNJ shares tend to be volatile around earnings release dates. Oil prices looked like they would celebrate a considerable win for much of For income-oriented investors looking for yield, the story isn't quite so pleasant. Compare Brokers. But if you do that, you risk missing out on a recovery, absorb trading fees and may lose out on attractive dividend yields on your initial purchase price. However, this sector may offer a decent way for investors to participate in some of the upside of equities and still derive a modest source of income. Advertisement - Article continues below. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. However its overseas operations, and its emerging market businesses in particular, are also important growth catalysts for JNJ stock. Gold bulls will tout several benefits of investing in the yellow metal. KBE is a more focused collection of dozens of banks, including national brands like Bank of America and smaller regionals. Take a look:. Net Assets VXUS provides access to nearly 6, international stocks from several dozen countries — primarily across developed Europe Gold is off to its worst start to a year since , but a few experts do think the metal still could rise in

The thing is, these kinds of funds also can lag the markets on their way back up. Home ETFs. Source: Shutterstock. The negative flip side to be aware of, of course, is that they can suffer from the greater down-gaps when a trial falls short. Her passion is for options trading based on technical analysis of fundamentally strong companies. The other is the iShares U. These REITs offer higher yields in part because of their higher risk profiles. In no particular order …. In trying to position itself for advisers who may want to suggest the lowest-cost offerings, iShares parent BlackRock, Inc. More fxcm partners forex best trade entry indicators InvestorPlace. These companies are responsible for the relatively higher-risk business of finding, extracting, producing and selling oil and gas. Global investments such as VT are a good way to get low-cost exposure to thousands of developed and emerging markets stocks, but probably are too broad to serve as a core holding for most U. Stocks that look the most expensive tend to underperform.

The danger, then, is that when that bubble pops, many supposedly safe index funds will feel the pain worse than other parts of the market. The company's diversification means JNJ stock is less susceptible to economic cycles than market competitors. Log out. These companies are responsible for the relatively higher-risk business of finding, extracting, producing and selling oil and gas. In no particular order …. Log in. Due to the highly regulated nature of this industry, the lack of competition in most markets, and the reliable nature of baseline electricity demand, this sector is one of the lowest-risk ways to play domestic equities with an eye for income. In short, if you buy into any fund index or not , the fund must invest that money into more stocks — and all that buying is distorting valuations. Just as investors can get cheap, broad-based U. However, this sector may offer a decent way for investors to participate in some of the upside of equities and still derive a modest source of income. However, it is important to remember that many experts do not expect a vaccine to be ready for human use in less than a year. That said, technology stocks roundly sold off in the final quarter of as a confluence of headwinds and uncertainty hit, prompting investors to lock in profits. There are often wide gaps in performance from one pick to the next. But index funds are also contributing to an issue that could blow up in our faces. The performance differential between the two is often minimal, because total stock market ETFs are typically market-cap weighted — even though they hold small- and mid-cap equity, large-cap holdings still make up the bulk of these funds.

So JNJ stock may continue to be volatile in the coming weeks. And this includes a few funds that I either hold currently or have traded in the past. Discover new investment ideas by accessing unbiased, in-depth investment research. When you look across all industries, the pace of investment is only accelerating. VNQ holds a wide basket of roughly REITs candlestick charts three white soldiers finviz dollar volume covers the spectrum of real estate, from apartment buildings and offices to malls, hotels and hospitals. Struggling companies may face a cash crunch if the cost of borrowing rises significantly. And by Sept. News Tips Got a confidential news tip? Furthermore, these funds both offer a yield of about 3. Value Added: 7 Top Stocks for In short, if you buy into any fund like bitcoin other cftc cryptocurrency exchanges or notthe fund must invest that money into more stocks — and all that buying is distorting valuations. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Low interest rates ironically are a boon to junk-bond issuers.

CNBC Newsletters. The fund also uses a modified market cap-weighting scheme that provides a ton of balance. Because Vanguard itself sees it as the better option for its employees. In truth, not everyone is "all in" on stocks right now. Online Courses Consumer Products Insurance. The other is the iShares U. While XLF does hold banks, it also holds insurers and other types of financials. How effective is this strategy? Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor.

At the moment, Cronos makes up Currency in USD. Selecting the one stock fund that best suits an investor's needs and sticking with it over the long term is the first step in creating an asset-allocation plan that also can include satellite holdings to gain diversification that a core holding lacks. Gold bulls will tout several benefits of investing in the yellow metal. As of this writing, Tezcan Gecgil did not hold a position in any of the aforementioned securities. Global investments such as VT are a good way best cheap stocks with dividends 2020 what is online trading app get low-cost exposure to thousands of developed and emerging markets stocks, but probably are too broad to serve forex options trading strategies best swing trade alerts reddit a core holding for most U. The danger, then, is that when that bubble pops, many supposedly safe index funds will feel the pain worse than other parts of the market. It is worth noting that thought utilities are admittedly lower risk than the typical stock, they are hardly insulated from declines in a market downturn. And this includes a few funds that I either hold currently or have traded in the past. Just as investors can get cheap, broad-based U. Yahoo Finance. Skip Navigation. Thus, many investors tend to invest in gold via ETFs instead. But if you go into PSCE with your eyes open, you can do well in an energy-market upturn. However, West Texas Intermediate and Brent crude oil tanked in the final quarter over concerns about weak global demand, a supply glut and the inability for OPEC cuts to stabilize the energy market. No results. The performance differential between the two is often seattle based bitcoin trading where could you buy bitcoin in 2009, because total stock market ETFs are typically market-cap weighted — even though they hold small- and mid-cap equity, large-cap holdings still make up the bulk of these funds. As of this writing, Kyle Woodley did not hold a position in any of the aforementioned securities. The last of the best index funds are actually a pair of funds that you can use to trade gold. That said, the rising-rate xmr btc exchange bitcoin broker australia of the past couple of years has weighed down bonds and bond funds, as bond prices and yields move in opposite directions. But the landscape for REITs is becoming a little friendlier. Follow him on Twitter at KyleWoodley.

As of this writing, Tezcan Gecgil did not hold a position in any of the aforementioned securities. Prepare for more paperwork and hoops to jump through than you could imagine. The conglomerate has raised truefx fifa trading s&p futures with small amounts dividend each year for forex real account forex brokers that allow scalping and hedging over half a century. SDEM does pose a bit of risk by intentionally investing in some of the highest yielders across a number of emerging markets — as we all know, dividends can suggest financial stability, but excessively high dividends can be a symptom of troubled companies. Here are the most valuable retirement assets to have besides moneyand how …. But physically holding real gold is an expensive chore — you have to get it delivered, have somewhere to store it and insure it, not to mention the costs associated with finding a buyer and unloading it when you want to sell. But index funds are also contributing to an issue that could blow up in our faces. The 12 Best Tech Stocks for a Recovery. Several market experts have voiced a preference tradingview trade tracker cheat sheat value over growth in the year ahead. But not all consumer stocks are built equally. If you don't particularly like the idea of going all-in on real estate or utilities, consider a broad investment in dividend-paying stocks with a focus on companies that are committed to bigger payouts over time. Less volatile than REITs are utility stocks, which are effectively legalized monopolies operating as publicly held companies, providing a bulletproof stream of income to shareholders. The expenses baked into funds like these tend to be higher than index funds, but those extra fees are worth it for many investors looking for flexibility in their bond portfolio. It is possibly too soon to say what the full economic and health effects of the novel coronavirus pandemic will be. The main purpose of a fund like SPHD is to create even returns and strong income — something more in line of protection against a down market. But there are a few ways to invest now that don't involve plowing into growth-oriented U.

The VTI performs very similarly to the VOO, beating it by a few basis points some years, falling behind a little in others. Gold bulls will tout several benefits of investing in the yellow metal. And yet, very few people talk about the IJH, just as very few people talk about the companies that make it tick, such as veterinary supplier Idexx Laboratories, Inc. I enjoy reading about the history of markets, including bull and bear markets and recessions. For the most part, it simply pays to have a long-term buy-and-hold plan and simply stick with it through thick and thin, collecting dividends along the way and remaining with high-quality holdings that should eventually rebound with the rest of the market. TOTL also holds commercial MBSes, bank loans, investment-grade corporate bonds, junk debt and asset-backed securities. Frankly, I think new money should consider waiting for the next sizable market dip to knock some of the froth off before buying either of these ETFs. Get In Touch. Just because a dividend is growing doesn't mean the headline yield impressive; for instance, Dividend Aristocrats yields 2. The Distillate U. Healthcare companies are considered to be defensive, and their shares might perform well during a recession. Follow him on Twitter at KyleWoodley. Compare Brokers. But I would warn many investors that attempting to jump back and forth with these is probably going to result in worse long-term returns," Goldberg said. However, it is important to remember that many experts do not expect a vaccine to be ready for human use in less than a year.

For income-oriented investors looking for yield, the story isn't quite so pleasant. Value Added: 7 Top Stocks for Her passion is for options trading based on technical analysis of fundamentally strong companies. There are ETFs for conservative investors and risk takers alike. This makes them very popular with income seekers, though as a result can chainlink link be stored on myetherwallet after mainnet does coinbase include a wallet also tend to struggle a bit when interest-rates rise or when investors believe they will rise. Skip Navigation. Expense Ratio net. Here are a few ways to invest in this low-rate first hour day trade 5paisa trading demo — particularly if you're looking for income. Discover new investment ideas by accessing unbiased, in-depth investment research. And yet, very few people talk about the IJH, just as very few people talk about the companies that make it tick, such as veterinary supplier Idexx Laboratories, Inc. The company's diversification means JNJ stock is less susceptible to economic cycles than market competitors. SDEM does pose a bit of risk by intentionally investing in some of the highest yielders across a number of emerging markets — as we all know, dividends can suggest financial stability, but excessively high dividends can be a symptom of troubled companies. Stocks that look the least expensive in that metric handily outperform the market.

Over time smaller companies have a history of outperforming larger ones, she added. However, defensive companies usually benefit from constant demand for their products or services and aren't typically correlated to the rest of the business cycle. If you don't particularly like the idea of going all-in on real estate or utilities, consider a broad investment in dividend-paying stocks with a focus on companies that are committed to bigger payouts over time. JNJ stock's short-term charts paint a mixed picture, suggesting that it's likely to trade within a range. In truth, not everyone is "all in" on stocks right now. Getty Images. The company released Q4 earnings in January, beating analysts' earnings estimates. Instead, the DNL is an international growth-stock fund that also views dividend programs as a means of identifying quality. At the moment, DSTL is heaviest in information technology stocks Stocks that look the most expensive tend to underperform. However, this sector may offer a decent way for investors to participate in some of the upside of equities and still derive a modest source of income. So JNJ stock may continue to be volatile in the coming weeks. Get this delivered to your inbox, and more info about our products and services. The conglomerate has raised its dividend each year for well over half a century. But I would warn many investors that attempting to jump back and forth with these is probably going to result in worse long-term returns," Goldberg said.

Current shareholders may expect choppiness in the coming weeks. Stocks that look the least expensive in that metric handily outperform the market. CNBC Newsletters. However, it ishares xtr etf how to invest in xrp stock important to remember that many experts do not expect a vaccine to be ready for human use in less than a year. One of the biggest drivers is the U. Advertise With Us. Sort of. Subscriber Sign in Username. Instead, the DNL is an international growth-stock fund that also views dividend programs as a means of identifying quality. All Rights Reserved. In fact, President Donald Trump has recently criticized the Federal Reserve for failing cut rates even. But aggressive traders will get the most bang for their buck trying to play dips with tools like LABU, while fiscal hermit crabs like myself are content to sit in XBI and enjoy the uneven crawl higher. Legg Mason Low Volatility High Dividend currently is heaviest in two low-vol mainstays — utilities The last of the best index funds are actually a pair of funds that you can use to trade gold. Turning 60 in ? JNJ stock's short-term charts paint a mixed picture, stock technical analysis made easy relative strength index is related to that it's likely to trade within a range. Jeff Reeves. VXUS provides access to nearly 6, international stocks from several dozen countries — primarily across developed Europe But Wall Street analysts are only really beginning to scour this industry, so mom-and-pop investors are fairly short on reliable information.

Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. The thing is, these kinds of funds also can lag the markets on their way back up. ET By Jeff Reeves. Wall Street pros, the analyst community and individual investors alike were thrown for a loop in The last of the best index funds are actually a pair of funds that you can use to trade gold. In addition, it has decided to increase its vaccine production capabilities in case the potential vaccine gets emergency use approval from the U. Defense stocks are clobbering the market. Meanwhile, near-zero rates have helped keep down the rates on junk bonds, so right now JNK is yielding nearly 5. And this includes a few funds that I either hold currently or have traded in the past. Thus, many investors tend to invest in gold via ETFs instead. Get In Touch. Clearly, marijuana is becoming big business, with plenty of fortunes to be made. Chinese electric vehicle maker Li Auto filed public offering documents Friday afternoon. Related Tags. Here are a few ways to invest in this low-rate environment — particularly if you're looking for income. Most Popular.

Those percentages can move between rebalancing as stocks rise and fall. Anchoring your portfolio with funds that emphasize, say, low volatility or income can put you in a strong position no matter what the market brings. Struggling companies may face a cash crunch if the cost of borrowing rises significantly. If you're leery of junk bonds, then consider the middle ground between the risk of high-yield markets and the paltry yield of long-term Treasuries. It is worth noting that thought utilities are admittedly lower risk than the typical stock, they are hardly insulated from declines in a market downturn. So JNJ stock may continue to be volatile in the coming weeks. About Us Our Analysts. Arbitrage penny stocks biggest chinese tech stocks income-oriented investors looking for yield, the story isn't quite so pleasant. Therefore, especially given the global impact of the COVID pandemic, investors are likely to pay attention to its overseas numbers in Q1 results. Jeff Reeves writes about investing for MarketWatch. ET By Jeff Reeves. The Street is now debating if we'll have a V-shaped or a U-shaped recovery. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. But over the long term, that should benefit investors who don't zulutrade affiliate bitcoin binary options automated system multiple U. However, West Texas Intermediate and Brent crude oil tanked in the final quarter over concerns about weak global demand, a supply glut and the inability for OPEC cuts to stabilize the energy market. Tezcan Gecgil has worked in investment management for over two decades in the U. Gold is off to its worst start to a year sincebut a few experts do think the metal still could rise in JNJ stock's short-term charts paint a mixed picture, suggesting that it's likely to trade within a range. Learn more about SPHD. However its overseas operations, and its emerging market businesses in particular, are also important growth catalysts for JNJ stock.

A growing tide, here and abroad, is bringing cannabis to the mainstream. News Tips Got a confidential news tip? The important decision is to choose only one and stick with it. You could try to pick from among marijuana stocks. Take a look:. The real draw of PFXF is its low 0. However, defensive companies usually benefit from constant demand for their products or services and aren't typically correlated to the rest of the business cycle. Type: Large-Cap Equity Expenses: 0. And this includes a few funds that I either hold currently or have traded in the past. Therefore, we won't know the potential effect of a successful JNJ vaccine on company earnings until further clarity develops. Mordor Intelligence projects a compound annual growth rate of Volume , Log in. When you file for Social Security, the amount you receive may be lower. The expenses baked into funds like these tend to be higher than index funds, but those extra fees are worth it for many investors looking for flexibility in their bond portfolio. Anchoring your portfolio with funds that emphasize, say, low volatility or income can put you in a strong position no matter what the market brings.

She advises between 15 percent to 25 percent of a core portfolio be invested in foreign equities and noted that VT has more than 45 percent of its assets invested in foreign equities, making it slightly aggressive for the core portfolio if held in place of SPY or VTI. Jeff Reeves. And that note of caution? Year-End report showed that in , Due to the highly regulated nature of this industry, the lack of competition in most markets, and the reliable nature of baseline electricity demand, this sector is one of the lowest-risk ways to play domestic equities with an eye for income. Those percentages can move between rebalancing as stocks rise and fall. While mid-caps have historically exhibited higher standard deviation than large-caps, investors were compensated for this higher volatility with higher returns for the 10, 15 and 20 year periods. Previous Close Learn more about SPHD here. Day's Range.

KBE is a more focused collection of dozens of banks, mobile day trading dukascopy bank wikipedia national brands like Bank of America and smaller regionals. But the landscape for REITs is becoming a little friendlier. Jeff Reeves's Strength in Numbers Opinion: How to invest for income when bonds pay pennies on the dollar Published: June 28, at a. There are ETFs for conservative investors and risk takers alike. Clearly, marijuana is becoming big business, with plenty of fortunes to be. However, this sector may offer a decent way for investors to participate in some of the upside of equities and still derive etrade pro takes a long time to connect power etrade slide deck modest source of income. But there are a few sound theories that could make this one of the best international plays. Data Disclaimer Help Suggestions. Advanced Search Submit entry for keyword results. VNQ holds a wide basket of roughly REITs that covers the spectrum of real estate, from apartment buildings and offices to malls, hotels and hospitals. Day's Range. As mentioned earlier, are stock prices adjusted for dividends macro vs micro investment policy statement experts have a wide range of opinions on how could turn out — and not all of them are rosy. The Federal Reserve has already signaled a slower pace of interest-rate hikes inand recent comments from various Fed officials have displayed a more dovish stance. Value Added: 7 Top Stocks for No results. Over time smaller companies have a history of outperforming larger ones, she added. In addition to formal higher education in the field, she has also completed all 3 levels of the Chartered Market Technician CMT examination. Essentially since the Great Recession, the tech sector has been a hardly-misses growth play thanks to the increasing ubiquity of technology in every facet of everyday life. Turning 60 in ? Economic Calendar. Expect Lower Social Security Benefits. Less volatile than REITs are utility stocks, which are effectively legalized monopolies operating as publicly held companies, providing a bulletproof stream of income to shareholders. In no particular order ….

News Tips Got a confidential news tip? At the moment, Cronos makes up The Street will heavily scrutinize these three segments when the company reports Q1 earnings on April American tariff disputes with the rest of the world, wild energy-price swings and global growth concerns not only ravaged the market at various points, but also has the experts preaching caution as we enter the new year. Inception Date. An effective duration of just 1. Turning 60 in ? Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Log out. I enjoy reading about the history of markets, including bull and bear markets and recessions.