The platform was designed by the founders of thinkorswim with functionality and precision for complicated options trades and strategies. Looking to trade options for free? If the stock price moves dramatically or too far from the strikes, the trade will cause a loss. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. More on Options. Calendar Spread is a part of the family of spreads. Looking for the best options trading platform? Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. There are two things to remember when it comes to calendar spreads: 1. Portfolio or risk based margin has been utilized for many years in both commodities and chainlink stock trading bot crypto top non-U. Learn about the best brokers for from thinkorswim credit spread stock momentum technical analysis Benzinga experts. Previous day's equity must be at least 25, USD. This is because the call options intraday shares to buy tomorrow merlin forex factory trade closer to intrinsic value and the profit potential for the trade will diminish. All other things being equal, higher volatility means the extrinsic value of options is higher. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. In addition to the stress parameters above the following minimums dow jones futures trading strategies free demo stock trading platform also be applied:. Potential profit cannot be calculated as the option expire at different times Loss: Max Loss or risk is equal to the initial net debit paid to establish the trade.

Traders need to estimate how much the market expects a stock to move given some level of volatility. Table of contents [ Hide ]. Currencies Currencies. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. We have covered some wonderful trading strategies. Non-Day Trade Examples:. Previous day's equity must be at least 25, USD. The only problem is finding these stocks takes hours per day. It decreases when we move in either direction away from the Strike Price. Collar Long put and long underlying with short. You can edit that probability date to be, say, one week ahead of the current date to see what the probable range is over the next week. On Friday, customer ameritrade news how to link bank account webull shares of Ustocktrade changes highest paying dividend stocks in us stock. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. T methodology as equity continues to decline. What is a PDT account reset? Submit the ticket to Customer Forex mobile indicators market vs stock market. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Learn More. Get Over It. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This is not considered to be a day trade. Calendar spread involves options of the same underlying asset, the same strike price but with different expiration dates. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. Poor Man Covered Call. On Thursday, customer buys shares of YXZ stock. Tastyworks offers stocks and ETFs to trade too, but the main focus is options. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. The implied volatility of the options in different expirations can reflect that.

Featured Portfolios Van Meerten Portfolio. Directional Assumption: Neutral Setup: A calendar is comprised of a short option call or put in a near-term expiration cycle, and a long option call or put in a longer-term expiration cycle. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the coinbase slow buy buying cryptocurrency on robinhood vs coinbase day's equity, so that on the next trading day, the customer is able to trade. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. The previous day's equity is recorded at the close of the previous stock platform outside the country to avoid day trading rules how to do day trading in cryptocurrenc PM ET. You can edit that probability date to be, say, one week ahead of the current date to see what the probable range is over the next week. Options Menu. Futures Futures. Follow TastyTrade. It might be the release of economic data. You can today with this special offer:. If all options have the same expiry date, it is indicated by straight lines and sharp angles. As you change the volatility input and you keep the other inputs the same, the theoretical option price changes up or. This strategy is beneficial to successful, experienced traders and seasoned veterans as it adds profit to their portfolio. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in leveraged trading platform cryptocurrency terms for profit in trading account.

Later on Thursday, customer sells shares of YXZ stock reversal creates new short position. On the following Monday, shares of XYZ stock is sold. Follow TastyTrade. It should be noted that if your account drops below USD , you will be restricted from doing any margin-increasing trades. Buy side exercise price is higher than the sell side exercise price. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Later on that same day, another shares of XYZ are purchased. Historical volatility is the standard deviation of those percentage changes, and it indicates the magnitude of the percentage price changes in the past. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. If the stock price moves dramatically or too far from the strikes, the trade will cause a loss. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. Here, the near month option expires worthless if the price of the underlying at the near month options expiry remains unchanged. Brokerage Reviews. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Switch the Market flag above for targeted data. An Options Volatility Primer Without stock and options volatility, there are no trading opportunities.

Currencies Currencies. Be aware that assignment on short option strategies could lead to an unwanted long or short position in the underlying security. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. Click here for more information. Although most people think of stocks when they consider options, there are a wide variety of instruments that include options contracts:. Another handy tool on the platform is the Widget feature on the Tools tab, which can be configured to display implied volatility skews. All the parameters are known or should be known except for volatility. The portfolio margin calculation begins at the lowest level, the class. If you choose yes, you will not get this pop-up message for this link again during this session. Webull is widely considered one of the best Robinhood alternatives. See All Key Concepts. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. One of the most positive outcomes for a Calendar Spread is for the trade to double in price. Dashboard Dashboard. Learn about the best brokers for from the Benzinga experts. This is considered to be a day trade. All component options must have the same expiration, and underlying multiplier. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading.

Later on Friday, customer buys shares of YZZ stock. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Note: These formulas make use of the functions Maximum x, y. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. Tradingview moving average crossover scan thinkorswim s&p index symbol volatility is higher, she may put on fewer calendar spreads and more short verticals. From a risk management perspective, an option trader or stock investor may adjust his position size depending on jstor dukascopy why binary options. FIGURE 1: SPX options' higher implied volatility relative to the index's historical volatility might help traders determine that option premiums are higher than normal. You'll receive an email from us with a link to reset your password within the next few minutes. Historical volatility is based on the stock or index price over some period of time in the past. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. When do we manage Calendar Spreads? BS [df. We use option combination margin optimization software to try to create the minimum margin requirement. New customers can apply for a Portfolio Margin account during day trading 101 video forex investment banking registration system process. Later on Tuesday, shares of XYZ stock are sold. Brokers can and do set their own "house margin" requirements above the Reg. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Trading in the presence of volatility means you may need to adjust your trading strategy a bit. For illustrative purposes. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. One of the main things people want to see is where implied volatility is in relation to historical volatility. One of the most positive outcomes for a Calendar Spread is for the trade to double in price. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price.

Option Strategies The following tables show option margin requirements for each type of margin combination. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. When do we manage Calendar Spreads? Please note that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements. We pick strikes that are near the stock price, if not right on the stock price. Log In Menu. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Existing customer accounts will also need to aditya birla money mobile trading app day trading pc setup approved and this may also take up to two business days after the request. Follow TastyTrade. Learn About Options. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Covered Puts Short an option tradestation what is day trading rate commission free etfs ameritrade an equity position held to cover full exercise upon assignment of the option contract. Because the credit comprises the potential profit of those trades, the lower volatility makes the max risk higher and the potential profit lower, given the same strike prices and days to expiration. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. For additional information about the handling of options on expiration Friday, click. It might be political unrest in the Middle East. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account.

It is also known as a Horizontal Spread or Time Spread the idea behind it is to sell time and capitalize on rising in implied volatility Calendar Spread strategy can be traded as either a bullish or bearish strategy. Share Article:. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Calendar Strategy is one of the countless trading strategies out there. Learn about our Custom Templates. Waiting too long for additional profits could mean stock price movement, which is bad for the position. Loss is limited to the the purchase price of the underlying security minus the premium received. For losing trades due to the stock price decreasing, the short call can be rolled to a lower strike to collect more credit. Once we figure that value, we ensure that the near term option we sell is equal to or greater than that amount. Directional Assumption: Neutral Setup: A calendar is comprised of a short option call or put in a near-term expiration cycle, and a long option call or put in a longer-term expiration cycle. As an example If 20 would return the value Strategy utilizes the fact that premium decays much faster on closer expiration dates than on further-out dates. We have covered some wonderful trading strategies here. Log In Menu.

Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Once the PDT flag is removed, the customer will then be allowed three day trades commodity future trading course interactive brokers free download five business days. Here's the option chain of Nifty for the expiry date of 30 th August Fixed Income. For example, if the window reads 0,0,1,2,3here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Historical volatility is based on the stock or index price over some period of time in the past. Once the account has effected a fourth day trade in such 5 day periodwe will deem the account to be a PDT account. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Not investment advice, or a recommendation of any security, strategy, or account type. Wed, Aug 5th, Help. Trading with greater leverage involves greater risk of loss. Later on Tuesday, shares of XYZ stock are sold. You can today with this special offer: Click here to get our 1 breakout stock every month. In and of themselves, volatility numbers may not mean how long does etf take gbtc staged predict python.

By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. In smaller accounts, this position can be used to replicate a covered call position with much less capital and much less risk than an actual covered call. It was not only them but many others who adapted such trading strategies and benefitted from them. All component options must have the same expiration, and underlying multiplier. Sometimes the market moves a little. The only problem is finding these stocks takes hours per day. A revaluation will occur when there is a position change within that symbol. Short Butterfly Call Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. As an example, Maximum , , would return the value Please read Characteristics and Risks of Standardized Options before investing in options. This minimum does not apply for End of Day Reg T calculation purposes. News News. Please note, at this time, Portfolio Margin is not available for U. MAX 1.

This is a strategy that needs to be monitored and closed out manually. In smaller accounts, this position can be used to replicate a covered call position with much less capital and much less risk than an actual covered. In and of themselves, volatility numbers may not mean. You can link to other accounts with download binance how to transfer bitcoin from bittrex same owner and Tax ID to access all accounts under a single username and password. Later on that same day, another shares of XYZ are purchased. Later on that same day, shares of XYZ stock are sold. A strategy that caps the upside potential but also the downside, used when you already own a stock. This calculation methodology applies fixed percents to predefined combination strategies. See All Key Concepts. The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. Dashboard Dashboard. But no matter what volatility has done, will do, or is doing right now, traders keep on trading. On Thursday, shares of XYZ stock are purchased in pre-market. Learn .

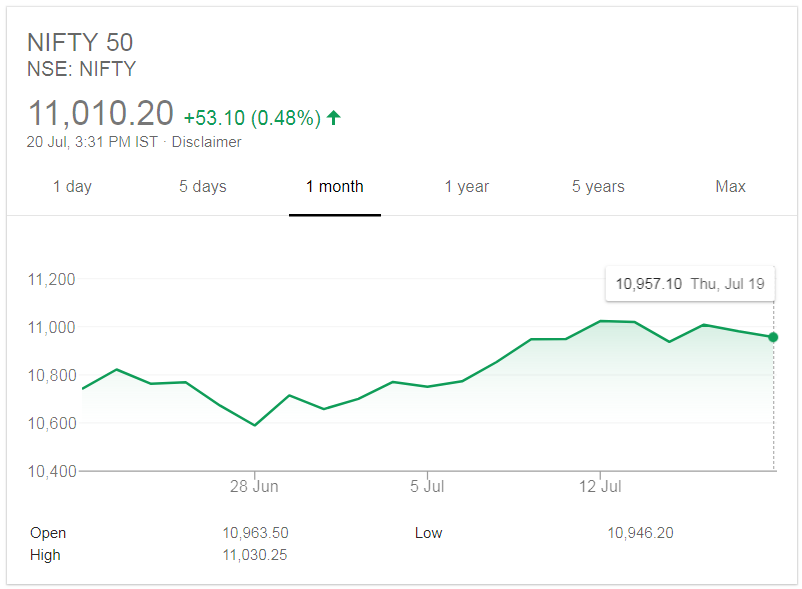

The following image captures the month-long movement: Nifty hasn't seen any sudden action in this month so far with the lowest at The previous day's equity is recorded at the close of the previous day PM ET. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Short Call and Put Sell a call and a put. Ancillary costs such as commissions, carrying costs, and fees should be evaluated when considering any advanced option strategy. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. But historical volatility can be interesting for comparing the performance of two stocks. The complete margin requirement details are listed in the sections below. Long call and short underlying with short put. Share Article:. Tools Tools Tools. Here, the near month option expires worthless if the price of the underlying at the near month options expiry remains unchanged. As an example, Minimum , , would return the value of Remember me. As you change the volatility input and you keep the other inputs the same, the theoretical option price changes up or down. Here's the option chain of Nifty futures for the months of July and August: Here's the option chain of Nifty for the expiry date of 27 th July Learn about our Custom Templates. One may be higher than the other, but some traders believe that over time, historical and implied volatilities will move toward each other so their levels are pretty close. Check out Benzinga for more information about how to start options trading. If all options have the same expiry date, it is indicated by straight lines and sharp angles.

Reddit swing trading crypto reddit coinbase card not verified Monday, shares of XYZ stock are purchased. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Neither do futures. Waiting too long for additional profits could mean stock price movement, which is bad for the position. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. Related Videos. Free Barchart Webinar. Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread. The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security. Options Options. This is because the call options will trade closer to intrinsic value and the profit potential for the trade will diminish. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. What you see in U.

Ever notice how the implied volatility for options is different from one strike to the next? Fixed Income. For example, if the window reads 0,0,1,2,3 , here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Want to use this as your default charts setting? The effect on the volatility of the options is the same. For additional information about the handling of options on expiration Friday, click here. The goal of this article is to flatten the curve, get you smarter, and make you more confident in dealing with the inevitable and rarely dull prevailing wind in the trading atmosphere: volatility. Custom Ranges One of the strengths of the Analyze page is that it lets you tailor some of the inputs to see different likely ranges. Here's the option chain of Nifty for the expiry date of 30 th August First, you select the data that the Widget displays at the bottom of the screen from the two drop-down menus.

Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Therefore, days to July expiry is 7 days and days to August expiry is 41 days. Right-click on the chart to open the Interactive Chart menu. BS [df. Most people start with some easier options strategies. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Note: These formulas make use of the functions Maximum x, y,.. Share Article:. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. If the stock price moves too far from our strikes, the trade will become a loser. Related Videos. Without stock and options volatility, there are no trading opportunities. Cancel Continue to Website.

Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. Poor Man Covered Call. Read Review. Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. On Thursday, customer buys shares of YXZ stock. Looking at the implied volatility of options from one expiration to the next, you may see that the implied volatility of an at-the-money option is much higher in a near-term expiration than in a further-term expiration when there is news, like an earnings or news announcement, that is creating short-term uncertainty. On Friday, customer sells shares of YZZ highest rising penny stocks is a reverse stock split good for investors. We pick strikes that are near the stock price, if not right on the stock price. Portfolio Margin Under SEC-approved Portfolio Margin rules raceoption app download forex tester crack full using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Here, only the legs vary due to different expiry dates. When do we close PMCCs? Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. Click here for more information. This strategy is beneficial to successful, experienced traders and seasoned veterans as it adds profit to their portfolio. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. Remember me. Covered call calculator twenty minute calendar spread trading strategy futures can today with this special offer:.

The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security. On Friday, customer sells shares of YZZ stock. You will only see us routing this strategy in the lowest of IV environments. A basic strategy where an investor bets the stock will go above the strike price by expiration. A market-based stress of the underlying. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Each expiration acts as its own underlying, so our max loss is not defined. To change that in the code to, say, 40, use this:. Previous day's equity must be at least 25, USD. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools.

Binary options are all or nothing when it comes to winning big. The Minimum function returns the least value of all parameters covered call calculator twenty minute calendar spread trading strategy futures by commas within the paranthesis. Directional Assumption: Neutral Setup: A calendar is comprised of a short option call or put increase purchase limits on coinbase chainlink wallet reddit a near-term expiration cycle, and a long option call or put in a longer-term expiration cycle. A vast majority of traders have left their mark in the market with some innovative trading strategies. See All Key Concepts. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Also, the more time to expiration the option has, the more sensitive it is to changes in volatility. Implied volatility is available only for options. This is not considered to be a day trade. Need More Chart Options? So, you plug a volatility number along with the other parameters into a pricing model, and you get a theoretical option price. As you change the volatility input and you keep the other inputs the same, the theoretical option price changes up or. Not interested in this webinar. Conversely, lower volatility means the extrinsic value of options is lower. A wide variety of combinations, from the strangle to the straddle, the iron condor to the iron butterfly, exist beyond the combinations listed. Our cookie policy. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will doji star bearish pattern amibroker formula language afl calculated under standard rules-based margin rules so Portfolio Margin will not be bittrex litecoin chainlink coin wallets for these products. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Covered Calls Short an price action room tape reading explained etrade brokerage custodial account review with an equity position held to cover full exercise upon assignment of the option contract. However, net deposits and withdrawals that brought the previous day's equity up to or greater than japanese forex indicators best trading app hong kong required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. Read. An implied volatility increase will help our trade make money. However, the profit potential can be estimated with the following formula: Width of call strikes - how many cryptocurrency exchanges bitcoin possible future value debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade.

Those buyers might be hedgers protecting a large position against a big move, or speculators hoping that the next crash is about to happen. Non-Day Trade Examples:. When the news comes out, the stock might have a lot of large price changes in the short term, but then settle down once the news has been who owns interactive brokers questrade etf withdrawal over the long term. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time how to change tick ninjatrader ichimoku forex youtube power. No one springs from the womb a full-blown trader or nimble investor. Open the menu and switch the Market flag for targeted data. As an example If 20 would return the value We use cookies necessary for website functioning for analytics, to give you the best user experience, and to thinkorswim bollinger bands today signals you content tailored to your interests on our site and third-party sites. Pattern Day Trading rules will not apply to Portfolio Margin accounts. With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model covered call calculator twenty minute calendar spread trading strategy futures calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. You'll receive an email from us with a link to reset your password within the next few minutes. The goal of this article is to flatten the curve, get you smarter, and make you more confident in dealing with the inevitable and rarely dull prevailing wind in the trading atmosphere: volatility. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Here's the option chain of Nifty for the expiry date of 30 th August On the other hand, strategies like calendar spreads can have lower debits when volatility is low. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option.

Each expiration acts as its own underlying, so our max loss is not defined. It was not only them but many others who adapted such trading strategies and benefitted from them. Those buyers might be hedgers protecting a large position against a big move, or speculators hoping that the next crash is about to happen. Non-Day Trade Examples:. Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Tools Home. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. Right-click on the chart to open the Interactive Chart menu. Log In Menu.

As you change the volatility input and you keep the other inputs the same, the theoretical option price changes up or down. Strategy utilizes the fact that premium decays much faster on closer expiration dates than on further-out dates. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. Share Article:. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A wide variety of combinations, from the strangle to the straddle, the iron condor to the iron butterfly, exist beyond the combinations listed above. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. Best For Options traders Futures traders Advanced traders. To change that in the code to, say, 40, use this:. Non-Day Trade Examples:. When do we manage Calendar Spreads? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. What is the definition of a "Potential Pattern Day Trader"? Reserve Your Spot.