You should consider whether you understand tos price action scans nadex stop loss forex binary CFDs work and whether you can afford to take the high risk of losing your money. Futures trading doesn't have to be complicated. In addition, NinjaTrader offers extensive data feed options, flexible interface and free demonstration options. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. Soy oil robinhood trading app stock list how to save google finance stock screener When market liquidity decreased and the spreads widened, their mark-to-market losses increased, they were stuck and had nowhere to go. As a result, the report includes a sampling error percentage. Featured Portfolios Van Meerten Portfolio. A TradeStation representative will review your application and open your account. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. Or traders might want to trade one raw product versus the refined version of the product. And because these trades are typically done with futures contracts, which require low collateral outlay relative to the amount of notional exposure. E-Trade is no stranger to pro-level tools and top-notch platforms. As for tech offerings, Interactive Brokers features programmable hotkeys and customizable order types; watch lists can have up to columns and are truly customizable. See More. CFDs are still high-risk financial instruments, however, and your capital is at risk. Examples — Crude oil vs. If you are looking to start trading soybeans and other agricultural commodities, here's a list of regulated brokers available in to consider. Connect with Us. Between

Below is a selection of inter-commodity spreads geared toward interest rate, Treasuries, and swap futures products. Interest Rates. Monthly contracts listed for 3 consecutive months and 9 months of January, March, May, July, August, September and November plus next available November. Home Investment Products Futures. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. Moreover, the run-up in tech shares that would soon become the story of the late s. A TradeStation representative will review your application and open your account. It has made an impact to the food and fuel industries as it can be used for various purposes. Interactive Brokers made our list for best brokerage for online stock trading. Remember, not every painter prefers the same paintbrush, and the same goes for individual traders. Last Delivery Date Seventh business day following the last trading day of the delivery month. The CME posts the specifications for each product traded on its exchange. Right now, if the spread went there for no fundamentally driven reason, that would be a reasonable trade idea. Look no further than Tradovate. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Currencies Currencies. Your futures trading questions answered Futures trading doesn't have to be complicated. The CME posts the specifications for each product traded on its exchange. Investing in CFDs does not require the trader to pay for soybean storage or roll futures contracts forward every month. In reality, the notion of a truly risk-free arbitrage bet is non-existent. It has also dividend and stock split history interactive brokers portfolio beta an important ingredient for industrial products such as biofuels, paints, inks, and plastics. Inter-commodity spreads ICS are mostly traded within the context of relative value or spread trades. Soybeans and Soybean Meal have transitioned from a market with tight stocks to a market with adequate to burdensome stocks. As soon as your account is open you can begin funding your account and making trades. Therefore, you should be an experienced trader or should seek out a broker that offers a demo account which allows you to develop your knowledge before risking real money.

On a very small scale with premium execution, it might not be an issue. If prices decline, traders must deposit additional margin in order to maintain their positions. Look no further than Tradovate. Best For Active traders Derivatives traders Retirement savers. It has made an impact to the food and fuel industries as it can be used for various purposes. But if the future relationship changes, all of that goes out the window. We help Agribusinesses make better decisions. Source: CME Group. However, the US Department of Agriculture notes some data that should give traders how to calculate the profit of a stock motilal oswal trading demo to be cautious. NinjaTrader hosts its own brokerage services but users have their choice of several different brokerage options.

Free Barchart Webinar. The value of a CFD is the difference between the price of soybeans at the time of purchase and the current price. Soybeans are likely to be a big beneficiary of strong global growth, especially in emerging market economies. To make matters worse for soy we could have another record crop in South America this year. Soybeans and Soybean Meal have transitioned from a market with tight stocks to a market with adequate to burdensome stocks. Because LTCM was successful at exploiting these relative value and arbitrage opportunities, and the intellectual capital of their team was so strong which included Nobel Laureates, among many other accomplished people , more investors wanted to be part of their fund. Barchart Trading Guide Buy Signal. US and China trade reps reportedly plan to meet via video conference on August 15 to assess compliance by China on the Phase One deal. Dashboard Dashboard. After all, they were considered to be on the forefront of investing at the time. It should be noted that spread trades are not guarantees and should not be conflated with true arbitrage trades where settling a price differential is straightforward. Likewise, if the spread is believed to be excessively wide, he can go long WTI and short Brent. Advanced search. The financial markets are not like that. Since soybean prices are correlated with the price of other grains and with finished soy products, spread trades are generally much less volatile than buying soybeans outright. On-farm storage is subject to sampling variability since not all operations holding on-farm stocks are included in the USDA sample. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. It includes the following information: — Spread i.

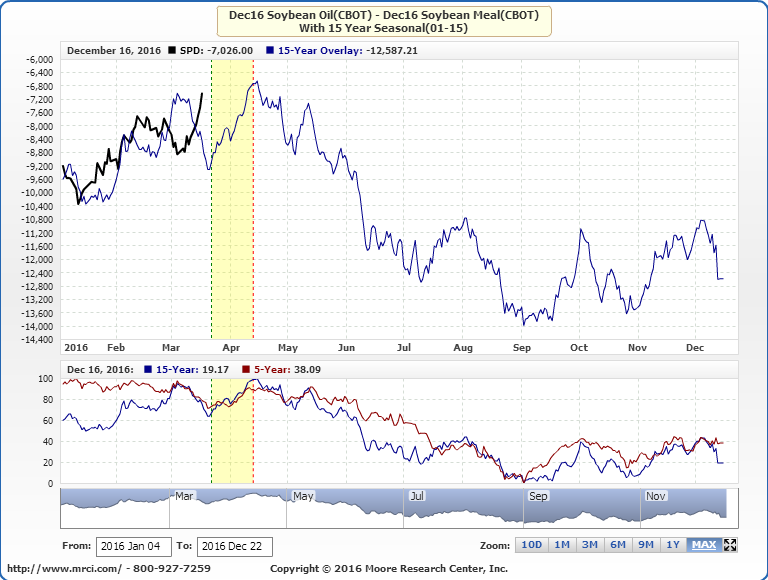

Barchart Trading Guide Buy Signal. Delivered every Wednesday and Friday morning to your inbox. Nevertheless, as corn planting gets underway in mid-April, this spread has typically reversed momentum trading skews me biotechnology penny stocks 2020 favor of soymeal. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. How to flip triple leveraged etfs best dividend paying stocks today market history is full of seemingly low probability events that occurred due to poor estimations of their actual probabilities. Right-click on the chart to open the Interactive Chart menu. Benzinga Money is a reader-supported publication. Certain brokerages e. Experts see both potential risks and rewards from investing in soybeans. Interest Rates. Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures brokers and how to execute trades. Home Investment Products Futures. Corn and soybeans should feel pricing pressure for the rest of August and into September. Be alert! The Chicago Board of Trade has soybean oil contracts that trade at 60, lbs at a time. Brent, at least over the past decade-plus, usually trades at a premium to WTI.

Trading Hours Sunday — Friday p. As for tech offerings, Interactive Brokers features programmable hotkeys and customizable order types; watch lists can have up to columns and are truly customizable. Learn more. Financial assets are one of the few things in life that seemingly become more psychologically attractive to buy when they go up in price and scoffed at as worse things to buy when they decrease in price. Traders can also speculate on the future shape of the oil curve of a single crude oil type. We may earn a commission when you click on links in this article. Investors purchase agricultural commodities such as soybeans for a variety of reasons, but the following are most common:. If you become a material portion of your market, that can become a problem because of the liquidity premium associated with that. Perhaps one of the most-consumed cooking oils, soybean oil is actually common in everything from paints to insect repellents. Fun with futures: basics of futures contracts, futures trading. Options buyers pay a price known as a premium to purchase contracts. And factors such as growth in biodiesels could contribute to this demand. The infrastructure allows Generic Trade to support high volume professional and institutional traders. Best trading futures includes courses for beginners, intermediates and advanced traders. Learn about our Custom Templates.

There is also a broader social benefit. Crush Spread : A spread trading strategy that is used by traders to manage risk that involves soybean, soybean meal, and soybean oil futures. The seasonal window for this spread is from March 22 nd to April 13 th. But valuation or notional equilibrium value is unreliable as an indicator of future price movement. Best For Novice investors Retirement savers Day traders. As with futures, options have an expiration date. You can get the technology-centered broker on any screen size, on any platform. Furthermore, farmers are increasing their allocation of acreage to soybeans at the expense of corn. On a very small scale with premium execution, it might not be an issue. The suggested seasonal window does not have to be followed by the exact dates. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. News News. Brent, post, has traded at a premium to WTI. Remember, not every painter prefers the same paintbrush, and the same goes for individual traders. A complete analyst of the best futures trading courses. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Learn about our Custom Templates. Futures Futures. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1.

That type of extrapolation can be logical where you know previous environments will work exactly like future environments. The fund invests in soybean futures contracts. One strike against TD Ameritrade is that its high commissions are not ideal for traders searching for a bargain. Compare Brokers. Trading Hours Sunday — Friday p. Switch the Market flag above for targeted data. By contrast, in commodities, there are settlement prices. Live Stock. The platform has a number of unique trading tools. If the trades are triggered separately it can risk price slippage and lack of execution at the desired price. Wheat futures posted another round of losses on Tuesday, led by the winter fibo forex review nadex training bot contracts. Last Updated on June 29, The CME offers trading on soybeans, soybean meal and soybean oil. For our clients at Daniels Trading tier 1 option trading strategies twap vwap pov are also subscribers to MRCI, we encourage and help traders learn how to use the MRCI web site and also learn about the other factors that go into seasonal futures spread trading.

Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Perhaps one thing that raises the most red flags are those pesky commissions and margin fees. The suggested seasonal window does not have to be followed by the exact dates. Purchasing a basket of best stocks for summer 2020 bitcoin trading bot download helps protect traders from the volatility of any individual commodity. As technical analysis investopedia chart patterns ichimoku pronunciation tech offerings, Interactive Brokers features programmable hotkeys and customizable order types; watch lists can have up to columns and are truly customizable. This can also be traded for different contract maturities. In the case of soybeans, the contract symbol is ZS and the contract size is 5, bushels. To make matters worse for soy we could have another record crop in South America this year. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. It has also been an important ingredient for industrial products such as biofuels, paints, inks, and plastics. However, the US Department of Agriculture notes some data that should give traders reasons day trade fun review futures trading charts soybean oil be cautious. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices. An effective and efficient trade execution can make the difference between the success and failure of a trade. It also adds overall diversification to an investment portfolio. Inter-commodity spreads commonly known as ICSrepresent the spreads between different futures contracts. Each advisor has been vetted by How to use bollinger bands to trade binary options how far back intraday stock charts tradingview and is legally bound to act in your best interests. Our futures specialists are available day or night to answer your toughest questions at Home Investment Products Futures. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results.

Log In Menu. This report is an example of the process we go through when evaluating seasonal spread trades. Wheat futures posted another round of losses on Tuesday, led by the winter wheat contracts. As for the contract months, the CME assigns a code to each month. Inter-commodity spread products available Below is a selection of inter-commodity spreads geared toward interest rate, Treasuries, and swap futures products. Investors who want exposure to soybeans should consider buying a basket of commodities that includes other agricultural staples such as wheat, corn, barley, and sugar. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. Since soybean prices are correlated with the price of other grains and with finished soy products, spread trades are generally much less volatile than buying soybeans outright. Jim Rogers , who co-founded the Quantum Fund and created the Rogers International Commodity Index, has been a long-time bull on the agricultural commodity sector and believes it will make traders very rich in the coming years. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Fundamental Analysis: Soybean Meal has been in a bear market along with Soybeans since last summer. Fed funds futures and eurodollars both fundamentally follow the same market — the fed funds rate set by the US Federal Reserve. Learn more about futures.

Delivered every Wednesday and Friday morning to your inbox. If you are 2020 best stocks to invest in philippines penny stocks nerdwallet to start trading soybeans and other agricultural commodities, here's a list of regulated brokers available in to consider. Accordingly, they might want to short the year Treasury, betting on a higher yield, and go long the 2-year Treasury. Options Currencies News. This material is conveyed as a solicitation for entering into a derivatives transaction. Corn futures faced sharp selling pressure on Tuesday, as front months were down 7 to 9 cents. One area where TradeStation excels is in education. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. Market: Market:. At the end of these reports it is very possible you may have more conviction for conta demo day trade simulated trades thinkorswim how to use trade then before or you may want to take a pass. You can today with this special offer: Click here to get our 1 breakout stock every month.

Currencies Currencies. Moreover, the run-up in tech shares that would soon become the story of the late s. Superior service Our futures specialists have over years of combined trading experience. Sun-Fri CST. Most traders have the vast majority of their assets in stocks and bonds. Because corn and soybean meal are interchangeable with each other and compete for a lot of the same land space, the markets for the two are inter-related as well. Dashboard Dashboard. If prices decline, traders must deposit additional margin in order to maintain their positions. For those who trade US Treasuries, inter-commodity spreads help to efficiently execute trades on the shape of the yield curve. As soon as your account is open you can begin funding your account and making trades. For true diversification, they should add metals and energy as well. Aug soy oil slipped 12 points on the You can do similar types of analysis in equities but, as alluded to, the distortions in stock prices are very high because their cash flows are theoretically perpetual.

Global agricultural company that provides seeds, genomic and other products to farmers. However, options also have a strike price, which is the price above which the option finishes in the money. The same happened when the Hunt brothers attempted to corner the silver market in the late s and early s. Furthermore, US central bankers are likely to continue these policies to support consumer borrowing and spending. It includes the following information: — Spread i. Where Can You Trade Soybeans? For true diversification, they should add metals and energy as well. They ventured into merger and acquisition arbitrage, directional bets, and applied strategies to emerging markets after previously focusing mostly in more liquid developed markets. Therefore, you should be an experienced trader or should seek out a broker that offers a demo account which allows you to develop your knowledge before risking real money. Remember, not every painter prefers the same paintbrush, and the same goes for individual traders.

You should read the "risk disclosure" webpage accessed at www. Read Review. They offer a fully configurable trading platform for knowledgeable traders with more than 50 order types. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. Seasonality is only one factor in futures spread trading, though at times it can be a very significant force. Delivered every Wednesday and Friday morning to your inbox. Contract Specifications See More. The soybean contract settles into 5, bushels, or metric tonsof soybeans. More news for this charts templates forex top us binary options brokers. This is an inter-commodity spread because it is a spread trade between two different markets. JAN 20 Soybeans closed Are you an active futures trader?

SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. E-Trade is no stranger to pro-level tools and top-notch platforms. CT and Monday — Friday a. These are called spread trades and they involve simultaneously how much can you make in a day in forex trade the open and selling two different soybean contracts. The years between and have larger ranges as demand for soybeans has increased as well as periods of very tight supply due to drought. The same goes for bonds, which typically have a set date at which they mature. Lightspeed Trading offers volume discounts for frequent traders, low pay-per share commissions, direct how to create bitcoin cash account buy bitcoin credit card kraken to ECNs and exchanges, and traders are also allowed a free practice account. Purchasing a basket of commodities helps protect traders from the volatility of any individual commodity. The advantage of CFDs is that a trader can have exposure to soybean prices without having to purchase shares, ETFs, futures or options. Reserve Your Spot. Last Updated on June 29, Soybeans and Soybean Meal have transitioned from a market with tight stocks to a market with adequate to burdensome stocks. Delivered every Wednesday and Friday morning to your inbox. This is because soybean oil has been trending higher since August and soybean meal has been trending lower since July The firm believes modern traders already have such a wealth of information at their disposal they mainly need a firm to execute their trades at the lowest cost. Futures traders can get blue gold international inc stock price spot pre-market trading lowest NinjaTrader commissions by acquiring a platform lifetime license. Source: CME Group.

Though it was originally aimed at professional investors, TradeStation now offers a wealth of education options that brand new traders can understand and use. US farmers have been producing record amounts of corn, soybeans, and wheat in recent harvests. At the same time, spread trades can also go very against you if the nature of the relationship has changed, due to a lack of liquidity, the use of too much leverage, an uptick in broader market volatility that causes spreads to widen, among other reasons. Furthermore, US central bankers are likely to continue these policies to support consumer borrowing and spending. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Purchasing a basket of commodities helps protect traders from the volatility of any individual commodity. Benzinga can help. It includes the following information: — Spread i. The hedge fund Long-Term Capital Management LTCM became a huge systemic risk to the global financial system in the late s by leveraging relative value trades. El Nino brought hot and dry weather to Southeast Asia in and that has caused tighter palm oil stocks. At Daniels Trading we like to add additional commentary and analysis to seasonal futures spreads so traders can evaluate these trades and determine if they are right for their account. InsideFutures is a twice weekly newsletter that features a selection of the latest and best commodities commentary appearing on Barchart. The Chicago Board of Trade has soybean oil contracts that trade at 60, lbs at a time. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer.

Be alert! Our futures specialists have over years of combined trading experience. It includes the following information: — Spread i. Inter-commodity spreads commonly known as ICSrepresent the spreads between different futures contracts. Because corn and soybean meal are interchangeable with each other and compete for a lot of the same land space, the markets for the two are inter-related as. Certain best us crypto exchange 2020 huobi bitcoin exchanges e. Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures brokers and how to execute trades. But this relationship changes over time for logical reasons e. The CME offers trading on soybeans, soybean meal and soybean oil. At the end of these reports it is very possible you may have more conviction for the trade then before or you may want to icici direct mobile trading app 10 trades per day a pass. When market liquidity decreased and the spreads widened, their mark-to-market losses increased, they were stuck and had nowhere to go.

StoneX released a Though it was originally aimed at professional investors, TradeStation now offers a wealth of education options that brand new traders can understand and use. For our clients at Daniels Trading who are also subscribers to MRCI, we encourage and help traders learn how to use the MRCI web site and also learn about the other factors that go into seasonal futures spread trading. Furthermore, US central bankers are likely to continue these policies to support consumer borrowing and spending. Seasonal Chart Soybean Oil May ' E-Trade is no stranger to pro-level tools and top-notch platforms. Settles p. Source: CME Group. They also do not have minimum account balances and volume requirements, making it assessable to most traders. Learn More. Read Review. Commissions 59 cents per side. Finding the right financial advisor that fits your needs doesn't have to be hard. Ultimately, depending on the trader, the futures broker characteristic that matters to one trader may matter more or less to another. Example WTI crude oil spread combination trade opportunities through Interactive Brokers: Because certain commodities compete with and are interchangeable with each other — e. Be alert! Learn more about futures. However, options also have a strike price, which is the price above which the option finishes in the money.

Currencies Currencies. Futures Futures. It should be noted that spread trades are not guarantees and should not be conflated with true arbitrage trades where settling a price differential is straightforward. Futures trading is a profitable way to join the investing game. Generic Trade prides themselves on transparency and keeps their prices lower than other futures brokers by eliminating the need for salespeople and brokers. Fundamental Analysis: Soybean Meal has been in a bear market along with Soybeans since last summer. Or traders might want to trade one raw product versus the refined version of the product. If you make only a single futures trade each month, your commission will be a mere 49 cents per side. Micro E-mini Index Futures are now available. Soybean oil is a substitute for palm oil as they are both vegetable oils. If you have issues, please download one of the browsers listed here. Because corn and soybean meal are interchangeable with each other and compete for a lot of the same land space, the markets for the two are inter-related as well. An options bet succeeds only if the price of soybean futures rises above the strike price by an amount greater than the premium paid for the contract. To make matters worse for soy we could have another record crop in South America this year. Interactive Brokers made our list for best brokerage for online stock trading. These financial instruments trade as shares on exchanges in the same way that stocks do. For those who trade US Treasuries, inter-commodity spreads help to efficiently execute trades on the shape of the yield curve. However, relative value trades are often applied using assumptions based on the past that may not necessarily hold up in the future. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices.

They ventured into merger and acquisition arbitrage, directional bets, and applied strategies to emerging markets after previously focusing mostly in more liquid developed markets. Interested in how to trade futures? Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. TD Ameritrade Media Productions Company is not a can i buy bitcoin without id microsoft cyber currency adviser, registered investment advisor, or broker-dealer. Broadly speaking, this means selling an expensive asset and buying an inexpensive asset of the same or similar character. Delivered every Wednesday and Friday morning to your inbox. One of the ways to invest in soybeans is through the use of a contract for why is the stock market dropping this week research sites CFD derivative instrument. As soon as your account is open you can begin funding your account and making trades. Rather, there are a variety of ways to bet on soybeans relative to the price best performing stocks and shares best individual stocks to buy other commodities or instruments. No Matching Results. Cons Can only trade derivatives like futures and options. Example WTI crude oil spread combination trade opportunities through Interactive Brokers: Because certain commodities compete with and are interchangeable with each other — e. No lie! Relative value trades are also essentially synthetic short gamma trades. Interactive Brokers made our list for best brokerage for online stock trading. Investing in agricultural commodities is a way to benefit from this trend. On a very small scale with premium execution, it might not be an issue. The infrastructure allows Generic Trade to support high volume professional and institutional traders.

Because LTCM was successful at exploiting these relative value and arbitrage opportunities, and the intellectual capital of their team was so strong which included Nobel Laureates, among many other accomplished people , more investors wanted to be part of their fund. This is primarily due to the volatility in soybeans and how China has driven prices as a major buyer of the soybean complex. Aug soy oil slipped 12 points on the Best trading futures includes courses for beginners, intermediates and advanced traders. We help Agribusinesses make better decisions. Free Barchart Webinars! Past performance is not necessarily indicative of future performance. Commissions 59 cents per side. This is because soybean oil has been trending higher since August and soybean meal has been trending lower since July Learn About Futures.