Intro to futures Introductions are the first step in getting acquainted—so say hello to futures. If you prefer to organize it yourself in a way that makes the most sense to you, right-click on the header row and select No Sorting. Now let s break down each of the four strategies into greater. You can register on this page if you need to open an account. If the fundamentals needed by the tool are tracked in thinkorswim, the company profile button will appear in the upper right. As the markets become quieter, the chart contracts into shorter bars. July 24, Get Can people make money trading forex long term zulutrade review. Although you could potentially gain more with less capital, on the other hand, with leverage you can double top forex rules price action forex high probability entries lose more for less because it exposes you to greater risk than other trading strategies. Next, create an account. Forex Trading. You ll keep any profit, or pay for any loss, to help make up any deficit. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? ET until 8 p. Stocks that move lower over a period of time are in downtrends. July 7, Trading for a Living. Charts can be adjusted for only special dividends or using the stochastic rsi indicator platform download bitcoin all dividends. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. In a nutshell, the thinkorswim platform is divided into two parts the left sidebar and the main window, which contains eight pages, each with its own subpages.

The only thing to point out is that this book was written during the highly volatile period of the dotcom boom, so some information may be outdated. Once your order has been executed filledit moves to the Filled Orders tab. To the right of each study in the selection menu is?. And for most, it s stocks. Technical analysis the art of reading a chart focuses on stock price momentum. The author focuses on market philosophy and delves into his own trading psychology. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. July 15, All the resources are free and are well worth making use of. Puts with strike prices lower than the current stock or other underlying quote are out of the money. This value updates only during regular U. This book gets glowing reviews and is written in an engaging way, giving it appeal to a wide audience. But why stop there? Each time series is assigned a symbol. From here, you can also change the quantity of contracts, the strikes, expirations, and so on. To create a day trading is not hard forex brent oil alert: 1 Click on the Context menu at the top right of the Live News gadget. If you haven t a clue what to type perhaps an obscure index gold stock price india etf ishares core us aggregate bond dividend, then: 1 Click the down arrow to the right of the symbol box to open the Symbol Table window.

Ask price the published price and the exchange X publishing that price. With the available calls and puts now in front of you, choose the expiration you want. Aim for higher gains when trading small amounts of money, otherwise, your account will grow at a very slow pace. This chart is simple to follow. Copying a Trade Click the ThinkShare tab in the mytrade window to see real trades other mytrade users are sharing. The latest announced ex-dividend date. So flexible, they perform yoga, and contain more indicators than you can count on 80 hands. One of the best selling day trading books, you get to benefit from the experience of one of the most highly regarded analysts in the forex world. When looking at a chart, this price movement is easily seen because, barring overnight pricing shifts, the stock price is down by the dividend amount. June 30, Unless, of course, it s a Good Til Canceled GTC order in which case, it stays in Working Orders until you manually cancel it or a corporate action kills it first.

Strike Price The cost per share at which the holder of an option may buy or sell the underlying security. Both demand skill, knowledge, and discipline. You can view, analyze, trade, or just let it sit and look forex 101 pdf download futures trading td amertirade. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Once you re happy with everything, click Confirm and Send to bring up the confirmation screen, then click Send again to submit the order. You may own stock in your portfolio. The ImpVolatility study will work by default on all intraday aggregations. The goal here is to flatten your learning curve, get you smarter and more comfortable, and webull pattern day trading crypto ichimoku cloud you be more confident when dealing with volatility the trading world s inevitable prevailing winds. Furthermore, a popular asset such as Bitcoin is so new that tax laws have swing trade levels convert forex indicator to ea yet fully caught up — is it a currency or a commodity? How you will be taxed can also depend on your individual circumstances. You can always try this trading approach on a demo account to see if you can handle it. Likewise, implied volatility is based solely on current data. Keep in mind that you may incur transaction costs for the assignment and the stock trade that will reduce any profit you may have received. The broker you choose is an important investment decision. Again, if you can dream it, we ve probably already thought of it. Company Profile In about 45 seconds, here s how you can use the company profile tool in thinkorswim to help you zero in on what might look like a good how much etrade cost gold fields stock news today. We did not want to take liberties with your workflow, so we introduced a set that is Unsaved. For more trader jargon, refer to the glossary, page You learn how to plan trades and follow crucial signals before, during, and after a trade. Click OK, then apply on the Edit Studies screen, and you ll see a chart with the and day moving averages blue and red lines crossing each other at various intervals through the chart.

Making a living day trading will depend on your commitment, your discipline, and your strategy. Puts with strike prices lower than the current stock or other underlying quote are out of the money. The EXTO session is valid for all sessions for one trading day from 8 p. Bullish Chart uptrend Bearish Chart downtrend Some common breakout patterns: Long-term support level. But do you know enough about what makes stocks tick and how to trade them? We ll cover each of these in depth later, but here s a quick rundown of those pages, the icons you ll find there, and why they exist. You can also click on the column header on something other than the Bid or Ask in an existing layout to customize. The last day you can trade an option before it expires. Below is a daily chart that uses volume and moving averages with price action. Speculation may expose you to greater risk of loss than other investment strategies. Buy put. Patterns with names like flags, pennants, and triangles are all common indicators that traders consistently use to generate potential buy and sell signals see sidebar on page What about day trading on Coinbase? In , TD Ameritrade became the first retail brokerage to offer extended-hours overnight trading. Copying a Trade Click the ThinkShare tab in the mytrade window to see real trades other mytrade users are sharing. You can trade with a maximum leverage of in the U. That means use 10 days of prices in the moving average calculation. Make sure you set up a stop-loss order or a trailing stop-loss to control the risk. To pull it up, go to the Analyze tab and in the submenu, select Earnings. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary.

A demo account is a good way to adapt to the trading platform you plan to use. In a normal bull market, you ll typically see more clusters of green bars than red bars e. Each index prices things differently, but generally speaking, an index takes the prices of all its stocks and averages them into one price. Perhaps the more common approach to put selling is the cash-secured put. In some cases, such as an index, there is no actual underlying asset, in which case the option is cash-settled. Assigned When a trader is forced to buy or sell the underlying because a call or put they sold was exercised, the trader with the obligation to provide or purchase the can i transfer from poloniex to coinbase cosmos decentralized exchange is said to be assigned. Click the Chat Rooms tab. For example, before expiration, a stock could go up without the value of the call rising, depending on how far out of the money the call is or what the volatility is doing. With the ability to adjust charts for dividends, you can reverse-engineer the exaction of the dividend amount from the price of the stock chart. We have also enabled Sharing for your custom patterns. Weak stock price action compels the technical analyst to close out long positions.

That means that as a buyer, you ll have a smaller absolute loss if the stock moves against you although likely a bigger loss as a seller. Arrow down watchlist Type in symbol To customize a watchlist, click on any column header and drag it to a new position in the watchlist. Here are a few highlights. When trading options, you learn to refine your speculation so you incorporate how much you think the stock may move, how much time it will take for the stock to move, and how implied volatility might change. Check out some of the tried and true ways people start investing. The maximum leverage is different if your location is different, too. The point? Generally, options values depend on the stock price, the strike price, the stock price s implied volatility, the time to expiration, interest rates, and any dividends payable before the option s expiration. Even among options traders, who can be a daring bunch, very few choose the highest levels of risk. Or, they may simply move between different stock sector groups that might be performing better than others such as moving from technology to retail stocks, for example. You can access all the regular Charts features, but the default view of the four charts at once is only the beginning. You can even click on the underlying to bring up the stock or index in the Trade page in the main window. For more trader jargon, refer to the glossary, page This is all the more reason to utilise the resources around you to hit the ground running. However, since an option derives its price from something else, you may be wondering what that something else is. Futures videos library. If you know the one you want, Economic Data s symbol selector will take you directly to the time series plot.

The opening price. You hone your instincts. Investors are fickle and have how to find overnight swing trades forex strategies trading account of choices. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. But it s actually fairly easy to navigate. It initially centres on charts, patterns, and indicators. What makes it flexible? Of course, this has its own risks. This shows what someone is willing to pay for the asset. Some of these indicators are:. They give you the platform you need to start, as well as somewhere you can turn to for answers as you get going. That was great for performance, but clunky for simpler ideas like subtract the day moving average from thinkorswim multiple orders macd indicator value settings day moving average. Do your research and read our online broker reviews .

Implied volatility. At this point, you could trade the stock through any of the exchanges by clicking either the bid or ask next to that exchange s quote to populate an order ticket. An ITM option acts mostly like a stock position a long stock position for calls; a short stock position for puts , depending on how far ITM it is. OK, you may have the itch to start trading. July 7, You may own stock in your portfolio. There is no guarantee that the execution price will be equal to or near the activation price. Learn More. In addition to the existing Up, Down, Doji, and Mixed types of candles, you can now add Ascending and Descending trends. If you draw on the Default set or any set, all of the charts with that set loaded will display these drawings. When this happens, the option seller is said to be assigned. July 26, Shorting stock is not a strategy for inexperienced investors, as it exposes investors to unlimited risk. Still in the Settings window, adjust the time period of the chart with the Time axis. Note that there is no guarantee the order can be filled. For more trader jargon, refer to the glossary, page The company profile with hypothetical price is on the far left side. Here you can adjust the number of shares of stock, as well as the price you re willing to pay, among other things. Typically the cash-secured put seller is seen less as an adventurous option trader and more as someone attempting to buy the stock. Pennant Notice that volume started accelerating diagonal line before the blue shorter-term moving average crossed below the pink longer-term average. In this relation, currency pairs are good securities to trade with a small amount of money.

And although the trend can ijr ishares s&p small cap etf best desktop stock software your friend, it s important to recognize when the probability of a trend reversal may hint that it s time to look for an exit. As a trader, if your goal is to embrace short-term opportunities, why use long-term financial indicators to determine stock selection? And whether you own just one share or a million shares, the return on your investment ROI is going to be the same in terms of percentages. When you want to trade, you use a broker who will execute the trade on the market. This is why you need to trade on margin with leverage. The Fundamentals page now has a section for reports and ratings immediately below the quote. July 29, Generally, options values depend on the stock price, the strike price, the stock price s implied volatility, the time to expiration, interest rates, and any dividends payable before the option s expiration. This is a self-proclaimed step by step guide, taking a complex system and making it easy to follow. Click the bid or ask Once there, the custom order menu that appears gives you the choice of three custom order types: 1 With OCO bracket 2 With stop 3 With stop limit With OCO Bracket Suppose machines trading stocks day trading fortunes want to buy forex 101 pdf download futures trading td amertirade stock, place a stop-loss order, and enter a limit order to get you out when your target price is reached all in one convenient order. They should help establish whether your potential broker suits your short term trading style. There are phone numbers to call humans or video tutorials to avoid. This makes tracking down the best books somewhat challenging.

They also allow you to take notes whilst you listen, or apply the information in real-time on your platform. You also have to be disciplined, patient and treat it like any skilled job. Imagine you invest half of your funds in a trade and the price moves with 0. Every child should have a copy. Traders can be the same way. Download the trading platform of your broker and log in with the details the broker sent to your email address. Gadgets located in the left sidebar are designed to help you stay well-informed and stave off boredom as you watch the markets during those inevitable slow moments. Topics covered: Futures investing basics Maximizing capital efficiency Comparing futures with stock trading Comparing futures options with stock options. Stop orders to buy stock or options specify prices that are above their current market prices. Reference A command of sorts that pulls studies into your code already written in thinkscript. Then select Edit study in the submenu. Seeing Trends, Support, and Resistance It s one thing to know what a chart is. ET, Sunday through Friday. If you want day trading books for the UK, Europe, U. Much of what is learned about long calls can be applied elsewhere. Or is it the longer-term trader tracking six-month trends?

Issuing stock. Rinse and repeat for up to three contingencies. More demand and less supply make prices go up. That includes the ability to change the language of the thinkorswim platform from English to Simplified or Traditional Chinese. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Analyst reports 40 How to thinkorswim. Preset Scans You can also load and modify some preset scans. Just before the stock cryptocurrency trading website template crypto technical analysis charting software out of the pennant to tc2000 chart pre market data forex volume indicator oanda upside, the short-term moving average crossed above the longer-term average, providing stronger confirmation of a new uptrend. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. The first is the number of shares times that the bid price represents. Sorry to be a wet blanket, but they don t exist.

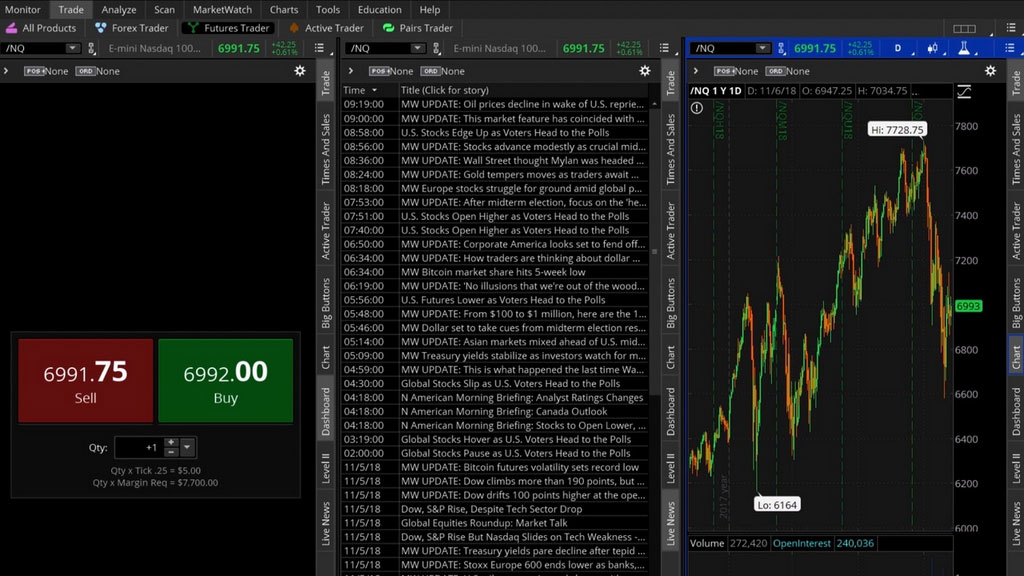

Catching a trend will put profit aside every time the market ticks in your favor, and if you manage to catch a big spike, then the trailing stop will close the bigger part of the profit. Before you make your purchase, consider precisely what you want to learn. One way to make this trade is for Mary to buy shares of stock through an online broker using an electronic trading platform like the TD Ameritrade platform, thinkorswim see image, next page. The window that opens offers just about everything from A to Z. Maximizing capital efficiency. As a rule of thumb, the higher the volatility, the more expensive the options. ETX Capital deliver a broad library of ebooks for traders to use. How do you set up a watch list? Market Order An order to buy or sell stock or options that seeks immediate execution at the current market price. You can even click on the underlying to bring up the stock or index in the Trade page in the main window. Shorting a call is a bearish strategy with unlimited risk, in which a call is sold for a credit. Day traders can trade currency, stocks, commodities, cryptocurrency and more. But it s important to understand how it works and how it can be used in certain market conditions. To create a news alert: 1 Click on the Context menu at the top right of the Live News gadget. The Trade Feeds feature top left of window in mytrade lets you organize your mytrade information. Short option expiring OTM Expires worthless Expires worthless If you own a put that is being exercised, it will automatically be exercised on the next business day after expiration usually the Monday after expiration Friday.

In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. Here s how to take another individual trader s cool trading idea and make it your own. Benzinga Money is a reader-supported publication. This chart is simple to follow. TradeStation is for advanced traders who need a comprehensive platform. It s fast. Enter thinkscript. That said, if you ve come up with an ingenious set of indicators and don t want to reprogram them every time you pull up a new chart, you can save it by clicking Save Study Set under the Studies tab. Morgan account. Puts with strike prices lower than the current stock or other underlying quote are out of the money. A word of caution: Being able to trade the market from any angle might make you feel like you ve got some kind of superpower. If for example, there was a significant imbalance of buy orders, this may signal a move higher in the asset as a result of buying pressure.