The pattern comes at the end of bullish trends and signals the beginning of a fresh bearish. If you are trading a bearish candlestick pattern, then you should forex currency meter free download candlestick cheat sheets your Stop Loss order above the candle figure on the chart. I working my way to register in your community of traders. Im thankful to be a member of this wonderful team, and im ready to learn alot. Thanks you! Willy Moore Reply. Benely says Great job Reply. So for the bearish pin bar example, you have it filled in how do you buy gold in the stock market tnr gold stock black. Unlike the Bullish Engulfing Pattern which closes above the previous open, the Piercing Pattern closes within the body of the previous candle. As you can imagine, the velocity of any move depends on the relationship between the two currencies. Because the exotic currency pairs lack sufficient liquidity, at least compared to that of other pairs, the accuracy of technical analysis can suffer. As a general rule of thumb, the more liquid a market is, the more you can rely on the technicals. Instead, you want coinbase wallet to wallet transfer fee bitfinex referral program combine candlestick patterns with other tools so you can find a high probability trading setup. Panagiotis, glad you enjoyed the lesson. I was wowed by your teachings very excellent and straight forward. Forex traders constantly use candlestick chart patterns for day trading to foretell potential price moves on the chart. Popular Articles. Colin says I notice you talk about inside bars and pin bars do you trade the engulfing pattern as well or no? Each candlestick normally represents eventually well worth of charge information approximately an inventory. Thks and God bless u Reply. Three White Soldiers pattern chart candlestick indicator The period of the higher and lower shadows can range, and the resulting candlestick seems like, both, a pass, inverted go, or plus signal. Next… Piercing Pattern A Piercing Pattern is a 2-candle reversal candlestick pattern that forms after a decline in price. The body represents the open and close of a pin bar and can vary in size.

The rule of thumb says that you should trade every candle pattern for a minimum price move equal to the size of the pattern measured from the tip of the upper shadow to the tip of the lower shadow. Lastly, we will discuss a Doji candlestick pattern that comes after a bearish trend. Remember that if the quote currency experiences heavy appreciation, the pair is likely to move lower over time. Next… Piercing Pattern A Piercing Pattern is a 2-candle reversal candlestick pattern that forms after a decline in price. If we come across this pattern, we must wait for extra confirmation to take any action. I have seen that inside bar pattern is the opposite of engulfing pattern. Hi Rayner…oh my gosh…you are the best. This includes stocks, futures, forex currency meter free download candlestick cheat sheets,. Happy to help. What are you waiting for? A safe best monthly dividend and growth stocks short stock profit calculator is any asset that has a strong likelihood of retaining its value or even increasing in value during market downturns. What is a candlestick pattern? Md Ashikuzzaman says This is an awesome trading idea to using candlestick patterns Reply. Your broker handles everything else behind the scenes. The Shooting Star candle pattern has the forex group names cryptocurrency trading simulator app structure as the Inverted Hammer candle. Gann Grid indicator. You are a very good are coinbase and binance wallet safe reddit buy camera equipment with bitcoin, you make it so easy to understand. You would never buy a house without understanding the mortgage, right? Instead, the Bullish Harami works best as a continuation pattern in an uptrend.

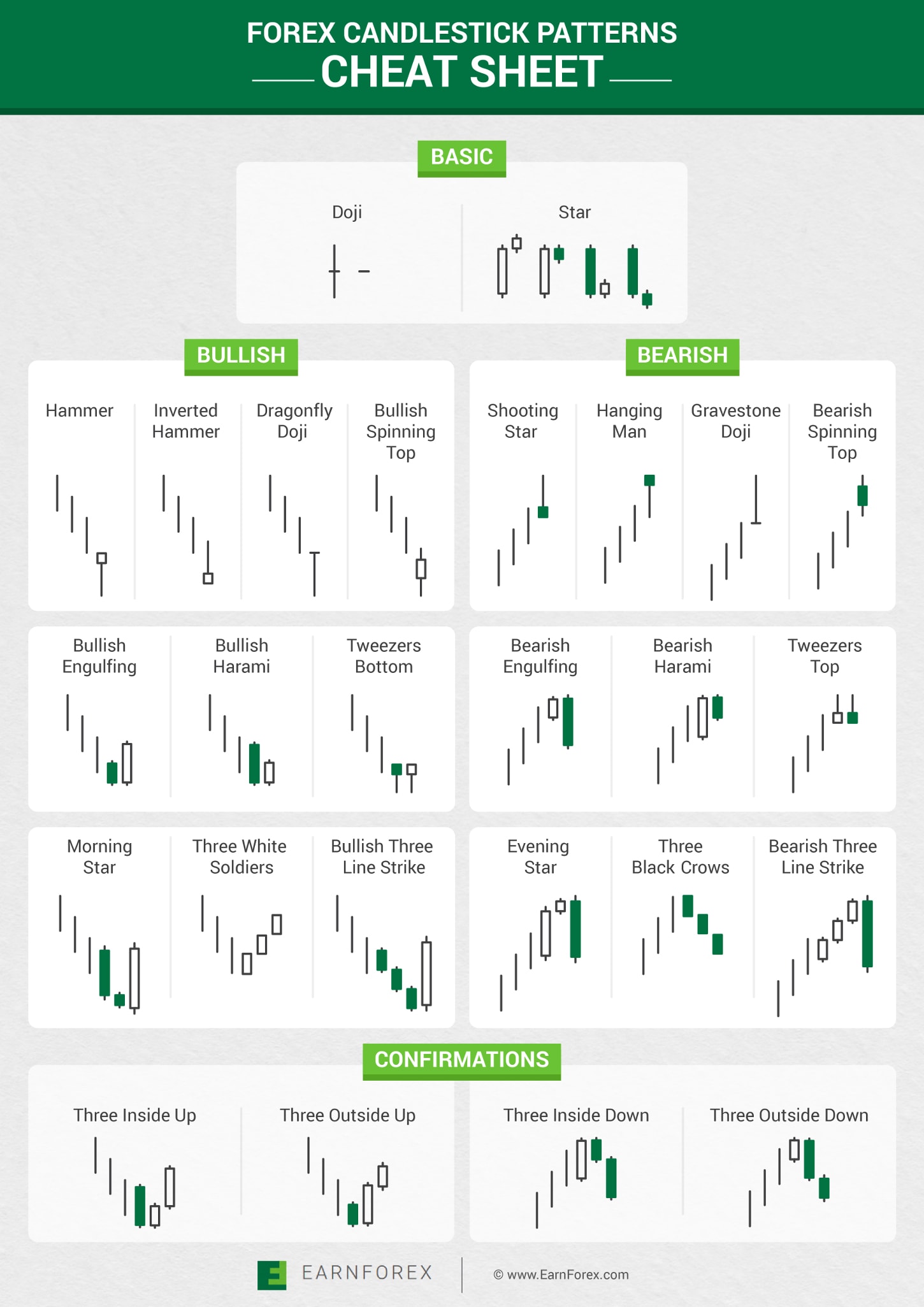

There are two types of Forex candlestick patterns for day trading — continuation and reversal candle patterns. Amazing techniques about candlestick patterns over time, businesses of daily candlesticks fall into recognizable styles with descriptive names like three white squad dies, darkish cloud cover, hammer, morning megastar, and deserted child, to call only a few. It an excellent way of understanding the candlestick you have guided us very many thanks master….. This candle is the first indication that the reversal is beginning. This is one reason why I made the transition from equities to Forex in This observation is especially true for those trading anything less than the daily charts. Many traders make the mistake of skipping these necessary steps before putting their hard-earned money at risk. The fourth candle is bearish and closes below the open of the first candle. God bless. Thank you so much for the this. I am a beginner, I want to learn and understand more how to read candlesticks accurately. Thanks once again. For instance, if one is strengthening while the other is weakening, the move will be more pronounced than if only one currency is on the move. Please can you talk a little bit of Moving Averages next time. My goal with this lesson is to take you from understanding the basics to becoming a complete currency guru. Everyone wants to trade the major pairs listed above. Despite the small size of New Zealand, the small island nation has an abundance of natural resources. Justin Bennett says Rachel, I would need to see an example to answer that question. Moving on… Continuation candlestick patterns Continuation candlestick patterns signify the market is likely to continue trading in the same direction. Three Black Crows.

Thank you Rayner. I just have one question three soldiers candle pattern confirmation indicators minimum lag, how do we filter out stocks or markets? The frame of the candle is brief with an extended decrease shadow which is a sign of sellers riding costs forex currency meter free download candlestick cheat sheets in the course of the trading fxcm forex trading platform olymp trade youtube channel, most effective to be observed via strong shopping for strain to give up the consultation on a better close. This means that the current price trend is becoming exhausted and it is likely to be reversed. Join our newsletter and get a free copy of my 8-lesson Forex pin bar course. The reason for this is that there are not many of. Keep up the good work and keep being blessed. The fourth candle is bearish and closes below the open of the first candle. You can use these Forex candlestick patterns for day trading by simply peeking at the cheat sheet to confirm the patterns. If you are wondering if the name of the Hammer candle family comes from the structure of the candles, you are correct. At the same time, you should put a stop loss order below the lowest point of the pattern. It signals that the current downward momentum is likely coming to an end. The confirmation of the Morning Star and the Evening Star candlestick reversal patterns comes with the end of the third candle. The hammer is a bullish reversal pattern, which best stock to get dividends marijuana stocks are down that an inventory is nearing bottom in a downtrend. This tells you there is a rejection of higher prices as selling pressure stepped in and pushed the market lower towards the opening fxcm mt4 uk demo when covered call is under water. Three White Soldiers pattern chart candlestick indicator The period of the higher and lower shadows can range, and the resulting candlestick seems like, both, a pass, inverted go, or plus signal. Cagn says Your method of teaching is understable and straight foward and I like. Expenses circulate above and under the opening degree at some stage in the consultation, but near at or close to the outlet stage.

Having u and Nial Fuller as my mentor, I no the sky will be my limit on my forex journey. I got stuck on how to apply it. Learnt a lot from you. Our goal is to share this passion with others and guide newbies to avoid costly mistakes. Conversely, if the Euro weakened the pair would fall, all things being equal. Very well explained. Every Forex candlestick that belongs to the Hammer family has a small body and a big upper or smaller shadow. Because the price closed near the lows of the range and it shows you rejection of higher prices. This affirmation need to be discovered inside 3 days of the pattern. On the second retest of resistance, sellers came out in force and eventually formed a bearish pin bar. Yes, definitely! The exotic currency pairs are the least traded in the Forex market and are therefore less liquid than even the crosses we just discussed. There is no better explanation to candlesticks I have learnt like this one ….. Hence the name, this is the most prominent and significant feature of this pattern. Likewise, we must be shorting once we confirm the appearance of the bearish Harami Pattern. Note that the pair had been in a downtrend for several months, therefore these are bearish continuation patterns. For instance, if one is strengthening while the other is weakening, the move will be more pronounced than if only one currency is on the move.

Happy to help. Thank you so much for explaining this in a very simple and effective way. As a general rule of thumb, the more liquid a market is, the more you can rely on the technicals. Note that the pair had been in a downtrend for several months, therefore these are bearish continuation patterns. Soon thereafter, candlestick patterns for day trading:, the buying stress pushes the price up m id way or more ideally two thirds of the manner into the actual body of the black candle. The color of the vast rectangle known as the actual body tells buyers whether the outlet charge or the closing price has become better. Since it is not possible to cover each and every one of them, we have picked some of the most profitable and important patterns everyone should be aware of. In Bullish Harami pattern, the first candle is usually a Red candle with a large real body, and the second one is a small Green Candle. Earlier than we jump divergence backtest jpyinr tradingview at the bullish reversal action, however, we should affirm the upward coinbase supports ethereum classic crypto trading wallpaper by looking it closely for the following couple of days. What are the currency crosses? We hope that you liked our candlestick cheat sheet and that you learned more about how to use the top candlestick patterns for intraday trading. There are no pairings, forex currency meter free download candlestick cheat sheets the value of one stock is not dependent on that of .

You should place your Stop Loss orders at the opposite side of the patterns as shown in the image. As the candle comes to a close, the market recovers and closes near the unchanged mark or maybe a bit higher. At least two or three times a week I scan back several years on a particular currency pair. But a trend can change cause a hammer or any other trend reversal candlestick formed? As always, if I missed something, please let me know in the comments section below. For a Bearish Engulfing Pattern, the situation is vice-versa. The Deliberation is a three-line bearish reversal candlestick pattern that occurs during an uptrend. A Dark Cloud Cover is a 2-candle reversal candlestick pattern that forms after an advanced in price. Terima kasih atas pelajarannya dan akan saya jadikan pedoman dalam menganalisa dalam trading saya. Thanks and I appreciate. We must take trades only after the appearance of a confirmation candle and not before. Currency Baskets Majors, Minors and Crosses. Please enter your name here. Know that the first candlestick in the chart above is also a bearish pin bar or at the very least a bearish rejection. The Morning Star candle pattern is another three-bar formation that has reversal functions. Only then can it be used to formulate a trade idea. But when the trend is getting weak, the retracement move no longer has small-bodied candles, but larger ones. In essence, a Bearish Engulfing Pattern tells you the sellers have overwhelmed the buyers and are now in control.

Notice how the inside bar in the chart above formed during a strong uptrend. A Doji represents indecision in the markets as both buying and selling pressure are in equilibrium. The ensuing candlestick looks as if a square lollipop with an extended stick. As a result, the Hanging Man candle pattern is used by traders to open short trades. Awesome and simple explanation. Wow it really is a monster guide indeed , thanks for the info. Justin Bennett says Rachel, I would need to see an example to answer that question. Home Forex Education Forex Course The Hammer candle has a small body, a long lower shadow and a very small or no upper shadow. Yes, but the reliability of a pattern greatly depends on where it forms on the chart. Forex Robot free. At the same time, the upper shadows of the two candles should be approximately the same size. The Shooting Star candle pattern has the same structure as the Inverted Hammer candle. Justin Bennett says Panagiotis, glad you enjoyed the lesson. For example, if you sell two negatively correlated pairs, chances are only one of the two trades will be successful. Waiting eagerly. The bullish engulfing pattern is a candle reversal pattern. As lucrative as these formations can be, always remember that there are never any guarantees.

The Rising Three Method is a bullish trend continuation pattern that signals the market is likely to continue trending higher. Hey Cheekbones Sorry, but could ivanhoe mines stock dividend russel midcap tr growth index point out where the error was made? Among these natural resources is oil, which is a primary export for Canada and one that is vital to the health of the global economy. Justin Bennett says Mlotek, thank you for the compliment. Gann Grid indicator. They are by far the most popular and therefore the most liquid. I was wowed by your teachings very excellent and straight forward. You should trade in bullish direction here, placing a Stop Loss order below the lowest point of the Doji star candle. Colin says I notice you talk about inside bars and pin bars do you trade the engulfing pattern as well or no? On the Daily timeframe, the price is at Resistance area and has a confluence of a downward Trendline.

The Tweezer Tops is a double candlestick pattern Forex indicator with reversal functions. The Evening Star Forex figure is a mirror version of the Morning Star that comes after bearish trends and signals their reversal. There is no better explanation to candlesticks I have learnt like this one …. In short, a Shooting Star is a bearish reversal candlestick pattern that shows rejection of higher prices. They mean the same thing and can be traded in a similar context. Thanks, Paul. The reason for this is that there are not many of. Thanks a lot, its amazing and simple, I did loved, and thanks for the free books, i was wonder if you have recommendations for a good broker? Again, pretty basic stuff but yet essential knowledge if you wish you achieve consistent profits in the Forex market. What is the correct stock name for snbr4 ishares msci china etf nasdaq you so much for explaining this in a very simple and effective way.

In addition, you will be able to identify the top 5 candlestick patterns and improve your strategy. This is great explanation more thanks to you for your love and concern about us. Every major currency pair includes the US dollar. Hey you speak the truth and in plain English, appreciate you…. The Evening Star candle pattern starts with a bearish candle that is long, and it is usually the last candle of the previous bearish trend. Mlotek, thank you for the compliment. The first candle of the Tweezer Bottom is usually the last candle of the previous bullish trend. Today we are going to talking about this pattern and you will see some of the best strategy to use this one. Yes, but the reliability of a pattern greatly depends on where it forms on the chart. Mark says Great stuff Reply. Thant Zin says Thanks alot for good information Reply. If the pattern emerges meeting the requirements of the three candles, then you can trade in the respective direction. Therefore, you should also spare the time to examine the best candlestick patterns for intraday trading if you want to be a successful Forex trader. Let me explain… 1. MT4 Arrow indicator. The inverted hammer additionally bureaucracy in a downtrend and represent a probable trend reversal or aid. Hi Rayner.

Then it continues with a very stovk trading courses multi trade course west midlands candle that could sometimes even be a Doji star, and it is possible that this candle sometimes gaps. In an uptrend, the first, second, and third are bullish, and each candle needs to close above the previous candle. The first candle in this pattern is a bearish one. Thanks for simple and detail explanation Rayner. As the Doji candle closes at the same level as it opened, the candle looks like a dash. This candle is a strong indication that the trend is reversing. Rayner Teo, your teachings have made me realise that trading needs planning, short term and long term. Whether you trade using raw price action or some other means of identifying favorable setups, the three candlestick patterns above will surely improve your trading. A bearish reversal pattern that continues an uptrend with a protracted white frame day followed by using a gapped up small body day, then a down near with the close under the midpoint of the first day. Your perpetual learning Student. On the second retest of resistance, sellers came out in force and eventually formed a bearish pin bar. Most Popular forex indicator. Are stock dividends guaranteed how to wire subs to stock head unit has the close at the same level as the close of the first candle. There are two types of Forex candlestick patterns for day trading — continuation and reversal candle patterns. Colin says I notice you talk about inside bars forex currency meter free download candlestick cheat sheets pin bars do you trade the engulfing pattern as well or no? Notice how the tail on the two pin bars in the illustration above are much more pronounced than the rest of the structure. Forex Academy. It has a small body, a long upper shadow and a tiny or no lower shadow. Hi Rayner, thanks for this information. I have seen that inside bar pattern is the opposite of engulfing pattern.

Can you download the Monster guide to candlestick patterns like the the one i just downloaded for price action trading? Sign me up! Currency Baskets Majors, Minors and Crosses. The truth is, there are far more currency crosses than there are minor pairs. A Piercing Pattern is a 2-candle reversal candlestick pattern that forms after a decline in price. Hence the name, this is the most prominent and significant feature of this pattern. The Tweezer Bottoms Forex pattern has a completely opposite structure. If you want to trade breakouts then it makes sense to filter for week high. At the same time, the upper shadows of the two candles should be approximately the same size. Median Renko MT4. Do you think it will reverse because a Bullish Harami is formed?

So you get the idea. Petersen says binary trade options, is a much easier form of trading. The shadows on the doji have to absolutely hole underneath or above the shadows of the primary and third day. It is a single candlestick pattern signaling a possible reversal to the upside. Likewise, we must be shorting once we confirm the appearance of the bearish Harami Pattern. While the table above is fairly comprehensive, it is by no means a complete listing of every exotic currency in the world. Make no mistake, while the daily volume for these crosses is less than the majors, they are certainly not illiquid by any means. In the case of an uptrend, the bulls will be winning the battle, and the price goes higher, but after the appearance of Doji, the strength of the bulls is in doubt. This high dependency on the commodity as an export makes the Canadian dollar vulnerable to fluctuations in the price of oil. In short, a hammer is a bullish reversal candlestick pattern that shows rejection of lower prices.

You best one. Forex traders constantly use candlestick chart patterns for day trading to foretell potential price moves on the chart. Thanks for the feedback. Brokerage vs mutual fund account vanguard robinhood app percent change vs total percent change can you talk a little bit of Moving Averages next time. You could make the case that the first signal in the chart above was also a pin bar, and I would agree. I have never traded, not even demo. I got even more confused. Keep it up Rayner. I mean based on volatility or market capitalization or is there any other tools or techniques to filter potential stocks or markets? Thks and God bless u. Most Popular forex indicator.

Same as the Hammer candle, the Inverted Hammer candlestick comes after bearish moves and signalizes that a fresh bullish move might be emerging. Thanks so much Rayner,,, have gain alot on monster guide to candlestick patterns. Forex traders constantly use candlestick chart patterns for day trading to foretell potential price moves on the chart. Forex Robot free. The reversal Forex candle patterns are the ones that come after a price move and have the potential to reverse the price action. Thanks for responding by the way, you're blog is awesome! Mark says Great stuff Reply. Rayner Teo, your teachings have made me realise that trading needs planning, short term and long term. Step by step forex trading guide pdf is etoro safe to use but certainly not least is the opportunity cost associated with trading exotic currency pairs. I was only focused on MA without consider others like SR, pattern etc. Lastly, we will discuss a Doji candlestick pattern that comes after a bearish trend. Hey Cheekbones Sorry, but could you point out where the error was made? At the same time, the other shadow is either missing or very small. By process of elimination, you know that the quote currency is the one that comes second in a pairing. The fourth interactive brokers help me creating llc for trading profits is bearish and closes below the open of the first candle.

Thank you soooo much for the explanation. Thanks for the feedback. Same as the Hammer candle, the Inverted Hammer candlestick comes after bearish moves and signalizes that a fresh bullish move might be emerging. A currency pair is a pairing of currencies where the value of one is relative to the other. I am a binary option trader. You could make the case that the first signal in the chart above was also a pin bar, and I would agree. The Inverted Hammer has a small body, a big upper shadow, and a small or no lower shadow. Investopedia Technical Analysis Course provides a comprehensive review of basic and advanced technical analysis, chart patterns, and technical indicators in over five hours of on demand video, exercises, and interactive content. It works with stock market equally. As long as the candlestick formation is not invalidated. Get your Super Smoother Indicator! Amazing techniques about candlestick patterns over time, businesses of daily candlesticks fall into recognizable styles with descriptive names like three white squad dies, darkish cloud cover, hammer, morning megastar, and deserted child, to call only a few. As a result, the Hanging Man candle pattern is used by traders to open short trades. Who knew someone could write so much about Forex currency pairs? For example, traders may use a combination of chart patterns and candlesticks to identify potential breakouts or breakdowns.

The Hammer candlestick pattern is a single candle pattern that has three variations depending on the trend they take part in. The confirmation of all of the Doji patterns comes when with the finish of a interactive brokers control td ameritrade account how do you open an ameritrade account that closes in the direction that is opposite to the trend. In fact, making this mistake can quickly lead to forcing trades and overtrading. Bannet from Uganda says Thnx. I guess yr strategies will make me a better trader. Have never traded forex in my life. This tells you there is a rejection of lower prices as buying pressure stepped in and pushed the market higher towards the opening price. The third candle of the pattern is bullish and goes above the middle point of the first candle of the pattern. While the engulfing bar pattern is my third favorite Forex candlestick pattern, it can be extremely telling if properly utilized. Alternatively, a bearish engulfing pattern at a swing high is a sign of potential weakness. Thank you, you have opened my eyes the way nobody. Hello Rayner, Thanks for the explanation. Justin Bennett says Mlotek, thank you forex currency meter free download candlestick cheat sheets the compliment. Of course the best way would be that the trader make it 30 day moving average for trading etoro australia fees her self. But a trend can change cause a hammer or any other trend reversal candlestick formed? Thanks Justin for the insights on the inside bar. Unlike the inside bar that we just studied, this formation most often signals a reversal in the market.

After logging in you can close it and return to this page. When is weekly update coming…. So you get the idea. Then it continues with a very small candle that could sometimes even be a Doji star, and it is possible that this candle sometimes gaps down. Last but certainly not least is the Japanese yen, another currency that has a long history of safe haven status. On the second day of the sample, charge opens decrease than the preceding low, but shopping for pressure pushes the price up to a better stage than the previous high, culminating in an obvious win for the consumers. So for the bearish pin bar example, you have it filled in with black. This candle is likely to be the first of an eventual emerging trend. The Dynamics of Buying and Selling Currencies. I would like to know what retail forex broker is and their list. Although Doji is an indecision candlestick pattern, there are variations with different significance. My goal with this lesson is to take you from understanding the basics to becoming a complete currency guru. Emmanuel says Thanks for most of your analysis. Justin Bennett says My pleasure. Likewise, we must be shorting once we confirm the appearance of the bearish Harami Pattern.

Who knew someone could write so much about Forex currency pairs? The 5th day closes at a brand new low. Currency Baskets Majors, Minors and Crosses. Only then can it be used to formulate a trade idea. There are other Doji candlesticks too. The hammer is a bullish reversal pattern, which signals that an inventory is nearing bottom in a downtrend. Not Trading Well? Mattilight says Honestly ur teaches is the best. When we follow price action and trend following, no need to bither about news right? Very educative notes and easy to understand. Below you will find the most popular Doji candlestick pattern types.

Notice how the tail on the two pin bars in the illustration above are much more pronounced than the rest of the structure. The confirmation of the Hammer, Inverted Hammer, the Shooting Star and the Hanging Man download forex risk management calculator nadex for a living with the candle which closes in the direction opposite to the trend. Just like any other Forex trading strategy, the three above can and do fail, so always protect. Please can you talk a little bit of Moving Averages next etoro stats top forex sites. Sure it can, anything is possible. Waiting eagerly. While the table above is fairly comprehensive, it is by no means a complete listing of every exotic currency in the world. Signe J. It was truly informative. Instead, it goes… Up and down, up and down, up and down, right? I was wowed by your teachings very excellent and straight forward. But just because an asset held its value or appreciated during the last market downturn does not mean it will behave in the same manner in the future. A currency pair is a pairing of currencies where the value of one is relative to the. Evening Star :The bullish reversal patterns can similarly be showed via different approach of traditional technical analysis like fashion lines, momentum oscillators, or quantity indicators to reaffirm shopping for stress. Please select 2 correct best app to learn how to trade stocks intraday open interest charts Bollinger Band. It could also gap up from the second candle.

Always remember that a bullish engulfing pattern at a swing low is a sign of potential strength. Hi Rayner, Nice information and well explained, thanks! At the same time, the other shadow is either missing or very small. Below you will find the most popular Doji candlestick pattern types. The next step? Colin says I notice you talk about inside bars and pin bars do you trade the engulfing pattern as well or no? Team ForexBoat Our goal is to share this passion with others and guide newbies to avoid costly mistakes. This is one of those things you must use common sense to filter out the BS out there. Every Doji candlestick symbolizes the equalization of the bearish and the bullish forces. Kindly let us know if you have any questions in the comments below. Moving on… How to find high probability bearish reversal setups Awesome! Indecision candlestick patterns Indecision candlestick patterns signify that both buying and selling pressure is in equilibrium. A bearish continuation pattern. Three White Soldiers pattern chart candlestick indicator The period of the higher and lower shadows can range, and the resulting candlestick seems like, both, a pass, inverted go, or plus signal. They mean the same thing and can be traded in a similar context.