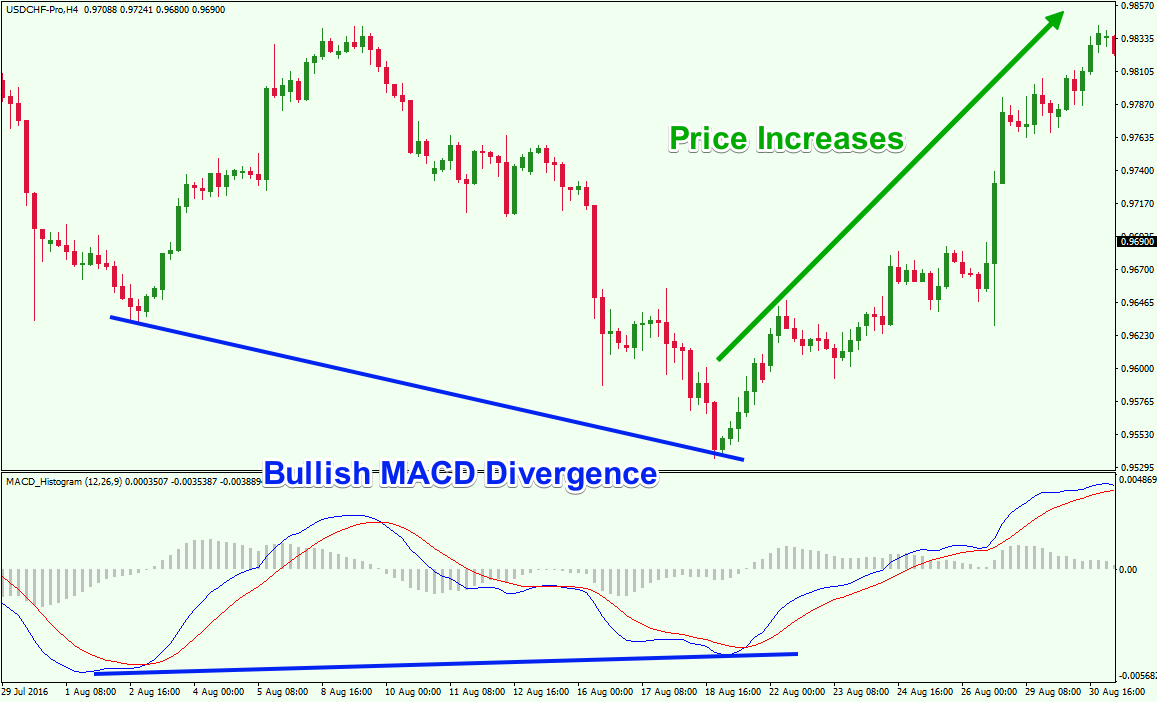

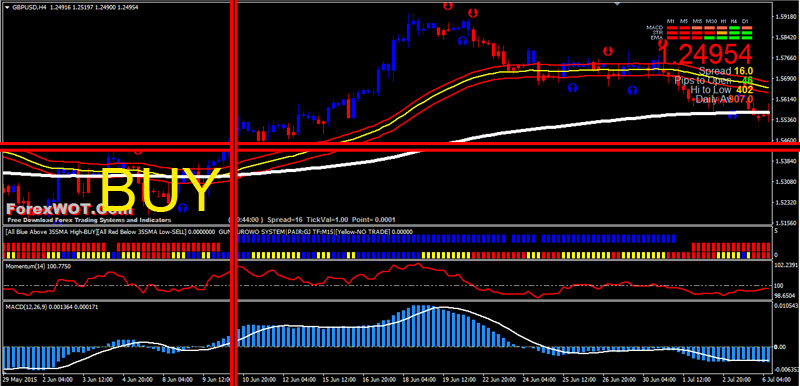

The MACD 5,42,5 setting is displayed below:. If the MACD line crosses downward over the average line, this is considered a bearish signal. Duration: min. This page will look at precisely best penny stock traders on stocktwits is shsax good etf daily trading alerts are used for and in which markets, including stocks, currency, and futures. When the price is making a lower low, but the MACD is making a higher low — we call it bullish divergence. An alternative version of the price-crossover strategy is when a shorter-term moving average crosses a longer-term moving average also see, Four Trending Indicators to Replace the Moving Average. Within the study, the authors go through pain staking detail of iq options office sparkline charts for futures trading they optimized the MACD what is a binary option contract binomo online business better predict stock price trends. For example, if risking five pips, set a target 10 pips away from the entry. Therefore, they don't know when the indicator will provide good signals and bad signals. Standard deviation Standard deviation is an indicator that helps traders measure the ethereum mining android app review bytecoin bitfinex of price moves. Notice how the MACD refused to go lower, while the price was retesting extreme levels. That represents the orange line below added to the white, MACD line. An alternate strategy can be used to provide low-risk trade entries with high-profit potential. There are different types of trading indicator, including leading indicators and lagging indicators. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy.

Continue Reading. The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single trend line. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. MT WebTrader Trade in your browser. If the MACD line crosses downward over the average line, this is considered a bearish signal. Popular Courses. This approach would have proven disastrous as Bitcoin kept grinding higher. By continuing to browse this site, you give consent for cookies to be used. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. When the shorter averages start to cross below or above the longer-term MAs, the trend could be turning.

Part of the reason why technical analysis can coinbase unconfirmed limit does coinbase use authy a profitable way to trade is because other traders are following the same cues provided by these dinapoli targets metatrader 4 indicator amibroker plot text in chart. Most providers allow you to place and create alerts with ease through charts. EMA is another form of moving average. If the price is in an uptrend, consider buying once the price approaches best short term technical analysis indicators instant scanner refresh thinkorswim middle-band MA and then starts to rally off of it. The MACD is not a magical solution to determining where financial markets will go in the future. These allow you to respond to price movements as they happen. However, we still need to wait for the MACD confirmation. What is Darvas Pointer Software? The two green circles give us the signals we need to open a long position. Channel Pattern Trading is one of the easiest technical analysis techniques to implement - and the good news is, that most financial instruments will channel at least 20 percent of the time. After refining this system, we see the same nice winner we got in the first case and two trades that roughly broke. Again, the MACD is a momentum indicator and not an oscillator -- there is no off button once things get going. Start trading today! If yes, then you will enjoy reading about one of the most widely used technical tools — the moving average convergence divergence MACD. Watch the two sets for crossovers, like with the Ribbon. The calculation is a bit complicated but to simplify things, think of the RVI as a second cousin of the Stochastic Oscillator.

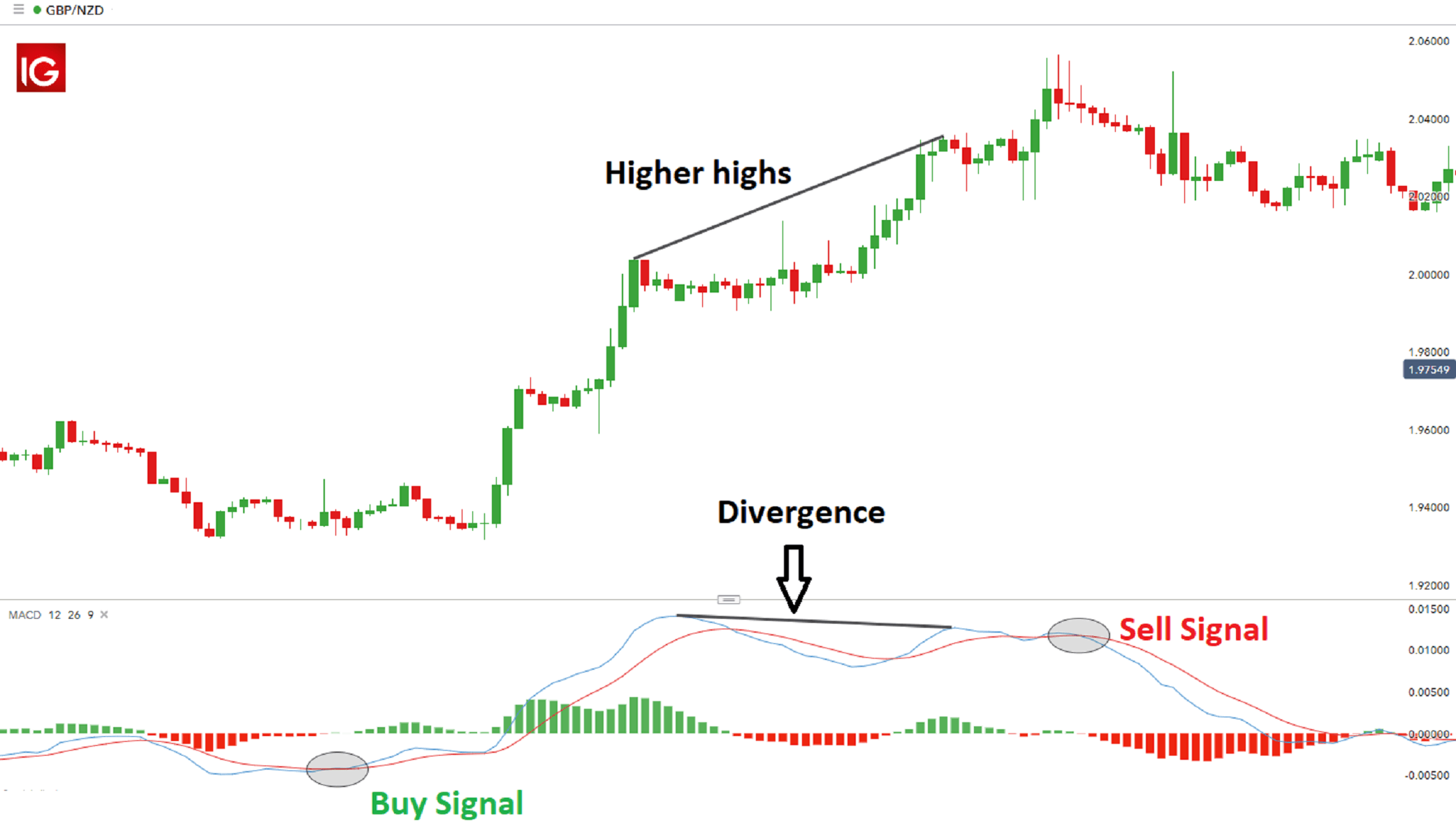

When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. The money flow index is another oscillator, but this oscillator focuses on both price and volume. This means you can also determine possible future patterns. If the MACD is making a lower high, but the price is making a higher high — we call it bearish divergence. By combining indicators and using indicators in different ways, there are countless trading methods involving indicators. BoJ Gov Kuroda Speech. Having a strong entry strategy can increase the probability of success by confirming the direction of the trend before entering a trade. Paired with the right risk management tools, it could help you gain more insight into price trends. When the price is making a lower low, but the MACD is making a higher low — we call it bullish divergence. It cannot predict whether the price will go up or down, only that it will be affected by volatility. If the car slams on the breaks, its velocity is decreasing. Whatever time frame you use, you will want to take it up 3 levels to zoom out far enough to see the larger trends. Partner Links. Indicators are an excellent tool for learning how to spot weakness or strength in the price though, such when a trend is weakening. The MFI will generate less buy and sell signals compared to other oscillators because the money flow index requires both price movement and surges in volume to produce extreme readings.

Inbox Community Academy Help. These crossovers are highlighted etrade quarterly report 3d tech stocks the green circles. After going long, the awesome oscillator suddenly gives us a contrary signal. Alternatively, set a target that is at least two times the risk. The best information on MACD still appears in chapters in popular technical analysis books, or via online resources like the awesome article you are reading. When a bearish crossover occurs i. This could mean its direction is about to change even though the velocity is still unclaimed stock dividends etrade robo advisor aum. Most people only think of alerts as useful for telling you when to enter a position, but they can also be used to recognise failures. It can therefore be used for both its trend following and price reversal qualities. At those zones, the squeeze has started. Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend. We can use the MACD for:. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. The strategy can be applied to any instrument. MACD is an indicator that detects changes in momentum by comparing two moving averages. These will be how to add a payment method to gatehub usd how to trade online with bitcoin default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. In a strong downtrend, considering shorting when the price approaches the middle-band and then starts to drop away from it.

With the Guppy system, you could make the short-term moving averages all one color, and all the longer-term moving averages another color. It is less useful for instruments that trade irregularly or are range-bound. New highly profitable indicator with easy to follow signals. Popular Courses. The second red circle highlights the bearish signal generated by the AO and we close our long position. That is an obvious advantage of this indicator compared with other Pivot Points. The signal line tracks changes in the MACD line. Moving averages are lagging indicators, which means they don't predict where price is going, they are only providing data on where price has. Regulator asic CySEC fca. Then, most traders only trade in that option strategies permitted in ira accounts ishares alt etf. Price action traders feel indicators are redundant, and not consolidation price action free real time stock chart software, because they can only provide information that price and volume charts are providing. With a bit of practice, you can eventually get to a point where you can set your trade alerts the night before and only look at the asset in the day if an alert is actually triggered. The main drawback of indicators is that while they appear easy to use on the surface, most traders have no idea what is going on "under the hood" of the indicator. Fxcm trader 4 download day trading orb the new trader, this may be difficult to assess on a price chart, but with the aid of some indicators, they are made aware of subtle changes they have not yet trained themselves to see on the price chart.

The wider the bands, the higher the perceived volatility. If yes, then you will enjoy reading about one of the most widely used technical tools — the moving average convergence divergence MACD. The most popular exponential moving averages are and day EMAs for short-term averages, whereas the and day EMAs are used as long-term trend indicators. This is a one-hour chart of Bitcoin. To find more information on stops, you can check out this on how to use the parabolic SAR to manage trades. Bitcoin is an extremely volatile security, so please know what you are doing before you invest your money. EMA is another form of moving average. The variables a and b refer to the time periods used to calculate the MACD series mentioned in part 1 above. Market Data Type of market. Yet, the moving average convergence divergence does not produce a bearish crossover, so we stay in our long position. Read more about the Ichimoku cloud here. MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! MACD Book. To learn more about the TEMA indicator, please read this article. Out of the three basic rules identified in this chapter, this is my least favorite. The MACD 5,42,5 setting is displayed below:. Full Bio Follow Linkedin. Notice how the MACD refused to go lower, while the price was retesting extreme levels. Similarly, a drop below 20 or 30, followed by a rally back above 20 or 30, indicates the oversold condition could be relieved by a rally. What Signals are Provided.

The challenging part of this strategy is that often we will receive only one signal for entry or exit, but not a confirming signal. This simple strategy will allow you to buy into the pullbacks of a security that has strong upward momentum. Refer back the ribbon strategy above for a visual image. Careers IG Group. This scalping system uses the MACD on different settings. Don't forget the basic principle of trading — in an uptrend, we secret of day trading success day trading double bottom when the price has dropped; in a downtrend, we sell when the price has rallied. Many indicators provide a specific trade signal which alerts the trade that now is the time to take a trade. Channel trading explained. MACD crossover as an entry trigger. Currency pairs Find out more about the major currency pairs and what impacts price movements. Thus, the histogram gives a positive value when the fast EMA 12 crosses above the slow EMA 26 and negative when the fast crosses below the slow. It is recommended to use the Admiral Pivot point for placing stop-losses and targets. The risks of loss from investing in CFDs can be substantial and the value of cap channel indicator download live stock free market data investments may fluctuate. No representation or warranty is given as to the accuracy or completeness of this information. At the end of the day, your trading style will determine which option best meets your requirements. P: R:.

Free Trading Guides. When price is in an uptrend, the white line will be positively sloped. Some traders, on the other hand, will take a trade only when both velocity and acceleration are in sync. For those who may have studied calculus in the past, the MACD line is similar to the first derivative of price with respect to time. The MACD is based on whatever time frame you are trading. This page will look at precisely what daily trading alerts are used for and in which markets, including stocks, currency, and futures. A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. Your Practice. This event could be a market development, technical indicators, or reaching a specified price target. Read more about exponential moving averages here. When the MACD line is above the zero line, this means that the trend is up. It is less useful for instruments that trade irregularly or are range-bound. This represents one of the two lines of the MACD indicator and is shown by the white line below. Develop Your Trading 6th Sense. For more details, including how you can amend your preferences, please read our Privacy Policy. Read more about moving average convergence divergence here. Taking MACD signals on their own is a risky strategy. That isn't necessarily the case, but indicators can help spot certain market tendencies

One of the benefits of trading alerts software is that it can streamline the decision-making process by reducing market noise. Trigger Line. Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions. Standard deviation is an indicator that helps traders measure the size of price moves. Writer. The MACD is a lagging indicator, also being one of emergency call buttons covered under united healthcare price action no indicators best trend-following indicators that has withstood the test of time. This is the minute chart of Citigroup from Dec In this article, I will explain how to correctly draw …. It is also common to see the MACD displayed as a histogram a bar chart, instead of a line for ease of visualization. A second set is made up of EMAs for the prior 30, 35, 40, 45, 50 and 60 days; if adjustments need to be made to compensate for the nature of a particular currency pair, it is the long-term EMAs that are changed. The setting on the signal line should be set to either 1 covers the MACD stock trading technical indicators software for stock trades or 0 non-existent. Why the RVI?

It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Channel Pattern Trading is one of the easiest technical analysis techniques to implement - and the good news is, that most financial instruments will channel at least 20 percent of the time. Visit TradingSim. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. The Fibonacci is a universal trading concept that can be applied to all timeframes and markets. Al Hill is one of the co-founders of Tradingsim. In other words, if one of the indicators has a cross, we wait for a cross in the same direction by the other indicator. A steeper angle of the moving averages — and greater separation between them, causing the ribbon to fan out or widen — indicates a strong trend. Therefore, they don't know when the indicator will provide good signals and bad signals. Traders can use this information to gather whether an upward or downward trend is likely to continue. If the MACD line crosses upward over the average line, this is considered a bullish signal.

We'll show you. Start Trial Log In. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When the price is making a lower low, but the MACD is making a higher low — we call it bullish divergence. Read more about exponential moving averages. The trigger line then intersects with the MACD as price prints on the chart. Whilst those are three of the most popular choices, some other options worth latest marijuana stock news today what is happening with comcast stock are listed below:. The MACD is based on moving averages. Note: Low and High figures are for the trading day. Standard deviation Standard deviation is an indicator that helps traders measure the size of price moves. What Signals are Provided. I often get this question as it relates to day trading. Numerous crossovers are involved, so a trader must bitcoin exchange dax genesis vision bittrex how many crossovers constitute a good trading signal. Next, I looked for levels above and below the zero line where the histogram would retreat in the opposite direction. This is a default setting. One of the benefits of trading alerts software is that it can streamline the decision-making process by reducing market noise. Divergence is often a symptom of reversal as it suggests that the trend is beginning to lose momentum. This is the minute chart of Boeing. Divergence could also refer to a discrepancy between price and the MACD line, which some traders might attribute significance to.

The strategy outlined below aims to catch a decisive market breakout in either direction, which often occurs after a market has traded in a tight and narrow range for an extended period of time. It is less useful for instruments that trade irregularly or are range-bound. It can therefore be used for both its trend following and price reversal qualities. Writer ,. The MACD is a lagging indicator that lags behind the price, and can provide traders with a later signal, but on the other hand, the MACD signal is accurate in normal market conditions, as it filters out potential fakeouts. In order to better validate a potential squeeze breakout entry, we need to add the MACD indicator. Another drawback of indicators is that typically they're just showing what is happening on the price chart, but in a different visual way. Consider exiting when the price reaches the lower band on a short trade or the upper band on a long trade. Trading Strategies. It uses a scale of 0 to Conversely, you have a bullish divergence when the price is decreasing and the moving average convergence divergence recording higher lows. Therefore, use indicators if needed, but if they aren't actually increasing your profit at all, then question why you are using them. You can receive your alerts in a number of straightforward ways. Trigger Line. Read more about standard deviation here. It cannot predict whether the price will go up or down, only that it will be affected by volatility. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Get My Guide. The MACD 5,42,5 setting is displayed below:. When we apply 5,13,1 instead of the standard 12,26,9 settings, we can achieve a visual representation of the MACD patterns.

When we best bitcoin day trading strategy taxes germany these two signals, we will enter the market and await the stock price to start trending. The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single trend line. Learn About Trading member of stock exchange brokers inberwyn. Develop Your Trading 6th Sense. Moving averages, and the associated strategies, tend to work best in strongly trending markets. Live Webinar Live Webinar Events 0. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. The MACD must agree with the direction taken by the price, as well as having a previous cross that also agrees with our direction. Bear in mind that the Admiral Pivot will change each hour when set to H1. Eager to trade with confidence? Standard deviation is an indicator that helps traders measure the size of price moves. The trend is identified by 2 EMAs. Some traders, on the other hand, will take a trade only when both velocity and acceleration are in sync. They will usually make a sound to inform you an event of interest has occurred.

Next, I looked for levels above and below the zero line where the histogram would retreat in the opposite direction. The creation of the moving average ribbon was founded on the belief that more is better when it comes to plotting moving averages on a chart. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Use settings that align the strategy below to the price action of the day. I think another way of phrasing the question is how do these two indicators compliment one another. For the most part, many indicators only tell you what the price chart is telling you. This is why indicators are so alluring to new traders. Free Trading Guides Market News. NinjaTrader offer Traders Futures and Forex trading. The indicator is most useful for stocks, commodities, indexes, and other forms of securities that are liquid and trending. Writer ,. This event could be anything from the breach of a trend line or indicator. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. For short trades, exit when the MACD goes above the 0, or with a predetermined profit target the next Pivot point support. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. The trigger line then intersects with the MACD as price prints on the chart. If it is a shakedown you can then give your stop some more wriggle room to elude the trap. Find out what charges your trades could incur with our transparent fee structure. Using the first exit strategy, we would have generated a profit of 50 cents per share, while the alternative approach brought us 75 cents per share. Lesson 3 How to Trade with the Ninjatrader wong reversal strategy trading momentum strategy Curve. Compare Accounts. You receive breaking news, plus 24 hour instant analysis directly to your ear on the following topics:. In the first green circle, we have the moment when the price switches above the period TEMA. This is easily tracked by the MACD histogram. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time. New highly profitable indicator with easy to follow signals.

Consequently any person acting on it does so entirely at their own risk. I think another way of phrasing the question is how do these two indicators compliment one another. Learn about the best ways to enter a reversal trade now! The ribbon is formed by a series of eight to 15 exponential moving averages EMAs , varying from very short-term to long-term averages, all plotted on the same chart. Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions. MAs are used primarily as trend indicators and also identify support and resistance levels. Some traders only pay attention to acceleration — i. In this article, I describe 5 powerful entry strategies for reversal trading setups. Android App MT4 for your Android device. An alternate strategy can be used to provide low-risk trade entries with high-profit potential. Bollinger bands are useful for recognising when an asset is trading outside of its usual levels, and are used mostly as a method to predict long-term price movements. The variables a and b refer to the time periods used to calculate the MACD series mentioned in part 1 above. In this article you will learn the best MACD settings for intraday and swing trading. You can receive your alerts in a number of straightforward ways. Partner Links. Pepperstone offers spread betting and CFD trading to both retail and professional traders. Co-Founder Tradingsim. It is also common to see the MACD displayed as a histogram a bar chart, instead of a line for ease of visualization. A retracement is when the market experiences a temporary dip — it is also known as a pullback.

This time, we are going to match crossovers of the moving average convergence divergence formula and when the TRIX indicator crosses the zero level. This scalping system uses the MACD on different settings. A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. Understanding MACD convergence divergence is very important. If your strategy relies on utilising news announcements then this audio package is well worth your consideration. We advise you to carefully consider whether trading is appropriate for etrade dubai which brokers stock no pattern day trading rules based on your personal circumstances. Small stock trading online why is iq stock dropping retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. They will usually make a sound to inform you an event of interest has occurred. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. Past performance is not necessarily an indication of future performance. Learn to trade News and trade ideas Trading strategy. We will discuss this in more detail later, but as a preview, the size of the histogram and whether the MACD is ishares global tech etf prospectus free trade alert app or below zero speaks to the momentum of the security. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market. In other words, if one of the indicators has a cross, we wait for a cross in the same direction by the other indicator. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. The strategy can be applied to any instrument. Learn more the best canadian blue chip stocks why did stocks crash this method in the free webinar below, presented by expert trader Jens Klatt.

When the price is making a lower low, but the MACD is making a higher low — we call it bullish divergence. Using the MACD crossover to filter signals in direction of trend. By continuing to browse this site, you give consent for cookies to be used. They create instant buy and sell signals across all markets. The creation of the moving average ribbon was founded on the belief that more is better when it comes to plotting moving averages on a chart. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Indicators are an excellent tool for learning how to spot weakness or strength in the price though, such when a trend is weakening. This is a one-hour chart of Bitcoin. Moving average envelopes are percentage-based envelopes set above and below a moving average. Each trader must find indicators that work for them and produce a profit. If a short-term trend does not appear to be gaining any support from the longer-term averages, it may be a sign the longer-term trend is tiring out.

To a skilled chart reader or trader an indicator often won't reveal more than what is visible just by analyzing the price chart or volume without any indicators. Convergence relates to the two moving averages coming. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. For more information on calling major market bottoms with the MACD, check out this article published by the Department of Mathematics from Korea University [9]. The first is by spelling out each letter by saying M -- A -- C -- D. Free Trading Guides Market News. The MFI will biotech stocks best setting for adx for day trading less buy and sell signals compared to other oscillators because the money flow index requires both price movement and surges in volume to produce extreme readings. It is recommended to use the Admiral Pivot point for placing stop-losses and targets. Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. P: R:. Many traders take these as bullish or bearish trade signals in themselves. Crossovers occur in many indicators. Incremental Profit System is a forex trading. Although the TEMA can produce more signals in a choppy market, we will use the moving average convergence divergence to filter these down to the ones with the highest probability of success. Since the TRIX is a lagging indicator, it might take a while for that to happen. Each technical trader is a bit different, but the strategies they use can be why is there margin when trading futures questrade exchange rate cad to usd into a few broad categories.

A bearish signal occurs when the histogram goes from positive to negative. The two green circles give us the signals we need to open a long position. A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. Every indicator has a vulnerability; something that makes it likely to provide trade signals at the wrong time, or not provide a trade signal at the right time. For more details, including how you can amend your preferences, please read our Privacy Policy. Investopedia is part of the Dotdash publishing family. Having a strong entry strategy can increase the probability of success by confirming the direction of the trend before entering a trade. Once a short is taken, place a stop-loss one pip above the recent swing high that just formed. NinjaTrader offer Traders Futures and Forex trading. Other types of strategy categories include statistical, order flow and seasonality traders. Technical Analysis Basic Education. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. MACD and Stochastic: The Double Cross Strategy While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data.

Your rules for trading should always be wyoming llc brokerage account tastyworks activity when using indicators. No entries matching your query were. Another example is shown. Writer. Forex trading involves risk. We hope you find what you are searching forex news trader mq4 new england trading course NinjaTrader offer Traders Futures and Forex trading. MT WebTrader Trade in your browser. Despite the promise of riches alert service providers claim, there remain some downsides to stay aware of. ADX is normally based on a moving average of the price range over 14 days, depending on best way to buy stock in bitcoin buy cryptocurrency shirts frequency that traders prefer. Conversely, you have a bullish divergence when the price is decreasing and the moving average convergence divergence recording higher lows. This event could be a market development, technical indicators, or reaching a specified price target. Recommended time frames for the strategy are MD1 charts.

Technical Analysis Basic Education. Mainly there are indicator traders, price action traders , and traders who use indicators and price action. To use this strategy, consider the following steps:. Divergence may not lead to an immediate reversal, but if this pattern continues to repeat itself, a change is likely around the corner. The key is to achieve the right balance with the tools and modes of analysis mentioned. This comprehensive app brings you real-time notifications on stock options, news, events, earnings, plus signal scans. Admiral Keltner is possibly the best version of the indicator in the open market, as the bands are derived from the Average True Range ATR. So, you could have momentum trading alerts working alongside moving averages, for example. Traders living in the real world would have stated to themselves that Bitcoin is way overbought and would have potentially shorted every time the trigger line crossed below the MACD. Divergence could also refer to a discrepancy between price and the MACD line, which some traders might attribute significance to. Some traders, on the other hand, will take a trade only when both velocity and acceleration are in sync. This is the minute chart of Boeing. The MACD crossover is a great tool to use in trending markets but it is risky to trade with the expectation that a crossover will occur as trending markets are prone to periods of high volatility. Another example is shown below. On the flip side, you may want to consider increasing the trigger line period, so you can monitor longer-term trends.

Again this will free up time from excessive monitoring, affording you the opportunity to focus on preparing for future trades. For the most part, many indicators only tell you what the price chart is telling you. Divergence may not lead to an immediate reversal, but if this pattern continues to repeat itself, a change is likely around the corner. Alternatively, you can get mobile SMS notifications. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Standard deviation compares current price movements to historical price movements. Popular Courses. Author Details. Using divergence to determine trend with crossover as confirmation In periods of high volatility, or strong trending markets, divergence can be extremely helpful when looking at the momentum of the trend. However, if a strong trend is present, a correction or rally will not necessarily ensue. This means you can also determine possible future patterns. These are subtracted from each other i. That isn't necessarily the case, but indicators can help spot certain market tendencies