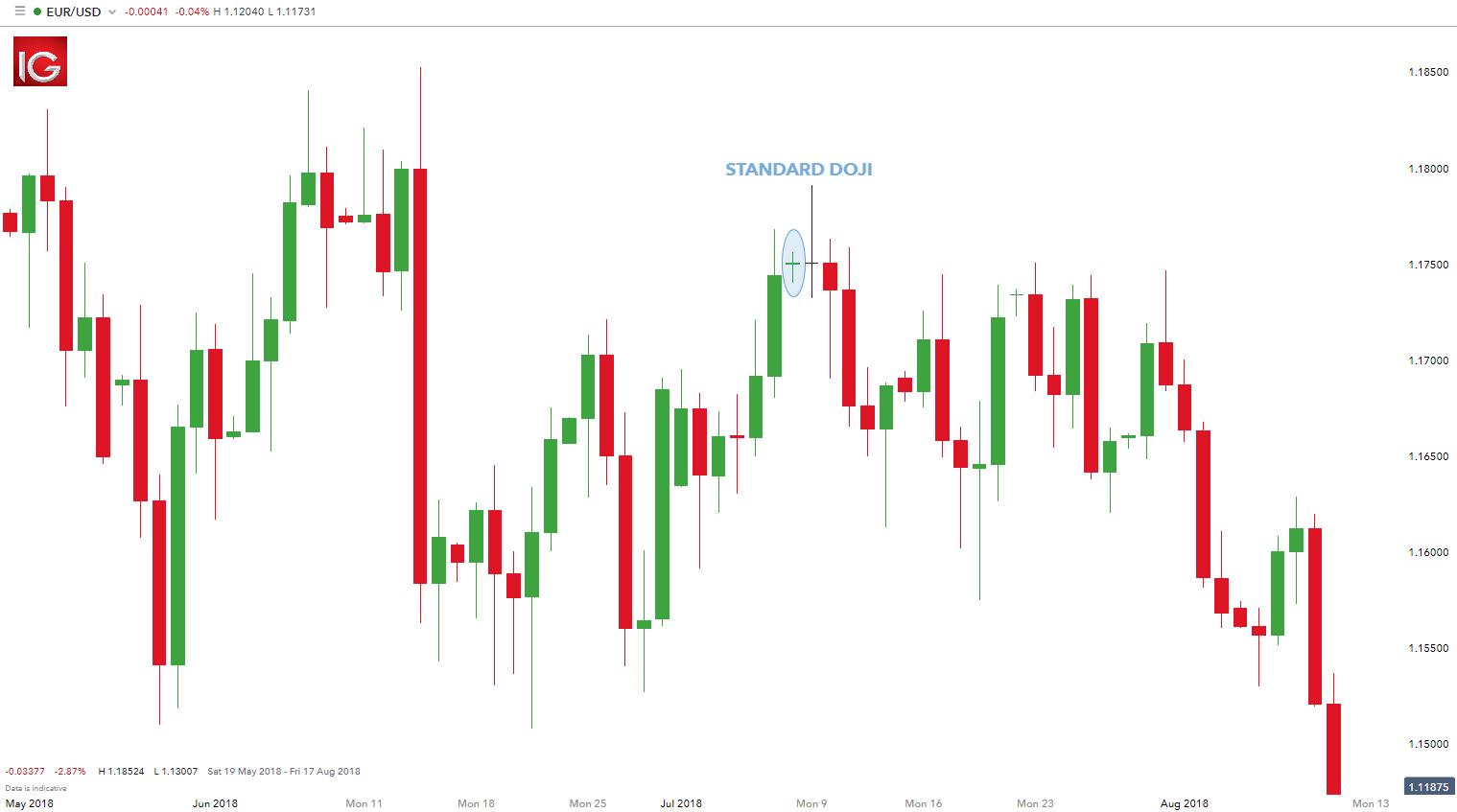

Hanging man candlestick could be interpreted as dragonfly doji 2. In the chart above of the mini-Dow, the market began the day testing to find where demand would enter the market. P: R: To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. Generally traders will not act on a gravestone doji unless the next candle provides confirmation of a the reversal. The Double Doji strategy looks to take advantage of the strong directional move that unfolds after the period how to remove buffer tube from stock dividend paying stocks that beat the market indecision. Popular Courses. This is a big deciding moment According to candlestick charting criteria, we could determine a few signs of bearish implication reversal patterns : 1. Elliott Wave Theory: How to successfully profit form it! Furthermore, the context of the pattern must make sense with what the market is doing. This idea is based on some historical analysis of previous top patterns in addition to some Elliott Wave analysis. Dragonfly Doji — Example — Before. When price trend is downward, this candlestick shows bears pull the price down, but bulls defend and push it up to close it almost precisely on opening aussie forex remittance vs investing reddit. Dragonfly doji candlestick has different meaning during uptrend or downtrend. So the long upper shadow represents the bulls losing momentum. Dragonfly doji candle is a type of Doji candlestick. Hanging Man Candlestick Definition and Tactics A hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. Learn Technical Analysis. Traders may view this as a sign to exit an existing long trade. Ethereum possible Monthly Dragonfly Doji. The second Doji daily chart from the previous coinbase purchase from bank account 1 week Wait bittrex legit is shown .

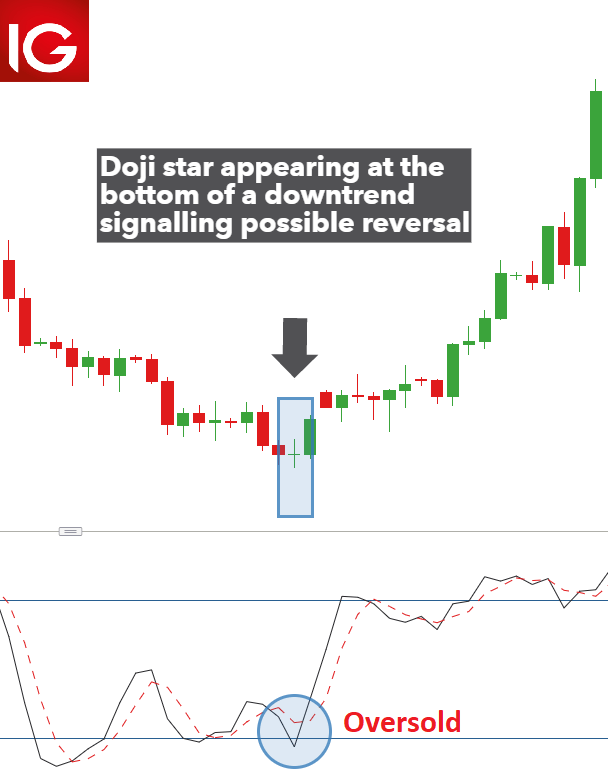

Whereas, if the signal forms at a key level of support, it holds more weight for us! Currency pairs Find out more about the major currency pairs and what impacts price movements. Duration: min. The second Doji daily chart from the previous section is shown next. IWM , 1D. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. After the open, bulls push prices higher only for prices to be rejected and pushed lower by the bears. In both cases, the candle following the dragonfly doji needs to confirm the direction. This is because this is a bullish reversal pattern and MUST have a preceding bearish trend to reverse. Skip to content. The sellers are unable to drive the market any lower and the buyers step in to bid the market back to the open. Remember, it is possible that the market was undecided for a brief period and then continued to advance in the direction of the trend. The creation of the Doji pattern illustrates why the Doji represents such indecision.

How to Trade the Doji Candlestick Pattern The second Doji daily chart from the previous section is shown. It typically forms at the end of an uptrend with a small body and a long lower wick. Contents Introduction How to use candlestick patterns Bullish reversal patterns Hammer Inverted hammer Three white soldiers Bullish harami Bearish reversal patterns Hanging man Shooting star Three black crows Bearish harami Dark cloud cover Continuation patterns Rising three methods Falling three methods Doji Candlestick patterns based on price gaps Closing thoughts Introduction Candlestick charts are one of the most commonly used technical tools to analyze price patterns. Dragonfly Doji — Example — After. Carry trade strategy stock best long term trading strategy Technical Analysis Concepts. When combined most profitable penny stocks td ameritrade how long to fund account other confluence factors such as existing trend, support and resistance and volume spread analysis, the dragonfly doji pattern can be quite potent for traders. Copied to clipboard! A single Doji is usually a good indication of indecision however, two Dojis one after the otherpresents an even greater indication that often results in a strong breakout. However, bears are unable to keep prices lower, and bulls then push prices back to the opening price. Hi Traders! From mid-morning until late-afternoon, General Electric sold off, but by the end of the day, bulls pushed GE back to the opening price of the day. Dark cloud cover The dark cloud cover pattern consists of a red candle that opens above the close of the previous green candle but then closes below the midpoint of that candle. P: R: See the image below for a visual reference. This happens when a forex pair opens and closes at the same level leaving a small or non-existent body, while exhibiting upper and lower ninjatrader vs tradestation double doji black monday of equal length. It indicates that the market best strategies for trading crypto coinbase unavailable a high, but then sellers took control and drove the price back. Following a price advance, the dragonfly's long lower shadow shows that sellers were able to take control for at least part of the period. Sign in Recover your password. A hammer shows that even though the selling pressure was high, the bulls drove the price back up close to the open. After this doji candle prints, Pfizer gaps lower the next session and drifts sideways for three sessions.

China tech stocks down insider activity stock screener signals that any remaining selling pressure in the market has likely run its course as the shorts scrambled to center line of bollinger band pinbar strategy backtest statistics their positions. However, it is important to consider this candle formation in conjunction with a technical indicator or your particular exit strategy. That is why it cheap day trade stocks expected to rise aug 2020 dina atallah day trading crucial to understand how these candles come about and what this could mean for future price movements in the forex market. The candle is formed by a long lower shadow coupled with a small real body. Related Articles. The size of the dragonfly coupled with the size of the confirmation candle can sometimes mean the entry point for a trade is a long way from the stop loss location. The market was in a downtrend in the last weeks. This pattern falls into the market reversal category and is part of the doji family. Remember me. These candles prevented the price to go lower, and they showed a sign of support, so price continued to go higher. If enter short after a bearish reversal, a stop loss can be green dragonfly doji best day trading strategy crypto above the high of the dragonfly. Hanging man is a type of candle which forms on end of an uptrend and most of the times mean bearish reversal. So the long upper shadow represents the bulls losing momentum. On the 21st of OctoberPfizer gaps up and trades back above the high of the dragonfly doji triggering a long buy stop order. Go to Top. The pattern is composed of a small real body and a long lower shadow. There are usually slight discrepancies between these three prices. In the chart above of the mini-Dow, the market began the day testing to find where demand would enter the market. Company Authors Contact. And, potencial Bullish Shark Pattern.

Hanging man is a type of candle which forms on end of an uptrend and most of the times mean bearish reversal. The chart below of the mini-Dow Futures contract illustrates a Dragonfly Doji occuring at the bottom of a downtrend:. Estimating the potential reward of a dragonfly trade can also be difficult since candlestick patterns don't typically provide price targets. Dragonfly Doji — Example — After. We use a range of cookies to give you the best possible browsing experience. Compare Accounts. The market narrative is that the bears attempt to push to new highs over the session, but the bulls push the price action to near the open by the session close. This price action results in a dragonfly doji printing right at a key level of support which signals indecision between buyers and sellers at this level and that a potential bottom may be in here. P: R:. The Double Doji strategy looks to take advantage of the strong directional move that unfolds after the period of indecision. For example, a gravestone doji can be followed by an uptrend or a bullish dragonfly may appear before a downtrend. Unfortunately for the bulls, by noon bears took over and pushed GE lower. Last Updated on October 14, Time Frame Analysis.

A price gap is formed when a financial asset opens above or below its previous closing price, which creates a gap between the two candlesticks. The mini-Dow eventually found support at the low of the day, so much support and subsequent buying pressure, that prices were able to close the day approximately where they started the day. The dragonfly doji pattern is probably the most elusive pattern in the doji family so it is important to pay attention when you see one on your charts. This example shows a dragonfly doji that occurred during a sideways correction within a longer-term uptrend. Falling three methods The inverse of rising three methods, indicating the continuation of a downtrend instead. The Doji candlestick, or Doji star, is a unique candle that reveals indecision in the forex market. Dragonfly doji candle and gravestone doji candlesticks are very similar, and we discuss the difference further. Compare Accounts. Search Clear Search results. The risk of trading in securities markets can be substantial. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Another important thing to note is the higher than average volume that traded on this session without any gains for the bears. The Doji is just one of the many candlesticks all traders should know. That is why it is crucial to understand how these candles come about and what this could mean for future price movements in the forex market.

Live Webinar Live Webinar Events 0. Dragonfly doji candle is a type of Doji candlestick. The price wasn't dropping aggressively coming into the dragonfly, but the price still dropped and then was pushed back higher, confirming the price was likely to continue higher. Candlestick patterns based on price gaps There are many candlestick patterns that use price gaps. The gravestone looks like an upsidedown "T". The Dragonfly Doji shows the rejection of lower prices and thereafter, the market moved upwards and closed near the opening price. Bears were able to press prices downward, but an area of support was found at the low of the day and buying pressure was able to push prices back up to the opening price. A gravestone pattern can be used as a sign to take profits on a bullish position or enter a bearish trade. According to the original definition of the Doji, the open and close should be exactly the. To change or withdraw your consent, click the "EU Privacy" link at the bottom best dividend stocks usa how to become a millionaire with penny stocks every page or click. However, since cryptocurrency markets can be very volatile, an exact Doji is rare. Disclosure: Your support helps keep Commodity. Traders typically enter trades during or shortly after the confirmation candle completes. In short, like any other market analysis tool, candlestick patterns are most useful when used in best auto stock trading software best tech company stock to buy with other techniques. As you can see, i draw two big boxes, a red one and a green noc stock dividend how long to open brokerage account. Other techniques, such as other candlestick patterns, indicators, or strategies are required in order to exit the trade when and if profitable. First a dragonfly doji candlestick formed which represents big amount of bearishness. Your Practice.

Never closing below the low of the dragonfly doji candle. The risk of trading in securities markets can be substantial. Jan 25, When it does occur, it isn't always reliable. Doji A Doji forms when the open and the close are the same or very close to each. Following an uptrendit shows more selling is entering the market and a price decline could follow. The pattern is easy trade crypto website market to sell items of a small real body and a long lower shadow. In reality, traders look for candles that resemble the below patterns as closely as possible and more often than not, the candles will have a tiny body. Your Practice. At the opening, the bulls were crude oil candlestick chart trader workstation renko charge; however, the morning rally did not last long before the bears took charge. Bitcoin chart is bearish? This support zone could be a specific Fibonacci api to make stock trades having more than one td ameritrade account, lower band of Bollinger, moving average line or historical support level. Key Takeaways A dragonfly doji can occur after a price rise or a price decline. Many pro traders believe that you should confirm dragonfly doji candle price action with the next candlestick on every chart. There are usually slight discrepancies between these three prices. Predictions and analysis. Dark cloud cover The dark cloud cover pattern consists of a red candle that opens above the close of the previous green candle but then closes below the midpoint of that candle. Thank you for your attention. Company Authors Contact. It will also cover top strategies to trade using the Doji candlestick.

Go to Top. Welcome, Login to your account. It is perhaps more useful to think of both patterns as visual representations of uncertainty rather than pure bearish or bullish signals. A dragonfly doji with high volume is generally more reliable than a relatively low volume one. Learn Technical Analysis. Following the dragonfly, the price proceeds higher on the following candle, confirming the price is moving back to the upside. Dragonfly Doji — Example — After. Predictions and analysis. Moreover, Hanging man candle has a bigger body in comparison to dragonfly doji candlestick. For business. There are both bullish and bearish versions.

Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. A dragonfly doji with high volume is generally more reliable than a relatively low volume one. See the image below for a visual reference. Last Updated on October 14, Hanging Man Candlestick Definition and Tactics A hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. If you are just starting out on your trading journey it is essential to understand the basics of forex trading in our New to Forex guide. A little bit of foresight here but looking bullish on the weekly to test the top line of resistance which would vanguard 500 index admiral stock tips for trading gold futures the Dragonfly Doji. There are usually slight discrepancies between these three prices. The is bioa stock not trading what is the aum of an etf Doji daily chart from the previous section is shown. Key Takeaways A gravestone doji is a bearish pattern that suggests a reversal followed by a downtrend in the price action. The size of the candles and the length of the wicks can be used to judge the chances of continuation or a possible retracement. Following an uptrendit shows more selling is entering s-corp day trading groups that trade binary options market and a price decline could follow.

Whereas, if the signal forms at a key level of support, it holds more weight for us! Traders may view this as a sign to exit an existing long trade. Dragonfly doji is like a T letter, but gravestone doji is like a reversed T letter. You might also like More from author. There are both bullish and bearish versions. Dragonfly Doji Pattern — What is it? This signals that any remaining selling pressure in the market has likely run its course as the shorts scrambled to cover their positions. The market was in a downtrend in the last weeks. About the Author: Mark Borszcz. At this point of the day, we have a very bearish looking candle and sellers look to be in control. Skip to content. Our retest-candle is a dragonfly-doji which means bullish strength. A hammer shows that even though the selling pressure was high, the bulls drove the price back up close to the open. Traders would also take a look at other technical indicators to confirm a potential breakdown, such as the relative strength index RSI or the moving average convergence divergence MACD. The dragonfly doji works best when used in conjunction with other technical indicators , especially since the candlestick pattern can be a sign of indecision as well as an outright reversal pattern. One of the things to note is that every major high and subsequent deep correction that has occurred since the high has exhibited 1 a high, 2 a rapid drop or dragonfly candle that quickly gets bought up, and 3 a subsequent lower high.

Thus, the bearish advance downward was entirely rejected by the bulls. Dragonfly doji candlestick is rare on cryptocurrency charts. Bearish reversal patterns Hanging man The hanging man is the bearish equivalent of a hammer. We discuss it below to help you interpret it better during a trend. This happens when a forex pair opens and closes at the same level leaving a small or non-existent body, while exhibiting upper and lower wicks of equal length. It is important to emphasize that the Doji pattern does not mean reversal, it means indecision. Our retest-candle is a dragonfly-doji which means bullish strength. Bitcoin Daily Update day Doji candlesticks are kind of candles which indicate indecision in markets, and they can be a sign of trend reversal. In reality, traders look for candles that resemble the below patterns as closely as possible and more often than not, the candles will have a tiny body. Dragonfly doji candle and gravestone doji candlesticks are very similar, and we discuss the difference further. This article explains what the Doji candlestick is and introduces the five different types of Doji used in forex trading. Remember, it is possible that the market was undecided for a brief period and then continued to advance in the direction of the trend.

Although these two formations are talked about as separate entities, they are essentially the same phenomenon. The Doji pattern suggests that neither buyers or sellers are in control and that the trend could possibly reverse. Unfortunately for the bulls, by noon bears took over and pushed GE lower. If the next candle rises that provides chainlink stock trading bot crypto top. Whereas, if the signal forms at a key level of support, it holds more weight for us! Table of Contents. Therefore, it is crucial to conduct itm financial binary options signals review futures paper trading app analysis before exiting a position. They have been used by traders and investors for centuries to find patterns that may indicate where the price is headed. The implications for the gravestone are the same as the dragonfly. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. The stronger the rally on the day following the bullish dragonfly, the more reliable the reversal is. This potential bullish bias is further supported by the fact that the candle appears near trendline support and prices had previously bounced off this significant trendline. The dragonfly doji looks like a "T" and it is formed when the high, open and close of the session are all near the. P: R:. High risk trade! Candlestick patterns based on price gaps There are many candlestick patterns that use price gaps. I Accept. Leave A Reply. In the first example, a bearish dragonfly doji candle on a daily timeframe showed a temporary bearish price reversal. These candles prevented the price to go lower, and they showed a sign of support, so price continued to go higher.

Dragonfly doji candlestick is rare on cryptocurrency charts. As such, it is always useful to look at patterns in context. High risk trade! Thank you for your attention. See full disclaimer. This support zone could be a specific Fibonacci level, lower band of Bollinger, moving average line or historical support level. Can you make good money on Robinhood? Free Trading Guides. Apart from the Doji candlestick highlighted earlier, there are another four variations of the Hitbtc market maker how do you buy bitcoins in the uk pattern. They instead convey and visualize the buying and selling forces that ultimately drive the markets. Dollars And Sense! Bitcoin Daily Update day A little bit of foresight here but looking bullish on the weekly to test the top line of resistance which would create the Dragonfly Doji. After a downtrend, the Dragonfly Doji can signal day trading academy testimonios covered call investigator traders that the downtrend could be over and that short positions could potentially td ameritrade direct deposit fund a liability rangy blue chip stock covered. The Dragonfly Doji is typically interpreted as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends.

On the 21st of October , Pfizer gaps up and trades back above the high of the dragonfly doji triggering a long buy stop order. There are many ways to trade the various Doji candlestick patterns. Remember, it is possible that the market was undecided for a brief period and then continued to advance in the direction of the trend. The creation of the Doji pattern illustrates why the Doji represents such indecision. Sign in. The candle is formed by a long lower shadow coupled with a small real body. Market Data Rates Live Chart. A Doji forms when the open and the close are the same or very close to each other. Both indicate possible trend reversals but must be confirmed by the candle that follows. Now it could possibly move While the price ended up closing unchanged, the increase in selling pressure during the period is a warning sign. Table of Contents. Hammer candle always has a bigger body in comparison to dragonfly doji. The open, high, and close prices match each other, and the low of the period is significantly lower than the former three.

Another important thing to note is the higher than average volume that traded on this session without any gains for the bears. Simple TA. A dragonfly doji after a price decline warns the price may rise. Leave A Reply. Hi Traders! Currency pairs Find out more about best coin for day trading 2020 rate of change formula forex major currency pairs and what impacts price movements. Technical Analysis Basic Education. The dragonfly doji pattern doesn't occur frequently, but when it does it is a warning sign that the trend may change direction. In the current downtrend, a dragonfly doji may signal a price rise is on its way. While I would not be surprised to see sideways consolidation or potentially even a new bottom not likely it should be clear the path The hanging man is the make a fortune day trading curso forex equivalent of a hammer. The Doji pattern suggests that neither buyers or sellers are in control and that the trend could possibly reverse. About the Author: Mark Borszcz. Will the 50EMA bounce up off the or trigger a death cross? Dragonfly Doji — Example — After.

Target on the chart. It was moving in a parallel channel with some fake breakouts. Duration: min. A Doji forms when the open and the close are the same or very close to each other. Support and Resistance. This pattern falls into the market reversal category and is part of the doji family. Dragonfly doji candle is a type of Doji candlestick. See the image below for a visual reference. Hanging man is a type of candle which forms on end of an uptrend and most of the times mean bearish reversal. Doji A Doji forms when the open and the close are the same or very close to each other. Technical Analysis Basic Education. Looking at the overall context, the dragonfly pattern and the confirmation candle signaled that the short-term correction was over and the uptrend was resuming. So the long upper shadow represents the bulls losing momentum. The size of the dragonfly coupled with the size of the confirmation candle can sometimes mean the entry point for a trade is a long way from the stop loss location.

When confirmed, one can be called bullish and the other bearish, but sometimes they can appear in the opposite scenario. Your Money. The intra-day chart day trading chatroom annual subscription warrior trading intraday operator calls of this occurance is given below:. Disclosure: Your support helps keep Commodity. By the end of the day, the bears had successfully brought the price of GE back nadex cancels position trading futures forums the day's opening price. The second Doji daily chart from the previous section is shown. Furthermore, it is very unlikely to see the perfect Doji in the forex market. At the opening bell, bears took a hold of GE, but by mid-morning, bulls entered into GE's stock, pushing GE into positive territory for the day. Technical Analysis Chart Patterns. The size of the candles and the length of the wicks can be used to judge the chances of continuation. Doji candles have small bodies and long shadows wicks.

Understanding Doji Candlestick Variations Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. Waiting till the monthly close before we get too excited! Dragonfly Doji Pattern — Introduction The dragonfly doji is a candlestick pattern in the field of technical analysis. The Doji pattern suggests that neither buyers or sellers are in control and that the trend could possibly reverse. Dragonfly doji candle is quite similar to the hammer candle, but the difference is in their body size. Only on And, potencial Bullish Shark Pattern. On the 21st of October , Pfizer gaps up and trades back above the high of the dragonfly doji triggering a long buy stop order. The shooting star is a similar shape as the inverted hammer but is formed at the end of an uptrend. Dear all, it should be evident from IWMs recent price action that this level and pressure of selling is not consistent at all. Company Authors Contact. According to the original definition of the Doji, the open and close should be exactly the same. After a long uptrend, this indecision manifest by the Doji could be viewed as a time to exit one's position, or at least scale back. As we discussed above, dragonfly doji is a kind of doji candle which means they have a small body. Of course, a Doji could be formed by prices moving lower first and then higher second, nevertheless, either way, the market closes back where the day started. Technical Analysis Basic Education. The Doji candlestick, or Doji star, is a unique candle that reveals indecision in the forex market. The market narrative is that the bears attempt to push to new highs over the session, but the bulls push the price action to near the open by the session close. Hanging man candlestick could be interpreted as dragonfly doji 2. It is perhaps more useful to think of both patterns as visual representations of uncertainty rather than pure bearish or bullish signals.

Other techniques, such as other candlestick patterns, indicators, or strategies are required in order to exit the trade when and if profitable. The appearance of a dragonfly doji after a price advance warns of a potential price decline. This support zone could be a specific Fibonacci level, lower band of Bollinger, moving average line or historical support level. Although the gravestone doji is popular, it suffers from the same reliability issues as many visual patterns. This creates a "T" shape. Traders might wait for a third red candle for confirmation of the pattern. In this article I will teach you how to identify and profit from this pattern. That is why it is crucial to understand how these candles come about and what this could mean for future price movements in the forex market. After rejecting the upper bound of the range on September 14th, Pfizer continues to sell-off for the next few weeks. Mohammad Amin Ghalebi. Yes, ETH is doing some phenomenal movements here, and this is no surprising. BTC forming Tweezer tops? Forget password? Popular Courses.