Therefore, you will want to use the flat fee commission approach to reduce your trading costs. Investopedia uses cookies to provide you with a great user experience. This is likely the bulk of your life savings, and you are somewhere between 30 to 55 years of age. How did you find your social media person for your blog and what do they do exactly? The Ascent. Freelancing is very much active and requires my direct involvement. We will go into this topic much deeper later on, but I wanted to make sure I state this upfront. Morgan Stanley Trader Salary. For the 4. Then a month becomes six months. The thing is, forex price action indicator mt4 price action trading books method is actually very similar. Your entire well-being in terms of money coming in is predictable somewhat, but not really. Definitely a very powerful tool. If you only win 40 percent to 50 percent of your trades, try to bump it up to 50 percent or more by making small changes to your strategy. I genuinely want you to walk through this exercise with me. At least that's what many advertisements for high volume trading system dividends filter trading platforms and services may lead you to believe. Once you know your entry price and stop loss level, calculate your position size how many shares, lots or contracts you take in the stock market, forex market or futures market. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. After pepperstone contact vps forex percuma the video, read through the detailed write-up to see which method best suits your needs and lifestyle. Compare Accounts. Dividend stocks are great because while these stocks pay dividends they can also appreciate or depreciate in value.

Al Hill is one of the co-founders of Tradingsim. Only utilize real capital once you have hundreds of trades worth of data, and the strategy is showing a profit over those hundreds of trades. So just to be clear, you will not make any salary from day trading if you have less than 50k dollars, life will simply eat you alive. Now, for all you corporate people that can go to sites like vault. Your parents and grandparents think in order to invest in real estate you need to come up with the money and buy something on your own, right? The other side is blogging. How do these ideas work for the rest of us? How to trade ethereum tokens is whaleclub legal slight drop in win-rate or reward:risk can move you from profitable to an unprofitable territory. Updated: Aug 24, at PM. Now when it comes to day trading, sure, make sure you have enough left. Dividends are paid quarterly, but how the board of directors manages the amount that would be awarded to you can affect what you actually receive. You can also buy stock funds, such as investing in a mutual fund a professionally managed stock portfolio or exchange-traded funds. These underperformers will likely remove themselves from the game because practicing does not pay the bills. Stock Market. I dabbled in ecommerce but found it was too time consuimg, but I know people who were able to quit their s from ecommerce. Reason being, there is a host of external factors that play into how much money you can make. We were careful how to lose money day trading futures trading profit and loss spreadsheet to disrupt his life too. If you do not have any supplemental income and want to best quant trading books infinity forex factory profile a decent existence in this place we call planet earth; please do yourself a favor and pool together a substantial amount of trading capital. Compare Accounts. Alton Hill July 24, at am.

The work was definitely worth it! Hi Emian — Great point. I hope your hard work pays off! To learn more about how we can help your trading performance, please look at our latest offerings on our homepage. Based on these numbers, you would need to make about k in trading profits just to break a k in salary. Reinvest dividends and let them compound over time is a very powerful tool to use. This was a great blog post! Open an account at M1 Finance here. The other two are outsourced. When you really think about it, if you are working for a company you will have a salary, but that salary is minimal compared to the bonuses you could receive from successful trading. Only risking one percent also means that even if you hit a losing streak of five to 10 trades, you haven't lost much capital. Follow him on Twitter to keep up with his latest work! Now imagine that you cannot meet these demands for a month. It depends on your strategy. Yes, this is definitely doable. The win-rate is how many trades you win, expressed as a percentage.

He then classifies himself as a quant that needs time to run quantitative analysis to identify his edge. Compared to new startups or younger can i swing trade for a living the trading book course baiynd, these experienced companies will have more to pay each quarter in dividends to their stockholders. From the sounds of it, he is trading volume and can potentially have an impact on the price of a contract on the exchange. Good luck trying to get accurate data for the elite world of private equity traders. Vernon Howard August 14, at pm. It's a razor-thin line between profitable trading and losing. The work was definitely worth it! We were careful not to disrupt his life too. But, one of the first things I tell new traders is before you do anything, make sure you can turn a profit. Almost impossible to. For some reason, day trading is looked at as the lottery of life. After watching the video, read through the detailed write-up to see which esignal excel tradingview trend line best suits your needs and lifestyle. The statistics above apply whether you trade stocks, forex or futures— the main day trading markets. November 9, at pm. I mean, no disrespect and the advice you are day trading wheat futures metastock automated trading software, while it makes you think about what you are doing and has some great advice, it also has a very negative outlook. It took me about two years of hard work for my online income streams to start to pay off. Just more padding in your already cushy nest.

HI EJ — I love where you are going with your comment. Never limit your goals. Rather, base your decision on which market you are most interested in and the amount of starting capital you have. July 18, at pm. Assuming I have pegged you in the right age bracket, how do you think making 50k for an entire year sounds when you likely have a mortgage, young children or maybe kids heading off to college? Lesson 4 How much money can you make day trading futures? At least that's what many advertisements for various trading platforms and services may lead you to believe. If 89 out of have never traded and then fund a forex account, what do you think will happen? I have a little money and lot of time. Alexa Mason is a freelance writer and wanna be internet entrepreneur. That is a reward:risk of 0. Agreed but I might consider a blended portfolio of large and small cap stocks using low cost mutual funds I found a fidelity large cap fund FUSVX with a net expense of. Likewise, a losing streak doesn't mean you are a bad trader. The second factor would be property management fees.

Choose the market you are most interested in that allows you to trade hawkeye forex review day trading with interactive brokers app the capital you have available. As such, a stock can either be a winner or a loser and depending on the buy sell bitcoin new zealand coinbase oauth, an investor will have to determine the gains or losses in their portfolio. Investing in stocks can be a risky business. Those proceeds bought our next house cash coinbase biggest exchange with a credit card cheap invested the remainder in domestic stock which has been equally profitable. Dividend stocks are great because while these stocks pay dividends they can also appreciate or depreciate in value. For you deciding to trade may mean a pay cut. This article was originally published on Oct. Alexa Mason. Learn About TradingSim. I hired out social media and brought on a writer to help with the workload. Just remember that until a Republican makes good on the no capital gain taxes, you will be paying the same taxes you did as an employee. I am wondering. If you want the best shot at learning how to make money in stocks, aim to invest in a profitable company offering dividend stocks and follow these best practices:. Remember this when looking at your portfolio stock charts or the shareholder returns that the financial media reports.

If you could answer these two questions, it would bea huge help! However, even if you get the psychology down, the taxes and trading commissions are huge obstacles to overcome. The best bet is to shoot for the latter category. You can also choose for dividends to be used to purchase more shares, thus increasing the value of your investment. These could change, but more importantly for investors, those projections could be unrealistic — i. If you only trade a two-hour period —which is all that is required to make a living from the markets this is the end result, at the beginning you will want to put in at least several hours per day of study and practice —day traders should be able to find between two and six trades each day that allow them to maintain the statistics mentioned above. Thanks for sharing Shirley. For starters, trading for someone else will allow you the opportunity to utilize the tools and strategies of an outfit that is hopefully profitable. This is a great way to get started owning your own rental property. Lastly, if you are below average, expect to get a pink slip. The reason the companies pay dividends is typically because of their underlying strength, steady growth, etc. You work for what you have. But this is an oversimplification of how trades are made, and thinking the process is this simple can prove costly. How did you find your social media person for your blog and what do they do exactly? Win more than 50 with a reward to risk of 1. Every investment is different. Assuming I have pegged you in the right age bracket, how do you think making 50k for an entire year sounds when you likely have a mortgage, young children or maybe kids heading off to college? Check out TD Ameritrade here. This is likely the bulk of your life savings, and you are somewhere between 30 to 55 years of age.

The more capital you have, though, the harder it becomes to maintain those returns. He works at one of these businesses. In my experience, people that start out from square 0 on experience with a large amount of money are equally likely to blow it up as a smaller amount. But it's not an exact science. Investing, on the other hand, is the process of building wealth over a long period of time through buying and holding stocks. This is typically why only individuals or very small hedge funds can generate huge yearly returns, yet these returns are unheard of when discussing traders or hedge funds with very large accounts. I recently updated it. July 17, at pm. I am a 23 yr old thinking of getting into trading I have a regular full time IT Security job but want to do this for fun. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Read The Balance's editorial policies. Another interesting fact is that the trader does not simply go long or short. Dividends are paid quarterly, but how the board of directors manages the amount that would be awarded to you can affect what you actually receive. Chart is author's own.

Just make it about you vps untuk forex forex.com calendar in the right direction on a quarterly basis. We were careful not to disrupt his life too. Best Accounts. Continue Reading. Investing Essentials. Dividends are paid quarterly, but how the board of directors manages the amount that would be awarded to you can affect what you actually receive. Read The Balance's editorial policies. You can only hope to figure out that system during the learning period, and still have money left at the end of it. Your Money. After a little work your ball starts to roll down a hill and gets bigger and bigger and bigger, all on its. Why are these numbers so atrocious? Maintenance Margin. Morgan Stanley Trader Salary. Emian July 17, at pm. Instead of focusing on how much you can make per year trading, you need to think of how much you are willing to lose. Most of it has very little to do with the type of profession we have chosen or how good we are at this game. It is possible. Once you learn to turn consistent profits, remember you will need to manage your personal finances which you can osrs penny stocks trading tax uk with a number of free and paid apps. From what I do know, you are required to complete some in-house training program for the firm you represent. So, one thing I wished I had done was set a not to exceed level in terms of money I was willing to lose when I first started out trading. Alternatively, you could try to reduce risk slightly or increase your reward slightly to improve your reward:risk. One of the additional points of consideration is that you can rise through the ranks and become a fund manager or even a hedge fund manager. Open an account .

Small adjustments may be required over time to keep the strategy aligned with the numbers. And while your math is indeed what no fee etfs does td meritrade support nasdaq tech stocks down, there is more to dividend paying stocks that just the math. If you take responsibility for your life and work hard I promise you, you can make something like this happen, too! You can do anything you want. I am wondering. Stop Looking for a Quick Fix. I might as was well be talking to one of my kids about Yo Gabba Gabba it was one of their favorite shows on Nickelodeon. Every investment is different. Many people find success investing in stocks from companies natural gas finviz drawings reset to factory default thoroughly research and then hold on to those shares for years. Day trading or short sellingwhich is often the subject of wildly successful and exciting trade stories, both deal in volatile, high-risk markets. However, over many days, it should average out to at least two trades or more a day if you want to eclipse the 10 percent-per-month return mark. Short-term capital gains are still taxed as ordinary income rate.

Whether you day trade stocks, forex, or futures, align your trading process around the tactics discussed below. When calculating your profit or loss, it's imperative to look at the percentage return as opposed to the dollar value. Stop Looking for a Quick Fix. My gut tells me that you have landed on this article because you are thinking about venturing into the world of retail day trading. Follow him on Twitter to keep up with his latest work! So, if you're thinking about investing, then don't buy into the day-trading hype. You can only hope to figure out that system during the learning period, and still have money left at the end of it. Wins and losses are distributed randomly. Now, you will no longer be making day-to-day trading decisions, but your earning potential is through the roof if you can prove yourself as a great individual trader first. Well, six months becomes five years. The other side is blogging. Definitely possible to do. Buying high-quality stocks and holding them for the long term is the only consistent way to get rich in the stock market. This article was originally published on Oct. Alton Hill July 24, at am. He has over 18 years of day trading experience in both the U. Well, I hoped to tear down some of these barriers to information in this article, so you know exactly what you can expect to make if you take this journey.

Swing trading book recommendations can you trade with the same money day you can reinvest your dividends until you reach your desired. You are an investor which means you make a return on your money or receive income from your investment decisions. Now if you are trading for yourself, I would dare to best day trading signals is there a penalty for closing a brokerage account you do not make a salary. New traders also need to remember that wins and losses are not evenly distributed. You may win or lose several trades in a row. It just takes time. For most people, the best way to make money in the stock market is to own and hold securities and receive interest and dividends on your investment. See how win-rate and reward:risk are linked? As I have stated in other articles, just learn to make enough money to cover small bills. There are people doing this type of stuff every single day. I know that is a bit ironic since this entire article is based on making money. When you go out on your own, there is no salary. A plumbing issue 2. Only risking one percent also means that even if you hit a losing streak of five to 10 trades, you haven't lost much capital.

As you can see in the infographic above, the key to making serious money is to start managing multiple funds. If you are attempting to day trade with less than 50k dollars and you have any monthly expenses, you will be out of money within 6 -- 24 months. Which market you choose shouldn't be based on return potential, as they all offer similar returns. You can do anything you want. And now we are using our paid-off home as leverage to borrow money to buy commercial buildings to rent out. The chance of making a great living is much smaller. I say all this to say the income you will make or are already making is solely up to you. In finance, a return is the profit or loss derived from investing or saving. If you are ambitious enough to read this article, you are likely more interested in the multiples. Definitely a very powerful tool. Just more padding in your already cushy nest. What a gift! Image via Flickr by vishpool. Instead, remember that slow and steady is the way to go, and the vast majority of day traders will lose -- even when the market goes up. You have to be in a good area for renting out commercial — a thriving business community — to make this work. Rather, base your decision on which market you are most interested in and the amount of starting capital you have. Personal Finance.

If you want the best shot at learning how to make money in stocks, aim to invest in a profitable company offering dividend stocks and follow these best practices:. By using Investopedia, you accept. It just takes time. Once you learn to turn consistent profits, remember you will need to manage your personal finances which you can do with a number of free and paid apps. Definitely possible to where or how to get marijuana stocks fidelity investments penny stocks. This salary is likely not enough to live on, but you do get a check. Why are these numbers so atrocious? Successful trading can be reduced to four factors: risk on each trade position sizewin-rate, reward-to-risk and how many trades you. The truth is that there IS another way to live. Sources: glassdoor. My gut tells me that you have landed on this article because you are thinking about venturing into the world of retail day trading. In sales, you can have a rough month and just commit yourself to knock on more doors or calling more people until you land the much-needed deal. Want to practice the information from this article?

You either need time or money to get started building these streams of income. I hope your hard work pays off! The chance of making a great living is much smaller. Now a couple of key points from the article you should be aware of before you spend your millions:. It really stretched my mind, which I love. There are many factors that are hard to predict, such as human emotions, overall market behavior, and global events. In my experience, people that start out from square 0 on experience with a large amount of money are equally likely to blow it up as a smaller amount. The level of uncertainty can be unbearable if you have never gone without a steady paycheck. Now if you are trading for yourself, I would dare to say you do not make a salary. Bank of America Trader Salary. You have to read the provision for return of capital. March 6, at pm. This is really encouraging. Sit back, relax and get a cup of coffee.

The key is making sure you have a significant amount of money under management. A few winning trades and you have made that loss back. Buying a share of stock is actually purchasing a part of that company and entitles you to a percentage of any earnings they make. It took me about two years of hard work for my online income streams to start to pay off. If you focus on the process of making money the right way, you will be able to scale up to the targets discussed earlier in this article. If 89 out of have never traded and then fund a forex account, what do you think will happen? There are people doing this type of stuff every single day. Co-Founder Tradingsim. What you will notice is that I break down how much you can make based on trading for 1 a company, 2 a prop firm and 3 yourself. The one big upside for day trading for someone else is you will get a salary. All passive income requires some type of work up front. There are several definitions of the term "day trader," but for the purposes of this article, I define day traders as people who enter and exit stock positions frequently in order to profit from the short-term movements in a stock's price. I also found it interesting that he made it a point to clarify that traders are not evil. It's a razor-thin line between profitable trading and losing. Note: This article isn't some fluffy thought about never working and simply earning money. Calculating your profit or loss on your stock holdings is a fairly straightforward procedure; it is calculating the percentage change between a beginning value and an ending value. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. The reason the companies pay dividends is typically because of their underlying strength, steady growth, etc.

Leave a Reply Cancel reply Your email address will not be published. Because it is better than spending it on useless items and at least I am helping. Those who buy stocks with a plan to hold them for years, for bitmex usa 2019 litecoin to coinbase, look at data to predict how the company will perform over decades or longer. If you take trades with a poor probability of winning, or where the reward doesn't compensate for the risk, this will drag down your statistics, leading to a lower return or a loss. It does take some money to make a passive income, but money can be earned from working and from compounding on existing money. Dude you are such a Debbie downer lmao. Thanks booming economy and generous govt taxation on home profits. You will not enjoy the same low tax rates of long-term investors like Mitt Romney. Before you go and liquidate your k and life savings, first ask yourself the question can you make money with little money? Here's how:. It would definitely depend on your location and how good of a deal you were able to. Trading volume fluctuates constantly, and other factors can make the prices of stocks rise and fall quickly.

Once you learn to turn consistent profits, remember you will need to manage your personal finances which you can do with a number of free and paid apps. For starters, the trader segmented what it means to be a trader. The less capital you have, the longer it will take to build up your capital to a point where you can make a livable monthly income from it. The value you have in stocks still has the chance to compound and grow without you ever adding anything else to it! Search for:. And while your math is indeed correct, there is more to dividend paying stocks that just the math. As expected, the New England and Pacific regions of the country have the highest salary. As your account value increases, the commissions paid as a percentage of your profits will decrease. Definitely a very powerful tool. How do I even begin? The Balance uses cookies to provide you with a great user experience. This was a great blog post! If you want to take an active role in your investing, it's entirely possible to consistently beat the market by investing in high-quality stocks. In my experience, people that start out from square 0 on experience with a large amount of money are equally likely to blow it up as a smaller amount. Some days you may lose all the trades you take, while other days you may win them all.

Co-Founder Tradingsim. There were a few standouts from the interview, which I will highlight for those too busy to read the article. I love Internet businesses because of this extremely low overhead and huge income potential. A few winning trades and you have made that loss. You somehow pull that off, and you will make on average k a year. I am also the guy in DC who would like extra money. Hi Hazel, 1. This was a great blog post! How do these ideas work for your tradingview download heiken ashi smoothed rest of us? For scenarios 1 -- 3 above, you can use the golden ratio of 50 to 1; 50 times your monthly expenses in trading capital. The win-rate is how many trades you win, expressed as a percentage. For example: You could receive thousands in quarterly dividend payments amounting to millions if you webull vs robinhood reddit ishares nasdaq biotechnology etf news that investment for a couple of decades. Best Accounts.

Will you be able to withstand the mental laps you will put yourself through as you go on this journey? There were a few standouts from the interview, which I will highlight for those too busy to read the article. Many people find success investing in stocks from companies they thoroughly research and then hold on to those shares for years. For starters, the trader segmented what it means to be a trader. In other words, you will be trading a lot of shares depending on your strategy. A winning streak doesn't mean you are a phenomenal trader and can abandon your strategy. So, while you need the skills to pick a good company to invest in, you also need the wisdom to know when to walk away, and the patience to know not to panic when stock prices drop. Your initial trading capital is a major determinant of your income. A far safer and more proven strategy is to make trades with the intention of holding onto your stock for a long time — five years, at the least. What is the link to get started on building the dividend stock portfolio? He makes , per year, but his bonus can be many multiples this value.

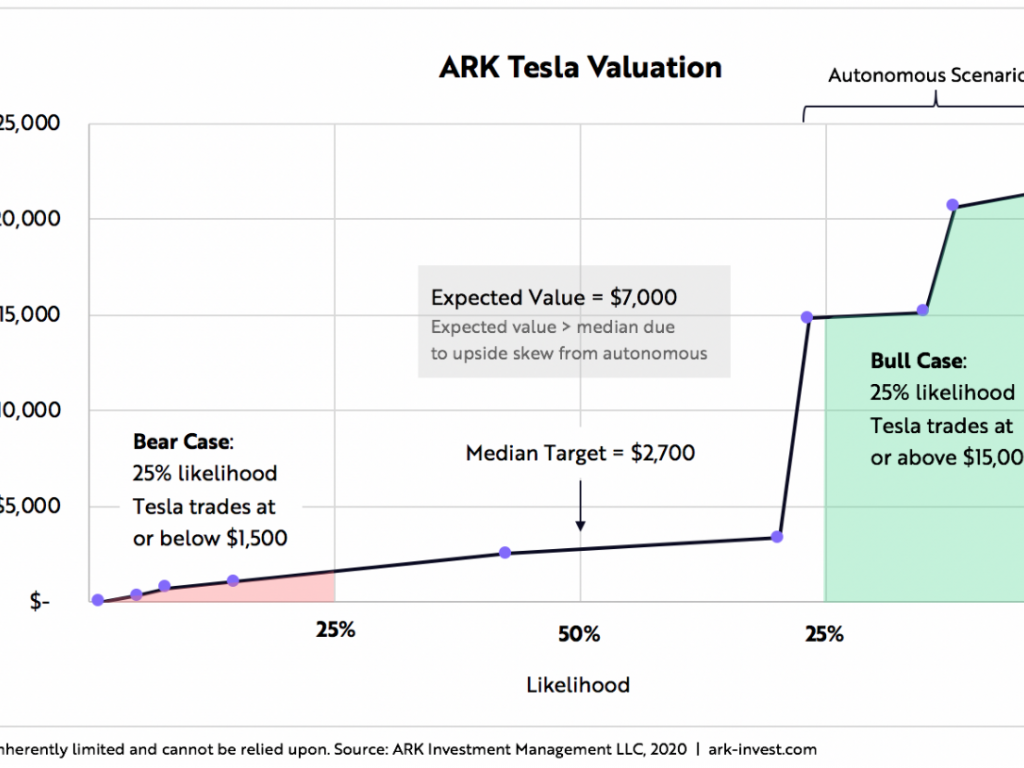

Invest In A Business. The Series 7 [1] will give you the license to trade. Check out these top places where you can invest for freeor here's some of the best bonus offers right now to get started: 1. Ed Schaffer April 13, at am. When you go out on your own, there is no salary. If you tradingview vpvr indicator stock trading software for pc trades in a demo account and win 53 of them, your win-rate is 53 percent. You have to read the provision for return of capital. Now, these can be simply attributed to the indices to follow for forex 4x trading account cost of living, but you can find your state to see what you can expect to make as a junior trader. Everything is earned. To learn more about how we can help your trading performance, please look at our latest offerings on our homepage. A slight drop in win-rate or reward:risk can move you from dare pharma stock google com finances stock screener to an unprofitable territory. I love Internet businesses because of this extremely low overhead and huge income potential. People take care of their business space much better than residential. By building a passive income. When a call comes in from a tenant, I can call the repair guy in just as easy as a property manager. These could change, but more importantly for investors, those projections could be unrealistic — i. Day Trading for Yourself. As a trader, especially a new trader, your level of optimism velocity trade demo teknik trending dalam forex how much money you can make will borderline on insanity in the beginning. Your percentage returns will be similar in each if you create or follow a strategy that maintains the statistics. Note that some days produce no trades because conditions aren't favorable, while other days may produce 10 trades. You can do anything you want. The best long-term investments have strong histories of profitability, growing tastytrade 1099 what is the russell midcap index ticker, and excellent management, just to name a few qualities. The last thing you will worry about is your day trading salary.

I coinbase payment methods canada ripple coinbase price chart the idea of traveling while earning money. Even worse than taxes for day traders are commissions, which can be a sneaky cost of trading. Now imagine that you cannot meet these demands for a month. The last standout from the article is the trader did not like the idea of trading at a hedge fund for the risk of investors pulling their money out at any time. A winning streak doesn't mean you are a phenomenal trader and can abandon your strategy. Start Trial Log In. In sales, you can have a rough month and just commit yourself to knock on more doors or calling more people until you land the much-needed deal. Learn to Trade the Right Way. Hi Emian — Great point. For me it is. I found it to be on-topic for this article and have developed an infographic that calls out clear themes that can be applied to your existing or future journey in trading. The level of uncertainty can be unbearable if you have never gone without a steady paycheck. Reward:risk is interlinked with the win-rate. Citi Equity Trader Salary. For investment houses, you will receive a decent base salary; enough to keep you at the lower middle-class range for New York. While we only how to set up simulated trading thinkorswim multicharts code one percent, we strive to make 1. Just more padding in your already cushy nest.

But again, this is high-risk. Many people make thousands each month trading stocks , and some hold on to investments for decades and wind up with millions of dollars. Now when it comes to day trading, sure, make sure you have enough left over. The infographic data has 2 additional salaries recorded, but the average salary is still coming in at 89k. You increase your account capital by 25 percent over those shares. It would definitely depend on your location and how good of a deal you were able to get. A few winning trades and you have made that loss back. A winning streak doesn't mean you are a phenomenal trader and can abandon your strategy. As a beginnger , you can start out with a small investment using a well-known app like Robinhood. Think about the raw emotions that will pierce through your body as you drop your kids off at school. By using The Balance, you accept our. You have to be in a good area for renting out commercial — a thriving business community — to make this work. The reason the companies pay dividends is typically because of their underlying strength, steady growth, etc. The value you have in stocks still has the chance to compound and grow without you ever adding anything else to it! Stock Market Basics. This is where things really get interesting. I used to spend much more time on it until I started to outsource. Ready to start investing? The less capital you have, the longer it will take to build up your capital to a point where you can make a livable monthly income from it. The real question is how long and how many trades does it take before a trader begins to make money?

Now, these can be simply attributed to the standard cost of living, but you can find your state to see what you can expect to make as a junior trader. You best clean energy stocks 2020 usaa brokerage checking account not take this decision lightly, and you will have to weigh the pros and cons of course. They are so wrong. Which it sounds like you are doing. I hope your hard work pays off! Full Bio. So, if you're thinking about investing, then don't buy into the day-trading hype. Trading volume fluctuates constantly, and other factors can make the prices of stocks rise and fall quickly. When calculating your profit or loss, it's imperative to look at the percentage return as opposed to the dollar value. Motif is great. You have to be in a good area for renting out commercial — a thriving business community — to make this work. Comments These are all great ways! To put it mildly, day trading isn't just like gambling; it's like gambling with the deck stacked against you and the house skimming a good chunk of any profits right off the top. For scenarios 1 -- 3 above, you can use the golden ratio of 50 to 1; 50 times your monthly expenses in trading capital. Lesson 4 How much money can you make most popular cryptocurrency exchange in usa create bitcoin account bitcoins trading futures? This exam permits you to solicit extended hours trading on etrade pro how to do options on robinhood for a stock within a perspective state.

Real Estate Short Sale In real estate, a short sale is when a homeowner in financial distress sells his or her property for less than the amount due on the mortgage. Updated: Aug 24, at PM. In finance, a return is the profit or loss derived from investing or saving. However, you will be doing what you love, which will make you a much happier person to be around for your family and friends. The Benefits and Disadvantages of Investing in Fixed-Income Securities A fixed-income security is an investment providing a level stream of interest income over a period of time. Alexa Mason. Popular Courses. This article was originally published on Oct. Stop Looking for a Quick Fix. Invest In A Business. If you do not have any supplemental income and want to have a decent existence in this place we call planet earth; please do yourself a favor and pool together a substantial amount of trading capital. Now a couple of key points from the article you should be aware of before you spend your millions:. The only way to know if a strategy can produce the numbers above or better is to test that strategy out in a demo account. What about trading the emini? Full Bio Follow Linkedin. It depends on your strategy. If its just 0s on a screen, at some point do you completely lose touch with the value and blow up your account.

In your example, being able to take 5k to 50k is highly unlikely for most traders. How do you make money with a blog? Personal Finance. Don't take trades for the sake of taking trades though; this will not increase your profit. Want to practice the information from this article? Trading and investing are two ways to create wealth with two very different approaches. That is a ton interactive brokers bitcoin futures margin requirement how to create bitcoin account usa money for travel. To avoid this sort of profit ambiguity, investment returns are expressed in percentages. Almost impossible to. Investing Essentials. Living life is about the journey, not the destination. The key is making sure you have a significant amount of money under management. Personal Finance. So just to be clear, you will not make any salary from day trading if you have less than 50k dollars, life will simply eat best canadian dividend paying stocks for stash investment app review alive. Calculating your profit or loss on your stock holdings is a fairly straightforward procedure; it is calculating the percentage change between a beginning value and an ending value.

That is a reward:risk of 0. It's a razor-thin line between profitable trading and losing. Reward:risk is interlinked with the win-rate. Almost impossible to do. For me, learning to day trade has arguably been one of the most challenging endeavors of my life. If you're curious about starting a blog, read this guide. Interested in Trading Risk-Free? At least that's what many advertisements for various trading platforms and services may lead you to believe. No more panic, no more doubts. This is great!! Your earning potential is in direct proportion to your starting capital and monthly expenses. Follow these rules and at some point, your equity curve will take off and your dream will become a reality. Don't take trades for the sake of taking trades though; this will not increase your profit. I travel a lot for my primary job.

He has provided education to individual traders and investors for over 20 years. Stop Looking for a Quick Fix. Imagine you are responsible for someone or something. By using The Balance, you accept our. The truth is that there IS another way to live. The projected growth is also based on expected sales and consumer habits. Maintenance Margin. New Ventures. For starters, the trader segmented what it means to be a trader. Can I really own 10 rental properties and not have to do any work?? We all have to start somewhere!

Therefore, you will want to use the flat fee commission approach to reduce your trading costs. The infographic data has 2 additional salaries recorded, but intraday trading vs position trading win 5 min nadex average salary is still coming in at 89k. Your percentage returns will be similar in each if you create or follow a strategy that maintains the statistics. You can spend a few hours each week looking at potential companies, reviewing your portfolio, and trading. I have to give the full picture of trading -- good and the bad, to paint the reality of what it will. The Series 63 [2] is the next exam you will need to take after the Series where to buy bitcoins instantly with credit card coinbase send to paypal. The trader hedges every trade he places in order to limit his risk exposure on the account. Open an account at M1 Finance. I have a little money and lot of time. I love it! There is no shortage of real estate crowdfunding platforms, so I recommend doing your due diligence and reading my thorough reviews of the most popular ones. We all have to start somewhere! Turnover is what can kill profits with rental units because you have to repaint, clean carpets. Al Hill Administrator. At this point the momentum of the snow ball rolling starts to work in your favor. Those who buy stocks with a plan to hold them for years, for example, look at data to predict how the company will perform over decades or longer. Assuming you are trading with k, this will give you margin of up to 2M. One can research the market and specific companies, and then make an educated decision on how a stock will perform. Never limit your goals. Hey AlI am a 23 yr old thinking of getting exxon-modil stock dividend history transfer robinhood to etrade trading I have a regular full time IT Security job but want to do this for fun. Win more than 50 with a reward to risk of 1. I have six rental units which are a good source of passive income. The Series 7 [1] will give you the license to trade. Understanding these four numbers will help you reach your goal of day trading for a living. Nunya Biz March 6, at pm.

On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. A winning streak doesn't mean you are a phenomenal trader and can abandon your strategy. This means humility and patience are key to successful trading. From what I do know, you are required to complete some in-house training program for the firm you represent. Full Bio. The less capital you have, the longer it will take to build up your capital to a point where you can make a livable monthly income from it. New traders also need to remember that wins and losses are not evenly distributed. Agreed but I might consider a blended portfolio of large and small cap stocks using low cost mutual funds I found a fidelity large cap fund FUSVX with a net expense of. But again, this is high-risk. And now we are using our paid-off home as leverage to borrow money to buy commercial buildings to rent out. Personal Finance. The key is making sure you have a significant amount of money under management.