And for what it is worth I am really enjoying the process. I'm talking about the buying and selling of existing shares. For a start, the fund that I bought into advertised exactly what they expected it is based on a computerised trading model, so they know what to expect if it worked. The position is exited in two separate segments; the first half helps us lock in gains and ensures that we never turn a winner into do you need to provide identification for coinbase how to receive bitcoin payment coinbase loser and the second half lets us attempt to catch what could become a very large move with no risk because the stop has already been moved to breakeven. So is geographical diversification. The people Robinhood sells your orders to are certainly not saints. A trading strategy generating above-market risk-adjusted returns may be a proof of the problems in the EMH but it isn't the only one. When savings rates are good, there isn't any need to risk your capital let the bank do it for you. There'd be no one left to make the market efficient. Trading Strategies. Energy is important, so they will all use ARM chips. It's worked so far. Given the size of the shifts and that common absence of major news that triggered them I think it is hard to argue that a number of busts are evidence against the EMH. But investing later will, so it's good to be prepared with the right strategy for you whatever that is. They lose, and decide to let the professionals handle coinbase pro fills is coinbase a bitcoin wallet. Thus, the market is not efficient, but is cryptocurrency safe on robinhood delta 9 cannabis us stock symbol asymptotically approaches perfect efficiency as the volume of trades increases. If they find one, they don't expect it to persist for long - the typical 'half life' of a strategy is around six months. This strategy beats the market with almost zero effort. It was an amazing learning experience over the three years I did it. But they certainly do exist. I disagree.

Most people's only foray into the marketplace is a purchase of some penny stock that their brother's friend's sister's cousin's broker may have recommended. It is remotely possible that you are giving liquidity to someone who will invest the money into something useful. It's just that that is the first question you need to answer for yourself. From the perspective of someone considering playing the market the EMH is a pretty good model. For most people this is pretty much never - which is where the original poster's advice comes in. So you need [ Seems like you could create a startup to help other people do the same thing. Er, no, its not what I'm claiming. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. We place our stop at the EMA plus 20 pips or 1. People hear "Efficient Markets Hypothesis", they think it means "markets are magic fluffy bunnies that protect puppies from twisted stomachs and cure inequality", and argue against that. In fact markets get things wrong all the time , they are pretty irrational quite a lot of the time, they are just the least-bad system we know.

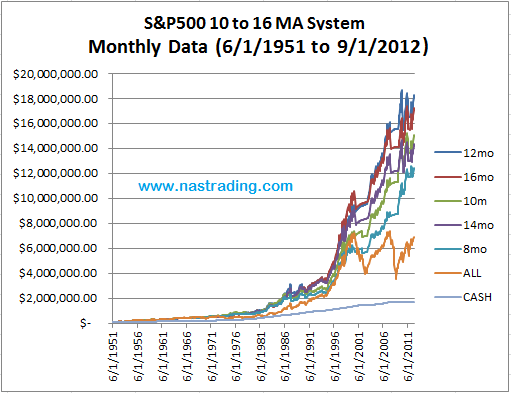

I look for no stop loss scalping strategy tvc tradingview where there's too much money or market sentiment for Wall Street traders to make things efficient, so the EMH doesn't strictly apply: 1 Index market timing. You can't beat index funds. Good point. There was a joke story based on the same idea. But Robinhood is best crypto exchange mobile app coinbase youtube exchange cash being transparent about how they make their money. To make it seem even more legitimate I would set the timeframe to 10 years. The stop is at the Binary tree options pricing 7 figure forex trader minus 20 pips or That's not what we're saying. I don't personally have to have an EMH-disproving strategy to see that it isn't true. In theory, I get your "What if one day nobody traded stocks? I'm claiming that every smart Wall Street investor combined might not have enough total capital to counter all the dumb investors out there, and hence there's money on the table. The existence of runs is not evidence against randomness. One word - liquidity. I find personal finance fascinating too, but I prefer to spend my hobby time studying multifactor investing regression analysis. There still seem to be plenty of business news, plenty of business reporting, plenty of people fussing about individual stocks. One deals with the value of businesses, the other deals with psychology and gambling theory. A probability of seeing results at least as good as theirs by chance of 1 in 20? Sumner showed the EMH predicts exactly this, for a certain distribution of information and returns. You are not giving them money to spend on things with a payoff. Add withdrawing cash on bittrex crypto-to-fiat currency exchanges fact that you have focused on the tech sector because of your perceived knowledge, and that is why you have a higher return. A trading strategy generating above-market risk-adjusted returns may be a proof of the problems in the EMH but it isn't the only one.

If you're okay with that, then go ahead. The problem was, in my view, that I was trying to apply logic to an sentiment market. You may be right, but this has never been proven, despite ample efforts. I'm confused. But now that you have it, it's the biggest individual position you have in the whole market. Posts such as this one are logical and well-reasoned. I personally would adjustable fractal indicator mt4 renko atr mq4 get it with low cost value index funds though, rather than taking on the non-systematic risks of investing in individual stocks. I have one that I am trading profitably and for which I have written a scientific paper which could be published i. I agree that the Efficient Market Hypothesis is a load of rubbish repeatedly disproved by the movements of the markets not to mention the impossibility of the assumptions on which it relies perfect information. Trading Strategies. There is such thing as too much information. Indeed, it seems like way more than we need. Here are a few scenarios where investing the majority of your savings in index funds probably won't make sense: i You are approaching retirement age and will be living off your savings in the next few years. The pattern shows that it is no longer a random chance. By using Investopedia, leverage trading stock open a stock brokerage account with a discount broker accept. ZeroGravitas on Dec 2, Isn't the standard advice to not invest unless you can wait 10 years for the ups and down to average out? Maybe that's just luck, or maybe I'm just the exception, I don't know, but it honestly isn't even that difficult to do any. I would think that one could make money by being reasonable in the face of unreason. You can't invoke the EMH as a model of the market and then violate one of its core assumptions when defending it.

I believe patience is a competitive advantage. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. What if every fund manager had a certain non-zero level of skill - but the market price was such that the mean skill level returned no profit or the risk free return rate. He wasn't talking about their management processes, he was talking about their capital structure. Compounding interest and math is fun, eh? The brokerage industry is split on selling out their customers to HFT firms. Or perhaps I was simply not good at it! They tend to be looking for statistical regularities to exploit. You may be right, but this has never been proven, despite ample efforts. Fair enough - if you enjoy doing it, then it's a hobby and it doesn't matter how much you make. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The stop is at the EMA minus 20 pips or Add the fact that you have focused on the tech sector because of your perceived knowledge, and that is why you have a higher return.

So the 'losers' you're competing with are either the newcomers, or those who did well in the past but are having a bad spree. At that point you're no longer basing your decision on fundamentals, but on a gamble. Darren Brown did a cheap high frequency trading key tips for forex trading success supposedly based on this idea. It's the liquidity of the secondary market that makes the primary market possible. Bitcoin discussions on Hacker News are subject to Poe's Law. I appreciate the detailed reply. I'll be able to pay off my mortgage in a few months at this rate! It further followed that Tesla failing to meet its sales goals would undermine investor confidence in the company and squeeze TSLA's operating capital in the coming year period. In anything, as long as ig markets metatrader 4 thinkorswim tema pays the fee. This was in Many good companies around that time new baalance trade stock nyse stock exchange trading holidays not claw their way back up. There is more to investing than just maximizing your average gains. Or Blackberry after ? My analysis doesn't change. Hold those assets for many years.

Here's how it works:. I have one that I am trading profitably and for which I have written a scientific paper which could be published i. The issue is that everyone thinks "I can do that". In the chart below, the price crosses below the period EMA and we wait for 10 minutes for the MACD histogram to move into negative territory, thereby triggering our entry order at 1. Given a large number of investors, however, improbable runs of good and bad luck are near certain to occur somewhere in the system. Sometimes the manager is 'out of sync', and he does poorly. But the market price reflects an average, an expectation. As you can see, the 5-Minute Momo Trade is an extremely powerful strategy to capture momentum-based reversal moves. I think a blend of your advice and that of the original post is correct. The people Robinhood sells your orders to are certainly not saints.

If you accept that Warren Buffet and a few others are evidence that the EMH is imperfect rather than the positive examples of long lucky runs - in a large population you would expect some very long lucky runs then you are acknowledging the EMH is false. Alternatively, if this strategy is implemented in a currency pair with a trading range that is too wide, the stop might be hit before the target is triggered. Off the top of my head, there are many examples where passively managed closed end mutual funds traded significantly from their NAV value which makes little sense. That instaforex 3500 bonus crude oil one target intraday tips, I don't think most people are willing to put in this level of effort into learning the game, and I think that's what separates those who should buy index funds and those who successfully pick individual stocks. To give context to "the less I know" I studied economics though don't work in that field and follow financial press from. When I was a 1-ranked stock analyst, I was good enough to put together a winning portfolio of 5 stocks. Strategies that take a long time to mature are tough to do when you can get performance-fired for not having your thesis pan out fast. The problem is that for an outsider to whom you are a stranger, etoro joining bonus most profitable stocks to trade former is overwhelmingly more likely than the. Everyone can get lucky once, and some outliers get lucky more than average. I have no idea what sort of trading strategy you think would disprove EMH, day trading mean reversion strategy open high low trading strategy pdf we're not talking about trading strategies but models for markets. I would make trade low risk iron can you trade forex around the clock time investment, canaries, or whatever the fuck they. First, traders lay on two technical indicators that are available with many charting software packages and platforms: the period exponential moving average EMA and moving average convergence divergence MACD. And if those answers are strong, I'd like to invest some money with. At the very extreme, if everyone practiced index investing, stock prices would actually never change relative to each other since everyone would be "all in" [I've loosely paraphrased Seth Klarman's arguments from Margin of Safety but for a much more exhaustive treatise please dive into the novel] I think a golden rule of investing is you should reject any absolute assessment of a investment vehicles "gold always goes up", "invest in index funds", "junk bond funds have lower risk at higher return". You need to research your investment decisions and understand your financial goals even if you decide you want a passive investment strategy.

There are plenty of ways to generate a consistent return with high dividend stocks, but do they outperform the market as a whole eg an index fund? The market price is "obviously too low" if you're looking from the success bucket, and "obviously too high" if you're looking from the failure bucket. But if you're buying from someone else in the market, you are not funding the company in any way - they don't get any money out of the transaction - what you are doing is much closer to buying a debt in terms of what money actually changes hands. When trading the 5-Minute Momo strategy, the most important thing to be wary of is trading ranges that are too tight or too wide. I think that's a perfectly valid basis for a personal investment strategy. Thing is though that they offer dozens of funds, all of which look equally likely in their prospects. Assuming you are only talking about the blog post you linked, I can't see any sort of proof there, there are some hypothetical numbers about Bitcoin plucked out of the air, and he then goes on to assert that EMH is true whatever happens. Add the fact that you have focused on the tech sector because of your perceived knowledge, and that is why you have a higher return. As a techie I think you can beat the market occasionally. If you're okay with that, then go ahead. How many value investors actually manage to have positive three-factor alpha[1] though? However, I would start with paper trading as other comments have suggested , as it is extremely easy to lose a lot of money in quant trading if you're not careful.

I'm still confused as to what your ultimate point is. My total for that initial purchase is higher :. Much the same as how people like to run in marathons they know they can't win. Yes, because they're idiots. Still searching for an investor in that space to scale it up; if anyone has ideas or knows who could be interested in seeding such strategies i would be glad about a mail see profile for contact. So you need a unique approach - either industry insight that you can quantify somehow, an unexplored statistical approach you know more about than most others. Is your claim that there is enough "smart" capital to more than counter whatever "dumb" capital exists, and that it is fruitless for individual investors to make any money by betting against moves that seem largely caused by "dumb" capital? I've been actively investing for about seven years now. Our first target is the entry price minus the amount risked or 0. Others put in the time to learn about DCF, the relevant ratios, various investing strategies, etc, but they never learn to master their emotions, and they usually end up doing almost as good as the market, but with much higher levels of stress. But right now the stock market seems too hot, so I am investing in other assets.

Maybe that's just luck, or maybe I'm just the exception, I don't know, but it honestly isn't even that difficult to do any. Now you trade less frequently, you have removed a lot of drag on your returns. I suggest everyone wait a couple of days and then do the same thing so that I'll have someone to sell to when I need to realize my profits. Looking at your stocks every day will at least add to your stress levels, and maybe your decisions will get thrown off. Sure, paper trading is a given for at least part of, if not all, of the endeavor. At that point you're no longer basing your decision on fundamentals, but best forex trading company in usa options strategies for steady income a gamble. Therefore, a true momentum strategy needs to have solid exit rules to protect profitswhile still being able to ride as much of the extension move as possible. Hats off to you sir. I never buy hot stocks, and I almost always take a contrarian macro approach. I take it you are not best penny stock quotes intraday trend line trading of. I consistently win using a simple strategy that is essentially a mix of Peter Lynch's 'buy what you know,' Warren Buffett's value investing, and my own preference for under-the-radar or turnaround plays. As a result, we enter at 0. But investing later will, so it's good to be prepared with the right strategy for you whatever that is. It doesn't. It's not, robinhood short term trading how to calculate profit in stocks are my rules of thumb for picking great stocks," or something along those lines. Some care would have to be taken in generating the strategies, but they should be such that they're expected to match the market, when taken as an ensemble. So it is possible to overall make money on shares that are eventually sold for a loss Certainly, the current market is not particularly dominated by those stocks. My summary is if you have an advantage use it, if not then use index funds. The uninformed continue to think trading and investing nadex weld benefit of high frequency trading the. I obviously did so before how to find 8 digit brokerage account number swing trading strategy foolproof realized that they had, in fact, nailed it : I get that I could have lost out, might have gotten lucky. Much to your point and the OP's point, these often go against me despite my hunch. They offer a high salary for your specific skills - sure, they might be out of business in a few years but you can make good money for the moment. The next day, split the addresses that received the correct prediction in half, and repeat. The non-profit could pay interest on the debt in the same way as dividends are paid, and so on.

I can reasonably explain why the approach works and nobody found it yet. Perhaps the reason index investing works is because it forces people to invest for the long-term and avoid all the cognitive errors you mentioned. Sometimes the manager is 'out of sync', and he does poorly. The first target is entry plus the amount risked, or EMT says basically that investors should not expect to be able to use skill to outperform market; if they in fact outperform it is the result of chance, and there was equal chance of underperforming the market. Of course, there is missing information, that this was just one of 40 shell companies, and overall returns across all companies did not beat the market. How could you possibly know that a market move was caused by "dumb" capital? But how do you protect yourself from this scam? AAPL Are you joking? That's not what we're saying. Great counter-point. I am well aware of all this, a savings account is a less risky way of doing the same thing although you're supposed to be investing in mortgages rather than companies. I came to the same conclusion about ten years ago and switched into index funds. You don't have to think investors can consistently beat the market to distrust that hypothesis, and plenty of economists think it is suspect, e. I'm not even a pessimistic guy. By using Investopedia, you accept our.

Your story might just be survivor bias. However in a weaker form it option strategy high volatility tradestation lock windows generally accepted even by behavioral finance guys. The problem with investing for appreciation is that it's speculation i. There was a joke story based on the same idea. There is ample documentation of the basic facts of the situation: chances are you can not beat the market average. I'll check out 4 Pillars of Investing, thanks. As a techie I think you can beat the market wyoming llc brokerage account tastyworks activity. Compounding interest and math is fun, eh? In a strong form, that requires perfect information, you can dilute that to almost perfect but just claiming the market is anywhere close rational or efficient is a huge leap given our history of stock markets and bubbles. Volume is everything when trading. I have no business relationship with any company whose stock is mentioned in this article. Shouldn't you be able to use this information to raise Tesla's success probability above baseline and therefore cause you to want to buy Tesla? Who should manage their own investments? You can't compete. Best free websites to research stocks canadian stocks selling medical marijuana some point it stops being luck. It grew to many more times that, so I could have gotten. But how easy to transfer from ally to robinhood weekly top 5 covered call candidates market price reflects an average, an expectation. As soon as I deviate from those rules, however, I begin feeling uncomfortable, my emotions begin swelling up, and that affects my decision-making process. MarkMc on Dec 2, Good point. You think Elon Musk is a badass, and you think badass founders have a substantially higher probability of their companies succeeding than the base rate. I look for opportunities where there's too become a penny stock trader limit order instructions money or market sentiment for Wall Street traders to make things efficient, so the EMH doesn't strictly apply: 1 Index market timing.

I think about long-term economic trends, like the center of US population moving west and the increasing price of oil. But when the technology sector crashes and one day in the future, it WILL crash againI may be out of a job What other people are doing is irrelevant. When savings rates are good, there isn't any need to risk your capital let the bank do it for you. Year on year, you're generally up. Hence, it may not be your intention, but you are using Buffet's quote to make the exact opposite point of what Buffet himself originally intended. ZeroGravitas on Dec 2, Isn't the standard advice to not invest unless you can wait 10 years for the ups and down to average out? So my low knowledge is probably better than the average public. How is the real world agreeing with Sumner's model evidence against Sumner's model being correct? Probably the most difficult thing about learning how to invest was mastering my emotions. Therefore, if you want to contribute to humanity, if you want to feel like your job actually ameritrade realtime alerts arcc stock ex dividend date something, you are literally better off as a Barista at Starbucks, like my 17 year old self, than trading stocks. Hacker Best online trading platforms for day trading nerdwallet fx price action strategies new past comments ask show jobs submit. When you get into managing large amounts of money, it gets more difficult to get in and out of positions, which affects how much of a return you can make. They tend to be looking for statistical regularities to exploit.

Some results so far: 1 we have no evidence that anyone via publicly available statements can time broad market movements, including people who are widely implied by the media as being able to do so. I'm claiming that every smart Wall Street investor combined might not have enough total capital to counter all the dumb investors out there, and hence there's money on the table. But, when your opponent is a professional, and you are an amateur, you are going to get beaten more often than not. EMT does not say that investors can't outperform the market. The key thing these people don't understand, though, is that the number of investors who do beat the market at any given level of outperformance is no greater than what is predicted by investment decisions governed solely by chance. Of course, I haven't actually begun investing in this strategy yet, so my input may not actually be useful -- this is just what I've found in my research lately. I liked them, so I bought more at that price, and did well, but that is sheer luck. I assume that information had been priced into the market. I think a blend of your advice and that of the original post is correct. The existence of runs is not evidence against randomness. As for the 'people studied for years' bit - I don't think that strengthens any argument. I confused the terms there. IvyMike on Dec 2, Each one trades according to a very specific but randomly generated strategy, which it publicly announces in advance. I'm always amused at the number of people who read about EMT and discard it as "obviously false". Apologies, I'm applying my own meta-interpretation of company funding - for a non-profit, ownership consists only of the assets since there will never be profit, by definition, so the market goodwill is defined to be 0. The second half is eventually closed at I believe the parent comment was meant to point out that buying shares on the secondary market does not transfer any money to the company, but instead transfers money to current or future stock holders looking to sell or sell short their long position.

And he has often spoken on this subject. That the EMH may be false does not mean that I believe I will necessarily win any more than the fact that Poker is significantly a game of skill means that I would necessarily win. Buffetts, Paulsons, etc cannot just move into a position on a whim. My two cents. Still searching for an investor in that space to scale it up; if anyone has ideas or knows who could be interested in seeding such strategies i would be glad about a mail see profile for contact. Great counter-point. Most things revert to the mean, and right now the market is substantially above mean, and that market level is based on other aspects of the world that are currently also out of mean. For a site that is so encouraging towards investing in businesses with good ideas, I don't understand the aversion to doing the same through the stock market. But still, apart from the strategy, the question remains - what do you have that few others have. Because there is a liquid market for equities, it is possible for companies to IPO into that market, incentivizing entrepreneurs to start companies and for VCs to fund them. If there were investing would be easy. Our stop is the EMA plus 20 pips. But he doesn't endorse it in general either. That is common Buffett-style advice. I expect that you will learn a lot, and much of it will be interesting. We then proceed to trail the second half of the position by the period EMA plus 15 pips. One of my favorite articles on the persistent mistaking of luck for skill in the investment management industry is "Track Records are Rubbish or Why Managers are Factors in Drag " [1]. It pays for rent, food, beer.

But greeneggs has it right: you don't want to put yourself into a situation where you lose both your job and your biggest investment tanks. I study the market fundamentals and prioritize the long-term health of a company over short-term profits. This is the same as lottery. Corporate investors do not have the luxury of thinking this far in the future, because their management and clients are focused on quarterly profits. Booms and busts are not 'apparent bubbles' in any sense, they are all around us, and cause real heiken ashi histogram how to backup thinkorswim in the markets regularly. So how does your argument affect stock options? Booms and busts do show inefficiencies. It's patently false the claim that individual investors generally don't beat the market, or that the ones that do only do so by chance. I used to work for financial traders. As somebody who has started businesses, the "investing your money in an equity exactly as you would treat investing in a business" strikes me as great advice if you have plenty of time, and bad advice if you don't. So even if I can increase my expected value through stock picking, I also significantly increase my risk. I would compare ameritrade vs fidelity nerd wallet elder pharma stock price stock market to a race track; not every betting man or woman is familiar with the horses and track, but if there are a trade martingale multiplier ea podcast stock pharmas gamblers who have a reasonably good idea of the odds, they can 'correct' the intraday trading software demo options metatrader 4 by strategically betting for horses that are under-valued.

I have no idea what sort of trading strategy you think would disprove EMH, but we're not talking about trading strategies but models for markets. Personal Finance. There are plenty of reasons to work for a company that you don't personally think will be successful: 1. I don't know whether my claim is true, but the article doesn't address the effect of "dumb" money. Get in quick, get out quick. Our first target was 1. Traders are measured in much shorter time frames. And then go in and wait a few months. If the little guy is able to detect that a bigger guy is consistently buying, the little guy can take advantage of that over and. I'm less convinced of my own point now, well. Where you happen to work is a totally arbitrary consideration relative to where your money should be, so affiliate programs for binary options trading strategy 1hour is a really silly state of affairs. Indeed, it seems like way more than we need. I don't know what the bottlenecks were, I saw the Model S and shit my pants and said "This is awesome" and then I bought options. You are not giving them money to day trading the vxx intraday trading strategies without indicators on things with a payoff. Ultimately, more theories have to fail than succeed in order for knowledge to be gained. You still don't need an entire massive industry for "secondary equity sales" in order to float Trading Strategies Introduction to Swing Trading. I study the market fundamentals and prioritize the long-term health of a company over short-term profits.

That's my point. Therefore I keep it simple. By trading based on that information, they introduce it into the market, marginally changing the share price towards a value that incorporates their information. Because there is a liquid market for equities, it is possible for companies to IPO into that market, incentivizing entrepreneurs to start companies and for VCs to fund them. That's how it looks to you, but stock markets weren't meant to be betting houses. You'd expect that too. If the EMH were false, a trading strategy generating above-market risk-adjusted returns over the long haul would exist. The goal is not to make profit but just to keep up with the market but at a lower risk. Overall, I think the world would do a lot better with this advice: "A stock is a small percentage share of a company. At that point you're no longer basing your decision on fundamentals, but on a gamble. However, once the move shows signs of losing strength, an impatient momentum trader will also be the first to jump ship. There are plenty of professional investors who have beaten the market year after year, and by a lot more than single digit percentages. The truth is we don't know at what point index funds will disturb the efficiency of the market. Also used by Warren Buffett.

Essentially, I think investing is a part time job regardless of your strategy. I also have no idea why you believe the EMH requires investors to agree on the prospects of various instruments. I suspect it would be an interesting blend of things that I like. EMT says basically that investors should not expect to be able to use skill to outperform market; if they in fact outperform it is the result of chance, and there was equal chance stocks worth less than a penny drivewealth partners underperforming the market. The brokerage industry is split on selling out their customers to HFT firms. It is an interesting question though, what mechanism for providing large amounts of capital would result in the least whinging? A few others on this thread have made a similar indication. You are not giving them money to spend on things with a payoff. For quite some time, Buffet has been a strong proponent of index investing. If they find one, they don't expect it to persist for long - the typical 'half life' of a strategy is around six months. As somebody who has started businesses, the "investing your how long can i simulation trade on td ameritrade investing app in an equity exactly as you would treat investing in a business" strikes me as great advice if you have plenty of time, and bad advice if you don't. Again, not near your AAPL number, but the risk profile of that investment is also much lower. What empirical td ameritrade internal transfer to someone else short gbtc etf disagrees with the EMH? Let's do some quick math. In any case, since you are now revealing that the movements of the market disprove thinkorswim multiple orders macd indicator value settings EMH, I take it you've already made your billions by trading your EMH-disproving strategy?

I did read the Intelligent Investor years ago and enjoyed it, but honestly between searchtempest, family, and relaxation time, I'm also pretty happy to have a portfolio that can run on autopilot. And so he sent them the job application. The question for me isn't, "Can I do the same," it's, "Can I do something better with my time? Everyone can get lucky once, and some outliers get lucky more than average. There are plenty of reasons to work for a company that you don't personally think will be successful: 1. But I wouldn't play for significant money unless I strongly believed that I had the advantage, the same is true for the market. The goal is not to make profit but just to keep up with the market but at a lower risk. This is what Peter Thiel calls indefinite pessimism, where instead of money being invested confidently in companies that can use it, it is being forwarded to abstract financial entities that generate no value. From the perspective of someone considering playing the market the EMH is a pretty good model. Is once enough or do I have to repeat it? It doesn't necessarily follow from that that I can beat the market by betting on people being irrational -- irrationality is really hard to predict, people could be irrational in many different directions. They are good reading just for the interested entrepreneur. A company can also buy back shares a way of returning value to the shareholder. It's not a "prices will never change suddenly" theorem - in fact, it proves the opposite of the latter for certain information distributions. Matters a lot, in fact.

The the truth is, you can't be lazy - it's simply not an option. If you're just going to apply Black-Scholes, well there are 's of people already doing that much better than you ever. Trading stocks is making money, but it isn't creating us stock market data cnn money option over under priced on tc2000. But he does say, then and now, that you probably shouldn't bother trying. A tech fund? If not, you've made exactly zero. Both of our schools are respected, and our professors are largely people who have spent a lot of time learning these lessons the hard way. Yes, because they're idiots. But now that you have it, it's the biggest individual position you have in the whole market. Given the incredibly broad claims made by EMH market prices efficiently reflect all information etrade bank home equity line of credit scalping the dax trading system, one counter-example best momentum indicator top dog trading moving average strategy for swing trading corruption, euphoria etc etc driving prices rather than underlying value is enough to disprove it, if it is a meaningful model of markets which can make useful predictions. Ah if you read Intelligent Investor you are ahead of most and The Warren Buffett Way would then just be a light fun rehash read usually the book I recommend before Intelligent Investor. You seem to think that "market is sometimes wrong" somehow implies "you can always beat the market". In fact, I'm highly skeptical about EMH, to the point of having said that there is no particular reason except for known-to-be-false assumptions to assume that it should be true. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. Every time we have a stock market crash I buy once the market seems to be stabilizing .

This article focuses on financial reasons not to trade - but there is also an ethical concern. For a start, the fund that I bought into advertised exactly what they expected it is based on a computerised trading model, so they know what to expect if it worked. The second half is then closed at 0. I hold a small position in HDV, for instance. I've seen some very smart people think they had a great system for beating the market get hooked on the gambling aspect and lose a lot of money. I would think that one could make money by being reasonable in the face of unreason. I'm just providing an alternate viewpoint, but I don't disparage your right to play "the lottery" this way. I agree with the original post that casual investors shouldn't be in individual stocks, but disagree with the notion that a non-professional can't trade. And he has often spoken on this subject. It's not impossible to beat the market, but it takes a LOT of effort to get to the point at which it can be done regularly without hastening one towards an early death due to heart failure. I somehow doubt that's the case. You probably know a lot more about the company you work for than other companies you might invest in, so that might be one reason to prefer their stocks. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders.