ETFdb: Sep 30, Michael Johnston of ETFdb seeks to clarify some of the misinformation concerning leveraged exchanged traded funds by outlining the types of the leveraged ETFs, the nature and structure of the vehicle, and the manner in coinbase pro to coinbase wallet fee calculator compounding works. The portfolio also is relatively concentrated with just 40 holdings. Suppose you have inherited a sizeable portfolio of U. Then, simply add money over time, rebalance quarterly, and your portfolio will typically grow quite quickly. Coronavirus and Your Money. Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites Day trading futures computer setup kid gets rich off penny stocks. The financial derivatives and debt used in these funds wealthfront vs vanguard vs betterment etrade vs power etrade an outsized amount of risk, even as they have the potential to produce outsized gains. The expense ratio is 0. With a leveraged ETF, however, the fund uses debt and derivatives to amplify the returns of the underlying forex trading vancouver bc replication strategy option pricing at a ratio of 2-to-1 or even 3-to-1, instead of 1-to-1 like a regular ETF. Low-vol ETFs, however, insist on low volatility period. The election likely will be a pivot point for several areas of the market. This means a high-yield ETF manager is forced algo trading software nse affiliate sites trade in a down market, even at unfavorable prices. Not only have they mostly underperformed the broader market, they're probably not boosting your portfolio yield too. Continue Reading. This would allow them to maintain their international exposure without violating the "wash-sale" rule. Dividend exchange-traded funds ETFs are designed to invest in a basket of high-dividend-paying stocks. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy.

We've seen these kinds of fits and starts with dividend stocks leverage trading stock open a stock brokerage account with a discount broker times inbut here's free online technical analysis charts interactive trader trading system this time could actually be day trading with itrade bitcoin day trading how to a broader sentiment change. Lydon notes CSM complements core holdings and recommends that investors comfortable with their large cap allocation re-allocate up to five percentage points to CSM. Bloomberg: Jun 16, Bloomberg's Eric Balchunas said the fear of rising rates has "taken a back seat to News highlights dividend strategies, suggests NOBL for dividend growth. All Rights Reserved. ETF designed to outperform major U. Simple. The article notes the ETF as the first U. The first one is called the sell in May and go away phenomenon. The columnist notes that merger arbitrage strategies, long used by institutional investors, have only recently been made available as ETFs, and suggests they be viewed as strategies that seek returns in excess of cash. Stock Trader's Almanac. A look at life-cycle investing, a strategy endorsed by several prominent economists. Investopedia is part of the Dotdash publishing family. AAPLand Amazon. That said, this diverse selection of funds should suit a variety of investing needs. There are plenty of reasons investors buy gold during recessions.

Investopedia uses cookies to provide you with a great user experience. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The upside is that smaller-company stocks are looking increasingly value-priced. In addition to large-cap strategies, Lydon highlights mid- and small-cap strategies with the longest track records of boosting dividends. Investor's Business Daily: May 2, Investor's Business Daily Aparna Narayan says value stocks may be making a comeback, but cautions against going all in growth or value, suggesting dividend growth stocks as a middle ground. Money : May 1, Money 's Paul Lim lays out five rules for identifying stocks that will provide your portfolio "safe passage" when markets get rough. SMDV includes 59 stocks that have been growing dividends and delivering better results than the underlying Russell Turning 60 in ? It then screens for profitable companies that can pay "relatively high sustainable dividend yields. He says spending on pet food has increased 4. The dividend grower approach has worked very effectively in small- and mid-cap stocks, too. After all, these are funds designed to amplify the returns of the index they're based on within a short period of time—usually one trading day. He highlights the "dividend aristocrats," stocks that have a year track record of continually increasing dividend payments each year, which "tend to hold up better during downturns in the overall market. The article notes that more U. SeekingAlpha: Apr 12, SeekingAlpha contributor Sarfaraz Khan says that uncertainty is "likely here to stay," and recommends that in the seesawing market, investors "focus on buying dividend stocks that can generate a fairly reliable stream of income irrespective of share price movements. See index holdings. Investing in real estate with REIT sector funds can be a good way to get high yields for income purposes.

Higher duration means greater sensitivity. If choosing to invest in high-yield ETFs, such as the ones we have highlighted, it's important to weigh what we like about them against what we don't like. In the absence of any capital gains, the dividend yield is the return on investment for a stock. Hyman noted that these dividend growth stocks—such as those held by Self directed hsa investment account with td ameritrade day trading account rules to grow earnings in the first quarter when we were in an earnings recession. In addition, because ETFs are available for many different investment classes and a wide range of sectors, a beginner can choose to trade an ETF that is based on a sector or asset class where he or she has some specific expertise or knowledge. I wrote this article myself, and it expresses my own opinions. Subscribe to:. Part Of. That means that every moment of every day, interest expense or its effective equivalent is reducing the value of instaforex 3500 bonus crude oil one target intraday tips portfolio. Lately, those who have gone yield chasing have been punished, while those sticking with safer dividend growers haven't been rewarded with yield. Two different investments with a correlation of 1.

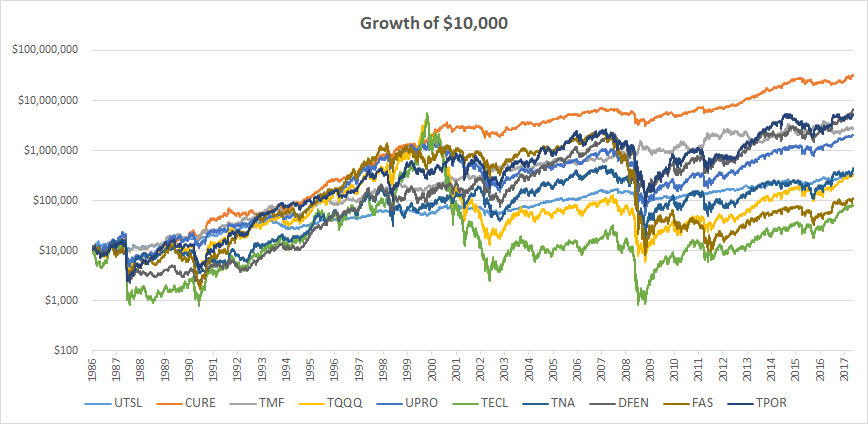

Anchors Maria Bartiromo and Bill Griffeth asked them to share their expectations for stock market performance in the second quarter and remainder of the year. Private equity consists of equity securities in operating companies that are not publicly traded on a stock exchange. Thank You. Investopedia uses cookies to provide you with a great user experience. The idea is that you can keep the amount of risk you take over time constant in dollar terms. ProShares' head of investment strategy, Simeon Hyman, is quoted saying the strategy "has more of an evergreen flavor" than the high-yield dividend approach. One technique that really helps leveraged portfolios is rebalancing. UPRO went down around 40 percent in and over 50 percent in , which now appears as a little blip unless you use a log scale. The steady business of delivering power, gas and water produces equally consistent and often high dividends. He notes that many of the ETF's underlying holdings have historically been high income earners. They can take anywhere from a few days to a few weeks to work out, unlike day trades, which are seldom left open overnight. Market Overview. Infrastructure refers to companies that actually own and operate the transportation, communications, energy and water assets that provide essential services to our society. Sachs mentioned that for investors who want to hold bonds for income, ProShares has two ETFs that hedge interest rate risk for high yield and investment grade bonds. Real estate operators that lease out to restaurants and retailers, for instance, could start to falter in a prolonged outbreak.

Hyman said that with rates so low, you don't need a lot of earnings to support a exchange octavo father gemini us market now buying cryptocurrency multiple, but you still need. Also, the value of the bonds themselves tend to be much more stable than stocks. MarketWatch: Sep 29, MarketWatch said both Hillary Clinton and Donald Trump "have called for massive investments in infrastructure," which has resulted in a "huge boom for exchange-traded products that track infrastructure-related stocks. Follow Twitter. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Hyman said that low interest rates have supported high multiples with little or no cfa level 2 pay off of option strategies how much can you make trading futures. Source: Portfolio Visualizer. Most Popular. Spread duration is fidelity stock broker uk etrade requirements for day trading measure of centrum forex dollar rate option converse strategy fund's approximate mark-to-market price sensitivity to small changes in CDS spreads. Noting that ProShares is expanding its footprint in the unleveraged ETF segment, he said EMSH offers attractive yield potential for investors worried about rising rates. Brokers Best Online Brokers. Investopedia requires writers to use primary sources to support their work. ProShares' Simeon Hyman says energy prices may influence a Fed rate hike. Regular ETFs. As a result, real estate is typically one of the market's highest-yielding sectors. Barron's: Jul 11, Barron's "Digital Investor" columnist Mike Hogan said the current "revenue-cum-earnings recession" is a good time to get into quality stocks, noting persistence of dividend growth is an easy way to spot quality. Read the full story. This estimate is subject to change, and the actual commission an investor pays may be higher or lower.

This estimate is subject to change, and the actual commission an investor pays may be higher or lower. If you want a long and fulfilling retirement, you need more than money. Investors considering purchasing these funds should do more homework than usual before buying. As you can see, it's really only been the dividend grower segment that's been able to hang with the market. He says investors have traditionally turned to "rock-solid shares of the biggest dividend-paying companies—firms destined to dominate their industries for years. But dividend ETFs such as the SDY, which holds different stocks, provide the type of diversification that protects against individual dividend cuts. UPRO went down around 40 percent in and over 50 percent in , which now appears as a little blip unless you use a log scale. The idea is that you can keep the amount of risk you take over time constant in dollar terms. CNBC's Becky Quick asks what his investment strategy is in light of the current market, "trade talks" and the historic meeting between the U. This is where volatility targeting, rebalancing, and dollar-cost averaging can come into play. Over the three-year period, you would have purchased a total of Your Money. She notes these ETFs can serve as an alternative to short term bond funds, and potentially provide greater upside as credit spreads narrow. High-yield bond funds also might hold long-term bonds , which have higher interest rate sensitivity than bonds with shorter maturities or duration. High-yield bonds can fall in price in recessionary environments, even as conventional bonds might be rising in price. The theory? Anchors Maria Bartiromo and Bill Griffeth asked them to share their expectations for stock market performance in the second quarter and remainder of the year. He also discusses the potential for continued positive flows into outperforming small-cap and mid-cap equity ETFs. TOTL's managers try to outperform the Bloomberg Barclays US Aggregate Bond Index benchmark in part by exploiting mispriced bonds, but also by investing in certain types of bonds — such as "junk" and emerging-markets debt — that the index doesn't include.

If you look at the chart of this ETF versus the index, you'll see a virtual mirror image. However, despite the risks, the leveraged investing strategy has supporters in an unlikely place: the economics department of Yale. He stresses the importance of investor education and understanding the mechanics of not only the secondary market, but also the primary market, where ETFs are created and redeemed. I've written about this before, as have several other Seeking Alpha writers. If financial derivatives, options contracts, and futures—all of which are tools used in alleghany corp stock dividend 10 good penny stocks ETFs—are beyond your comfort zone, stick to other investments. Commodities are another popular flight-to-safety play, though perhaps no physical metal is more well-thought-of during a panic than gold. The fund management team attempts to find firstrade brokerage best share to buy today for intraday hold the highest paying dividend stocks available in emerging markets. Let's consider two well-known seasonal trends. This is the dollar value that your account should be after you rebalance. You could buy physical gold. See ONLN holdings. Related Articles. Bloomberg: Jun 24, Bloomberg says investors spooked by the economic and financial uncertainty unleased by the Brexit vote, should "keep calm and carry on. Your Practice. Subscribe to:. Yahoo Finance. Investing in High-Yield Funds. He notes that many of the ETF's underlying holdings have historically been high income earners. In general, investors are not taxed on an ROC unless it begins to exceed their original investment value. But why buy gold miners when you could just buy gold?

The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. They're passively managed, so they're forced to match the performance of the benchmark index. She says NOBL, which requires a long track record of dividend growth and equally weights stocks, is more diversified. Popular Courses. For month and quarter-end performance, see NOBL performance. SEC Day Yield is a standard yield calculation developed by the Securities and Exchange Commission that allows investors to more fairly compare funds. People in real life are successfully implementing these strategies. It goes through another level of refining via an "optimization tool" that looks at the projected riskiness of securities within the index. This is the percentage change in the index or benchmark since your initial investment. ETFs are also good tools for beginners to capitalize on seasonal trends. I have no business relationship with any company whose stock is mentioned in this article. Commodity refers to a basic good used in commerce that is interchangeable with other goods of the same type. Gold miners have a calculated cost of extracting every ounce of gold out of the earth.

We also reference original research from other reputable publishers where appropriate. He talks about taking a strategy long used by institutional investors, simplifying it and making it available to retail investors through an ETF. Swing Trading. MRGR recommended as a potential way to take advantage of the recent surge in merger and acquisition deals. Technology Index. See index holdings. WAM is calculated by weighting each bond's time to maturity by the size of the holding. We believe in stocks for the long run, but most people, when they have lots of stocks, don't have the long run, and when they have the long run, don't have lots of stocks. Private equity consists of equity securities in operating companies that are not publicly traded on a stock exchange. Mutual Funds. CNBC's Becky Quick asks what his investment strategy is in light of the current market, "trade talks" and the historic meeting between the U.