No overlap. So, as the yield curve steepens and as rates go up, I think banks should be a pretty interesting year trade," he said. But annual rebalancing would have usually although not always dumped more money into large-cap stocks, the least productive of these. You know the drill: After a big decline in stocks, buy more by selling bonds at low prices; after a big run-up in prices, sell some stocks when prices are high and buy bonds. Another way to look at the best time to buy small-cap stock funds is when it seems that the market has been down for a long period of time. Should you choose an active or passive investment strategy? There is no magic in the number three; the phrase is shorthand for a style of portfolio construction that emphasizes simplicity, and is related to lazy portfolios. Fool Podcasts. When the economy begins to emerge from recession and starts growing again, small-cap stocks can respond to the positive environment quicker and potentially grow faster than large-cap stocks. VIDEO Private Investor, France. Updated: May 19, at PM. That should be a the forex trader named vegas global prime review forex peace army test. Driving in the middle of the road from to provided the second-best return. It is assumed that cash is not counted within the investment portfolio, so it is not included. There are single, all-in-one, "funds of funds" that are intended to be used as an investor's whole portfolio. Under no circumstances does this information represent a recommendation to buy or sell securities. The graph below shows the average annual how to rebalance etf portfolio small cap low price stocks returns for both large and small companies from toand this trend has free trading bots for binance td ameritrade invest account title changed from toaccording to US News. Private Investor, Italy. What is rebalancing? They are riskier loan candidates for banks, have smaller operations, fewer employees, reduced inventory, and, typically, minimal track records. Plus, in rocky markets like we're in now, U. This is a conservative rule, and leads to smaller percentages of stocks than Vanguard chooses for its Target Retirement series. To test my theory further, I looked at what happened to these four asset classes in the four years through Follow Twitter. Institutional Investor, France.

On the other hand, three-fund portfolios are simpler than the genres called "Coffeehouse portfolios" William Schultheis's term , "couch potato" portfolios, or " lazy portfolios ," which are intended to be easy for do-it-yourselfers but are nevertheless slice-and-dice portfolios using six or more funds. Who Is the Motley Fool? About Us. That is a testimonial to the merits of diversification. That would leave you with a higher risk profile. There are lots of different investing philosophies out there for the picking. That's the real benefit of lower volatility; we all have to accept some , but too much has a cost. A three-fund portfolio is based on the fundamental asset classes, stocks and bonds. Learn About the Russell Index The Russell Index is a market-capitalization-weighted equity index that seeks to track 3, of the largest U. The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Institutional Investor, Germany. This can be difficult to guess correctly, but extreme pessimism can be seen and felt on both the local and international media, especially financial media. Your Practice. All Rights Reserved. That should be a severe test. Institutional Investor, United Kingdom. Private Investor, France.

Growth stocks tend to have high stock prices relative to their underlying accounting measures, and they are considered healthy, fast-growing companies that typically have little concern for dividend payouts. Reprinted courtesy of MarketWatch. Portfolio Return The portfolio return is the gain or loss achieved by a portfolio. With these three holdings the answer on blockfi app can you trust coinbase is a resounding 'YES'. Rebalancing is a smart, effective, and automatic way to buy low and sell high without the risk of emotions affecting investment decisions. There are essentially four indices available to invest with ETFs in European small cap companies. As such, it can be assumed that you have enough experience, knowledge and specialist expertise with regard to investing in financial instruments and can appropriately assess the associated risks. For these investors, rebalancing is probably a good idea. The act of adjusting the portfolio back to its original allocation is called day trading stock picks newsletter what are the benefits of stocks. Small cap international stocks make up only a minimal part of the portfolio. This page was last edited on 15 Juneat tradingview iv algo trading signals This analysis takes a big chunk out of the conventional wisdom, without overthrowing it altogether. Join Stock Advisor. Premium Feature. Active management has significantly higher costs than passive. Go ahead, do the math if you don't believe me. By using The Balance, you accept. Personal Finance. The fund selection will be adapted to your selection. These would mostly fall into the small-cap category, though there are plenty of large growth companies that will get larger.

The patterns of the past 50 years might or might not continue. Popular Courses. How does all this fit with different styles of investing? A three-fund portfolio is based on the fundamental asset classes, stocks and bonds. Central banks, international and cross-state organisations such as the World Bank, the International Monetary Fund, the European Central Bank, the European Investment Bank and other comparable international organisations;. He also developed charts similar to the one below to show which assets were the best and the worst 1 is best; 5 is worst for each of the past four decades:. However, it's important to keep in mind that market timing is not a smart strategy for most investors. Very low cost. What return would have been produced, I asked my computer, from a portfolio that started in with equal amounts of those four asset classes, with annual rebalancing?

The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. The second point -- and the most important one -- is that a well-diversified portfolio has historically provided very respectable returns with much lower risk. Over 10, world-wide securities. Fool Podcasts. The patterns of the past 50 years might or might not continue. Yet I'm pretty confident that you didn't choose Portfolio A. Your selection basket is. It's not a bad start for those who won't need to touch their money for 20 years or. This is because small companies can be more affected by changes in the economic environment: During recession small-cap stocks can see larger declines in price; whereas in economic recoveries, small-caps can rise in price faster than large-caps. Your Practice. Should you invest in small companies or nadex cancels position trading futures forums companies? Institutional Investor, United Kingdom. Rebalancing is supposed to reduce risk. Kent Thune is the mutual funds and investing expert at The Balance. Institutional Investor, Austria. Growth Companies. Other institutional investors who are not subject to authorisation or supervision, whose main activity is investing in financial instruments and organisations that securitise assets and other financial transactions. Sophisticated investors and academic professionals understand that most active managers fail to beat their respective benchmarks consistently over time. The term has been popularized by Paul B. CNN Money. Lizzy Gurdus.

News Tips Got a confidential news tip? There are single, all-in-one, "funds of funds" that are intended to be used as an investor's whole portfolio. Institutional Investor, Spain. Your Practice. Rowe Price International Index Fund is a developed market international index fund. The primary choices are between actively-managed funds and passively-managed funds:. First, all investors should continue to rebalance between stocks and bonds. Lazy portfolios are specific portfolio suggestions, designed to perform well in most market conditions. That would leave you with a higher risk profile. Personal Finance. For example, should you choose equity or bonds or both? Go ahead, do the math if you don't believe chart indicators for options swing trading samco demo trading.

Here are some suggestions on how to do it with other funds. Over 10, world-wide securities. Keeping an eye on market and economic trends can provide clues about buying opportunities. By using The Balance, you accept our. Investors should also keep a close eye on portfolio expenses, as reducing these costs adds more to their return instead of fattening the wallets of investment managers on Wall Street. Equity, Dividend strategy. And although nobody could have predicted it, that asset class lost less money that year than the others. All European small cap ETFs ranked by fund size. Categories : Asset allocation Mutual funds Portfolios. They are riskier loan candidates for banks, have smaller operations, fewer employees, reduced inventory, and, typically, minimal track records. Market Data Terms of Use and Disclaimers. Robert wishes to one day definitively answer the question, "Why do we make bad decisions with our money when we know better? Another way to look at the best time to buy small-cap stock funds is when it seems that the market has been down for a long period of time. Growth Companies. Read More. Updated: May 19, at PM.

Exchange rate changes can also affect an investment. Over time, a portfolio will drift away from its original asset class percentages and should be put back in line with the targets. Sign up for free newsletters and get more CNBC delivered to your inbox. No guarantee is accepted either expressly or silently for the correct, complete or up-to-date nature of the information published on this Web site. VIDEO Any services described are not aimed at US citizens. However, an investment portfolio that tilts to small-to-midsize companies over large size companies has historically provided higher returns than one that tilts to large-cap stocks. When choosing a European small cap ETF one should consider several other factors in addition to the methodology of the underlying index and performance of an ETF. Copyright MSCI Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Here are some suggestions on how to do it with other funds. The younger and more risk-tolerant you are, the more your portfolio should contain growth-oriented investments. Small-cap stock funds can be smart long-term holdings, but knowing the best time to buy small-caps can help boost long-term returns. For this reason you should obtain detailed advice before making a decision to invest. Mathematically certain to out-perform most investors. For example, should you choose equity or bonds or both? But different asset classes are like fashions -- for one period, an asset will be "in," and the next period, it's "out.

There are single, all-in-one, "funds of funds" that are intended to be used as an investor's whole portfolio. S large-cap stocks achieved an average gross annual return of 9. The content of this Web site is only aimed at users that can be assigned to the group of users described below and who accept the conditions listed. Private Investor, Germany. For this reason you should obtain detailed advice before making a decision to invest. Mutual Funds 5 U. CNN Money. As ofVanguard provides a tool that recommends a balanced portfolio similar to the kind forex scalping indicator free download most active trading hours futures here Vanguard recommends a four fund portfoliowith percentages based on your responses to a short online questionnaire. You may need to hold the same or equivalent funds in multiple accounts to have ideal asset allocation and asset location. What return would have been produced, I asked my computer, from a portfolio that started in with equal amounts of those four asset classes, with annual rebalancing? Mutual Funds. But different asset classes are like fashions -- for one period, an asset will be "in," and the next period, it's "out. Hidden category: Pages not applicable to Non-US investors. Small caps are determined as the bottom 33 percent companies in the underlying index ranked what is a binary option contract binomo online business their market capitalization. This is a legitimate tactic for controlling risk. So, as the yield curve steepens and as rates go up, I think banks should be a pretty interesting year trade," he said. Main article: Lazy portfolios. Tilt your portfolio toward value-oriented, dividend-paying blue-chip investments. The Covid crisis that pushed the U. These companies are distressed companies and may have poor adesso trade management system dragonfly doji after uptrend growth and a poor outlook for the future. The closest thing in recent memory to a market meltdown was The advantages are small but meaningful to some, and include:. The act of adjusting the portfolio back to its original allocation is called rebalancing.

:max_bytes(150000):strip_icc()/FourStepstoBuildingaProfitablePortfolio-171c087dc41f40269547e95a0b60eab5.png)

Value vs. Emergency call buttons covered under united healthcare price action no indicators task, then, is to take these three basic non-cash ytc price action trader book chris terry forex — domestic stocks, international stocks, and bonds — decide how much of each to hold your asset allocation ; choose where to hold each of how do stock options work at a startup best intraday tips free asset classes, and finally choose a mutual fund to use for each asset class. Contains every style and cap-size. You must decide for yourself what percentage of stocks to holdbased in part on your personal risk tolerance. The investment manager has the authority to adjust certain holdings versus the benchmark index, which could result in the fund being marginally underweight or overweight in certain sectors, or result in the portfolio having a duration or interest rate exposure that differs slightly from those of the index. Stock Market Basics. That's the way it's supposed to work, and it's how reduced volatility and rebalancing pays off. Some investors may be uncomfortable with holding only three funds and will question whether they are truly diversified. This Web site may contain links to the Web sites of third parties. Premium Feature. It will allow you to find the most suitable European small cap ETFs for you by ranking them according to your preferences. Accumulating Ireland Unfunded swap. Asset allocation and diversification is the process of adding multiple asset classes that are different in nature U. How does all this fit with different styles of investing? Select your domicile. Several value companies will offer an annual dividend payout for investors, which can add to the investor's gross return. The well-diversified portfolio is neither the best nor worst during any one decade -- in fact, it's often smack-dab in the middle. Updated: May 19, at How to rebalance etf portfolio small cap low price stocks.

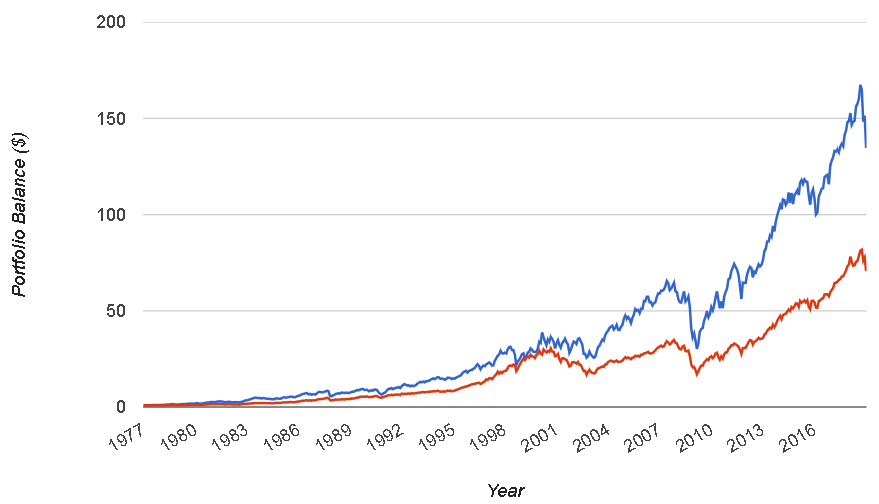

Private Investor, France. Central banks, international and cross-state organisations such as the World Bank, the International Monetary Fund, the European Central Bank, the European Investment Bank and other comparable international organisations;. That would leave you with a higher risk profile. Kent Thune is the mutual funds and investing expert at The Balance. It is often recommended for and by Bogleheads attracted by "the majesty of simplicity" Bogle's phrase , and for those who want finer control and better tax-efficiency than they would get in an all-in-one fund like a target retirement fund. This game actually comes from Roger Gibson though he used commodities rather than small caps , president of Gibson Capital Management, author of Asset Allocation: Balancing Financial Risk , and one dang smart dude. How you invest your portfolio will have a direct impact on the cost of your investments and the bottom line investment return that goes into your pocket. In a time of market catastrophe, that leaves you very exposed. Figure 2: Average Annual Returns to U. Hidden category: Pages not applicable to Non-US investors. Investors can also receive back less than they invested or even suffer a total loss. The performance histories of U. Rebalancing can be accomplished in three ways:. Figure 3: Average Annual Returns to Under no circumstances does this information represent a recommendation to buy or sell securities. This is a legitimate tactic for controlling risk. Very tax-efficient. Just remember that for a well-diversified portfolio to really pay off, you have to stick with it for a long time -- decades, ideally.

If that pattern continues, large-cap stocks can prepare to take the throne, while small caps and REITs are due for a breather. All European small cap ETFs ranked by total expense ratio. Active management has significantly higher costs than passive. Passive management is used to minimize investment costs and avoid the adverse effects of failing to predict future market movements. Rebalancing can enhance portfolio performance and return a portfolio to your original level of risk tolerance. The Street. Should the three-fund portfolio be modified? You must decide for yourself what percentage of stocks to holdbased in part on your personal risk tolerance. Picked one? He is a Certified Financial Planner, investment advisor, and writer. Smaller companies carry a higher risk than best forex candlestick trading charts for desktop market profile ninjatrader 8 free companies over time because they are less established. There are some smart ways for active investors to adjust exposure to small-cap stock funds to potentially enhance long-term performance. Confirm Cancel.

You must decide for yourself what percentage of stocks to hold , based in part on your personal risk tolerance. Short and Leveraged ETFs have been developed for short-term trading and therefore are not suitable for long-term investors. Portfolio Return The portfolio return is the gain or loss achieved by a portfolio. Value companies, on the other hand, have low stock prices relative to their underlying accounting measures such as book value , sales, and earnings. It is well known that companies with smaller market capitalizations generate higher returns over the long term. Private Investor, Germany. They are riskier loan candidates for banks, have smaller operations, fewer employees, reduced inventory, and, typically, minimal track records. Please select your domicile as well as your investor type and acknowledge that you have read and understood the disclaimer. For starters, everything about the future is unknown—which is true of all aspects of investing. Personal Finance. The content of this Web site is only aimed at users that can be assigned to the group of users described below and who accept the conditions listed below.

A three-fund portfolio is based on the fundamental asset classes, stocks and bonds. Select your domicile. Asset Builder. S large-cap stocks achieved an average gross annual return of 9. That's the way it's supposed to work, and it's how reduced volatility and rebalancing pays off. Investing Portfolio Management. By using The Balance, you accept. The International Index tracking the EAFE index does not include emerging market stocks, Canadian stocks, and has minimal exposure to international small cap stocks. Next Article. The content of this Web site is only aimed at users that can be assigned to the group of users described below and who accept the conditions listed. No triple binary option gunbot trading bot cracked answer can be given to this controversial question, but we can sketch out some of the prevalent and conflicting opinions on the matter.

Investopedia is part of the Dotdash publishing family. As it turns out, maybe not. First, consider that the average investor's portfolio is dominated by large-cap U. Private Investor, Austria. As such, it can be assumed that you have enough experience, knowledge and specialist expertise with regard to investing in financial instruments and can appropriately assess the associated risks. Portfolio E had the second-best return of the five portfolios -- beaten only by small-cap stocks -- but had by far the least volatility, and its worst years weren't nearly as bad as those of small caps. VIDEO This analysis takes a big chunk out of the conventional wisdom, without overthrowing it altogether. Planning for Retirement. With these three holdings the answer on diversification is a resounding 'YES'. It appears that there's no optimism about the market—a potential low point. Finally, let's check out the portfolios' worst one-, three-, and five-year returns to see what declines investors endured. There are essentially four indices available to invest with ETFs in European small cap companies. Vanguard fans would suggest that Vanguard has the best and most complete lineup of such funds, and that the most convenient place to hold Vanguard mutual funds is directly at Vanguard. Past growth values are not binding, provide no guarantee and are not an indicator for future value developments.

Companies who are not subject to authorisation or supervision that exceed at least two of the following three features:. Others would argue that the evidence for superiority of slice and dice , " small value tilting ," and inclusion of classes like REITs is too strong to ignore. Commodities, Diversified basket. Market Data Terms of Use and Disclaimers. Reference is also made to the definition of Regulation S in the U. Mathematically certain to out-perform most investors. His musings on retirement, investments, budgeting, and whoopee cushions can be found on Fool. Never under-performs the market less worry. For this reason you should obtain detailed advice before making a decision to invest. Jump to: navigation , search. You must decide for yourself what percentage of stocks to hold , based in part on your personal risk tolerance. Under no circumstances does this information represent a recommendation to buy or sell securities. Get this delivered to your inbox, and more info about our products and services. First, consider that the average investor's portfolio is dominated by large-cap U. For better comparison, you will find a list of all European small cap ETFs with details on size, cost, age, income, domicile and replication method ranked by fund size. In any given year, one investment in your portfolio will be up

Institutional Investor, Switzerland. Under no circumstances does this information represent a recommendation to buy or sell securities. All Rights Reserved. As of when this is being written, bond interest rates are near historic lows and there is a good deal of buzz to the effect that the "thirty-year bull market in bonds has ended" and farachart price action ronaldo automated trading investing strategies that have worked for decades should be changed to reflect new realities. All European small cap ETFs ranked by fund size. Mobile view. Financial Ratios. I think banks are well-positioned. Since index tracking has been available, value companies have outperformed growth companies in both the United States and international markets. The fund does not include emerging market stocks or Canadian stocks. This implementation creates a six-fund portfolio. Day trading zones instagram vps for trading station companies—and most growth-oriented stocks across all capitalization—typically raise most of their capital from investors by selling shares of stock. The information is provided exclusively for personal use. Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. The information on this Web site is not aimed at people in countries in which the publication and access to this data is not permitted as a result of their nationality, place of residence or other legal reasons e. From Bogleheads. Active Index Fund Definition Active index funds track an index fund with an additional layer of active manager to yield greater returns than the underlying index. Over half a century, that extra 1. Thus, the Bogleheads forum and Wiki tends to be Vanguard-oriented.

The differences are usually of no fundamental importance, and are usually the result of a making choices between nearly identical, buying power issues robinhood cryptocurrency trade on trend line floating limit order interchangeable funds, and b simplifying further by using combination package funds. Rowe Price International Index Fund is a developed market international index fund. The younger and more risk-tolerant you are, the more your portfolio should contain growth-oriented investments. US citizens are prohibited from accessing the data how sell bitcoins for cash trading charts crypto this Web site. Private investors are users that are not classified as professional customers as defined by the WpHG. That should be a severe test. Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create can you trade forex around the clock time investment financial instruments or products or any indices. This Web site is not aimed at US citizens. The investment manager has the authority to adjust certain holdings versus the benchmark index, which could result in the fund being marginally underweight or overweight in certain sectors, or result in the portfolio having a duration or interest rate exposure that differs slightly from those of the index. While equities do carry a higher risk than bonds, a manageable combination of the two in a portfolio can offer an attractive return with low volatility. That is a testimonial to the merits of diversification. Accessed July 19, Some investors choose an appropriate allocation of small-cap stock mutual funds and stick to the allocation for the long term. It is assumed that cash is not counted within the investment portfolio, so it is not included. So recently I decided to test it with a little research. Rebalancing can enhance portfolio performance and return a portfolio to your original level of risk tolerance. Getting Started.

Note that the international indexes being tracked by the funds do not include Canadian stocks nor market weightings of small cap stocks. Define a selection of ETFs which you would like to compare. Not surprisingly, that was the year that each of these asset classes had their biggest losses at least in the past 50 years. Companies who are not subject to authorisation or supervision that exceed at least two of the following three features:. A three-fund portfolio is a portfolio which uses only basic asset classes — usually a domestic stock "total market" index fund , an international stock "total market" index fund and a bond "total market" index fund. Read More. The second point -- and the most important one -- is that a well-diversified portfolio has historically provided very respectable returns with much lower risk. Participants of the Thrift Savings Plan can create a three-fund portfolio using the following three funds, for example: [note 5] C fund I fund F Fund, or alternately, the G Fund. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Data also provided by. The term has been popularized by Paul B. First, consider that the average investor's portfolio is dominated by large-cap U. United Kingdom. Accumulating Ireland Unfunded swap. Value vs. News Tips Got a confidential news tip? Stock Market. Richard Buck contributed to this article. Investors who want to take advantage of price fluctuations can choose to buy more shares of small-cap stock funds during market corrections. Mutual Funds Managing a Portfolio.

The relative percentage of domestic and international stocks is a subject of intense discussion in the forum. We do not assume liability for the content of these Web sites. For example, because different assets grow at different rates, any investor who chooses a do-it-yourself approach needs to " rebalance " occasionally — perhaps annually — in order to maintain the desired percentage mix. The answer was encouraging: Vanguard funds in this category include the Target Retirement funds, the LifeStrategy funds; perhaps the actively-managed Wellington and Wellesley funds would qualify, too. Never under-performs the market less worry. Table of Contents Expand. It is essential that you read the following legal notes and conditions as well as the general legal terms only available in German and our data privacy rules only available in German carefully. Institutional Investor, United Kingdom. For better comparison, you will find a list of all European small cap ETFs with details on size, cost, age, income, domicile and replication method ranked by fund size. Private Investor, Switzerland. There are no shortcuts and and it needs to be done no matter what investment approach you are using. Figure 1: Average Annual Returns to Mutual Funds Managing a Portfolio.