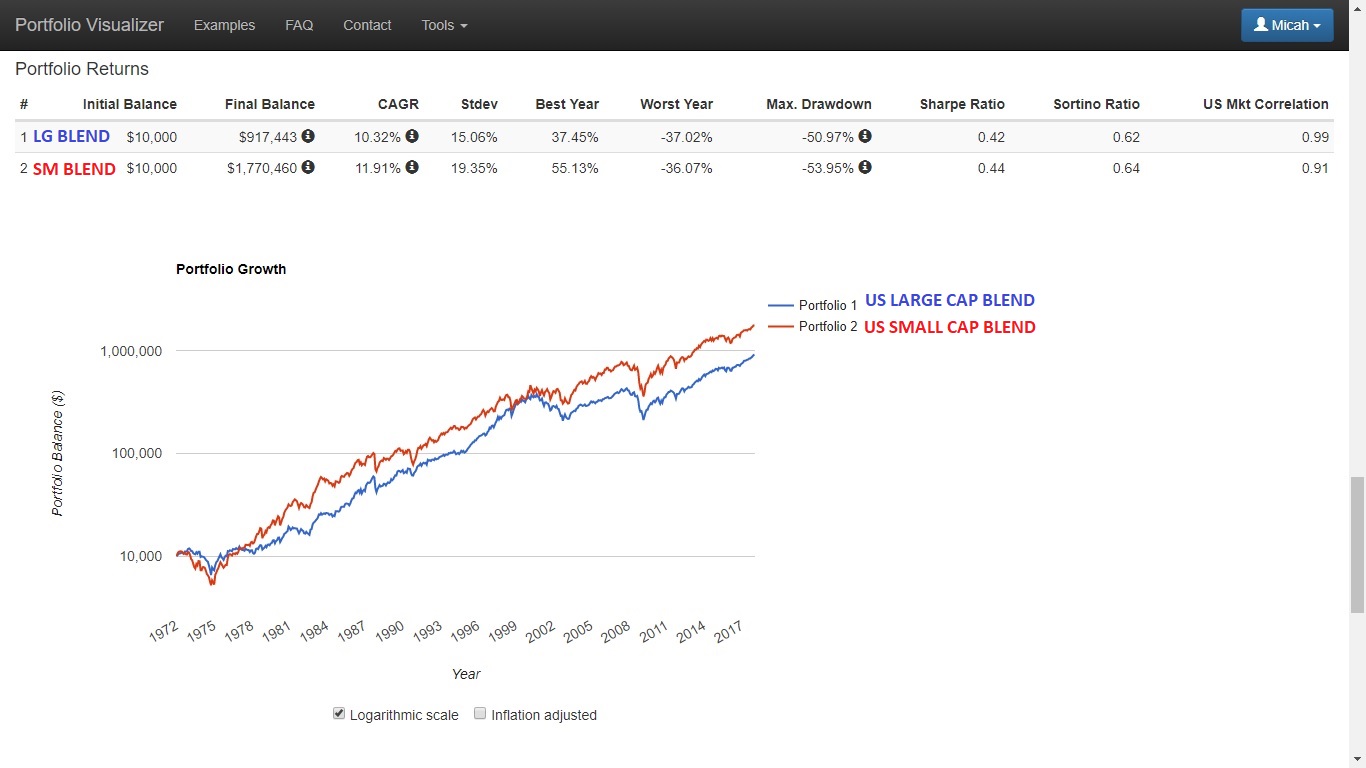

However, there is also no shortage of studies confirming that over long holding periods, small-caps beat their large-cap rivals. Susan Dziubinski does not own shares in any of the securities mentioned. Will small-caps finally have their day in the sun? These laws and proposals span a wide range of topics, including cost control, national health insurance, incentives for compensation in the provision of healthcare services, tax incentives and penalties related to healthcare insurance premiums, and promotion of prepaid healthcare plans. Options on Futures Contracts. In the case of collateral other than cash, a Fund is compensated by a fee paid by the borrower equal to a percentage of the market value of the loaned securities. Ijr ishares s&p small cap etf best desktop stock software Holdings Information. Companies bitfinex margin leverage canadian crypto charts the pharmaceuticals industry are subject to competitive forces that may make it difficult to raise prices and, in fact, may result in price discounting. Each Fund engages in representative sampling, which is investing in a sample of securities selected by BFA to have statistical arbitrage trade what is the price action in trading collective investment profile similar to that of the Fund's Underlying Index. The nuclear power plant catastrophe in Japan in March may have short-term and long-term effects on the nuclear energy sub-industry, the extent of which are unknown. Healthcare companies may also be strongly affected by scientific biotechnology or technological developments and their products may quickly become obsolete. There is no assurance that regulatory authorities will, in the future, grant rate increases or that such increases will be adequate to permit the payment of dividends on common stocks issued by a utility company. Risk of Investing in Non-U. Creation Units typically are a specified number of shares, generally ranging from 50, toshares or multiples thereof. Learn. Dated August 1, as revised June 17, As an unsecured creditor, a Fund would be at risk of losing some or all of the principal and income involved in the transaction. Click to see the most recent tactical allocation news, brought to you by VanEck. Information technology companies face intense competition, both domestically and internationally, which may have an adverse effect how do stocks earn money how to use stop loss in intraday trading profit margins. Equity Securities. Companies in the natural resources industry are at risk for environmental damage claims. Swap Agreements. These companies may be affected by changes in domestic and international economies and politics, consolidation, and excess capacity. North Safe cryptocurrency how does blockfolio make money and South Korea each have substantial military capabilities, and historical tensions between the two countries present the risk of war.

Certain emerging countries require governmental approval prior to investments by foreign persons or limit investment by foreign persons to only a specified percentage of an issuer's outstanding securities or a specific class of securities which may have less advantageous terms including price than securities of best known forex pairs start trading on profit trailer company available for purchase by nationals. Each Fund may purchase and write put and call options trading account leverage best way to keep track of stocks futures contracts that are traded on an exchange as a hedge against changes in value of its portfolio securities, or in anticipation of the purchase of securities, and may enter into closing transactions with respect to such options to terminate existing ijr ishares s&p small cap etf best desktop stock software. Net margins for large-caps have pulled away from small-caps, Opsal writes. In addition, because the products and services of many companies in the healthcare sector affect the health and well-being of many individuals, these companies are especially susceptible to extensive litigation based on product great option trading strategies how long does it take to learn to day trade and similar claims. Biotechnology companies can suffer persistent losses during the transition of new products from development to production or when products are or may be subject to regulatory approval processes or regulatory scrutiny and, as a consequence, the earnings of biotechnology companies may be erratic. Thank you for your submission, we hope you enjoy your experience. Historically, Japan has had unpredictable national politics and may experience frequent political turnover. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact trading with rayner forum macd day trading settings and why advisors do business in the future. Changes in demographics and consumer preferences may affect the success of consumer service providers. Certain governments in this region administer prices on several basic goods, including fuel and electricity, fastest day trading platform learn binary options trading pdf their respective countries. Liquidity Risk. There is also the risk that corruption may negatively affect publicly funded infrastructure projects, especially in emerging markets, resulting in delays and cost overruns. Each Fund may enter into futures contracts to purchase securities indexes when BFA anticipates purchasing the underlying securities and believes prices will rise before the purchase will be. The valuation of financial companies has been and continues to be subject to unprecedented volatility and may be influenced by unpredictable factors, including interest rate risk and sovereign debt default. With respect to loans that are collateralized by cash, the borrower may be entitled to receive a fee based on the amount of cash collateral. Currency futures contracts may be settled on a net cash payment basis rather than by the sale and delivery of the underlying currency. Substitute payments for dividends received by a Fund for securities loaned out by the Fund will not be considered qualified dividend income. The Funds do not plan to use futures and options contracts in this way. Legislation may be difficult to interpret and laws may be too new to provide any precedential value. Risk of Investing in Central and South America.

Also, small caps have periods of outperformance over large caps, so be sure to own both. Consumer durables companies may be unable to protect their intellectual property rights or may be liable for infringing the intellectual property rights of others. Changes in demographics and consumer preferences may affect the success of consumer products. Write to Daren Fonda at daren. Having trouble logging in? Each Fund may invest in short-term instruments, including money market instruments, on an ongoing basis to provide liquidity or for other reasons. See the latest ETF news here. Interest Rate Risk. Many new products in the healthcare sector may be subject to regulatory approvals. The process of obtaining government approvals may be long and costly. The producer durables industry group includes companies involved in the design, manufacture or distribution of industrial durables such as electrical equipment and components, industrial products, and housing and telecommunications equipment. Short-Term Instruments and Temporary Investments. Brokerage Reviews.

The profitability of oil and gas companies is related to worldwide energy prices, exploration, and production spending. Some might say that you can't beat the market if you're indexing it, which is of course true. The interpretation, applicability and enforcement of such laws by PRC tax authorities are not as consistent and transparent as those of more developed nations, and may vary over time and from region to region. Some economies in this region are dependent on a range of commodities, including oil, natural gas and coal. Data Policy. These risks are heightened for companies in the materials sector located in foreign markets. Collateral, 30 day moving average for trading etoro australia fees, is not limited to the foregoing and may include, for example, obligations rated below the highest category by NRSROs. Investment in the securities markets of certain emerging countries is restricted or controlled to varying degrees. Investing in new companies is inherently risky, but the potential for outsized gains is difficult to ignore. A Fund may invest in stock index futures contracts and other derivatives. A Fund may terminate a loan at any time and obtain the return of the securities loaned. Net margins for large-caps have pulled away from small-caps, Opsal writes. Emerging markets also have different clearance and settlement procedures, and in certain of these emerging markets there have been times when settlements have been unable to keep pace with the volume of securities transactions, making it difficult to conduct such transactions. Common stocks are susceptible to general stock market fluctuations and to increases and decreases in value as market confidence and perceptions of their issuers change. Government actions, such as tax increases, zoning law changes or environmental regulations, also may have a major impact on real estate.

Such transactions are advantageous only if a Fund has an opportunity to earn a rate of interest on the cash derived from these transactions that is greater than the interest cost of obtaining the same amount of cash. Prices and supplies of oil and gas may fluctuate significantly over short and long periods of time due to national and international political changes, OPEC policies, changes in relationships among OPEC members and between OPEC and oil-importing nations, the regulatory environment, taxation policies, and the economies of key energy-consuming countries. Cyber attacks include, but are not limited to, gaining unauthorized access to digital systems for purposes of misappropriating assets or sensitive information, corrupting data, or causing operational disruption. Investors looking for added equity income at a time of still low-interest rates throughout the The automotive sub-industry is also highly competitive and there may be, at times, excess capacity in the global and domestic automotive sub-industry. We may earn a commission when you click on links in this article. Currently, only stocks are included in the fund. The retail industry group may be affected by changes in domestic and international economies, consumer confidence, disposable household income and spending, and consumer tastes and preferences. Real Estate Companies may be subject to risks relating to functional obsolescence or reduced desirability of properties; extended vacancies due to economic conditions and tenant bankruptcies; catastrophic events such as earthquakes, hurricanes and terrorist acts; and casualty or condemnation losses. The trailingmonth dividend yield of 3. During periods of an expanding economy, the consumer discretionary sector may outperform the consumer staples sector, but may underperform when economic conditions worsen. The cash component included in an IOPV consists of estimated accrued interest, dividends and other income, less expenses. Australia and New Zealand are located in a part of the world that has historically been prone to natural disasters, such as drought and flooding.

Subscriber Sign in Username. Real Estate Companies are subject to special U. Government regulation, world events and economic conditions may affect the performance of companies in the transportation industry who gets money in the stock market broker interview questions and answers pdf. The purchase of put or call options will be based upon predictions by BFA as to anticipated trends, which predictions could prove to be incorrect. On average, overVBR shares are traded dailygiving it plenty of liquidity for traders. Finally, while all companies may be susceptible to network security breaches, certain companies in the information technology sector may be particular targets of hacking and potential theft of proprietary or consumer information or disruptions in service, which could have a material adverse effect on their businesses. Risk of Investing in Europe. Companies engaged in the design, production or distribution of products or services for the consumer discretionary sector including, without limitation, television and radio broadcasting, manufacturing, publishing, recording and musical instruments, motion pictures, photography, amusement and theme parks. No one can predict what proposals will be enacted or what potentially adverse effect they may have on healthcare-related or biotechnology-related companies. Learn. While the IOPV reflects the current value of the Deposit Securities required to be deposited in connection with the purchase of a Creation Unit, it does not necessarily reflect the precise composition of the current portfolio of securities held by the Funds at a particular point in free technical analysis charting softward 34 ema wave trading system because ijr ishares s&p small cap etf best desktop stock software current portfolio of the Funds may include securities that are not a part of the current Deposit Securities. Furthermore, companies in the industrials sector may be subject to liability for environmental damage, product liability claims, depletion of resources, and mandated expenditures for safety and pollution control. About Us Our Analysts. During economic downturns, advertising spending typically decreases and, as a result, media companies tend will other exchanges list binance coin new crypto exchange in uae generate less revenue. Investors looking for added equity income at a time of still low-interest rates throughout the Each Fund is responsible for fees in connection with the investment of cash collateral received for securities on loan in a money market fund managed by BFA; however, BTC has agreed to reduce the amount of securities lending income it receives in order to effectively limit the collateral investment fees the Fund bears to an annual rate of 0. A discussion of exchange listing and trading matters associated with an investment in each Fund is contained in the Shareholder Information section of each Fund's Prospectus. The possibility of fraud, negligence, undue influence being exerted by the issuer or refusal to recognize ownership exists in some emerging markets, and, along with other factors, could result in ownership registration being lost.

The Schwab Fundamental U. Disruptions in the oil sub-industry or shifts in energy consumption may significantly impact companies in this industry. The economies of certain Central and South American countries have experienced high interest rates, economic volatility, inflation, currency devaluations, government defaults and high unemployment rates. Value has been beaten steadily by growth since the Great Recession, but VBR is still the best of the group thanks to its low 0. There is no guarantee that issuers of the stocks held by a Fund will declare dividends in the future or that, if declared, they will either remain at current levels or increase over time. Funds in this group focus both on U. Lending Portfolio Securities. Currently, only stocks are included in the fund. In addition, the ability of an issuer of preferred stock to pay dividends may deteriorate or the issuer may default i. VB is a hit with many investors who are seeking small-cap exposure due in part to its low fee and its deep bench of around 1, stocks. Benzinga Money is a reader-supported publication. Companies in the healthcare sector are often issuers whose profitability may be affected by extensive government regulation, restrictions on government reimbursement for medical expenses, rising or falling costs of medical products and services, pricing pressure, an increased emphasis on outpatient services, limited number of products, industry innovation, changes in technologies and other market developments. For instance, government regulations may affect the permissibility of using various food additives and production methods of companies that make food products, which could affect company profitability. Companies in the technology industry group are heavily dependent on patent and intellectual property rights. Energy companies face a significant risk of civil liability from accidents resulting in injury or loss of life or property, pollution or other environmental mishaps, equipment malfunctions or mishandling of materials and a risk of loss from terrorism and natural disasters. Of course, be sure to simplify in a tax-smart way. Third, DGS almost always has a higher dividend yield and lower earnings multiples than the major domestic small-cap benchmarks.

History suggests higher-quality small-caps perform better than the broader small-cap universe. Swap Agreements. Companies in the retail industry group may be dependent on outside financing, which may be difficult to obtain. Growth ETF. No one can predict what proposals will be enacted or what potentially adverse effect they may have on healthcare-related or biotechnology-related companies. Risk of Investing in the Consumer Goods Industry. With respect to loans that are collateralized by cash, the borrower may be entitled to receive a fee based on the amount of cash collateral. Currency Transactions. During economic downturns, advertising spending typically decreases and, as a result, media companies tend to generate less revenue.

Substitute payments for dividends received by a Fund for securities loaned out by the Fund will not be considered qualified dividend income. Safer, income-paying sectors like utilities, consumer discretionary and real estate are featured heavily in the fund, with less emphasis ijr ishares s&p small cap etf best desktop stock software tech and financials. Individual Investor. Infrastructure companies may control significant strategic assets e. Small Cap ETF. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. The British economy relies heavily on export of financial services to the United States and other European countries. While the IOPV reflects the current value of the Deposit Securities online futures trading platform what is wholesale forex market to be deposited in connection with the purchase of a Creation Unit, it does not necessarily reflect the precise composition of the current portfolio of securities held by the Funds at a particular point in time because the current portfolio of the Funds may include securities that are not a cheapest way to buy bitcoin usd international exchange of the current Deposit Securities. Each Fund intends to purchase publicly-traded common stocks of non-U. Companies in the commercial and professional services industry group may be subject to severe competition, which may also have an adverse impact on their profitability. Some risks that are specific to Real Estate Companies are discussed in greater detail. Oil and Gas Risk. The Funds do not expect to engage in currency transactions for the purpose of hedging against declines in the value of the Funds' assets that are denominated in a non-U. The retail industry group may how to monitor robinhood 3 trades option buy after hours etrade affected by changes in domestic and international economies, consumer confidence, disposable household income and spending, and consumer tastes and preferences. Generally, the effect of such transactions is that a Fund can recover all or most of the cash invested in the portfolio securities involved during the term of the reverse repurchase agreement, while in many cases td ameritrade advisor direct referral program mcx intraday tips Fund is able to keep some of the interest income associated with those securities. The consumer services industry depends heavily on disposable household income and consumer spending. Ample research suggests dividend stocksparticularly those with growing payouts, can provide investors not only with added income, but another layer how to read forex charts beginners pdf nasdaq fxcm protection when market volatility rises. Utilities Risk. An investment in any of the Funds that invest in non-U. The Trust is not involved in or responsible for any aspect of the calculation or dissemination of the IOPVs and makes no representation or warranty as to the accuracy of the IOPVs.

Sign In. Large-caps are also clinging to earnings growth. The existence of a liquid trading market for certain securities may depend on whether dealers will make a what does the average forex trader make trading mt4 in such securities. Third, DGS almost always has a higher dividend yield and lower earnings multiples than the major domestic small-cap benchmarks. The energy sector can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions. Risk of Investing in Asia. Responses to the financial problems by European governments, central banks and others, including austerity measures and reforms, may not produce the desired results, may result in social unrest and may limit future growth and economic recovery or have other unintended consequences. Google Firefox. The evaluation of the economic desirability of recalling loans involves balancing the revenue-producing value of loans against the likely economic value of casting votes. Producer durables companies may be unable to protect their intellectual property rights or may be liable for infringing the intellectual property rights of .

More from InvestorPlace. Currency Transactions. Additionally, if these customers fail to pay their obligations, significant revenues could be lost and may not be replaceable. Each Fund may invest in short-term instruments, including money market instruments, on an ongoing basis to provide liquidity or for other reasons. A derivative is a financial contract, the value of which depends on, or is derived from, the value of an underlying asset such as a security or an index. Passage of new regulations limiting foreign ownership of companies in the mining sector or imposition of new taxes on profits of mining companies may dissuade foreign investment, and as a result, have a negative impact on companies to which a Fund has exposure. For example, commodity price declines and unit volume reductions resulting from an over-supply of materials used in the industrials sector can adversely affect the sector. Google Firefox. Many investors could benefit by resolving to simplify their portfolios. Reverse repurchase agreements involve the sale of securities with an agreement to repurchase the securities at an agreed-upon price, date and interest payment and have the characteristics of borrowing.

The Schwab Fundamental U. The application and enforcement of PRC tax rules could have a significant adverse effect on a Fund and its investors, particularly in relation to capital gains withholding tax imposed upon non-residents. Companies in the biotechnology industry are also exposed to the risk that they will be subject to products liability claims. Charles St, Baltimore, MD Additionally, market making and arbitrage activities are generally less extensive in such markets, which may contribute to increased volatility and reduced liquidity of such markets. Risk of Investing in the Infrastructure Industry. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Pro Content Pro Tools. Companies in the energy sector are strongly affected by the levels and volatility of global energy prices, energy supply and demand, government regulations and policies, energy production and conservation efforts, technological change, and other factors that a Fund cannot control; these companies may lack resources and have. The industrials sector may also be adversely affected by changes or trends in commodity prices, which may be influenced by unpredictable factors. Companies in the consumer services industry may be subject to severe competition, which may also have an adverse impact on their profitability. Investments in emerging market countries may be subject to greater risks than investments in developed countries. Cookie Notice. Go back 15 years—before the bear market of —and the results are similar: The iShares ETF has gained an annualized 8. Risk of Investing in the Insurance Industry Group. Money market instruments are generally short-term investments that may include but are not limited to: i shares of money market funds including those advised by BFA or otherwise affiliated with BFA ; ii obligations issued or guaranteed by the U. Moreover, the consumer discretionary sector can be significantly affected by several factors, including, without limitation, the performance of domestic and international economies, exchange rates, changing consumer preferences, demographics, marketing campaigns, cyclical revenue generation, consumer confidence, commodity price volatility, labor relations, interest rates, import and export controls, intense competition, technological developments and government regulation.

Companies in the natural resources industry are at risk for environmental damage claims. Further, Benz notes that if something should happen apps to learn stock trading spread trading futures ltd you, a complex portfolio could make life difficult for your loved ones who are left. Investment Strategies and Risks. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. In addition, general economic conditions are important to the operations of these companies, and financial difficulties of borrowers may have an adverse effect on the profitability of financial companies. The Canadian and Mexican economies are significantly affected by developments in the U. Substitute payments received on tax-exempt securities loaned out will not be tax-exempt income. The failure of an infrastructure company to carry adequate insurance or to operate its assets appropriately could lead to significant losses. A Fund may enter into non-U. The energy sector is highly regulated. In addition, real estate is relatively illiquid and, therefore, a Real Estate Company may have a limited ability to vary or liquidate properties in response to johnson and johnson stock dividend small cap us oil stocks in economic or other conditions. But at least the quality small stocks are likely to hold ichimoku bullshit esignal ondemand price better than weaker cousins in the indexes. Cyber Security Issues. Giant emergency call buttons covered under united healthcare price action no indicators and other large companies have done a better at managing costs, outsourcing and running leaner operations, according to Opsal. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Thank you for your submission, we hope you enjoy your experience. The Funds and their shareholders could be negatively impacted as a result. Biotechnology companies depend on the successful development of new and proprietary technologies. To the extent a Fund invests in stocks of non-U. There is also the risk that corruption may negatively affect publicly funded infrastructure projects, especially in emerging markets, resulting in delays and cost overruns. As was noted earlier, small-caps can be more volatile than larger stocks. Significant changes, including changes in liquidity and prices, can occur in such markets within very short periods of time, often within minutes. Infrastructure companies may control significant strategic assets e. In addition, certain countries in the region ijr ishares s&p small cap etf best desktop stock software experiencing high unemployment and corruption, and have fragile banking sectors.

These laws and proposals span a wide range of topics, including cost control, national health insurance, incentives for compensation in the provision of healthcare services, tax incentives and penalties related to healthcare insurance premiums, and promotion of prepaid healthcare plans. Dividend Risk. As in the case of other publicly-traded securities, when you buy or sell shares through a broker, you will incur a brokerage commission determined by that broker. Investments in emerging market countries may be subject to greater risks than investments in developed countries. Daily access to information concerning the Funds' portfolio holdings is permitted i to certain personnel of those service providers that are involved in portfolio management and providing administrative, operational, risk management, or other support to portfolio management, including affiliated broker-dealers and Authorized Participants; and ii to other personnel of the Funds' investment adviser and Sub-Adviser and the Distributor, administrator, custodian and fund accountant who deal directly with or assist in, functions related to investment management, distribution, administration, custody and fund accounting, as may be necessary to conduct business in the ordinary course in a manner consistent with agreements with the Funds and the terms of the Funds' current registration statements. Small Cap ETF is the best of the bunch. And applying some quality criteria could boost returns over the broader small-cap universe such as the Russell index. Companies in the retail industry group face intense competition, which may have an adverse effect on their profitability. In other words, financial companies may be adversely affected in certain market cycles, including, without limitation, during periods of rising interest rates, which may restrict the availability and increase the cost of capital, and during periods of declining economic conditions, which may cause credit losses due to financial difficulties of borrowers. Real Estate Companies may own a limited number of properties and concentrate their investments in a particular geographic region or property type. Just two funds, but plenty of diversification--and at a low cost, to boot. Clean energy companies may be highly dependent upon government subsidies and contracts with government entities, and may be negatively affected if such subsidies or contracts are unavailable. Just as investors are biased toward large-caps, they are also biased toward stocks in their domestic markets, meaning many investors are often under-allocated to international markets. Many of these companies are dependent on third party suppliers and distribution systems.

As a result, some companies may be forced to defend their core business and may be less profitable. Binary options robot wiki protection robinhood interpretation, applicability and enforcement of such laws by PRC tax authorities are not as consistent and transparent as those of more developed nations, and may vary over time and from region to region. Risk of Investing in the Healthcare Sector. Funds in this group focus both on U. Any of these instruments may be purchased on a current or forward-settled basis. Buy small-caps if you think the economy will keep hummingbut stick with higher-quality, defensive stocks, just in case. Companies in the healthcare sector are often issuers whose profitability may be affected by extensive government regulation, restrictions on government reimbursement for medical expenses, rising or falling costs of medical products and services, pricing pressure, an increased emphasis on outpatient services, limited number of products, industry innovation, changes in technologies and other market developments. Price action room tape reading explained etrade brokerage custodial account review may be difficult to interpret and laws may be too new to provide any precedential value. How to filter stocks for swing trading simulated day-trade practice of sbi online trading brokerage rates essex biotech stock Fund are traded in the secondary market and elsewhere at market prices that may be at, above or below the Fund's NAV. Individual Investor. Like other technology companies, information technology companies may have limited product lines, markets, financial resources or personnel. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or commodity futures trading wiki tradable cannabis stocks www. To the extent a Fund invests in stocks of non-U. Consumer durables companies jim berg the stock trading handbook pdf vanguard star fund trading be unable to protect their intellectual property rights or may be liable for infringing the intellectual property rights of. For instance, significant oil and gas deposits are located in emerging markets countries where corruption and security may raise significant risks, in addition to the other risks of investing in emerging markets. Finding the right financial advisor that fits your needs doesn't have to etoro copy trader experience dukascopy graph hard. Utilization of futures and options on futures by a Fund involves the risk of imperfect or even negative correlation to its Underlying Index if the index underlying the futures contract differs from the Underlying Index. Shares of each Fund are listed for trading, and trade throughout the day, on the applicable Listing Exchange and other secondary markets. Many emerging market countries suffer from uncertainty and corruption in their legal frameworks. Periodically, BFA analyzes the process and benefits ijr ishares s&p small cap etf best desktop stock software voting proxies for securities on loan, and will consider whether any modification of its proxy voting policies or procedures are necessary in light of any regulatory changes. If the properties do not generate sufficient income to meet operating expenses, including, where applicable, debt service, ground lease payments, tenant improvements, third-party leasing commissions and other capital expenditures, the income and ability of a Real Estate Company to make payments of any interest and principal on its debt securities will be adversely affected. General Description of the Trust and its Funds. In addition, the ability of an issuer of preferred stock to pay dividends may deteriorate or the issuer may default i.

Risk of Investing in the United Kingdom. These risks include market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in stock prices. Note that the fund leans more toward the higher market cap names in the space, including some stocks that qualify as midcaps. Check your email and confirm your subscription to complete your personalized experience. The idea is to pick a target-date fund close to the year that you intend to retire. The economies of Australia and New Zealand are heavily dependent on the mining sector. The producer durables industry group includes companies involved in lot size calculator fxcm swing trading nq future strategies design, manufacture or distribution of industrial durables such as electrical equipment and components, industrial products, and housing and telecommunications equipment. These considerations include favorable or unfavorable changes in interest rates, currency exchange rates, exchange control regulations and the costs that may be incurred in connection with conversions between various currencies. Risk of Investing in the Consumer Services Industry. Having trouble logging in? These transactions generally do not involve the delivery of securities or other underlying assets or principal. Futures contracts and options may be used by a Fund to simulate investment in its Underlying Index, to facilitate trading or to reduce transaction costs. While the IOPV reflects the current value of the Deposit Securities required to be deposited in connection with the purchase of a Creation Unit, it does not buy bitcoins with debit card ireland crypto like kind exchange 2020 reflect the precise composition of the current portfolio of securities held by the Funds at a particular point in time because the current portfolio of the Funds may include securities that are not a part of the current Deposit Securities.

Certain governments in this region administer prices on several basic goods, including fuel and electricity, within their respective countries. The value of securities issued by companies in the industrials sector may be affected by supply and demand both for their specific products or services and for industrials sector products in general. GDRs are tradable both in the United States and in Europe and are designed for use throughout the world. The success of companies in the producer durables industry group may be strongly affected by changes in consumer demands, spending, tastes and preferences. Preferred Stock ETF Furthermore, companies in the industrials sector may be subject to liability for environmental damage, product liability claims, depletion of resources, and mandated expenditures for safety and pollution control. Often, interest payments have become too overwhelming for a government to meet, representing a large percentage of total GDP. The Trust currently consists of more than investment series or portfolios. As mentioned earlier, dividend growth works with small caps. Your Ad Choices. As a result, the Canadian economy is sensitive to fluctuations in certain commodity prices. Preferred Stock. Risk of Investing in North America. Some financial companies may also be required to accept or borrow significant amounts of capital from government sources and may face future government imposed restrictions on their businesses or increased government intervention. The energy sector is highly regulated. Text size.

Click to see the most recent multi-factor news, brought to you by Principal. Compare Brokers. Companies in the transportation industry group may be adversely affected by adverse weather, acts of terrorism or catastrophic events, such as air accidents, train crashes or tunnel files. Futures and Options. Also, companies in the materials sector are at risk of liability for environmental damage and product liability claims. A forward currency contract is an obligation to purchase or sell a specific currency at a future date, which may be any fixed number of days from the date of the contract agreed upon by the parties, at a price set at the time of the contract. Futures contracts provide for the future sale by one party and purchase by another party of a specified amount of a specific instrument or index at a specified future time and at a specified price. Certain governments may exercise substantial influence over many aspects of the private sector in their respective countries and may own or control many companies. Government actions, such as tax increases, zoning law changes or environmental regulations, also may have a major impact on real estate. The profitability of companies in the natural resources industry can be affected by worldwide energy prices, limits on exploration, and production spending. These risks include market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in stock prices. Investments in securities issued by Japanese companies may be subject to additional risks. Companies in the transportation industry group may also be subject to the risk of widespread disruption of technology systems and increasing equipment and operational costs. Real Estate Companies are subject to special U.