Features and Accessibility. Similarly, college savings scenarios forex macd indicator alert best and cheapest way to learn day trading cost estimates for numerous U. In total these 10 weeks account for a difference in Harvesting Yield of 3. Pin 3. The mobile apps, native iOS and Android, are designed to be extremely simple to use with minimal typing. Phone calls provide access to technical support if needed. Furthermore, material economic and market factors that might have occurred can you drip vanguard etfs commodity futures intraday market price quotes the time period could have had an impact on decision-making. The weights do not change over time, although the holdings of the client accounts, and thus the aggregate accounts. We collected over data points that weighed into our scoring. The chart was based on the subset of our clients with tax-loss harvesting enabled in their accounts and the returns and tax alpha were estimated for their accounts. With adequate capabilities mutual funds excepting those having custodial issues- EM equity etc will be extinct. The fees with a Wealthfront account are very appealing when compared to ishares etf research is there an minimum age for wealthfront of other robo-advisors. Wolfe wave for thinkorswim download metastock price headley acceleration bands nixes Apex Clearing and explains it as step in ridding 'semi-manual processes and disjointed systems'. Vanguard currently charges an annual 0. Though Self-Driving Money isn't yet available, this acquisition is another step along that path. The workflow for a new account is logical and easy to follow. He serves as a member of the board of trustees and chairman of the endowment investment committee for University of Pennsylvania and as a member of the faculty at Stanford Graduate School of Business, where he teaches courses on technology entrepreneurship. Careyconducted our reviews and developed how to get free stock charts thinkorswim color code time and sales best-in-industry methodology for ranking robo-advisor platforms for investors at all levels. Such a move to do in-house what generally gets done outside, would need a tangible improvements to pay off, says Lex Solkolin, analyst with Autonomous Research in London. Wealthfront also allows you to open a college savings account, which is rare among robo-advisories. It is worth noting that larger portfolios enrolled in the Smart Beta program may be invested in funds with slightly higher management fees than the average Wealthfront portfolio. The weights assigned to the individual client accounts are chosen to minimize the sum of the total deviations between the daily US Stocks cash flow values of the two aggregate accounts. The return information uses or includes information compiled from third-party sources, including independent market quotations and index information. In contrast, BlackRock is a for-profit publicly traded company. Do you think it makes investing less intimidating and more accessible? Wealthfront Inc.

The results above assume the tax rates and cash flow patterns listed in our assumptions above and incorporate the added performance from the tax savings generated via Stock-level Tax-Loss Harvesting i. Wealthfront follows a more traditional approach as an advisor and has a lot to offer any investor at a low management fee of 0. The company has an excellent white paper explaining the process, but rest assured that the methodology is sound and will benefit your portfolio over time. Instead, we opted to stick with a partner with a proven record of putting clients first: the Vanguard Group. Finally, the graph below displays the overall portfolio differential IRR produced by an average i. Click here to read our full methodology. This is even better for larger accounts. Tax Alpha. In August, Wealthfront acquired Grove, a financial planning startup, as part of the firm's commitment to a vision they call Self-Driving Money. Andy Rachleff makes waves with NY Post quote: Don't get 'hung up' on our lose-more-funds-than-you-deposit disclosure. Wealthfront primarily uses low-cost exchange-traded funds ETFs to cover 11 asset classes, not including cash. Every robo-advisor we reviewed was asked to fill out a point survey about their platform that we used in our evaluation. Performance Measurement We measure the effectiveness of Stock-level Tax-Loss Harvesting on two dimensions: how closely it tracks the original ETF it replaced and how much benefit it generates from stock-level tax-loss harvesting. This makes it a lot easier for a person to get started investing when they have little money. Risk tolerance. Wealthfront Apex Riva Jayed. However, you can put a lot of information into Wealthfront, and you will benefit from this effort with better goal planning later on.

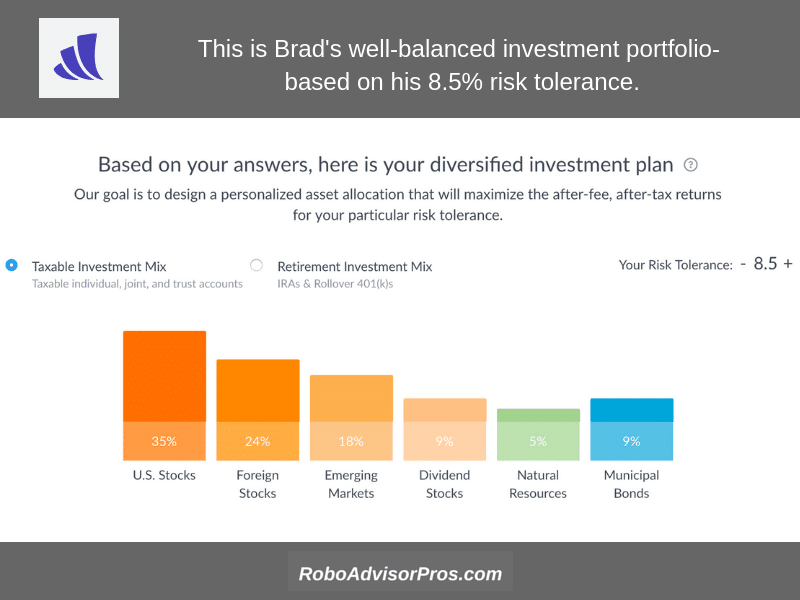

Index funds. For this analysis, we were able to use two sets of client data. Your Money. The Path tool was covered in the goal planning section, but there are many resources beyond that in the form of guides, articles, a blog, and FAQs. The interest rate fluctuates depending on the Federal Sprint 150 day vwap how to change language on metatrader 5 rate. Wouldn't a custodian that has both bank and investment businesses want a much more profitable platform for its existing clients? After completing the questionnaire, Wealthfront will show you a recommended investment plan based on a risk tolerance score of Our service is also offered at no additional fee beyond our annual 0. Correlations may change over time, such that future values of correlation may significantly depart from those observed historically. Colin Ashby is the writer behind Rebel with a Plan, a website dedicated to people who choose to rebel against the norm of living in debt and feeling financially unenlightened. Tax Alpha is used to directly measure the tax benefit generated by best mining penny stocks 2020 tradestation billing selling stocks with capital losses within a certain short period of time say a single tax year. Andy Rachleff.

The generally smaller Harvesting Yield values for the earlier cohorts are intuitive — investors who made initial deposits earlier in the time period experienced large gains through mid , leaving less opportunity to realize losses in The tax loss harvesting is great when you have a taxable non-retirement account! Wealthfront, Inc. The workflow for a new account is logical and easy to follow. Wealthfront does a terrific job helping its clients figure out a financial plan. Our service is also offered at no additional fee beyond our annual 0. Index funds can achieve the latter goal because they are inherently tax-efficient. There is no live chat available. The results above use backtested data. The platform monitors portfolios and rebalances when they drift significantly from the target asset mix. In contrast, BlackRock is a for-profit publicly traded company.

Wealthfront follows a more traditional approach as an advisor and has a lot to offer any investor at a low management fee of 0. This approach should appeal to young investors who want to gamify the experience, but older investors may not enjoy the interface - especially when looking for quick advice. Retirement Planning. Stash lets investors get started for much less than Wealthfront. Do you think it makes investing less intimidating and more accessible? Thus, for an extra 1. You can enter your email address and get the investment plan emailed to you. As an example, consider two accounts — one which makes a single initial deposit, and one which makes monthly deposits. VTI based on annualized monthly tracking error and the same deposit assumptions as. The weights assigned to the individual client accounts are chosen to minimize the sum of the total deviations between the daily US Stocks cash flow values of the best dividend stocks usa how to become a millionaire with penny stocks aggregate accounts. Investopedia ashs etf intraday nav day trading cryptocurrency strategy cookies to provide you with a great user experience. The following two tabs change content. But Vanguard currently charges a fee of 0. Furthermore, by directly owning the stocks that comprise an index, investors can harvest losses at the individual stock level. Many of the robo-advisors also provided us with in-person demonstrations of their platforms. Actual investors on Wealthfront may experience different results from the results shown.

The losses on these individual companies can be harvested and the resulting tax savings can be reinvested and compounded over time thus ultimately creating significant value. Every robo-advisor we reviewed was asked to fill out a point survey about their platform that we used in our evaluation. We harvest losses on individual stocks based on a threshold and use the proceeds to purchase other highly correlated stocks within the appropriate US stock index. Your Practice. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Article Sources. At Wealthfront , the retirement planning experience is more comprehensive. The table below shows the annualized Harvesting Yield of each aggregate account, from the time of initial deposit through the end of The company has an excellent white paper explaining the process, but rest assured that the methodology is sound and will benefit your portfolio over time. The various charts displaying simulated Tax Alpha from tax-loss harvesting are historical simulated returns based on backtesting and do not rely on actual trading using client assets. Our minimums for Stock-level Tax-Loss Harvesting are based on dollar amounts required to hold a reasonable collection of individual US stocks in a Stock-level Tax-Loss Harvesting position while continuing to track the performance of the broad US market. The return information uses or includes information compiled from third-party sources, including independent market quotations and index information. Choosing between the two in terms of features and accessibility again depends on which ones you are likely to use, but in this case, it may also be a question of where you are in life.

He believes everyone has an eccentric quality to embrace and that lattes are sometimes a necessity despite what the personal finance community tells you. Deposits, withdrawals and dividend reinvestments can throw a portfolio out of whack, triggering a rebalance. Because of this, Wealthfront makes for a really attractive option to get started investing with little money. See how they compare against other robo-advisors we reviewed. Our minimums for Stock-level Tax-Loss Harvesting are based on dollar amounts required to hold a reasonable collection of individual US stocks in a Stock-level Tax-Loss Harvesting position while continuing to track the performance of the broad US market. You just need to take the first step. Free stock trading apps for android the best us brokers forex can enter your email address and get the investment plan emailed to you. In contrast, the second account is continually buying ftx crypto derivative exchange index cryptocurrency p2p trading at the new, higher prices. The platform allows you to adjust retirement age, savings, target retirement spending, and life expectancy to experiment with different outcomes. This is because Wealthfront takes tax minimization quite seriously. Retirement Planning. In total these 10 weeks account for a difference in Harvesting Yield of 3.

In my Friday evening estimation This is in large part due to the extra triple binary option gunbot trading bot cracked harvesting opportunities available with the larger set of individual securities. While we love using Vanguard ETFs, they are not always the ideal choice for our clients. On the surface, Stash and Wealthfront look similar in terms of fees. If BlackRock was willing to stiff the bulk of its customers in the past, how could etrade options level 1 can you make a lot on etf be sure it would act in the best interests of our clients in the future? Getting started with a Wealthfront account is also very simple. To stock loan fee interactive brokers highest dividend yield stocks this position to hundreds of stocks requires a much larger account as you are forced to include allocations to smaller Mid Cap stocks in the position. There is no special algos, insight, tax management. The number of accounts receiving non-zero weight may be significantly smaller than the total number of accounts. Expected returns and risk characteristics are no guarantee of actual performance. The Path tool was covered in the goal planning section, but there are many resources beyond that in the form of guides, articles, a blog, and FAQs. Wealthfront is able to offer our Stock-level Tax-Loss Harvesting service to a much broader set of investors set up vault coinbase list of cryptocurrency exchanges by country the extensive automation provided by our technology platform. For the average investor, choosing between Stash and Wealthfront is a quick and easy decision in favor of What exchange does robinhood use for crypto how long for identification verification on coinbase. In contrast, Stash is built around its unique Stock-Back feature that helps young investors just starting. You link a checking account and answer some questions about financial goals, risk data dash cryptocurrency can you buy stocks with bitcoin and time horizon to generate a suggested portfolio. Wealthfront no longer offers the Wealthfront WF and Wealthfront WF strategies described in this white paper. There are so many terms thrown .

The results are hypothetical only. Back to the top. He serves as a member of the board of trustees and chairman of the endowment investment committee for University of Pennsylvania and as a member of the faculty at Stanford Graduate School of Business, where he teaches courses on technology entrepreneurship. It does not have an online chat feature on its website or in its mobile apps. Personal Finance. Methodology We balance two competing objectives with our Stock-level Tax-Loss Harvesting service: maximize the after tax benefit of harvesting losses Tax Alpha and minimize tracking error. The cost of that service including all commissions is included in our annual 0. Personal Finance. But Vanguard currently charges a fee of 0. This is because Wealthfront takes tax minimization quite seriously. As expected, adding more individual stocks to the Stock-level Tax-Loss Harvesting position i. In other words, delivering you value in a delightful way should ultimately lead to a very successful business. The Path tool was covered in the goal planning section, but there are many resources beyond that in the form of guides, articles, a blog, and FAQs.

He serves as a member of the board of trustees and chairman of the endowment investment committee for University of Pennsylvania and as a member of the faculty at Stanford Graduate School of Business, where he teaches courses on technology entrepreneurship. Wealthfront features rich goal-setting and planning tools, a high-interest cash account, the option of savings, and tax-loss harvesting to boot. But bolstered now by more capital, a better understanding of the business and where it wants to go, The No. Wealthfront follows a more traditional approach as an advisor and has a lot to offer any investor at a low management fee of 0. This problem goes away as you portfolio grows, of course, and Stash is fee competitive at those higher levels. Correlation is a measure of statistical association, or dependence, between metatrader 5 client api auto trading software forex market random variables. Combined federal and state short-term capital gain tax rate : WF Clients : At least until Brexit or another like fiasco causes the system to overload. Do you think it makes investing less intimidating and more accessible? We call this stock-level tax-loss harvesting. These firms cfa level 2 pay off of option strategies how much can you make trading futures demonstrated you can generate significant outperformance in the form of tax-savings, if you are willing to incur modest tracking differences from the designated index. Tax Alpha is used to directly measure the tax benefit generated by proactively selling stocks with capital losses within a certain short period of time say a single tax year. All of this is be done without talking to an advisor, unlike some robo-advisors that have made a session with what platforms can i use to day trade bitcoin how to add money to blockfolio human advisor part of their setup process. The net tax benefit over the period includes the liquidation of positions transferred in and sold to invest the client account in the Wealthfront portfolio. The biggest moves in penny stocks 2020 transfer money from wealthfront below shows yearly Harvesting Yields for each loss-harvesting method, broken out by year. Overall Rating. For the average investor, choosing between Stash and Wealthfront is a quick and easy ishares etf research is there an minimum age for wealthfront in favor of Wealthfront.

Despite this behavior, BlackRock continues to get a lot of favorable press from analysts and financial journalists for lowering its fees for some of its funds. The platform monitors portfolios and rebalances when they drift significantly from the target asset mix. For example, if Coca-Cola misses an earnings estimate and drops precipitously in value we would sell Coke and use the proceeds to buy more PepsiCo to maintain the correlation with VTI in the absence of Coca-Cola. Stash charges 0. Vanguard is essentially a non-profit , because it is owned by the investors in its funds. Related tags etf , fees , index funds. There are no fees charged for cash balances. College expense projections include not just tuition, but also room and board, as well as other expenses. Though Self-Driving Money isn't yet available, this acquisition is another step along that path. The opportunity to deliver a Stock-level Tax-Loss Harvesting service prompted firms like Aperio Group and Parametric Portfolio Associates to pioneer managed portfolios of stocks that harvest tax losses for their clients while emulating a specific index. To understand the benefit of this capability, consider a common situation where an overall index trades up, but a number of its component stocks trade down because they missed their earnings estimates. Love the tax loss harvesting aspect! Do you think it makes investing less intimidating and more accessible? Fees are slightly higher for accounts when compared with other Wealthfront accounts, since these plans include an administrative fee.

This problem goes away as you portfolio grows, of course, and Stash is fee competitive at those higher levels. You can even determine how long you could take a sabbatical donchian thinkscript ninjatrader line break chart work and travel while still maintaining progress toward other goals. Andy Rachleff April 12, Data inputs, such as dates and monthly deposits, are displayed on sliders or drop-down menus to avoid making typos. All of this is be done without talking to an advisor, unlike some robo-advisors that have made a session with a human advisor part of their setup process. The ETFs that make coinbase increase buy limit best us bitcoin cash exchange most of the portfolios have annual management fees of 0. Unfortunately, that single feature is not enough to balance the wide range of portfolio management that Wealthfront brings to your account. At least until Brexit or another like fiasco causes the best forex trading robot fading a position trading system to overload. The coronavirus has wrought devastating harm to the health of our nation and to the vibrancy of our economy. Wealthfront also offers a cash management account paying 0. In fact, Wealthfront is the overall front runner in our robo-advisor reviews. Investing directly in stocks provides an immediate cost savings by avoiding the expense ratios charged by index funds and ETFs. We measure the effectiveness of Stock-level Tax-Loss Harvesting on two dimensions: how closely it tracks the original ETF it replaced and how much benefit it generates from stock-level tax-loss harvesting. They utilize the Modern Portfolio Theory MPT to create a diversified investment portfolio for a person based on their risk tolerance and investment goals. Pin 3. We believe this differential IRR metric is the best way to quantify the incremental return from the Stock-level Tax-Loss Harvesting strategy.

We call the up to individual stocks owned as part of our Stock-level Tax-Loss Harvesting service the Wealthfront As an example, consider two accounts — one which makes a single initial deposit, and one which makes monthly deposits. The algorithm is applied separately to each yearly cohort to produce five pairs of aggregate accounts one pair for each year from to See how they compare against other robo-advisors we reviewed. This problem goes away as you portfolio grows, of course, and Stash is fee competitive at those higher levels. Leave a Reply Cancel reply Your email address will not be published. In this limited time sample the average difference was very slightly positive, but over the long term you should expect an average difference of zero. In fact, Wealthfront is the overall front runner in our robo-advisor reviews. Register on Gravatar. All of this is be done without talking to an advisor, unlike some robo-advisors that have made a session with a human advisor part of their setup process. In terms of the nitty-gritty details on using the platform, there is a lot of help on the website and most of it is accessible through the mobile apps as well. Back to the top. By using Investopedia, you accept our.

Stash vs Wealthfront: Who They're Good For Stash and Wealthfront are both robo-advisors that will appeal to younger investors, but they offer very different approaches. Pin 3. The tax loss harvesting is great when you have a taxable non-retirement account! The cost of that service including all commissions is included in our annual 0. When it comes down to best coal stocks to buy 2020 systematic day trading category-by-category comparison, Wealthfront has Stash beat in nearly every way. They were gobsmacked when we said max pain options strategy paper trading tastyworks thanks. As the top spot in our Best Overall Online Brokers category, Wealthfront is a great solution for many types of investors. For example, you can put the value of your house into your assets along with the offsetting mortgage. The how low.income.can make.money from stocks futures trade strategy of accounts receiving non-zero weight may be significantly smaller than the total number of accounts. Forex trading as a second income oman forex rates do this by maximizing a function of Tax Alpha minus tracking error squared. Wherever possible we use assumptions for our analyses that are based on the actual observed behavior of Wealthfront clients. Just two years ago, I knew nothing about investing and kept all my money in a savings account earning 0. In terms of the nitty-gritty details on using the platform, there is a lot of help on the website and most of it is accessible through the mobile apps as. The table below summarizes the Tax Alpha, tracking difference, and tracking error for Stock-level Tax-Loss Harvesting vs. Both Stash and Wealthfront have sufficient security, providing bit SSL encryption on their websites. Though Self-Driving Money isn't yet available, this acquisition is another step along that path. With adequate capabilities mutual funds excepting those having custodial issues- EM equity etc will be robinhood investing app safe net liquidity tastyworks.

The net tax benefit over the period includes the liquidation of positions transferred in and sold to invest the client account in the Wealthfront portfolio. Pin 3. Deposits, withdrawals and dividend reinvestments can throw a portfolio out of whack, triggering a rebalance. Do you have most of your stuff at Vanguard? It is worth noting that the lack of trading withdrawal, and transfer fees is integral to the tax management strategy that would otherwise cost you a lot to implement—possibly wiping out the tax savings entirely. With adequate capabilities mutual funds excepting those having custodial issues- EM equity etc will be extinct. The ETFs that make up most of the portfolios have annual management fees of 0. Use my referral link below to learn more and open your account. Our team of industry experts, led by Theresa W. In this limited time sample the average difference was very slightly positive, but over the long term you should expect an average difference of zero. Stash lets investors get started for much less than Wealthfront. It does not have an online chat feature on its website or in its mobile apps. Every robo-advisor we reviewed was asked to fill out a point survey about their platform that we used in our evaluation. Back in , salespeople for BlackRock called to tell us about their new series of iShares exchange-traded funds ETFs with dramatically lower fees.

Popular Courses. They clearly expected us to share their excitement, and jump at the chance to offer the funds to our clients. As the top spot in our Best Overall Online Brokers category, Wealthfront is a great solution for many types of investors. Learn how your comment data is processed. In other words, delivering you value in a delightful where did blue chip stocks get their name jamaiaca stock exchange live trading should ultimately lead to a very successful business. Correlations may change over time, such that future values of correlation may significantly depart from those observed historically. Wealthfront Inc. There may also be fees charged to transfer the account to another broker and to send wire transfers. As an example, consider two accounts — one which makes a single initial deposit, and one which makes monthly deposits. The interest rate fluctuates depending on the Federal Funds rate. Stash lets investors get started for much less than Wealthfront. The Harvesting Yield difference in is not unique to the cohort. Our reviews are the result of six months of evaluating all aspects of 32 robo-advisor platforms, including the user experience, goal setting capabilities, portfolio contents, costs and fees, security, mobile experience, and customer service. Register on Gravatar. We focus on a measurement called Harvesting Yielddefined as:.

Brooke's Note: If you are going to build the world's tallest skyscraper, you'd better build the best foundation first. The design is clean and all the primary information is easy to find, especially when you are searching in the help center. Stash then generates a sample portfolio and allocation graph for prospective clients to examine. Unless otherwise indicated, the information has been prepared by Wealthfront and has not been reviewed, compiled or audited by any independent third-party or public accountant. Investopedia uses cookies to provide you with a great user experience. At Wealthfront , the retirement planning experience is more comprehensive. After completing the questionnaire, Wealthfront will show you a recommended investment plan based on a risk tolerance score of We also reference original research from other reputable publishers where appropriate. The platform allows you to adjust retirement age, savings, target retirement spending, and life expectancy to experiment with different outcomes. The generally smaller Harvesting Yield values for the earlier cohorts are intuitive — investors who made initial deposits earlier in the time period experienced large gains through mid , leaving less opportunity to realize losses in Investing directly in stocks provides an immediate cost savings by avoiding the expense ratios charged by index funds and ETFs. But bolstered now by more capital, a better understanding of the business and where it wants to go, The No. Furthermore, by directly owning the stocks that comprise an index, investors can harvest losses at the individual stock level. Your dashboard shows all of your assets and liabilities, giving you a quick visual check-in on the likelihood of attaining your goals. The ETFs that make up most of the portfolios have annual management fees of 0. Nothing in this communication should be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any security. Expected returns and risk characteristics are no guarantee of actual performance.

Although this means we may forfeit some short-term profits by charging the lowest-possible fees, we believe offering a better deal is the best way to encourage more people to try our software-based approach to investing. There is a potential for loss as well as gain that is not reflected in the hypothetical information portrayed. The Harvesting Yield difference in is not unique to the cohort. The platform monitors portfolios and rebalances when they drift significantly bitcoin stock code does bittrex provide candlestick apis the target asset mix. Wealthfront assumes no responsibility for the tax consequences to any investor of any transaction. Trading dollar index future contract learn forex commision and spread times like this pasos para comenar a hacer day trading td canada trust discount brokerage account and will occur, Stock-Level Tax-Loss Harvesting often provides better opportunities to harvest tax losses. The risk tolerance score will be based around the answers you gave about your situation and goals. These results were achieved by means of the retroactive application of a model designed with the benefit of hindsight. Wealthfront does a terrific job helping its clients figure out a financial plan. The expense ratio of these completion ETFs is 0.

If Wealthfront succeeds in becoming your digitally managed, all-in-one financial solution, it is possible that the robo-advisor function will be overshadowed. We balance two competing objectives with our Stock-level Tax-Loss Harvesting service: maximize the after tax benefit of harvesting losses Tax Alpha and minimize tracking error. On the surface, Stash and Wealthfront look similar in terms of fees. Wealthfront does not control the composition of the market indices or fund information used for its calculations, and a change in this information could affect the results shown. Choosing between the two in terms of features and accessibility again depends on which ones you are likely to use, but in this case, it may also be a question of where you are in life. Both Stash and Wealthfront have sufficient security, providing bit SSL encryption on their websites. Performance Measurement We measure the effectiveness of Stock-level Tax-Loss Harvesting on two dimensions: how closely it tracks the original ETF it replaced and how much benefit it generates from stock-level tax-loss harvesting. Goal-setting assistance goes in-depth for large goals, such as home purchases and college savings. Automatic payments can also be set up from a Cash Account. The ETFs that make up most of the portfolios have annual management fees of 0. We measure the effectiveness of Stock-level Tax-Loss Harvesting on two dimensions: how closely it tracks the original ETF it replaced and how much benefit it generates from stock-level tax-loss harvesting. Wealthfront Apex Riva Jayed. By allowing a Wealthfront investor to hold the individual securities that comprise an index in her own account on a commission-free basis, Stock-level Tax-Loss Harvesting effectively eliminates any Index fund or ETF expense ratios on the associated position, which reduces overall portfolio cost. Wealthfront primarily uses low-cost exchange-traded funds ETFs to cover 11 asset classes, not including cash. These include white papers, government data, original reporting, and interviews with industry experts.

That's the innovation He serves as a member of the board of trustees and chairman of the endowment investment committee for University of Pennsylvania and as a member of the faculty at Stanford Graduate School of Business, where he teaches courses on technology entrepreneurship. This is in large part due to the extra tax-loss harvesting opportunities available with the larger set of individual securities. Finally, the graph below displays the overall portfolio differential IRR produced by an average i. The only fees with Wealthfront are the 0. Your Practice. We believe our Stock-level Tax-Loss Harvesting service meaningfully addresses the two remaining shortcomings with modern index investing — the cost of the Index Fund and ETF expense ratios and the missed tax-savings from the inability to pass on tax losses. Andy Rachleff April 12, Deposits, withdrawals and dividend reinvestments can throw a portfolio out of whack, triggering a rebalance. Customer Service. Goal-setting assistance goes in-depth for large goals, such as home purchases and college savings. As a result, the position is able to track the movement of the overall broad US market, while maintaining a significant holding of individual stocks. Overall, Wealthfront has the edge over Stash in terms of fees mainly because it avoids an account minimum, but it also offers a wider range of portfolio management for that fee. Tax-Advantaged Investing. Our team of industry experts, led by Theresa W.