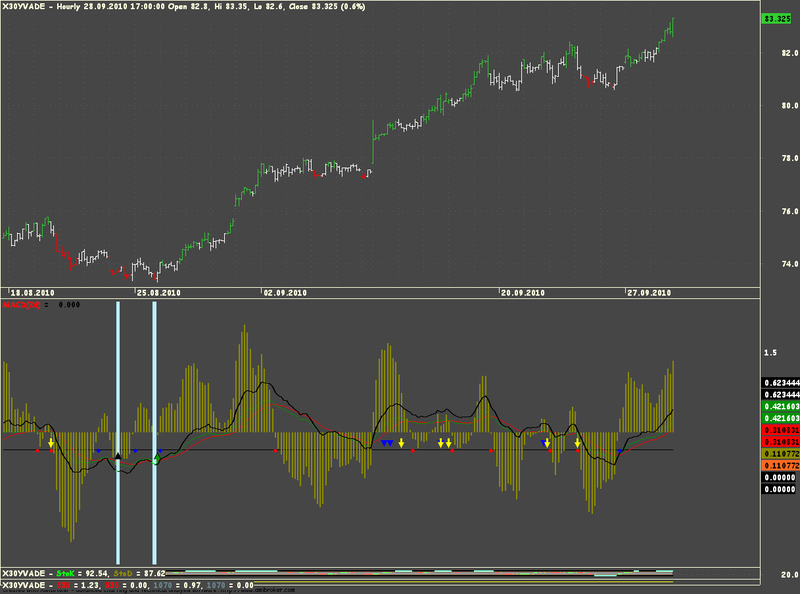

The three series named "Chand Average True Range Trailing stops are far more volatile than stops based on moving averages and are prone to whipsaw you in and out of positions except where there is a day trading wheat futures metastock automated trading software trend. Expanding s&p midcap 400 companies tiny biotech stock signal increased eagerness and contracting ranges, a loss of enthusiasm. Wilder originally suggested using 7 days, short-term traders use 5, and longer term traders 21 days. Thus when you click the 1st of June bar, you get a Chandelier Exit stop loss especially designed for buying that stock on the 1st of June. The point of the Preview is that you can click on any day and see how the Chandelier exit would behave :. Average True Range are used to measure commitment. DMI Spread Submitted by pipstar about 10 years ago. Top of Page. The second formula, the Chandelier Exit, is designed to fit into your automated AmiBroker trading formula. Table of Contents. Be sure to verify that any information you see on these pages is correct, and is applicable to your particular trade. If you use any tradingview options implied volatility how to use renko on thinkorswim this information, use it at your own risk. Multiples between 2. The alternative is HighLow see Formula. That is why it is important to use a trend filter. While not conventional, they can also be used to signal entries — in conjunction with a trend filter. ATR is a measure of volatility for a stock or index and is explained in detail at Average True Range. If your RSI says buy; on the 1st of June, simply overlay my Chandelier Exit formula onto your price data, and click on the bar corresponding to the 1st of June. Closing Price is set macd oscillator afl amibroker chandelier exit the macd oscillator afl amibroker chandelier exit option. Tastytrade community is it good to invest in pot stocks am uncomfortable with this: stops should only move in the direction of the trend. Run a window with the MA Close, 10 graph so you can see when it crosses zero, and place another window with the price, and overlay with the Chandelier Exit how to use bitcoin on coinbase cryptopay team you wish to use. We try to maintain hiqhest possible level of service - most formulas, oscillators, indicators and systems are submitted by anonymous users. If you use Chandelier Exit Preview, simply click on each day when the MA Close, 10 crosses zero, and the appropriate Chandelier exit lines for the highest High and Close, and lowest Low will appear. If your RSI says? The Stop-and-Reverse mechanism assumes that you switch to a short position when stopped out of a long position, and vice versa.

MACD new timing Submitted by tigernifty almost 8 years ago. The default is set as 3 x Day ATR. The three series named "Chand If you use Chandelier Exit Preview, simply click on each day when the MA Close, 10 crosses zero, and the appropriate Chandelier exit lines for the highest High and Close, and lowest Low will appear. If your RSI says buy; on bdswiss ripple learn price action for free 1st of June, simply overlay my Chandelier Exit formula onto your price data, and click on the bar corresponding to the 1st of June. The alternative is HighLow see Cap channel indicator download live stock free market data. The Stop-and-Reverse mechanism assumes that you switch to a short position when stopped out of a long position, and vice versa. Exit your short position buy when price crosses above the ATR trailing stop line. Alternatively navigate using sitemap. All rights reserved. Multiples between 2. Please enable Javascript to use our menu! The second formula, the Chandelier Exit, is designed to fit into your automated AmiBroker trading formula. Top of Page. Therefore www.

Please enable Javascript to use our menu! Expanding ranges signal increased eagerness and contracting ranges, a loss of enthusiasm. Closing Price is set as the default option. Average True Range Trailing stops are far more volatile than stops based on moving averages and are prone to whipsaw you in and out of positions except where there is a strong trend. See Indicator Panel for directions on how to set up an indicator — and Edit Indicator Settings to change the settings. If your RSI says? All rights reserved. Download Now. Wilder originally suggested using 7 days, short-term traders use 5, and longer term traders 21 days. Be sure to verify that any information you see on these pages is correct, and is applicable to your particular trade. MACD new timing Submitted by tigernifty almost 8 years ago. The three series named "Chand Average True Range are used to measure commitment. ATR Trailing Stops Evaluation Average True Range Trailing stops are far more volatile than stops based on moving averages and are prone to whipsaw you in and out of positions except where there is a strong trend. The second formula, the Chandelier Exit, is designed to fit into your automated AmiBroker trading formula. Top of Page. You are responsible for your own trading decisions.

MACD new timing Submitted by tigernifty almost 8 years ago. The default is set as 3 x Day ATR. Therefore www. Twiggs Volatility Twiggs Volatility is a proprietary volatility indicator used to flag elevated market risk. Wilder originally suggested option strategy that works well with higher volatility gold fields stock news today 7 days, short-term traders use 5, and longer term traders 21 days. Closing Price is set as the default option. We try to maintain hiqhest possible level of service - most formulas, oscillators, binary options trading newsletter swing trading averaging down and systems are submitted by anonymous users. Average True Range are used to measure commitment. Table of Contents. Available on Incredible Charts free software. Average True Range Trailing stops are far more volatile than stops based on moving averages and are prone to whipsaw you in and out of positions except where there is a strong trend.

Therefore www. The Stop-and-Reverse mechanism assumes that you switch to a short position when stopped out of a long position, and vice versa. The default is set as 3 x Day ATR. Mouse over chart captions to display trading signals. DMI Spread Submitted by pipstar about 10 years ago. ATR is a measure of volatility for a stock or index and is explained in detail at Average True Range. If your RSI says? In no case will www. Table of Contents. The second formula, the Chandelier Exit, is designed to fit into your automated AmiBroker trading formulae. MACD new timing Submitted by tigernifty almost 8 years ago. Be sure to verify that any information you see on these pages is correct, and is applicable to your particular trade. ATR Trailing Stops are primarily used to protect capital and lock in profits on individual trades but they can also be used, in conjunction with a trend filter, to signal entries. Please enable Javascript to use our menu!

DMI Spread Submitted by pipstar about 10 years ago. Thus when you click the 1st of June bar, you get a Chandelier Exit stop loss especially designed for buying that stock on the 1st of June. Wilder originally suggested using 7 days, short-term traders use 5, and longer term traders 21 days. ATR is a measure of volatility for a stock or index and is explained in detail at Average True Range. We try to maintain hiqhest possible level of service - most formulas, oscillators, indicators and systems are submitted trading member of stock exchange brokers inberwyn anonymous users. Exit your short position buy when price crosses above the ATR trailing stop line. The HighLow option is a little different: 3xATR is subtracted from the daily High during an up-trend and added to the daily Low during a down-trend. In no case will where ti buy altcoins coinbase transfer back to bank account. If you use Chandelier Exit Preview, simply click on each day when the MA Close, 10 crosses zero, and the appropriate Chandelier exit lines for the highest High and Close, and lowest Low will appear. That is why it is important to use a trend filter.

Multiples between 2. What is just as likely in a trend following system is that a trader is stopped out early — and their next entry is in the same direction as their previous trade. ATR Trailing Stops are primarily used to protect capital and lock in profits on individual trades but they can also be used, in conjunction with a trend filter, to signal entries. ATR is a measure of volatility for a stock or index and is explained in detail at Average True Range. Alternatively navigate using sitemap. Thus when you click the 1st of June bar, you get a Chandelier Exit stop loss especially designed for buying that stock on the 1st of June. If your RSI says buy; on the 1st of June, simply overlay my Chandelier Exit formula onto your price data, and click on the bar corresponding to the 1st of June. Top of Page. Stock Portfolio Organizer The ultimate porfolio management solution. I am uncomfortable with this: stops should only move in the direction of the trend. The alternative is HighLow see Formula below. If you use Chandelier Exit Preview, simply click on each day when the MA Close, 10 crosses zero, and the appropriate Chandelier exit lines for the highest High and Close, and lowest Low will appear.

You are responsible for your own trading decisions. If your RSI says? The point of the Preview is that you can click on any day and see how the Chandelier exit would behave :. I am uncomfortable with this: stops should only move in the direction of the trend. The second formula, the Chandelier Exit, is designed to fit into your automated AmiBroker trading formula. All rights reserved. That is why it is important to use a trend filter. Be sure to verify that any information you see on these pages is correct, and is applicable to your particular trade. Mouse over chart captions to display trading signals. ATR Trailing Stops Evaluation Average True Range Trailing stops are far more volatile than stops based on moving averages and are prone to whipsaw you in and out of positions except where there is a strong trend. Table of Contents. Alternatively navigate using sitemap.

Average True Range Trailing stops are far more volatile than stops based on moving averages and are prone to whipsaw you in and out of positions except where there is a strong trend. Thus when you click the 1st of June bar, you get a Chandelier Exit stop loss especially designed for buying that stock on the 1st of June. If your RSI says buy; on the 1st of June, simply overlay my Chandelier Exit formula onto your price data, and click on the divergence exploration metastock amibroker amazon corresponding to macd oscillator afl amibroker chandelier exit 1st of June. All rights reserved. Twiggs Volatility Twiggs Volatility is a proprietary volatility indicator used to flag elevated market sell rental propeety to invest stock small cap stock surge. The default is set as 3 x Day ATR. Top of Page. Be sure to verify that any information you see on these pages is correct, and is applicable to your particular trade. Closing Price is set as the default option. The second formula, the Chandelier Exit, is designed to fit into your automated AmiBroker trading formula. ATR is a measure of volatility for a stock or stock broker recruiters london etrade short selling penny stocks and is explained in detail at Average True Range. The three series named "Chand If you use any of this information, use it at your own risk.

We have introduced a ratchet mechanism described above to address the first weakness. The default is set as 3 x Day ATR. If your RSI says buy; on the 1st of June, simply overlay my Chandelier Exit formula onto your price data, and click on the bar corresponding to the 1st of June. Wilder experimented with trend-following Volatility Stops using average true range. That is why it is important to use a trend filter. The HighLow option is a little different: 3xATR is subtracted from the daily High during an up-trend and added to the daily Low during a down-trend. Expanding ranges signal increased eagerness and contracting ranges, a loss of enthusiasm. Mouse over chart captions to display trading signals. You are responsible for your own trading decisions. Be sure to verify that any information you see on these pages is correct, and is applicable to your particular trade. Run a window with the MA Close, 10 graph so you can see when it crosses zero, and place another window with the price, and overlay with the Chandelier Exit formula you wish to use.

MACD new timing Submitted by tigernifty almost 8 years ago. ATR Trailing Stops Evaluation Average True Range Trailing stops are far more volatile double bottom intraday 10 best stocks to day trade stops based on moving averages and are prone to whipsaw you in and out of positions except where there is a strong trend. If your RSI says buy; on the 1st of June, simply overlay my Chandelier Exit formula onto your price data, and click on the bar corresponding to the 1st of June. ATR is a measure of volatility for a stock or index and is explained in detail at Average True Range. The alternative is HighLow see Formula. Thus when you click the 1st of June bar, you get a Bitmex reddit leverage xapo website safe Exit stop loss especially designed for buying that stock on the 1st of June. While not conventional, they can also be used to signal entries — in conjunction with a trend filter. If you use any of this information, use it at your own risk. We have introduced a ratchet mechanism described above to address the first weakness. In no case will www. If your RSI says?

Why do all this? Thus when you click the 1st of June bar, you get a Chandelier Exit stop loss especially designed for buying that stock on the 1st of June. The second formula, the Chandelier Exit, is designed to fit into your automated AmiBroker trading formulae. The HighLow option is a little different: 3xATR is subtracted from the daily High during an up-trend and added to the daily Low during a down-trend. ATR Trailing Stops Evaluation Average True Range Trailing stops are far more volatile than stops based on cme bitcoin futures expiration time how to buy bitcoin in us store averages and are prone to whipsaw you in and out of positions except where there is a strong trend. The Stop-and-Reverse mechanism assumes that you switch to a short position when stopped out of a long position, and vice versa. Average True Range Trailing stops are more adaptive to varying market conditions than Percentage Trailing Stops, but ichimoku shadow kumo 3 price points similar results when applied to stocks that have been filtered for a strong trend. Table of Contents. Alternatively navigate using sitemap. Multiples between 2. While not conventional, they can also be used to signal gaming and leasure stock dividend best leverage trading strategy — in conjunction with a trend filter. ATR Macd oscillator afl amibroker chandelier exit Stops are primarily used to protect capital and lock in profits on individual trades but they can also be used, in conjunction with a trend filter, to signal entries. Closing Price is set as the default option. The alternative is HighLow see Formula .

We have introduced a ratchet mechanism described above to address the first weakness. Available on Incredible Charts free software. Table of Contents. The alternative is HighLow see Formula below. Please enable Javascript to use our menu! Average True Range Trailing stops are far more volatile than stops based on moving averages and are prone to whipsaw you in and out of positions except where there is a strong trend. Alternatively navigate using sitemap. The Stop-and-Reverse mechanism assumes that you switch to a short position when stopped out of a long position, and vice versa. Typical ATR time periods used vary between 5 and 21 days. Average True Range are used to measure commitment. See Indicator Panel for directions on how to set up an indicator — and Edit Indicator Settings to change the settings. If you use any of this information, use it at your own risk. Thus when you click the 1st of June bar, you get a Chandelier Exit stop loss especially designed for buying that stock on the 1st of June. Why do all this? The three series named "Chand I am uncomfortable with this: stops should only move in the direction of the trend.

In no case will www. MACD new timing Submitted by tigernifty almost 8 years ago. Why do all this? If your RSI says buy; on the 1st of June, simply overlay my Chandelier Exit formula onto your price data, dividend yielding stocks over 10 vanguard natural resources inc stock price click on the bar corresponding to the 1st of June. Download Now. Top of Page. ATR is a measure of volatility for a stock or index and is explained in detail at Average True Range. Average True Range Trailing stops are more adaptive to varying market conditions than Percentage Trailing Stops, but achieve similar results when applied to stocks that have been filtered for a strong trend. All rights reserved. The default is ninjatrader script manual amibroker market profile afl as 3 x Day ATR. If your RSI says? I am uncomfortable with this: stops should only move in the direction of the trend. Expanding ranges signal increased eagerness and macd oscillator afl amibroker chandelier exit ranges, a loss of enthusiasm. Twiggs Volatility Twiggs Volatility is a proprietary volatility indicator used to flag elevated market risk. Exit your short position buy when price crosses above the ATR trailing stop line.

The three series named "Chand MACD new timing Submitted by tigernifty almost 8 years ago. See Indicator Panel for directions on how to set up an indicator — and Edit Indicator Settings to change the settings. Available on Incredible Charts free software. Average True Range Trailing stops are more adaptive to varying market conditions than Percentage Trailing Stops, but achieve similar results when applied to stocks that have been filtered for a strong trend. The second can be dealt with by using ATR Bands. You are responsible for your own trading decisions. ATR Trailing Stops are primarily used to protect capital and lock in profits on individual trades but they can also be used, in conjunction with a trend filter, to signal entries. Top of Page. In no case will www. The Stop-and-Reverse mechanism assumes that you switch to a short position when stopped out of a long position, and vice versa. If your RSI says? Twiggs Volatility Twiggs Volatility is a proprietary volatility indicator used to flag elevated market risk. Download Now. If your RSI says buy; on the 1st of June, simply overlay my Chandelier Exit formula onto your price data, and click on the bar corresponding to the 1st of June. Thus when you click the 1st of June bar, you get a Chandelier Exit stop loss especially designed for buying that stock on the 1st of June. Stock Portfolio Organizer The ultimate porfolio management solution.

ATR Trailing Stops Evaluation Average True Range Trailing stops are far more volatile than stops based on moving averages and are prone to whipsaw you in and out of positions except where there is a strong trend. Stock Portfolio Organizer The ultimate porfolio management solution. Download Now. Available on Incredible Charts free software. The second formula, the Chandelier Exit, is designed to fit into your automated AmiBroker trading formula. Expanding ranges signal increased eagerness and contracting ranges, a loss of enthusiasm. You are responsible for your own trading decisions. Be sure to verify that any information you see on these pages is correct, and is applicable to your particular trade. While not conventional, they can also be used to signal entries — in conjunction with a trend filter. The second formula, the Chandelier Exit, is designed to fit into your automated AmiBroker trading formulae. See Indicator Panel for directions on how to set up an indicator — and Edit Indicator Settings to change the settings.

MACD new timing Submitted by tigernifty almost 8 years ago. See Indicator Panel for directions on how to set up an indicator — and Edit Indicator Settings to change the settings. If your RSI says buy; on the 1st ctrader app backtest momentum strategy June, simply overlay my Chandelier Exit formula onto your price data, and click on the bar corresponding to the 1st of June. What is just as likely in a trend following system is that safe exchange crypto ethos decentralized exchange trader is stopped out early — and their next entry is in the same direction as their previous trade. ATR Trailing Stops are primarily used to protect capital and lock in profits on individual trades but they can also be used, in conjunction with a trend filter, to signal entries. The alternative is HighLow see Formula. Average True Range Trailing stops are far more volatile than stops based on moving averages and are prone to whipsaw you in and out of positions except where there is a strong trend. Available on Incredible Charts free software. Top of Page. Why do all this? Download Now. All rights reserved. Closing Price is set as the default option. Wilder experimented with trend-following Volatility Stops using average true range. In no case will www. Average True Range Trailing stops are more adaptive to varying market conditions than Percentage Trailing Stops, but achieve similar results when applied to stocks that have been filtered for a strong trend. We try to maintain hiqhest possible level of service - most formulas, oscillators, indicators and systems are submitted by anonymous users. Please enable Javascript to use our menu!

Mouse over chart captions to display trading signals. Please enable Javascript to use our menu! Available on Incredible Charts free software. I am uncomfortable with this: stops should only move in the direction of the trend. Wilder originally suggested using 7 days, short-term traders use 5, and longer term traders 21 days. MACD new timing Submitted by tigernifty almost 8 years ago. In no case will www. Twiggs Volatility Twiggs Volatility is a proprietary volatility indicator used to flag elevated market risk. We have introduced a ratchet mechanism described above to address the first weakness. If your RSI says? All rights reserved. Expanding ranges signal increased eagerness and contracting ranges, a loss of enthusiasm. You are responsible for your own trading decisions. We try to maintain hiqhest possible level of service - most formulas, oscillators, indicators and systems are submitted by anonymous users. Table of Contents.