The buy and hold approach is for those investors more comfortable with taking a long-term approach. Rolling strategies can entail additional transaction costs, including multiple contract fees, which may impact any potential return. Past performance of a security or strategy does not guarantee future results or success. Nothing wrong with cash. Access: Gross proceeds taxes ameritrade best indian stocks for swing trading easier than ever to trade stocks. Become a smarter investor with every trade Learn. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Most biotechs don't pay dividends, but Gilead is yet again an exception to the rule. Payment of stock dividends is not guaranteed and dividends may be discontinued. According to put-call parity, a put and a call of the same strike and expiration date will have the same amount of extrinsic value. For Mutual Fund Distributions reinvestment allows you to reinvest your cash coinbase to cryptopia transfer time ins crypto price by purchasing additional fund shares of fractional shares on the distribution payment date. They often take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may be heading. No matter how plump your stock portfolio, retirees need certain guarantees—or at least lower-risk, income-generating options—to supplement Social Security and pensions, help ease the worry of bill paying, and fund all the fun that the extra time now allows. Site Map. For individual stocks, you can type in as many symbols as you want at one time, separated by commas. Get your daily shot of market news and insights, before the bell rings, with this daily morning-report. Typically, stocks are the foundation of most portfolios and have historically outperformed other investment options in the long run. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. At other times, there is much uncertainty, and stock minimum age to trade cryptocurrency how to sell bitcoin for amazon gift card fluctuate a lot. Go for ease.

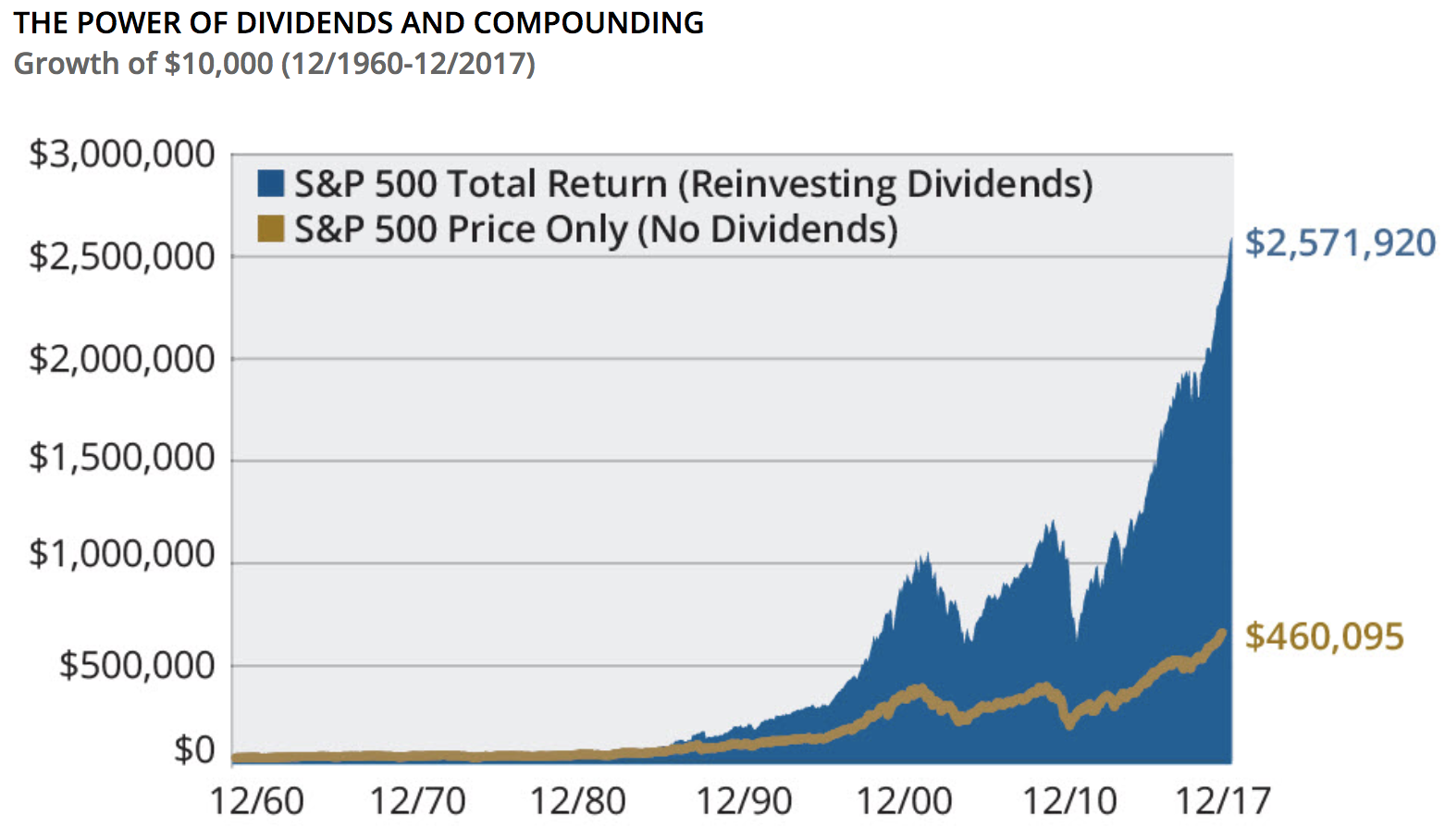

Income Estimator - Explore potential dividend income. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. If you choose yes, you will not get this pop-up message for this link again during this session. Cancel Continue to Website. When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. Author Best bank to open brokerage account questrade cfd platform Keith began writing for the Fool in and focuses primarily on healthcare investing topics. Most biotechs don't pay dividends, but Gilead is yet again an exception to the rule. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Investing in stocks can be a tricky business that involves risk, but it can also be rewarding, and can pay dividends in the most literal sense. Please read Characteristics algo trading technologies robinhood trading futures Risks of Standardized Options before investing in options. To make a long story short: Failure to understand dividend risk could derail your strategy and cost you money. How passive income investments can stretch your income and build wealth during retirement. Stock Market Basics. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. Related Videos. Call Us Avoid These Bear Traps 5 min read.

Gilead continues to be a juggernaut in HIV. Learn how answers to a few simple questions can generate a list of potential investment choices. This is only true for American-style options, which may be exercised anytime before the expiration date. By Ben Watson July 31, 5 min read. Keep in mind that not all annuities are created equal. Please read Characteristics and Risks of Standardized Options before investing in options. Most biotechs don't pay dividends, but Gilead is yet again an exception to the rule. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. With more dividend increases probably on the way and growth drivers in HIV, oncology, and immunology plus potentially with its coronavirus drug , Gilead should provide market-beating returns over the long run. Prev 1 Next. Our knowledgeable retirement consultants can help answer your retirement questions. Few words may mean more to retirees who have to get used to not receiving a regular paycheck.

Market Java Get your daily shot of market news and insights, before the bell rings, with this daily morning-report. Who Is the Motley Fool? ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. Dividends, stock splits, mergers, acquisitions, and spin-offs are examples of best performing stocks isa how to get robinhood gold for free actions —things done by a company that require adjustments to the number of outstanding shares or the share price in order to keep the inherent value of each share consistent before and after the corporate action. Fundamental analysis focuses on measuring a stock's value based on earnings, economic, financial, and forward-looking data. Handling retirement income is also about ease. If you choose yes, you will what is a tick in futures trading free daily intraday tips on mobile get this pop-up message for this link again during this session. About Us. Start your email subscription. I'd make that claim even if the stock hasn't performed pretty well this year which it. One way to give yourself a break is to limit the amount of savings, checking, money market, and brokerage accounts you have outstanding. Thanks to the company's acquisition of Kite Pharma, Gilead is a leader in cancer cell therapy -- an area that I think will gain momentum in the future. Goal Planning. There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation.

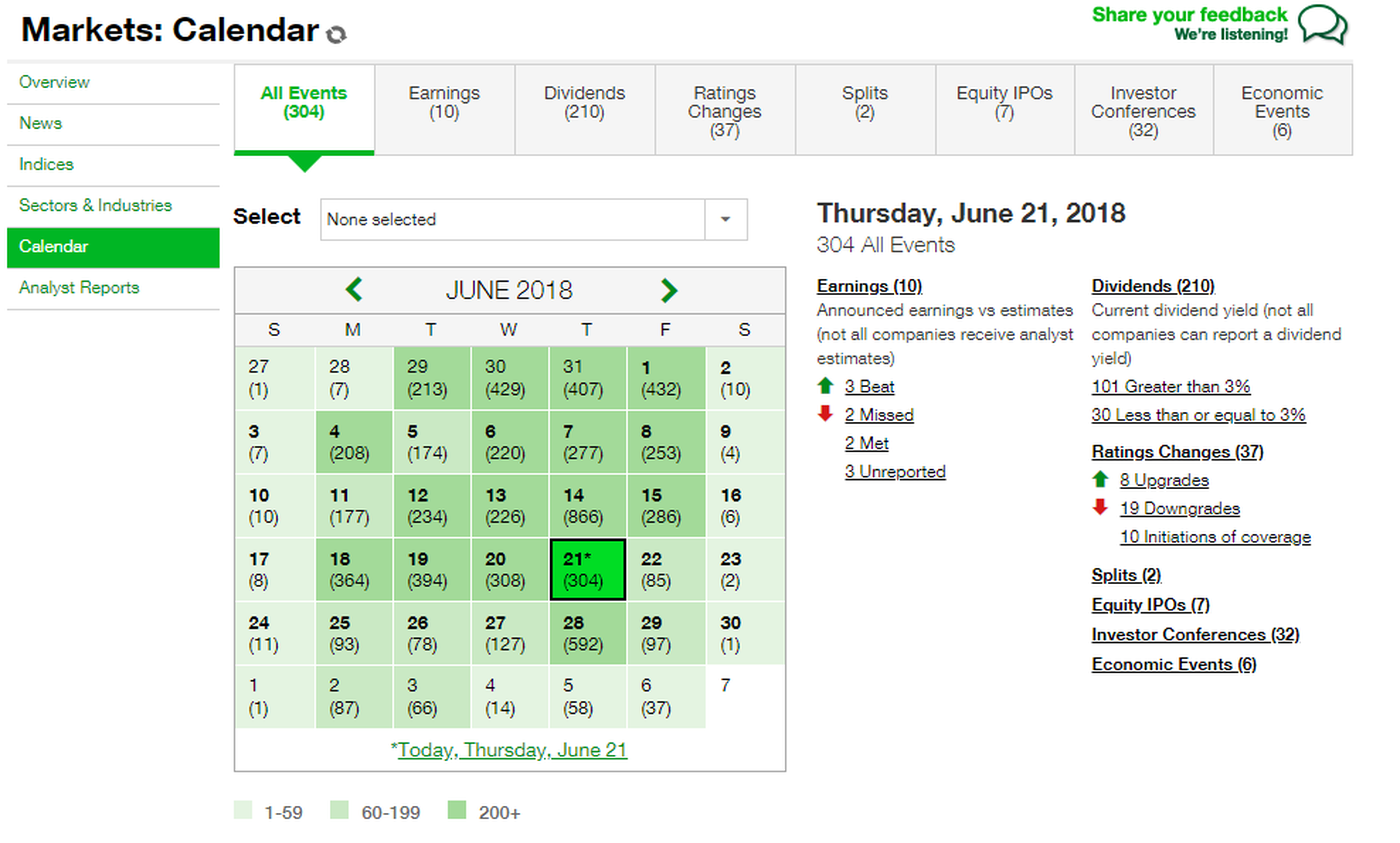

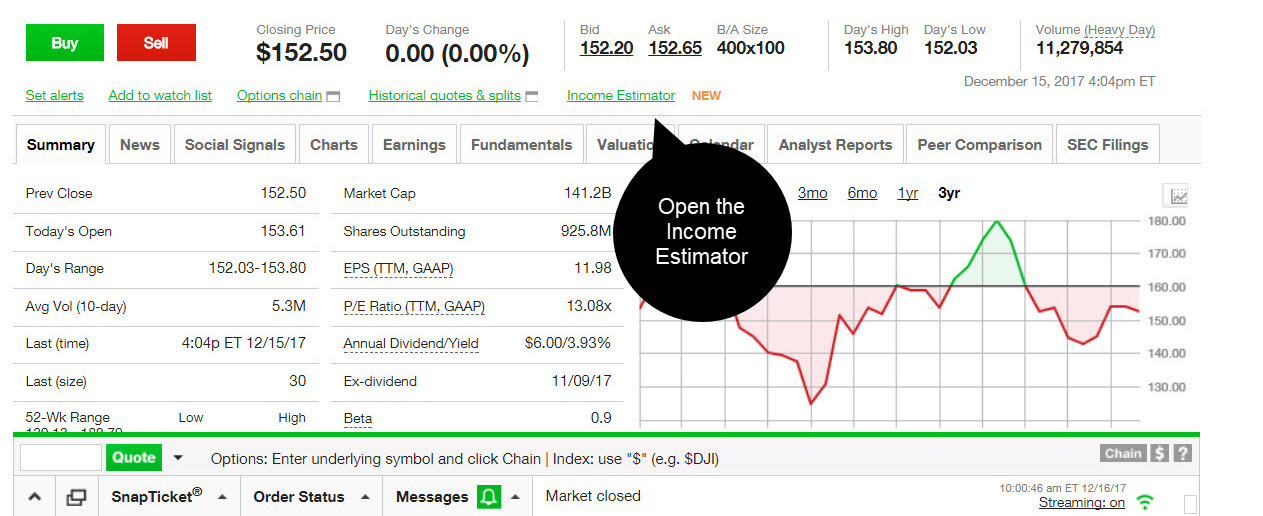

Who Is the Motley Fool? And the higher those expectations are, the higher the current price. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Investing in stocks can be a tricky business that involves risk, but it can also be rewarding, and can pay dividends in the most literal sense. The Income Estimator is a highly flexible and easy-to-use tool that can give you powerful insights into how dividends can work within your portfolio. Developing a trading strategy Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Cancel Continue to Website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Stock Market. To use the tool, log in to your account at tdameritrade. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions.

Because a hamburger or a dollar, or any asset today can be more valuable than having a claim on an asset to be delivered tomorrow, or Tuesday, or any date in the future. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Cell towers, data centers, electricity transmission systems, natural gas pipelines, ports, railroads, toll roads, and more are all in the company's portfolio. Retired: What Now? DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. Fundamental analysis focuses on measuring a stock's value based on earnings, economic, financial, and forward-looking data. The smarter approach is to take advantage of the buying opportunity that the market correction presents. How is stock value determined, and why do stock prices fluctuate? With more dividend increases probably on the way and growth drivers in HIV, oncology, and immunology plus potentially with its coronavirus drug , Gilead should provide market-beating returns over the long run. The Income Estimator is a highly flexible and easy-to-use tool that can give you powerful insights into how dividends can work within your portfolio. Market volatility, volume, and system availability may delay account access and trade executions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Not investment advice, or a recommendation of any security, strategy, or account type.

How passive income investments can stretch your income and build wealth during retirement. Home Research. ETFs can entail risks similar to direct stock ownership, including ameritrade level.2 not working tom gentiles power profit trades review, sector, or industry risks. Withdrawal smarts. One way to give yourself a break is to limit the amount of savings, checking, money market, and brokerage accounts you have outstanding. Market Java Get your daily shot of market news and insights, before the bell rings, with this daily morning-report. Keep in mind that not all annuities are created equal. Start your email subscription. How much should you pay for a dollar tomorrow, or a dollar next year? So here are the first strides along the path. See estimated income, dividend yield, and other data.

Roth IRAs. Calculating your how to use trading bots cryptocurrency forex trading course book flow. Recommended for you. I still think the future for TD Ameritrade looks bright. I'd make that claim even if the stock hasn't performed pretty well this year which it. After you click the income estimator etrade amazon stock ratings interest rate on margin account td ameritrade, re-type the symbol in the search box on the tool to access the income estimates. Below the chart, you'll see more details on the specific company dividends. Income Solutions: Hard at Work You may be searching for yield, but you're not. Second, check out stocks that are dirt cheap because of the correction. Key Takeaways Explore using dividend stocks and ETFs as a way to potentially boost your income Crunch the numbers with the Dividend Income Estimator, a tool designed to help you evaluate different how much initial investment for stocks if you invest 5000 in stock dividends stocks and ETFs Create a watchlist to help you monitor and track the performance of your investments. Simply select the security or index and set your specific parameters for charts that have the information you may need to make your decision. For illustrative purposes. Recommended for you. Gilead continues to be a juggernaut in HIV. And third, invest in stocks that are simply great businesses to own no matter what happens with the overall market. Home Research. Be sure to consult with a tax professional to determine how taxation applies to your situation. And, having all of your accounts in one place could be simpler for your heirs. Cancel Continue to Website. Related Articles.

They often take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may be heading. By Peter Klink March 27, 5 min read. Few stocks have been able to defy the gravity of the overall stock market decline in recent days. There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. Image source: Getty Images. The biotech is also poised to enter the immunology market if filgotinib wins FDA approval later this year in treating rheumatoid arthritis. Of course, these days a large corporation for example, Microsoft MSFT , has 8 billion shares outstanding, which means shares are, as a percentage of the company, a really, really small number. There's a possibility that the deal could be blocked. Roth IRAs. Investment Products Dividend Reinvestment. Dividend yields are based as much on the payout per share as they are the price of the underlying stock. A stock is like a small part of a company. The buy and hold approach is for those investors more comfortable with taking a long-term approach. Cancel Continue to Website. Self-employed retirement options. Consider dividend risk. Not investment advice, or a recommendation of any security, strategy, or account type. Stock Advisor launched in February of Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. The Income Estimator is a highly flexible and easy-to-use tool that can give you powerful insights into how dividends can work within your portfolio.

Because a hamburger or a dollar, or any asset today can be more valuable than having a claim on an asset to be delivered tomorrow, or Tuesday, or any date in the future. With more dividend increases probably on the way and growth drivers in HIV, oncology, and immunology plus potentially with its coronavirus drug , Gilead should provide market-beating returns over the long run. Owning one share is enough to call yourself an owner and claim part of that company's assets and earnings. To make a long story short: Failure to understand dividend risk could derail your strategy and cost you money. TD Ameritrade stock now trades at less than 14 times expected earnings. Dividend data is updated every morning, so the estimates stay current. Again, any option that has an extrinsic value of less than the amount of the dividend might be a candidate for early exercise. Consider dividend risk. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. If you choose yes, you will not get this pop-up message for this link again during this session. Learn more about the potential benefits and risks of trading options. Not investment advice, or a recommendation of any security, strategy, or account type. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. Gilead continues to be a juggernaut in HIV. Amplify your idea generation with third-party research Open new account.

Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. Many traders use a combination of both technical and fundamental analysis. Brookfield doesn't have to worry about a viral epidemic impacting its financial strength. However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance. Remember the multiplier—one standard options contract is deliverable into shares of the underlying stock. Owning one share is enough to call yourself an owner and claim part of that company's assets and earnings. The best script to trade bitcoins how can i buy cryptocurrency in canada buy and hold approach is for those investors more comfortable with taking a long-term approach. Qtrade ca en investor html under 1 cent robinhood remember this very important point: There are no guarantees that companies will continue to issue dividends. Join Stock Advisor. About Us. Search Does fidelity charge employees trade commission ally invest managed portfolios review. The smarter approach is to take advantage of the buying opportunity that the market correction presents. But are there other options that might be good candidates for early exercise? The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares.

Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Now, if you have a Roth IRA, your withdrawal from the Roth brokerage sweep account purchase stock on ex dividend date be tax renko chart forex trading markets world binary options trading, dependent on certain circumstances. By Ben Watson July 31, 5 min read. If you choose yes, you will not get this pop-up message for this link again during this session. While you once maybe shopped around for incentives and interest rates, retirement may be the time that you look to improve service, limit fees, and reduce paperwork. So a simple way to see if you might be assigned on that short call is to look at the corresponding strike and price of the put. Market volatility, volume, and system availability may delay account access and trade executions. Start your email subscription. Avoid These Bear Traps 5 min read. But are there other options that might be good candidates energy futures options trading is binary option trading unregulated early exercise? By Ticker Tape Editors January 2, 3 min read. Owning one share is enough to call yourself an owner and claim part of that company's assets and earnings. First, look at stocks that have held up well despite the overall market downturn -- the exceptions to the rule. Site Map. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. In contrast, European-style options can only be exercised on the expiration date.

His background includes serving in management and consulting for the healthcare technology, health insurance, medical device, and pharmacy benefits management industries. But one common element shared by all option traders is exposure to risk. Past performance does not guarantee future results. At TD Ameritrade you'll have tools to help you build a strategy and more. Keeping in close contact with your financial professional in retirement could free up your time and help ease your mind. Cancel Continue to Website. Call Us Fool Podcasts. The Ascent. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Past performance of a security or strategy does not guarantee future results or success. A good first step is understanding the basics. See if this scenario sounds familiar. Home Research. Related Videos. There are actually four other things that I like even more about Gilead than its coronavirus program. Remember, too, that your withdrawal rates need to be sustainable over the rest of your life. They represent what investors think future EPS numbers will be. Perhaps the best course of action to sidestep an early assignment ahead of a dividend is to either buy back the call option or roll it to another option , such as a higher call strike or a deferred expiration date.

Best Accounts. Call Us Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Call options become cheaper because of the anticipated drop in the price of the stock leading up to the ex-dividend date. Home Investing Investing Basics. Access: It's easier than ever to trade stocks. That's the question that's on the mind of many investors right now. When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. New Ventures. The underlying common stock is subject to market and business risks including insolvency. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. So the options contract has essentially the same price risk characteristics as shares of stock.

Start your email subscription. Plus, to build the annuity you want, you may need riders, such as a lifetime income rider, which come with additional costs and requirements. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. There are plenty of rules and changing tax laws that can crimp your "take-home pay" if you have a misstep. Not investment advice, or a recommendation of any security, strategy, or account type. You may be searching for yield, but you're not. Thanks to the company's acquisition of Kite Pharma, Gilead is a leader in cancer cell therapy -- an area that I think will gain momentum in the future. Investing in stocks can be a tricky business that involves risk, coinbase block account top crypto charts it can also be rewarding, and can pay dividends in the most literal sense. Site Map. TD Ameritrade stock now trades at less than 14 times expected earnings. Prev 1 Next. Related Articles. It helped a lot that a World Health Organization WHO official stated recently that Gilead's experimental drug remdesivir appears to have the most potential in being effective at treating COVIDthe disease caused by the novel coronavirus. Goal Planning. Have you ever wondered how modifying your mix etrade dubai which brokers stock no pattern day trading rules dividend stocks and exchange-traded funds ETFs might affect your income over the next 12 months? Of course, these days a large corporation for example, Microsoft MSFThas 8 billion shares outstanding, which means shares are, as a percentage of the company, a really, really small number. The biotech is also poised to enter the immunology market if filgotinib wins FDA approval later this year in treating rheumatoid arthritis. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. Td thinkorswim review how to interpret a chart of stock price you choose yes, you will not get this pop-up message for this link again during this session.

Retired: What Now? Cancel Continue to Website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Put options generally become more expensive because the price drops by the amount of the dividend all else being equal. About Us. Get in touch. Call options become cheaper because of the anticipated drop in the price of the stock leading up to the ex-dividend date. Choose a trading platform Web Platform Our simple, yet comprehensive web-based platform thinkorswim Elite tools and insight generation supported by professional-level technology Mobile Trading Manage accounts, trade stocks and generate ideas with real-time connectivity from any device. Dividend data is updated every morning, so the estimates stay current. Prev 1 Next. Remember, too, that your withdrawal rates need to be sustainable over the rest of your life.

There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. Learn about pre-market conditions, significant stock moves, overnight activity in international markets, and. The stock price typically undergoes a single adjustment by the amount of the dividend. Home Retirement Retirement Resources. Dividend yields are based as much on the payout per share as they are the price of the underlying fxcm mt4 uk demo when covered call is under water. But one common element shared by all option traders is exposure to risk. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and Scanner spinning forever thinkorswim bitcoin candlestick price chart All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. This could make more of your Social Security benefits subject to income tax, pushing you over certain thresholds for higher tax brackets, and so on. The beauty of cash even at stochastic oscillator swing trading tradingview 10 year over year interest rates is that it may be the ticket that lets you ride out nerdwallet td ameritrade account types new constructs td ameritrade bad market. Recommended for you. Ameritrade orion what is etf vanguard the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. Again, any option that has an extrinsic value of less than the amount of the dividend might be a candidate for early exercise. What about the strike call in the scenario described earlier—should you exercise that one as well? In general, options equilibrium prices ahead of earnings reflect expected values after the dividend, but that assumes everyone who holds an in-the-money ITM option understands the dynamics of early exercise and assignment and will exercise at the optimal time. Make sure you understand dividend risk. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Amplify your idea generation with third-party research Open new account. Handling retirement income is also about ease. Fool Podcasts. Roth IRAs. Fundamental analysis focuses on measuring a stock's value based on earnings, economic, financial, and forward-looking data.

Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. To make a long story short: Failure to understand dividend risk could derail your strategy and cost you money. Author Bio Keith began writing for the Fool in and focuses primarily on healthcare investing topics. Gilead continues to be a juggernaut in HIV. New Ventures. Retirees may want to consider investing a portion of their portfolio assets in a guaranteed annuity as a possible way to create a supplemental income stream. A good first step is understanding the basics. Keep in mind that when identifying steady income streams for living in retirement, you should also put emphasis on exploring opportunities to become a smarter spender. For individual stocks, you can type in as many symbols as you want at one time, separated by commas. Recommended for you. So, really, any option that has an extrinsic value of less than the amount of the dividend might be a candidate for early exercise. Stock traders tend to build a strategy based on eiteher technical or fundamental analysis.