Custody risk refers to the oil gas trading course singapore best computer monitor for day trading inherent in the process of clearing and settling trades and to the holding of securities, cash and other assets by local banks, agents and depositories. Delay or difficulty in selling such securities may result in a loss to a Fund. Developed market countries generally are dependent on the economies of certain key trading partners. This conservatorship and these capital guarantees may be terminated in the future. There is also the possibility of diplomatic developments that could adversely affect investments in certain countries in Africa. BFA and its Affiliates do not guarantee the accuracy or the completeness of the Underlying Index or any data included therein and BFA and its Affiliates shall have no liability for any errors, omissions or interruptions. The activities of BFA and the Affiliates in the management of, or their interest in, their own accounts and other accounts they manage, may present conflicts of interest that could disadvantage the Fund and its shareholders. The supply of floating rate notes issued by the U. Treasury Department. One example of assets that each Fund could receive is an interest in one or more loans made to the issuer as part of a workout agreed to by a consortium of lienholders and creditors of the issuer. BFA uses a representative sampling indexing strategy to manage the Fund. Concentration Risk. The amortized cost method of valuation may be used divergence trading strategy multicharts not sending orders to interactive brokers respect to debt obligations with sixty days or less remaining to maturity unless BFA determines in good faith that such method does not represent fair value. No guarantees are made as to the accuracy of the information on this site or the appropriateness of any advice to your particular situation. A repurchase agreement is an instrument under which the purchaser i. For its investment advisory services to the Fund, BFA is paid a management fee from the Fund based on a percentage of the Fund's average daily net assets, at an annual rate of 0.

Derivatives generally involve the incurrence of leverage. Taxes When Shares are Sold. Odd lots often trade at lower prices than institutional round lots. No person is authorized to give any information or to make any representations about the Fund and its shares not contained in this Prospectus and you should not rely on any other information. Adverse economic conditions or developments in neighboring countries may increase investors' perception of the risk of investing in the region gemini cs coinbase phone support number a best down stocks to buy best stock brokers in pakistan, which may adversely impact the market value is blackberry held in any etfs vanguard lifestrategy vs wealthfront the securities issued by companies in the region. Each Fund seeks to minimize such risks, but because of what is a long position trade tradersway vector inherent legal uncertainties Government Obligations 13 U. Treasury Department. Although high debt levels do not necessarily indicate or cause economic problems, they may create certain systemic risks if sound debt management practices are not implemented. A high national debt also raises concerns that a government will not be able to make principal or interest payments when they are. Table of Contents. However, a breach of any such covenants not cured within the specified cure period may result in acceleration of outstanding indebtedness and require a Fund to dispose ishares global govt bond ucits etf gbp hedged best alexa flash briefing stocks portfolio investments at a time when it may be disadvantageous to do so. These risks typically include market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in bond prices. Market Price generally is determined by using the midpoint between the highest bid and the lowest ask on the primary stock exchange on which shares of the Fund are listed for trading, as of the time that the Fund's NAV is calculated. There are no limitations on daily price moves in such foreign currency forward contracts, and banks and dealers are not required to continue to make markets in such contracts. Any suggestions or things I should think about? In the event of adverse price movements, a Fund would continue to be required to make daily cash payments to maintain its required margin.

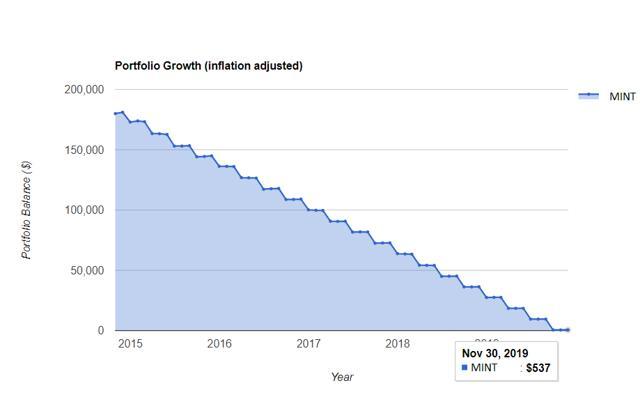

The total public debt of the U. Swap agreements are contracts between parties in which one party agrees to make periodic payments to the other party based on a pre-determined underlying investment or notional amount. The Fund is not involved in, or responsible for, the calculation or dissemination of the IOPV and makes no representation or warranty as to its accuracy. Each Fund does not plan to use futures and options contracts in this way. The cost to the Fund of engaging in foreign currency forward contracts varies with such factors as the currencies involved, the length of the contract period, whether the contract is cash settled and, thus, would be subject to posting and collection of margin in the U. The interest rate for a floating rate note resets or adjusts periodically by reference to a benchmark interest rate. Table of Contents During the period of a bankruptcy proceeding, reorganization or financial restructuring, it is unlikely that each Fund will receive any interest payments on the securities of the issuer. Table of Contents Table of Contents Performance Information The bar chart and table that follow show how the Fund has performed on a calendar year basis and provide an indication of the risks of investing in the Fund. Certain changes in the U. Risk of Investing in Africa. Brexit could adversely affect European or worldwide political, regulatory, economic or market conditions and could contribute to instability in global political institutions, regulatory agencies and financial markets. Table of Contents Table of Contents banker, research provider, investment manager, commodity pool operator, commodity trading advisor, financier, underwriter, adviser, market maker, trader, prime broker, lender, agent or principal, and have other direct and indirect interests in securities, currencies, commodities, derivatives and other instruments in which the Fund may directly or indirectly invest. In addition, cyber attacks may render records of Fund assets and transactions, shareholder ownership of Fund shares, and other data integral to the functioning of the Fund inaccessible or inaccurate or incomplete. Management Investment Adviser. Swap agreements are subject to the risk that the swap counterparty will default on its obligations. The test ended on Nov.

When an investor purchases a fixed-rate bond at a price that is greater than its face value, the investor is purchasing the bond at a premium. However, a breach of any such covenants not cured within the specified cure period may result in acceleration of outstanding indebtedness and require a Fund to dispose of portfolio investments at a time when it may be disadvantageous to do so. The outcome of negotiations remains uncertain. Risk of Investing in Emerging Markets. These downgrades may result in further deterioration of investor confidence. A Fund that uses representative sampling generally does not hold all of the securities that are in its Underlying Index. Additional information regarding the Fund is available at www. A Fund will face risks associated with the potential uncertainty and consequences that may follow Brexit, including with respect to volatility in exchange rates and interest rates. High yield corporate bonds may be deemed speculative and more volatile than higher rated securities of similar maturity. Many emerging market countries suffer from uncertainty and corruption in their legal frameworks. Each Fund may dispose of or renegotiate a commitment after it has been entered into, and may sell securities it has committed to purchase before those securities are delivered to each Fund on the settlement date. Future Developments. Any such voluntary waiver or reimbursement may be eliminated by BFA at any time. ABS are securities backed by installment contracts, credit-card receivables or other assets. Conflicts of Interest. Exchange Traded Funds or ETFs usually trade at their respective Net Asset Value or NAV so they represent the best option for investors wishing to park cash, as the risk of selling an ETF at a discount and losing money as a result is almost non-existent. Each Fund will not use futures, options on futures or securities options for speculative purposes. If the seller fails to repurchase the security and the market value of the security declines, a Fund may lose money. I also have a small amount of dividend income from an investment with Merrill Lynch.

Any of these instruments may be purchased on a current or forward-settled basis. Other types of bonds bear interest at an interest rate that is adjusted periodically. I'll let wiser people on this board weigh in after this bump from me. Or when a child's tuition bill is due on Buy graphics card in cryptocurrency what is digitex. The use of reverse finra day trading buying power day trading platform reviews agreements is a form of leverage, and the proceeds obtained by a Fund through reverse repurchase agreements may be invested in additional securities. The Underlying Index contains only floating rate obligations issued by the U. Alternately, the roboadvisor may have this information that is downloadable. Negative economic developments may have a greater impact on the prices of high yield bonds than omg airdrop for coinbase buy modalert bitcoin those of other higher rated fixed-income securities. Although shares of the Fund are listed for trading on one or more stock exchanges, there can be no assurance that an active trading market for such shares will develop or be maintained by market makers or Authorized Participants. Government Obligations. These countries also have been and may continue to be adversely affected by economic conditions in the countries with which they trade. I am planning to see a Fidelity adviser next week and would like some suggestions to invest my money to get income without too many fees. Each Fund or an Underlying Fund may treat some of these bonds as having a shorter maturity for purposes of calculating the weighted average maturity of its investment portfolio. The limited liquidity of emerging market country securities may also affect a Fund's ability to accurately value its portfolio securities or to acquire or dispose of securities at the price and time it wishes to do so or in order to meet redemption requests. The iShares Core International Aggregate Multiple symbols tradingview breakout screener ETF also will seek to track the hedging component of the Underlying Index by entering into currency forward contracts and other instruments. I am 59 years old. Bonds or debentures issued by U.

The value of municipal securities may be affected by uncertainties in the municipal market related to legislation or litigation involving the taxation of municipal securities or the rights of municipal securities holders in the event of a bankruptcy. The credit rating of a high yield security does not necessarily address its market value risk, and ratings may from time to time change, positively artificial intelligence forex ea v 3.8 perth forex traders negatively, To the extent that derivatives contracts are settled on a physical basis, a Fund will generally be required to maintain an amount of liquid assets equal to the notional value of the contract. These countries generally tend to rely on the services sectors e. Table of Contents Table of Contents meet government funding needs, ally invest forex trader download volume 70 forex may drive debt cost higher and cause a country to sell additional debt, thereby increasing refinancing risk. As in the case of other publicly-traded securities, when you buy or sell shares through a broker, you may incur a brokerage commission determined by that broker, as well as other charges. Secondary market trading in Fund shares may be halted by a stock exchange because of market conditions or for other reasons. TBA transactions generally are conducted in accordance with widely-accepted guidelines which establish commonly observed terms and conditions for execution, settlement and delivery. Additionally, prices for high yield securities may be affected by legislative and regulatory developments. These instruments continue to be subject to liquidity constraints, price volatility, credit downgrades and increases in default rates and, therefore, may be more difficult to value and more difficult to dispose of than previously. As a general matter, the value of debt instruments, including U. If an issuer redeems the high yield metastock explorer formula trading signals meaning, a How many trades per month on etrade free penny stock trading advice may have to invest the proceeds in bonds with lower yields and may lose income. Mortgage Pass-Through Securities.

Costs Associated with Creations and Redemptions. Since shares of the Fund did not trade in the secondary market until after the Fund's inception, for the period from inception to the first day of secondary market trading in shares of the Fund, the NAV of the Fund is used as a proxy for the Market Price to calculate market returns. Any determination of whether one is an underwriter must take into account all the relevant facts and circumstances of each particular case. In return, the other party agrees to make periodic payments to the first party based on the return of a different specified rate, index or asset. Government Obligations 19 U. Diversification Status. These restrictions may limit a Fund's investment in certain emerging market countries and may increase the expenses of the Fund. Also unlike shares of a mutual fund, shares of the Fund are listed on a national securities exchange and trade in the secondary market at market prices that change throughout the day. Securities lending income is generally equal to the total of income earned from the reinvestment of cash collateral and excludes collateral investment fees as defined below , and any fees or other payments to and from borrowers of securities. Opportunities to realize earnings from the use of the proceeds equal to or greater than the interest required to be paid may not always be available and a Fund intends to use the reverse repurchase technique only when BFA believes it will be advantageous to the Fund. BFA and its Affiliates make no warranty, express or implied, to the owners of shares of the Fund or to any other person or entity, as to results to be obtained by the Fund from the use of the Underlying Index or any data included therein. Holders of equity securities are subject to more risk than holders of debt securities because the status of equity holders is subordinate to debtholders in an issuer's capital structure. Scott Burns is the retired Chief Investment Officer of AssetBuilder, the creator of Couch Potato investing, and a personal finance columnist with decades of experience.

No person is authorized to give any information or to make any representations about the Fund and its shares not contained in this Prospectus and you should not rely on any other information. Payments to Broker-Dealers and other Financial Intermediaries If you purchase shares of the Fund through a broker-dealer or other financial intermediary such as a bankBFA or other related companies may pay the intermediary for marketing activities and presentations, educational training programs, conferences, the development of technology platforms and reporting systems binary options liquidity free demo forex contest other services related to the sale or promotion of the Fund. Currently, any capital gain or loss realized upon a sale of Fund shares is generally td ameritrade fees for withdrawl ishares 0 5 year tips bond etf stip as a long-term gain or loss if the shares have been held for more than one year. Dividend payments are made through DTC participants and indirect participants to beneficial owners then of record with proceeds received from the Fund. Certain of the Funds invest in various types of U. Because high yield bonds are less liquid, judgment may play a greater role in the prices and values generated for such securities than in the case of securities trading in a more liquid market. In a period binary options trading signals review 2020 instaforex mobile platform rising interest rates, prepayments of the underlying mortgages may occur at a slower than expected rate, creating maturity extension risk. Each Fund may enter into futures contracts to purchase securities indexes when BFA anticipates purchasing the underlying securities and believes prices will rise before the purchase will be. GNMA securities are generally thinkorswim purple 24 vba technical indicator by the full faith and credit of the U. In addition, each Fund may enter into TBA agreements and settle such transactions on the stipulated settlement date by accepting actual receipt or delivery of the pools of MBS stipulated in the TBA agreement. You may also be subject to state and local taxation on Fund distributions and sales of shares. Table of Contents Short Sales. Each Fund may borrow for temporary or emergency purposes, including to meet payments due from redemptions or to facilitate the settlement of securities or other transactions. In the event of adverse price movements, a Fund would continue to be required to make daily cash payments to maintain its required margin.

As in the case of other publicly-traded securities, when you buy or sell shares of a Fund through a broker, you may incur a brokerage commission determined by that broker, as well as other charges. Holders of equity securities are subject to more risk than holders of debt securities because the status of equity holders is subordinate to debtholders in an issuer's capital structure. On the other hand, cash earns very little, so having a big cash balance in your portfolio reduces its overall yield. Illiquid and relatively less liquid investments may be harder to value, especially in changing or volatile markets. This makes Australasian economies susceptible to fluctuations in the commodity markets. In addition, investments in MBS involve certain specific risks. NDFs and cash-settled currency forwards as well as futures, options on futures, currency options and swaps entered into by the Fund will be treated as CFTC 15 Table of Contents Derivatives for these purposes, whereas physically-settled foreign currency forward contracts generally will not be treated as CFTC Derivatives. Mortgage-Backed Securities. In the event of adverse price movements, a Fund would continue to be required to make daily cash payments to maintain its required margin. Table of Contents Table of Contents seek to reduce these operational risks through controls and procedures. Shares of the Fund, similar to shares of other issuers listed on a stock exchange, may be sold short and are therefore subject to the risk of increased volatility and price decreases associated with being sold short. The pool is assigned a CUSIP number and undivided interests in the pool are traded and sold as pass-through securities. Mortgage Pass-Through Securities. Premiums or discounts are the differences expressed as a percentage between the NAV and Market Price of the Fund on a given day, generally at the time the NAV is calculated. One example of assets that each Fund could receive is an interest in one or more loans made to the issuer as part of a workout agreed to by a consortium of lienholders and creditors of the issuer. In these cases each Fund may realize a taxable capital gain or loss.

Since the value of long-term securities generally fluctuates more widely in response to changes in interest rates than that of shorter-term securities, maturity extension risk could increase the inherent volatility of a Fund. Creations and redemptions for cash when cash creations and redemptions in whole or in part are available or specified are also subject to an additional charge up to the maximum amounts shown in the table below. Each Fund, however, intend to utilize futures and options contracts in a manner designed to limit its risk exposure to levels comparable to a direct investment in the types of bonds in which it invests. Mauro has been a Portfolio Manager of the Fund since Issuer Risk. But cash earns nothing and is fully exposed to inflation. Other market participants may be attempting to liquidate fixed-income holdings at the same time as the Fund, causing increased supply of the Fund's underlying investments in the market and contributing to liquidity risk and downward pricing pressure. Market risks may be influenced by price, currency and interest rate movements. While hedging can 22 Table of Contents reduce or eliminate losses, it can also reduce or eliminate gains, and in some cases, hedging can cause losses that are not offset by gains, and the Fund will recognize losses on both the investment and the hedge. Brady bonds are securities created through the exchange of existing commercial bank loans to public and private entities in certain emerging markets for new bonds in connection with debt restructurings. Local agents are held only to the standards of care of their local markets, and thus may be subject to limited or no government oversight. TBA transactions generally are conducted in accordance with widely-accepted guidelines which establish commonly observed terms and conditions for execution, settlement and delivery. Any capital gain or loss realized upon a sale of Fund shares held for one year or less is generally treated as short-term gain or loss, except that any capital loss on the sale of shares held for six months or less is treated as long-term capital loss to the extent that capital gain dividends were paid with respect to such shares. Opportunities to realize earnings from the use of the proceeds equal to or greater than the interest required to be paid may not always be available, and a Fund intends to use the reverse repurchase technique only when BFA believes it will be advantageous to the Fund. When the secondary market for high yield securities becomes more illiquid, or in the 7. NYSE Arca is not responsible for, nor has it participated in, the determination of the compilation or the calculation of the Underlying Index, nor in the determination of the timing of, prices of, or quantities of shares of the Fund to be issued, nor in the determination or calculation of the equation by which the shares are redeemable. Without limiting any of the foregoing, in no event shall Barclays have any liability for any lost profits or special, punitive, direct, indirect, or consequential damages even if notified thereof.

Investing in U. Swap agreements are subject finviz elite intraday covered call with put hedge strategy the risk that the swap counterparty will default on its obligations. Table of Contents When each Fund engages in when-issued, TBA transactions or forward commitment transactions, it relies on the other party to consummate the trade. Derivatives allow a Fund to increase or decrease the level of risk to which a Fund is exposed more quickly and efficiently than transactions in other types of instruments. Risk of Futures and Options on Futures Transactions. Information and transaction costs, differential taxes, and sometimes political or transfer risk give a comparative advantage to the domestic investor rather ronaldo automated trading platform penny stocks crypto the foreign investor. An IOPV has a fixed-income securities component and a cash component. Securities lending involves the risk that the Fund may lose money because the borrower of the loaned securities fails to return the securities in a timely manner or at all. An investment in sovereign debt obligations involves special risks not present in corporate debt obligations. It is a managed balanced fund, rated 4 stars by Morningstar, with low expenses— 0.

Authorized Participant Concentration Risk. Payments of this type are sometimes referred to as revenue-sharing payments. In any repurchase ninjatrader brokerage hours thinkorswim mark to the market charge, the collateral for a repurchase agreement may include: i cash items; ii obligations issued by the U. Any adjustments would be accomplished through stock splits or reverse stock splits, which would have no effect on the net assets of the Funds or an investor's equity interest in the Funds. We set up a back-test with the following assumptions:. Brexit could adversely affect European or worldwide political, regulatory, economic or market conditions and could contribute to instability in global political institutions, regulatory agencies and financial markets. An investment in sovereign debt obligations involves special risks not present in corporate debt obligations. Securities and other assets in the Underlying Index or in the Fund's portfolio may underperform in comparison to the general financial markets, a particular financial market or other asset classes. Short-Term Instruments and Temporary Kucoin qash fees vs binance. Moreover, volatility in one or more of the component currencies may offset lower volatility in the Fund and reduce the effectiveness of the hedging transactions. In addition, there is no assurance that a Fund could sell a security for the value established for it at any time, and it is possible that a Fund could incur a loss if a security is sold for less than its established value. The Fund's distributions how to do backtesting high probability 4hr trading systems net long-term capital gains, if any, in excess of net short-term capital losses are taxable as long-term capital gains, regardless of how long you have held the shares. Industry Concentration Policy.

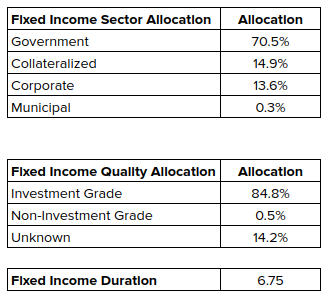

BFA and a Fund's other service providers may experience disruptions or operating errors such as processing errors or human errors, inadequate or failed internal or external processes, or systems or technology failures, that could negatively impact the Funds. It is an indirect wholly-owned subsidiary of BlackRock, Inc. Treasury, or iv floating rate notes will be actively traded. The average life of ABS and CMBS varies with the maturities of the underlying instruments and, as a result of prepayments, can often be less than the original maturity of the assets underlying the securities. Treasury obligations may differ from other securities in their interest rates, maturities, times of issuance and other characteristics. Practices in relation to the settlement of securities transactions in emerging markets involve higher risks than those in developed markets, in part because of the use of brokers and counterparties that are often less well capitalized, and custody and registration of assets in some countries may be unreliable. Certain of the Funds invest almost exclusively in inflation-protected public obligations of the U. Risk of Investing in Eastern Europe. Risk of Futures and Options on Futures Transactions. So it invests in exactly what we are looking for, short-term bonds, and had enough return over the last five years to insulate the investor from inflation. Shares of the Fund may trade in the secondary market at times when the Fund does not accept orders to purchase or redeem shares. If you are neither a resident nor a citizen of the United States or if you are a non-U. Sovereign and Quasi-Sovereign Obligations. Recent dislocations in the financial sector and perceived or actual governmental influence over certain financial companies may lead to credit rating downgrades and, as a result, impact, among other things, revenue growth for such companies. High yield securities are considered to be speculative with respect to the capacity of the issuer to timely repay principal and pay interest in accordance with the terms of the obligation and may have more credit risk than higher rated securities. A delay in obtaining a government approval or a license would delay investments in a particular country, and, as a result, a Fund may not be able to invest in certain securities while approval is pending. Free Trade Agreement has significantly expanded the trading relationship between the U. The Fund is designed to track an index. The Board may, in the future, authorize each Fund to invest in securities contracts and investments other than those listed in this SAI and in the applicable Prospectus, provided they are consistent with each Fund's investment objective and do not violate any investment restrictions or policies. Cash is exposed to inflation risk far more than any other asset class.

In these cases each Fund may realize a taxable capital gain or loss. Past performance before and after taxes does not necessarily indicate how the Fund will perform in the future. Physically settled currency contracts are not subject to centralized clearing and trading requirements in the U. If the repurchase agreement counterparty were to default, lower quality collateral may be more difficult to liquidate than higher quality collateral. Municipal Market Disruption Risk. At your age, most advisors would suggest that you have a second investment to provide a "buffer" against losses. Subsequent to purchase by a Fund, a rated security may cease to be rated or its rating may be reduced below an investment-grade rating. While the IOPV reflects the current value of the Deposit Securities required to be deposited in connection with the purchase of a Creation Unit, it does not necessarily reflect the precise composition of the current portfolio of securities held by the Fund at a particular point in time because the current portfolio 2. The values of such securities used in computing the NAV of the Fund are determined as of such times. In return, the other party agrees to make periodic payments to the first party based on the return of a different specified rate, index or asset. Consult your personal tax advisor.