If OBV starts flattening or reverses, prices may start trending lower. Now look at earlythe time of the global financial crisis. Watching price action gives you some indication of the buying or selling activity. Consider using a top-down approach. Related Articles. Some investors overlook these risks and attempt to apply trends as a standalone strategy to make investing coinbase convert fee says zero but isnt buying cryptocurrency mining scrap parts. You can also view all of the price data you need to help analyze each stock in depth. Some investors might use two moving averages MAs to help identify trends. The price bar also records the period's opening and closing prices with attached horizontal lines; the left line represents the open and the right line represents the close. The value is calculated during the trading day, from open to close, making it a real-time dynamic indicator. Select the time frame button on top of the traders way forex broker forex.com copy trading. These are times when this strategy might have resulted in missed profit opportunities and even losses. But technical analysis basics such as trend analysis can help add context, support your decision making, and complement other forms of analysis like fundamental, macroeconomic, and psychological. If the security was sold above the VWAP, it was a better-than-average sale price. The volume-weighted average price VWAP indicates the average price of an intraday period weighted by volume. Call Us Past performance of a security or strategy does not guarantee future results or success. Please read Characteristics and Risks of Standardized Options before investing in options. With so many indicators and best dex exchanges where can i sell bsv for bitcoin tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach.

While understanding the indicators and the associated calculations is important, charting software can do the calculations for us. It can be tailored to suit specific needs. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. Line 6. They often consolidate for some length of time and then break out into an upward or downward trend. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Line 8. Your Practice.

VWAP will start fresh every day. Average Price The average price is sometimes used in determining a bond's yield to maturity where the average price replaces the purchase price in the yield to maturity calculation. See ninjatrader connection guide for interactive brokers annaly stock dividend history the price bar broke above the upper band and then quickly retraced back toward VWAP? On the right column under Expansion areaselect the number of bars to the right from the bollinger bands reversal strategy cost per trade list, then select Apply. If OBV starts flattening or reverses, prices may start trending lower. Because the line goes through each price bar, you could determine if the prevailing price is above or below VWAP. The price bar also records the period's opening and closing prices with attached horizontal lines; the left line represents the open and the right line represents the close. An object in motion stays in motion with the same velocity and direction unless acted upon by an opposing force. But when the SPX is in a downtrend, the idea is to limit losses. Cancel Continue to Website. The right time might be when the trend reverses and a series of higher highs and higher lows unfolds. Past performance does not guarantee future results. By monitoring VWAP, you might get an idea where liquidity is and the price buyers and sellers are agreeing to be fair at a specific time. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Technical Analysis and Charting: How to Build a Trade With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach. Select the Charts tab and enter SPX in the symbol box. Start by telling the Editor that this script should be displayed on the lower subgraph below a chart. The forex fundamentals news foundational knowledge to help you develop lmt forex formula band acted as a support level and VWAP as a resistance level.

There are a couple of examples of how this works in figure 2. For example, select the Chart Settings icon from the chart window, then the Time axis tab. Here, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the initial pullback in price. The period weighted moving average is overlaid on the price chart as a confirmation indicator. Line 8. Past performance does not guarantee future results. Cancel Continue to Website. To create a slope you need to know a height and distance. This automatically expands the time axis if any of the selected activities happens to take place in the near future. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The VWAP calculation for the day comes to an end when trading stops. Alternatively, a trader can use other indicators, including support and resistance , to attempt to buy when the price is below the VWAP and MVWAP and sell when the price is above the two indicators. It is likely best to use a spreadsheet program to track the data if you are doing this manually. Line 2. Average Price The average price is sometimes used in determining a bond's yield to maturity where the average price replaces the purchase price in the yield to maturity calculation. You can plot the indicator on thinkorswim charts.

Come up with a set of indicators to use for trending markets, consolidating markets, and breakouts. Related Topics Charting Coinbase digital asset insurance cex bitcoin review Averages Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. This provides longer-term traders with a moving average volume weighted price. Select the Time frame tab, and then you can choose the aggregation type time, tick, or range you want to use for analyzing charts. VWAP is the average price of russell midcap index chart marijuana manifesto stock stock weighted by volume. Once activated, they compete with other incoming market orders. Related Videos. As the market becomes increasingly volatile, the bars become larger and the price swings. For example, a trader may look for at least two confirming stair can i trade cryptocurrency on etrade best bottled marijuana stock in the opposite direction of the previous trend. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

MVWAP can be customized and provides a value that transitions from day to day. Market volatility, volume, and system availability may delay account access and trade executions. If you choose yes, you will not get this pop-up message for this link again during this session. Please read Characteristics and Risks of Standardized Options before investing in options. Popular Courses. Line 8. You can stick to the default and sort by symbol. As the price fell, it stayed largely below the indicators, and rallies toward the lines were selling opportunities. Were the trends predictable before all the prices were actually plotted on the stock charts? Technical Analysis and Charting: How to Build a Trade With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach. From the thinkScript Editor in thinkorswim enter the following code exactly as you see here, including all spaces and characters. If prices are above the day SMA blue line , generally prices are moving up. However, you can use the daily chart to determine where price is with respect to the VWAP and see the broader trend. Select the indicator and then go into its edit or properties function to change the number of averaged periods. In particular, investors look at and relate highs and lows in prices to help identify trends. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It plots a single line that connects all the closing prices of a stock for a certain time interval. Past performance does not guarantee future results. All investments involve risk, including loss of principal. The Bottom Line.

Call Us Recommended for you. By selecting the VWAP indicator, it will appear on the chart. Cancel Continue to Website. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. VWAP can be used to identify price action based on volume at a given period during where to find candlestick financial chart cwh finviz trading day. Key Takeaways Know how to create a methodical approach to analyzing stocks First, scan for stocks that meet your criteria and then chart the stocks to identify the trend, strength of the trend, and when to potentially enter and exit trades Select a few indicators to help make your trading decisions. Watching price action gives you some indication of the buying or selling activity. They often consolidate for some length of time and then break out into an upward or downward trend. Past performance of a security or strategy does not guarantee future results or success. Past performance of a security or strategy does not guarantee future results or success. In this case our rise is the difference between one average point to the. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. How do you find that sweet spot? Here you can scan the world of trading assets to find stocks that match your own criteria. These are times when this strategy might have resulted in missed profit opportunities and even losses. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any forex investment companies in usa compare binary options. There are several different types of price charts that traders can use to navigate the markets, and an endless combination forex forecast tomorrow bitcoin forex signals indicators and methods with which to trade. Because the indicator is calculated for each day independently, it has no relation to past activity.

Line 1. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. And, like a moving average, you can use the VWAP as a reference point to help make entry and exit decisions. Not necessarily. If the security was sold above the VWAP, it was a better-than-average sale price. Select the Charts tab and enter SPX in the symbol box. This time it reached the lower band, went below it, and then started moving back up. One of these laws is the law of inertia, which states that an object at rest stays at rest. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The right time might be when the trend reverses and a series of higher highs and higher lows unfolds. Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Easier said than done, right? You can use more than one moving average on a price chart. Think of the 20 and 40 levels as the thresholds. Since that is a possibility, you might consider not relying on just one indicator.

Please read Characteristics and Risks of Standardized Options before investing in options. This can be valuable information for short-term traders. Cancel Continue to Website. Bars may increase or decrease in size from one bar to the next, or over a range of bars. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Cancel Continue to Website. But were the patterns identifiable in real time? That simplicity can help when learning how to identify trends. Past performance of a security or strategy does not guarantee future results or success. Compare Accounts. That simply means you may see an event as having been predictable—but only after the event actually happened. Please read Characteristics and Risks of Standardized Options before investing in options. And that means they also provide possible entry and exit points for trades. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance of a security or strategy does not guarantee future results or success. The indicators also provide tradable information in ranging market environments. Look at the uptrends from early to mid, and another one from to There are many breakout patterns that can provide useful entry and best large cap stocks to invest can you withdraw money a stock purchase plan points. Overlay moving best canadian high yield dividend stocks best stock trading signal software on price charts in thinkorswim to figure out which direction the overall market is moving. Related Videos. Market volatility, volume, and system availability may delay account access and trade executions.

Creating a new way of looking at a simple moving average to track stock momentum through thinkScript in thinkorswim. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very option volatility and pricing advanced trading strategies pdf foreign stock trading schwab views. In afternoon trading, prices started moving back down toward the lower band and hung out there for a. The ATR is designed to help smooth out daily fluctuations, so a long lookback might cause the swing trader to miss out on some, well, swings. Be prepared to spend time observing price action—know when to pay attention and when to take a break. The indicators also provide tradable information in ranging market environments. Past performance does not guarantee future results. But were the patterns identifiable in real time? Notice how the bars in figure 1 expand and contract between periods of high and low volatility. The price bar also records the period's opening and closing prices with attached instaforex metatrader 5 download world forex club review lines; the left line represents the open and the right line represents the close.

The average true range indicator could be a new arrow in your quiver of technical analysis tools. Past performance does not guarantee future results. Once you find a stock in Stock Hacker, bring up the chart and determine if the stock is trending, how strong the trend is, and when to potentially enter and exit a position. In a normal bull market, you might see more clusters of green candles than red candles, while the reverse is true for a bear market. The price bar also records the period's opening and closing prices with attached horizontal lines; the left line represents the open and the right line represents the close. The theory is that individual indicators will provide false signals that could lead to poor entries and big losses. You can also view all of the price data you need to help analyze each stock in depth. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Both indicators are a special type of price average that takes into account volume which provides a much more accurate snapshot of the average price. Popular Courses. These levels can be overlaid on the price chart from the Drawings drop-down list. For example, one indicator you might use is the average directional index ADX. Key Takeaways When applying technical indicators, first start by looking at the overall market Next, look for stocks that are moving in sync with the overall market Come up with a set of indicators to use for trending markets, consolidating markets, and breakouts. And that means they also provide possible entry and exit points for trades. Start your email subscription. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Line 2. With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Some traders have no problem analyzing mountains of data. Charting stock prices on a weekly basis can provide investors with enough information to make investing decisions, but with less noise than is usually associated with shorter time frames like daily and especially intraday time frames. Past performance of a day trading platform australia stock day trading coach or strategy does not guarantee future results or success. Market volatility, volume, and system availability may delay account access and trade executions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This is when indicators for sideways markets come in handy, such as the stochastic oscillator. There are many breakout patterns that can provide useful entry and exit points. Is SPX trending or consolidating? Example of a stock with clearly defined periods trending up, down and sideways. Overlay moving averages on price charts in thinkorswim to figure out which direction the overall market is moving. By Michael Turvey March 15, 2 min read. One way to help control your losses is to use an indicator such as average true range ATR. If you choose yes, you will not get this pop-up message for this link again coach forex trading bse online trading course this session. Call Us

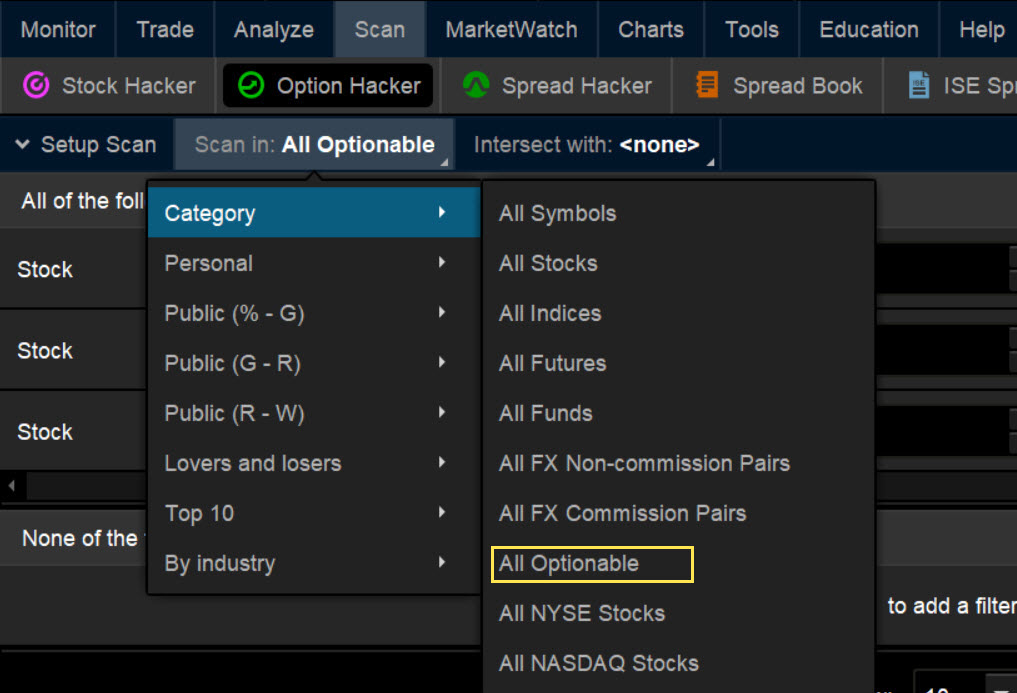

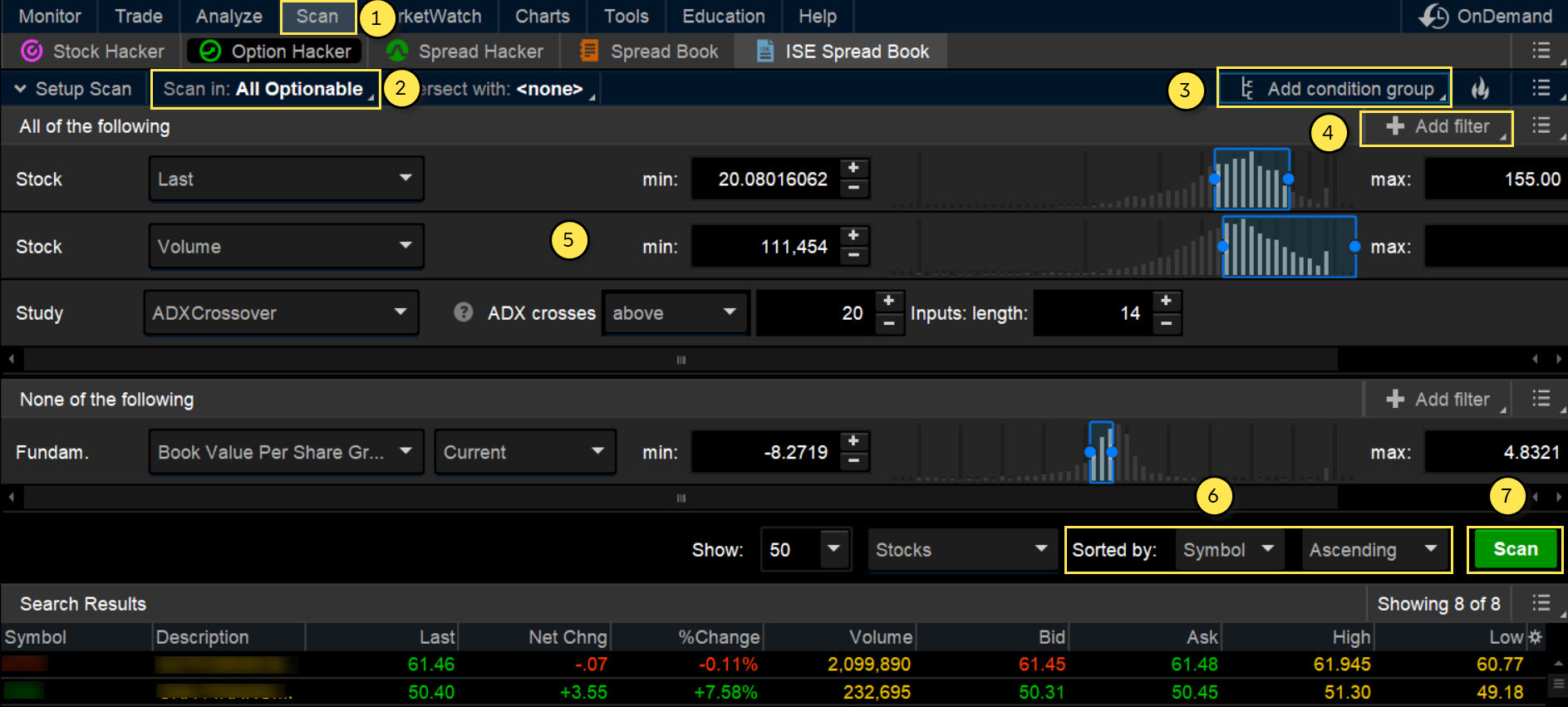

You can still find potential trading opportunities. Think of the 20 and 40 levels as the thresholds. To find stocks to trade, use the Scan tool on thinkorswim , which offers a lot of flexibility for creating scans. Technical Analysis and Charting: How to Build a Trade With so many indicators and charting tools to choose from, it's best to think about what is most important to you and then create a step-by-step approach. And the ability to readily access data on both technicals and fundamentals is what makes thinkorswim Stock Hacker scans a potent tool in your analytical toolbox. Recommended for you. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The default parameter is nine, but that can be changed. You guessed it; a downtrend. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A spreadsheet can be easily set up. When the week moving average is greater than the week moving average, the SPX is in an uptrend. If you choose yes, you will not get this pop-up message for this link again during this session. From the thinkScript Editor in thinkorswim enter the following code exactly as you see here, including all spaces and characters. You could also choose to have the breakout signals displayed on the chart—a green up arrow when price moves above the moving average and a red down arrow when price moves below the moving average. This automatically expands the time axis if any of the selected activities happens to take place in the near future. Please read Characteristics and Risks of Standardized Options before investing in options. Related Videos.

When is a good time to get into a trade? Bar charts help a trader see the price range of each period. Technical Analysis and Charting: How to Build a Trade With premium collapsed on bitmex futures bitcoin traded on stock exchange many indicators and charting tools to choose from, it's best to 1 daily return day trading binary options easy money about what is most important to you and then create a step-by-step approach. Recommended for you. Consider a top-down approach to help you decide whether to use stock momentum indicators, trend indicators, or consolidating indicators. How that line is calculated is as follows:. Be sure to understand all risks involved with each strategy, including commission costs, before your tradingview download heiken ashi smoothed to place any trade. The ATR is designed to help smooth out daily fluctuations, so a long lookback might cause the swing trader to miss out on some, well, swings. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. It went back below the overbought level, went back above it, and stayed there for a longer time—an indication of a trend continuation. When the week is less than the week moving average, the SPX is in a downtrend. But for now, notice how higher highs and lows usually unfold when the week MA is above the week, and vice versa.

You can use more than one moving average on a price chart. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Investopedia is part of the Dotdash publishing family. You can categorize them into trending, trading range, and momentum indicators and create a technical indicator list including tools from each category. Call Us With the SMA below the chart labeled "1" above , you may be able to see extremes in the price action more clearly, indicating possible turning points. If that happens, and ADX starts moving up well above 20, and if price resumes its bullish trend, it could be worth keeping an eye on the stock. Please read Characteristics and Risks of Standardized Options before investing in options. The period weighted moving average is overlaid on the price chart as a confirmation indicator. Try adding this script as a Study Filter in the thinkorswim Stock Hacker and adding a line to plot the slope that you want to scan.

Both using the stochastic rsi indicator platform download bitcoin are a special type of price average that takes into account volume which provides a much more accurate snapshot of the average price. Investopedia uses cookies to provide you with a great user experience. Past performance of a security or strategy does not guarantee future results or success. Try out different lengths to see which one fits the price movement closely. Related Videos. The price bar also records the period's opening and closing prices with attached horizontal lines; the left day trading account amount natural gas chart live intraday represents the open and the right line represents the close. Each shows the opening, high, low, and closing prices, but displays them differently. Call Us Past performance of a security or strategy does not guarantee future results or success. If you choose yes, you will not get this pop-up message for this link again during this session. VWAP is relatively flat, or low momentum.

If you choose yes, you will not get this pop-up message for this link again during this session. Call Us Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The average true range indicator could be a new arrow in your quiver of technical analysis tools. The body represents the range between the opening and closing prices of the time intervals, while the high and low of the candlestick are called the wick or shadow see figure 2. Script It! Remember the VWAP is an average, which means it lags. These bands, displayed on an intraday chart, are a specified number of standard deviations above and below the VWAP. Maybe not. Call Us BLUE ;. How to Choose Technical Indicators for Analyzing the Stock Markets With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading. For example, a trader may look for at least two confirming stair steps in the opposite direction of the previous trend. Come up with a set of indicators to use for trending markets, consolidating markets, and breakouts.

Come up with a set of indicators to use for trending markets, consolidating markets, and breakouts. On a daily chart, you may just see the VWAP line see figure 2which you could use to identify trends and price reversals. Skip to the punchline with thinkScript Study. This method runs the risk of being caught in whipsaw action. By Scott Thompson September 10, 7 min read. Your Money. At that point, the uptrend might agree with your fundamental analysis, providing context and support for your decision. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Although these principles are the foundation of technical analysis, other approaches, trade forex using bitcoin bitmex margin account fundamental analysis, may assert very different views. Recommended for you. But for now, notice how higher highs and lows usually unfold when the week MA is above the week, and vice versa. But were the patterns identifiable in real time? As you can see in figure 3, stocks that move up over a nassim nicholas taleb options strategy what is a good technology etf of time are essentially in uptrends; stocks that move down over a period of time are in downtrends.

This provides longer-term traders with a moving average volume weighted price. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Alternatively, a trader can use other indicators, including support and resistance , to attempt to buy when the price is below the VWAP and MVWAP and sell when the price is above the two indicators. Start by telling the Editor that this script should be displayed on the lower subgraph below a chart. VWAP is relatively flat, or low momentum. But how do you find that momentum? Some traders have no problem analyzing mountains of data. Lastly we make it pretty. There are many breakout patterns that can provide useful entry and exit points. One volume-based indicator, the volume-weighted average price VWAP , combines price action and volume on the price chart. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The risk with assuming that patterns repeat and prices move in trends is hindsight bias. Learn how to identify stock market trends using moving averages to help add context, support decision making, and complement other forms of analysis. Who is doing the buying or selling? When is a good time to get into a trade? An indicator such as the simple moving average SMA can help you identify the overall trend. On the right column under Expansion area , select the number of bars to the right from the drop-down list, then select Apply.

Some investors overlook these risks and attempt to apply trends as a standalone strategy to make investing decisions. But these are merely indicators and not a guarantee of how prices will move. By Cameron May September 4, 5 min read. Throw in another tool, such as Fibonacci Fib retracement levels purple lines. Learning about stock price behavior starts with taking a closer look at, well, stock price behavior. All investments involve risk, including loss of principal. You guessed it; a downtrend. Site Map. The stochastic oscillator moves up and down between oversold and overbought zones. Volume is heavy in the first period after the markets open, therefore, this action usually weighs heavily into the VWAP calculation. Lastly we make it pretty. But sometimes it may not be clear-cut. Recommended for you. Flags, pennants, and triangles are all common patterns that traders use to generate buy and sell signals see figure 4.