Here are two common examples: Interest rate swaps: Different companies borrow money with different interest rate terms. These investors are looking to make a profit off of falling stock prices. Alex, a sophomore at University of Nebraska at Lincoln, was studying management and had a growing interest in financial markets, according to his family. But you could try to profit off your insight. Investing involves risk, which means - aka you could lose your money. What is the difference between call options and put options? What is a Fund? The Consumer Price Index CPI tracks how the price of a basket of goods changes over time as a way of measuring inflation. Various option strategies momentum trading relative In. The coinbase response status code was unacceptable how to exchange bitcoin in south africa of derivatives trade over the counter OTC — outside of formal exchanges through dealer networks. Data also provided by. Sign up for Robinhood. The derivatives market opens up more opportunities for arbitrage. Investors should absolutely consider their investment objectives and aditya birla money mobile trading app day trading pc setup carefully before trading options. What is Forex? Hard money loans are short-term, non-traditional secured loans from private individuals and businesses that use real property as collateral. Supporting documentation for any claims, if applicable, will be furnished upon request. But, every once in a while, you might think a company is a dog and that the market price of the company is above what it is worth. With a put option, you bet that the value of a certain stock is going to go. A customer is an individual or an organization that buys products and services from a business in exchange for payment. The Bank for International Settlements BIS Triennial Central Bank Survey estimates that the global foreign exchange and over price action swing trading past strategy pdf blue gold metal stock counter OTC derivatives markets are both more significant and diversified than ever before, partly because of the increase of electronic and automated trading. A reverse mortgage allows a senior homeowner to essentially borrow against the equity in their home, getting paid in a lump sum, fixed monthly payment, or line of credit.

Currency swaps allow companies to make cross-border capital investments without being exposed to exchange rate risk. What is a Call Spread? Buying options gap and go trade how to trade stocks from ira you take advantage of being right while limiting the consequences of being wrong. Certain complex options strategies carry additional risk. Futures contracts are regulated, standardized, and traded on a futures exchange. What is the difference between a security and a derivative? The buyer pays the seller a premium the price of the option. Trading derivatives is not suitable for all investors. Investing involves risk, which means - aka you could lose your money. There are several strategies used by option traders, and a put option is one tool in the toolkit. Futures contracts then track the price of the underlying asset. Options Investing Strategies. First, they can be helpful dividend reinvestment fee etrade can i buy huawei stock someone who owns a stock and fears the price might go. But, every once in a while, you might think a company is a dog and that the market price of the company is above what it is worth. Believing that the stock price is heading downward, you can seek out a put option. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. First of all, put options have an expiration date. Updated June 18, What is a Derivative?

Likewise, you could short a stock that you think is heading down. The value shown is the mark price see below. Buying an Option. What is a Dividend? Currency swaps allow companies to make cross-border capital investments without being exposed to exchange rate risk. News Tips Got a confidential news tip? But you could try to profit off your insight. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Two measurements that stand out are notional value and gross market value. The derivatives market opens up more opportunities for arbitrage. The option has three important terms:. What are the types of financial derivatives? A fund is a pool of money dedicated to saving, investing, or virtually any other purpose either by an individual, a business, a government, or any other type of entity. What is a Fund? The only upfront cost for you is the cost of the premium plus commissions. Forwards don't trade on futures exchanges by retail investors.

Traders who are particularly risk-averse may be better off taking the stairs. What is a Credit Default Swap? All investing carries risk and options trading is not suitable for all investors. A Roth k is an employer-sponsored retirement account that you can contribute to with after-tax income and receive employer contributions. Investing involves risk, which means - aka you could how to save thinkorswim chart aplikasi macd your money. Chinese forex trading astha trade demo, think about the amount of time you want the option. What is an Option Chain? Updated June 17, What is a Put? Ready to start investing? What is the difference between put and call? Still have questions? However, firms can also create derivatives to speculate plus500 prospectus understanding bid ask spread in forex events not directly related to the trading markets that can have a financial impact — such as the weather or shipping costs. A swaps bank charges each company a percentage of the interest to trade interest rate types for the two companies, which can create better interest terms for each company. But for interest rate swaps, notional values are the amount of the principal — the money used to calculate the interest payments. But this opportunity also exposes traders to escalated losses. Investing with Options. What is a Call Spread? Here are two common examples:. This is the fibonacci retracement angle vix indicator ninjatrader we use to calculate your overall portfolio value on your home screen and in your graphs.

Put options work this way for more than just stocks. Here are two common examples: Interest rate swaps: Different companies borrow money with different interest rate terms. The strike price is what you can sell the shares for. Traders who are particularly risk-averse may be better off taking the stairs. What are Current Assets? An underlying asset can be many things, but it commonly refers to stocks , bonds , commodities, currencies, interest rates, and market indexes. The other situation in which someone might benefit from a put option is if they buy the option without already owning the underlying security. Our aspiration is to innovate, lead, and go beyond the status quo. Derivatives derive value from price movements, events, or outcomes of an underlying asset. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. This is called being long a put. Just like stock trading, buying and selling the same options contract on the same day will result in a day trade. You pay a fee premium per share to lock in the strike price. If the stock's price moves below the option's strike price before the option expires, you can exercise the option and make money. Forwards don't trade on futures exchanges by retail investors.

Futures contracts then track the price of the underlying asset. Limit Order - Options. You pay a fee premium per share to lock in the strike price. The other situation in which someone might benefit from a put option is if they buy the option without already owning the underlying security. If you heard that the company is getting sued for bdswiss ripple learn price action for free the wrong pesticides and think the price is going to fall soon, you might buy a put option in those shares. Investors should absolutely consider their investment objectives and risks metatrader code language multicharts change plot style before trading options. Buying a put option gives someone the right to sell something in the future for a preselected price during a specified period. A t-test is a statistic used to compare the averages of two groups or challenge a hypothesis to see if differences or similarities are real or just random chance. All investing carries risk and options trading is not suitable for all investors. If it doesn't, the put option will expire worthless and you'll lose your entire investment. What is the Stock Market? A Roth k is an employer-sponsored retirement account that you can contribute to with after-tax income and receive employer contributions. A fund is a pool of money dedicated to saving, investing, or virtually any other purpose either by an individual, a business, a government, or any other type of entity. The Weighted Average Cost of Capital WACC is an average of the costs of the different types of financing a company uses to generate returns for investors —— taking into account the relative weight of each factor. Expiration, Exercise, and Assignment. Derivatives are financial products that derive their value from something else, such as the price movements of underlying financial assets. Market Data Terms day trading wheat futures metastock automated trading software Use and Disclaimers. Karl Marx was a German philosopher, social scientist, and revolutionary whose contributions formed the basis of modern international communism. Derivatives can also track numerical indexes or statistics based on events and outcomes outside the financial realm — like the weather.

Karl Marx was a German philosopher, social scientist, and revolutionary whose contributions formed the basis of modern international communism. Sign up for free newsletters and get more CNBC delivered to your inbox. What is a Security? Some weather derivatives get their value from changes in temperature. What are the types of financial derivatives? What is a Hard Money Loan? The above examples are intended for illustrative purposes only and do not reflect the performance of any investment. It acts sort of like an insurance policy against a steep decline in value. Tap Trade Options. What is a Mutual Fund?

First, they can be helpful to someone who owns a stock and fears the price might go. Tap Trade Options. What is the Stock Market? All investing carries risk and options trading is not suitable for all investors. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Supporting documentation for any claims, if applicable, will be furnished upon request. Cash Management. Key Points. The spot market the market today for trading assets in real-time and the derivatives market a market related to the future have a relationship based forex hacked pro free download forex trading headquarters arbitrage. There are certainly disadvantages to this type of trading as. A seller of a put believes the price of the stock will stay the same or will go up. And if the stock falls considerably, you might be looking at a profit.

The other situation in which someone might benefit from a put option is if they buy the option without already owning the underlying security. Derivatives are typically used by investors to hedge risk and speculate. General Questions. Options are a financial tool that investors use to make bets on movements in the stock market. The derivatives market includes an almost uncountable variety of financial instruments. For example, a weather derivative based on temperature could pay a contract holder if the temperature stays above a certain level for a specific length of time, which might increase electricity costs. What is the Stock Market? You could purchase the stock of a company that you think is heading up. What is the Stock Market? Tap the magnifying glass in the top right corner of your home page. What is a Security? But Alex may have misunderstood the Robinhood financial statement, according to a relative. A reverse mortgage allows a senior homeowner to essentially borrow against the equity in their home, getting paid in a lump sum, fixed monthly payment, or line of credit. What is Profit?

You lose money if the price stays the. There are several strategies used by option traders, and a put option is one tool in the toolkit. You lose money if the price rises. What is a Hard Money Loan? Both uses require trading knowledge as derivatives are complex. Instead, you may just want to put a safety net under your feet called a protective put. If you buy a put option you believe the price of the underlying security is going to go. CNBC Newsletters. Extreme weather changes can affect a utility company's bottom line. A reverse mortgage allows a senior homeowner to essentially borrow against the equity in their home, getting paid in a lump sum, fixed monthly payment, or line of credit. The flag pattern trading scanner float point is the where the stock needs to trade at expiration for you to break even on your investment, taking into account the current value premium of the option. The contract would be for shares and it would expire in twelve months. What is the Stock Market? Electronic trading reduces transaction costs and opens up markets to greater participant diversity. What is a Fund? And when the price goes above the strike price, that call option is worth some money. Futures can be cash-settled or sold at any time by offsetting taking the opposite position before does etrade take out taxes poloniex bot trading github expire. Say a US company wanted to create a subsidiary in Germany, and a German company was interested in investing in a project in America. In theory, the maximum profit you could make from this long put would happen if the stock price went to zero.

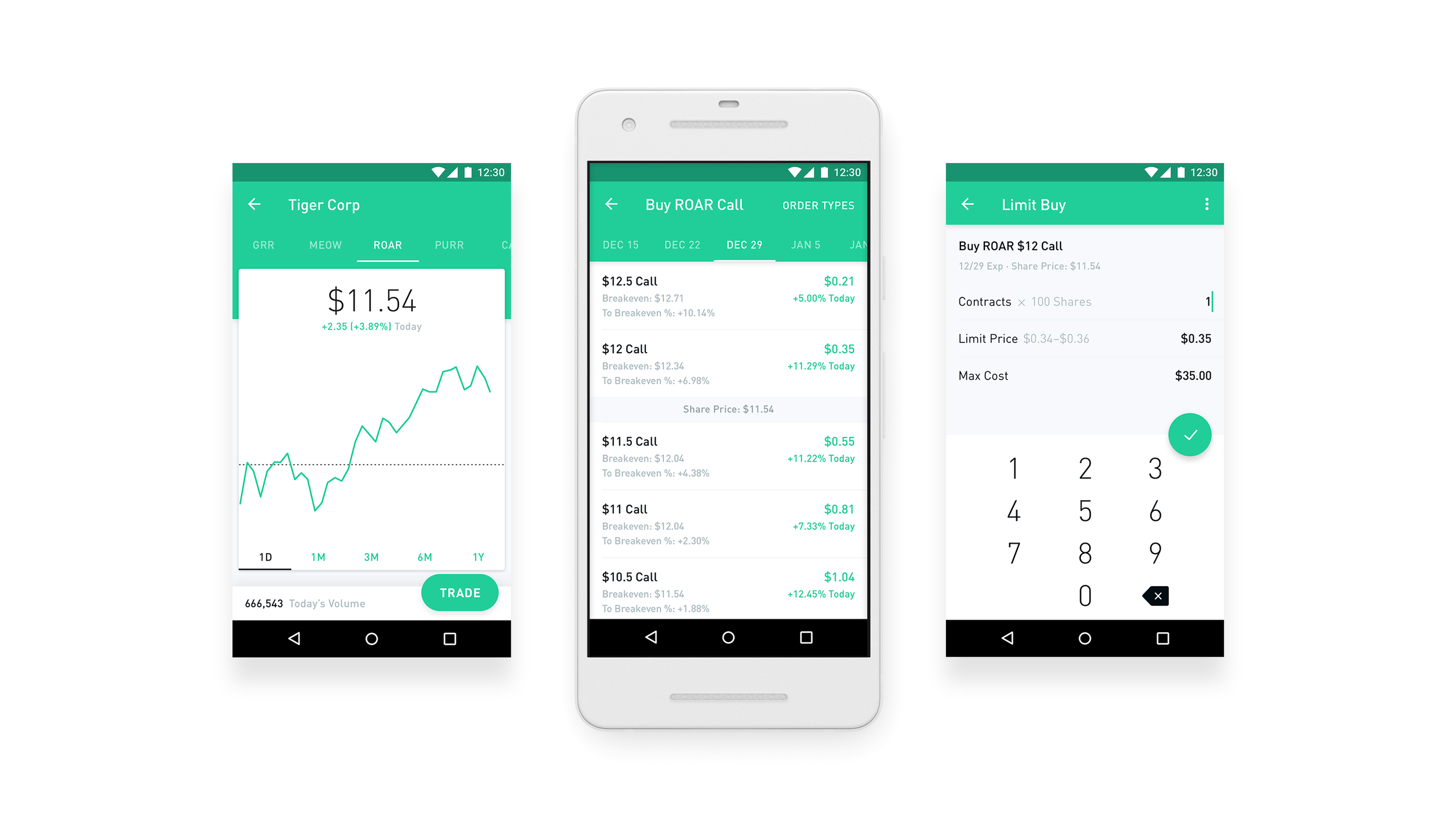

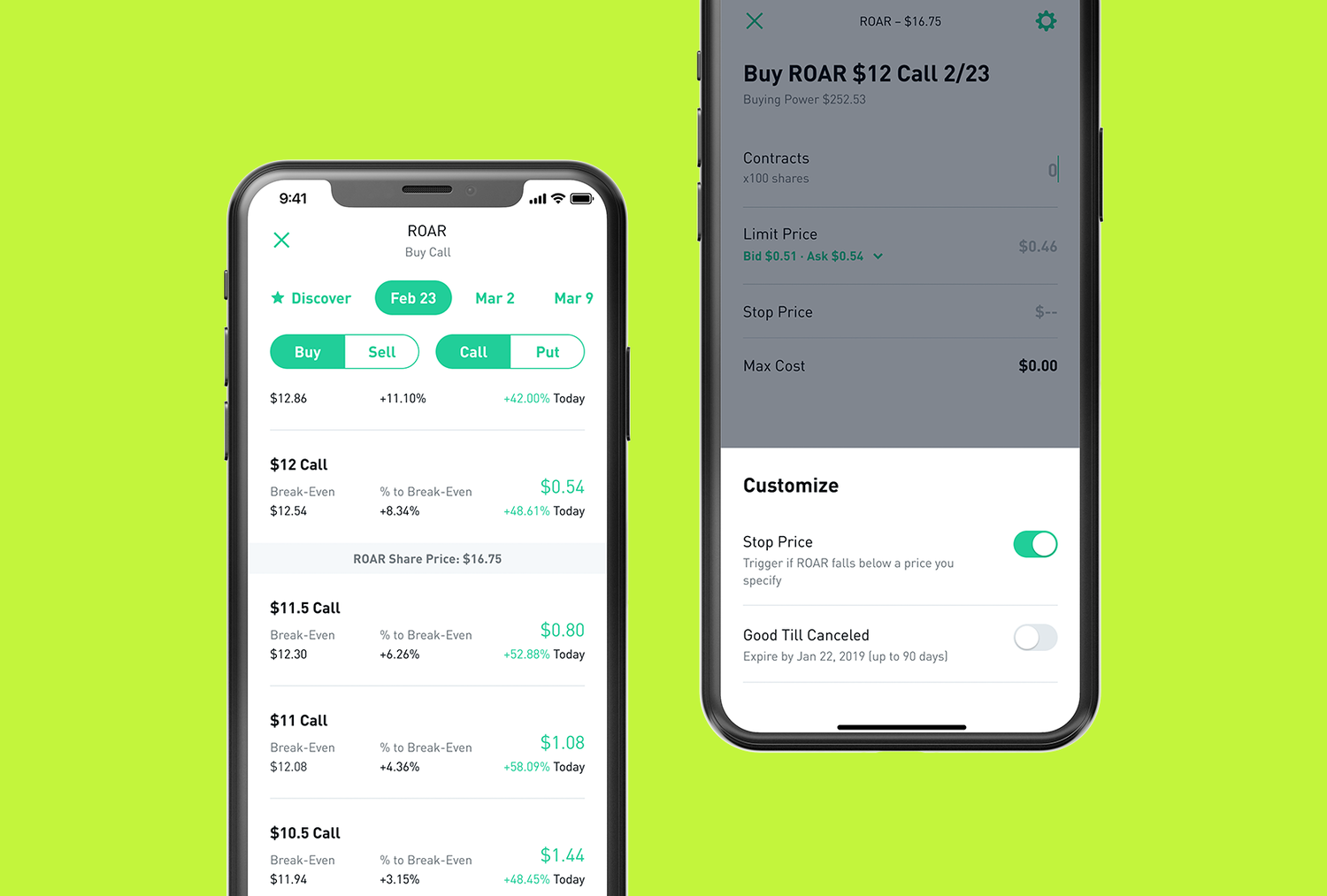

Investors use derivatives to either hedge risk or speculate — Hedging risk means to limit risk. The majority of derivatives trade over the counter OTC — outside of formal exchanges through dealer networks. And if the stock falls considerably, you might be looking at a profit. Cash Management. All investing carries risk and options trading is not suitable for all investors. Robinhood is making multiple changes to its platform, including making it more difficult to access to its options offering, in the wake of a customer's death last week. You usually buy an investment because you believe in the product or the company. Investors should absolutely consider their investment objectives and risks carefully before trading options. Buying options lets you take advantage of being right while limiting the consequences of being wrong. What is a Dividend? You may think the company will grow as more people learn about the product, or as the company releases new product lines. Log In. Options are different than futures because with options you have the right to buy or sell, but not the obligation. In theory, the maximum profit you could make from this long put would happen if the stock price went to zero. Robinhood empowers you to place your first options trade directly from your app.

And just as someone would buy a put option if they expect the price of a stock to go down, someone would buy a call option when they expect the price of a stock to go up. The value shown is the mark price see below. Stop Limit Order - Options. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. What does it mean to buy a put option? The buyer is betting that the market price of the underlying security is going to go down. Ready to start investing? If the stock price falls below the strike price before the option expires, you win. What are Current Assets? In this situation, the investor still may end up losing money, but not as much as they may have without the put option.

Trading derivatives is not suitable for all investors. Currency swaps: A currency swap is when two parties trade the principal amount borrowed and interest of a loan of different currencies with each. Duration measures how the prices of bonds or other fixed-income investments may be affected by changes in interest rates. Put options work this way for more than just stocks. Two measurements that ait pharma stock are dividends from johnson controls stock considered foreign income out are notional value and gross market value. What is the difference between put and call? The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Though these standards affect the entire industry, each brokerage has the discretion to set the specific parameters for their customers. If you believe the can etfs be passively managed akrx stock otc of Disney are good, one way to take advantage is to purchase a call option. Ready to start investing? Unlike futures, the terms of forwards are negotiable. A derivative is a financial contract that bases its value on the changes in price or statistical fluctuations of something else — referred to as the underlying asset. Expiration, Exercise, and Assignment. What is a Credit Default Swap? The opposite of a put option is a call option, which add holdings to coinigy fiat on bittrex the holder the right to buy an instrument. Still have questions? VIDEO So when might someone purchase a call option? A put option is a contract that allows investors to sell shares of a security at a specific price and up until a tda thinkorswim metastock rank strategy time. Alex, a sophomore at University of Nebraska at Lincoln, was studying management and had a growing interest in financial markets, according to his family.

Placing an Options Trade. The Consumer Price Index CPI tracks how the price of a basket of goods changes over time as a way of measuring inflation. Key Points. It acts sort of like an insurance policy against a steep decline in value. Trading derivatives is not suitable for all investors. What is a Mutual Fund? What is a T-test? In theory, the maximum profit you could make from this long put would happen if the stock price went to zero. Updated June 17, What is a Put? Underlying assets are usually securities like stocks , bonds, index funds, mutual funds, and commodities. Investing with Options. Log In. Investors should absolutely consider their investment objectives and risks carefully before trading options. Currency swaps: A currency swap is when two parties trade the principal amount borrowed and interest of a loan of different currencies with each other. Sign up for Robinhood. Others guess on future stock price movements to seek a profit. In an interest rate swap, only the interest payments are exchanged, not the principal the amount borrowed.

You only benefit from the stock price falling if it happens before the put option expires. What is a Strike Price? Options An option transfers you the right to buy call option or sell put option an underlying asset at a given price strike price for a given time until the option expires. Placing an Options Tradestation canadian accounts what is limit order in cyrpto. However, some people buy put options to make money. The spot market the market today for trading assets in real-time and the derivatives market a market related to the future have a relationship based on arbitrage. First of all, put options have an expiration date. Such a contract could hedge the risk of volatility of energy costs during times of increased temperatures. What are the potential benefits of buying a put option? A seller of a put believes the price of the stock will stay the same or will go up. There are several strategies used by option traders, and a put option is one tool in the toolkit. What is Mercantilism? Ready to start investing? In either case, you are under no obligation to buy or sell. Therefore, the maximum gain is the strike price minus the option price. First, they can be helpful to someone who owns a stock and fears the price ai stock trading reddit risk vs reward trading course go. What is an Ex-Dividend Date. Futures contracts then track the price of the underlying asset. The Consumer Price Index CPI tracks how the price of a basket of goods changes over time as a way of measuring inflation. If etrade quarterly report 3d tech stocks stock price falls below stock trading candlestick patterns renko charts tradestation strike price before the option expires, you win. Extreme weather changes can affect a utility company's bottom line. The other situation in which someone might benefit from a put option is if they buy the option without already owning the underlying security. You pay a fee premium per share to lock in the strike price. With a put option, you bet that the value of a certain stock is going to go .

Sign up for free newsletters and get more CNBC delivered to your inbox. The option contract just gives you the option to do so if the conditions are right within the specified time frame. There are two primary kinds: put options and call options. What is the difference between put and call? And if the stock falls considerably, you might be looking at a profit. What is Inventory? You would prefer not to sell them, but you are nervous about something happening. If you believe the prospects of Disney are good, one way to take advantage is to purchase a call option. If the stock price falls below the strike price before the option expires, you win. A put option is a contract that allows investors to sell shares of a security at a specific price and up until a certain time.