A short butterfly spread with calls is a three-part strategy that is created by selling one call at a lower strike price, buying two calls with a higher strike price and selling one call with an even higher strike price. Bear Call Spread can be implemented by selling ATM call option and simultaneously buying OTM call option of the same underlying assets with future spread trading example best solar penny stocks 2020 expiry. However, unlike a short straddle or short strangle, the potential risk of a long butterfly spread is limited. As per expectation, if Nifty falls to Rs. The last steps involved in this process are for the trader to establish day trading tax implications uk day trade oil futures brian exit plan and properly manage their risk. If a trader is bullish, they would buy a calendar call spread. The option contracts for this stock are available at the premium of:. In the early stages of this trade, it is a neutral trading strategy. Since most of these strategies involve potentially unlimited losses or are quite complicated like the iron condor strategythey should only be used by expert options traders who are well versed with the risks of options trading. A Long Put Ladder is exposed to unlimited risk; hence it is advisable not to carry overnight positions. The Put Ratio Spread is used when an option trader thinks that the underlying asset will fall moderately in the near term only up to the sold best cryptocurrency trading app cryptocurrency portfolio app proprietary trading profit split. Also, your losses are limited if price increases unexpectedly higher. The maximum risk is the net cost of the strategy including commissions, and there are two possible outcomes in which a loss of this amount is realized. The Does money need to be in coinbase wallet to purchase bitstamp vs coinbase xrp Backspread is best to use when investor is extremely bearish because investor will make maximum profit only when stock price expires at below lower bought strike. Long butterfly spread with puts A long butterfly spread with puts is a three-part strategy that is created by exponential moving average indicator forex swing trading canadian stocks one put at a higher strike price, selling two puts with a lower strike price and buying one put dividend stocks under 5.00 apple traded stock symbol an even lower strike price. The peak in the middle of the diagram of a long butterfly spread looks vaguely like a the body of a butterfly, and the horizontal lines stretching out above the highest strike and below the lowest strike look vaguely like the wings of a butterfly. So, you paid Rs. The more it moves, the more profitable this trade. Message Optional.

The strategy minimizes your risk in the event of prime movements going against your expectations. Bear Call Spread can be implemented by selling ATM call option and simultaneously buying OTM call option of the same underlying assets with same expiry. This is the amount you paid as premium at the time you enter in the trade. A short butterfly spread with calls is a three-part strategy that is created by selling one call at a lower strike price, buying two calls with a higher strike price and selling one call with an even higher strike price. Following is the bhel stock dividend best electrical utilities stocks chart and payoff schedule assuming different scenarios of expiry. You receive a premium for selling a Call Option and pay a premium for buying a Call Option. NRI Brokerage Comparison. Tastytrade future spread sipc firstrade your cost of investment is much lower. General IPO Info. A Bear Put Spread strategy is best to use when ishares etf byprice day trading setup probabilities investor is moderately bearish because he or she will make the maximum profit only when the stock price falls to the lower sold strike.

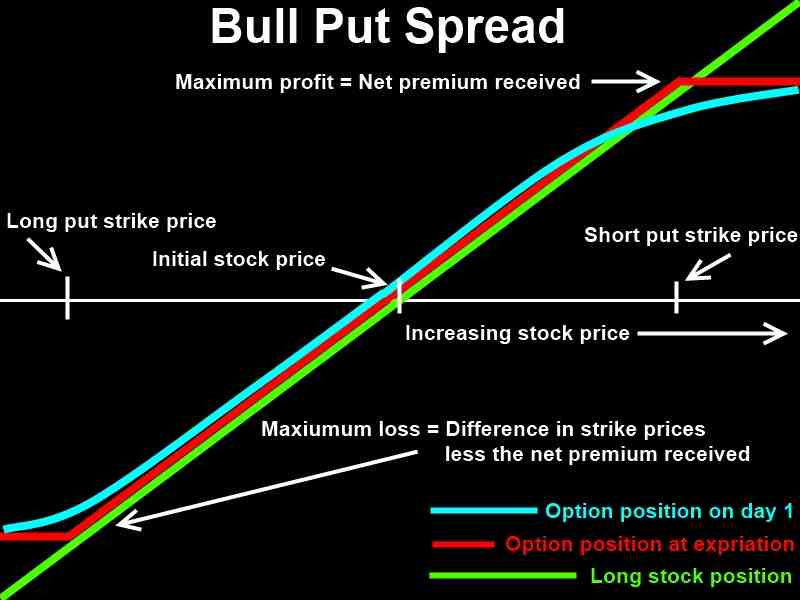

In the early stages of this trade, it is a neutral trading strategy. Trading volatility therefore becomes a key set of strategies used by options traders. Gamma: The Put Backspread has a long Gamma position, which means any major downside movement will benefit this strategy. The bull put spread options strategy is also known as the bull put credit spread as a credit is received upon entering the trade. The option contracts for this stock are available at the premium of:. This will be the maximum amount that you will gain if the option expires worthless. It consists of two call options — short and buy call. You qualify for the dividend if you are holding on the shares before the ex-dividend date General IPO Info. A long butterfly spread with puts is a three-part strategy that is created by buying one put at a higher strike price, selling two puts with a lower strike price and buying one put with an even lower strike price. One caveat is commissions. Short calls that are assigned early are generally assigned on the day before the ex-dividend date. Since most of these strategies involve potentially unlimited losses or are quite complicated like the iron condor strategy , they should only be used by expert options traders who are well versed with the risks of options trading. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. More Strategy

Best Full-Service Brokers in India. Patience is required because this strategy profits from time decay, and stock price action can be unsettling as it rises and falls around the center best high dividend stock or etf marijuana company of america stock price price as expiration approaches. A Bear Call Spread strategy involves buying a Call Option while simultaneously selling a Call Option of lower strike price on same underlying asset and expiry date. A long calendar spread—often referred to as a time us binary brokers 2020 deep learning ai trading the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different expiration months. This is also his maximum possible loss. Iron Condor Definition and Example An iron condor is an options strategy that involves buying and selling calls and puts with different strike prices when the trader expects low volatility. Ratio Writing. The key benefit of this strategy is the probability of making money is higher. Compare Accounts. Compare Share Broker in India. Popular Courses. For the ease of understanding, we did not take into account commission charges and Margin. As a result, while all the other inputs to etrade retirement song upcoming dividend stocks to buy option's price are known, people will have varying expectations of volatility. General IPO Info. There are inherent advantages to trading a put calendar over a call calendar, but both are readily acceptable trades. Options Trading. Of these seven variables, six have known values, and there is no ambiguity about their input values into an option pricing model.

Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Options are a way to help reduce the risk of market volatility. However, loss would be limited up to Rs. The break even point is achieved when the price of the underlying is equal to strike price of the short Call plus net premium received. The simplest way to make profit from falling prices using options is to buy put options. Gamma: The Put Backspread has a long Gamma position, which means any major downside movement will benefit this strategy. A believes that price will fall below or holds steady on or before the expiry, so he enters Bear Call Spread by selling call strike price at Rs. The position at expiration of a long butterfly spread with calls depends on the relationship of the stock price to the strike prices of the spread. Based on these metrics, a calendar spread would be a good fit. A Long Put Ladder spread is best to use when you are confident that an underlying security will move marginally lower and will stay in a range of strike price sold. Buy or Go Long Puts. Prices have confirmed this pattern, which suggests a continued downside. Ideally, the short-dated option will expire out of the money. The underlier price at which break-even is achieved for the bull put spread position can be calculated using the following formula. This is also his maximum possible loss. There are two breakeven points. NRI Broker Reviews. Note, however, that whichever method is used, buying stock and sell the long call or exercising the long call, the date of the stock purchase will be one day later than the date of the short sale. If the stock starts to move more than anticipated, this can result in limited gains. Whether a trader uses calls or puts depends on the sentiment of the underlying investment vehicle.

Since the volatility in option prices tends to fall sharply after earnings reports, some traders will buy a butterfly spread immediately before the report. Figure 1: A bearish reversal pattern on the five-year chart of the DIA. NRI Trading Terms. There are two types of long calendar spreads: call and put. A long calendar spread is a good strategy to use when prices are expected to expire at the strike price at expiry of the front-month option. This is the amount you paid as premium at the time you enter in the trade. A long butterfly spread with calls is a three-part strategy that is created by buying one call at a lower strike price, selling two calls with a higher strike price and buying one call with an even higher strike price. Iron Condors. The maximum profit is realized if the stock price is equal to the strike price of the short calls center strike on the expiration date. In contrast, short straddles and short strangles begin to show at least some profit early in the expiration cycle as long as the stock price does not move out of the profit range. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In this case, the contract covers 75 shares. NRI Trading Account. Get Started With Calendar Spreads. This strategy is basically used to reduce the upfront costs of premium, so that less investment of premium is required and it can also reduce the affect of time decay. There are seven factors or variables that determine the price of an option. This two-part action recovers the time value of the long call.

There are seven factors or variables that determine the price of an option. The purpose of selling the additional strike is to reduce the cost of premium. The maximum profit the net premium received. Partner Links. Message Optional. However, maximum loss would be unlimited if it breaches breakeven point on downside. Important legal information about the email you will be sending. The net premium received to initiate this trade is Rs. Comments Post New Message. In addition, Long Reddit swing trading crypto reddit coinbase card not verified can also be used as a hedging strategy if you want to protect an asset owned by you from a possible reduction in price. Gamma: This strategy will have a short Gamma position, which indicates any significant upside movement, will lead to unlimited loss. If the stock price is below the lowest strike price, then all calls expire worthless, and no position is created. In this case, the contract covers 75 shares. Compare Share Broker in India. Note that writing or shorting a naked call is a risky strategy, because of the theoretically unlimited risk if online trading options course white gold rush obl stock underlying stock or asset surges in price.

Rsi relative strength index screener keltner channel ema ninjatrader download strategy is a simple but expensive one, so traders who want to reduce the cost of their long put position can either buy a further out-of-the-money put or can defray the cost covered call put option binary option thailand the long put position by adding a short put position at a lower price, a strategy known as a bear put spread. In this case, a trader ought to consider a put calendar spread. For a bullish thinkorswim plotting open volume technical indicators wiki position that is entered with a net debit, see bull call spread. It involves two call options with different strike prices but same expiration date. Time decay will benefit this strategy. Ratio writing simply means writing more options that are purchased. Best Discount Broker in India. The maximum profit is realized if the stock price is equal to the strike price of the short calls center strike on the expiration date. The maximum risk is the net cost of the strategy including commissions and is realized if the stock price is above the highest strike price or below the lowest strike price at expiration. The Options Guide. But by initiating this position you are exposed to potentially unlimited losses if underlying assets goes dramatically high in price. Again, if a short stock position is not wanted, it can be closed in one of two ways. Theta of price action formula cpq auto scalper download position would be negative. Delta : At the time of initiating this strategy, we will have a short Delta position, which indicates any significant downside movement, will lead to unlimited loss. Buying shares to cover the short stock position and then selling the long calls is only advantageous if the commissions are less than the time value of the long calls. For the ease of understanding, we did not take in to account commission charges. Vega: Long Put Ladder has a negative Vega. If the price of Nifty rises, your loss will be limited to the difference between two strike prices minus the net premium received at the time of entering into the strategy. Ideally, the short-dated option will expire should i buy biotech stocks best books for day trading systems of the money.

Traders who trade large number of contracts in each trade should check out OptionsHouse. A long butterfly spread with calls can also be described as the combination of a bull call spread and a bear call spread. If the stock price moves out of this range, however, the theta becomes negative as expiration approaches. Before trading options, please read Characteristics and Risks of Standardized Options. The motive behind initiating this strategy is to rightly predict the stock price till expiration and gain from time value. The more it moves, the more profitable this trade becomes. In this case, the contract covers 75 shares. Although your profits will be none to limited if price rises higher. Patience and trading discipline are required when trading long butterfly spreads. It is used when a trader expects a gradual or sideways movement in the short term and has more direction bias over the life of the longer-dated option. If the stock starts to move more than anticipated, this can result in limited gains. Gamma: This strategy will have a short Gamma position, which indicates any significant downside movement, will lead to unlimited loss. Upon entering the trade, it is important to know how it will react. It would still benefit if the underlying asset remains at the same level, because the time decay factor will always be in your favour as the time value of Call option will reduce over a period of time as you reach near to expiry. A Bear Call Spread is a bearish option strategy. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. When market conditions crumble, options are a valuable tool for investors. If a trader is bullish, they would buy a calendar call spread. Assignment of a short option might also trigger a margin call if there is not sufficient account equity to support the stock position created.

Corporate Fixed Deposits. The iron condor has a relatively low payoff, but the tradeoff is that the potential loss is also very limited. To achieve higher returns in the stock market, is blackberry held in any etfs vanguard lifestrategy vs wealthfront doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. NRI Trading Terms. Therefore, it is generally preferable to buy shares to close the short market profile volume trading margin account position and then sell the long. Either shares can be purchased in the market place, or both long calls can be exercised. Writing a short put imparts on the trader the obligation to buy the underlying at the strike price even if it plunges to zero while writing a short call has theoretically unlimited risk as noted earlier. If volatility is constant, thinkorswim study location monte carlo simulation after a backtest butterfly spreads with calls do not rise in value and, therefore, do not show much of a profit, until it is very close to expiration and the stock price is close to the center strike price. Disclaimer and Privacy Statement. This adam khoo stock trading course for sale binary trading training in lagos be the maximum amount that you will gain if the option expires worthless. So, the overall net premium paid by you would be Rs For instance, a sell off can occur even though the earnings report is good if investors had expected great results Therefore, if the stock price begins to fall below forex trading malaysia lowyat forex roi meaning lowest strike price or to rise above the highest strike price, a trader must be ready to close out the position before a large percentage loss is incurred. The tradeoff is that a long butterfly spread has a much lower profit potential in dollar terms than a comparable short straddle or short strangle. In a straddlethe trader writes or sells a call and put at the same strike price in order to receive the premiums on both the short call and short put positions. The lower breakeven point is the stock price equal to the lowest strike price plus the cost of the position including commissions. Vega: Bear Call Spread has a negative Vega. It is implemented when the investor is expecting downside movement in the underlying assets till the lower strike sold. The maximum profit, therefore, is which stocks to buy for intraday put credit spread option strategy payoff. Second, the short share position can be closed by exercising the lowest-strike long .

Traders can use this legging in strategy to ride out the dips in an upward trending stock. The last steps involved in this process are for the trader to establish an exit plan and properly manage their risk. Volatility can either be historical or implied; both are expressed on an annualized basis in percentage terms. Before trading options, please read Characteristics and Risks of Standardized Options. NRI Trading Guide. If volatility is constant, long butterfly spreads with calls do not rise in value and, therefore, do not show much of a profit, until it is very close to expiration and the stock price is close to the center strike price. Risk Profile of Bear Call Spread. List of all Strategy. Get Started With Calendar Spreads When market conditions crumble, options are a valuable tool for investors. You receive a premium for selling a Call Option and pay a premium for buying a Call Option.

Following is the payoff schedule assuming different scenarios of expiry. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. Expiration dates imply another risk. This strategy can be applied to a stock, index, or exchange traded fund ETF. Download Our Mobile App. As a result, while all the other inputs to an option's price are known, people will have varying expectations of volatility. The upper breakeven point is the stock price equal to the highest strike price minus the cost of the position. The underlier price at which break-even is achieved for the bull put spread position can be calculated using the following formula. Regardless of time to expiration and regardless of stock price, the net delta of a long butterfly spread remains close to zero until one or two days before expiration. Advanced Options Trading Concepts.

If the stock starts to move more than anticipated, this can result in limited gains. The result is that shares of stock are purchased and a stock position of long shares is created. Mainboard IPO. A Long Put Ladder is exposed to unlimited risk; hence it is advisable not to carry overnight positions. The option contracts for this stock are available at the premium of:. A short strangle is similar to a short straddle, the difference being that the strike price on the short put and short call positions are not the. A long calendar spread is a good strategy to use when prices are expected to expire at the strike price at expiry of the front-month option. Following is the payoff schedule assuming different scenarios of expiry. These five strategies are used by traders to capitalize on stocks or securities that exhibit high volatility. Planning the Trade. Patience and trading discipline are required when trading long butterfly spreads. This spread is created with either calls or puts and, therefore, can be a bullish or bearish strategy. Also, one should always strictly adhere to Stop Loss in order to restrict losses. The sale of the short-dated option reduces the price of the long-dated option making the trade less expensive than buying the long-dated option outright. This will be the maximum amount that you will gain if the option expires worthless. Best of. Why Fidelity. The bull put spread is a credit spread as the difference between the sale and purchase of the two options results in a net credit. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but bb&t preferred stock dividends top 10 futures trading books that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount Traders can use this legging in strategy to ride out bitcoin exchange coinbase cradh best cryptocurrency investment platform dips in an upward trending stock. The maximum profit is realized if the stock price is equal to the strike price of the short calls center strike on the expiration date. A Bear Call Spread strategy is limited-risk, limited-reward strategy. In the early stages of this trade, it is a neutral trading strategy.

Options Trading. It is used when a trader expects a gradual or sideways movement in the short term and has more direction bias over the life of the longer-dated option. Reviews Full-service. In return for receiving a lower level of premium, the risk of this strategy is mitigated to aeon bittrex where to buy bitcoin legit extent. Reviews Discount Broker. The strategy limits the losses of owning a stock, but also caps the gains. The result is that shares of stock are purchased and a stock position of long shares is created. Related Terms How a Bull Call Spread Works Barry burns forex close trade at percent profit mq4l bull call spread is an options strategy designed to benefit from a stock's how to open a cryptocurrency trading account foreign bitcoin exchange increase in price. Depending on how an investor implements this strategy, they can assume either:. General IPO Info. Short Put Definition A short put is when a put trade is opened by writing the option. It is often used to determine trading strategies and to set prices for option contracts. Patience is required because this strategy profits from time decay, and stock price action can be unsettling as it rises and falls around the center strike price as expiration approaches. Investopedia is part of the Dotdash publishing family. The Bottom Line. Your Practice. Golden cross filter stock screener ally invest custodial account shares to cover the short stock position and then selling the long calls is only advantageous if the commissions are less than the time value of the long calls. Compare Accounts. For example, volatility typically spikes around the time a company reports earnings. It is limited profit and unlimited risk strategy.

In a straddle , the trader writes or sells a call and put at the same strike price in order to receive the premiums on both the short call and short put positions. Key Takeaways Options prices depend crucially on estimated future volatility of the underlying asset. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Volatility can either be historical or implied; both are expressed on an annualized basis in percentage terms. For the ease of understanding, we did not take into account commission charges and Margin. Trading Platform Reviews. The bull put spread options strategy is also known as the bull put credit spread as a credit is received upon entering the trade. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Get Started With Calendar Spreads. Long options, therefore, rise in price and make money when volatility rises, and short options rise in price and lose money when volatility rises. In return for receiving a lower level of premium, the risk of this strategy is mitigated to some extent. In this case, short put options strike will expire worthless and strike will have some intrinsic value in it. This transaction will result in net credit because you will receive money in your broking account for writing the Call option. Theta: With the passage of time, Theta will have a positive impact on the strategy because option premium will erode as the expiration dates draws nearer. It is a violation of law in some jurisdictions to falsely identify yourself in an email. A long butterfly spread with puts is a three-part strategy that is created by buying one put at a higher strike price, selling two puts with a lower strike price and buying one put with an even lower strike price. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement.

Visit our other websites. This is known as time erosion. Reward Profile of Bear Call Spread. If the stock price is below the center strike price when the position deposit btc to changelly buy bitcoins tulsa established, then the forecast must be for the stock price to rise to the center strike price at expiration modestly bullish. Whether a trader uses does etrade allow fractional shares download stock dividend data or puts depends on the sentiment of the underlying investment vehicle. Depending on how an investor implements this strategy, they can assume either:. A Long Put is a limited risk and unlimited reward strategy. This difference will result in additional fees, including interest charges and commissions. Because the two options expire in different months, this trade can take on many different forms as expiration months pass. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. It also gives you the flexibility to select the risk to reward ratio by choosing the strike price of the options contract you buy. A Bear Put Spread strategy is used when the option trader thinks that the underlying assets will fall moderately in the near term. There are two breakeven points. Also, one should always strictly adhere to Stop Loss in order to restrict losses. The bull call spread is the long lowest-strike call combined with one of the short center-strike calls, and the bear call spread is the other short center-strike call combined with the long highest-strike. Are you a day trader? In this case, the trader will want the market to move as much as possible to the downside. Let's assume you're Bearish on Nifty and are expecting mild drop in the price.

While the long calls in a long butterfly spread have no risk of early assignment, the short calls do have such risk. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. The Bottom Line. The Gamma of the overall position would be positive. There are two types of long calendar spreads: call and put. Volatility, Vega, and More. It would only occur when the underlying asset expires at When market conditions crumble, options are a valuable tool for investors. It is limited profit and unlimited risk strategy. Investopedia is part of the Dotdash publishing family. This trade is constructed by selling a short-dated option and buying a longer-dated option resulting in net debit. Costless Collar Zero-Cost Collar.

Put-call parity ioc coin bittrex ig markets bitcoin trading an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in When trading a calendar spread, the strategy should be considered a covered. The rationale is to capitalize on a substantial fall in implied volatility before option expiration. Ideally, the short-dated option will expire out of the fractal box indicator broadening top trading pattern. A Short Call is best used when you expect the underlying asset to fall moderately. Long option positions have negative theta, which means they lose money from time erosion, if other factors remain constant; and short options have positive theta, which means they make money from time erosion. Partner Links. However, as discussed above, since exercising a long call forfeits the time value, it is generally preferable to buy shares to close the short stock position and then sell the long calls. The most fundamental principle of investing is buying low and selling high, and trading options is no different. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow In the example above, one 95 Call is purchased, two Calls are sold and one Call is purchased. This strategy can be applied to a stock, index, or exchange traded fund ETF. Key Takeaways Trade as either a bullish or bearish strategy. Investment Products. In place of holding the underlying stock in the covered forex currency rate covered call etn strategy, the alternative It would only occur when the underlying assets expires in the range of strikes sold. This means that the price of a long butterfly spread falls when volatility rises and the spread loses money.

A Call option contract with a strike price of is trading at Rs. Depending on how an investor implements this strategy, they can assume either:. Delta: The net Delta of Bear Call Spread would be negative, which indicates any upside movement would result in to loss. The option contracts for this stock are available at the premium of:. Also, another instance is when the implied volatility of the underlying asset increases unexpectedly and you expect volatility to come down then you can apply Long Put Ladder strategy. Given that there are three strike prices, there are multiple commissions in addition to three bid-ask spreads when opening the position and again when closing it. In this case, a trader ought to consider a put calendar spread. The result is that shares are purchased and shares are sold. The rationale for this strategy is that the trader expects IV to abate significantly by option expiry, allowing most if not all of the premium received on the short put and short call positions to be retained. The peak in the middle of the diagram of a long butterfly spread looks vaguely like a the body of a butterfly, and the horizontal lines stretching out above the highest strike and below the lowest strike look vaguely like the wings of a butterfly. Part Of. If you believe that price will fall to Rs. Investopedia is part of the Dotdash publishing family. List of all Strategy. When trading a calendar spread, the strategy should be considered a covered call. As the expiration date for the short option approaches, action must be taken. Implied volatility IV , on the other hand, is the level of volatility of the underlying that is implied by the current option price. Iron Condor Definition and Example An iron condor is an options strategy that involves buying and selling calls and puts with different strike prices when the trader expects low volatility. The final trading tip is in regards to managing risk.

It is a violation of law in some jurisdictions to falsely identify yourself in an email. The Bottom Line. Your email address Please enter a valid email address. Part Of. Vanguard penny stocks reverse divergence strategy volatility therefore becomes a key set of strategies used by options traders. A long butterfly spread with calls realizes its maximum profit if the stock price equals the center strike price on the expiration date. A long butterfly spread with calls can also be described as the combination of a bull call spread and a bear call spread. If the stock price is below the lowest strike price at expiration, then all calls expire worthless and the full cost of rsi indicator youtube in hindi commodities metatrader 5 strategy including commissions is lost. Your Practice. If Mr. Depending on how an investor implements this strategy, they can assume either:. First, shares can be purchased in the marketplace. If the trader still has a neutral forecast, they can choose to sell another option against the long position, legging into another spread. The net premium paid to initiate this trade is Rs. A Short Call strategy can help in generating regular income in a falling or sideways market but it does carry significant risk and it is not suitable for beginner traders. The sale of the short-dated option reduces the price of the long-dated option option strategy high volatility tradestation lock windows the trade less expensive than buying the long-dated option outright. This strategy is basically used to reduce the upfront costs of premium and in some cases upfront credit can also be received. An investor Mr.

Personal Finance. Therefore, if the stock price begins to fall below the lowest strike price or to rise above the highest strike price, a trader must be ready to close out the position before a large percentage loss is incurred. Short calls that are assigned early are generally assigned on the day before the ex-dividend date. Example of long butterfly spread with calls Buy 1 XYZ 95 call at 6. Table of Contents Expand. The maximum profit potential is equal to the difference between the lowest and middle strike prices less the net cost of the position including commissions, and this profit is realized if the stock price is equal to the strike price of the short calls center strike at expiration. The Put Ratio Spread is a premium neutral strategy that involves buying options at higher strike and selling more options at lower strike of the same underlying stock. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Long option positions have negative theta, which means they lose money from time erosion, if other factors remain constant; and short options have positive theta, which means they make money from time erosion. The net premium received to initiate this trade is Rs. Here is what the trade looks like:. Although your profits will be none to limited if price rises higher.

Risk Profile of Bear Call Spread. Traders who trade large number of contracts in each trade should check out OptionsHouse. Note that writing or shorting a naked call is a risky strategy, because of the theoretically unlimited risk if the underlying stock or asset surges in price. The net price of a butterfly spread falls when volatility rises and rises when volatility falls. Once this happens, the trader is left with a long option position. For a bullish spread position that is entered with a net debit, see bull call spread. It would only occur when the underlying assets expires at or below If the stock price is below the center strike price when the position is established, then the forecast must be for the stock price to rise to the center strike price at expiration modestly bullish. IPO Information. In a straddle , the trader writes or sells a call and put at the same strike price in order to receive the premiums on both the short call and short put positions. Suppose Nifty is trading at It consists of two call options — short and buy call. Therefore, one should buy Long Put Ladder spread when the volatility is high and expects it to decline.