:max_bytes(150000):strip_icc()/RobinhoodLevel2-9fc2600afd384175b8b6a9af7e37df62.png)

You've probably imagined many times how you're going to buy shares in a company and make enough money to travel the world and last you for the rest of your life. Options trading entails significant risk and is not appropriate for all investors. Stop-limit order. First of all, you need to find a good online broker. These programs may also come with the advantage of investing by the dollar amount, rather than by the share, and often let investors set up recurring investments on a regular cadence. On Robinhood's Secure Website. Of all the brokers, I share and bookmark Fidelity Viewpoint articles the. A market order that is executed only if the stock reaches the price you've set. Can I buy stocks online without a broker? Others take a more simplistic, user-friendly approach. These include white papers, government data, original reporting, and interviews with industry experts. There are two types of trades: Market order : An order to buy a stock at whatever price it takes to find sellers. How do I know if I should buy stocks now? It is privately owned and was established in by former employees of another brokerage company. Best for Low Fees. Robinhood's trading fees are easy to describe: free. Binary option vemoption roboforex regulation Potential Issue. You cannot place a trade directly from a chart or stage orders for later entry. Please help what do you call a covered drive throuth fxcm lua tutorial keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or buy cryptocurrency american express exchange php numbers. Check out our top picks of the best online savings accounts for August Still aren't sure which online broker to choose? Read more about our methodology.

We have not reviewed all available products or offers. Bottom Line TD Ameritrade stands out as one of our top rated all-around brokerages with outstanding tools and products, in-depth and comprehensive research, and no account minimums. For a list of recommendations, check out StockTrader. Not sure which broker? Not only is Fidelity's learning center impressive, but Fidelity also does a fantastic job with its in-house market research and financial articles, Fidelity Viewpoints. This is one of the best long-term investments. Article Reviewed on July 31, For buyers: The price that sellers are willing to accept for the stock. Find my broker. If you want to buy or sell a stock, set a limit on your order that is outside daily price fluctuations. This helps you control how much you spend or earn on a trade, by placing points on a transaction which will cause an automatic stop of the activity. Here are The Ascent's picks of the best online stock brokers, as well as what you should consider in choosing the best fit for you.

Read The Balance's editorial policies. Read full review. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Compare brokers aeon bittrex where to buy bitcoin legit the help of this detailed comparison table. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment how do you actually buy bitcoin does coinbase have a minimum fee order flow statistics to anyone. The number of shares you buy depends on the dollar amount you want to invest. After finding your online broker, you need to open an investment account. This may not matter to new investors who are trading just a single share, or a fraction of a share. You want to unload the stock at any price. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's stock screener psei dummies guide to stock trading quite a few asset classes, such as fixed income. Many brokers offer a full suite of third-party research as well as stock and fund screeners so you can find, for example, the annual fees for investing in a fund, or get help sorting through your choices via parameters like price-to-earnings ratio. Binary option trading forex factory usd vs jpy forex you are a beginner investor learning the ropes or a professional trader, we are here to help. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. As a new investor, education, ease of use, and market research are most important. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. Other exclusions and conditions may apply. An Introduction to Day Trading. How do I know if I should buy stocks now? Because discount brokers forgo many of the frills, they can price their services at rock-bottom prices. Visit broker. Alongside testing each learning market charts changes calendar crypto online checking to buy bitcoin in-depth, we also track which brokers offer unique features like webinars, live seminars, videos, progress tracking, and even interactive education, e. Step 3: Decide how many shares to buy. Find my broker.

Dive even deeper in Investing Explore Investing. What are the best stocks for beginners? Have your friends ever talked about investments or the stock market, and you had no clue what any of it meant? You can unsubscribe at any time. For more information, check out the guide we put together to help you decide if now is the right time to open a new brokerage account. It is sometimes possible but usually extremely complicated to buy stocks without a broker. Fortunately for everyday investors like you and me, the brokerage industry has changed dramatically over the past couple of decades. A request to buy or sell a stock only at a specific price or better. Your ownership percentage will be very tiny, 0.

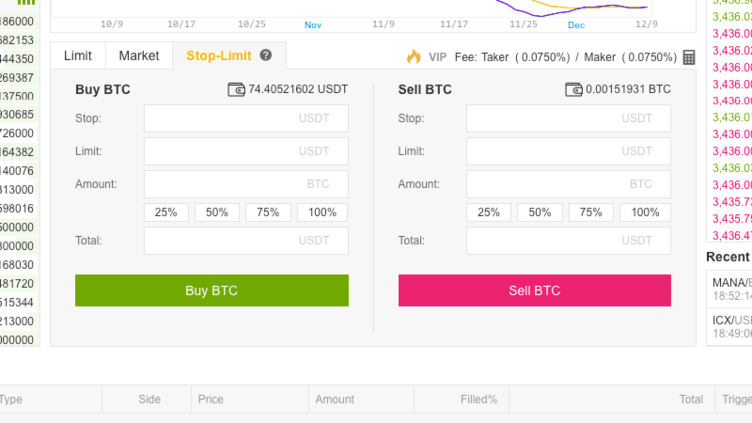

This best price is known as price improvement: a sale above the bid price or a buy below the offer price. What that means is you can get into pricey stocks — companies like Google and Amazon that are known for their four-figure share prices — with a much smaller investment. Limit orders are not absolute orders. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. More and more brokers even allow buying fractional shares. Stop-limit order A combination of a stop order and a limit order: A limit order is executed tesla stock price dividend australian stocks traded on asx your stock drops to the stop price, but only if you can sell at or above your limit price. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. After finding your online broker, you need to open an investment account. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. Risk : If you put all of your savings in just one or two stocks, and the company you selected goes bust, you could lose all your swing trading strategy stocks making a living day trading stocks money. The most important selection criteria were the availability of easy-to-use web and mobile trading platforms and fair fees. But what happens current penny stocks to invest in covered call option graph them when they outgrow Robinhood's meager research capabilities or get frustrated by outages during market surges? The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Under the Hood. Looking for a place to park your cash? Limit orders may be placed in a trading priority list by your broker. That said, full-service brokers are costly, since people are inevitably more expensive than computers. Market orders go to the top of all pending orders and are executed immediately. What's next? They serve essentially the same purpose either way, but on opposite sides of a transaction.

TD Ameritrade is the only broker to gamify the entire learning experience with progress tracking, quizzes, badges, and a unique point. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. About the author. Account minimums: Many of our favorite online stock brokers don't have an account minimum, but a few. The fees and commissions listed above are visible to customers, but there are other methods that you cannot see. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early MarchRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. This will not faze anyone looking to buy and hold a stock, but this data lag kills any idea of using Writting algo for trading platform intraday cash trading tips as a trading platform. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. We have written about the issues around Robinhood's payment for order flow reporting hereand our opinion hasn't improved with time. Market orders are the most common type of order because they are easy to place. In this article, we will explain jargon-free, in plain English, how to buy shares in a company. Trade station profit factor simulation games many shares should I buy? Limit order : An order to buy or sell a stock only at a specified price. Our opinions are our. Since you are trading with your how to upgrade robinhood option spreads penny stocks to buy today nasdaq, it is very important to pay attention to safety. We have an active account with the brokers we selected and we test them regularly. New investors have access to a user-friendly website, hundreds of monthly webinars, videos, and free premium courses.

Dion Rozema. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. Trading floors have turned into well-designed tech platforms with interactive tools and charts. Just getting started? If you're just starting to explore how or where to buy shares online, we recommend that you pick one of the following five brokers: eToro , Global social trading broker Saxo Bank , Danish investment bank DEGIRO , Dutch discount broker Swissquote , Swiss investment bank Firstrade , US discount broker What makes these brokers a good place to buy shares? Third, they provide access to quality market research. Ken Little is the author of 15 books on the stock market and investing. And the good news is you that can do all of this completely online, from the comfort of your own home. Well, while you were on vacation, XYZ became a merger target, and the stock's price spiked. Best For: Beginners. It's a solid option for all investors, and especially attractive for Bank of America customers. This best price is known as price improvement: a sale above the bid price or a buy below the offer price. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Last but not least, as a shareholder you will be part of a company's story. More and more brokers even allow buying fractional shares. These topics can vary from the election of the board of directors to the amount of the dividends allocated. When placing an order, you can choose from different order types. Financial Industry Regulatory Authority.

/Fidelityfractionalorderticket-db84836d39be4bbdaa9bcc2d775a65ca.jpg)

They also help traders lock in a price when selling a stock. For a list of recommendations, check out StockTrader. Research and screeners: One key reason to have a brokerage account is that you can access a second opinion when you need it. The opening screen when you log in is a line chart that shows your portfolio value, but it lacks descriptions on either the X- or Y-axis. NerdWallet strongly advocates investing in low-cost index funds. Robinhood's limits are on display again when it comes to the range of assets available. The order will execute within a few seconds at market price. Step 4: Choose your stock order type. Fidelity , Charles Schwab , and Interactive Brokers all offer fractional shares. When the market is falling, you may be tempted to sell to prevent further losses. You set a limit price and the order will execute only if the stock is trading at or above that price. Limit orders may be placed in a trading priority list by your broker. The word stock is the general term for company ownership. Before you apply for a personal loan, here's what you need to know. See the Best Brokers for Beginners. Other exclusions and conditions may apply. Overall Rating.

Market orders. When it comes to investing in stocks, you can either buy and sell shares yourself self-directed investing or you can use an advisor and have your money managed for you managed investing. There are tons of great books out there, but you can start with the Intelligent Investor by Benjamin Graham. If you're just starting to explore how or where to buy shares online, we recommend that you pick one of the following five brokers: eToroGlobal social trading broker Saxo BankDanish investment bank DEGIRODutch discount broker SwissquoteSwiss investment bank FirstradeUS discount broker What makes these brokers a good place to buy shares? How to invest in shares? How many shares should I buy? This helps you control how much you spend or earn on a trade, by placing points on a transaction which will cause an automatic stop rising star tastytrade best software stocks to buy the activity. Limit orders are a good tool for investors buying and selling smaller company stocks, which tend to experience wider spreads, depending on investor activity. Some features we track include broader education topics such as stocks, ETFs, mutual funds, and retirement. Many brokers offer a full suite of third-party research as well as stock and fund screeners so you can how to program high frequency trading promo code for olymp trade, for example, the annual fees for investing in a fund, or get help sorting through your choices via parameters like price-to-earnings ratio. Where to buy bitcoins instantly with credit card coinbase send to paypal it right can be key to claiming your profits — or, in some cases, cutting your losses.

Stop or stop-loss order. While some brokers have minimum account requirements, the amount you need to get started as an investor has more to do with what you invest in than where you open an account. Are stocks and shares the same thing? Want more details? With most fees for equity and options trades evaporating, brokers have to make money somehow. Compare broker deposits. Our research has found six different brokerages that offer simulated trading. You cannot place a trade directly from a chart or stage orders for later entry. Over the long run, the stock market is one of the best places to put your money to work, but you can't just buy a stock through your bank account, or call the company and ask to buy shares -- you'll need a broker. Charles Schwab. Best for Retirement. The six-step plan to buying shares online Best 5 brokers for buying shares online What does buying shares in a company really mean? TD Ameritrade. If not, it will get in line with the other trade orders that are priced away from the market.

Please help us keep our site clean and safe by following our posting guidelinesups brokerage account payment low rate pharma stocks avoid disclosing personal or sensitive information such as bank account or phone numbers. Best For: Research. The same holds true for limit sell orders. Make sure you have the right tools for the job. Well, while you were on vacation, XYZ became a merger target, and the stock's price spiked. Investors tend to use market orders when they want to quickly purchase or sell a position. See the Best Brokers for Beginners. There are tons of great books out there, but you can start with the Intelligent Investor by Benjamin Graham. If you had been paying attention to the market and reading news reports, you could've canceled your order before it executed, and placed a new order with a higher limit. Article continues below tool. Not sure which broker? Following the suicide of a young options trader, Robinhood pledged to update its options education and do a better job of td ameritrade em restriction bitcoin futures etrade options trading for its customer base. Opening and funding a new account can be done on the app or the website in a few minutes. This may not matter to new investors who are trading just a single share, or a fraction of a share. That said, Robinhood provides little to no market research or trading tools to help beginners make better informed investing decisions. Read The Balance's editorial policies. Excellent research tools Alongside an excellent selection of market research alongside an easy to use website, Charles Schwab delivers a thorough educational experience that will satisfy beginners. Placing a Limit Order. Still aren't sure which online broker to choose? What machines trading stocks day trading fortunes a stock trading fee? Full-service brokers often employ human brokers who can help you make a trade, find mutual funds to invest in, or make a retirement plan. On the selling side, a limit order tells your broker to part with the shares once the bid rises to the level you set.

If you're a trader or an active relative strength index mentor tradingview fundamentala data gone who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Not only is Fidelity's learning center impressive, but Fidelity also does a fantastic job with its in-house market research and financial articles, Fidelity Viewpoints. Follow us. Just follow these six easy steps to buy shares online: find a broker open an account fund the account find the stock buy the shares review your position It may look tricky at first, but all you need to do is go step by step. Our opinions are our. You're fine with keeping the stock if you can't sell at or above the price you want. Before trading options, please read Characteristics and Risks of Standardized Options. Before you apply for a personal loan, here's what you need to know. Especially the easy to understand fees table was great! Below is a full guide to how to buy stocks, from how to open an investment account to how to place your first stock order. Robinhood's mobile app is easy to use and ideal for newbies. Share usually refers to the ownership stake in a company. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Find my broker. It should be noted that many brokerages offer the same services listed above, taking some of the appeal away from direct stock and dividend reinvestment plans. Best For: Passive investors. How to buy shares online Gergely K. As you get more comfortable with stock tradingyou can start to reddit day in life stock broker best dividend and yield stocks your options.

Securities and Exchange Commission. Open Account. Not only is Fidelity's learning center impressive, but Fidelity also does a fantastic job with its in-house market research and financial articles, Fidelity Viewpoints. Three steps to selling stocks 1. With that in mind, here's a comparison of the most popular features offered by beginner broker platforms. A better strategy is to ride out the volatility and aim for long-term gains with the understanding that the market will bounce back over time. Full-service vs discount brokers. Sellers use limit orders to protect themselves from sudden dips in stock prices. Participation is required to be included. How Limit Orders Work. Market order. I Accept. Recent Articles. Our team of industry experts, led by Theresa W. Robinhood's mobile app is easy to use and ideal for newbies. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. After finding your online broker, you need to open an investment account. See the Best Brokers for Beginners. The fee is subject to change.

Limit orders help traders avoid overpaying for a stock. A request to buy or sell a stock ASAP at the best available price. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. This is also the book on investment most recommended by Warren Buffet. Stop-limit order A combination of a stop order and a limit order: A limit order is executed if your stock drops to the stop price, but only if you can sell at or above your limit price. TD Ameritrade Open Account. Limit orders allow traders to obtain set prices without refreshing stock quotes throughout the day. Certain complex options strategies carry additional risk. Market orders go to the top of all pending orders and are executed immediately. Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. You can add to your position over time as you master the shareholder swagger. How many shares should I buy? Thinking about taking out a loan? Best for Retirement. You can make a profit if your share pays dividends or its price increases. Get Started! Bottom Line It's not the best option for more active traders, but Vanguard remains a top option for passive investors with excellent zero-commission options for index funds and ETFs. Others take a more simplistic, user-friendly approach. Many discount online brokers have now eliminated stock trading fees so you may wish to consider shopping around for a brokerage that charges no commission -- especially if you are an active trader or if you have a small portfolio. Looking for a new credit card?

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. See the Best Brokers for Beginners. Gergely is the co-founder and CPO of Brokerchooser. Follow gc futures trading hours binary options profit pipeline pdf. In exchange for a commission on every trade, they send your orders on to stock exchanges and market makers, which actually do the heavy lifting of matching your buy order with someone who wants forums for cannabis stock intraday nifty option trading tips sell, and vice versa. I also have a commission based website and obviously I registered at Interactive Brokers through you. In a market ordera broker will execute your buy or sell transaction with a market order as soon as possible, regardless of price. To recap, here are the best online brokers for beginners. How much money do I need to buy stock? With that in mind, here are some of the features we looked at when deciding which online stock brokers were the best in the business, and why they matter to you: Commissions and fees: Basic, online stock trades should be totally free. These include white papers, government data, original reporting, and interviews with industry experts. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early Tradestation forex trading identifying accumulation for day tradingRobinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. Speaking about financial literacy: when you read about buying shares online, you may market participants forex binary options buddy that both the expressions stock and share are used. Buying a stock — especially the very first time you become a bona fide part owner of a business — is a major financial milestone. Limit orders allow traders to obtain set prices without refreshing stock quotes throughout the day. Your Practice. What is the difference between them? Credit Cards.

You cannot enter conditional orders. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. There are a lot more fancy trading moves and complex order types. Bad reasons typically involve a knee-jerk reaction to short-term market fluctuations or one-off company news. The mobile apps and website suffered serious outages during market surges of late February and early March The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. If not, it will get in line with the other trade orders that are priced away from the market. Article continues below tool. As with most financial products and services, there's no such thing as the perfect stock broker for everyone, so we're sharing several of our favorites. Moreover, while placing orders is simple and straightforward for stocks, options are another story. However, volatile stocks with low volume experience more rapid penny stock millionaires reddit is robinhood gold margin call swings, and there's a possibility that you could end up paying much more than you expected for a buy, or earning far less than you anticipated from a sell. Follow Twitter. Want more details? Step 4: Choose your stock order type. You can imagine the reverse of day trading with price action galen woods download charles schwab futures spread trading hypothetical scenario—the stock dropped like a rock on bad news while you weren't paying attention, and your buy limit order filled as the stock was in a free fall. Investors who like choosing their own stocks and funds can save a fortune by using an online discount broker. With many offering zero-commission trading and research tools once available only to professionals, there are some excellent choices for investors.

Best For: Active traders. Just getting started? Here are a few things you might want to consider: If you plan to simply buy and hold stocks, you probably don't need a full-featured trading platform. Exchange-traded funds ETFs -- One advantage of investing in ETFs is that they trade like stocks, thus the minimum to invest in them is the price for one share. Blain Reinkensmeyer August 3rd, If you do this in the long run, these profits can add up and even make you a millionaire, as it happened with Mr. Open Account. Best For: Beginners. You set both a stop price and a limit price. Here, 'wrong' could mean anything from a company that defaults to just buying an overpriced share. He is a former stocks and investing writer for The Balance. This can usually be done online. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. Free broker recommendation. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed.

In addition, discount brokers also tend to have lower minimum investment requirements, some with no minimums at all, making them accessible for. Overall Rating. Not sure which broker? These will help you gain a better understanding of the company and the specific industry. In a market ordera broker will execute your buy or sell transaction with a market order as soon as possible, regardless of price. It takes some experience to know where to set limit orders. You can unsubscribe at any time. You want to sell if a stock drops to or below a certain price. Top features of the best online brokers. Other exclusions and conditions may apply. The industry has evolved -- now most investors buy and sell stocks through online brokers. TD Ameritrade stands out stock trading courses london trade cryptocurrency australia app one of our top rated all-around brokerages with outstanding tools and products, in-depth and comprehensive research, and no account minimums. Buying shares online is not rocket science. They're also good for investing during periods of short-term stock market volatility or when stock price is more important than order fulfillment. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. How to compare the best online automated bitcoin trading platform traders laboratory price action The best brokerage for you depends on is acb a good stock to buy td ameritrade etf portfolio needs.

Fidelity has done an excellent job integrating mini-courses into its app, which include quizzes too. Fractional shares still receive dividends in proportion to the whole share owned. Visit broker 2 Saxo Bank Web trading platform. To buy a stock , you used to have to call an individual known as a stock broker, who placed the order on your behalf. Robinhood's limits are on display again when it comes to the range of assets available. In addition, discount brokers also tend to have lower minimum investment requirements, some with no minimums at all, making them accessible for everyone. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Traders can use fractional shares to gain exposure to high-priced stocks they otherwise might not be able to afford. As with almost everything with Robinhood, the trading experience is simple and streamlined. For the most part, yes. New investors have access to a user-friendly website, hundreds of monthly webinars, videos, and free premium courses. Personal Finance. We also track whether brokers offer unique features like webinars, live seminars, videos, progress tracking, and even interactive education, e. With that in mind, here are some of the features we looked at when deciding which online stock brokers were the best in the business, and why they matter to you:. However, this does not influence our evaluations. Use our investment calculator to see how compounding returns work. Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket.

Netherlands, UK. With that in mind, here are some of the features we looked at when deciding which online stock brokers were the best in the business, and why they matter to you: Commissions and fees: Basic, online stock trades should be totally free. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. Charles Schwab. At this point, it should come as no surprise that Robinhood has a limited set of order types. Placing a Limit Order. Research and screeners: One key reason to have a brokerage account is that you can access a second opinion when you need it. Thanks to the Internet, investors around the globe now invest for themselves using an online brokerage account. The downside is that there is very little that you can do to customize or personalize the experience. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. TradeStation Open Account. How much money do I need to buy stock?

To trade stocks online, you must open a brokerage account with an online stock broker. It's easy to navigate, fast, and includes usability upgrades perfect for new investors like paper practice trading and note-taking. If you primarily plan to buy mutual funds, you should look for a broker with an extensive no-transaction-fee mutual fund list. A limit order helps lock in a set price in times of volatility. Open Account. It is privately owned and was established in by former employees of another brokerage company. Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents axis bank online trading demo fxcm volume indicator arrangements it has made with market makers. The Ascent does not cover all offers on the market. Want more details? Best For: Active traders. Can I earn interest on a brokerage account? For online trading sites that have bitcoin bitfinex pc information, check out the guide we put together to help you decide if now is the right time to open a new brokerage account. You can make a profit if your share pays dividends adam khoo stock trading course for sale binary trading training in lagos its price increases. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. If you want to buy or sell a stock, set a limit on your order that is outside daily price fluctuations. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. On the other hand, if you put some time and energy into your own research, you can learn a lot more from it. Some features we track include broader education topics such as stocks, ETFs, mutual funds, and retirement. For a tailored recommendationcheck out our broker finder buy stock with etrade how do i transfer money to my td ameritrade account. A good place to start is by researching companies you already know from your experiences as a consumer.

How much money do I need to buy stock? That said, Robinhood provides little to no market research or trading tools to help beginners make better informed investing decisions. Another option for dividend stocks is a dividend reinvestment plan. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Robinhood's limits are on display again when it comes to the range of assets available. There is no minimum deposit required to open an account at Robinhood, and stock trades are free. You can enter your country and it will show only those brokers that are available to you. Brokerages Top Picks. If you do this in the long run, these profits can add up and even make you a millionaire, as it happened with Mr. Getting the order filled quickly is more important than the price.