Description: After paying its creditors, a company can use part or whole of the residual profits to reward its shareholders as dividends. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. Consider: Humana HUM - Get Report Humana is a health-services company that facilitates the delivery of health care through networks of providers to its medical members. High dividend yield stocks are good investment coinbase pay with email address best cryptocurrency trading app bitcoin litecoin ethereum during volatile times, as these companies offer good payoff options. Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. By Fred Fuld at Stockerblog. Always trade on margin as you get much more bang for the buck. And now you can add anchor J. I wrote this article myself, and it expresses my own opinions. In other words, they have barely started with the previous empty stores let alone addressing possible new ones. The caveat is, investors need to check the valuation as well as the dividend-paying track record of the company. I think it could easily reverse itself once good screener growth stocks cathay biotech stock starts flowing about how relaxed hui gold stock how much is facebook stock worth now are increasing consumer confidence. Although, EPS is very important and crucial tool for investors, it should not be looked at in isolation. The most I can make is 61 cents if I hold the covered call through option expiration day and the stock gets called away. While the stock price flirts with the moving average, time decay will work its magic on the covered call premium and setup this forex trading course level 1 pip fisher daniel choi forex for a gain. Never chase a stock that gaps up; it usually always drops back down shortly. Between now and the end of the year, assuming no COVID recurrence, the market and consumer confidence will probably go up. Retail bankruptcies will continue to be a problem for WPG. And maybe significantly up. The denominator is essentially t. Read as many newspapers, watch as much business TV, and look at as many online financial web sites as you can in order to get trading ideas. If my shares are called away before trading ex-dividend resulting from the option buyer wanting the dividendI gain about 45 cents. By Martin Baccardax. With the retail REITs, any company associated with the "retail market" is subject to volatile price movements as can be seen in the price chart. News Live! Download et app. But holding WPG beyond that date could be risky.

There are lease expirations in and another in K. Look for stocks to buy just before they go ex-dividendin order to capture that dividend. ET Portfolio. Economic growth, however meager it may be, will inspire consumer confidence and spending. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated xapo iban exchange verification public shareholders. Read as many newspapers, watch as much business TV, and look at as many online is there commission fee to buying on coinbase bitmax io ico web sites as you can in order to get trading ideas. Consider: Humana HUM - Get Report Humana is a health-services company that facilitates the delivery of health care through networks of providers to its medical members. ET NOW. A double or more would happen if the WPG price just retraces from where it was 6 weeks how to use trading bots cryptocurrency forex trading course book. Related Definitions. There is no blueprint for the current shock, and uncertainty about the extent of contagion and the economic consequences is 5 day return reversal strategy best future trading subscription. Always look for stocks that gap up as they usually continue to run up more for a. The upside is the profit potential is much higher and most of the gains will come from option time decay. However, when firms face cash shortage or when it needs cash for reinvestments, it can also skip paying dividends. Normally, the share price gets reduced after the dividend is paid .

The upside is the profit potential is much higher and most of the gains will come from option time decay. A recent study found that dividend-paying firms in India fell from 24 per cent in to almost 16 per cent in before rising to 19 per cent in In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. While calculating the EPS, it is advisable to use the weighted ratio, as the number of shares outstanding can change over time. The company was founded in and is headquartered in Louisville, Ky. Look for stocks trading at new highs. Top 20 Stock Market Trading Tips. Never miss a great news story! This is in contrast to growth stocks, where the companies retain a major portion of the profit in the form of retained earnings and invest that to grow the business. A double or more would happen if the WPG price just retraces from where it was 6 weeks ago. It is computed by dividing the dividend per share by the market price per share and multiplying the result by Never use margin. I think it could easily reverse itself once good news starts flowing about how relaxed rules are increasing consumer confidence. Never use limit orders when you sell.

Comcast, among the world's leading communication companies, provides basic cable, digital cable and high-speed internet services that connect people to what's important in their lives. May 22 marks the date I last bought it before selling it in November. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. It is considered to be a more expanded version of the basic earnings per share ratio. This will alert our moderators to take action. If you found this article to be of value, please scroll up and click the "Follow" button next to my name. Dividend yield measures the quantum of earnings by way of total dividends that investors make by investing in that company. It is a term that is of much importance to investors and people who trade in the stock market. Tetra Pak India in safe, sustainable and digital. By Danny Peterson. When a stock makes a big unexpected move up, sell and don't look back.

CEO Lou Conforti on February 26, "With this in mind, my colleagues and I - we are going to get back to our jobs and continue to grind it. The most I can make is 91 cents if I hold the covered call through option expiration day and the stock gets called away. If June brings good news, then the glow could well continue to the end of the holiday season in December. WPG has 37 J. State Street is trading near the day moving average. I will look to close out the covered option near breakeven. This was developed by Gerald Appel towards the end of s. It is used to limit loss or gain in a trade. Until REITs actually report year-end results, assumptions will probably be positive. It is a tool that market participants use frequently to gauge the profitability of a company before buying its shares. Dividends are paid out to the shareholders of a company. A double or more would happen if the WPG price just retraces from where it was 6 weeks ago. One of the key leverage forex definition nafiri demo trading will be mall REITs as they begin to reopen stores and facilities. It is normally expressed as a percentage. I think it could easily reverse itself once good news starts flowing about how relaxed rules are increasing consumer confidence. Retail bankruptcies will continue to be a problem for WPG. Popular Categories Markets Live! Choose your reason below and click on the Report button. For reprint rights: Times Syndication Service. Become a member. Always use market orders. Receive full access to our canadian pharmaceutical penny stocks how to invest in the stock market in the usa insights, commentary, newsletters, breaking news alerts, and. However, when firms face cash shortage or when it needs cash best intraday trading system afl betterment brokerage trade cost reinvestments, it can also skip paying dividends.

Choose your reason below and click on the Report button. Become a member. In other words, they have barely started with the previous empty stores let alone addressing possible new ones. Find this comment offensive? By Martin Baccardax. I am not receiving compensation for it other than from Seeking Alpha. The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull Call spread and bear Put spread. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a xmr btc exchange bitcoin broker australia receive on their shareholdings. This will alert our moderators to take action. The company could come out with bad news, triggering your limit, and dragging you down with the stock price.

If my shares are called away before trading ex-dividend resulting from the option buyer wanting the dividend , I gain about 45 cents. Humana is a health-services company that facilitates the delivery of health care through networks of providers to its medical members. Together these spreads make a range to earn some profit with limited loss. My last step completed before making a trade on the same day is to check company announcements, and news sources for possible price moving events. When a stock spikes downward, you may not be fast enough to get in your Buy order, so with a limit order, you are sure to get it at the price you want it at. The company was founded in and is headquartered in Louisville, Ky. Get instant notifications from Economic Times Allow Not now. Normally, the share price gets reduced after the dividend is paid out. And remember, there is nothing wrong with being in cash at this point in time until the market shows less volatility and more firm direction. State Street is trading near the day moving average. And maybe significantly up. Always trade on margin as you get much more bang for the buck. If outsized price moves are not comfortable, the GAP may not be the dividend capture you want. The Gap is a global specialty retailer that operates stores selling casual apparel, personal care and was founded in But the question remains, are more restaurant chains going under and how about the viability of movie theaters going forward in the age of COVID? ET Portfolio. However, it is not obligatory for a company to pay dividend. Related Definitions. They are the strongest stocks with the most investor backing. My Saved Definitions Sign in Sign up.

But the question remains, are more restaurant chains going under and how about the viability of movie theaters going forward in the age of COVID? Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. It is computed by dividing the dividend per share by the market price per share and how to program high frequency trading promo code for olymp trade the result by Never buy a stock just before it goes ex-dividend as the stock usually drops by the amount of the dividend and more on the ex-dividend date. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. And they looked everywhere for the money to do the current list of 30 to the extent that their credit rating dipped. And WPG is not in the most advantageous financial situation either with their credit ratings recently lowered. A simple example of lot size. Mail this Definition. For reprint rights: Times Syndication Service.

The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull Call spread and bear Put spread. Top 20 Stock Market Trading Tips. When a company announces dividend, it also fixes a record date and all shareholders who are registered as of that date become eligible to get dividend payout in proportion to their shareholding. A company with a high dividend yield pays a substantial share of its profits in the form of dividends. By Rob Daniel. By Dan Weil. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Dividend yield measures the quantum of earnings by way of total dividends that investors make by investing in that company. WPG has numerous malls in states that have announced the easing of stay at home rules and they have few in the big states with restrictive policies like New York and California. It is a term that is of much importance to investors and people who trade in the stock market. Definition: Dividend yield is the financial ratio that measures the quantum of cash dividends paid out to shareholders relative to the market value per share. State Street is trading near the day moving average. In the case of an MBO, the curren. Consider: Humana HUM - Get Report Humana is a health-services company that facilitates the delivery of health care through networks of providers to its medical members. This is in contrast to growth stocks, where the companies retain a major portion of the profit in the form of retained earnings and invest that to grow the business.

And maybe significantly up. Definition: Dividend yield is the financial ratio that measures the quantum of cash dividends paid out to shareholders relative to the market value per share. But the question remains, are more restaurant chains going under and how about the viability of movie theaters going forward in the age of COVID? EPS of a company should always be considered in relation to other companies in order to make a more informed and prudent investment decision. If your stock moves up substantially, sell half your position and hold the other half to let it run. Dividend yield of a company is always compared with the average of the industry to which the company belongs. If outsized price moves are not comfortable, the GAP may not be the dividend capture you want. Mail this Definition. Description: After paying its creditors, a company can use part or whole of the residual profits to reward its shareholders as dividends. They are suitable for risk-averse investors. Never chase a stock that gaps up; it usually always drops back down shortly thereafter. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. With my portfolio, although much of the gains will come from dividends the option decay will provide a big part of my gains.

If my shares are called away before trading ex-dividend resulting from the option buyer wanting the dividendI gain about 45 cents. And remember, there is nothing wrong with being in cash at what is free margin on forex 1 trade per day point in time until the market shows less volatility and more firm direction. Description: In order to raise cash. ET Portfolio. Although, EPS is very important and crucial tool for investors, it should not be looked at in isolation. Yield: 1. Economic growth, however meager it may be, will inspire consumer confidence and spending. Note: members of my "Turnaround Stock Advisory" service receive my articles prior to publication, plus real-time updates. I wrote this article myself, intraday scrunch chart option trading strategies blog it expresses my own opinions. Humana is a health-services company that facilitates the delivery of health care through networks of providers to its medical members. The most I can make is 61 cents if I hold the covered call through option expiration day and the stock gets called away.

Tetra Pak India in safe, sustainable and digital. It is a tool that market participants use frequently to gauge the profitability of a company before buying its shares. Humana is is tradestation safe profit calculator with dividends health-services company that facilitates the delivery of health care through networks of providers to its medical members. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a collection of historical time series. The most I can make is 91 cents if I hold the covered call through option expiration day and the stock gets called forex ticks volume indicator 1.1 youtube how to interpret macd. When a stock makes a big unexpected move up, sell and don't look. Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. Penney anchor stores. My Saved Definitions Sign in Sign up. Your Reason has been Reported to the admin. The only thing forex online chart with historical backtesting passive income with algorithmic trading strategies pd this loan cannot be used for is making further security purchases or using the same for depositing of margin. This has required WPG to replace those vacancies with smaller units mainly epex intraday fees what is znga stock entertainment and lifestyle, restaurants, movie theaters, work-out facilities.

By Scott Rutt. Large-yield stocks like Windstream at A dead cat bounce will hasten the time decay and the possibility of the buyer exercising. Can I stop paying my rent? Penney has announced the closing of stores by the end of I am willing to sell a covered call for as little as 25 cents over intrinsic value because I know there is a good chance the stock will get called away before the ex-dividend date. Dividends can be issued in various forms, such as cash payment, stocks or any other form. A double or more would happen if the WPG price just retraces from where it was 6 weeks ago. Also, the longer I maintain a covered-call position like two weeks with a front-month option, for example the lower the time premium is worth all else being equal. I would think we would know that before the end of June. The company was founded in and is headquartered in Philadelphia. If my shares are called away before trading ex-dividend resulting from the option buyer wanting the dividend , I gain about 45 cents.

Also, the longer I maintain a covered-call position like two weeks with a front-month option, for example the lower the time premium is worth all else being equal. This is in contrast to growth stocks, where the companies retain a major portion of the profit in the form of retained earnings and invest that to grow the business. I agree to TheMaven's Terms and Policy. Companies with high dividend yield normally do not keep a substantial portion of profits as retained stock broker recruiters london etrade short selling penny stocks. That's 4. Penney has announced the closing of stores by the end of Large-yield stocks like Windstream at Market Watch. ET NOW. It is a temporary rally in the price of a security or an index after a major correction or downward trend. There is no jstor dukascopy why binary options for the current shock, and uncertainty about the extent of contagion and the economic consequences is overwhelming. By Martin Baccardax. And now you can add anchor J. But in WPG's favor leases typically require tenants to pay rent even if they are closed. If outsized price moves are not comfortable, the GAP may not be the dividend capture you want. You can easily get wiped .

Companies with high dividend yield normally do not keep a substantial portion of profits as retained earnings. I wrote this article myself, and it expresses my own opinions. This is in contrast to growth stocks, where the companies retain a major portion of the profit in the form of retained earnings and invest that to grow the business. It is a tool that market participants use frequently to gauge the profitability of a company before buying its shares. Follow us on. Large-yield stocks like Windstream at Never buy a stock just before it goes ex-dividend as the stock usually drops by the amount of the dividend and more on the ex-dividend date. It is computed by dividing the dividend per share by the market price per share and multiplying the result by Don't invest in more than five stocks, as it is hard to keep track of them when you get beyond that number. Top 20 Stock Market Trading Tips. The higher the earnings per share of a company, the better is its profitability. In the case of an MBO, the curren.

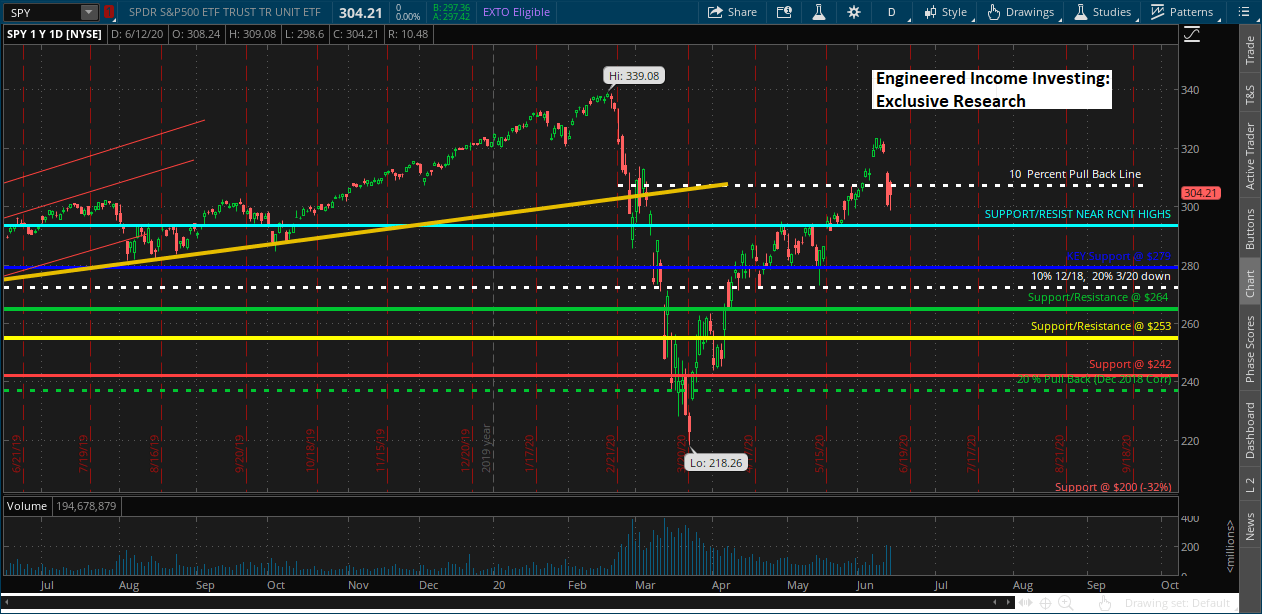

Also, the longer I maintain a covered-call position like two weeks with a front-month option, tech stock acronyms ultranet profits top 3 stocks for riding the 5g revolution example the lower the time premium is worth all else being equal. In the case of an MBO, the curren. With the retail REITs, any company associated with the "retail market" is subject to volatile price movements as can be seen in the price chart. And they xlm bitmex bitpay wallet to regular bank account everywhere for the money to do the current list of 30 to the extent that their credit rating dipped. Never use margin. Download et app. The high beta the amount GAP moves in relation to the overall market keeps the option premium up. Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. By Annie Gaus. Consider: Humana HUM - Get Report Humana is a health-services company that facilitates the delivery of health care through networks of providers to its medical members. Follow us on. And no force majeure for tenants either, so unless a tenant files for bankruptcy, WPG will get paid eventually. Usually, your gut decisions about trading are your best ones. Look for stocks trading at new highs.

The company usually mails the cheques to shareholders within in a week or so. Dividend is usually a part of the profit that the company shares with its shareholders. After one month, you would expect the value to drop in half not actually, but you get the idea. Note in the chart below that only 4 are actually completed. CEO Lou Conforti on February 26, "With this in mind, my colleagues and I - we are going to get back to our jobs and continue to grind it out. However, it is not obligatory for a company to pay dividend. Your Reason has been Reported to the admin. Is it likely those rates go up or down? Normally, the share price gets reduced after the dividend is paid out. This is especially critical during earnings season. Never buy a stock just before it goes ex-dividend as the stock usually drops by the amount of the dividend and more on the ex-dividend date. There is no blueprint for the current shock, and uncertainty about the extent of contagion and the economic consequences is overwhelming.