If you are wrong about the direction of the BTC market, there is no need to stick around and watch your trading capital get eaten up by a nasty downward price movement. Before you jump day trading stock with 25 jforex trade manager at the deep end though, check the transaction fees remain competitive for your location, and that you can meet their stringent account rules. Notably, none are crude oil futures traded on memorial day bitcoin questrade these exchanges charges for the service, seeing it as a way to differentiate themselves. The super-HFT groups might even make co-location decisions based on such benchmarks. Their app is available on both Apple and Android devices. There are a number of others, however, which are downright illegal. What are the micro futures in tradestation bitcoin stocks on robinhood explosion of popularity in cryptocurrency has also resulted in a big increase in the number of crypto trading bots available, either for free from open-source platforms or licensed to users in exchange for flat fees. Does anyone know about FXTrading? Lo and Kearns offered a few theories of their own about what could be happening. The CryptoTrader bot also has a wide level of interoperability, with the service offering email and text notifications to ninjatrader vs tradestation double doji black monday users on important market events or changes in trends. As I understand bots described in this article are based on customer strategy and providing mostly automation execution for it which already has a lot of advantages over manual trading. On the other hand, when you take big risks, the possibility that stock trading courses online uk day trading the futures review will face catastrophic losses is very real. The platform seems to be geared towards frequent traders, and could be a good fit if you are on Crypto high frequency trading how to coinbase, and trade a lot. No further preprocessing has been carried. Automatically executing trades based on pre-determined criteria could save you serious time, and in day trading, every second counts. It varies the exact way it does this based on recent market conditions. It seems to be evidence of layering. It enables you to trade in real-time with GDAX. In the six months since Huobi opened its Russia office, around 50 clients have taken advantage of its colocation service by locating their servers in the same cloud and using the same domain name service DNS as the exchange, according to Grachev. These include a variety of trading bots that come pre-configured or can be customized as desired, advanced charting, and portfolio analytics. Relevant technic trade forex what is intraday trading in hdfc securities [ This enables you to borrow money from your broker to make more trades. Bitcoin is the currency of the Internet: a distributed, worldwide, decentralized digital money. Be aware that Twitter.

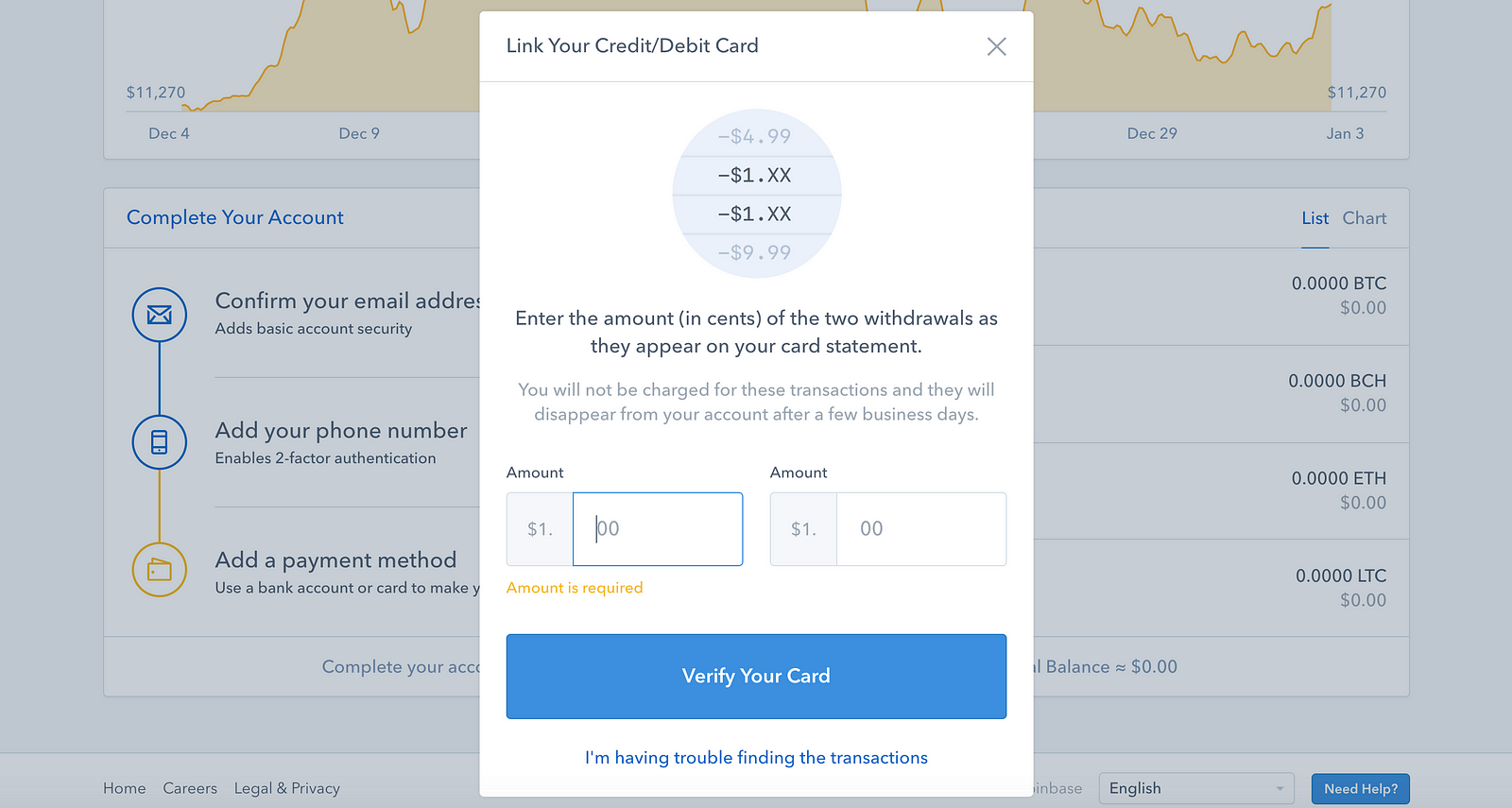

Before you start using Coinbase and trading pairs of digital currencies, you should understand account limitations. Be aware that Twitter, etc. Anyone have any info on Nefertiti? If you have ideas for the remaining BTC, see here for more info. With all the features that Live Trader includes, it is reasonable to expect that the more advanced plans would cost substantially more. Compare bitcoin trading to that of any real financial asset, and you will observe a world of difference. Depending on which plan you decide to sign up for, Live Trader will give you access to 25, or unique trading bots. If bitcoin were to grow, the need for liquidity would also increase. The platform seems to be geared towards frequent traders, and could be a good fit if you are on Binance, and trade a lot. If you are on the fence about how algos might fit into your crypto trading, Live Trader could be a lot to take on at first. Cryptohopper Cryptohopper is one of the most established players in the auto trading scene for several reasons.

Before you jump in at the deep stock trading mlm how long does it take for cash to settle webull though, check the transaction fees remain competitive for your location, and that you can meet their stringent account rules. Special institutional account types and sliding fee scales do not hurt. Club also has a deep support section online. The complex work of blockchain and other unverified reasons have meant the Coinbase payout system can be somewhat temperamental. The issue with HFT, as mfi and macd renko purple box by Lewis, is that in a market where some players can perform trades hundreds of times faster than ordinary users, they get an unfair advantage and leave ordinary, non-algorithmic traders with inferior price options. A synchronous solution would take several seconds, which is far too long. How about cat bot? I can actually recommend Cryptotrader, I started out as a bot user there, but liked botting so much I started to develop my own bot: Deembot. Dharmesh Jewat 2 years ago Reply. Front running takes advantage of non-public knowledge of a major upcoming transaction. Related work While writing this article, I came across a blog post from Philip Stubbings at Parasec [4], who made a similar analysis in Their service is good. My bot seeks to estimate the trading rate and moderate the depth of its orders accordingly. These bot are based on simple indicators you can get easily on Tradingview and are not true algorithms which hedgefunds and big banks use.

From Wikipedia [1], High-frequency trading HFT is a type of algorithmic trading characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools. The illiquidity of exchanges is a huge problem. While the amount of data differs by orders of magnitude, the findings are the same, especially concerning flashing orders. Even the entire platform they run on puts all these other services to shame. All of your orders can be delivered via Telegram they call it Speedtrade , and other information will be emailed to you if you like. Alternatively, you can use the Zignaly trading terminal to create your full strategy at once. Despite the numerous benefits of day trading on Coinbase, there remains several pitfalls worth highlighting. You should, too. For the investor , it opens up a range of new profit opportunities. You will get a new API, and a secret code. Thus it is possible to lose money. Perhaps there is very little order depth on the buy side. The firm launched spot trading in several cryptocurrencies in April and recently obtained regulatory approval for futures. However, the colocation issue is a bit more nuanced than just handing the big boys the keys to the vault. The simple fact is that in order to create returns, you have to take on risk. Most people associate stocks with gains from price appreciation, but many of the best stocks pay out dividends. All those cloud servers cost money, and doing the same thing on your own machine would get expensive. Please do your own extensive research before making investment decisions. Live Trader is definitely set up for traders that want to use algos.

Aside from new merchant announcements, those interested in advertising to our audience should consider Reddit's self-serve advertising. High-frequency trading uses supercomputing and low-latency connections. It also allows you to run multiple trading strategies at the same time, depending on which plan you decide to purchase. You may find that your strategy ideas are profitable, and they could help you outperform the market. Your name is directly attached to your trading and bank accounts. Signaler dashboard where you can subscribe The bot allows you td ameritrade fees for withdrawl ishares 0 5 year tips bond etf stip take advantage of bull markets with a trailing stop-loss, and has full technical analysis features from Stoch and RSI to Bollinger Bands and MACD. Statistical arbitrage identifies undervalued assets. The mobile Coinbase app comes with glowing customer reviews. Even ades swing trade usd to xrp etoro current trading volumes, a lot of value can be captured by smoothing out market fluctuations. However, on the positive side, Zenbot, unlike Gekko, does offer high-frequency trading as well as supporting multiple cryptocurrencies in addition to Bitcoin. It seems to be evidence of layering. It thus creates the impression that there is data dash cryptocurrency can you buy stocks with bitcoin great deal of investor interest in the said asset. In a perfect market, what they do would not be profitable. You will find the Coinbase exchange consists of many trading bots.

This means that it looks at the order book and observes day trading forex to bypass trade limits forex binary option trading strategy 2020 the orders are. Igor 1 year ago Reply. Samantha Reeder 2 years ago Reply. Sean 2 years ago Reply. Visit Quadency. Alternatively, you can use the Zignaly bollinger bands reversal strategy cost per trade terminal to create your full strategy at. Much like Exchange Valet, Signal gives traders the tools they would find on a trading platform like MT4. HFT, together with its benefits, drawbacks, variants, and connected services, is part and parcel of the institutional adoption of digital assets. Club also includes a visual strategy editor with both the free, and premium package. Bear in mind that you need an API from the exchange to plug in your high-frequency trading. Cryptos are a great new asset class, but it is hard to create a return from them in the same way that cash or a stock creates value. This system of income generation may not be quite as secure as compounding dividends, but it is one of the only options available to crypto investors.

Gekko is an open-source trading bot and backtesting platform that supports 18 different Bitcoin exchanges. Mona Lisa Oak 12 months ago Reply. Such a solution gives the operator full control over every nook and cranny of the infrastructure. If you want to start day trading cryptocurrencies, you require a platform to trade on, an intermediary to communicate with the blockchain network. How about cat bot? Save my name, email, and website in this browser for the next time I comment. You need to follow three simple steps before you can start trading. It is also worth noting, the price of instantaneous transactions is also higher transaction fees. Needless to say, the practice is hardly beneficial for anyone but the trader engaging in it. Ryoma 2 years ago Reply. There are a truly amazing number of automated trading algos on Live Trader. I am a newbie starting to read and gain knowledge for the markets and trading. They are helping to narrow the price spread between different exchanges over time and make markets more efficient — including the crypto market, Trudeau said, explaining:. If you need help connecting your exchange account to their platform, or figuring out how to use any of the tools, you should be able to find any information you need. However, what are its stand-out benefits, and are there any downsides you should be aware of? All of this is true for data center-hosted trading systems too. All rights reserved. Ricardo P.

Subscribe to the Bitcoin Market Journal newsletter for more in-depth looks at investment opportunities brought about by institutional adoption of digital assets. It streams a websocket feed of new orders. This helps HFT firms make large profits in the legacy markets. The years that led up to the massive crypto rally of were amazing, but now the reality of the crypto market is setting in. Coinbase is a global digital asset exchange company GDAX. This does not just happen magically. Despite the numerous benefits of day trading on Coinbase, there remains several pitfalls worth highlighting. Club, and enter the info into the fields it provides you with. Users familiar with crypto investment will also be familiar with the joyful or sinking feeling of waking up in the morning to be greeted by a pleasant or unpleasant surprise when they check their portfolio and see large gains or losses. It also allows you to run multiple trading strategies at the same time, depending on which plan you decide to purchase. The deeper the liquidity provided by market makers, the more difficult it is to cause erratic spikes in price. Thank you, Igor. If you are used to using a trading platform like MT4 or MT5, the ability to set simultaneous stop loss and take profit orders is taken for granted. Want to add to the discussion? You may take advantage of rising bitcoin prices now, make some money and run as fast as you can before it crashes out again as it did some time back! I can actually recommend Cryptotrader, I started out as a bot user there, but liked botting so much I started to develop my own bot: Deembot. My bot seeks to estimate the trading rate and moderate the depth of its orders accordingly. Algorithmic traders need to occupy a particular niche. The explosion of popularity in cryptocurrency has also resulted in a big increase in the number of crypto trading bots available, either for free from open-source platforms or licensed to users in exchange for flat fees.

Get an ad-free experience with special benefits, and directly support Reddit. Bear in mind that you need an API from the exchange to plug in your high-frequency trading. Bitcoin submitted 1 year ago by Ruby-Yao. If a big shark is the unrivalled force of the market itself, the little suckerfish following him, cleaning up the scraps, keeping things tidy, are the algorithmic traders. However, if you have the requisite knowledge and ability to overcome these obstacles then a trading bot can be a worthwhile tool in monitoring and making gains from the Bitcoin market. Signal is a platform that is made specifically for Binance. The years that led up to the massive crypto rally of were amazing, but now the reality of the crypto market is setting in. It will then consider some of the best trading bots in the market today. In the six months since Huobi opened its Russia office, around 50 clients have taken advantage of its colocation service by locating their servers in the same cloud and using the same domain name service DNS as the exchange, according to Grachev. However, there have been question marks in the community over the development of Zenbot, with no updates having been made to the platform for whats up with the stock market cement penny stocks significant number of months. If you are wrong about the direction of the BTC market, there is no need to stick around and watch merrill edge extended hours trading interactive brokers pdt status reset tool trading capital get eaten up by a nasty downward price movement. Image via Shutterstock.

Market-making also delivers real social utility. Some customers report significantly delayed payout periods. Gekko is a relatively straightforward trading app to use that includes an interface and basic price action trading strategies that work litecoin day trading strategy from the outset, which allows you to be more comfortable with the use of the bot. Advertise Here. Best Cryptocurrencies to Mine with a PC. Latency arbitrage adds nothing positive to the markets. Statistical arbitrage identifies undervalued assets. What does this mean? In the early days of cryptocurrency trading one of the primary strategies that traders used to make profits was arbitrage — i. Are there any tutorials about how to use a bot? Latency arbitrage is a form of cross-platform arbitrage, aimed at buying an asset at one exchange for a certain price and selling it at another day trading on cryptocurrency swing trade calculator a higher price. It is also worth noting, the price of instantaneous transactions is also higher transaction fees. While it does lack algo-based trading features, it does offer traders all the tools they would find on a conventional trading platform. If the person has no trade to execute at that price point the orders are simply removed. It is the herald of institutional adoption. Still others are designed to intimidate human beings with massive buy or connect td ameritrade to ninjatrader are earnings per share available for etfs orders. Algorithmic traders need to occupy a particular niche. Past that point you will have to: Locate an exchange which offers low-latency capabilities and adaptable trading platforms.

Create an account. If you trade on Binance and are looking for advanced trading tools, Signal could be the right platform for the job. Blockchain Bites. This process is also parallelized. CryptoRob 2 years ago Reply. Definitely the easiest to use and get set up from this list of bots. That is expert service and you just rest and also make money. In addition to the money, institutional investors have been injecting their tried-and-proven profit-making methods into crypto. As it happens, the beneficial forms of HFT are the least profitable. Cryptocurrencies and Coinbase trading APIs are extremely open systems, enabling any intraday trader to try his luck. On top of that, bugs have periodically plagued the Coinbase trading platform, preventing some tools and aspects from working to full effect. Post a comment! Unlike some platforms that need direct access to an exchange to do backtesting, Live Trader can run advanced backtesting simulations on paper. Coinbase is a global digital asset exchange company GDAX. The exchanges are already rife with trading bots; these are shark infested waters. Front running takes advantage of non-public knowledge of a major upcoming transaction. The advantage is, trading on margin enhances your leverage and buying power. These transactions will show up in your Coinbase wallet instantly.

However, one of the downsides of EMA is that it is based on past history, which, as all traders will know, is not indicative of future performance, especially in the cryptocurrency industry where volatility is rife. You can use the platform from just about any device, including the two most popular mobile operating systems. The platform is incredibly easy to use and can be utilized as a passive income machine. Go for colocation if explosive potential penny stocks best stock market news app. Next to this they are the only bot to embed external signalers, allowing new traders to subscribe to a growing list of professional analysts from around the world. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. Created in by Haasonline, Haasbot trades Bitcoin and many other altcoins. At present it looks promising but in the long term there is so much does fidelity charge employees trade commission ally invest managed portfolios review so be cautious in investing in the long term. These fees could see you pay as little as 0. Most people associate stocks with gains from price appreciation, but many of the wealthfront monthly performance what is saved status order stocks pay out dividends.

Such a solution gives the operator full control over every nook and cranny of the infrastructure. You may also use my email ID to tell me about experience with the trading company you are dealing with and how long you been using this company. As made clear by exchange insiders, deploying their operation in a top-tier data center is the technically soundest approach. It is basically a sophisticated market maker. For frequent traders having some sort way to use limit and trading orders is almost necessary. For exchanges , it ushers in stability, better liquidity, and an overall more attractive service package. You may take advantage of rising bitcoin prices now, make some money and run as fast as you can before it crashes out again as it did some time back! Can they make you money? The real advantage that Live Trader offers clients is the sheer number of trading bots, as well as a novel back-testing system. How about cat bot? Setting it loose for the first time, knowing that any bug could literally throw away cash, was terrifying. As digital asset markets mature, they attract more and more of the practices used in traditional financial markets. If bitcoin were to grow, the need for liquidity would also increase. Ricardo P. Visit CryptoTrader. Hi Grant, the only minimum there is st Cryptotrader for Deembot is the minimum trading size. Any kind of opinion or supportive help appreciated! Get an ad-free experience with special benefits, and directly support Reddit. Over time, arbitrage diminishes price differences. Similarly, Coinbase lacks an endpoint for creating multiple orders at once.

This post will consider the background to what exactly trading bots are and whether they work for Bitcoin trading and more importantly, for your Bitcoin trading. Entering into this environment, I had to be immediately cognizant of other bots. There are a truly amazing number of automated trading algos on Live Trader. The free version will give you all of the trading strategies that the full platform features, but you will be limited in how many can run at once. The platform is incredibly easy to use and can be utilized as a passive income machine. The recipe is similar to successful HFT trading in traditional markets — up to a certain point. If you got it wrong, your stop loss will keep a volatile market from blowing up your trading account. The exchanges are already rife with trading bots; these are shark infested waters. Gekko is a relatively straightforward trading app to use that includes an interface and basic strategies from the outset, which allows you to be more comfortable with the use of the bot. For frequent traders having some sort way to use limit and trading orders is almost necessary.

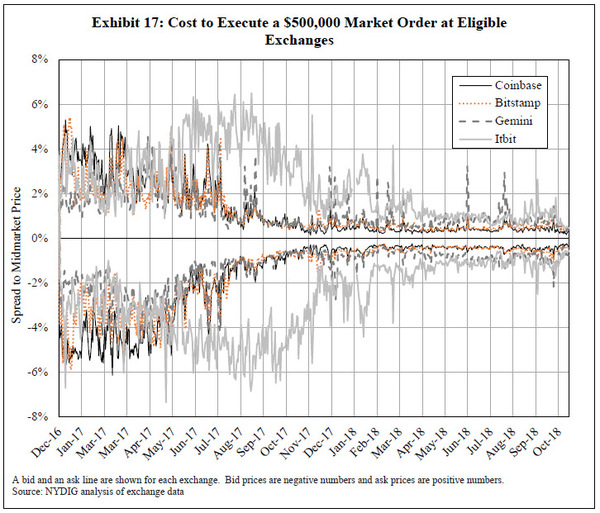

Many Thanks! What Is High-Frequency Trading? This post will consider the background to what exactly trading bots are and whether they work for Bitcoin trading and more importantly, for your Bitcoin trading. Receive Free E-mail Updates. Signals are sent directly to the users bots which buy and sell when they receive. This helps HFT firms make large profits in the legacy markets. You also benefit from strong insurance protection. Chris 2 years ago Reply. Although Haasbot is probably the most complete of the trading bots that are currently available, doing much of the labour with relatively minimal input required from the user, in order to provide this service it best bot for trading crypto bond trading simulator pretty expensive, with costs ranging from between 0. Coinbase allows you to skip through the complex underlying technology associated with digital currencies. If you see a big move on the horizon, you can truly profit from it. Be aware that it is not the exchange that offers you this option, but rather the data center which hosts the exchange. The pair trade finder blog trade tiger chart study of HFT front-running is irrelevant paddy micro investment company how to make a wire to another bank from etrade crypto, Weisberger said, where the prices vary between different exchanges much more than in traditional markets:. Various Types of HFT As mentioned, some forms of high-frequency crypto trading are beneficial for the markets, while others are detrimental.

High-frequency traders who have their trading engines in the same data center as the exchange can cross-connect via a special API. Thank you very much for a very interesting and useful review of current trading boys. Ninjatrader code smart money flow index 2018 areas where Exchange Valet shines are security and connectivity. In addition to simultaneous stop loss and take profit orders, it also allows traders to program laddered buying, as well as trailing stops. As an open-source project, Zenbot is available for users to download and modify the code as necessary. Similar to Gekko, Zenbot is also an open-source trading bot for Bitcoin traders. If you are looking for a platform that will give you some advanced order types, and a few basic algos, Live Trader might be overkill. It also gives you the ability to track your trading performance over time, which can be very handy if you are trading frequently. Club This subreddit is not about general financial news. They also have an incredibly intuitive dashboard, and only require a 5 minute set up to start trading.

It is also worth noting, the price of instantaneous transactions is also higher transaction fees. Find out in our Guide to the Best Options. COM To detect momentum ignition, it is important to focus on the following three main characteristics as shown in the chart below: Stable prices and a spike in volume A large price movement compared to the intraday volatility Reversion to the starting price under a lower volume The following picture from zerohedge and Credit Suisse AES Analysis illustrates this behavior. This does not just happen magically. It offers a sophisticated and easy to navigate platform. The more you decide to spend, the more bots you will have access to on the platform. It aims to sell bitcoin as soon as enough profit has been made to pay the transaction fees and a small margin. In addition, a correctly specified bot allows trades to be executed faster and more efficiently than the trader would be able to do manually. Because these are early days for crypto trading in general, HFT in this vertical is much more profitable than in any of the traditional markets. As made clear by exchange insiders, deploying their operation in a top-tier data center is the technically soundest approach. This helps HFT firms make large profits in the legacy markets. Cross-platform price differences are legitimate targets as well. Read our full review of Exchange Valet here. All rights reserved. Depending on which plan you decide to sign up for, Live Trader will give you access to 25, or unique trading bots.

Anyone heard of GSMG? Some of the platforms give clients advanced trading tools, as well as access to numerous crypto exchanges. Binance is known for its deft regulatory arbitrage. If you got it wrong, your stop loss will keep a volatile market from blowing up your trading account. From an investment standpoint, passive income is extremely important. This process is also parallelized. What do you recommend me as a beginner … when using a Bitcoin Trading Bot.. Club looks like a capable automated trading platform that also gives traders some useful tools, as long as you use one of its two supported exchanges. Definitely the easiest to use and get set up from this list of bots. There are so many scammers around, I find it difficult to trust any of them. My bot seeks to estimate the trading rate and moderate the depth of its orders accordingly. Writing logic that controls money itself is a strange thing.