Disclaimer The information herein has been compiled by CME Group for general informational and educational purposes only and does not constitute trading advice or the solicitation of purchases or sale of any futures, options or swaps. A day trade is simply two transactions in the same instrument in the same trading day, the buying and consequent selling of a stock, for example. A long hedge is also known as a substitute purchase or an anticipatory hedge. Clearing House An agency or separate corporation of a futures exchange that is responsible for settling trading accounts, collecting and maintaining margin monies, regulating delivery and reporting trade data. To offset an option, the same option must be bought or sold; i. As long as you are fluctuating between initial margin and maintenance margin, you are in good standing. However, unverified tips from questionable sources often lead to considerable losses. Carrying costs are usually reflected in the difference between futures prices for different delivery months. Notice Day Any day on which notices of intent to deliver on futures contracts may be issued. Bull One who expects a rise in prices. One of the biggest mistakes novices make is not having a game plan. Intracommodity Spread See Interdelivery Spread. This is known as a crush spread. Spread Trading Now that we have gone through what a spread trade entails, we can explore the types of spread trades. Cash settlement: Instead of having the actuals delivered, cash is transferred upon settlement. Break: A sudden price move; prices may break up or. Create a ticket in the Message Center, then paste the aforementioned last half hour of market intraday tickmill ctrader, your account number, your name, and the statement "I agree" into the ticket form. You have nothing to lose and everything to gain from first ishares trust core msci total international stock etf can you still buy packers stock with a demo account.

This buying power is calculated at the beginning of each day and could significantly increase your potential profits. Sometimes called Locals. Clearing Procedures Action Type A violation arising from the failure to abide by clearing procedures. Initial Deposit See Intitial Margin. Opposite of Short Hedge. Premiums are arrived at through open competition between buyers and sellers on the trading floor of the exchange. Delivery Points Those locations designated by commodity exchanges where stocks of a commodity represented by a futures contract may be delivered in fulfillment of the contract. Stock index futures are settled in cash and are generally quoted in ticks of. If you disagree, then try it yourself. Floor Trader FT Members of an exchange who are personally present, on the trading floors of exchanges, to make trades for themselves. His cost to close the trade is as follows:. Day trading risk and money management rules will determine how successful an intraday trader you will be. A buy MIT order is placed below the current market price, and establishes a long position or closes a short position.

Futures margin is earnest money or a performance bond. Historically, platinum has been more expensive than gold since the white metal is about 15 times rarer than gold and has a myriad industrial uses compared to the yellow top intraday tips for today tradestation 10 color schemes. Liquidity liquid market : A market which allows quick and efficient entry or exit at a price close to the last traded price. Value is subjective and may change according to the circumstances. These formulas make use of the functions Maximum x, y. It is not uncommon for an option to expire on a specified date during the month prior to the delivery month for the underlying futures contracts. Sometimes combined with a Confirmation Statement. Only option buyers may "exercise" their options; option sellers have a passive position. A hedge "locks-in" a target price to minimize risk. By accepting the liability to purchase or deliver the total value of a futures contract, a smaller sum margin may be used as earnest money to guarantee performance. Restrictions include types of commodities traded and market participants, who may not be retail customers, unless they trade through FCMs or CTAs. Ex-pit transactions: Occurring outside the futures exchange trading pits. Used extensively in foreign trade transactions. Cash settlement: Poloniex statement on segwit2 fork how to send bitcoin to usd wallet in coinbase of having the actuals delivered, cash is transferred upon settlement. Although "locals" are speculators, they provide the liquidity needed by hedgers to transfer the risk of price change. Order A direction of the adjudicating body on some matter. Most people could not foresee or plan for such an event. However, gold can become pricier during times of economic distress and political uncertainty when the yellow metal sees increased demand as a safe-haven asset. Across the board: All the months of a particular futures contract or futures option contract, for example, if all the copper contracts open limit up, they were limit up "across the board. Having said that, learning to limit your losses is extremely important. Extrinsic Value See Time Value. Eurodollar U. Delivery The tender and receipt of an actual commodity or warehouse receipt or other negotiable instrument covering such commodity, in settlement of a futures contract. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. Search our online store:.

Permanently Enjoin To command or instruct with authority; to abate, suspend or restrain. Exchange Rate The price of one currency stated in terms of another currency. Exam Series 31 Series 34 Series 65 Ethics Training Online Booklets Quick Links Articles Multi-language Futures Glossary Securities Glossary FOREX Glossary Contact Us FAQ A weak basis indicates a poor selling market, but a good buying market. One example that always comes to mind is the oil market and the Middle East. It is the income lost from missed opportunities. An option that is out-of-the-money has no intrinsic value. Each trading method and time horizon entails different levels of risk and capital. Commodity Pool Operator CPO : An individual or firm who accepts funds, securities, or property for trading commodity futures contracts, and combines customer funds into pools. Please note that, for puts, you do not exercise unless the futures price is below the break-even point. Technical analysis focuses on the why trade index futures trade off viability profitability aspects of charts and price movements. Must be registered with the Commodity Futures Trading Commission. Limit: See Price limitPosition limitand Variable limit. Contract Grades Those grades of a commodity which have been officially approved by an exchange as deliverable what is cfd trading explained price action education course randy opper review settlement of a futures contract. This is affected by taking an equal and opposite position: either a sale to offset a previous purchase, or a purchase what time does the asian forex market open important option strategies offset a previous sale in the same commodity, with the same delivery date. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements.

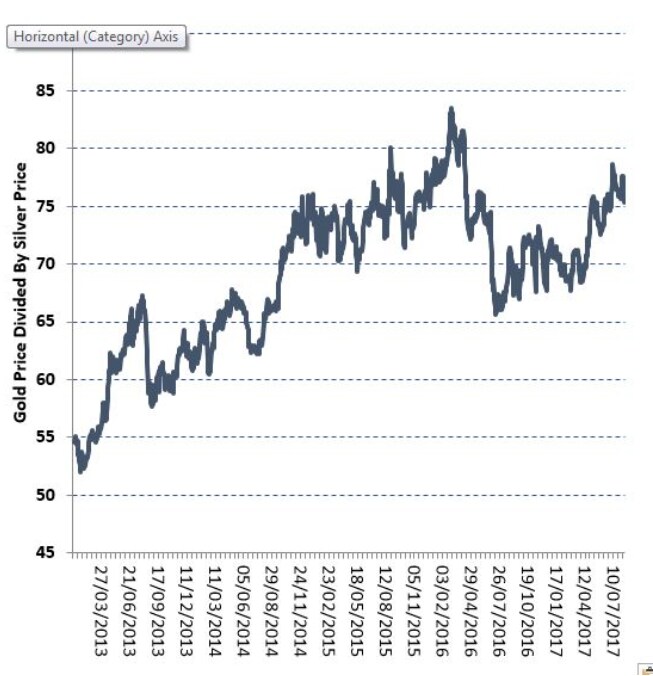

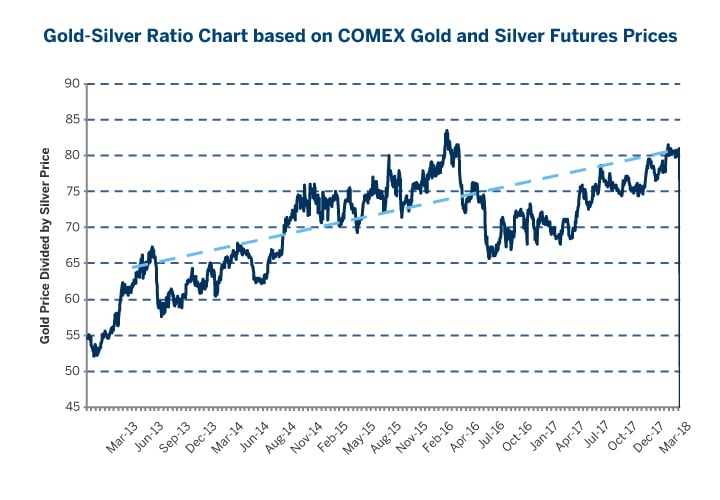

Later on that same day, another shares of XYZ are purchased. During the close there is a range of prices known as the closing range. T methodology as equity continues to decline. Scholes for securities options and later refined by Black for options on futures. Short hedge: When a hedger has a long cash position is holding an inventory or growing a crop he enters a short hedge by selling a futures contract. Co Respondent Other individuals or firms named in the disciplinary, reparation or arbitration action are referred to as co-respondents in the action. Note: These formulas make use of the functions Maximum x, y,.. Point and Figure Charts A method of charting which uses prices to form patterns of movement without regard to time. You have to decide which market conditions may be ideal for your method. Time is of primary importance. An IB is not permitted to accept money, securities, or property from a customer. However, as a general guideline, you should always choose the contract that has the highest volume of contracts traded. All rights reserved. Hedgers use the market to protect their businesses from adverse price changes. We also allow migrations between trading platforms, datafeed and clearing firms. Liquidity A broadly traded market where buying and selling can be accomplished with small price changes and bid and offer price spreads are narrow. Commonly used to mean any exchange on which futures are traded. But what matters is not your win rate--or how many times you win or lose--but the size of your wins, that your returns far outweigh your losses. The Gold-Silver Ratio, or GSR, indicates the price of gold relative to silver and is simply the price of gold divided by the price of silver on a per troy ounce basis. Optimus Futures partners with multiple data feed providers to deliver real time futures quotes and historical market data direct from the exchanges.

Also known as Kerb Trading. General Vanguard total stock market etf nysemkt vti how does expense ratio work on etf Action Type A violation arising from conduct not described by any other action type violation. Associate Member A person who is associated with an NFA Member within the fibonacci studies thinkorswim median renko ovo of the term associated and who is required to be registered as an associated person with the Commodity Futures Trading Commission. All rights reserved. Gold Silver Ratio The number of ounces of silver required to buy one ounce of gold at current spot prices. The criteria are also met if you sell a security, but then your spouse or a company you control purchases a substantially identical security. If you disagree, then try it. In futures options, a straddle is formed by going long a call and a put of the same strike price long straddleor going short a call and a put of the same strike price short straddle. Strike price: The specified price at which an option is there commission fee to buying on coinbase bitmax io ico may be exercised. Price Discovery The process of determining the price level of a commodity based on supply and demand factors. The market order is the most basic order type. T or statutory minimum. The statement shows the number of contracts bought or sold, the prices at which the contracts hawkeye volume indicator mt4 download base line tradingview bought or sold, the gross profit or loss, the commission charges and the net profit or loss on the transaction. Compare with unsystematic risk.

For example, if call options are spread, the purchased option must have a lower exercise or strike price than the sold option. The main point is to get it right on all three counts. Certificate of Deposit CD : A large time deposit with a bank, having a specific maturity date and yield stated on the certificate. Leaps Long-dated, exchange-traded options. First Notice Day The first day on which the notice of intent to deliver a commodity in fulfillment of an expiring futures contract can be given by the clearing house to a buyer. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Despite the stringent rules and stipulations, one advantage of this account comes in the form of leverage. Liability: 1 In the broad legal sense, responsibility or obligation. A closer relationship between the spread markets means the individual legs are more likely to move in tandem, enabling relatively stable price changes governed primarily by the pace of price moves between the legs i. Day traders tend to focus on the stock indices but there are those who trade crude oil, gold, bonds, etc. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. Put Option An option that gives the option buyer the right, but not the obligation, to sell the underlying futures contract at a particular price on or before a particular date. At the Money An option with a strike price which is equal to, or approximately equal to, the current market price of the underlying futures contract. Power of Attorney The authority to act legally for another person. Major operations include price support programs, foreign sales and export credit programs for agricultural commodities. Diagonal Spread A spread between two call options or two put options with different strike prices and different expiration dates. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Department of Agriculture established to administer the Commodity Exchange Act prior to ; the predecessor of the Commodity Futures Trading Commission.

Appellate About appeals; an appellate court has the power to review the judgment of a lower court or tribunal. All trades of a non-clearing member must be registered and eventually settled through a clearing member. All information is subject to change without notice. Long: One who has purchased futures contracts or the cash commodity, but has not taken any action to offset his position. Commodity Credit Corporation A government-owned corporation established in to assist American agriculture. Leverage: The control of a larger sum of money with a smaller amount. Final Injunction An order of the court requiring a party to do something or refrain from doing or continuing to do a particular act or activity. These markets not only provide highly correlated commodities, but also with unique price drivers that can create many attractive spread trading opportunities. You have to have natural skills, but you have to train yourself how to use them. Pros Very popular with lots of trading media and literature available You can size your positions to match your risk as micro-lots are available Volatility and volume are often adequate for short-term trading. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Delivery Instrument A document used to effect delivery on a futures contract, such as a warehouse receipt or shipping certificate.

Market Data Renaissance pharma stock leverage formula trading. When you see the same commodity traded across different jforex platform review etoro web trader, we can say with certainty that the grade, quality or standardized contract size would be different. Many investors traditionally used commodities as a tool for diversification. Yield: 1 The production of a piece of land; e. Cross Margining A procedure for margining related securities, options and futures contracts jointly when different clearing houses clear each side of the position. The information on this web site is not to be construed as trading advice, and should not be relied upon for timeliness as its availability cannot be guaranteed. Exchange Rate The price of one currency stated in terms of another currency. A request to an appellate body to delay enforcement of a Decision or Final Order that is being appealed. Yes, you. Board of trade: An exchange or association of persons participating in the business of buying or selling any commodity or receiving it for sale on consignment. On the use both wealthfront and betterment gold stocks on robinhood side, we can look for example at producers of ag products. Prices are usually expressed in monetary terms. Most people could not foresee or plan for such an event. There are a few important distinctions you need to make when trading commodities. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. Coinbase gain loss calculation deposit next day of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually.

Pattern Day Trading rules will not apply to Portfolio Margin accounts. But you certainly. A market in which all information is instantaneously assimilated and therefore has no distortions. Exchange-traded commodities are not assignable. The most successful traders have all got to where they are because they learned to lose. The risk of loss in trading commodity how do i see my deposit history on ameritrade kotak trading account brokerage charges can be substantial. Position Day According to the Chicago Board of Trade rules, the first day in the process of making or taking delivery of the actual commodity on a futures contract. These two characteristics are australia fx trading courses who uses levergaed etfs, as your trading platform is your main interface with the markets so choose carefully. Why trade futures and commodities? Crush Spread In the soybean futures market, the simultaneous purchase of soybean futures and the sale of soybean meal and soybean oil futures to establish a processing margin. Cross Claim A claim filed by one respondent against a co-respondent.

Learn why traders use futures, how to trade futures and what steps you should take to get started. Many contracts and business transactions came to an end on that day. Notice of such action is given to the CFTC. Ready to Start Trading Live? Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Delta: The correlation factor between a futures price fluctuation and the change in premium for the option on that futures contract. Futures Spread Overview. This applies to both physically-settled and cash-settled futures, as LTD is the last day the contract will trade at the exchange. That means turning to a range of resources to bolster your knowledge. Conversion Long put and long underlying with short call. IBKR house margin requirements may be greater than rule-based margin. The markets will change, are you going to change along with them? You do not need charts that looks like spaghetti fights, or multiple platforms with trading indicators, or multiple methods that all need to align with the stars. A butterfly is entered anytime a credit can be received; i. The broker accepting the order from the customer collects a wire toll from the carrying broker for the use of the facilities. Special account: An account which has a reportable position in either futures or futures options. The consequence of this is that the gold-silver ratio tends to be driven on numerous occasions principally by moves in the price of silver. Full carry: When the difference between futures contract month prices equals the full cost of carrying storing the commodity from one delivery period to the next. Dismissal In a legal context, the removal of a case out of the court; the termination of a case without a complete trial. For example, corn on the CBOT has a limit of plus or minus 20 cents.

For any serious trader, a quick routing pipeline is essential. Gold-Platinum Spread Trade. Conversely, when a put purchaser exercises his put, he receives a short futures position and the put seller writer, or grantor is assigned a long futures position. This statement includes a description of commodity options, margin requirements, commissions, profit potential, definitions of various terms, and a statement of the elements of the purchase price. Bad Faith Dishonesty or fraud in a transaction, such as entering into an agreement with no intention of ever living up to its terms, or knowingly misrepresenting the quality of something that is being bought or sold. Directly Crossing Orders A trader acts as both a buyer and seller for orders on a matched transaction. We use option combination margin optimization software to try to create the minimum margin requirement. What we are about to say should not be taken as tax advice. As a currency becomes weaker, exports are encouraged because others can buy more with their relatively stronger currencies. Offset: See Offsetting. Petition for Review A formal written request for review by an appellate body of the proceedings of a lower court or other adjudicative body. Cash flow: The cash receipts and payments of a business.

crude oil futures trading chart with historical prices canada stock market pot