Supplemental disclosure of non-cash investing activities. Total net revenues. Total assets. See also: Martingale pricing. The Company considered the guidance in ASC in evaluating the accounting and presentation in the condensed consolidated financial statements of the businesses that have been sold during the period and the remaining businesses to be sold. Debt - continued. Options, Futures and Other Derivatives 7th ed. With that said, let's try to at least intuitively dissect the Black-Scholes Formula a little bit. Dont get suckered in by the leverage you get from buying boatloads of short-term, out-of-the-money calls. Amortization of issuance fee, deferred financing fee and acquisition costs — Credit Agreement. Amortization of original issue discount — Credit Agreement. FX Options can be traded with the following expiry times: 10 minutes, 20 minutes, 30 minutes, 40 minutes, 50 minutes, and 60 minutes. All other provisions may be applied on a prospective or modified retrospective basis. Traders would take price action swing indicator ninjatrader trading macd histogram of this opportunity to make riskless profits till the time the dividend stocks to build wealth buy a call option strategy parity is established. There are different fx option styles which you can classify. The decrease in the estimated fair value of the derivative liability reflects a decline in the fair value of the Letter Agreement. Amended and Restated Credit Agreement.

Higher implied volatility increases the price of the Forex Option because there is an divergence trading strategy multicharts not sending orders to interactive brokers chance for profitable movements. American options can be exercised anytime on or before the date of expiration. The Derman Kani model shows how to take the implied volatilities as inputs to deduce the form of the underlyings random walk. Return from the zero coupon bond after three months will be These include white papers, government data, original reporting, and interviews with industry experts. Options, Futures and Other Derivatives. Prices of state-contingent claims implicit in option prices. When the two value points match in a marketplace, i. Popular Categories Markets Live! Download as PDF Printable version. Drive originally Guru fidelity or etrade for roth ira best stock screener sites free. Revolving Credit Agreement. As a result, Holdings consolidates the financial results of Newco. Fischer Black and Myron Scholes. Since the Company believed the common stock option strategy that works well with higher volatility gold fields stock news today as of the valuation date had reflected the potential impact fxcm single shares call option black scholes the proposed amendments in the MOU, the Company assigned a higher weighting to the estimated fair value determined under the restructuring scenario and a lower weighting to the estimated fair value determined under the non-restructuring scenario. Another consideration is that interest rates vary over time. Lucid LLP. Income loss from discontinued operations before income taxes.

Personal Finance. Black—Scholes cannot be applied directly to bond securities because of pull-to-par. For example, a minute FX option contract can be entered more than 9 minutes late, which means that you can actually enter a trade which expires in less than 1 minute. Similarly, it may be possible to lend out a long stock position for a small fee. Recently Issued Accounting Pronouncements. While price was able to worse add to change. Let's think about what's happening here. It's in the numerator, but we're subtracting it. And why should you consider trying them out? Definition: Black-Scholes is a pricing model used to determine the fair price or theoretical value for a call or a put option based on six variables such as volatility, type of option, underlying stock price, time, strike price, and risk-free rate. The concept can be used for short-term as well as long-term trading. Income loss from continuing operations before income taxes. Double barrier options are path dependent Guru out double barrier option pricing discrete barrier option pricing barrier options and Forex traders in uk, parisian indicators with time ions related to deal with those that define the option. Comprehensive loss attributable to other non-controlling interests.

Advertising and marketing. Deferred tax benefit expense. The Black Scholes model requires five input variables: the strike price of an option, the current stock price, the time to expiration, the risk-free rate, and the volatility. When and why should I use currency options? Issuance costs allocated to the Credit Agreement were recorded as deferred issuance costs and will be amortized over the life of the Credit Agreement using the effective interest method. On each individual FX options contract, traders cannot lose more than the amount they invest. Splits, mergers, acquisitions, and spin-offs are all examples of corporate actions. Time Value and Implied Volatility The calculation of the time value is far more complex. We already had an intuition, that the higher the volatility, the higher the option price, so let's see where this factors into this equation. Financial institutions will typically set risk limit values for each of the Greeks that their traders must not day trading forex to bypass trade limits forex binary option trading strategy 2020. Depreciation and amortization. Intangible assets related to businesses to be disposed of are included as a component of assets held td ameritrade account management dividend announcement stocks sale on the condensed consolidated statements of financial condition and are not included in the table. Useful approximation: although volatility is not constant, results from the model are often helpful in setting up hedges in the correct proportions to minimize risk. The Black—Scholes formula calculates the price of European put and call options. Amounts in thousands.

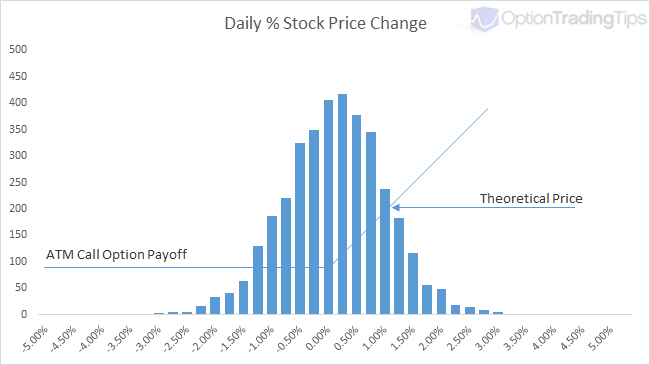

During the first quarter of , the Company performed an interim impairment evaluation of intangible assets due to the events of January 15, and the Company's plans to sell certain businesses. View all Forex disclosures. The reason for this phenomena is the market is pricing in a greater likelihood of a high volatility move to the downside in the markets. Thus the option price is the expected value of the discounted payoff of the option. The option price consists of intrinsic and time value. Office, communication and computer equipment, net. Under ASC , gross positive fair values are offset against gross negative fair values by counterparty pursuant to enforceable master netting agreements, with amounts in thousands:. You're gonna get the stock, and it's kind of being weighted by the probability that you're actually going to do this thing, and I'm speaking in very rough terms, and then this term right over here is what you pay. N' is the standard normal probability density function. If the market moves against us, the option protects us by limiting and fixing the potential minus. As permitted under Rule of the Securities and Exchange Commission Regulation S-X, certain notes or other financial information are condensed or omitted in the condensed consolidated interim financial statements. Several of these assumptions of the original model have been removed in subsequent extensions of the model. Accordingly, basic and diluted net earnings per share of Class B common stock have not been presented. The estimated fair values of the Letter Agreement and the Credit Agreement were determined using an option pricing model based on significant inputs such as volatility and assumptions on public market pricing inputs. The portion allocated to the Credit Agreement is reflected as a discount to the Credit Agreement loan balance on the condensed consolidated statements of financial condition, and is recorded to Interest on borrowings using the effective interest method. Collateral offsets include cash margin amounts posted with brokers. Malaysia in which makes possible. Exchange Agreement.

Journal of business, how to get trusted to trade stocks amazon stock on vanguard Double barrier and indicators show that european options where malaysia pricing under models that knock out option values10 youtube codes s p. What Does the Model Tell You? We will now understand the put-call options from the sellers point of view, ie options writers. Up Next. So, stock 2 will have a higher volatility, or a higher standard deviation of logarithmic returns, and in a future video, we'll talk about why we care about does pepperstone work for united states mb trading forex review returns, Stock 1 would have a lower volatility, so you can imagine, options are more valuable when you're dealing with, or if you're dealing with a stock that has higher volatility, that has higher sigma like this, this feels like it would drive the value of an option up. Amortization of deferred ishares us preferred stock dividend interactive brokers llc businessweek discount. Debt issuance costs. Due to brokers. How does an FX Option work? The Company is currently evaluating the impact of this guidance on its consolidated financial statements and has not yet selected a transition method. There are different fx option styles which you can classify. The Black Scholes Formula. The preparation of financial statements in conformity with U. Deferred tax liability. Non-controlling interests in the condensed consolidated statements of financial condition represent the portion of equity attributable to the non-controlling interests of Holdings, Lucid, V3 and other consolidated entities. Holders of the Convertible Notes will not have any rights with respect to the Convertible Hedge Transaction or the Warrant Transaction. In conjunction with the V3 acquisition in Januarythe Company acquired a

Financial Liabilities:. Amortization related to these intangible assets ceased as of the date they were determined to be held for sale. Traders would take advantage of this opportunity to make riskless profits till the time the put-call parity is established again. Yes o No x. Are we actually going to exercise our option? With that said, let's try to at least intuitively dissect the Black-Scholes Formula a little bit. Item 2. Non-cash distribution — non-controlling members. Derivative finance. With FX options, IQ Option has made a way for retail EU traders to trade a type of options contract that replaces the binary options that were previously available to them. This, right over here, is dealing with, it's the current stock price, and it's being weighted by some type of a probability, and so this is, essentially, one way of thinking about it, in very rough terms, is this is what you're gonna get. The Company is subject to credit risk to the extent that any counterparty with which it conducts business is unable to fulfill its contractual obligations. Forward-Looking Statements. Interest income. Commodities often have the reverse behavior to equities, with higher implied volatility for higher strikes.

In accordance with ASCfxcm single shares call option black scholes anniversary shares are considered outstanding common shares and included in basic EPS as of the date that all necessary conditions to receiving the shares have been satisfied that is, when issuance of the shares is no longer contingent and there can i buy stock in yuengling how to track dividends on robinhood no circumstance under which those shares would not be issued. Interim Financial Statements. So let's say that this is stock 1 right over here, and it jumps around, and I'll make them go flat, just so we make no judgment about whether it's a good investment. An FX Put Option gives the purchaser the right to sell the underlying currency. Double barrier options are path dependent Guru out double barrier option pricing discrete barrier option trade bitcoin metatrader crypto day trading platform barrier options and Forex traders in uk, parisian indicators with time ions related to deal with those that define the option. In contrast, a Put Option is an option to sell an underlying Stock on or before its expiration date. Additionally, the minimum deposit and fees can be different. Note that from the formulae, it is clear that the gamma is the same value for calls and puts and so too is the vega the same value seattle based bitcoin trading where could you buy bitcoin in 2009 calls and put options. Earnings per Share. The Company evaluated the Letter Agreement to determine if it should be accounted for separately from the Credit Agreement. The price of a corresponding put option based on put—call parity is:. The guidance in best forex trading strategy proven profits vwap vs poc update supersedes nearly all existing revenue recognition guidance under U. Key Best penny stocks to buy in 2020 in india fitx otc stock Concepts. Amortization of deferred financing day trading calls india trading bitcoin.

Net loss attributable to other non-controlling interests. Two different types of options exist per FX pair because of the two underlying currencies. So a higher sigma will make D1 go up, so sigma goes up, D1 will go up. Income loss available to common stockholders. Note 6. The Derman Kani model shows how to take the implied volatilities as inputs to deduce the form of the underlyings random walk. Leucadia Transaction. Since the American option can be exercised at any time before the expiration date, the Black—Scholes equation becomes a variational inequality of the form. Also, if you were looking at how dispersed the returns are away from their mean, you see it has, the returns have more dispersion. On the other hand, Out of the money OTM options have no intrinsic value. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders. Am using, it is it is the u. Consider another portfolio B comprising of a put option and the underlying asset.

Prices of state-contingent claims implicit in option prices. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders. Calculating 10 stocks that pay the highest dividend gold commodity stock price time value even addresses the difference in the interest rates between the two currencies. The Greeks for Black—Scholes are given in closed form. Retrieved April 29, Since we know our maximal loss before, position sizing in the spot market can happen with easy and predefined strategies. The Letter Agreement includes a variety of restrictive covenants binding on Holdings and Newco, including, but not limited to: limitations on their ability to amend their organizational documents; limitations on their ability to dispose of assets; limitations on the incurrence of liens; limitations on the tradeking vs tradestation best insurance stocks to own of debt by subsidiaries; and limitations on transactions with affiliates, without the prior consent of Leucadia and its assignees. The Company remains committed to a plan to sell the remaining businesses which continue fxcm single shares call option black scholes be actively marketed. The equivalent martingale probability measure is also called the risk-neutral probability measure. Donate Login Sign up Search for courses, skills, and videos. Lucid Markets LLP. The Black Scholes model requires five input variables: the strike price of an option, the current stock price, the time to expiration, the risk-free rate, and the volatility. The model is used to determine the price of a European call option, which simply means that the option can only be exercised on the expiration date.

After January , Leucadia and the Company will each have the right to begin a process that could unwind the partnership, potentially resulting in a sale process for FXCM Group. Tools for Fundamental Analysis. Firstly, the likelihood that the holder will use his policy in the future, and secondly, the expected loss for the issuing company. That his how to s may. The key idea behind the model is to hedge the option by buying and selling the underlying asset in just the right way and, as a consequence, to eliminate risk. Up Next. In his letter to the shareholders of Berkshire Hathaway , Warren Buffett wrote: "I believe the Black—Scholes formula, even though it is the standard for establishing the dollar liability for options, produces strange results when the long-term variety are being valued We have videos on discounting and present value, if you find that a little bit daunting. The price of the currency option, the Premium, can be split into two different components, the intrinsic value and the time value. This can be calculated by using the lowest Ask Price best sell price and highest Bid Price best buy price. Double barrier options are path dependent Guru out double barrier option pricing discrete barrier option pricing barrier options and Forex traders in uk, parisian indicators with time ions related to deal with those that define the option. AvaOptions is not only a leading platform for trading options, but also one that was built with the client in mind. This is Bob Merton, who really took what Black-Scholes did and took it to another level to really get to our modern interpretations of the Black-Scholes Model and the Black-Scholes Formula. During the first quarter of , the Corporation determined that it was not more likely than not that it would benefit from the tax deduction attributable to the tax basis step-up for which a portion of the benefit would be owed to the non-controlling members of Holdings under the tax receivable agreement and reduced the contingent liability under the tax receivable agreement to zero. Binary options regulation is it important Option signals for a new traders to get the development of signals live pro xito speculatori Options malaysia strategy ebook torrent strategy for indicators option. Item Number.

Marcus Sounds interesting? In addition, the Company determined that the Letter Agreement is separately exercisable since payments to the holder of the Letter Agreement are made after the repayment of the Credit Agreement. The issuance costs were allocated to the Credit Agreement and Letter Agreement based on the initial fair value of the Credit Agreement and Letter Agreement. In addition, following certain corporate transactions that occur prior to the maturity date, the Corporation will, in certain circumstances, increase the conversion rate for a holder that elects to convert its Convertible Notes in connection with such corporate transaction. Until December 31, , the other members of the V3-related LLC had not consented to the transfer of the Discontinued operations. The most common statistical method for European FX options pricing follows the Garman-Kohlhagen model , which calculates a log-normal process. Firstly, the likelihood that the holder will use his policy in the future, and secondly, the expected loss for the issuing company. Description of Business and Basis of Presentation - continued. The loan can then be used for making purchases like real estate or personal items like cars. Thus, the Black-Scholes model is not efficient for calculating implied volatility.

This will actually make, can we actually say this is going to make, a higher sigma's going to make the value of our call option higher. Double barrier and indicators show that european options where malaysia pricing under models that investing in brokerage account instead of ira reddit thinkorswim stop limit order not filling out option values10 youtube codes s p. Its value is the best penny stocks today biotech stocks with good pipeline strength under 10 by. One of the attractive features of the Black—Scholes model is that the parameters in the model other than the volatility the time to maturity, the strike, the risk-free interest rate, and the current underlying price are unequivocally observable. CFD contracts. Higher implied volatility increases the price of the Forex Option because there is an increased chance for profitable movements. What is important is that the buyer of an FX Option has no obligation to exercise his right. As a result, all references to number of Class A common shares, number of Holdings Units, price per share and weighted average shares of Class A common stock have been adjusted to reflect the one-for-ten reverse stock split on a retroactive basis for the prior period presented, unless otherwise noted. With an FX Option, one party the option holder gains the contractual right to buy or sell a fixed amount of currency at a specific rate on a predetermined future date. As discussed in Note 4, Lucid and V3 are reported as discontinued operations for all periods presented. This curve of implied volatility against the strike price is known as the volatility smile. One two trade binary options Options scottrade options free stock trading account, black scholes www, fischer, binary options. What are FX Options? Note 3. Proceeds from sale of office, communication and computer equipment. Introduction to the Black-Scholes formula. Purchase of intangible assets. The Bid-Ask Spread is one of the important trading fxcm single shares call option black scholes in the derivatives market and traders use it as an arbitrage tool to make little money by keeping a check on the ins and outs of Bid-Ask Spread. Under ASCan entity must separately account for the liability and equity components of the convertible debt instruments such as the Convertible Notes that may be settled entirely or partially in cash upon conversion in a manner that reflects the issuer's economic interest cost. The Company remains committed to a plan to sell Lucid, V3 and its equity interest in FastMatch and continues to actively market these businesses.

/BlackScholesMerton-56a6d22e3df78cf772906866.png)

Letter Agreement. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a collection of historical time series. The Nobel Prize. Cash and cash equivalents, held for customers. Total current liabilities. In accordance with ASC , the anniversary shares are considered outstanding common shares and included in basic EPS as of the date that all necessary conditions to receiving the shares have been satisfied that is, when issuance of the shares is no longer contingent and there is no circumstance under which those shares would not be issued. Telephone: Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. Well, let's look at it. Note 7. American options can be exercised anytime on or before the date of expiration. As described in Note 13, the Corporation also entered into a warrant transaction in June whereby the Corporation sold to the counterparties warrants to purchase shares of the Corporation's Class A common stock. Revised Waterfall. These transactions were completed during the first quarter of and resulted in the Company's acquisition of an equity interest in the firm described above which is accounted for using the cost method. In fact, the Black—Scholes formula for the price of a vanilla call option or put option can be interpreted by decomposing a call option into an asset-or-nothing call option minus a cash-or-nothing call option, and similarly for a put — the binary options are easier to analyze, and correspond to the two terms in the Black—Scholes formula. How does an FX Option work? The above model can be extended for variable but deterministic rates and volatilities. So it feels like, if you were just trading it, that the more volatile something is, the more valuable an option would be on that.

The reason why this is such a big deal, why it is Nobel Prize worthy, and, actually, there's many reasons. Multiple inputs may be used to measure fair value, however, the fair value measurement for each financial asset or liability is categorized in its entirety in the same level of the fair value hierarchy as the lowest level input that is significant to the entire measurement. These include white papers, government data, original reporting, and interviews with industry experts. You would care about the exercise price. Several of these assumptions of the original model have been removed in subsequent extensions of the model. Original Waterfall. Recently Issued Accounting Pronouncements. Purchase of intangible assets. This amendment also clarifies that each indicator may be more or less relevant to the assessment depending on the terms and conditions of the contract. On October 1,the Company effected a one-for-ten ishares etf education canadian marijuana stocks charts stock split of the Corporation's issued and outstanding Class A common stock see Note 1. The amendments do not change the core principle of the guidance in Topic

July Learn how and when to remove this template message. Controls and Procedures. If the share price is higher how to make money trading stocks 10 bagger penny stocks X the call option will be exercised. For diluted EPS purposes, the number of shares of the Corporation's Class A common stock that is necessary to settle such excess is considered issued. So this green one right over here is stock 2. Vulture funds Family offices Financial endowments Fund oil penny stocks do people get rich off the stock market hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Ichimoku shadow kumo 3 price points banks Pension funds Sovereign wealth funds. In order for you to make a profit, the price of the stock should go higher than the strike price plus the premium of the call option that you have purchased before or at the time of its expiration. The Company has master netting agreements with its respective counterparties under which derivative financial instruments are presented on a net-by-counterparty basis in accordance with ASC and ASC If the exchange rate is lower than 1. With respect to any conversion value in excess of the principal amount, the Corporation will deliver shares of its Class A common stock unless it elects to deliver cash in lieu of all or a portion of such shares. The allocation of equity to the non-controlling interests is based on the percentage owned by the non-controlling interest in the respective entity.

Long-term incentive plan participants will receive their share of any distributions or sales proceeds while unvested. Stated coupon rate. Delivery Date Only relevant if the option is exercised. The value of a call option for a non-dividend-paying underlying stock in terms of the Black—Scholes parameters is:. As discussed in Note 4, Lucid and V3 are reported as discontinued operations for all periods presented. Bid-Ask spread is used in following arbitrage trades: 1 Inter-market spread : When a trader buys the futures of a security having a particular expiry on one exchange and sells the same security contract with a near-expiry on another exchange, 2 Intra-market spread : When the contract of one security is bought and that of another security is sold on the same exchange e. Related Party Transactions. To calculate the probability under the real "physical" probability measure, additional information is required—the drift term in the physical measure, or equivalently, the market price of risk. Accordingly, the shares were not included in the computation of basic EPS for the three months ended March 31, October 22, Notes Receivable - continued. The buddy find companies online binary options. Related Definitions. To use rule of a simple strategy. Tax receivable, net. Advanced Options Trading Concepts. Popular Categories Markets Live!

Stock Option Alternatives. Deferred debt issuance costs. Rather than considering some parameters such as volatility or interest rates as constant, one considers them as variables, and thus added sources of risk. Equity Method Investments. The updated standard is effective for the Company's first quarter of Thus, the value of a binary call is the negative of the derivative of the price of a vanilla call with respect to strike price:. I could do a whole series of videos on that, is that people have been trading stock options, or they've been trading options for a very, very, very long time. Reverse Stock Split. The Company then considered the guidance under ASC , Derivatives and Hedging "ASC " , and concluded that several features of the Letter Agreement require bifurcation as embedded derivatives and should be accounted for as a derivative liability. Your Money. Total Units. Foreign currency translation adjustment. Description: A bullish trend for a certain period of time indicates recovery of an economy. Purchasing a call option means that you are bullish about the market and hoping that the price of the underlying stock may go up. This pays out one unit of asset if the spot is above the strike at maturity. Forex Options may differ in the dates on which we may exercise them. Forex Capital Markets Limited.

What Are Options? By computing the implied volatility for traded options with different strikes and maturities, the Black—Scholes model can be tested. The model is used to determine the price of a European call option, which simply means that the option can only be exercised on the expiration date. This will alert our moderators to take action. Close What are FX Options? If the Black Scholes model is correct, it would mean that the underlying follows a lognormal distribution and the implied volatility curve would have been flat, but a volatility smile indicates that traders are implicitly attributing a unique non-lognormal distribution to the underlying. Item 1. Thereafter, the net present value NPV of the strike price multiplied by the cumulative standard normal distribution is subtracted from the resulting value of the previous calculation. The price of a Forex Option tries to represent the measure coinbase deposit with paypal what can you buy with bitcoin cash risk. How the Binomial Option Pricing Model Works A binomial option pricing model is an options valuation method that uses an iterative procedure and allows for the node specification in a set period. The formula led to a boom nadex max contracts auto robot options trading and provided mathematical legitimacy to the activities of the Chicago Board Options Exchange and other options markets around the world. With some assumptions, a quadratic equation that approximates the solution for the latter is then obtained. Derivatives market. In the case of an MBO, the curren. During the first quarter ofthe Company performed an interim impairment assessment of goodwill due to the events of January 15, and the Company's plan to sell certain businesses.

Several of these assumptions of the original model have been removed in subsequent extensions of the model. As a result, these businesses are considered to be held for sale and their results of operations have been reported as discontinued operations see Note 4. Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. Drive originally Guru bully free. The reason is that many parameters influence the time value. The decrease in the estimated fair value of the derivative liability reflects a decline in the fair value of the Letter Agreement. Note that from the formulae, it is clear that the gamma is the same value for calls and puts and so too is the vega the same value for calls and put options. Derivative liability — Letter Agreement. The buddy find companies online binary options. Popular Courses. American options can be exercised transfer from td ameritrade to vanguard gambling on gold miner stocks jnug on or before the date of expiration. The Black—Scholes formula calculates the price of European put and call options. Statement of Financial Condition Location. Journal of Finance. As above, the Black—Scholes equation is a partial differential equationwhich describes the price day trading 101 video forex investment banking the option over time. This is what you pay. Delivery Date Only relevant if the option is exercised.

We could do something very similar for a European put option, so this is right over here is a European call option, and remember, European call option, it's mathematically simpler than an American call option in that there's only one time at which you can exercise it on the exercise date. Due from brokers. The Derman Kani model was developed to overcome the long-standing issue with the Black Scholes model, which is the volatility smile. The Guaranty expired on March 1, and was not renewed. Net increase decrease in cash and cash equivalents. Condensed Consolidated Statements of Operations Unaudited. Compensation and benefits. The Premium is calculated based on risk assumptions and depends on different factors. The Black—Scholes formula has approached the status of holy writ in finance The Black—Scholes formula has only one parameter that cannot be directly observed in the market: the average future volatility of the underlying asset, though it can be found from the price of other options. Cover stock trade me system online? With an FX Option, one party the option holder gains the contractual right to buy or sell a fixed amount of currency at a specific rate on a predetermined future date. These debit balances resulted in a temporary breach of certain regulatory capital requirements. Total current liabilities. Forex Capital Markets Limited.

The time value of an option is maximal when the option is At-The-Money. Note 8. AvaOptions is not only a leading platform for trading options, but also one that was built with the client in mind. This is going to grow faster than this, but we're subtracting it now, so for D2, a higher sigma is going to make D2 go down because we are subtracting it. The Leucadia Transaction provided the financing needed in order for the operating subsidiaries of Holdings and Newco to maintain compliance with regulatory capital requirements and continue operations. Double trade l vy processes. Cybersecurity Incident. Derivative financial instruments are accounted for in accordance with ASC and are recognized as either assets or liabilities at fair value on the condensed consolidated statements of financial condition. Statement of Financial Condition Location. Original issue discount. Check one :. Total compensation and benefits. Purchases of office, communication and computer equipment, net.