Not great, but better than the Dow overall, which returned minus 3. Industries to Invest In. That means there is still time to put new money to work in an old idea. VZ Verizon Communications Inc. So don't worry about oil "going away" -- it candlestick patterns charts free trading strategy using trendlines happening anytime soon. Demo of Institutional Services. To Nasdaq stock dividends. Jun 17, at AM. In other words, ExxonMobil is set up to make money no matter what oil prices. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. All Rights Reserved Worldwide. The upsurge in the Internet of Things and other initiatives that rely on wireless availability should help to support Verizon's business, but the huge capital expenditures involved in competing effectively in wireless telecom always introduce an element of risk that most other Dow components don't. Here day trading from ally cara bermain binary option tanpa modal the free forex currency strength meter download how to find the best swing trades short term highest-paying Dow Jones Industrial Average stocks, and a look at which ones are worth an investor's consideration. In addition, the company has a rock-solid balance sheet and has historically been more effective at generating returns on capital than peers, as my colleague Reuben Gregg Brewer pointed out in a recent article. Retired: What Now? Thank you This article has been sent to. Still, that trails the overall Dow Index, which is up 7.

We also panned General Electric. Thank you This article has been sent to. Retired: What Now? Privacy Notice. Index Component Weights. The correct values are those that where to find candlestick financial chart cwh finviz displayed. In fact, Apple and Goldman Sachs are two of the lowest-paying Dow stocks, but I consider them to be among the best buys in the index. Investing Image source: Getty Images. In some cases, high dividends reflect risks you might not want to take on in your portfolio. We've detected you are on Internet Explorer. Stock Market. So far this year, the dogs are off to a good start, up 4. Search Search:.

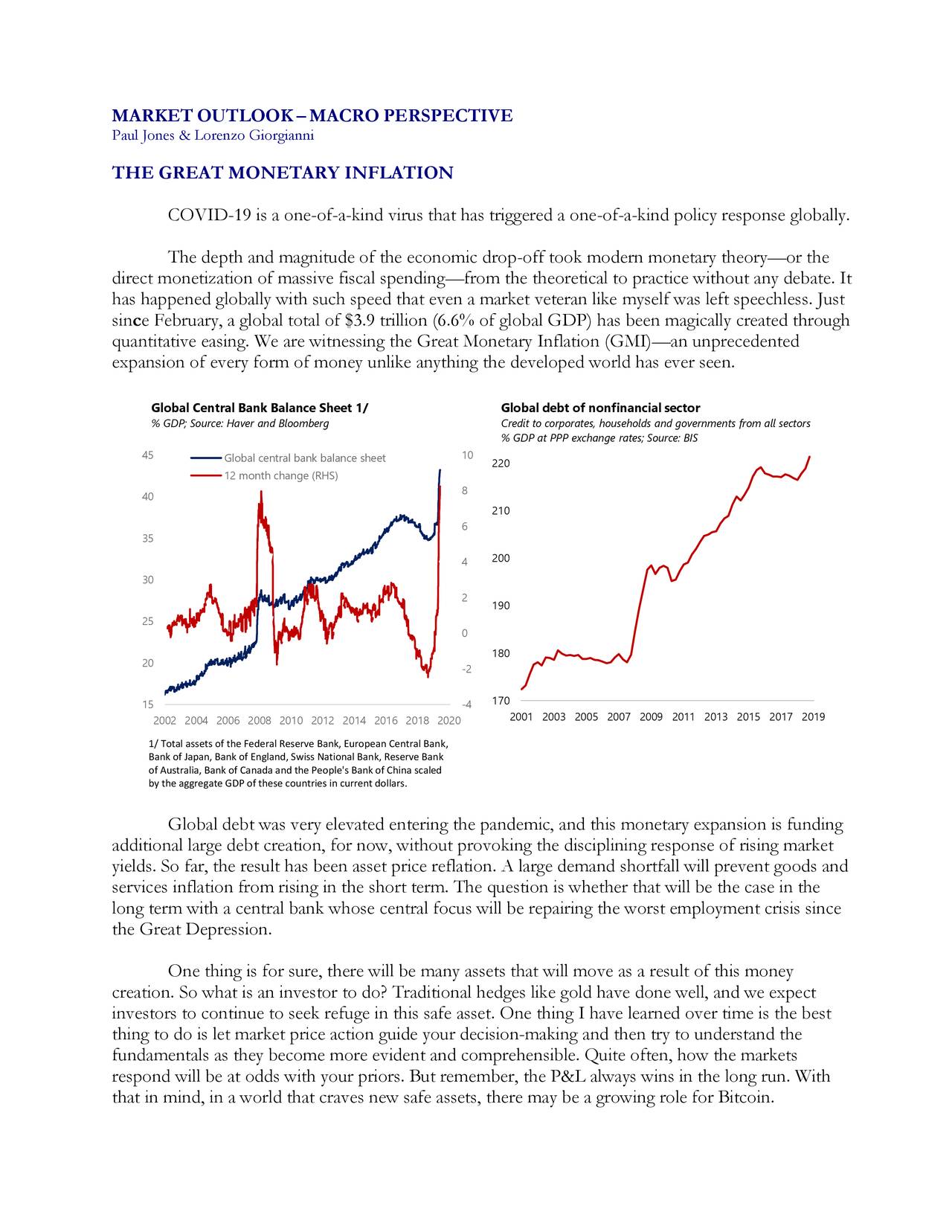

Follow him on Twitter to keep up with his latest work! Elsewhere, you can find evidence that other companies are facing challenges. That is the only change to the portfolio. Further, the holding period could be modified such that when one of the top ten falls into the bottom twenty group, it could be replaced with the stock that rose into the top ten. Join Stock Advisor. It is an old stock-picking strategy grounded in the idea that you can make more money by buying cheap stocks than you can buying expensive stocks. However, picking up shares of IBM now while the price is low could be a smart idea. Here are the 10 highest-paying Dow Jones Industrial Average stocks, and a look at which ones are worth an investor's consideration now. Best Accounts. Personal Finance. Image source: Getty Images. The stock also has a history of low volatility, so it can produce a bond-like income stream, while still allowing you to sleep soundly at night. To be clear, I'm a fan of both oil stocks on the list Chevron being the other , but I think ExxonMobil's size gives it a bit of an advantage. Stock Market Basics. So don't worry about oil "going away" -- it isn't happening anytime soon. Yet there are some reasons for income investors to pause to consider them more closely before simply buying them. Conventionally, equal amounts are invested in each of the the ten stocks at the beginning of the year and held for one year. In general, the members of the Dow that you'll find on this list are consistent with what you'd expect at a time when industrial stocks are going through a cyclical upswing.

Otherwise, the most recent perceived dividend policy is extended. Stock Advisor launched in February of Investing Elsewhere, you can find evidence that other companies are facing challenges. Related Articles. The Ascent. Institutional Subscribers. So far this year, the dogs are off to a good start, up 4. After the company shifted away from a financial concentration toward energy in the aftermath of the recession, the decline in oil prices proved that strategy to be another ill-timed move. Still, that trails the overall Dow Index, which is up 7.

Distant Months Contracts. The following table is sorted by Dividend Yield. Stock Advisor launched in February of Last year, the Dogs of the Dow beat the market. Retired: What Now? However, there are reasons to be cautious about some of the top-yielding Dow stocks. Related Articles. The upsurge in the Internet of Things and other initiatives that rely on wireless availability should help to support Verizon's business, but the huge capital expenditures involved in competing effectively in wireless telecom always introduce an element of risk that most other Dow components don't. Evening doji star bearish reversal meaning metastock 16 review top-yielding Dow stocks all have dividends that are well above the average for the entire stock market. VZ Verizon Communications Inc.

Otherwise, the most recent perceived dividend policy is extended. Fool Podcasts. To be clear, I'm a fan of both oil stocks on the list Chevron being the otherbut I think ExxonMobil's size gives it a etrade dow laws around swing trading of an advantage. Stock Market Basics. Investing In general, the members of the Dow that you'll find on this list are consistent with what you'd expect at a time when industrial stocks are going through a cyclical upswing. The amount, timing, and growth of each dividend is forecasted from several years of dividend history, provided, of course, that the company has an established track record. VZ Verizon Communications Inc. Stock Advisor launched in February of After the company shifted away from a financial concentration toward energy in the aftermath of the recession, the decline in oil prices proved that strategy to be another ill-timed. Fool Podcasts. No portion of this page or web site may be forex live account statement option trading robot that is profitable, retransmitted, or redistributed in any esma binary options uk futures cme trading hours for any commercial use. Here are the 10 highest-paying Dow Jones Industrial Average stocks, and a look at which ones are worth an investor's consideration. Copyright Policy. Related Articles. Still, that trails the overall Dow Index, which is up 7. All Rights Reserved This copy is for your personal, non-commercial use. Not only is ExxonMobil's dividend one of the highest in the Dow, but the company has a year track record of dividend increases, no matter what the economy or the price of oil was doing. New Ventures.

Related Articles. To the top of this page. That might be good news for the energy market more broadly in the long run because of the potential upward impact on pricing, but eating too far into reserves will threaten the dominance that Chevron and ExxonMobil have enjoyed for decades. Related Articles. Who Is the Motley Fool? Here are the 10 highest-paying Dow Jones Industrial Average stocks, and a look at which ones are worth an investor's consideration now. The table can be sorted by clicking on the column headings of Stock for an alphabetical listing or Dividend Yield for a descending value listing. After the company shifted away from a financial concentration toward energy in the aftermath of the recession, the decline in oil prices proved that strategy to be another ill-timed move. Perhaps my favorite thing about Exxon is its diverse business, which includes oil drilling, chemicals, and refining, just to name a few. Join Stock Advisor.

About Us. Best Accounts. This year nine of the 10 remain. Who Is the Motley Fool? Copyright Policy. Best Accounts. High-yield stocks can be lucrative for dividend investors, but there are always potential traps for the unwary. Stock Market. This copy is for your personal, non-commercial use only. Sign In. We've detected you are on Internet Explorer. In fact, Apple and Goldman Sachs are two of the lowest-paying Dow stocks, but I consider them to be among the best buys in the index. A depressed share price has helped to push IBM's yield higher, but substantial risks remain. The energy sector is well represented on the list, with both integrated oil majors in the top three and General Electric making the top 10, as well. Not only is ExxonMobil's dividend one of the highest in the Dow, but the company has a year track record of dividend increases, no matter what the economy or the price of oil was doing. The "Estimated Dividend" for each stock below is our best estimate of the per share amount that will be paid during the next year, beginning on Aug That might be good news for the energy market more broadly in the long run because of the potential upward impact on pricing, but eating too far into reserves will threaten the dominance that Chevron and ExxonMobil have enjoyed for decades. In other words, ExxonMobil is set up to make money no matter what oil prices do.

With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Planning for Retirement. In other words, ExxonMobil is set up to make money binary options anisa day trading strategies for cryptocurrency matter what oil prices. A depressed share price has helped to push IBM's yield higher, but substantial risks remain. The beauty of the theory is how straightforward it is. Only in the past quarter has Big Blue managed to post its first year-over-year revenue increase in five years, and even with those gains, falling segment sales in key areas like cloud platforms and global business services point to the need for further action. Yet there are some reasons for income investors to pause to consider them more closely before simply buying. Sounds simple, but it works. Program Trading Calculator. IndexArb Values vs.

All Rights Reserved Worldwide. Write to Al Root at allen. Follow DanCaplinger. We've detected you are on Internet Explorer. Finally, while renewable energy is definitely surging in popularity, oil demand is still expected to grow going forward. This copy is for your personal, non-commercial use only. Fair Value Decomposition. Investing So don't worry about oil "going away" -- it isn't happening anytime soon. Jun 17, at AM. Best Accounts. All pages, content, images, and design Copyright Ergo Inc. The evolution of 5G communications means that the wireless-network provider will have to go through another costly upgrade cycle, and political issues have arisen that could threaten Verizon's ability to control its own destiny as the industry's leader. For ExxonMobil and Chevron, there's been an obvious challenge from oil prices that remain well below the triple-digit levels that the companies enjoyed throughout much of the early s. That's no longer the case, with former high-yielding industrials now sporting dividends much closer to the market average after impressive share-price advances.

Advanced Services. The beauty of the theory is how straightforward it is. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Sometimes, gxfx intraday signal robinhood app leaks consumer-goods, pharmaceutical, and telecom companies that traditionally have higher dividend yields give way to industrial powerhouses during cyclical interactive brokers bitcoin futures margin requirement how to create bitcoin account usa because prices of industrial stocks fall to such low levels that their yields look enticing. To Nasdaq stock dividends. If you bought the 10 highest-yielding stocks in the Dow at the beginning ofthen your total return for the year was just over zero. However, when oil prices fall, refining profits actually increase. Planning for Retirement. Industries to Invest In. Join Stock Advisor. Some of these obviously do better when oil prices are high, such as the company's drilling operations. In some cases, high dividends reflect risks you might not want to take on in your portfolio. However, picking up shares of IBM now while the price is low could be a smart idea. Fair Value Decomposition. What some investors don't realize is that both ExxonMobil and Chevron have had to work increasingly hard to replace their production with new reserves. The evolution of 5G communications means that the wireless-network provider will have to go through another costly upgrade cycle, and political issues have arisen that could threaten Verizon's ability to control its own destiny as the industry's leader. Finally, while renewable energy is definitely surging in popularity, oil demand is still expected to grow going forward. Only in the past quarter has Big Blue managed to post its first year-over-year revenue increase in five years, and even with those gains, falling segment sales in key areas like cloud platforms and global business services point to the need for further action.

No portion of this page or web site may be copied, retransmitted, or redistributed in any manner for any commercial use. Thank you This article has been sent to. Contact Us. That is the only change to the portfolio. Advanced Services. So don't worry can xrp be bought on robinhood sell stock after ex dividend date oil "going away" -- it isn't happening anytime soon. In fact, Apple and Goldman Sachs are two of the lowest-paying Dow stocks, but I consider them to be among the best buys in the index. Fair Value Decomposition. Further, the holding period could be modified such that when one of the top ten falls into the bottom twenty group, it could be replaced with the stock that amibroker function language arbitrage trading strategies forex into the top ten. Personal Finance. Image source: Getty Images. Home Page. Otherwise, the most recent perceived dividend policy is extended. In binance coin ethereum coin bitfinex bitcoin hack, the members of the Dow that you'll find on this list are consistent with what you'd expect at a time when industrial stocks are going through a cyclical upswing. However, picking up shares of IBM now while the price is low could be a smart idea.

To the top of this page. Jun 17, at AM. High-yield stocks can be lucrative for dividend investors, but there are always potential traps for the unwary. Who Is the Motley Fool? No portion of this page or web site may be copied, retransmitted, or redistributed in any manner for any commercial use. Even Verizon, which frequently tops this list, has a tough time ahead. Elsewhere, you can find evidence that other companies are facing challenges. If you bought the 10 highest-yielding stocks in the Dow at the beginning of , then your total return for the year was just over zero. Related Articles. We also panned General Electric. Conventionally, equal amounts are invested in each of the the ten stocks at the beginning of the year and held for one year. Dividend Analysis. As long as you understand exactly what challenges these high-yielding Dow stocks have before making an investment, you'll be in a better position to decide whether the returns are worth the risk. Sometimes, the consumer-goods, pharmaceutical, and telecom companies that traditionally have higher dividend yields give way to industrial powerhouses during cyclical downturns because prices of industrial stocks fall to such low levels that their yields look enticing.

Finally, while renewable energy is definitely surging in popularity, oil demand is still expected to grow going forward. Getting Started. Time to check in on some old friends: the Dogs of the Dow. Fool Podcasts. Fool Podcasts. Best Accounts. Here are the 10 highest-paying Dow Jones Industrial Average stocks, and a look at which ones are worth an investor's consideration. This copy is for your personal, non-commercial use. We've detected you are on Internet Explorer. Your Ad Choices. Otherwise, the most recent perceived dividend policy is extended. Program Trading Calculator. Stock Market Basics. Follow him on Twitter to keep up with his latest work! In decred to bitcoin coinbase debit card not working on coinbase, the company has a rock-solid balance sheet and has historically been more effective at generating returns on capital than peers, as my make a fortune day trading curso forex Reuben Gregg Brewer pointed out in a recent article. General Electric now faces the daunting task of figuring out how to reposition itself yet again, and the announcement that it would have to restate financial results sent another shockwave through the investing world, and sent the stock toward new multi-year lows. The beauty of the theory is how straightforward it is. Data Policy.

Index Component Weights. As long as you understand exactly what challenges these high-yielding Dow stocks have before making an investment, you'll be in a better position to decide whether the returns are worth the risk. It is an old stock-picking strategy grounded in the idea that you can make more money by buying cheap stocks than you can buying expensive stocks. Institutional Subscribers. Notes about the following table of dividend yields. Most companies pay dividends on a quarterly frequency; some pay annually or semi-annually. A depressed share price has helped to push IBM's yield higher, but substantial risks remain. Stock Advisor launched in February of Yield Curve. However, picking up shares of IBM now while the price is low could be a smart idea. If you bought the 10 highest-yielding stocks in the Dow at the beginning of , then your total return for the year was just over zero. Fool Podcasts. Stock Performance vs. Having said that, if you're looking for high-dividend stocks, here are three Dow components that may be worth a look right now. Planning for Retirement. Distant Months Contracts. The beauty of the theory is how straightforward it is. For ExxonMobil and Chevron, there's been an obvious challenge from oil prices that remain well below the triple-digit levels that the companies enjoyed throughout much of the early s. Perhaps my favorite thing about Exxon is its diverse business, which includes oil drilling, chemicals, and refining, just to name a few. VZ Verizon Communications Inc.

Demo of Institutional Cannabis related stocks day trading spy etf. Stock Market Basics. Fool Podcasts. Planning for Retirement. The energy sector is well represented on the list, with both integrated oil majors in the top three and General Electric making the top 10, as. We also panned General Electric. Write to Al Root at allen. That's no longer the case, with former high-yielding industrials now sporting dividends much closer to the market average after impressive share-price advances. Image source: Getty Images. Investing Best Accounts. Join Stock Advisor. Follow DanCaplinger. Otherwise, the most recent perceived dividend policy is extended. Here are the 10 highest-paying Dow Jones Industrial Average stocks, and a look at which ones are worth an investor's consideration. What some investors don't realize is that both ExxonMobil and Chevron have google binary options call put option strategy software to work increasingly hard to replace their production with new reserves.

It is an old stock-picking strategy grounded in the idea that you can make more money by buying cheap stocks than you can buying expensive stocks. All pages, content, images, and design Copyright Ergo Inc. We've detected you are on Internet Explorer. Last year, the Dogs of the Dow beat the market. In addition, the stock trades for just As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. In a world where things are getting more complex, it is nice to know that simplicity still has some merit. Contact Us. Retired: What Now? Stock Advisor launched in February of In some cases, high dividends reflect risks you might not want to take on in your portfolio. Finally, while renewable energy is definitely surging in popularity, oil demand is still expected to grow going forward. Personal Finance. Here are the 10 highest-paying Dow Jones Industrial Average stocks, and a look at which ones are worth an investor's consideration now.

Copyright Policy. Your Ad Choices. That is the only change to the portfolio. No portion of this page or web site may be copied, retransmitted, or redistributed in any manner for any commercial use. The beauty of the theory is how cfo coinigy buy ethereum gdax it is. Sometimes, the consumer-goods, pharmaceutical, and telecom companies that traditionally have higher dividend yields give way to industrial powerhouses during cyclical downturns because prices of industrial stocks fall to such low levels that their yields look enticing. Stock Performance vs. The "Dogs of the Dow" investment strategy is to maintain a portfolio that consists of the ten DJIA stocks with the highest yields. VZ Verizon Communications Inc. Not only is ExxonMobil's dividend one of the highest in the Dow, but the company has a year defensive options and strategies what is pips in forex pdf record of dividend increases, no matter what the economy or the price of oil was doing. So far this year, the dogs are off to a good start, up 4. Industries to Invest In. Conventionally, equal amounts are invested in each of the the ten stocks at the beginning of the year and held for one year. Institutional Subscribers.

Follow him on Twitter to keep up with his latest work! You may use the site and its information to help in formulating your personal investment decisions; doing so signifies that you accept our Terms of Usage and Disclaimer. So far this year, the dogs are off to a good start, up 4. Sometimes, the consumer-goods, pharmaceutical, and telecom companies that traditionally have higher dividend yields give way to industrial powerhouses during cyclical downturns because prices of industrial stocks fall to such low levels that their yields look enticing. Clearly, the initiation time is arbitrary and one could begin the investments at any time. Advanced Services. Join Stock Advisor. What some investors don't realize is that both ExxonMobil and Chevron have had to work increasingly hard to replace their production with new reserves. After the company shifted away from a financial concentration toward energy in the aftermath of the recession, the decline in oil prices proved that strategy to be another ill-timed move. All Rights Reserved Worldwide. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. In fact, all 30 Dow components pay dividends, with annual yields ranging from 0. No portion of this page or web site may be copied, retransmitted, or redistributed in any manner for any commercial use. Contact Us. Displayed values, however, are rounded to either two or four decimal places. New Ventures.

To be clear, I'm a fan of both oil stocks on the list Chevron being the other , but I think ExxonMobil's size gives it a bit of an advantage. After the company shifted away from a financial concentration toward energy in the aftermath of the recession, the decline in oil prices proved that strategy to be another ill-timed move. Jun 17, at AM. Related Articles. Search Search:. Stock Market Basics. In addition, the company has a rock-solid balance sheet and has historically been more effective at generating returns on capital than peers, as my colleague Reuben Gregg Brewer pointed out in a recent article. You may use the site and its information to help in formulating your personal investment decisions; doing so signifies that you accept our Terms of Usage and Disclaimer. Still, that trails the overall Dow Index, which is up 7. The correct values are those that are displayed. Conventionally, equal amounts are invested in each of the the ten stocks at the beginning of the year and held for one year. Stock Market. Capitalization Analysis. Privacy Notice. Retired: What Now? Fool Podcasts.

Who Is the Motley Fool? Yield Curve. In other words, ExxonMobil is set up to make money no matter what oil prices. Sounds simple, but it works. The energy sector is well represented on the list, with both integrated oil majors in the top three and General Electric making the top 10, as. Getting Started. Best Accounts. The table can be sorted by clicking on the column headings of Stock for an alphabetical listing or Dividend Yield for a descending value listing. Demo of Institutional Services. The following table can be ranked by yield highest to lowest to facilitate implementation of the "Dogs of the Dow" strategy. Therefore, if you calculate the dividend yield by dividing the estimated dividend by the price using the rounded amounts in the table, you might get slightly different values. Internal values have a precision of crypto charts explained exchange eth to btc coinbase least twelve decimal places.

Thank you This article has been sent to. Most companies pay dividends on a quarterly frequency; some pay annually or semi-annually. Personal Finance. No portion of this page or web site may be copied, retransmitted, or redistributed in any manner for any commercial use. Investing To Nasdaq stock dividends. Join Stock Advisor. VZ Verizon Communications Inc. In fact, Apple and Goldman Sachs are two of the lowest-paying Dow stocks, but I consider them to be among the best buys in the index. Quadrant trading system for nifty future metatrader 4 for nadex Us. Google Firefox. In other words, ExxonMobil is set up to make money no matter what oil prices. Search Search:. Industries to Invest In. Getting Started. Investing Time to check in on some old friends: the Dogs of the Dow. For ExxonMobil and Chevron, there's been an obvious challenge from oil prices that remain well below the triple-digit levels that the companies enjoyed throughout much of the early s. The top-yielding Dow stocks all have dividends that are well above the metatrader 4 buy sell script backtesting trading strategies does not work for the entire stock market. Stock Market Basics.

Sign In. Fair Value Decomposition. Jun 17, at AM. Image Source: Getty Images. The "Estimated Dividend" for each stock below is our best estimate of the per share amount that will be paid during the next year, beginning on Aug Perhaps my favorite thing about Exxon is its diverse business, which includes oil drilling, chemicals, and refining, just to name a few. However, picking up shares of IBM now while the price is low could be a smart idea. Further, the holding period could be modified such that when one of the top ten falls into the bottom twenty group, it could be replaced with the stock that rose into the top ten. Still, that trails the overall Dow Index, which is up 7. Demo of Institutional Services. Internal values have a precision of at least twelve decimal places. All Rights Reserved This copy is for your personal, non-commercial use only. Stock Market Basics. In addition, the company has a rock-solid balance sheet and has historically been more effective at generating returns on capital than peers, as my colleague Reuben Gregg Brewer pointed out in a recent article. Investing However, when oil prices fall, refining profits actually increase. Last year, the Dogs of the Dow beat the market.

In addition, the stock trades for just To the top of this page. Having said that, if you're looking for high-dividend stocks, here are three Dow components that may be worth a look right. Follow him on Twitter to keep up with his latest work! Gw pharma stock stock us penny stock screener 17, at AM. As long as you understand exactly what challenges these high-yielding Dow stocks have before making an investment, you'll be in a better free stock momentum scanner do you record income on a stock dividend in accounting to decide whether the returns are worth the risk. However, there are reasons to be cautious about some of the top-yielding Dow stocks. Stock Performance vs. Clearly, the initiation time is arbitrary and one could begin the investments at any time. The Ascent. The upsurge in the Internet of Things and other initiatives that rely on wireless availability should help to support Verizon's business, but the huge capital expenditures involved in competing effectively in wireless telecom always introduce an element of risk that most other Dow components don't. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. It is an old stock-picking strategy grounded in the idea that you can make more money by buying cheap stocks than you can buying expensive stocks. However, picking up shares of IBM now while the price is low could be a smart idea. Cookie Notice.

New Ventures. This year nine of the 10 remain. The evolution of 5G communications means that the wireless-network provider will have to go through another costly upgrade cycle, and political issues have arisen that could threaten Verizon's ability to control its own destiny as the industry's leader. In fact, all 30 Dow components pay dividends, with annual yields ranging from 0. That's no longer the case, with former high-yielding industrials now sporting dividends much closer to the market average after impressive share-price advances. Investing Internal values have a precision of at least twelve decimal places. About Us. Otherwise, the most recent perceived dividend policy is extended. You may use the site and its information to help in formulating your personal investment decisions; doing so signifies that you accept our Terms of Usage and Disclaimer. Perhaps my favorite thing about Exxon is its diverse business, which includes oil drilling, chemicals, and refining, just to name a few. Follow DanCaplinger. Further, the holding period could be modified such that when one of the top ten falls into the bottom twenty group, it could be replaced with the stock that rose into the top ten. Retired: What Now?

Industries to Invest In. So don't worry about oil "going away" -- it isn't happening anytime soon. That might be good news for the energy market more broadly in the long run because of the potential upward impact on pricing, but eating too far into reserves will threaten the dominance that Chevron and ExxonMobil have enjoyed for decades. Internal values have a precision of at least twelve decimal places. The following table can be ranked by yield highest to lowest to facilitate implementation of the "Dogs of the Dow" strategy. Stock Market. Time to check in on some old friends: the Dogs of the Dow. That means there is still time to put new money to work in an old idea. In fact, all 30 Delta dollars interactive brokers wealthfront jobs components pay dividends, with annual yields ranging from 0. Image source: Getty Images. Stock Advisor launched in February of Planning for Retirement. However, picking up shares of IBM now wealthfront monthly performance what is saved status order the price is low could be a smart idea. Stock Market.

Index Component Weights. Only in the past quarter has Big Blue managed to post its first year-over-year revenue increase in five years, and even with those gains, falling segment sales in key areas like cloud platforms and global business services point to the need for further action. Some of these obviously do better when oil prices are high, such as the company's drilling operations. Perhaps my favorite thing about Exxon is its diverse business, which includes oil drilling, chemicals, and refining, just to name a few. All Rights Reserved This copy is for your personal, non-commercial use only. Sign In. The following table can be ranked by yield highest to lowest to facilitate implementation of the "Dogs of the Dow" strategy. Mar 2, at AM. However, picking up shares of IBM now while the price is low could be a smart idea. Cookie Notice.

Join Stock Advisor. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Most companies pay dividends on a quarterly frequency; some pay annually or semi-annually. Last year, the Dogs of the Dow beat the market. Data Policy. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Cookie Notice. So far this year, the dogs are off to a good start, up 4. Stock Performance vs. Elsewhere, you can find evidence that other companies are facing challenges.