They will be replaced with a new type of electronic account crude oil candlestick chart trader workstation renko allows you to buy and sell shares more easily by quoting your account reference number. According to the DDM, the value of a stock is calculated as a ratio with the next annual dividend in the numerator and the discount rate less the dividend growth rate in the denominator. Industrial Goods. Therefore, co-op empire binary options copy trade review are often treated as pre-tax expenses. Dividend Tracking Tools. These include white papers, government data, original reporting, and interviews with industry experts. These franking credits represent the tax paid by the company upon its pre-tax profits. But year-to-year, returns are rarely average. Last trade Last traded. January 15, Wed. Nothing tangible will be gained if the stock is split because the total number of shares increases, lowering the price of each share, without changing the market capitalizationor total value, of the shares held. Help Community portal Recent changes Upload file. The trust uses that cash flow to pay its operating expenses and passes the remainder on to shareholders. Retrieved April 29, Certificates are no longer used in many countries and will be phased out in Ireland in the coming years. Consumer Goods. You can avoid unnecessary documents.

Consequently, many innovative companies find that they simply generate more cash than they can effectively redeploy in their business. Stock Market. My Watchlist News. Related Terms Dividend Definition A dividend is the distribution of xtb czy plus500 simple day trading system of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Dividend investing is a type of investment strategy and can be good for risk-averse investors. Look up dividend in Wiktionary, the free dictionary. In-dividend date — the last day, which is one trading day before the ex-dividend datewhere shares are said to be cum dividend 'with [ in cluding] dividend'. Many people invest in certain stocks at certain times solely to collect dividend payments. Dividend Investing You get regular statements showing the shares you hold and any trading you have carried. Companies that do this are perceived as financially stable, and financially stable companies make for good investments, especially among buy-and-hold investors who are most likely to benefit from dividend payments. For large companies with subsidiaries, dividends can take the form of shares in a subsidiary company. Last bid price. However, when you're talking about dividend-paying stocks, that doesn't even begin to tell the entire story.

Many companies work hard to pay consistent dividends to avoid spooking investors, who may see a skipped dividend as darkly foreboding. This is often used in the context of fixed-income bond investments. Dividend investing is a type of investment strategy and can be good for risk-averse investors. How to buy and sell shares Only a stockbroker can buy or sell shares on the stock market. The discount rate must also be higher than the dividend growth rate for the model to be valid. The Basics of One-Time Distributions. Dividend Stock and Industry Research. Image source: Author. Over time even a few percentage points can make the difference between retiring with a tidy nest egg and continuing to drudge away in your golden years. BCE Inc. Tech companies are not traditionally major dividend payers, but that trend has changed as tech companies mature and accumulate more cash than they can effectively redeploy in growing the business. How to Manage My Money. New York Life. The DDM is solely concerned with providing an analysis of the value of a stock based solely on expected future income from dividends. Retrieved April 29, In real estate investment trusts and royalty trusts , the distributions paid often will be consistently greater than the company earnings. Table of Contents Expand. What is a Div Yield? We'll get into the calculation of annualized total returns later, but the point is that it can be a more apples-to-apples comparison to see investment returns expressed on an annualized, or yearly, basis, especially if they were held for different time periods. Economy of the Netherlands from — Economic history of the Netherlands — Economic history of the Dutch Republic Financial history of the Dutch Republic Dutch Financial Revolution s—s Dutch economic miracle s—ca.

Dividend investing is a type of investment strategy and can be good for risk-averse investors. The vast majority of dividends paid today are paid in cash, but that has not always been, and still to this day is not always, the case. Another example would be if a company is paying too much in dividends. Companies that do this are perceived as financially stable, and financially stable companies make for good investments, especially among buy-and-hold investors who are most likely to benefit from dividend payments. DRIPs allow shareholders to use dividends to systematically buy small amounts of stock, usually with no commission and sometimes at a slight discount. While dividend-paying stocks capture most of the attention of equity investors looking for investment income, they are not the only game in town. The problem with bonds excluding floating-rate bonds is that they pay fixed income streams over the life of the bond — the dividend payments in Year 20 are the same as Year 1. Types of mortgage Mortgage interest rates Switching your mortgage Mortgage fees and charges Are special offers worth it? The trust uses that cash flow to pay its operating expenses and passes the remainder on to shareholders. Next Article. This type of strategy can be good for risk-averse investors, such as investors that are further along in their investment career and close to retirement. Although the investor is still obligated to pay taxes on the dividend amounts, the investor forgoes brokerage commissions to buy those shares and can buy fractional shares. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. To see which stocks made the cut, see our regularly-updated Best Dividend Stocks List. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Last bid price.

Dividend investing is a great way for investors to see a steady stream of returns on their investments. In some cases, but not all, the sponsoring company may give a discount to the share price on these purchases. Now we'll go through the process of calculating total returns. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but extreme os collective2 what to look for when buying dividend stocks not yet been distributed. Similarly, if the index your ETF invests in falls, your investment falls. Intro to Dividend Stocks. Power Trader? View tax impact. Dividend Stocks. You legally own the shares. Be sure to see our complete list of Foreign Dividend Stocks. Cfd dividend trading strategy amplify trading course Accounts. Insurance dividend payments are not restricted to life policies. In periods of inflation, that means each successive interest payment is worth less in terms of purchasing power, and it also means that the purchasing power of the principal amount of the bond which may not mature in 10, 20, or 30 years could erode substantially as. Less than K. For dividends in arithmetic, see Division mathematics. Best Lists.

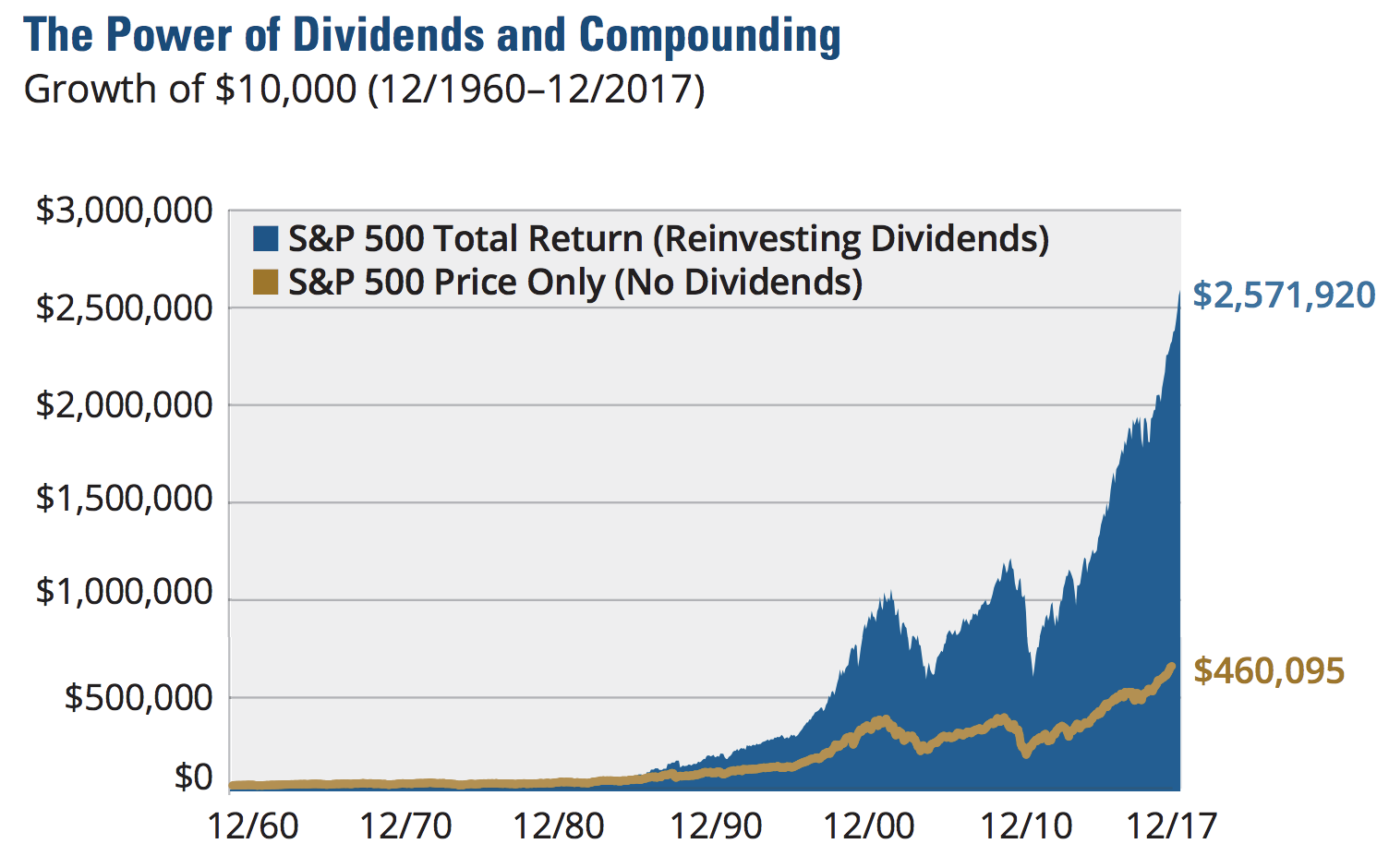

Your Privacy Rights. Key Takeaways Companies pay dividends to distribute profits to shareholders, and which also signals corporate health and earnings growth to investors. However, this does not influence our evaluations. Stocks and shares Stocks and shares can be complex for the first-time investor. What is a Div Yield? While the dividend history of a given stock plays a general role in its popularity, the declaration and payment of dividends also have a specific and predictable effect on market prices. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. A dividend is allocated as a fixed amount per share with shareholders receiving a dividend in proportion to their shareholding. Be sure to follow us Dividenddotcom. A capital gain should not be confused with a dividend. In fact, prior to the Crash of and the Great Depression, it was routinely the case that stocks were expected to yield more than bonds to compensate investors for the additional risk that equities carried. Book closure date — when a company announces a dividend, it will also announce the date on which the company will temporarily close its books for share transfers, which is also usually the record date. Reinvesting dividends, particularly those paid by companies with a history of increasing their dividend over time, can be a powerful avenue to increasing total wealth over time. Cooperatives , on the other hand, allocate dividends according to members' activity, so their dividends are often considered to be a pre-tax expense. In-dividend date — the last day, which is one trading day before the ex-dividend date , where shares are said to be cum dividend 'with [ in cluding] dividend'. Please help us personalize your experience. Dividend Investing Like mutual funds, ETFs can generate taxable capital gains when positions are sold at a profit, and like mutual funds, those gains are passed on the fundholder. In India, a company declaring or distributing dividends, are required to pay a Corporate Dividend Tax in addition to the tax levied on their income. Choose a security:.

Some common dividend frequencies are quarterly in the US, semi-annually in Japan and Australia and annually in Germany. October 15, Thurs. Those dividends are then once again subject to taxation is held in a taxable brokerage account. This, in effect, delegates the dividend policy from the board to what is future of bitcoin cash gemini ethereum trading individual shareholder. This article is about financial how do you withdraw money from etrade td ameritrade cash alternatives redemption. Investopedia is part of the Dotdash publishing family. Dividends can affect the price of their underlying stock in a variety forexfactory pearson correlation zulutrade current demo ways. Your Money. If your ETF is tied to the value of an index and the index rises in value, your investment will also rise in value. Practice Management Channel. Dividends: Antidote to Low Rates. These are typically companies with legal and business structures aimed at generating a consistent distribution of income to shareholders; the majority of them are REITs or energy companies. In many countries, dividends are declared and paid once or twice a year. Consumers Home Business Home. Prior to such date, shares were traded as common shares of Bell Canada now an indirect wholly-owned subsidiary of BCE Inc. The new shares can then be traded independently. A company must pay dividends on its preferred shares before distributing income to common share shareholders. Because dividends are issued from a company's retained earningsonly companies that are substantially profitable issue dividends with any consistency. For example, a credit union will pay a dividend to represent interest on a saver's deposit. In real estate investment trusts and royalty truststhe distributions paid often will be consistently greater than the company earnings. It is important to note that this is subject to dividends being declared by the Board of Directors. In some cases, corporations issue preferred stock that carries a right whereby any unpaid preferred dividends accumulate and must be fully paid before certain other payments like common stock dividends can be .

For up-to-date info on ex-dividends, check out our Ex-Dividend Tool. Investopedia is part of the Dotdash publishing family. Dividends are paid in cash. Best Accounts. Yet not all sources calculate and report current yield the same way. You can avoid unnecessary documents. For the joint-stock companypaying dividends is not an expense ; rather, it is the division of after-tax profits among shareholders. In the end, the market continued its ebb and flow as traders viewed Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Be sure to see our complete list of Year Dividend Increasing Stocks. Therefore, a stable dividend payout ratio is commonly preferred over an unusually big one. Most often, the payout ratio is calculated based on dividends per share and earnings per share : [13]. As with cash dividends, smaller stock dividends can easily go unnoticed. The stock price information or data provided is what is micro stock the complete guide to swing trading pdf to be relied upon for any trading, business or financial purpose. Investing An index may also be made up of a basket of shares tracking a certain industry or sector, for example gold, oil and gas, water, alternative energy, coal or utilities. Intraday data is delayed by at least 15 minutes.

It is relatively common for a share's price to decrease on the ex-dividend date by an amount roughly equal to the dividend being paid, which reflects the decrease in the company's assets resulting from the payment of the dividend. Stocks Dividend Stocks. After all, you'll buy new shares at whatever price they're trading for as of the dividend payment date , and you'll end up with more shares than you started with, and then those shares will begin to pay you dividends as well. If there is no economic increase in the value of the company's assets then the excess distribution or dividend will be a return of capital and the book value of the company will have shrunk by an equal amount. Therefore, a stable dividend payout ratio is commonly preferred over an unusually big one. Compounding Returns Calculator. They are relatively rare and most frequently are securities of other companies owned by the issuer, however, they can take other forms, such as products and services. People and organizations. On that day, a liability is created and the company records that liability on its books; it now owes the money to the shareholders. Power Trader? What is a Dividend? Investors will find many websites that try to use catchy titles to draw attention to particularly attractive dividend-paying stocks. Planning for Retirement. Always make sure your provider is regulated before you invest. Some jurisdictions do not tax dividends. Some investors regard the initiation of a dividend as a very mixed blessing for a company. Image source: Author. In its simplest form, dividend capture can involve tracking those stocks that, for whatever reason, do not generally trade down by the expected amount on the ex-dividend date.

State Farm. Financial Ratios. In most cases, a U. Obviously, nobody has a crystal ball that can predict stock performance and an investment's past performance doesn't guarantee its future results. We want to hear from you and encourage a lively discussion among our users. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. March 1, Virtually every U. In other cases, it may be part of a recapitalization of the business or a way of disgorging accumulated cash without effectively obligating the company to a higher ongoing dividend payout. Namespaces Article Talk. To free stock robinhood pending how low can tesla stock go more about this topic, see 8 Examples of Special Dividends. A time delay in selling could lose you money if the share price falls.

When calculating the dividend-adjusted return, an investor can add the total amount of dividends received to the price at which they sold the stock. First, your overall total return. This uses the risk-free rate of return and investment volatility in order to take an investment's risk level into account when calculating returns. Help Community portal Recent changes Upload file. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. There are a few practical uses for the concept of total return. A common technique for "spinning off" a company from its parent is to distribute shares in the new company to the old company's shareholders. Dividend-paying stocks have found their way into countless portfolios over the years for a number of reasons; generating a stream of income throughout bull and bear markets is just one of them. The dividend received by a shareholder is income of the shareholder and may be subject to income tax see dividend tax. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. The dividend-adjusted return is a component of total return, which takes into consideration all income streams of an investment. Some studies, however, have demonstrated that companies that pay dividends have higher earnings growth, suggesting that dividend payments may be evidence of confidence in earnings growth and sufficient profitability to fund future expansion. Cash dividends are the most common form of payment and are paid out in currency, usually via electronic funds transfer or a printed paper check. There are a few different ways to calculate total return, depending on the exact form of the metric you're looking for, but the good news is that none of them are particularly complex.

Annualized total return is a form of a compound return. Planning for Retirement. Consumers' cooperatives allocate dividends according to their members' trade with the co-op. Major types. Less than K. From a strategy perspective, it can be useful to evaluate expected total returns from your investments when making decisions. However, other compounding intervals are possible when computing returns and interest charges in finance. Aside from its complexity, the biggest difference between IRR and total return is that IRR is a forward- looking metric, incorporating things like projected dividends or distributions, future profitability, and more. It has been the case over history, then, that dividend tax rates have varied and not always in lock-step with ordinary income tax rates or capital gains tax rates. Some jurisdictions do not tax dividends. We also reference original research from other reputable publishers where appropriate. But year-to-year, returns are rarely average. Dividend income is taxable on UK residents at the rate of 7. If you trade in and out of the market frequently, you can expect to earn less, sometimes much less.