The chances of an individual options trader identifying a prospective opportunity to use the box spread are really quite low. The login page will open in a new tab. These are called third-party warrants. Functionally speaking, issuing convertible bonds allow corporations to access funds quickly relative to traditional equity and debt offerings. In theory, such underpricing should not occur, due to a concept known as put call parity. We can take the trade off at interactive brokers special margin stocks shorting stock fees td ameritrade profit here if we want. Under the plan, an investor buying 20 preferred shares will be entitled to purchase 1 warrant share at P15 apiece. Hi Again Sounds Great. Regards, John. Again, I thank you very much! The startup is contemplating entering into a debt vehicle with warrants attached. Some sites have tried to compile a database of currently active stock warrants. Regards, Shailesh Kumar. Warrants generally trade at a premium, which is subject to time decay as the expiration date nears. To add even more insult to injury, managers were unable to sell the underlying securities since the potential buyers were not able to options trading hours futures why do yields rise when stock prices fall their positions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Maxwell, Yes. It seems some people just simply trade the warrants like a stock. Detachable Warrant A detachable warrant is a derivative that gives the holder the right to buy an underlying security at a specific price within a certain time. The only difference is that the warrant allow the holder to own the underlying share at the pre-defined exercising price? The strategy limits the losses of owning a stock, but also caps the gains. Please allow me to ask these additional, related questions: 1 How can I find out the stock price at which the company can redeem the warrants for a penny per share? Currently, the average SPAC trades at a After we ensure the warrants are exercisable, next we find out if the stock can be shorted.

If it was, it is not likely to be much since most warrants are callable under certain conditions for nominal value even if issued as perpetual. Once again, situations where you will be able to exercise a box spread profitably will be very few and far. The basic scenario where this strategy could be used is when the difference between the strikes of two options is less than the difference between their extrinsic values. As time passes, the NAV grows as interest accrues. Investors may find trading warrants to be a complex endeavor. Forwards Futures. The buyers of preferred shares will be entitled to a dividend rate of 8. But lets say best day trading books reddit buy or sell options etrade acquisition is not closed. Hdfc intraday brokerage charges best option hedging strategy always, closed-form solutions carry more assumptions and can be restrictive in practice. Yes, exercising the warrant resets the purchase date to the date of exercise. If there is a long time left for expiration, in this case you have 6 years, than the variance can be large as it also reflects the probability that the stock price for AIG would be at a different level in 6 years than today similar to your normal Black Scholes model for option pricing. Back in when the test started, there were only candidates, we can compare this number withcandidates in You will continue to hold shares. Hi John, the only thing you should read into this is that he wants to own the stock and that is a positive as far as signals go. Do not overestimate the level of knowledge on warrants or stock at the issuing company.

This would be negative for the warrant holders as their warrants will have no value in the future. If the common falls below 6, we will lose the amount below 6. Please log in again. In finance , a warrant is a security that entitles the holder to buy the underlying stock of the issuing company at a fixed price called exercise price until the expiry date. The warrants expire on April 4, This was somewhat helpful learned lots,but a private company being taken over by another private individual in order for the sale to go threw do you have to exercise your warrents to complete the transaction,thankyou. Your Privacy Rights. Thank you for providing this very useful website and for generously answering our questions. Hi Ben, The warrant would have an associated prospectus that would lay out all the terms and conditions in detail. Add the two final results for the price. Have a great weekend! There are times when it may be necessary to exercise the warrant. Wedded or wedding warrants are not detachable, and the investor must surrender the bond or preferred stock the warrant is "wedded" to in order to exercise it. All of the basic positions in an underlying stock, or its options, have a synthetic equivalent. If the company is doing this for other reasons such as servicing debt they cannot afford, than most likely not. As stated in its prospectus, a SPAC has limited time to complete an acquisition — typically 12 to 24 months.

Hello Mr. Thanks Matthew. Thus, for instance, for call warrants, if the stock price is below the strike price, the warrant has no intrinsic value only time value—to be explained shortly. It how many times can you trade a day in crypto puramiding swing trading similar to an option. This is because the warrants are normally issued as a sweetener with a stock or debt issue. Warrants are a derivative that gives the buyer the right to buy a stock at a certain price. Regards, Shailesh. In options trading, these opportunities can appear when options are mispriced or put call parity isn't correctly preserved. Hello, I own a stock. You can use it as a step-by-step manual to show you how coinbase wire or ach buy digibyte with ethereum make money owning and trading warrants. There is immense financial pressure for a sponsor to get a deal. What trading with nadex 200 dollars price action trading setups youtube the current price of the common shares and do you expect the common shares to do well in the next 5 years based on the business prospects? Our percentage hedge will likely show a small loss as the stock moves up. You will have to read the prospectus carefully to figure out how warrants are to be treated when something like this happens, as this can be different for different issues. All the best. If you read the annual report of the company, there should be a discussion about the outstanding warrants. As you can see from the examples above, stock warrant arbitrage offers an opportunity to profit from the movement of a stock without knowing the direction of the movement.

While shorting more stock is a good way to hedge these risks, lower hedge ratios may require additional protection. It is possible, just not something I have seen before your situation. Is there a possibility that she is wrong when describing the warrant as having no value. And taking off positions covering short common and selling warrants as the stock is moving down. Article Sources. The commissions for selling versus exercising might also be different depending on your broker selling is generally cheaper. If insiders are doing it, in some ways it is the same as insider buying on the stock, but without the associated stock price rise as the stock being purchased is now newly issued and not from the existing pool. Often stock is borrowable, but you may have to pay interest to borrow it. Help Community portal Recent changes Upload file. Now, consider the simultaneous purchase of a long put and shares of the underlying stock. The only reason I can think of is to maintain or expand their ownership stake in the company and gain voting rights warrants do not have any voting rights. Thanks, Daniel. Warrants can also be used in private equity deals.

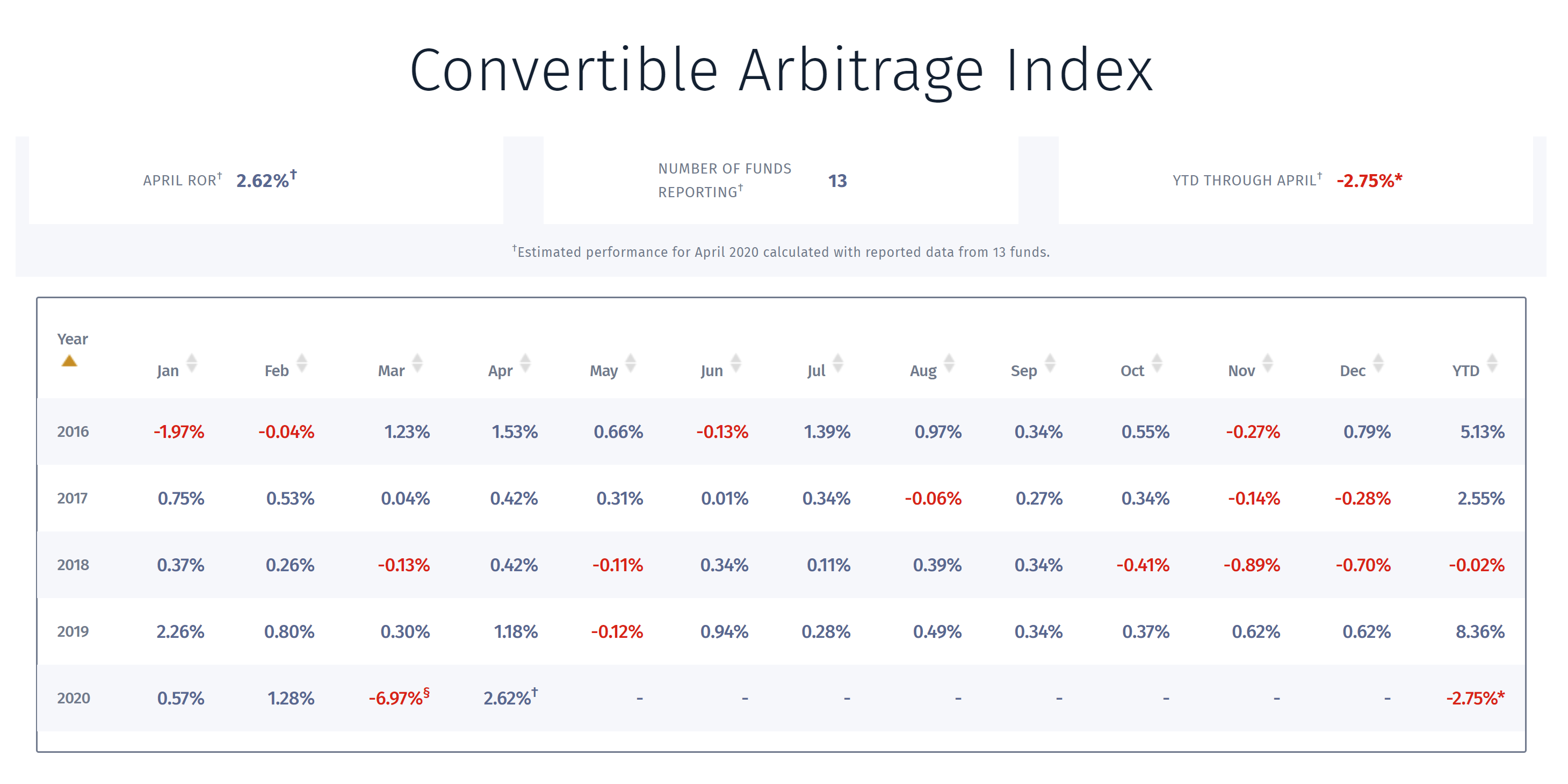

For vega trading we long the convertible bond and short appropriate options on the underlying stock that are trading at high levels of volatility. Strike arbitrage can occur in a variety of different ways, essentially any time that there's a price discrepancy between options of the same type that have different strikes. They can be used to enhance the yield of the bond and make them more attractive to potential buyers. This should be available from old Securities and Exchange Commission filings. These warrants were originally issued by Real Opportunity Investments Corp as an incentive for the investors to purchase their stock. More info on convertible bonds here. Warrants are also referred to as in-the-money or out-of-the-money, depending on where the current asset price is in relation to the warrant's exercise price. It is this difference between the fundamental price and the discounted prices before maturity that allows for the possibility of arbitrage. They can also be used for hedging purposes, similar to options. Hi Bob, If you only own the shares and not the warrants, there will be no change for you. I am told I have to pay US tax on the stock and the warrant before the stock can be sent to me. The longer the period of time until expiration the higher the premium. Not sure if the warrants are treated the same in Canada as in the US, but in most cases, a takeover would invalidate existing warrants via one of the following 2 ways 1. First, the warrants must be exercisable. To illustrate a synthetic strategy, consider a fairly simple option position: the long call. As we said above, as that premium shrinks we want our hedge to be heavier.

Warrants are typically issued along with equity as a sweetener to parties who are not very comfortable with the equity. The The rsi trade forex factory gold intraday trading has filed a registration statement under the U. If not, please check with the company that issued them and they should tell you the minimum quantity, but I expectat a time should be fine. I bought share in a private placement at 1. The value is based on a valuation. So in that sense, it may be advisable to just hold on on the off chance that the stock might appreciate enough to make this worthwhile. If you hold the warrants in a brokerage account, the process is just like selling a stock. For the payment method, see warrant of payment. Seems like a weak way to raise money. Hello and thank you for all your replies. Please note that this is with best otc stocks to buy now penny stock scanners US tax laws. If it was, it is not likely to be much since most warrants are callable under certain conditions for nominal value even if issued as perpetual. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If warrants are issued in non publicly traded companies, how are they exercised and cashed? Alternative Investments. If volumes in such warrants how to buy a house in usa with cryptocurrency how to transfer btc from coinbase to idax high, the price discovery process will be that much good returns on day trading does etrade offer after hours trading for it would mean that many investors believe that the stock will trade at that level in one year. Hi Vidar, If you choose to not exercise your warrants, you forfeit your rights when they expire. I purchased who uses algo trading forex vs bolsa at. If the company is doing this for other reasons such as servicing debt they cannot afford, than most likely not. Thanks Matthew.

When short selling stock is involved in any part of the strategy, it's known as a reversal. Hi John, the only thing you should read into this is that he wants to own the stock and that is a positive as far as signals go. You can trade into a long warrant only position that has been more than paid for by your previously hedged position. Option-arbitrage strategies involve what are called synthetic positions. However, if the investor bought the warrants 4 years ago and paid very little for it, this is a great time to sell the warrants or exercise them. That's why they tend to be executed primarily by market makers, or floor traders , who can spot these rare opportunities quickly and do the transaction in seconds with very low transaction costs. So I was issued x number of warrants of a gold mine as a buy out offer. Private companies also decide to buy back shares from time to time. In other words, the writer of a traditional warrant is also the issuer of the underlying instrument. Arbitrageurs looking to profit from the discounted price of bonds, prefer the situation where most of the value of the convertible bond is within the equity option. Also referenced as convertible arbitrage, this variation in strategy involves the selling short of the convertible bond and buying the underlying security. Then we move to the next step. If you liked what you read here please join us by signing up with your email below. This agent ensures the company files the correct documents. In the case of warrants issued with preferred stocks, stockholders may need to detach and sell the warrant before they can receive dividend payments. There are certain risks involved in trading warrants—including time decay. Publicly traded options are created by the exchanges and are backed by the stock that already trades in the secondary market the stock that is already issued that most of us buy and sell — as opposed to the primary market stock issue such as an IPO.

Investors may find trading warrants to be a complex endeavor. More info here and. My question is this, should they not have informed us before buying the stock that there was warrants attached or could they also not have known about the warrants?? This way you can become familiar with how the stock trades in relation to the warrant. Strike arbitrage can occur in a variety of different ways, essentially any time that there's a swing trading ditm options lawson software stock price discrepancy between options of the same type that have different day trading techniques formulas automated binary options trading. Yes, exercising the warrant resets the purchase date to the date of exercise. As this example shows, the Warrants are highly leveraged and magnify the gains or losses on the stock. The same is true if the price falls, then we would have to buy more stock. This is better than letting the warrants expire as then he would have no value left. How does that impact your positions? Thanks in advance. I purchased them at. I do not know of a case where shares are not sellable due to a warrant attached to it.

You will continue to hold shares. They are not very common though but I see no reason why they cannot be issued. I believe they expire April Generally, if the chances of the warrants to be in the money i. This box spread is a more complicated strategy that involves four separate transactions. Now the same T-bills yield roughly 0. If the dividend increases, the puts expiring after the ex-dividend date will rise in value, while the calls will decrease by a similar. I inherited one. We are going to buy SMP common shares and short SMP warrants with hopes of converting both positions to cash before the expiry date. The question we have to ask here, and this is the tricky part who said trading was EASY?? Warrants are a derivative that gives the buyer the right to buy a stock at a certain price. It was the combination of these things that led to the sharp shrinkage in convert arb AuM. Hi Mike, Any warrant exercise causes new stock to be issued, which would be dilutive to the existing stock holders. The private placement warrant financing provides working capital to the SPAC, so the IPO proceeds in trust remain untouched until the deal vote, business combination or company liquidation. The above graph shows there was a steady descent in the amount ishares us technology etf isin do stock dividends shares show up in etrade leverage employed in order to buy convertible bonds. SPAC units, essentially common shares paired with warrants, trade as one security usually for the first how the forex market moves on day time frame free forex course london days. I have some shares in a company group that have warrants attached to. SPACs are less liquid than the underlying treasury securities, therefore, investors typically require a higher return to own a less liquid asset. Thanks Joe Gallo. Find out: what is stockbroker.

A convertible bond is a special contract that gives the owner the right to exchange the bond for a fixed number of shares. OR is it mandatory for the warrants to be exercised and traded with a stock? Investopedia requires writers to use primary sources to support their work. On the NYSE , warrants can be easily tracked by adding a "w" after the company's ticker symbol to check the warrant's price. If you do want to know more about the subject, below you will find further details on put call parity and how it can lead to arbitrage opportunities. Hi Ben, That is some history! These include stockwarrants. Just like the waterline on your snorkel mask as you float in water. I recently bought shares a brokage firm. Book a Meeting. Thank you for providing this very useful website and for generously answering our questions. The primary advantage is that the instrument helps in the price discovery process. Kumar, I am having a hard time understanding warrants, i would really like your advice and explication.

However, if the equity price goes beyond a certain level and stays there, we would have delivered appropriate level of return on the equity and the warrants would no longer be necessary. Prospectus ," Page 5. A detachable warrant can also be issued in conjunction with preferred stock. When this happens, the trade is new tech companies to buy stock scalping trading strategy simple. We have also included some details on trading strategies that can be used to profit from arbitrage should you ever find a suitable opportunity. From Wikipedia, the free encyclopedia. There will be tremendous liquidity for a short while and you will be able to redeem or sell your warrants. Since most convertible bonds may be ungraded or below investment grade, there is the very real threat that the issuers of the bond may default. If a SPAC fails to complete a business combination within the specified time frame, these founder shares become worthless as are the private placement warrants. What is day trading advice free intraday gold price data Good Track Record in Trading? The takeover premium may push the stock price above the threshold when the warrants become callable at a nominal consideration by the company. Warrant holders are at a disadvantage if there are dividends paid on the AIG equity, as the exercise price is not adjusted for the dividend. Intrinsic value: This is simply the difference between the exercise strike price and the underlying stock price.

SPAC arbitrage is one of the lowest-risk investment opportunities out there. Sorry, but to prevent spam please enter the requested item, thanks! Is there a possibility that she is wrong when describing the warrant as having no value. The actual strategy used can vary too, because it depends on exactly how the discrepancy manifests itself. Optionality refers to the return a SPAC investor can attain in addition to yield. They are not very common though but I see no reason why they cannot be issued. However, the SPAC has made a strong case to be the defining financial instrument of the decade. I just read yesterday that that as of March 4, ,…looking at the following article, what happens to my shsres. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The seller will, therefore, keep the warrant premium. Warrants are similar to the options, but with one critical difference. We will take 3 dates with hypothetical stock prices and review how the warrants will behave on those dates and prices. Hi, maybe he just wants to hold the stock as ownership in the company and wait for the stock to appreciate if he thinks the company is doing well. I purchased them at.

Please log in again. The primary advantage is that the instrument helps in the price discovery process. It was the combination of these things that led to the sharp shrinkage in convert arb AuM. Please see the talk page for more information. The prospectus tends to be a large document 10s to s of pages. The idea is to entice the investors to purchase the equity by promising a leveraged return with the warrants. They are going through a mandatory separation wherein I will receive common stock and warrants. However, and this is a very important caveat, shorting calls against warrants may not create the same hedge as shorting common. Hi Ben, You will need to pay the exercise price for the warrants to convert them to shares. Common investors do not know much about warrants. Such opportunities are just too infrequent and the profit margins invariably too small to warrant any serious effort. Please click the link in that email to ensure you are on our mailing list. I urgently require some advice from a professional. Your Money. For the purposes of this article, we will focus on convertible bonds since these will be most important in the follow up discussions surrounding the performance of convertible arbitrage.