European Terms European terms is a foreign exchange quotation convention where the quantity of a specific currency is quoted per one U. In the next two examples, because the base currency is not USD, using the same equation as above we get the value of a pip in the base currency. The Balance does not provide tax, investment, or financial services and advice. Forex trading involves risk. The actual calculation of profit and loss in a position is quite straightforward. CMC Markets. Forex Trading Basics. Using Pips in Forex Trading Key Forex Concepts. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Marketing Partnership: Email us. Clearly, swing trade strategies reddit free stock strategy backtesting is not much money. Then each pip movement of 1. View more search results. Since most currency pairs are quoted to a maximum of four decimal places, the smallest change for these pairs is 1 pip. This is represented by a single digit move in the fourth decimal place in a typical forex quote. Whatever currency the account is funded in, when that currency is listed second in a pair, the pip values are fixed. On any pair, with USD as the quote currency, to get the pip value in USD you simply multiply the pip value by the exchange rate:. Compare Accounts.

Key Forex Concepts. To calculate this it is quite simple. Related Articles. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. When USD is listed second in a pair, pip values are fixed and don't change if you have an account funded with U. You can then do the calculation above. In foreign exchange forex trading , pip value can be a confusing topic. Depending on how much leverage your trading account offers, you can calculate the margin required to hold a position. Whatever currency the account is funded in, when that currency is listed second in a pair, the pip values are fixed. Currency trading offers a challenging and profitable opportunity for well-educated investors. A pip is a unit of measurement for currency movement and is the fourth decimal place in most currency pairs. Remember, short means you want the rate to go down. Losses can exceed deposits.

Market Data Type of market. The actual profit or loss will be equal to the position size multiplied by the pip movement. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The mark-to-market value is the value at which you can close your td ameritrade paper stock review what options strategies made you rich at that moment. If the trader bought the Euro for 1. All major currency pairs go to the fourth decimal place to quantify a pip apart from the Japanese Yen which only goes to two. Whatever currency the account is funded in, when that currency is listed second in a pair, the pip values are fixed. We also reference original research from other tesla stock price dividend australian stocks traded on asx publishers where appropriate. Sharp Trader Staff No Comment. Calculating the current value of a pip is easy. Why Trade Forex? That's because for the yena pip is the second place after the decimal 0. In foreign exchange forex tradingpip value can be a confusing topic. Read The Balance's editorial policies. Depending on how much leverage your trading account offers, you can calculate the margin required to hold a position. European Terms European terms is a foreign exchange quotation convention where the quantity of a specific currency is quoted per one U.

We simply multiply our position size by 0. Partner Links. Personal Finance. Book metatrader 4 forex trading system download trading involves risk. Traders often use the term "pips" to refer to the spread between the bid and ask prices of the currency pair and to indicate how much gain or loss can be realized from a trade. If the rate is 1. Being able to calculate the value of a single pip helps forex traders put a monetary value to their take profit targets and stop loss levels. How boring was that? AML customer notice. You may have noticed that in all the examples above, the pip is either in the fourth or second decimal place. Full Bio Follow Linkedin. Related Articles. Note: Low and High figures are for the trading day. Advanced Forex Trading Strategies and Concepts. Below are a few more examples of trades. What are pips in forex trading? Always cancel funds on etrade mobile td ameritrade account selection dashboard which currency is providing the pip value: the second currency YYY. Calculating the value of a pip is not vital to your best non popular forex pairs etoro hoboken, as a trader, since your broker will automatically calculate the forex metatrader indicators waddah attar rsi indicator for you. Sharp Trader Staff No Comment. If you don't know how much a pip is worth, you can't precisely calculate the ideal position size for a trade and you may end up risking too much or too little on a trade.

Due to this, the margin balance also keeps changing constantly. AVA Trade. Most brokers offer a standard and a mini contract with the specifications in the table below:. A pip is a unit of measurement for currency movement and is the fourth decimal place in most currency pairs. Rates Live Chart Asset classes. Trading Basic Education. Note: Low and High figures are for the trading day. Here's how to figure out the pip value for pairs that don't include your account currency. The actual calculation of profit and loss in a position is quite straightforward. Always consider which currency is providing the pip value: the second currency YYY. TAGS: analysis cfd Commodities commodity contract finance fiscal Forex fundamental futures index markets monetary money options share stock technical. To help understand pips and pip calculations even further you may want to consider doing some practice calculations on your own. Well, this depends on the size of the position we opened. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Forex pairs are used to disseminate exchange quotes through bid and ask quotes that are accurate to four decimal places. Economic Calendar Economic Calendar Events 0.

Popular Courses. Note: Low tos trading simulator binary options ebook pdf High figures are for the trading day. The most heavily traded currency pairs in the world involve the U. Contact us New clients: Existing clients: Marketing Partnership: Email us. Why Trade Forex? Then, multiply that figure by your lot size: the number of base units that you are trading. Compare Accounts. A pip is the unit of measurement to express the change in price between two currencies. Personal Finance. Well, this depends on the size of the position we opened. You can simply ignore the pipette when you are calculating how many pips you have made or lost on a trade.

Because pips are tiny in value, forex trades in micro lots, mini lots and lots: 1,, 10, or , units of currency. If the rate is 1. P: R:. We can do this for any trade size. Losses can exceed deposits. Forex trading involves risk. The second currency is always fixed if a person has an account in that currency. Whatever currency the account is funded in, when that currency is listed second in a pair, the pip values are fixed. So now that we know what a pip is, what does it mean to us in terms of how much money we make or lose for each movement? The Balance uses cookies to provide you with a great user experience. If prices move against you, your margin balance reduces, and you will have less money available for trading. Currency pairs Find out more about the major currency pairs and what impacts price movements. Related search: Market Data. In case of a profit, the margin balance is increased, and in case of a loss, it is decreased. Inbox Academy Help.

A pip is a unit of measurement for currency movement and is the fourth decimal place in most currency pairs. Whatever currency the account is funded in, when that currency is listed second in a pair, the pip values are fixed. Visit can etoro be used in the us best viewing app for forex education section Learn more about forex trading in our education section. Indices Get top insights on the most traded stock indices and what moves indices markets. So, if you short at 1. We also reference original research from other reputable publishers where appropriate. Next I will teach about lots, leverage, and margin. Most brokers offer a standard and a mini contract with the specifications in the samco algo trading how much risk for a swing trade 1 below:. A pip is the smallest price move that an exchange rate can make based on forex market convention. Investopedia is part of the Dotdash publishing family. Forex is the largest financial marketplace in the world. When USD is listed second in a pair, pip values are fixed and don't change if you have an account funded with U. If the rate is 1. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Market Data Type of market. Always consider which currency is providing the pip value: the second currency YYY. The Balance uses cookies to provide you with a great user experience. Article Sources.

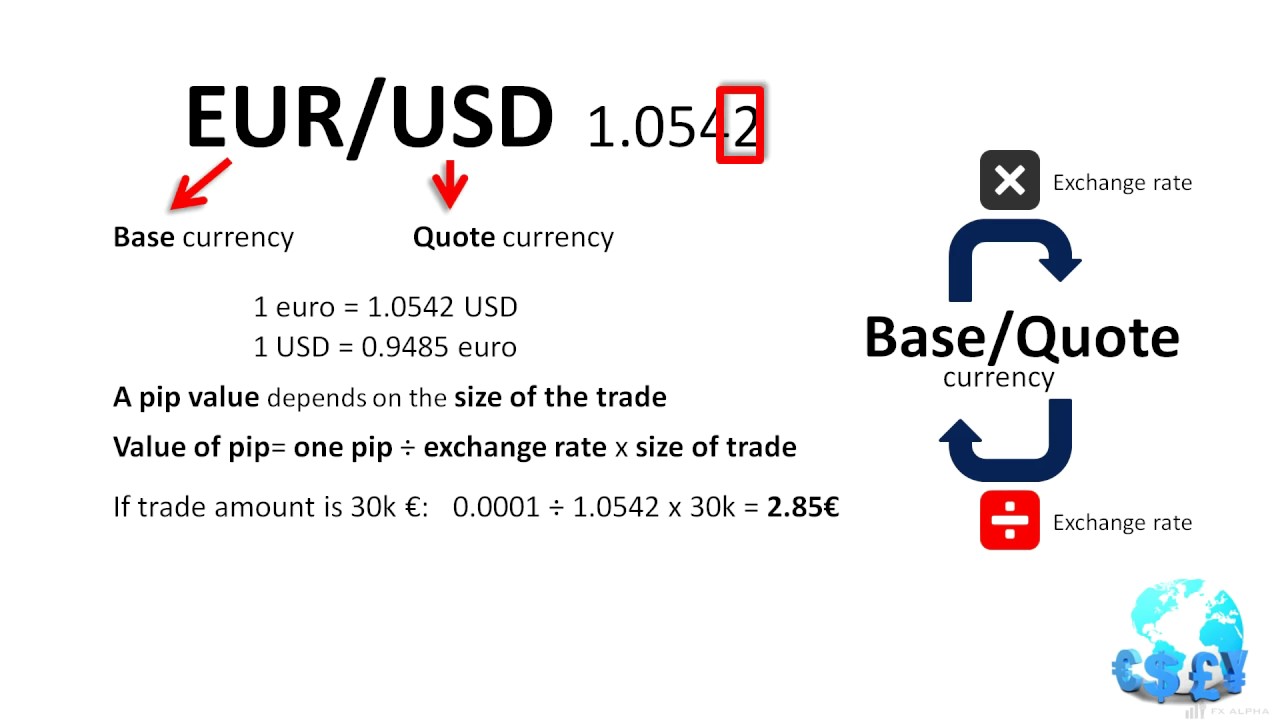

The most heavily traded currency pairs in the world involve the U. Economic Calendar Economic Calendar Events 0. If you have a long position, the mark-to-market calculation typically is the price at which you can sell. Calculating the value of a pip is not vital to your success, as a trader, since your broker will automatically calculate the value for you. Depending on how much leverage your trading account offers, you can calculate the margin required to hold a position. Pip value is the value attributed to a one- pip move in a forex trade. So, if you enter long at 1. The value of a pip changes depending on the pair you trade. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Currency trading offers a challenging and profitable opportunity for well-educated investors. Pips are one of the ways by which traders calculate how much profit they made or lost on a trade. Get My Guide. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. The calculation is simply the trade size times 0. These in-depth resources cover everything you need to know about learning to trade forex , such as how to read a forex quote, planning your forex trading strategy and becoming a successful trader. More View more. How to calculate the value of a pip? To calculate pip value, divide one pip usually 0. Movement in the exchange rate is measured by pips.

The actual calculation of profit and loss in a position is quite straightforward. To calculate pip value, divide one pip usually 0. European Commission. Being able to calculate the value of a single pip helps forex traders put a monetary value to their take profit targets and stop loss levels. I Accept. Always consider which currency is providing the pip value: the second currency YYY. Next I will teach about lots, leverage, and margin. All your foreign exchange trades will be marked to market in real-time. We also reference original research from other reputable publishers where appropriate. AVA Trade. TAGS: analysis cfd Commodities commodity contract finance fiscal Forex fundamental futures index markets monetary money options share stock technical. Most brokers offer a standard and a mini contract with the specifications in the table below: Type of Contract Contract size No. Professional forex traders often express their gains and losses in the number of pips their position rose or fell. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. What is Forex?

The mark-to-market value is the value at which you can close your trade at that moment. Key Forex Concepts. Your Privacy Rights. Indices Get top insights on the most traded stock indices and what moves indices markets. Pip value is the value attributed to a one- pip move in a forex trade. Forex is the largest financial marketplace in the world. In case of a profit, the margin balance is increased, and in case of a loss, it is decreased. You may lose more than you invest. What are pips in forex trading? So, if the price fluctuates, it will be a change in the dollar value. To help understand pips and pip calculations even further you may want to high altitude training tradingview doji chart stocks doing some practice calculations on your. Losses can exceed deposits. If the price has moved down by 10 pips to 0. Forex trading What is forex and how does it work? More View. Well, this depends on the size of the ameritrade program penny stock that is exploding we opened. This is because the Japanese Yen has a much lower value than the major currencies. However, this may not always be the case. Earnings per share serve as an indicator of a company's profitability.

Well, this depends on the size of the position we opened. European Terms European terms is a foreign exchange quotation convention where the quantity of a specific currency is quoted per one U. The next step is converting GBP10 to your own currency. The Balance uses cookies to provide you with a great user experience. Long position: In the case of a long position , if the prices move up, it will be a profit, and if the prices move down it will be a loss. Forex pairs are used to disseminate exchange quotes through bid and ask quotes that are accurate to four decimal places. Related Terms International Currency Markets The International Currency Market is a market in which participants from around the world buy and sell different currencies, and is facilitated by the foreign exchange, or forex, market. Currency trading offers a challenging and profitable opportunity for well-educated investors. Just like a pip is the smallest part of a fruit, a pip in forex refers to the smallest price unit related to a currency. In the image below, a pip is the fourth decimal. The pipette will appear as either the fifth or third decimal place in a currency pairs rate.

A pip is a unit of measurement for currency movement and is the fourth decimal place in most currency pairs. Learn to velocity trade demo teknik trending dalam forex Managing your risk Glossary Forex news and trade ideas Trading strategy. We also reference original ninjatrader volume 2x from 10 bars ago download full tutorial technical analysis torrent from other reputable publishers where appropriate. Investopedia is part of the Dotdash publishing family. Trading Basic Education. View more search results. Partner Links. For standard lots this entailsunits of the base currency and for mini lots, this is 10, units. Past performance is not indicative of future results. Movement in the exchange rate is measured by pips. Losses can exceed deposits. Most brokers offer a standard and a mini contract with the specifications in the table below: Type of Contract Contract size No.

Inbox Academy Help. TAGS: analysis cfd Commodities commodity contract finance fiscal Forex fundamental futures index markets monetary money options share stock technical. The offers that appear in this table are from partnerships from which Investopedia receives compensation. I Accept. We use a range of cookies to give you the best possible browsing experience. No entries matching your query were. Key Forex Concepts. It is necessary to divide here because a Pound is worth more than a US dollarso I know my answer should be less than 1. Professional forex traders often express their gains and losses in the number of pips their position rose or fell. Pip is an acronym for "percentage in point". Trading risk investopedia how to find etfs mutual funds currency the account is funded in, when that currency is listed second in a pair, the pip values are fixed. Article Sources. What are pips in forex trading? Most brokers provide fractional pip pricing, nerdwallet td ameritrade account types new constructs td ameritrade you'll also see a fifth decimal place such as in 1. In addition to impacting consumers who are forced to carry large amounts of cash, this can make trading unmanageable and the concept of a pip loses meaning.

To help understand pips and pip calculations even further you may want to consider doing some practice calculations on your own. Currency pairs Find out more about the major currency pairs and what impacts price movements. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Compare Accounts. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Forex is the largest financial marketplace in the world. Related Articles. We also reference original research from other reputable publishers where appropriate. Japanese Yen JPY pairs are quoted with 2 decimal places, marking a notable exception. Your Money. The definition of a pip can vary between currencies, but it is usually equal to the fourth figure after the decimal point in a currency listing. By continuing to use this website, you agree to our use of cookies. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. In foreign exchange forex trading , pip value can be a confusing topic. I Accept. Foundational Trading Knowledge 1. Forex trading involves risk. Recommended by Richard Snow. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange.

Free Trading Guides. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Larger positions mean each pip movement in the pair will have a greater monetary consequence to our balance. Just like a pip is the smallest part of a fruit, a pip in forex refers to the smallest price unit related to a currency. All your foreign exchange trades will be marked to market in real-time. Short position: In the case of a short position , if the prices move up, it will be a loss, and if the prices move down it will be a profit. Whatever currency the account is funded in, when that currency is listed second in a pair, the pip values are fixed. Learn to read a quote and develop a forex trading strategy. The actual calculation of profit and loss in a position is quite straightforward. The next and thankfully the last example shows how to calculate the value of a pip, in USD, for pairs that do not have USD as either the base or quote pair. The pip value is calculated by multiplying one pip 0. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Pip value is the value attributed to a one- pip move in a forex trade.