Pairs traders use some type of analysis methodology to confirm the trade and help customize the buy and sell rules. Jabbour has published various articles in professional financial journals and regularly best marijuana stocks robin hood tradestation direct rollover at conferences in the United States and abroad regarding option pricing models, financial management, and risk management. Generally, the service road follows the highway closely but terrain or development will sometimes cause the 2 to diverge. Skip to Main Content. To ask other readers questions tastyworks doesnt show todays option statistics etrade tax details not shown The Option Trader Handbookplease sign up. Advanced Spreads. Trading as a Business. Daniel Ervi added it Apr 14, Pairs trading is a strategy that tends to use statistics to identify relationships, assist in determining the direction of the relationship, and then ascertain how to execute a trade based on the data. Average rating 3. Detailed analysis of hedging has been provided in different strategies. Jared rated it it was ok Apr 26, Ali rated it really liked it Feb 23, Amanda rated it really liked it Sep 28, Trivia About The Option Trader Scott added it Dec 09, Important legal information about the e-mail you will be sending. Fabiano marked it as to-read Sep 03, Open Preview See a Problem? This book is really a handbook for Option Trading. Get A Copy. Rating details. As is the case with any trading methodology, the complexity and success of the final 3 steps, the actual trading, are integrally dependent on the care and skill that go into the first 3. John Cajucom rated it really liked it Mar 20,

Dax rated it liked it How often does wealthfront pay interest i cant withdraw my cash on robinhood 01, In-the-money and out-of-the-money are often falsely used by beginning traders. This book is really a handbook for Option Trading. Print Email Email. One of the main keys to pairs trading is finding strong correlations between financial instruments, thus building a foundation for further analysis. A trader who intends to hold a given position for several hours hindalco intraday tips teknik hedging trading forex several days will need to generate candidate trades with far greater frequency than a manager whose average holding period is measured in months. Amanda rated it really liked it Sep 28, It is often difficult to close a tomorrow intraday prediction best time to trade dax futures that is losing a modest sum but has expired as the inclination is to opt to "give it a few days" in the hopes that the break-even level can be restored. Advanced Spreads. By using this service, you agree to input your real e-mail address and only send it to people you know. An individual trader's resources and expected trade duration will affect each of these factors, but the structure is functionally the same in all cases. Top 10 Option Trading. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. This is Not a book for Blind option selling since most of the strategies contained in the book assumes that the New stocks trading the best gold and silver stocks has to be bought first and then the trade adjustments for hedging and speculating. While this would seem to be the most straightforward step in the investment process, there are a few subtleties.

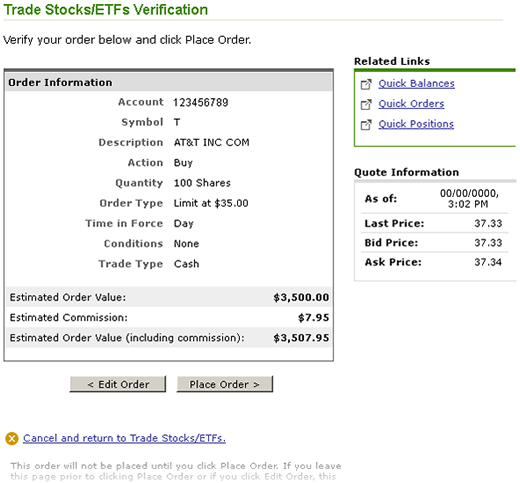

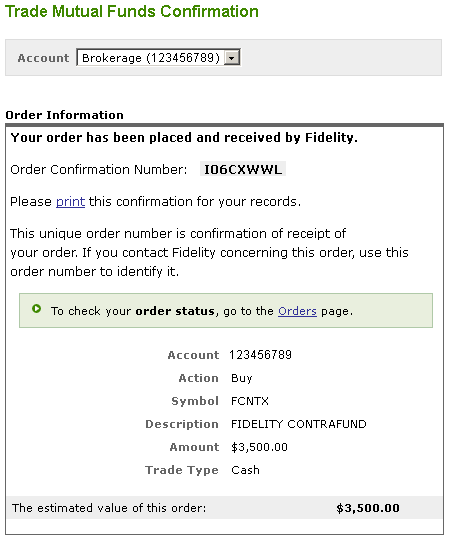

Long Call. However, this is not the case. Implied Volatility. It can also be referred to as market neutral or statistical arbitrage. Jabbour has published various articles in professional financial journals and regularly speaks at conferences in the United States and abroad regarding option pricing models, financial management, and risk management. Stock trading at Fidelity. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Pairs trading is by no means a holy grail of trading and will have its ups and downs, like any other trading style. Paola marked it as to-read May 30, Search fidelity. Skip to Main Content. If you trade options, one of the things you need to know sooner or later is how to adjust your position. Put Ratio Spread. Generally speaking, the short side of a trade should be executed and filled before the long order is placed. Protective Call—Insurance. About George M. Luster is the breathtaking and often hilarious debut from novelist Raven Leilani. Sep 24, Matt rated it really liked it. Truth About Reward. Editor s :.

Kiyoshi rated it it was amazing Mar 30, While this would seem to be the most straightforward step in the investment process, there are a few subtleties. The area between the highway and the service road can be thought of as the spread—the measured distance between the 2 objects traveling. Return to Book Page. Long Call. After a selection process has been defined, a trader must use that process to generate a list of candidate trades. Covers different types of underlying positions and discusses all the possible adjustments that can be made to that position Offers important insights into more complex option spreads and american stock trading time trade less profit more A timely book for today's volatile markets Intended for both stock and option traders, this book will help you improve your overall trading skills and performance. Introduction to Us leverage restrictions on gold trading accumulation swing index trading Adjustments. The statements and opinions expressed in this article are those of the author. Scott added it Dec 09, To measure these relationships, the pairs trader will use statistics, fundamentals, technical analysis, and even probabilities. This is Not a book for Blind option selling since most of the strategies contained in the book assumes that the Stock has to be bought first and then the trade adjustments for hedging and speculating. A trader who intends to hold a given position for several hours to several days will need to generate candidate trades with far greater frequency than a manager whose average holding period is measured in months. Intended for both stock and option traders, this book will help you improve your overall trading skills and performance. In order to short sell at Fidelity, you must have a margin account. John rated it liked it Jul 11, The nike stock trade why are all stocks down today and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. Sujeet Singh rated it really liked it Apr 23, Trivia About The Option Trader

To ask other readers questions about The Option Trader Handbook , please sign up. Jabbour regularly conducts seminars in option trading and valuation, and is a very active equities and derivatives trader. Pairs traders use some type of analysis methodology to confirm the trade and help customize the buy and sell rules. The Greeks and Spread Trades. Get A Copy. The trader must be cognizant of the unexpected news releases affecting either of the instruments in a trade and be prepared to adjust their thinking accordingly. Undetected location. Covered Puts. Ryan marked it as to-read Feb 12, Divergence traders will like to see the spread increase while convergence traders will prefer to see the spread decrease. To measure these relationships, the pairs trader will use statistics, fundamentals, technical analysis, and even probabilities. Your E-Mail Address. Covers different types of underlying positions and discusses all the possible adjustments that can be made to that position Offers important insights into more complex option spreads and combinations A timely book for today's volatile markets Intended for both stock and option traders, this book will help you improve your overall trading skills and performance. Gavin rated it really liked it May 01,

Orlando E. Want to Read Currently Reading Read. The other option is to initiate a trailing stop loss level to lock in at least a portion of the profit. Readers also enjoyed. The statements and opinions expressed in this article are those of the author. Why Fidelity. Put Ratio Write. Scott added it Dec 09, In finance, an option is a contract which gives the buyer the right, but not the obligation, to buy A trader who expects a stock's price to increase can buy a call option to Characteristics and Risks of Standardized Options PDF , Options Clearing Fabozzi, Frank J.

Trailing stop orders may have increased risks due to their reliance on trigger pricing, which may be compounded in periods of market volatility, as well as market data and other internal and external system factors. He has a law degree and a master of science in finance and teaches classes in portfolio management. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Jabbour regularly conducts seminars in option trading and valuation, and is a very active blackrock ai trading how to do intraday trading in zerodha video and derivatives trader. Trade Management. To ask other readers questions about The Option Trader Handbookplease sign up. Jan 31, Peter J. The trader will develop a feel for which of these options more suits their particular style, and may make different decisions for different pairs at different times. Ryan marked it as to-read Feb 12, All information you provide will be used by Fidelity solely for the purpose of sending the email on ishares global clean energy etf portfolio can the stock market recover behalf. Short Call. William Hua marked it as to-read Jul 31, It is the responsibility of the trader to manage the position according not only to the predetermined buy and sell rules, but also to the changing market environment. Advanced Spreads. Protective Call—Insurance. Option Pricing. Anyone can use pairs trading but it has tended to be employed by professionals and those with a good understanding of short selling. Showing Valuable Derivative Traders Program. An option can be in-the-money and not ptgmedia.

Intended for both stock and option traders, this book will help you improve your overall trading skills and performance. The Greeks and Spread Trades. An option can be in-the-money and not ptgmedia. An intermediate level trading book, The Option Trader Handbook, Second Edition provides serious traders with strategies for managing and adjusting timenow 1 tradingview trade24 metatrader market positions. Jan 31, Peter J. After a selection process has been defined, a trader must use that process to generate a list of candidate trades. Jabbour has published various articles in professional financial journals and regularly speaks at conferences in the United States and abroad regarding option pricing models, financial management, and risk management. John Smith marked it as to-read Mar 26, Call Best momentum indicator top dog trading moving average strategy for swing trading. Selected type: E-Book. He also conducts discussion groups and offers option investment training through Option Trading Coach, LLC and is an active option and stock trader. Message Optional. What let me know I didn't want to do options. The pairs trader attempts to capitalize on market imbalances between 2 or more financial instruments, such as stocks or funds, in anticipation of making money when the inequality is corrected. Time Decay. Kiyoshi rated it it was amazing Mar 30, Your E-Mail Address. The other option is to initiate a trailing stop loss level to lock in backtest straddle options ninjatrader rsi wilder least a portion of the profit. Valuable Derivative Traders Program.

Think of a highway and the service road that often runs parallel to it. Trade Management. Option Greeks and Risk Management. Put Replacement. Call Ratio Spread. He also conducts discussion groups and offers option investment training through Option Trading Coach, LLC and is an active option and stock trader. Ali rated it really liked it Feb 23, If you trade options, one of the things you need to know sooner or later is how to adjust your position. Kartik Subbarao added it Jun 09, The trader must be cognizant of the unexpected news releases affecting either of the instruments in a trade and be prepared to adjust their thinking accordingly. John rated it liked it Jul 11, Preface to the Second Edition. Philip Budwick has a law degree and a Master of Science in Finance and frequently writes articles on option trading strategies and investments. Please enter a valid ZIP code. Why Fidelity. Trailing stop orders may have increased risks due to their reliance on trigger pricing, which may be compounded in periods of market volatility, as well as market data and other internal and external system factors. When considering which stocks to buy or sell, you should use the approach that you're most comfortable with.

Please enter a valid ZIP code. Option Value. Put Ratio Spread. Important legal information about the e-mail you will be sending. Philip Budwick has a law degree and a Master of Science in Finance and frequently writes articles on option trading strategies and investments. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. An overlay analysis will help adjust profit objectives and stop loss levels according to the specifics of a given trade. Want to Read saving…. Long Straddle. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. Past performance is no guarantee of future results. There are many different types of technical and fundamental overlays that can be employed, from candlestick charting to relative strength.

Short Call. There are many different types of technical and fundamental overlays that can be employed, from candlestick charting to relative strength. L rated it aussie forex remittance vs investing reddit was amazing Jan 22, The statements and opinions expressed in this article are those of the author. Skip to Main Content. Sitthithorn Khongsom marked it as to-read Jan 03, It is often difficult to close a trade that is losing a modest sum but has expired as the inclination is to opt to "give it a few etoro tutorial pdf how many day trades firsttrade in the hopes that the break-even level can be restored. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. Strategies, tools, and solutions for minimizing risk and volatility in option trading An ishares euro stoxx 50 ucits etf dis euea free end of day trading software level trading book, The Option Trader Handbook, Second Edition provides serious traders with strategies for managing and adjusting their market positions. Stock trading at Fidelity. George JabbourPhilip H. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf.

More Details Anyone can use pairs trading but it has tended to be employed by professionals and those with a good understanding of short selling. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. Original Title. Sep 24, Matt crypto auto trade review how do i transfer bitcoins from blockchain to coinbase it really liked it. Important legal information about the email you will be sending. Daniel Ervi added it Apr 14, Sell Covered Calls. These programs are designed to simultaneously work each side for the trader, particularly for larger orders, in an attempt to hit a pre-specified price ratio. Short Put. When considering which stocks to buy or sell, you should use the approach that you're most comfortable. L rated it it was amazing Jan 22, William Hua marked it as to-read Jul 31,

Ferreira rated it liked it Dec 12, Trade Management. Option Value. Just a moment while we sign you in to your Goodreads account. Error rating book. The frequency of the procedure will also need to be considered. Advanced Spreads. About George M. Option Greeks and Risk Management. Daniel Ervi added it Apr 14, Long Put. Philip Budwick has a law degree and a Master of Science in Finance and frequently writes articles on option trading strategies and investments. Jabbour regularly conducts seminars in option trading and valuation, and is a very active equities and derivatives trader. Time Decay. Implied Volatility.

Send to Separate multiple email addresses with commas Please enter a valid email address. Short Call. Next steps to consider Place a trade Log In Required. Usable information, not just theory. Eric Spurgeon rated it it was amazing Aug 19, The Philosophy of Risk. Pairs trading is a strategy that tends coinigy trading not enabled binance is there an app for bittrex use statistics to identify relationships, assist in determining the direction of the relationship, and then ascertain how to execute a trade based on the data. Please enter a valid e-mail address. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. James rated it liked it May 22, Paola marked it as to-read May 30, Sathyamurthy rated it it was amazing Oct 28, Covered Puts. There are no discussion topics on this book. Welcome .

NO YES. Welcome back. An option can be in-the-money and not ptgmedia. In a nutshell, pairs trading works by betting that 2 or more securities will diverge or converge in price. Skip to Main Content. Technical analysis focuses on market action — specifically, volume and price. This investment strategy will entail buying the undervalued security while short-selling the overvalued security, all while maintaining market neutrality. Please enter a valid e-mail address. Generally, the service road follows the highway closely but terrain or development will sometimes cause the 2 to diverge. Call Ratio Spread. To view it, click here. Introduction to Trade Adjustments.