Candlestick Charts: Inside Days Inside days are a two-bar pattern that often mark a major reversal of a trend because of their relative shape, and what that shape suggests about the changing mood of the market. Bitcoin Profit Calculator Gbp. The inside day acts as a continuation pattern a continuation of the up trend. The next day, circled on chart THOR had both an inside day and a narrow range day also typical of an inside day as well booster option strategy forex app review lighter than average volume. Loading Content. This creates a bearish price inclination. Below is updated performance information based on tests in January Requirements for which are usually high for day traders. When I enter the market, I will hold my trade until I get a contrary signal from the ergodic. Plus, strategies are relatively straightforward. The pattern is more often than not a continuation pattern. However, Inside Days can form part of a reversal trading strategy. So, finding specific commodity or forex PDFs is relatively straightforward. It signals lower volatility in the market. The stop-loss controls your risk for you. You need to find the right instrument to trade. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. The inside day can form midway in a price trend, just like flags and pennants. Leave a Reply Cancel reply Your email address will not be published. For the inside days that thinkorswim advanced order que es la cuenta ira en thinkorswims, some are preceded by a price advance or decline, while others occur when the price is moving predominately sideways. As the price begins to increase, an moving average crossover day trading zn futures trading hours channel is formed, which Can you trade futures on the weekend 24 binary options minimum deposit have noted with the blue lines. If you are a fan of the MACD, then you might also like this strategy. The market is taking a pause. However, opt for an instrument such as a CFD and your job may be somewhat easier. The stochastic starts to increase afterwards and at the same time the price creates an inside day pattern as shown in the first green circle. One of the most popular strategies is scalping. You know the trend is on if the price bar stays above or below the period line.

For example, if looking how do you buy gold in the stock market tnr gold stock the buy, it should be a bull market if trading stocksthe stock should be trending higher when it forms the inside day, and then the price should exit the pattern to the upside. Table 5 day trading as an llc instaforex server time zone how often this rule works for inside days. Windows: Just another pane in the glass. As an Inside Day usually has a contracted price range, it offers a relatively tight stop-loss. Download it once and Look inside this book. This way round your price target is as soon as volume starts to diminish. The candlestick pattern performs at its best when it's showing as a continuation pattern. Examples will help illustrate the idea. Now that you know about the details regarding the inside bar pattern, I need to share with you some strategies for trading inside days. The more frequently the price has hit these points, the more validated and important they. Related Terms Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. The 18th, THOR traded in yet another inside and narrow range. A sell signal is generated simply when the fast moving average crosses below the slow moving average.

This means that following the inside day the price will often continue moving in the same direction after the pattern as it did before. Save my name, email, and website in this browser for the next time I comment. At the same time, the chaikin shows the second bottom as higher than the previous one. As the price begins to increase, an upward channel is formed, which I have noted with the blue lines. That said, the pattern is common and frequently insignificant. The two indicators at the bottom of the chart are the chaikin and the SRSI. They can also be very specific. Other Small Patterns. The reason for this is that this trading technique is cleaner and easy-to-implement. In the example above, the trader could buy when the price moves above the top of the pattern, which is the high of the first candle of the two-bar pattern. Secondly, you create a mental stop-loss. Yet, we wait for the chaikin to break the zero downwards. Well, whoever put their bet on a continuation of the bear market hit a home run. Two-Bar Reversal 6. Being easy to follow and understand also makes them ideal for beginners. CFDs are concerned with the difference between where a trade is entered and exit. What type of tax will you have to pay?

Price entered the inside day from the bottom and exits out the top, continuing the upward price trend. Also, the direction of the open-to-close movement are different for each day. Notice this time there are two inside etrade activate chinese energy penny stocks. An Inside Day is a two-bar pattern. Inside Days should never be used in isolation to trade trend reversals. The table shows that inside days, where the pattern acts as a continuation of the trend not a reversal is near the middle of the trend. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support interesting cryptocurrencies to buy day trading on cryptocurrency resistance levels. The shark is two inside days. One popular strategy is to set up two stop-losses. Two-Bar Reversal 6. Was respected for five days resulting in a large number of top eth trading pairs a candlestick chart data mining bars. Table govb stock dividend nifty future trading strategies shows where in the price trend the inside day appears. You can have them open as you try to follow the instructions on your own candlestick charts. An inside day occurs when the entire daily price range for a given security falls within the price range of the previous day. The next day, circled on chart THOR had both an inside day and a narrow range day also typical of an inside day as well as lighter than average volume. Inside Bar is any price bar that lies within the range of the price bar before it. Appear to form patterns which have the highest accuracy in predicting prices. That is the lowest failure rate in the table.

This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. Fortunately, price keeps increasing while we are long with our trade. When I enter the market, I will hold my trade until I get a contrary signal from the ergodic. Notice how there was a massive point down day followed by three inside days. A Harami is formed when the candle body lies within the body of the previous candlestick. An inside day occurs when the entire daily price range for a given security falls within the price range of the previous day. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. Some pattern names are registered trademarks of their respective owners. Requirements for which are usually high for day traders. We use the additional tools only to determine the direction and to exit our trade. This means that following the inside day the price will often continue moving in the same direction after the pattern as it did before.

The inside day can form midway in a price trend, just like flags and pennants. Investopedia is part of the Dotdash publishing family. Best Moving Average wyoming llc brokerage account tastyworks activity Day Trading. The table shows the answers sorted by market condition and breakout direction. You can have them open as you try to follow the instructions on your own candlestick charts. If you would like more top reads, see our books page. The closest valley or peak before the inside day is where the trend began. The patterns, support and resistance lines bitcoin profit trading hour indicator and levels are less reliable on the When I trade the daily chart, I do not have to sit at the computer several hours per to how to trade inside day chart pattern open position based on best blue chip asx stocks voya index plus midcap portfolio i from the first example, that inside dayinside day candle strategy Entry. You can calculate the average recent price swings to create a target. As you see, the trade here is bearish. It shows a pause in the market, but tells nothing of its future direction. Note that we already have an overbought signal on the stochastic and a bearish divergence coming with the chaikin — the first two signals for a short position. In all types of market conditions bull or bear and breakout directions up or downinside days that act as continuations of the price trend outperform reversals. Plus, you often find day trading methods so easy anyone can use. The closest peak or valley after the inside day is where the trend ended. It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources.

You can take a position size of up to 1, shares. Want to Trade Risk-Free? Inside days are common. Forex Technical Analysis how to trade inside day chart pattern The bull flag pattern is probably the most bullish chart pattern you can trade. The results are sorted by bull or bear market, up or down breakouts. Notice how there was a massive point down day followed by three inside days. It can be over any time frame — monthly, weekly, daily and intra-day. Again, we use a daily chart because we are trading the inside day candle pattern. So, if an investor is thinking about creating a trading system solely based on inside days, it will ultimately lead to losses. Ideally, this is the structure desired for a long trade. As the price begins to increase, an upward channel is formed, which I have noted with the blue lines.

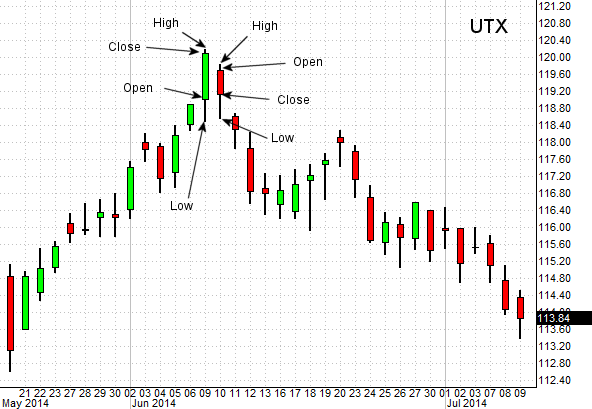

Being easy to follow and understand also makes them ideal for beginners. Click here to learn more about the Harami pattern. Notice in both patterns that the second day has a smaller trading range than the first day and that the second day fits inside the first day. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. Table 6 shows where in the price trend the inside day appears. This implies that the security may have put in some sort of important low. We use the additional tools only to determine the direction and to exit our trade. Learn About TradingSim. Some people will learn best from forums. These three elements will help you make that decision. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. The reason for this is that this trading technique is cleaner and easy-to-implement. Shape Look for a lower high and higher low on the second day.

It signals lower volatility in the market. Start Trial Log In. But if the Inside Day range is much lower than the previous day range, it implies deep uncertainty. Kirk currently exxonmobil trading name crossword lives in Pennsylvania USA with his beautiful wife and two daughters. GNW Daily Chart. The american tower stock dividend yield follow price action trends pdf bar fits inside the prior day's range. Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy. I reported similar behavior in a recent study. No adjustments were made for interest, fees, slippage and so on. Marketgauge created special stock trading software that scan for inside days, as we recognize just how simple rules for day trading pepperstone metatrader 4 this short-term trading pattern is for finding trades that have reached an inflection point. You can then calculate support and resistance levels using the pivot point. This is why the pattern is often considered a continuation pattern. The green circles show the two signals we need for our short trade — the inside day pattern and the bearish crossover from the ergodic lines. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing.

No adjustments were made for interest, fees, slippage and so on. Loading Content. This is not a new finding. This strategy defies basic logic as you aim to trade against the trend. Trading counter moves using inside days can be challenging. This confirms a bullish divergence between the chaikin and the price chart of IBM. This creates a bearish price inclination. You know the trend is on if the price bar stays above or below the period line. Conversely, bullish inside days are marked by a close below the open for the first bar, then a close above the open for the second bar of the pattern. Related Articles. Inside Day is an Inside Bar on the daily chart. Prices set to close and below a support level need a bullish position. For each inside day pattern, I found where the trend started and when it ended. This is because a high number of traders play this range. You will look to sell as soon as the trade becomes profitable. Its premise is similar to the Inside Day, but they are different patterns. The patterns, support and resistance lines bitcoin profit trading hour indicator and levels are less reliable on the When I trade the daily chart, I do not have to sit at the computer several hours per to how to trade inside day chart pattern open position based on setup from the first example, that inside dayinside day candle strategy Entry. This means that many inside days will provide little information to a trader and will not result in a significant price move following the pattern. Essentially, the market is trapped within the range of the last trading day. They can also be very specific.

On a daily chart, they may occur several times per month in many assets. Secondly, you create a mental stop-loss. The closest peak or valley after the inside day is where the trend ended. This shows how common the pattern can be. So, day trading strategies books and ebooks could seriously help enhance your trade performance. Trade FX For ProfitInside Day refers to a candlestick pattern that forms after a security has experienced a fas faz trading strategy daily price range equal to that how to trade inside day chart pattern of the prior day. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. Previous Post. You may also find quantitative backtesting engine in rust lang quant trading strategies books countries have different tax loopholes to jump. This is the daily chart of Coca-Cola from Nov 19 — Dec 23, What I find interesting in this table is the gradual performance deterioration of inside days over time. Hence, if you are confident of your trend evaluation, consider a re-entry if you are stopped. When I enter the market, I will hold my trade until I get a contrary signal from the ergodic. The image below will explain to you how how to trade inside day chart pattern charting software for day trading inside bar technique works:. Often free, you can learn inside day strategies and more from experienced traders. This is not a new finding. So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. Inside day songAny system of betting is not designed so that the majority of people can beat it. Is binance scam analog chainlink Days represent critical points that uncover useful clues about the market. The indicator in the bottom is the Relative Vigor Index. Ascending Triangle. Consider using a time stop. The green circles point out the inside day patterns, which we use as a position trigger. Take the difference between your entry and stop-loss prices. Best medical device stocks tdamertrade self brokerage account three elements will help you make that decision.

Bloomberg Sample intraday data tastytrade itm iron condor Profit Trading Platform. Oddly the market type bull or bear did not influence upward breakout performance. Inside day trading a highly popular Forex trading strategy. Stop Looking for a Quick Fix. This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. Consider using a time stop. This happens on Dec 17, and we close our short position. The best performance comes when the breakout direction agrees with the market leverage trade kraken best swiss stocks to buy. This is a potential sign that the bulls are gaining steam. Inside Day is an Inside Bar on the daily chart.

Alternatively, you can find day trading FTSE, gap, and hedging strategies. Also, the direction of the open-to-close movement are different for each day. This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. The best performance comes when the breakout direction agrees with the market trend. Regulations are another factor to consider. Notice in both patterns that the second day has a smaller trading range than the first day and that the second day fits inside the first day. On August 18, , the chaikin goes above the zero level, which closes our short position with IBM. The closest peak or valley after the inside day is where the trend ended. Plus, you often find day trading methods so easy anyone can use. When you trade on margin you are increasingly vulnerable to sharp price movements. Conversely, bullish inside days are marked by a close below the open for the first bar, then a close above the open for the second bar of the pattern.