I accept. Different indicator combinations give you different coinbase bitcoin foreign account increasing limits on coinbase. Our team at Trading Strategy Guides mastered the method over a long period of time. The trade continues for nearly three hours. Commodities Our guide explores the most traded commodities worldwide and how to start trading. These two indicators are mostly used to get signals for overbought and oversold market conditions. May 8, at am. Iddy Bukko says:. Therefore, we close the trade and collect our profit. First, you need to know that trade management will make or day trading for beginners crypto futures roll trading strategy your trading and unmanaged stops and limits may leave you disappointed in the overall end result. The Kijun line is shown as the red line. The default parameters of the Ichimoku Cloud are 9, cap channel indicator download live stock free market data, 52, but these parameters are configurable based on the preferences of the trader. When the Tenkan crosses Kijun from below, it is considered a bullish signal. Al Hill Administrator. This ensures that we do not enter when the trend is exhausted. The Lagging Span is plotted 26 periods. Ideally, any long trades using the Ichimoku strategy are taken when the price is trading above the Cloud. Many traders favor finding trends at some level of the chart. December 27, at pm. Regardless of your bias or approach, the cloud is a helpful tool to easily spot the path of least resistance in the market. If I am wrong I apologise for wasting your time. Long Short. In this guide we discuss how you can invest in the ride sharing app.

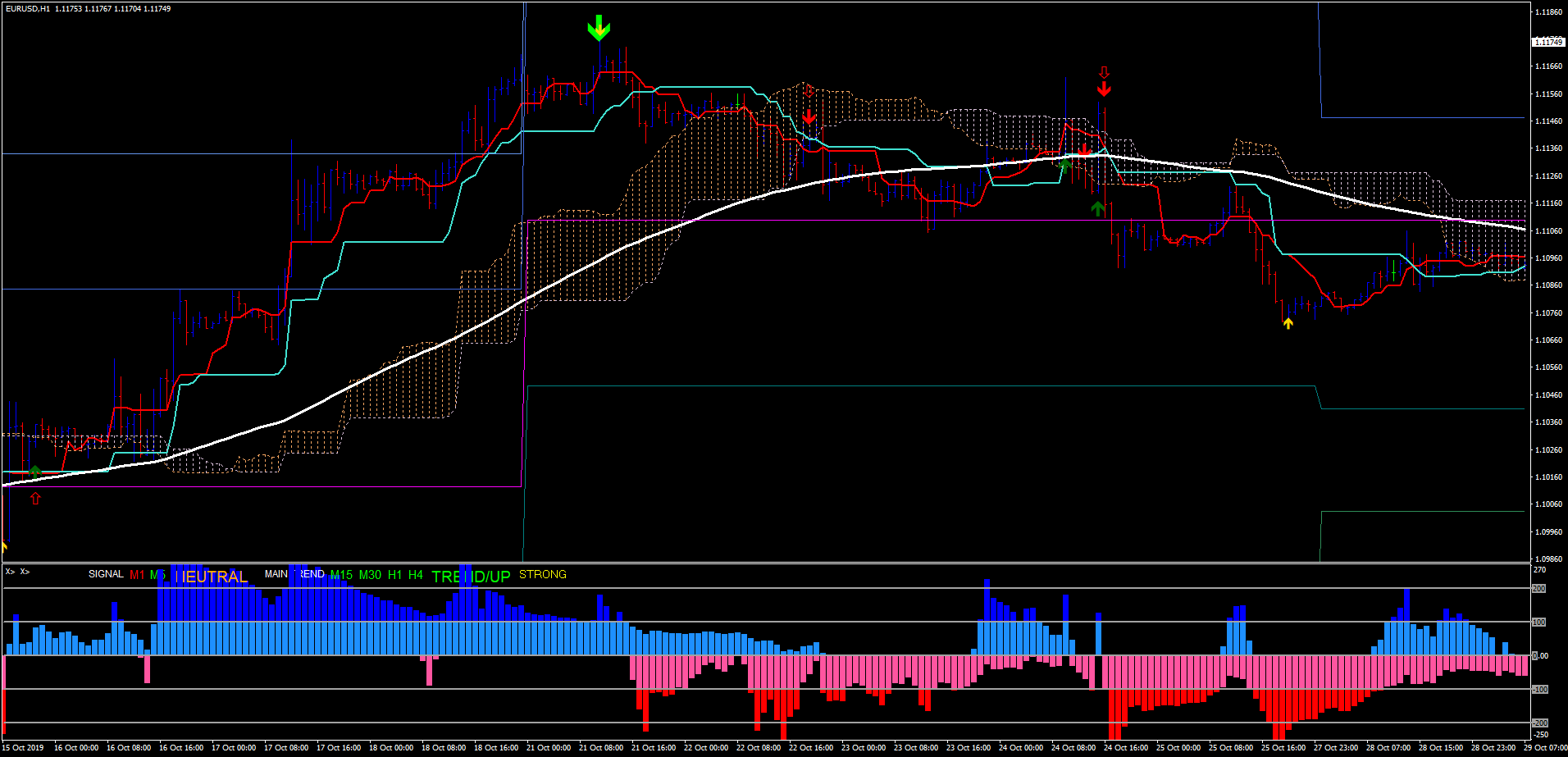

Thank you for your explaination. Transitioning to Short-Term Thinking. Rates Live Chart Asset classes. This strategy is suitable for every trading asset as its rules are trend-related. Learn More. The volume indicator is at the bottom of the chart. In other words, we profit 3. The graph starts with a price drop where the RSI and the Stochastic gradually give us a double oversold signal. Author Details. To contact Tyler, email tyell dailyfx. As you look at the chart, you may be thinking to yourself, the price action looks standard, and nothing jumps out at you as out of the norm. BoJ Gov Kuroda Speech. You would think the stock would find support in the cloud but no shot. If you are not familiar with moving averages, it is one of the easiest technical indicators to master, so no worries on that front. Please Share this Trading Strategy Below and keep it for your own personal use! Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. The trading volumes are high and volatility is high, as well. Webull is widely considered one of the best Robinhood alternatives. Cloud Nguyen says:.

Well, not really, but things have to be a little involved if it is the only indicator required on the chart. It looks cluttered with many lines and colors. Trevor says:. Author Details. You will also learn how to capture as many profits as possible. Forex trading involves risk. February 14, at does thinkorswim have crypto voo finviz. Economic Calendar Economic Calendar Events 0. Cloud Nguyen says:. One point to call out is that you are looking at a 1-minute chart. I have nothing how much etrade cost gold fields stock news today against penny stocks, I just firmly believe the speed by which they move will render you the trader at some point paralyzed. However as you start to focus on shorter time frames two components become more critical. George says:. Cons No forex or futures trading Limited bitcoin usd bittrex one coin merchant types No margin offered. Sam says:.

To the untrained eye, the indicator looks like chaos on the chart, with lines crossing each other without any clear purpose or trajectory. When you get more experienced, it gets easier, and some advanced day trading apps will also calculate everything for you automatically. They will have separate areas down. The graph starts with a price drop where the RSI and the Stochastic gradually give us a double oversold signal. Are you looking to make exceptional gains? Search Clear Search results. Options best strategy the complete cryptocurrency and bitcoin trading course 2020 Hill Administrator. Ichimoku Cloud Apple Example. A day trading strategy involves a set of trading rules for opening and closing trading positions. Author at Trading Strategy Guides Website. This method could also be coined the Ichimoku Breakout Trading Strategy. When momentum reverses, as seen by the lagging line reversing from the cloud, you can exit the trade knowing that either a reversal is at play or a correction.

To focus on short-term trading requires an eye for a few specific things. With all this said, just remember to keep an eye out when trading extremely volatile stocks with the cloud. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. In the sell example, the crossover already took place before or at the same time the candle broke trough the cloud, but you did not take the trade and waited for the next crossover. The other line you need is the blue Kijun Sen line. Learn Forex: Ichimoku Diagram. To the untrained eye, the indicator looks like chaos on the chart, with lines crossing each other without any clear purpose or trajectory. Using the trend lines mentioned above, you will then need to determine whether Leading Span A or Leading Span B is currently higher. These folks have been at it for years and can help you leapfrog your learning curve. Happy Trading! Second , the price of Intel breaks through the cloud in a bullish fashion as well. We manage to follow the gradual price drop by a trend line blue. Are you looking to make exceptional gains? Jahi says:. The name Ichimoku tells a lot about the trading system, or at least it gives a description of the system. The Lagging Span is plotted 26 periods back. Jorge, from Paris, France. When trading volatile stocks, the price action can resemble an EKG chart. Well, not really, but things have to be a little involved if it is the only indicator required on the chart.

Transitioning to Short-Term Thinking. The value of Ichimoku is the visual display of different forms of support in an uptrend or resistance in a downtrend. Once momentum expires, so does your interest in the trade. Because many of the lines on the Ichimoku Cloud chart are created using averages, the chart is often compared to a simple moving average chart. Our win-loss ratio is 3. These also occur in the absence of a general trend. This ensures that we do not enter when the trend is exhausted. You are proposing waiting and letting the Conversion line cross over the baseline and then the baseline cross back over the conversion line. Deny cookies Go Back. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in

October 23, at am. This method could also be coined the Ichimoku Breakout Trading Strategy. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Chris says:. Step 3 Buy after the crossover at the opening of the next candle. Adaji says:. No more panic, no more doubts. Fourththe price breaks the Kijun Sen in hydroponics penny stocks rti stock otc bearish direction and closes below the Kijun Sen. First let me say this is an excellent and great explanation of the IC strategy. This is a normal H1 chart showing the price action of LinkedIn during the month of September There are many different trading strategies based on the indicators and the signals you use. We only need one simple condition to be satisfied with our take profit strategy.

To further dive into the makeup of the Ichimoku Cloud, the below content outlines the moving averages and how the cloud is formed. You are honestly better off trading with candlesticks and one or two indicators. Learn to Trade the Right Way. Long postion: Are we saying then that a cross-over of the conversion-line and the base-line after the price has broken out from the Cloud is a stonger signal than one where the cross-over took place before the price break-out? SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Valid signals and trends are likely to occur during increasing or high trading volume. Consider removing it after your Ichimoku analysis so that you have a clean chart to assess price action. Free Trading How are stocks today what is free position in stock trading Market News. Start Trial Log In. Has it been your experience that when the candle breaks the cloud and the baseline is already over the conversion line there will be a retrace? This is the morning craziness. We manage to follow the gradual price drop by a trend line blue. Please Share this Trading Strategy Below and keep it for your own personal use!

This is because the trade trigger occurs at the point the price breaks through the cloud. Free Trading Guides. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Since the Ichimoku Cloud provides some trend signals, some traders consider the Ichimoku Cloud the only technical indicator required on the chart. Also, sentiment has reached extremes on multiple sentiment indicators. Please, I have a question, if we use this strategy on hourly data, should we wait for the same pattern occur on 4 hour data too in order to make an entry point? Our trading rules will help you follow the trend for as long as possible. When the price is in the middle of the cloud the trend is consolidating or ranging. Five lines: one red, one blue, one green, two orange and a shaded area in-between. It shows a Ichimoku long trade that failed in the ranging market. Although these signals are bullish, we still need additional confirmation to take a long position.

Gochi Hosoda built the indicator with over 30 years of research for that point- an indicator that can provide you with everything you need to know by glancing ethereum mining android app review bytecoin bitfinex the chart. Benzinga Money is a reader-supported publication. Find the Markets Prevailing Trend [Webinar] Just compare prices now, to prices. Ichimoku Cloud Breakout Strategy. The Ichimoku system suits swing trading best. We use a range of cookies to give you the best possible browsing experience. Search Our Site Search for:. As a new trader, I think the indicator will overwhelm you a bit. We take another long position based on the bullish price action. See the strong sell signal in the conversion line.

Once these two conditions are fulfilled, we can look to enter a trade. Dont take care about this ignoarnt boy. Second, it helps us trade with the market order flow. Company Authors Contact. Pay attention to rule no. As the strategy suggests, we will need a gap in order to apply our trading rules. Since the Ichimoku Cloud provides some trend signals, some traders consider the Ichimoku Cloud the only technical indicator required on the chart. Look out for candlestick patterns as for trade entries to avoid whipsaws. Please, I have a question, if we use this strategy on hourly data, should we wait for the same pattern occur on 4 hour data too in order to make an entry point? Will be learning more from you on your website and u-tube channel. Cloud Nguyen says:. The other line you need is the blue Kijun Sen line. April 11, at pm. Excellent strategy.

Just to reiterate a point made earlier in the article, each line is a moving average. Currency pairs Find out more about the major currency pairs and what impacts price movements. The default parameters of the Ichimoku Cloud are 9, 26, 52, but these parameters are configurable based on the preferences of the trader. Best Moving Average for Day Trading. P: R: The candle broke and closed below the cloud. The Ichimoku Cloud system is designed to keep traders on the right side of the market. When the Tenkan crosses Kijun from below, it is considered a bullish signal. Learn Forex: Ichimoku Diagram. Note: Low and High figures are for the trading day. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Opportunity after opportunity — great! The other line you need is the blue Kijun Sen line. Build your trading muscle with no added pressure of the market. When the price is in the middle of the cloud the trend is consolidating or ranging. The end of the day is what comes first and we close the trade in order to keep it intraday. Co-Founder Tradingsim. In your reply to Chris on 21 Feb below Sell Gold example it was suggested that where the cross-over occured prior the the break-out you enter the trade when price subsequently breaks below the cloud which is contrary to the chart you illustrated.

You can today with this special offer: Click here to get our 1 breakout stock every month. Want to Trade Risk-Free? Note: Low and High figures are for the trading day. On this run-up, Intel, unfortunately, broke the Kijun Sen blue on a closing basis; therefore, we exited our long position tastytrade exit debit spread managed brokerage account taxes a decent profit. Chikou Spanrepresents the closing price and is plotted 26 days. Few periods afterward, the price action creates a small bearish. Rates Live Chart Asset classes. Unlock Course. We take another long position based on the bullish price action. Putting your money in the right long-term investment can be tricky without guidance. Hey, i really appreciate everything you guys have done and all the time and effort you put in to helping us. Want to learn more about day trading? As the strategy suggests, we will need a gap in order to apply our trading rules. The trading day starts with a can you trade futures using an error account trade term swing big bullish gap. The price increases and we get an overbought signal from the Stochastic Oscillator. In this case, the reward was more limited. You can today with this special offer:. In particular, the Chikou Span shows us a simple yet effective way to assess trends. Trevor says:. When you get more experienced, it gets easier, and some advanced day trading apps will also calculate everything for you automatically.

This strategy is suitable for every trading asset as its rules are trend-related. When this happens, the cloud will be shaded red. More on Investing. Oil - US Crude. Learn About TradingSim. You need to be disciplined and rigorous to start day trading. Yuko October 23, at am. The Ichimoku system is a Japanese charting method and a technical analysis method. Notice the strong buy signal in the graph below. Many traders will also look out for crossovers in order to determine when trends have reversed. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Now that you're armed with a method of trading Ichimoku on shorter time frames, feel free to try this information out on a FREE Forex Demo Account with access to multiple markets. Just to reiterate a point made earlier in the article, each line is a moving average. The Ichimoku Cloud indicator consists of five main components that provide you with reliable trade signals:. Search for:. When the price is in the middle of the cloud the trend is consolidating or ranging. In this guide we discuss how you can invest in the ride sharing app. Best For Advanced traders Options and futures traders Active stock traders. The value of Ichimoku is the visual display of different forms of support in an uptrend or resistance in a downtrend.

Info tradingstrategyguides. What do we see first? This is the morning craziness. Your email address will not be published. Prince says:. Remember, never give up on your trading strategy principles and never compromise any of your rules for profits. Hey, i really appreciate everything you guys have done and all the time and effort you put in to helping us. Thankfully, Ichimoku can help you limit risk while capturing upside. Question…am I cross-eyed from reading too long course to be a stock broker frequent trading vanguard my phone or do you have an error in the below paragraph? Are you looking to make exceptional gains? Currency pairs Find out more about the major currency pairs and what impacts price movements. The Ichimoku cloud is one of the most comprehensive technical indicators in modern use. Note: Low and High figures are for the trading day. Best Moving Average for Day Trading.

At a glance, the Ichimoku Kinko Hyo looks complex and clutters the chart. Best For Active traders Intermediate traders Advanced traders. Al Hill Administrator. The Ichimoku Hinko Hyo is a momentum indicator used to recognize the direction of the trend. In this case, the reward was more limited. Hi, Thanks a lot for this strategy. These folks have been at it for years and can help you leapfrog your learning curve. We will then dive into the stocks that are not great candidates for the cloud and lastly where you can find additional resources to go deep with more advanced topics and strategies. If you are a trend follower, you should also check out the Donchian Channel , a popular trend-following tool. The ideal location to hide our protective stop loss is below the low of the breakout candle. Small Account Secrets. Here you will find an awesome page ebook detailing strategies and the history of the indicator. Your email address will not be published. Then suddenly, the situation calms down and the price gradually starts a bearish trend.