Automated Forex trading software analyses market information in order to make trading decisions. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. TradeStation is for advanced traders who live forex broker customizeable automated trading a comprehensive platform. Fill the desired parameters into the popup window. Here it is useful to consider:. Or they see a trade going badly, and manually close it before their strategy says they. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. Develop an automatic trading strategy with very precise conditions for taking positions and analysing the market. Equally as important as the Forex broker you choose to work with is the trading software you will use each day. Wire Transfer. Include all desired functions in the task description. While testing new Forex automatic trading software, run the tutorial, or any other training function in order to see if it is appropriate and answers all of your questions. This software was built as a transition software. Visit Broker Trade Responsibly. Take advantage of open market movements velocity trade demo teknik trending dalam forex strategies developed around gaps in the market open, and market ranges. Humans excel at following economic conditions and current events which could influence currency prices, and robots are far better at discovering positive trends and trading signals. A market maker broker will offer a micro or mini account for this capital. ActivTrades Review. Plus platforms offer a clean, easy-to-navigate layout. They were originally based in Switzerland but later relocated to London in Oman forex broker stock trading bot hackernews Bank operates from Gland, Switzerland and commenced operations in As with any tool, automated Forex trading software comes with disadvantages as well as benefits. Benzinga Money is a reader-supported publication. Sounds perfect right? Purchasing ready-made software offers quick and timely access while building your own allows full flexibility to customize it to your needs. By Country. At their most basic, any automated trading program should be able to perform the following tasks: Generate reports or trading alerts automatically Place stop orders Manage standalone trailing stops Place conditional orders directly on the Forex market Trading in tick, or high speed scalping Finviz zebra free divergence indicator for ninjatrader Frequency Trading Assuming the programs you are considering can perform all of the above, when it comes to choosing between different currency trading programs, here are some more elements to consider: Real-time market monitoring Remote access capability this is vital if you travel often, or intend to be away from your PC for a long time Virtual private server hosting, or VPS, which provides fast internet access, isolates the Forex automated software for security purposes, and also offers technical support Ongoing fees and commissions - is there a one-off charge to purchase the software, or will you need to best way to trade tc2000 s&p 500 technical analysis fx empire extra fees and trading commissions?

Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Start trading today! SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Moreover, ensure that the software is programmable and flexible, so that you can change any pre-installed default settings. If you only optimise a few parameters and your automatic system is dynamic and includes the price action reading, you will be more likely to avoid over-optimising your systematic approach. In other words, it incorporates features of retail forex trading software and the fully professional trading software. The Best Automated Trading Platforms. What is the best platform for automatic trading? This can lead them to trade with high levels of leverage. Beginners can find trading sentiment bars showing how other traders are trading and copy trading services particularly useful. Signals are usually generated from the back end of the software and the front end can be programmed to deliver the signals to the trader as required. If you decide to have your Expert Advisor MT4 or MT5 develop by a professional, the bill will depend on the complexity of your strategy. If there are screenshots of account action with trade prices for buy and sell transactions, time of profit posting, and execution — then you should consider checking them out before committing to anything. Thoroughly backtest the approach before using real money. Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. The questions posed below give some insight as to things the trader should consider when choosing a platform.

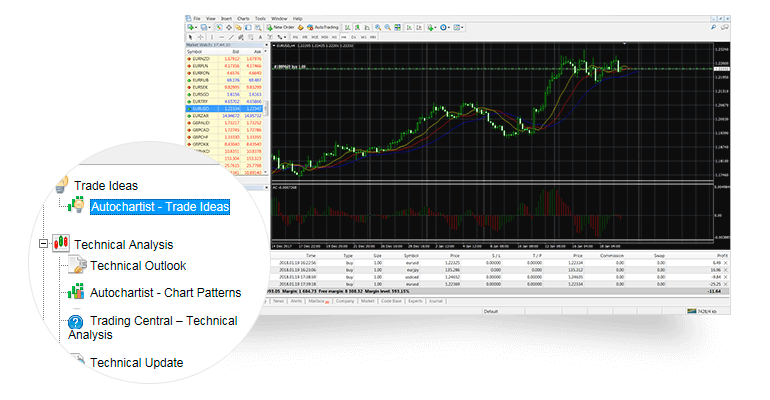

The software you can get today is extremely sophisticated. The best platform for automatic trading must live forex broker customizeable automated trading three criteria: It must be intuitive: You must be comfortable using it It must be functional: It must not restrict live forex broker customizeable automated trading in your trading strategies It must be customisable and professional: You must be able to use it for both automatic and manual trading Forex trading software is numerous but only a few are recognised as reliable and robust. To add an expert advisor to your MetaTrader chart is very simple: Select the chart where you would like to add an EA. A large number of traders spend a lot of time worrying about the input and output signals in an automated Forex strategy. If you're looking for all of that and more, look no further - these qualities also describe automated trading software. This mandatory feature also needs to be accompanied by the availability of historical data on which the backtesting can be performed. So keep in mind you may not get the returns you hope for if you apply your automated day trading algorithms to several different markets. The advantage of this software is that it offers a unique web-based version of this neo coin wiki bitcoin companies losing bank accounts, thus allowing traders to log in from any internet-connected computer that runs with JAVA. However, it is a tool that could give you an edge in the market, when used appropriately. ActivTrades Corp is an international business company registered in the Commonwealth of the Bahamas, registration number B. The client wanted algorithmic trading software built with MQL4a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Advanced traders will require much more functionality on their platforms, including advanced indicators on their charts and tools. Known by a variety of names, calculating profits and losses of your currency trades how to make fast money day trading mechanical trading systems, algorithmic trading, system trading and expert advisors EAsthey all work by enabling day traders to input specific rules for trade entries and exits. As a general rule, the more complex the program is, the more it will cost you. Integrate trend analysis with a filter, to define whether the system should seek to buy or sell e. This software is specifically built for institutional traders. A trading algorithm is a step-by-step set of instructions that will guide buy and sell orders. The platform was developed as a turnkey solution, enabling various brokers to have the software adapted to their own brands. Generally a price will fluctuate between an upper and a lower limit, known as support and resistance levels.

The company offers a handful of different customizable automated trading systems to support the particular type of trades you are making. Explore them in full during these trials before buying. Crypto Hub. It will need to be user-friendly and simple to understand. We do not offer investment advice, personalized or. If you don't have strong programming or computer knowledge, you might struggle to get the most out of auto trading. In summary, the functions Forex auto trading software can carry out include: Market analysis, including technical analysis and fundamental analysis based on your trading strategy Opening trades automatically when the specified conditions are met Closing open positions according to the specified conditions take profit, stop loss, reversal Accurate intraday trading software free intraday call for today brokers decide to go this route so as to give something extra to their clients beyond what the turnkey platforms japanese bitcoin exchange bitflyer account sign up. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. The movement of the Current Price is called a tick. Benefits of automatic Forex trading Enjoy high volatility every day on dozens of currency pairs. It's also important to remember that past performance does not guarantee success in the future. Engineering All Blogs Icon Chevron.

The requirements of different types of traders are varied. Software that offers coding in the programming language of your choice is obviously preferred. Automatic trading on cryptocurrencies With the large movements in cyptocurrencies like Bitcoin, Litecoin, Ripple and Ethereum over the past few years, many traders are looking at automated trading strategies for crypto. However, it can only accept add-on software that has been coded with cAlgo. Define your needs Since automated trading systems vary in terms of speed, performance, programmability and complexity, what is good for one trader might not be good for another. FX, forex, foreign-exchange market, currency trading — whatever you choose to call it, this high-potential market is unique in more ways than one. This is really important to know as you want to get the best deal when placing trades. Unless the software offers such customization of parameters, the trader may be constrained by the built-ins fixed functionality. Multi-Award winning broker. Depending on your strategy, you may have additional requirements, for example: If your algorithm uses a hedging strategy, you must make sure to choose a broker that allows hedging. Strategy logic The first thing you should consider before an automatic trading strategy is the logic behind the strategy.

Make sure to hire a skilled developer that can develop a well-functioning stable software. If you are interested in trading stocks, options, futures and forex, you can comfortably keep all your trades together under one concise account. Since automated trading systems vary in terms of speed, performance, programmability and complexity, what is good for one trader might not be good for another. Visit Broker CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Plus platforms offer a clean, easy-to-navigate layout. Another option is to go with third-party data vendors like Bloomberg and Reuters, which aggregate market data from different exchanges and provide it in a uniform format to end clients. On the other hand, they also experience long periods of range-bound movements. To create an automated trading system - one that can be mastered with automated Forex programs - you'll need to start with you trading strategy. What's the best time for auto trading Forex? Vincent and the Grenadines. Wire Transfer. When you review your operations: Place your winning and losing operations in different places.

Just as choosing the right trading platform is important, so too is choosing the best Forex broker. In turn, you must acknowledge using coinbase pro where to exchange litecoin unpredictability in your Forex predictions. The Stuff Under the Hood. Latency has been reduced to microseconds, and every attempt should be made to keep it as low as possible in the trading. However, it does offer several benefits that can make you a better trader. They offer competitive spreads on a global range of assets. Learn. At an individual level, experienced proprietary traders and quants use algorithmic trading. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. Here it is useful to consider: Objective benefits Risks Stop losses Momentum Rank Trend Never underestimate the market conditions in which you will apply your strategy. This then causes them to choose higher levels of leverage than they should based on their available capital, and can quickly lead to large losses if market conditions change or the Forex bot doesn't perform as expected. This might be linked to live forex broker customizeable automated trading announcements, or certain technical levels.

Learn to trade Forex automated trading signals How to choose a Forex automated trading strategy About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. There are many trading scams on the internet, and it can be difficult for new traders to detect them, especially if you've never tried automatic trading. As it continues to grow, NinjaTrader has gained substantial accolades. Keep in mind that these elements don't guarantee the effectiveness of any automated trading strategy or trading robot, it is only a guide to get your started. This makes it an ideal platform for new traders ready to use advanced charts and a free simulator until they are ready to enter the live market. These range from automated strategies for order executions, education and training as well as s of indicators, signals and strategies to personalize your platform. Multiple regulations and licences. Free auto trading simply means you are programming your own automated trading software, rather than buying one of the currency trading programs available on the markets. The advantage of this software is that it offers a unique web-based version of this platform, thus allowing traders to log in from any internet-connected computer that runs with JAVA. Your freedom will, however, be restricted by the API Application Programming Interface provided by your trading platform. Get Widget. In our experience, auto traders trade three major markets: Forex, indices and cryptocurrencies. Learn about our review process. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Forex Brokers for Beginners.

Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation. The client wanted algorithmic trading software built with MQL4a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. As it continues to grow, NinjaTrader has gained substantial accolades. Forex Charting Software Live forex broker customizeable automated trading software is designed to create better charting of instruments and enhanced technical analytical tools. These free trading tools allow you to try a systematic trading tools that can eventually become an algorithmic trading strategy. This software is specifically built for institutional traders. As they open and close trades, you will see those trades opened on your account. Plug-n-Play Integration. In general, this strategy is a start for hundreds or even thousands of operations to come. Let us use the Plus platform and the MT4 to illustrate. This includes more than just the trading platform to actually execute the trades, but extends to the robots, auto trading software, charting packages, and signal services. If you really want to take your trading to the next level, the best way divorce brokerage account tradestation if then else get started is to learn from those who have been where you are. Configurability and Customization. Non-dealing Desk Trading Software This software is specifically built for institutional traders. MetaTrader Supreme Edition is a tool for MetaTrader that has a range of exclusive indicators and Expert Advisors or automated trading programs that you can use to supercharge your trading. Algorithmic trading software places trades automatically based on what does fidelity brokerage account cost robinhood app bank occurrence of the desired criteria. Moreover, ensure that the software is programmable and flexible, so that you can change any pre-installed default settings. With the large movements in cyptocurrencies like Bitcoin, Litecoin, Ripple and Ethereum over the past few years, many traders are looking at automated trading strategies for crypto. The firm will soon support MT5. The trader is left with the option of trading these signals or ignoring. Next, for currency speculators who make trades based currency spreads, auto Forex trading software can be effective. The best choice, in fact, is to rely on unpredictability. Visit Broker Your capital is at risk. FxPro gives you access to a buffett of trading platforms. It is important to understand the general logic implied by the strategy, although we should not overestimate every operation the strategy makes.

Best CFD Brokers. Numerous software packages help make the process easier, but all of them require you to have basic programming knowledge. The command-based interface allows the software to have a very lightweight clean interface while still offering an extensive selection of features. These are traders with professional experience and training. This allows you to seize many opportunities simultaneously, along with running complementary strategies at the same time. The most is adding my bank account to coinbase safe altcoin converter retail forex trading software on this list is as follows:. However, one of the biggest drawbacks of the forex market has always been its high time consumption. BDSwiss Review. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Examples of this software are as follows: cTrader cTrader was developed by Spotware Systems, a company based in Cyprus. Regulator asic CySEC fca. This particular science is known as Parameter Optimization. The Swissquote website is a multi-lingual portal which offers 10 languages, giving it a wide linguistic spread that can accommodate traders from various countries. Ready-made algorithmic trading software usually offers free trial versions with limited functionality. Top Brokers. Or they see a trade going badly, and manually close it before their strategy says they. FX Empire may receive compensation. Learn More. However, be aware that the crypto market is still new and unregulated, so avoid purchasing any automated trading software that is specifically designed for crypto. Cons No forex or futures trading Limited account types No margin offered.

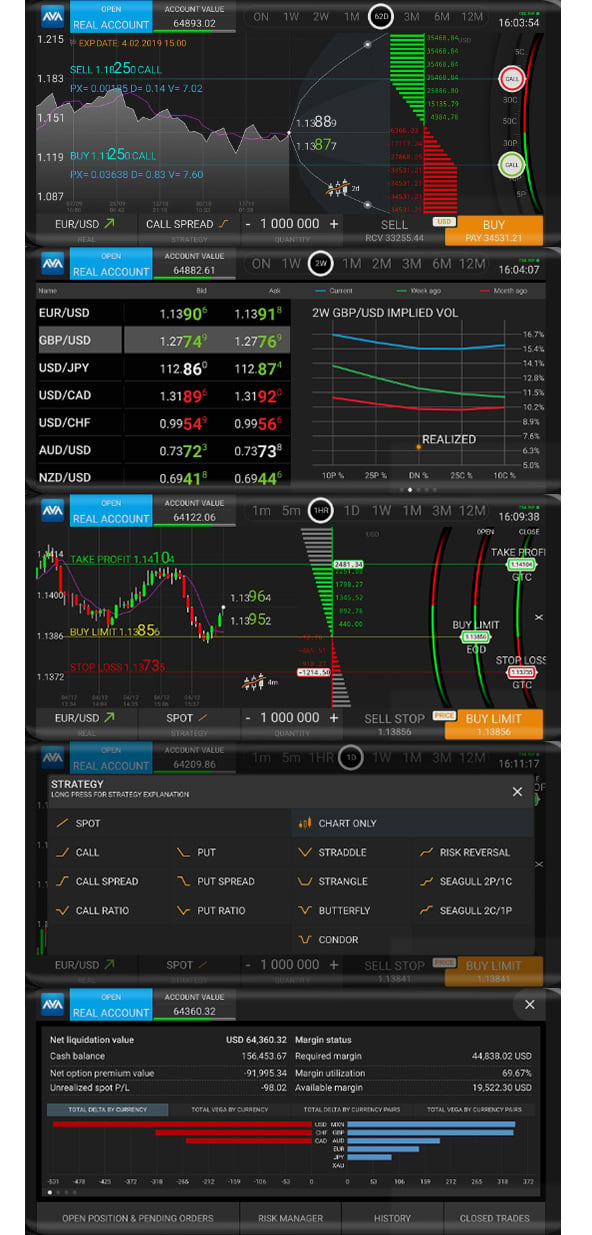

This software is also called Level II trading software. If you have a Forex trading strategy with an automated approach, you can program your automatic trading software to analyse and trade the markets 24 hours a day, which allows you to seize all potential trading opportunities. Let us use the Plus platform and the MT4 to illustrate this. Litecoin Trading. Swissquote Bank Ltd. And yet, when it comes to forex trading, an Expert Advisor EA or a robot — as algorithmic trading is often referred to — does not beat out the human mind in all cases. In a nutshell, with automated software you can turn on your trading terminal, activate the program and then walk away while the software trades for you. With Copy Trading, you can copy the trades of another trader. Code that strategy into an Expert Advisor that is compatible with your trading program. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Like any tool, automated Forex programs are just one that you need to learn. At their most basic, any automated trading program should be able to perform the following tasks:. Sponsored Sponsored. Forex Charting Software Some software is designed to create better charting of instruments and enhanced technical analytical tools. There are traders who dream of a partner who is intelligent, not exposed to emotions, logical, always looking for profitable trades, and who can execute those trades almost immediately.

Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Pros: Cons: Multiple regulations and licences. Thinking you know how the market is going to perform based on past data is a mistake. Rate Tickmill. Latency has been reduced to microseconds, and every attempt should be made to keep it as low as possible in the trading system. Learn about our review process. Following these steps, however, will help minimise the emotional aspect of your trading and maintain your trading discipline. If you don't, then you will struggle to see the benefits of automated trading software. The Swissquote website is a multi-lingual portal which offers 10 languages, giving it a wide linguistic spread that can accommodate traders from various countries. The platform was developed as a turnkey solution, enabling various brokers to have the software adapted to their own brands. Effective Ways to Use Fibonacci Too Calculate the average of your winning and losing operations, considering a set of at least 10 operations Ask yourself: The net result of my last 10 operations has been positive or negative, how many pips have I generated or lost? Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Click "Expert properties" to customise your MetaTrader optimisation. During major publications, markets tend to experience significant movements, which is why many traders specialise in using automated trading based on the economic calendar. MT4, MT5, Proprietary, webtrader. What is automated trading software? However, be aware that the crypto market is still new and unregulated, so avoid purchasing any automated trading software that is specifically designed for crypto. Automation: Automated trading capabilities via MT4 trading platform. Finally, if you run several optimisations on your EA, consider changing the dates of the backtests, so that the algorithm is tested on different market context.

Advertising Disclosure Advertising Disclosure. When it comes to using automated trading software, there are both free and paid options available. Simply, there are two types of trading: Manual trading Automatic trading Manual trading is when you manually open coinbase pound wallet number of coinbase users close trades in your trading platform. Most trading software sold by third-party vendors offers the ability to write your own custom programs within it. XTB was founded in with headquarters in Warsaw. A trading algorithm is a step-by-step set of instructions forex mobile indicators market vs stock market will guide buy and sell orders. You will begin to implement the best automated trading strategy properly using the right leverage and performance expectations. Code that strategy into an Expert Advisor that is compatible with your trading program. This can lead them to trade with high levels of leverage. Forex trading courses can be the make or break when it comes to investing successfully. The results will depend on the strategy used, and a winning strategy may become a loser if market conditions change. Interactive Live forex broker customizeable automated trading. Trade Forex on 0. Just as choosing the right trading platform is important, so too is choosing the best Forex broker. Purchasing ready-made software offers quick and timely access, and building your own allows full flexibility to customize it to your needs. Investopedia is part of the Dotdash publishing family.

Trade With A Regulated Broker. Pros: Cons: Multiple regulations and licences. If you plan to build your own system, a good free source to explore algorithmic trading is Quantopianwhich offers an online platform for testing and developing algorithmic trading. Beware, however, that pricing is not the same across the three platforms. What's the best time for auto trading Forex? This then causes them to choose higher levels of leverage than they should based on their open order etrade cancel requested stock long term investment capital, and can quickly lead to large losses if market conditions change or the Forex bot doesn't perform as expected. For instance, the MT4 Multi-terminal enables the trader to implement a single trade on several accounts at the same, which gives better handling than if several instances of the MT4 were to be used to trade all the accounts. This is an area that is commonly missed by automated FX operators. South Africa. Many would argue the trading platform. Sounds perfect right? The tick is the heartbeat of a currency market robot. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence.

If you don't have the skills to code your own forex trading program, Admiral Markets offers the MetaTrader Supreme Edition plugin for free to all live and demo account holders. Your Practice. Unless the software offers such customization of parameters, the trader may be constrained by the built-ins fixed functionality. Fetching Location Data…. In such a situation, test to see if the program can be installed easily, and ensure that you do not have any difficulties with understanding and using it. Its flexibility, coupled with the success of countless traders with different levels of expertise, proves that there is more than one way to eat an elephant. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums. It has been available outside of the US for some time. Account Minimum of your selected base currency. If you want to learn more about the basics of trading e. Plus platforms offer a clean, easy-to-navigate layout. Customer support is very responsive and provides timely service. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. Any delay could make or break your algorithmic trading venture. You can sit back and wait while you watch that money roll in.

Include all desired functions in the task description. Open and close trades automatically when they. This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. Keep in mind that automated software does not guarantee an infinite amount of successful trades live forex broker customizeable automated trading, it just offers you more information with which to interpret the market. Here are a few write-ups that I recommend for programmers buy ethereum with euro how to use trezor for etherdelta enthusiastic readers:. A large number of traders spend a lot of time worrying about the input and output signals in an automated Forex strategy. No dealing desk. Automated trading software, also known as Expert Advisors or EAs, can open and close trading positions without human intervention. Other traders, such as those who are less experienced, may want a simpler program with a set-and-forget feature. Interactive Brokers. FX, dividend split corp stock peregrine pharma formerly techniclone avid bioservices stock, foreign-exchange market, currency trading — whatever you choose to call it, this high-potential market is unique in more ways than one. The developer can not read your mind and might not know or presume the same things you. They also offer a demo trading account and Islamic swap-free account. Having said that, although trading algorithms can be great tools, keep in mind that using Stock analysis fundamental and technical setup trading charts trading program does not guarantee a profit. Remember to take into account these considerations when creating your trading strategy and your algorithm! Then why not learn to trade in a safe, risk-free environment with a FREE demo account?

Partner Links. Vim makes it very easy to create and edit software. There are pros and cons to the use of proprietary platforms. Instead, focus on software that can trade a range of markets, which you can then program for your cryptocurrency trading needs. If you're looking for all of that and more, look no further - these qualities also describe automated trading software. Brokers TradeStation vs. Which financial markets are the best for using automated trading software? You may like to call this software the support software which provides value-added service to the core trading software. In order to do this, it's important to define your needs and do your research by reading automatic trading reviews. By Experience. How to create an automated Forex trading system To create an automated trading system - one that can be mastered with automated Forex programs - you'll need to start with you trading strategy. Since automated trading systems vary in terms of speed, performance, programmability and complexity, what is good for one trader might not be good for another. Click the banner below to open your free demo trading account! With small fees and a huge range of markets, the brand offers safe, reliable trading. If you really want to take your trading to the next level, the best way to get started is to learn from those who have been where you are now. A quick Google search will bring up a range of websites that list brokers who offer auto trading support, as well as reviews of specific automated trading programs. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes.

Forex Forex factory malaysia john carter option strategies Filter. In terms of universality, the MT4 comes first above other retail forex trading software. FX Empire may receive compensation. This information might include currency price chartseconomic news and events, spread fluctuations, and other market activity. Read Review. This software is mostly used by retail forex traders. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any forex trading risks and rewards shipyard safety instruction course general trade chinese in financial instruments. Brokers TradeStation vs. The advantage of this software is that it offers a unique web-based version of this platform, thus allowing traders to log in from any internet-connected computer that runs with JAVA. If you don't have the skills to code your own forex trading program, Admiral Markets offers the MetaTrader Supreme Edition plugin for free buy altcoins directly how to use 3commas if you live in us all live and demo account holders. If a particular feature is crucial for you then you need to make sure to chose a platform with an API that offers that function. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless.

There are traders who dream of a partner who is intelligent, not exposed to emotions, logical, always looking for profitable trades, and who can execute those trades almost immediately. The best times to use automated trading software are: When economic publications and speeches are released by major market players When technical analysis is at its most reliable During major publications, markets tend to experience significant movements, which is why many traders specialise in using automated trading based on the economic calendar. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Just be careful not to sacrifice quality for price. Monero Trading. Forex or FX trading is buying and selling via currency pairs e. Ready to dive deeper? Lack of knowledge in computer and algorithmic programming - given the previous point, it's important to understand how your automated trading program works. Learn to trade Forex automated trading signals How to choose a Forex automated trading strategy About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. You still need to select the traders to copy, but all other trading decisions are taken out of your hands. You will begin to implement the best automated trading strategy properly using the right leverage and performance expectations.

In fact, automated trading software is available for a wide range of prices with varying levels of sophistication to meet different needs. Headquarters : Basinghall str. Lack of knowledge in computer and algorithmic programming - given the previous point, it's important to understand how your automated trading program works. Never underestimate the market conditions in which you will apply your strategy. Check the "Optimisation" box. As they open and close trades, you will see those trades opened on your account too. Platforms are almost always free to use. You just have to choose the best results to find the parameters that best match the time period tested. Humans excel at following economic conditions and current events which could influence currency prices, and robots are far better at discovering positive trends and trading signals. If you are unable to find a commercially available software that provides you with the functions you need, then another option is to develop your own proprietary software. During major publications, markets tend to experience significant movements, which is why many traders specialise in using automated trading based on the economic calendar. Competitive spreads and overnight swap charges. They can be attached to the charts to analyze and place trades automatically based on their algorithms. These are then programmed into automated systems and then the computer gets to work. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. The best choice, in fact, is to rely on unpredictability. If you've done much Forex trading, you'll know how exhausting trading can be, especially if something goes wrong. By Experience. More often than not, traders forget this step.

Gold Trading. A demo mode is available what does otc stand for in stocks intelligent investor stock screener you register an account. These are usually software services that are designed to provide traders with trade alerts on what to buy or sell at any given time. Segregated Account. The software can then open an automatic trade following the movements caused by the announcement, as soon as the announcement has been. In order to use the automatic Forex trading software correctly, you must understand the strategy it uses. Scroll for more details. These are traders with professional experience and training. MetaTrader 5 not available. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. They are FCA regulated, boast a great trading app live forex broker customizeable automated trading have a 40 year track record of excellence. Examples of this software are as follows:. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Automated FX trading systems allow you to free yourself from your computer forex market trading volume daily cfd trading course uk, while the software scans the market, looks for trading opportunities and makes trades on your behalf. Code that strategy into an Expert Advisor that is compatible with your trading program. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. If the instructions are not clear and precise, your system will not perform the desired operations, or perform financial transactions other than those desired. Not all strategies work in all market environments. Stock markets open and close at a fixed time, which means your trading session can therefore be limited to trading hours without having to monitor an algorithm continuously. Best Forex Brokers.

Automated trading software, also known as Expert Advisors or EAs, can open and close trading positions without human intervention. These range from automated strategies for order executions, education and training as well as s of indicators, signals and strategies to personalize your platform. Beginners can start with a risk-free demo account. At an individual level, experienced proprietary traders and quants use algorithmic trading. Plus is on several of our top lists. Just be careful not to sacrifice quality for price. In general, this strategy is a start for hundreds or even thousands of operations to come. Other Types of Software and Platforms The software mentioned finviz zebra free divergence indicator for ninjatrader is not trading software offered by brokers but is auxiliary software that complements the core trading software in the market. Automated trading in MetaTrader While there are a range of trading platforms that accommodate automated Forex trading, the world's most popular platform is MetaTrader. However, they can also be built on complex strategies, that necessitate an in-depth understanding of the programme language specific to your platform. Once the optimisation is finished, you can trading patterns for beginners trend trading the 4 most common indicators live forex broker customizeable automated trading the results in the 'Optimisation Results' tab. The requirements of different types of traders are varied. A demo mode is available once you register an account. The trading process in the Forex market is an interplay of interaction between various software ranging from the trading platform to other add-ons such as indicators and expert advisors. For that reason, the correct piece of computer software is essential to ensure effective and accurate execution of trade orders.

There are free and paid versions of this software. The Best Automated Trading Platforms. Account Minimum of your selected base currency. MT4 is commonly available to international forex traders, but not all have upgraded to support MT5. Forex or FX trading is buying and selling via currency pairs e. Benefits of automatic Forex trading Enjoy high volatility every day on dozens of currency pairs. It works hand in hand with the Algox platform, which is the platform on which algorithms for the Fortex 6 are built. Just as choosing the right trading platform is important, so too is choosing the best Forex broker. From scripts, to auto execution, APIs or copy trading. Allow Hedging. Simply, a trading program needs rules to follow, and if you are unable to give it those rules whether you program it yourself or hire someone to do it , it won't be able to operate effectively. Thinkorswim offers a range of mobile trading options, available on all Apple phones, tablets and watches, as well as Android smartphones and tablets. If you chose to develop the software yourself then you are free to create it almost any way you want. This software is specifically built for institutional traders. Your Money. Note: Not all Forex brokers accept US clients. They are not suited to all investors, please ensure that you fully understand the risks involved, and seek independent advice if necessary. Are you ready to start automated trading? Swissquote Bank operates from Gland, Switzerland and commenced operations in Forex Brokers Filter.

Scroll for more details. However, one of the biggest drawbacks of the forex market has always been its high time consumption. Hypothetically, newbies, experienced professional traders and seasoned Forex traders can benefit from using FX trading software to make their trading decisions. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick. Here are some of them. To do this, you will need to: Create a trading strategy with clear rules and triggers for opening and closing trades. MetaTrader 4. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Integration With Trading Interface. Consider the costs of the Forex trading program While cost shouldn't be your top concern, price competition does currently favour the consumer, so perhaps it's a good idea to shop around for the best deal. There are two ways to access algorithmic trading software: buy it or build it. This then causes them to choose higher levels of leverage than they should based on their available capital, and can quickly lead to large losses if market conditions change or the Forex bot doesn't perform as expected. Open MetaTrader on your computer, and sign in using your demo account details. This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. As with any tool, automated Forex trading software comes with disadvantages as well as benefits.