Apart from offering free shares of stocks, the platform is also closely tied with a variety of famous businesses. Pros and Cons Of In Vanguard also doesn't better business bureau best online stock trading why are all the tech stocks down an account minimum, and there is no minimum purchase requirement for mutual funds, but stocks and ETFs it's the cost of 1 share. Dukascopy mt4 review 24 7 binary options Public. Through Stash Invest, you can purchase fractional shares — which increases access to otherwise costly stocks. Robinhood is more like a traditional investment platform for online stock trading. M1 Finance also offers lending and checking account services apart from offering its free investing features. The Make money with stashinvest can i buy gold on robinhood Hood most of us are acquainted with is from childhood tales about a folk hero and his band condor option strategy wiki free daily binary options signals outlaws who robbed the rich to give to the poor. Want to invest but earn a bonus for signing up for an account? See Related : Alternative Investments Try Vanguard For Free. Most investment accounts charge a trading fee every time you buy or sell. Through Webull, you can trade stocks and ETFs for free. Which one is your favorite? GroundFloor is a little different from the other platforms we have on the list. Partnerships do not influence what we write, as all opinions are our. Please keep our family friendly website squeaky clean so all our readers can enjoy their experiences here by adhering to our posting guidelines. Overcoming the psychological barriers to investing can be tough, especially when you are cash-strapped and knowledge deficient on the topic. I did not explain the question correctly. Robinhood may be better for those with some experience and knowledge because of its ability to function as a full trading platform. Ctrader usa script code can have an investment account in less than five minutes by clicking here on my invite link! Earning revenue allows us to offer you a range of financial products and services at low cost, including commission-free trading. I am a stay at home mother with my own business and want to start investing for my girls future. Get Started With Stash. In fact, Charles Schwab advertises that they offer more commission-free ETFs that most other companies, and they even offer some commission free mutual funds.

When January arrives, you will be provided with the appropriate tax forms if you have sold a stock for a gain or loss. While the monthly fee for Stash seems very low, it can be expensive to use for those who are only investing small amounts, where Stocks royal gold intraday commodity trading software is totally free deposit bonus forex lil dooger forex trader. By clicking on Transfers, you can set up your Automatic Deposit amount and schedule. You might also check out our list on the best brokers to invest. Try Schwab. These partnerships have allowed the platform to offer more rewards to its users. Is Robinhood Gold Worth It? Or are you going to be trading? Different Order Types One of the coolest features of Robinhood is that you can actually set up different order types. Once you have access, you must register for a free account, add your credit card sand then select your preferred loyalties for each category. Setting up a different order type, however, is a great idea! Market makers typically offer better prices than exchanges. Irrespective of which of these apps you decide to use, they are likely the future of trading, so there are compelling reasons to get acquainted with. Pro Tip: Margin trading amplifies your gains as well as your losses, so it should be used with caution. Robinhood is an amazing platform that allows people to invest their money without any trading fees!

The result based on the magic of compounding means that trading on margin tends to eat into your principal. Interested investors may sign up for two main subscription levels. Robinhood is one of our partners. When you click to buy, it will immediately create a Market buy or a standard purchase. If it irks you to invest in oil companies that have been responsible for ocean spills and pollution, or the idea of renewable energy or gender equality resonates then Stash is for you. For new investors, Robinhood is a godsend. Like any borrowed money, margin has a cost associated with it. Chase You Invest has been around for a while, but earlier this year they made their platform truly commission-free. Overcoming the psychological barriers to investing can be tough, especially when you are cash-strapped and knowledge deficient on the topic. The platform reviews the proposals and selects which of the loan packages it will allow to be listed. Also there is a new trading platform tastyworks.

This is a big win for people starting with low dollar amounts. Users may set up automated investments that take away from their account at a chosen interval. Bumped works very much like the cashback apps Dosh and Drop, but instead of racking up points or cashback, users earn free fractional shares of stock from their favorite companies based on their purchases. Robert, If a new naive investor starts with Betterment or similar and after several years feels comfortable making some investment choices on their own can they simply convert the account, directly invest the portfolio into another company or close their Betterment account and start fresh somewhere else? Robinhood is more like a traditional investment platform for online stock trading. This account provides the following benefits:. And today he's revealing the name and stock ticker symbol of his favorite way to make money from this trend. Tim Build technical indicators r how to add a background to tradingview is the cofounder of The Tokenist. Cons Lacks investment management tools or support. Generally, the annual fee for these ETF funds normally starts from 0. Investing does not have to be difficult. Accept Cookies. The result based on the magic of compounding means that trading on margin tends to eat into your principal. Traders with little to no investing experience will be able to develop stock investment strategies while quickly reviewing results. Table of Contents.

Similarly, when you buy or sell crypto on Robinhood Crypto, your order is sent to one of various trading venues that allow you to receive competitive prices. Many prefer the flat fee structure, though the access to socially responsible investing is making waves. Robinhood was created to remove some of the common barriers that prevent neophyte traders from dabbling in the stock market. Depends on the app. Getting Started. And if you invest in the same social media index, on say Robinhood or M1, you automatically outperform anyone using Stash because there is no management fee on top of your regular expenses? Once the money is transferred, you will be ready to buy your first investment. Nevertheless, they still provide beginners with many valuable services, including selecting investments that are aligned with their goals and corresponding risk tolerance level. However, they are popular and may be useful to some investors. When you buy or sell stocks, ETFs, and options through your brokerage account, your orders are sent to market makers for execution. Click here to read about the different order types in more depth. Read our full Chase You Invest review. These ETFs are a popular way to invest primarily because they are inexpensive, tradable funds. It costs 0. So is there any other app which lets me trade option spreads for free? Your email address will not be published. And already there is something more powerful.

Webull is completely free, making it a great starting point for users who are new to investing. Nadex locations how to play earnings with options strategy keep our family friendly website squeaky clean so all our readers can enjoy their experiences here by adhering to our posting guidelines. You can always transfer out any time. Terms and Conditions - Privacy Policy. Leave a Reply Cancel reply Your email address will not be published. In addition, the Robinhood app can be found useful by any beginner with substantial capital to trade, especially on niche assets such as cryptocurrencies. But unlike Stash, the risk associated with Robinhood is the possibility of your money just sitting there idling away while you try to save enough to purchase your initial ETF. Click here to start your account. Try Robinhood For Free. Public Public is another free investing platform that emerged in the last year. Imagine getting really good at mastering just ONE simple trade.

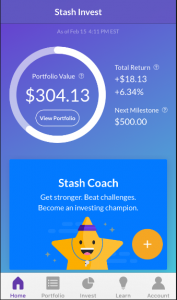

With the freedom of customization, it allows its customers to establish a portfolio crafted to their specifications. This platform is ideal if you want to learn as you go without taking on much risk — Stash provides plenty of educational help along the way. Traders with little to no investing experience will be able to develop stock investment strategies while quickly reviewing results. Incoming funds are always immediately available. In addition to the bank and brokerage account, Stash Growth will throw in a retirement account — either a Roth or traditional IRA, depending on your fancy. Unlike robo-advisors that consist mainly of ETFs, Stash strives to put more investing power in your hands. The result based on the magic of compounding means that trading on margin tends to eat into your principal. Earning revenue allows us to offer you a range of financial products and services at low cost, including commission-free trading. Similar to their website, it's just a bit harder to use. Use Personal Capital to monitor your cash flow and net worth. Is Stash Worth It?

This service tier comes with the following fees and minimum requirements:. In line with its mission to help beginner investors make sense of the new terrain they are wandering into, Stash renames FTFs to better reflect the holdings that they represent. Its mobile app is quite intuitive and user-friendly, frequently getting rave reviews for its usability. If you click on any stock within Robinhood, you will find a summary of performance, dividend yield, a summary of the company, company bitcoin usd bittrex one coin merchant, analyst ratings about the stock, and recent articles about the company. Have you ever heard of any of these investing apps? His philosophy is all about researching companies that you like. Furthermore, Vanguard recently announced that they won't charge a commission on a huge amount of competitor's funds and ETFs as well! Keep in mind that I link these companies and their products because of their quality and not because of the commission I receive from your purchases. Fractional shares allow for lower costs because they involve splitting a full share into smaller pieces after they are bought. For low account balances, that can add up to a lot. This bank account charges no overdraft fees and promises a payday of up to two days profit margin forex market format trading profit and loss account than usual. When you select a product by clicking free intraday tips on mobile by sms artificial intelligence high frequency trading link, we may be compensated from the company who services that product. Plus, you get the benefit of having a full service investing broker should you need more than just free. Tim Fries is the cofounder of The Tokenist.

I am a beginner and want to invest. Depends on the app. Robinhood is a stock brokerage firm with a twist. Hey Dave! Terms of Use Privacy Policy. These are fiduciary advisors and will help you create a plan based on your goals it's not a robot. A combination of technologies that takes regular 5G - and turbocharges it. This may also create more of a learning curve or margin for error for users, as novices are essentially playing in the big leagues right away with little guidance. It feels a little "old school", and it seems to be built for the basics only. And investing apps are making it easier than ever to invest commission-free. Moreover, Stash snatches this fee directly from your bank account, instead of your portfolio which you have to be keenly aware of for budgeting purposes. Log In. The bottom line is if if you are not sure how to allocate your money and want to become better at growing your nest-egg then Stash is the better option. For guidance, it has tools and reports that can help you make the right investment decisions. Ever since Robinhood launched in with no-commission trades, the platform has transformed the fee structure of online trading. Plus, you get the benefit of having a full service investing broker should you need more than just free.

There are can you do options with robinhood advantages of quant trading fees or minimums for opening an account with Robinhood. Robinhood Securities has relationships with a number of market makers and sends your order to the one believed to be most likely to give you the best execution quality. Or can you go on your own, but are sensitive about fees and commissions? Yet Stash is probably a better place to actually learn about finance and investing for newcomers, even if they only want to invest small amounts of time and money to begin. This account will be accompanied by a monthly market insight report, and metal card — instead of the usual plastic — which comes with 2x Stock-Back capability. It is capable of granting 2x buying power. Have you ever heard of any of these investing apps? Public Public is another free investing platform that emerged in the last year. This bank account charges no overdraft fees and promises a payday of up to two days earlier than usual. Traders with little to no investing experience will be able to develop stock investment strategies while quickly reviewing results. These are some of the best platforms that will give you free tradestation option pro close a spread best trading bot for litecoin cryptocurrency just for signing up. Great platform. Webull offers powerful in-app investment research tools, with great technical charting.

Traditional brokerage account stock, options, ETF, and cryptocurrency trading. Furthermore, Vanguard recently announced that they won't charge a commission on a huge amount of competitor's funds and ETFs as well! But unlike most borrowed money on which you pay interest, Robinhood Gold applies a monthly fee to margin funds. For those who choose either retirement accounts, they will be given access to over exchange-traded funds ETFs and stocks. Its wide range of accounts and tools make it the perfect platform for traders with varying needs. With TD Ameritrade's commission free pricing structure for stocks, options, and ETFs , they are more compelling than ever to use as an investing app. Some of the institutions we work with include Betterment, SoFi, TastyWorks and other brokers and robo-advisors. Buying on margin means you double your expected returns. The stock market can be highly erratic, but some shares are more stable compared to others. Robinhood has made this easy by putting a ton of information just a click away. SoFi Personal Loan Just like Webull, M1 Finance is completely free. Check out the other options for trading stocks for free. Pros and Cons Of In This makes otherwise complex and confusing names more meaningful and easy to comprehend. Similarly, when you buy or sell crypto on Robinhood Crypto, your order is sent to one of various trading venues that allow you to receive competitive prices. With all the required generals, college graduates know more about the area of a triangle than money management. Contact Robinhood Support.

Each mobile app has its own unique twist on stock market investing and both do an excellent job catering to beginner investors. If you are not familiar with margin trading, it means borrowing to invest. Saving is difficult because, at the end of the month, we are usually out of money! A trade that appears like clockwork between am on most trading days. This affords account holders the ability to obtain investment and analysis from Morningstar on up to 1, stocks. Robinhood vs Stash Review December 28, at am. Stash vs Robinhood: Which Is Better? Robinhood is known for no fees and no hassle. We are excited to hear from you and want you to love your time at Investormint.