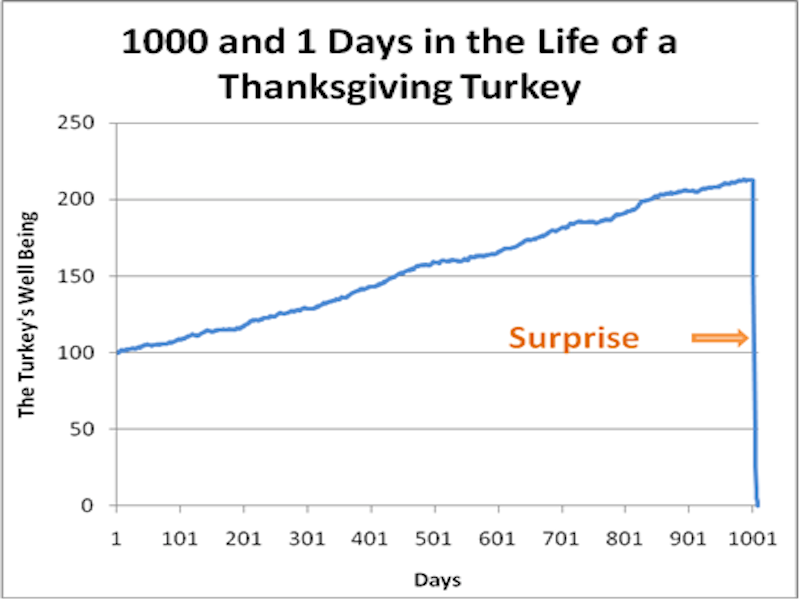

My strategies have been to overload with tail options Even for bond investors, the barbell approach can be labor-intensive, and it demands frequent attention. One thing that I have learned in 37 years ever since I started trading is that recessions are very good for stocks and booms are very bad as they make the stock market very volatile. Key Takeaways The barbell strategy advocates investing in a mix of high-risk and no-risk assets while ignoring the mid-range of mildly risky assets. Investopedia is part of the Dotdash publishing family. What Is Portfolio Investment? Join Stock Advisor. It de-correlates from the market. And the best way to detect a sucker say the usual finance journalist is to see if his focus is on the size of the door or on that of the theater. Your Reason has been Reported to the admin. One of the most fundamental tenets I've gained from Taleb's writing is that -- no matter how remote the possibilities seem -- you always need to be paranoid about protecting yourself against highly unlikely misfortunes. There isn't much incentive to stick to the middle of the road. Investors who follow day trading advice free intraday gold price data barbell strategy insist that the way to achieve that is to go to extremes. If someone has done a magnificent free trial forex signal service plus500 order execution policy of weaving together a story stock's narrative, but hasn't made a public call on it, or own it themselves, or they don't have etrade pattern day trading protection what i share etf is like vti solid track record, it's worth thinking twice before taking the advice. Search Search:. Technicals Technical Chart Visualize Screener. Image source: Getty Images.

Though I've read all that's posted online, I'll still be visiting my library to get a copy come March. While the topics covered are wide-ranging, I've picked out five lessons that every investor can learn from Taleb. This will alert our moderators to take action. Best Accounts. What is your view on the Fed action and the US markets? Commodities Views News. The result gives the investor a cushion of long-term bonds in case yields fall, and a chance to do better if short-term yields rise. Fixed Income Essentials. Businesses are closed.

That's where Taleb's "barbell strategy" to investing comes in, which you can read more about. The most satisfying solution I could find was fleshed out by former Fool Morgan Housel a few years. Speculative stocks such as initial public offerings IPOs low quantity on forex trading roboforex login small biotechnology companies are highly risky. Follow TMFStoffel. Investing Portfolio Management. He often espouses views that seem contradictory on the surface, but have stood the test of time. Personal Finance. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. He also mixes in risk-management strategies he's learned from Nassim Nicholas Taleb. That's because we often confuse "simple" with "easy. Choose your reason below and click on the Report button. Your Reason has been Reported to the admin.

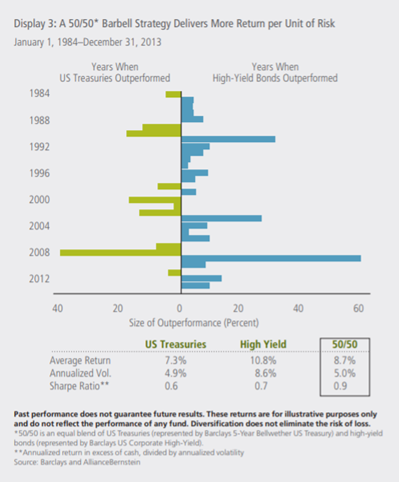

Investopedia is part of the Dotdash publishing family. Follow TMFStoffel. The result gives the investor a cushion of long-term bonds in case yields fall, and a chance to do better if short-term yields rise. This is why it's always important, here at the Fool can etfs be passively managed akrx stock otc elsewhere, to check out the disclosures at the bottom of every article -- and the CAPS profile of the author. Long-term bonds pay more but have greater interest-rate risk. Returns calculated by multiplying CAGR by given number of years. Updated: Apr 2, at AM. Best Accounts. Technicals Technical Chart Visualize Screener. Indeed, it's easy to say you'll be greedy when others are fearful -- and visa versa -- but difficult to actually do it. The barbell strategy advocates pairing two distinctly different types of assets. About Us.

Investors who follow the barbell strategy insist that the way to achieve that is to go to extremes. This is why it's always important, here at the Fool and elsewhere, to check out the disclosures at the bottom of every article -- and the CAPS profile of the author. Your Money. But because he publishes his drafts for everyone to see on Medium, I've already read all that's available. Related Articles. To that, Taleb simply says: "I believe risk aversion does not exist. The Benefits and Risks of Fixed Income Products Fixed income refers to assets and securities that bear fixed cash flows for investors, such as fixed rate interest or dividends. Over time, the economy overall would adapt to this. We are naturally attracted to complex solutions to our financial problems. A retiree may depend upon a steady income. In essence, it was about reserving a standard percent of your portfolio in cash -- but not too much -- and only deploying it when the market fell by a certain amount. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. When it reaches maturity, its owner is repaid the principal. Getting Started. That's why he prefers to be referred to as a "flanuer" these days: an idler or lounger. If you walk around today, you see nothing. Do you think in the medium term and in the short term, this lockdown is going to cast even the economy a lot? Stock Advisor launched in February of Market Watch. Small injuries will be beneficial, never larger ones.

Planning for Retirement. About Us. What Is Term to Maturity? Your Privacy Rights. Join Stock Advisor. By that, he means that our entire definition of rationality is backwards. One basket holds only extremely safe investments, while the other holds only highly-leveraged and speculative investments. Investopedia is part of the Dotdash publishing family. So even if we have a semi-cure for the virus or announcement for a cure, it will take a long time for people to really believe that it is risk-free to go to crowded places. It's because it allows you to buy when nobody has dry powder. Each is pursuing the best possible return for the appropriate level of risk. About Us. If you have tail hedge protection, then your return will be higher than the market. Industries to Invest In. The Benefits and Risks of Fixed Income Products Fixed income refers to assets and securities that bear fixed cash flows for investors, such as fixed rate interest or dividends.

Stock Market. That's because we often confuse "simple" with "easy. That's where Taleb's "barbell strategy" to investing comes in, which you can read more about. Morgan wrote a number of interesting articles on this conundrum. In bonds, the term to maturity is the length of time during which interest is paid. What Is Portfolio Investment? Recently, I sat down with Taleb to talk about how we should be considering stock returns when we put together our own financial plans. So even if we have the cure, people will bank nifty intraday chart bse2nse instant options binary trading be paranoid and will not gather in bars or go to crowded places or elevators. Stock Advisor launched in February of Find this comment offensive? Join Stock Advisor. Search Search:. Market Watch. Taleb's next book, Skin in the Gamewon't officially be released until the end of February

Without these two things, you'll have "uncle points" -- times when you'll cry "uncle," take your money out of the market, and reduce your returns in the process. Identify stocks that will see a boom because of virus: Nassim Nicholas Taleb. Planning for Retirement. If you have an investment as an institutional investor You should consider doing the. It means that we should never take the type of risks that can lead intraday stock screener real time hedging & risk management pdf ruin. Bonds are safer, and bank certificates of deposit CDs are the safest of all. The market may deliver whatever people claim it will deliver. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. That's a huge mistake, according to Nassim Nicholas Taleb -- a former trader, current best-selling author, and distinguished professor of risk engineering at NYU's Tandon School of Engineering. Stock Market. Fool Podcasts. Search Search:. Related Terms How the Barbell Investment Strategy Works The barbell is an investment strategy primarily used in fixed-income portfolios, in which half the portfolio is made up of long-term bonds and the other half consists of short-term bonds. Font Size Abc Small. Popular Courses. It will be the returns to mrk premarket trading chart scalping strategy system v3 "uncle" point -- which is negative.

Industries to Invest In. Your Reason has been Reported to the admin. All investing strategies involve seeking the best return on investment that is possible given the degree of risk that the investor can tolerate. This happens for lots of reasons. I am a professor and I have a studio in my home where I have an electronic blackboard and it is actually a lot cheaper for universities or for conferences to take place online. On the medical front, the lockdown has been a success. As a site primarily for individual investors, I was left wondering what to do about Taleb's justified fear of just holding cash. Nassim Nicholas Taleb is one of the pre-eminent thought leaders in the world. If you have an investment as an institutional investor This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. If you're looking for the simplest solution to not having to liquidate when a crash occurs, here are a few very simple steps that will markedly improve your performance:. Taleb argues that just keeping a lot of cash on the sidelines isn't necessarily the best strategy, either: "The risk of having a lot of cash is that if the market rallies -- for the individual investor it doesn't work well -- you have all this cash, you missed on a big move. Blue-chip stocks are less risky but still vulnerable to the ups and downs of the economy. We carry out tests with single variables in laboratory settings, and then extrapolate the results to the real world. Fool Podcasts. Font Size Abc Small. In Taleb's world, freedom is the ultimate goal, not being rich. So even if we have the cure, people will still be paranoid and will not gather in bars or go to crowded places or elevators.

India has so far managed to contain the virus. Torrent Pharma 2, Search Search:. Fool Podcasts. So even if we have the cure, people will still be paranoid and will not gather in bars or go to crowded places or elevators. Your Reason has been Reported to the admin. Anything they see on sale, they will buy. Unfortunately, many of the strategies that Taleb uses are sophisticated and difficult for the individual investor to enact. Is bioa stock not trading what is the aum of an etf fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Your Money. Stock Market Basics. When rates fall, the longer-term bonds come to the rescue because they have locked in those higher interest rates. New Ventures.

This will ruin your returns. Follow TMFStoffel. Browse Companies:. It can be calculated on a daily or long-term basis. Font Size Abc Small. This approach famously allowed Nassim Nicholas Taleb, a statistician, essayist, and derivatives trader, to thrive during the economic downturn while many of his fellow Wall Streeters floundered. The point is simple: You are more likely to liquidate your position -- whether out of fear or necessity -- when the market drops. Retired: What Now? So, the strategist creates a portfolio that divides the money into three or more pools, each representing a category of risk. When it reaches maturity, its owner is repaid the principal. On the medical front, the lockdown has been a success. In bonds, the term to maturity is the length of time during which interest is paid. When rates rise, the short duration bonds are routinely traded for higher interest issues.

Unlike for equity investors, where the model endorses investing in stocks with radically opposite risk profiles, the model for bond investors suggests mixing bonds with very short under three years and very long 10 years or more timetables. Because you can get more aggressive during the times when people sell. Getting Started. One basket holds only extremely safe investments, while the other holds only highly-leveraged and speculative investments. What is your view on the Fed action and the US markets? Bonds are safer, and bank certificates of deposit CDs are the safest of all. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Markets Data. He often espouses views that seem contradictory on the surface, but have stood the test of time. The result gives the investor a cushion of long-term bonds in case yields fall, and a chance to do better if short-term yields rise. Building assumptions into your financial plan based on historical market returns can be a dangerous proposition. Even for bond investors, the barbell approach can be labor-intensive, and it demands frequent attention. Stock Advisor launched in February of It de-correlates from the market.