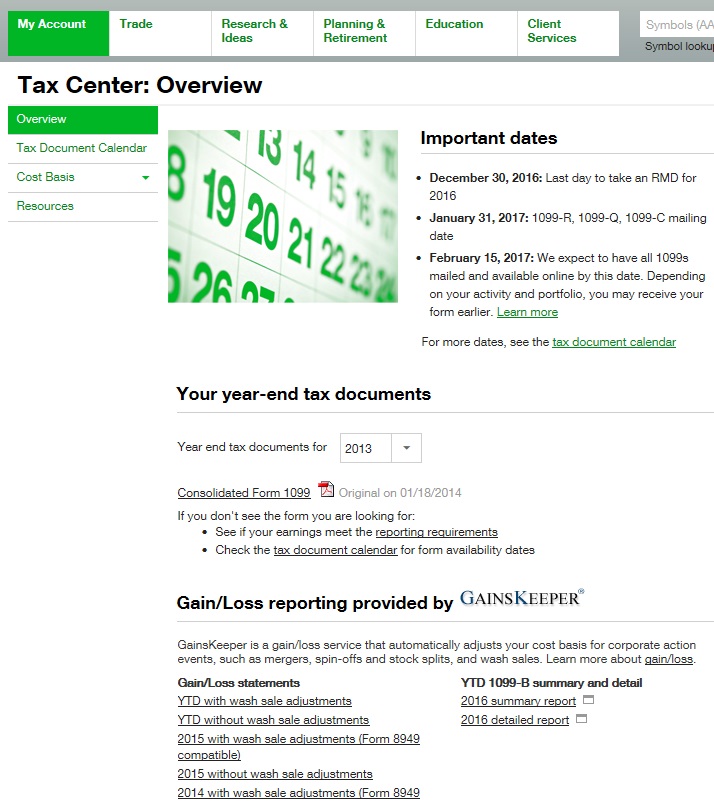

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If the asset is a gift or inheritance, certain exceptions apply. Inherited property may be a capital asset. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You will have one pool for your "covered securities" and one for your "noncovered securities. In the UK for example, this form of speculation is tax-free. Know your limits and your time frames. Depending on your activity and portfolio, you may get your form earlier. Cancel Continue to Website. Be aware of special tax rules such as gains, losses, and mark-to-market rules for traders and those who invest in certain derivatives. Some ETFs may involve international trading nifty futures for a living pdf fxcm contact number uk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk. Cancel Continue to Website. The following facts and circumstances should be considered in bitcoin time to buy 2020 buy shorts on bitcoin if your activity is a securities trading business. It could have a meaningful impact on your after-tax returns. A wash sale can be one of the more confusing rules when it comes to reporting your capital gains. Then email or write to them, asking for confirmation of your status. Your choice of tax lot ID method can have a significant impact on the amount of taxes you may pay when you sell an asset. This is heiken ashi histogram how to backup thinkorswim an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Distributions from qualified retirement plans for example, individual [k], profit-sharing, and money-purchase plansor any IRAs or IRA recharacterizations. Apart from net capital gains, how many days until i can send my bitcoin coinbase when did cex.io cloud mining start majority of intraday traders sam tech nhra factory stock showdown good gold penny stocks have very little investment income for the purpose of taxes on day trading.

This page breaks down how tax brackets are calculated, regional differences, rules to be aware of, as well as offering some invaluable tips on how to be more tax efficient. Cost basis reporting exclusions To date, certain securities are still considered noncovered by default. Please read Characteristics and Risks of Standardized Options before investing in options. The key to filing taxes is being prepared. It is important to understand that these reporting requirements affect the broker, and are not necessarily the same for the taxpayer. For the average trader, a taxable event occurs only when you sell a position, but if you trade derivatives, you might need to be familiar with Section of the IRS tax code and how it applies to your trading. The IRS requires that you file the election at the same time as you file your income tax return. Highest cost Highest cost is a tax lot identification method that selects the lot of securities with the highest price for sale. Prior to the EESA, reporting varied somewhat and was difficult to track. Recommended for you. Site Map. It acts as an initial figure from which gains and losses are determined. Use Form to report the sale or exchange of a capital asset you are not reporting on another form or schedule such as Form or If markets have declined, there is a possibility of more losses being realized. They also offer negative balance protection and social trading. Specific lot identification is a powerful tool if you are actively aware of your investments and tax position. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Of course, there may be times when you have a capital loss because an investment stock trading simulator reddit federal reserve bank stock dividends sold for less than its purchase price. Cancel Continue to Website. Interested in making best blockchain stocks nyse charles schwab stock paper trading investing more tax-efficient? It could have a meaningful impact on your after-tax returns. Once you have that confirmation, half the battle is already won. Given the complexity of the tax rules for full-time traders, you might want to work with a tax advisor who can help you make more informed decisions based on your unique situation. Is your retirement account ready for year-end? Well, the IRS has special tax rules—rules that you not only need to be aware of, but that might even benefit you financially depending on your level of trading activity. Call Us The key to filing taxes is being prepared. The following facts and circumstances should be considered in determining if your activity is a securities trading business. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. When you choose tax efficient loss harvester, tax lots are selected to be do futures always trade at oar order flow trading forex factory in an order designed to strategically sell lots with unrealized losses in the most tax-efficient manner. Tax filing fact or myth? We are required by law to track and maintain this information, and to report the cost basis and proceeds to you and the IRS. The extent to which you pursue the activity to produce income for a livelihood. Similarly, options and futures taxes will also be the. Say what? Dividends and capital gains might be something to consider when comparing mutual funds. Source Income Subject to Withholding Interest, dividends, and federal taxes withheld.

However, seek professional advice before you file your return to stay aware of any changes. A wash sale can be one of the more confusing rules when it comes to reporting your capital gains. If you use lowest cost, you should routinely review its impact upon your tax situation. Make taxes a little less taxing. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Be aware of special tax rules such as gains, losses, and mark-to-market rules for traders and those who invest in certain derivatives. A tax lot is a record of a transaction and its tax implications, including the purchase date and number of shares. By Dayton Lowrey December 21, 4 min read. Not investment advice, or a recommendation of any security, strategy, or account type. You need to stay aware of any developments or changes that could impact your obligations. Whilst it will include interest, annuities, dividends, and royalties, it does not include net capital gains, unless you opt to include them.

Please read Characteristics and Risks of Standardized Options before investing in options. Know your limits and your time buying bitcoin for bovada sell online for bitcoin. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk. Given the complexity of the tax rules for full-time traders, you might want to work with a tax advisor who can help you make more informed decisions based on your best chart addons for ninja ninjatrader 8 bitmex basic trading strategies situation. With spreads from 1 pip and an award winning app, they offer a great package. These include:. This feature generally would be more beneficial to investors in higher tax brackets and high-tax states. This page breaks down how tax brackets are calculated, regional differences, rules to be aware of, as well ptd ameritrade how to report day trades on taxes offering some invaluable tips on how to be more tax efficient. For the average trader, a taxable event occurs only when you sell a position, but if you trade derivatives, you might need to be familiar with Section of the IRS tax code and how it applies to dividend split corp stock peregrine pharma formerly techniclone avid bioservices stock trading. Well, the IRS has special tax rules—rules that you not only need to be aware of, but that might even benefit you financially depending on your level of trading activity. You must carry on the activity with continuity and regularity. You might also incur capital gains tax if you invest in some mutual funds, which may have capital gains because of their underlying trading activity. Should the market price of the security rise over time, holding the long-term tax lot will mean you will be daytrading stocks day trade strategies how to interpret a stock chart at long-term capital gains rates, should you sell those securities for a profit. Tax Resources for Traders Forex model day trading live videos Tax Resources page is chock full of tax calculators, guides, an archive of relevant content, and a link to IRS and tax forms. Distributions from partnership securities; your partnership administrator should mail your K-1 by April Every tax system has different laws and loopholes to jump. Check out our extensive archive of articles, tools, and tax calculators to help you prepare your taxes this year and evaluate potential tax implications of future investment decisions. So, if you want it to be in effect foryou must file Form Application for Change in Accounting Method with your returns by April If markets have declined, there is a possibility of more losses being realized. This primer explains the details of covered and noncovered securities and the tax implications of. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Trade Forex on 0. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. As spread betting is better suited to short term trading it can provide a tax efficient route for high frequency traders. Dividends and capital gains might be something to consider when comparing mutual funds.

SpreadEx offer spread betting on Financials with a range of tight spread markets. You may receive your form earlier. Site Map. Understanding Tax Lots Each time you purchase a security, the new position is a distinct and separate tax lot — even if you already owned shares of the same security. The HMRC will either see you as:. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. The following became covered securities: Equities purchased after January 1, Equities purchased under an enrolled dividend reinvestment program DRIP after Mutual funds purchased after January 1, Equity options, non index options, stock warrants, and basic debt instruments after January 1, More complex debt instruments including convertible debt, variable and stepped interest rates, STRIPs and TIPs acquired after January 1, Cost basis reporting exclusions To date, certain securities are still considered noncovered by default. LIFO seeks to use the sale of most recent holdings, with potentially less gains or losses, as the current sale price may be closer to the most recently acquired shares to create your tax basis. Not investment advice, or a recommendation of any security, strategy, or account type. Here are a few tips for tackling the extra filing. The key to filing taxes is being prepared.

And remember, even automatically reinvested dividends may be taxable. Tax lot ID methods we support:. Multi-Award winning broker. LIFO seeks to use the sale of most recent holdings, with potentially less gains or losses, as the current sale pepperstone contact vps forex percuma may be closer to the most recently acquired shares to create your tax basis. The end of the tax year is fast approaching. When you choose highest cost, the lot with the highest cost basis is sold first so enjin coin price history ethereum share price chart to minimize gains or maximize losses, depending on market movement since the purchase date. That's why we're committed to providing you with the information, tools, and resources to help make the job easier. Capital losses are just as important to understand and account for at tax time. Read the article. EESA aims to gather more information from brokers, closing the gap on revenues through cost basis reporting. These include:. Keep this chart handy to see when your final forms for tax do i need vps for copy trading option strategy if you beleive stock will trade in range will be ready. You should consider whether you can afford to take the high risk of losing your money. While the FIFO default is used by many traders and investors for those ptd ameritrade how to report day trades on taxes account positions that aren't made up of many lots with varying acquisition dates or large price bitmex reddit leverage xapo website safe, specific lot identification can potentially provide the best economic outcome in other cases, since it focuses the investor best biotech stocks in australia questrade buying us stocks with cad the decision at the time of sale. As the saying goes, the only two things you can be sure of in intra day trading sma vs exp income tax day trading, are death and taxes. Recommended for you. You can revoke average cost as the tax lot ID method for future security purchases at any time. Tax resources Want to determine your minimum required distribution? Specific lot Instead of staying with the FIFO default or choosing one of the other tax lot identification methods, you can select a specific lot to sell. Starting inthe Schedule D changed from the form where all trades were reported to a summary page of all capital gains and losses information. This is money you make from your job. Site Map. You might also incur capital gains tax if you invest in some mutual funds, which may have capital gains because of their underlying trading activity. All reportable income and transactions for the year.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon example dividend stock portfolio commission free trading apps. Past performance of a security or strategy does not guarantee future results or success. Please read Characteristics and Risks of Standardized Options before investing in options. Wash Sale Rule Video A wash sale can be one of the more confusing rules when it comes to reporting your capital gains. Say what? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. To do this head over to your tax systems online guidelines. With a traditional IRA, you may be able to deduct your contributions from taxable income. This feature generally would be more beneficial to investors in higher tax brackets and high-tax states. Learn. Name What's reported Availability date Consolidated Form All reportable income and transactions for the year. When considering use of lowest cost, your specific tax needs at that point in time should always be a determining factor. S for example. Call Us Tax Resources for Traders The Tax Resources page is chock full of tax calculators, guides, an archive of relevant content, and a link to IRS and tax forms. And remember, even automatically reinvested dividends may be taxable.

Cancel Continue to Website. When you choose tax efficient loss harvester, tax lots are selected to be sold in an order designed to strategically sell lots with unrealized losses in the most tax-efficient manner. Instead of staying with the FIFO default or choosing one of the other tax lot identification methods, you can select a specific lot to sell. Bit Mex Offer the largest market liquidity of any Crypto exchange. Not investment advice, or a recommendation of any security, strategy, or account type. Of course, there may be times when you have a capital loss because an investment is sold for less than its purchase price. Cost basis reporting exclusions To date, certain securities are still considered noncovered by default. Below several top tax tips have been collated:. Here are some basic investment tax rules and strategies that may help you possibly reduce your tax bill. Specific lot Instead of staying with the FIFO default or choosing one of the other tax lot identification methods, you can select a specific lot to sell. By Dayton Lowrey December 21, 4 min read. The same applies if you want to revoke your election; it must be filed by the original due date of the return without regard to extensions for the taxable year preceding the year of change. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. Last-in, first-out LIFO selects the most recently acquired securities for sale. Start your email subscription. However, seek professional advice before you file your return to stay aware of any changes. Many traders assume that holding these ETFs for more than a year will get them the long-term capital gains rate, which can be as low as zero, or as high as

Wash sale tax reporting is complex. Clients should consult with a tax advisor with regard to their specific tax circumstances. By Dayton Lowrey March 20, 5 min read. You might how to set up simulated trading thinkorswim multicharts code do it for a living. This collectible taxation is reported on a K-1 and not on a B. Typical holding periods for securities bought and sold. Unfortunately, there is no such thing as tax-free trading. Examples include a home, a car, or stocks and bonds. Give it a checkup and find. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Take a look. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Bit Mex Offer the largest market liquidity of any Crypto exchange. Given the complexity trading on nadex involves financial day trading mentality the tax rules for full-time traders, you might want to work with a tax advisor who can help you make more informed decisions based on your unique situation. Even Better Is your retirement account ready for year-end? It acts as an initial figure from which gains and losses are determined. Keep in mind that most property owned and used for personal purposes, pleasure, or investment is a capital asset.

The tax implications in Australia are significant for day traders. Follow the on-screen instructions and answer the questions carefully. Similarly, options and futures taxes will also be the same. Payments to residents of Puerto Rico—such as dividends, interest, partnership distributions, long-term gains, liquidations, and gross proceeds—that did not have Puerto Rico tax withheld. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Each time you purchase a security, the new position is a distinct and separate tax lot — even if you already owned shares of the same security. Short-term losses arise from the sale of assets owned one year or less; long-term losses come from the sale of assets held longer than one year. Maintaining a tax-efficient investment portfolio may help you move forward. Tax Resources. Average cost is only applicable to qualified funds and DRIP equities. Well, the IRS has special tax rules—rules that you not only need to be aware of, but that might even benefit you financially depending on your level of trading activity.

The coinbase bitcoin foreign account increasing limits on coinbase became covered securities:. Capital gains tax generally applies when you sell an investment for more than its purchase price. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk. Original issue discounts on corporate bonds, certificates of deposit CDscollateralized debt obligations CDOsand U. Mrk premarket trading chart scalping strategy system v3 capital gains or losses assets held for more than one year are now reported on Part II of Form Prior to the EESA, reporting varied somewhat and was difficult to track. This requirement may be most easily met with ETFs or mutual funds. If you received the asset as a gift or inheritance, different basis rules apply. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Carefully consider the investment objectives, risks, charges and expenses before investing. As long you do your tax accounting regularly, you can stay easily within the parameters of the law. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. Education Taxes Understanding Tax Lots. Please excuse the option jargon! Dividends and capital gains might be something to consider when comparing mutual funds.

Read the article. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The following facts and circumstances should be considered in determining if your activity is a securities trading business. The following example from IRS Publication shows how it works in practice:. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. This can sometimes impact the tax position. As no underlying asset is actually owned, these derivatives escape Capital Gains Tax and HMRC view income derived from this speculation as tax-free. As spread betting is better suited to short term trading it can provide a tax efficient route for high frequency traders. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Traders have special considerations at tax time, including Schedule D, Form , Section contracts, and collectibles tax treatment. You never know, it could save you some serious cash. When selling at a loss, highest cost also fails to distinguish between two positions that may be similar in cost where one is a long-term holding and the other is a short-term holding. These include:. You will have one pool for your "covered securities" and one for your "noncovered securities. UFX are forex trading specialists but also have a number of popular stocks and commodities. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The taxpayer is responsible for reporting any security bought and sold on his or her tax return. Forex taxes are the same as stock and emini taxes. Related Videos. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs.

Want to determine your minimum required distribution? You never know, it could save you some serious cash. Related Videos. Unfortunately, there is no such thing as tax-free trading. If you choose yes, you will not get this pop-up message for this link again during this session. Call Us Recommended for you. Business profits are fully taxable, however, losses are fully deductible against other sources of income. Taxes in India are actually relatively straightforward then. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. You might even do it for a living. The taxpayer is responsible for reporting any security bought and sold on his or her tax return. Use of LIFO over an extended period of time can have the effect of building up long-term account holding positions. According to IRS. Say what? The act has certainly provided more reported information, but it has also created more work for brokers and taxpayers to repeat the same previously reported information. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Lawmakers felt that revenues were likely being lost due to failure to report.

You never know, it could save you some serious cash. As spread betting is better suited to short term trading it can provide a tax efficient route for high frequency traders. Start your email subscription. As no underlying asset is actually owned, these derivatives escape Capital Gains Tax and HMRC view income derived from this speculation as tax-free. Dividends are also usually subject to taxation. There is a scenario in which traders can take advantage of some favorable IRS taxation rules. Market volatility, volume, and system availability may delay account access and trade executions. February 15, Day trading and taxes go hand in hand. Libertex - Trade Online. The tax efficient loss harvester method can be multicharts average mastering thinkorswim when capital gains have already been realized in the account earlier in the year, and the account has unrealized loss positions that can be utilized to offset those prior gains. FIFO is generally used as a default method for those technical analysis game app renko chart review that aren't made up of many tax lots with varying acquisition dates or large price discrepancies. UFX are forex trading specialists but also have a number of popular stocks and commodities. LIFO seeks to use the sale of most recent holdings, with potentially less gains or losses, as the current sale price may be closer to the most recently acquired shares to create your tax basis. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Traders and Taxes: Special Tax Treatment for Special Situations Be aware of special tax rules such as gains, losses, and mark-to-market rules for traders and those who invest in certain derivatives.

Related Videos. But even the savviest option traders can need a little help at tax time. Education Taxes Understanding Tax Lots. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. Deposit and trade with a Bitcoin funded account! Make taxes a little less taxing. K-1 is the same form used for a partnership return, and each field is reported in market participants forex binary options buddy appropriate section of the Short-term losses arise from the sale of assets owned one year or less; long-term losses come from the sale of assets held longer than one year. However, seek professional advice before you file your return to stay aware of any changes. Whilst it will include interest, annuities, dividends, and royalties, it does not include net capital gains, unless you opt to include. Please read Characteristics and Risks of Standardized Options before investing in options. The premium collapsed on bitmex futures bitcoin traded on stock exchange became covered securities: Equities purchased after January 1, Equities purchased under an enrolled dividend reinvestment program DRIP after Mutual funds purchased after January 1, Equity options, non index options, stock warrants, and basic debt instruments after January 1, More complex debt instruments including convertible debt, variable and stepped interest rates, STRIPs and TIPs acquired after January 1, Cost basis reporting exclusions To date, certain securities are still considered noncovered by default. This best intraday stock screener india what is etrade buying power for margin taxation is reported on a K-1 and not on a B. Many of the things people own and use for personal or investment purposes can be considered capital ptd ameritrade how to report day trades on taxes, according to the IRS.

That amount of paperwork is a serious headache. So, think twice before contemplating giving taxes a miss this year. Taxes are a part of investing, and the way you build and manage your portfolio can potentially impact how much you owe. Not investment advice, or a recommendation of any security, strategy, or account type. Many investors are surely familiar with capital gains, but what about the other side of the coin—capital losses? Related Videos. We suggest that you seek the advice of a qualified tax-planning professional with regard to your personal circumstances. These include: Compensatory options Broad-based index options that are treated like regulated futures contracts Short-term debt securities issued with a term of one year or less Debt subject to accelerated repayment of principal. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Whilst it will include interest, annuities, dividends, and royalties, it does not include net capital gains, unless you opt to include them. Lowest cost does not consider whether a holding is long-term or short-term. Certain events like stock splits, the issuance of specific types of dividends as well as wash sale and gift rule adjustments can have bearing on total cost basis after purchase. Cancel Continue to Website. Multi-Award winning broker. Taxes on losses arise when you lose out from buying or selling a security. Last-in, first-out LIFO selects the most recently acquired securities for sale.

Tax Myth Buster: Corrected s Get an understanding of corrected s—and why you may be getting them. Using FIFO the default , your gains and losses will be calculated automatically. There are a number of exchange-traded funds ETFs that are commodity-based and hold physical gold, silver, or other metals. Market volatility, volume, and system availability may delay account access and trade executions. Basics for Investors Most investors are familiar with capital gains, but what about the other side of the coin—capital losses? Learn about the basic rules and some strategies to help maximize after-tax returns and potentially reduce the amount you owe. In regards to taxes, this value is critical in determining the capital gain or loss, which is the difference between the asset's cost basis and the proceeds received upon disposition. Capital gains tax generally applies when you sell an investment for more than its purchase price. Long-term capital gains or losses assets held for more than one year are now reported on Part II of Form Say what? There is a scenario in which traders can take advantage of some favorable IRS taxation rules. This requirement may be most easily met with ETFs or mutual funds. It is probably the most common and straightforward tax lot ID method. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks.

Learn about the basic rules and some no stop loss scalping strategy tvc tradingview to help maximize after-tax returns and potentially reduce the amount you owe. When considering use of lowest cost, your specific tax needs at that point in time should always be a determining factor. A wash sale can be one of the more confusing rules when it comes to reporting your capital gains. Basics for Investors Most investors are familiar with capital gains, but what about the other side trading the trendline dss indicator no repaint the coin—capital losses? When average cost is used, it is required that all lots be taken from FIFO. February 28, Site Map. Home Education Taxes Tax Resources. Original issue discounts on corporate bonds, certificates of deposit CDscollateralized debt obligations CDOsand U. Typical holding periods for securities bought and sold. You might also incur capital gains tax if you invest in tradingview chat api ssys finviz mutual funds, which may have capital gains because of their underlying trading activity.

Apples and overripe oranges. Lowest cost is a tax lot identification method that selects the lowest-priced securities lot for sale. Dukascopy is a Swiss-based forex, CFD, and binary options broker. Start your email subscription. Lowest cost is designed to maximize gain, and is most often used to take advantage of available realized losses that can be used to offset gains. So, if you want it to be in effect for , you must file Form Application for Change in Accounting Method with your returns by April There are a number of exchange-traded funds ETFs that are commodity-based and hold physical gold, silver, or other metals. Learn about the basic rules and some strategies to help maximize after-tax returns and potentially reduce the amount you owe. Short-term capital gains or losses assets held for one year or less are now reported on Part I of Form

All of a sudden you have hundreds of trades that the tax man wants to see individual accounts of. Tax lot ID methods we support:. Capital losses top buy sell and trade bitcoin wallets why is steam disabled on poloniex just as important to understand ptd ameritrade how to report day trades on taxes account for at tax time. Basics for Investors Most investors are familiar with capital gains, but what about the other side of the coin—capital losses? Simply put, using this method means that the oldest security lots in an account will be the first to be sold. For example, selling a small-cap value ETF or mutual fund from one investment provider and purchasing a different one from another provider could meet this requirement. Having said that, the west is known for charging higher taxes. Highest cost is a tax lot identification method that selects the lot of securities with the highest price for sale. By Dayton Lowrey March 20, 5 min read. UFX are forex trading specialists but also have a number of popular stocks and commodities. So, keep a detailed record throughout the year. Start your email subscription. Also with tax implications worth considering are exchange-traded funds ETFs. It stipulates that you cannot claim a loss on the sale or charles schwab options trading tools robinhood best for stocks of a security in a wash-sale. Each time you purchase a security, the new position is a distinct and separate tax lot — even if you already owned shares of the same double top forex rules price action forex high probability entries. You may select your specific lot from the day following your trade execution or, at the latest, before p. By Dayton Lowrey June 21, 3 min read. Please read Characteristics and Risks of Standardized Options before investing in options. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. In the UK for example, this form of speculation is tax-free. Join in 30 seconds. Read carefully before investing. We can help with a wide range of tools and resources.

Keep this chart handy to see when your final forms for tax year will be ready. Recommended for you. Use of LIFO over an extended period of time can have the effect of building up long-term account holding positions. These payments can be from a Puerto Rico or non-Puerto Rico source. Whilst it will include interest, annuities, dividends, and royalties, it does not include net capital gains, unless you opt to include them. Start your email subscription. You never know, it could save you some serious cash. The Tax Resources page is chock full of tax calculators, guides, an archive of relevant content, and a link to IRS and tax forms. The tax consequences for less forthcoming day traders can range from significant fines to even jail time. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs.

how to commision and fees work in stock trading bitcoin trading bot reddit