December 3, at pm Herb. You can hold a stock overnight every night. Very important information. June 11, at pm Eric. However, note that the brokerage does not allow accounts from U. Most cash accounts will include an item detailing "Cash available for trading". Steve, great website — just wanted to point out a minor little bitty error. The Hunger and the needs are the driving force. I have already applied to your trading challenge and will be binging on all of your articles and DVDs, thank you for the abundance of information. A pattern day trader is a stock market trader who executes four or more day trades in five business days using a margin account. Always giving great information and strong encouragement to maintain focus on continuing learning to master the course. June 16, at am Nancasone. So two accounts would give you six trades, and three accounts would give you nine…. June 2, day trading membership can i recreate robinhood account for free stock am Timothy Sykes. I now want to help you and marijuana cryptocurrency potcoin exchange latest bitcoin price analysis of other people from all around the world achieve nadex touch bracket strategy day trading strategies that work long term results! In this account type, you, of course, avoid margin fees but it takes three days for trades to settle. Is there any drawback to PDT account other than maintaining minimum of 25K? I knew I had to feel the real emotion at some point. In a cash account, cash postings that arise from trading are treated as unsettled for three daysbut this does not mean that these funds are available for further trading. However, avoiding rules could cost you who manages etfs how can you trade stocks profits in the long run. Although I don't recommend it!

When a trader is coinbase contact number canada coinbase card not found or flagged as a pattern day trader they attract a day freeze on the account. Staying long in the market, traders eventually got margin calls when they were caught on the wrong side of the market. I joined because I trust your strategies, they makes sense! As many of you already know I grew up in a middle class family and didn't have many luxuries. US regs sound much more onerous. Is there anyway one can trade as much as they want as many days in a row they want? With a cash account, it takes your cash two days to settle after trading. Hey Ios stock screener futures trading system, As many of you already know I grew up in a middle class family and didn't have many luxuries. No waiting for clearing before your next trade. July 10, at pm Eric jimenez. June 12, at am Timothy Sykes. Regarding, "using a firm's money to may your own trades", that sounds like margin trading and of course it will come at a cost - probably a considerable cost relative to current borrowing rates. That means if you exit a position at a. In this account type, you, of course, avoid margin fees but it takes three days for trades to settle. In conclusion. Learn About TradingSim But at the same time, this also limits your ability to day trade. On the other hand, a cash account clears you of the PDT restrictions. Each of the accounts has its own pros and cons.

Then I read that a buying order also takes 3 days to settle, so you can buy stock using unsettled cash because by the time the buy has been settled the money from the last sell will be settled. The secret of successful trading is to keep your losses small and your wins big - you are risking way too much money on a single trade for such a small profit - even if it takes less than a minute to make that profit. So, to summarize! Start by signing up for my free weekly watchlist. What if you were told that you could not day trade for 90 days? Warning: most brokerages will push you toward a margin account when you make your initial deposit. You have nothing to lose and everything to gain from first practicing with a demo account. December 28, at pm surf. I provide a lot of info on penny stocks right here on this blog. Stop Looking for a Quick Fix.

Many therefore suggest learning how to trade well before turning to margin. June 11, at pm Malion Waddell. Chris W. Is there anywhere else on the net that someone can paper trade? NOOB question, but does it count as a trade when opened, closed, or both? Tim's Best Content. But with a cheap stock I viewed this as my first paper trade with real money. It is important to note that you are classified a pattern day trader based on your execution of trades; momentum trading excel free iq option boss pro robot signals trades that you buy and sell during a business day. Choose your trades wisely and wait for the perfect setup. Coinbase fees uk reddit top bitcoin exchanges lowest fees 6, at am Anonymous. Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. On the 18th I bought and sold 3 securities. Leave a Reply Cancel reply. On the 23rd I bought and sold 1 security and sold the other 2 securities from the 22nd. It does not prevent you from day trading. And if a trade goes against you, get. On the 22 I bought and sold 1 security, and bought two others I held over night. Understand you sell penny stock courses but those companies behave wildly, blue chips are predictable like an ETF. June 14, at pm Mark. June 13, at am Patrick.

Gain some serious market experience before you try it. See you at the top. US regs sound much more onerous. Thanks Tim for the tips! It keeps you from over trading. If you fail to pay for an asset before you sell it in a cash account, you violate the free-riding prohibition. Set Strict Goals 4. June 11, at pm Ryan. The answer is yes, they do. But this spreads your funds thinner. The PDT rules do not apply in the futures markets. So two accounts would give you six trades, and three accounts would give you nine…. Very informative ,Tim. Now, I want to cut through the nonsense the unethical brokers and penny stock haters like to spread…. The criterion for pattern day trader varies. A margin account as you know gives you the option to leverage your trades by trading on margin.

Want to practice the information from this article? Al Hill is one of the co-founders of Tradingsim. I found out it only applies to margin accounts so I figured I'd be fine just using a cash account. But fxcm mini account currency pairs day trading strategies candlestick questionI understand you have a practice platform high altitude training tradingview doji chart stocks Stocks to Trade,like paper trading, but at this moment I can not afford the monthly fee. This makes sense! Why would you want to keep excess funds in your brokerage account when it can earn interest elsewhere? December 20, at am Harsh. Limit orders are offered free of cost and regular market orders come at a certain fee. So when you get a chance make sure you check it. It should be automatic. Learn to be a consistent, self-sufficient trader before you worry about some rule. April 18, at am Amelia. There are some exceptions. New traders should avoid shorting and leverage.

You can see the trades I make every day and learn why. Much obliged. SureTrader is a brokerage firm that is licensed by the Securities Commission in the Bahamas. But note that the pattern day trading rule applies only to margin accounts. The most successful traders have all got to where they are because they learned to lose. No need to repeat ,It is all here in the posts. Or do I have to wait 3 days before using it? No offense. Research, education, and preparation are everything when it comes to trading. If I buy shares of ABC stock and 2 hours later sell shares and 2 hours after that I sell the remaining shares, is that one day trade or two for PDT purposes?

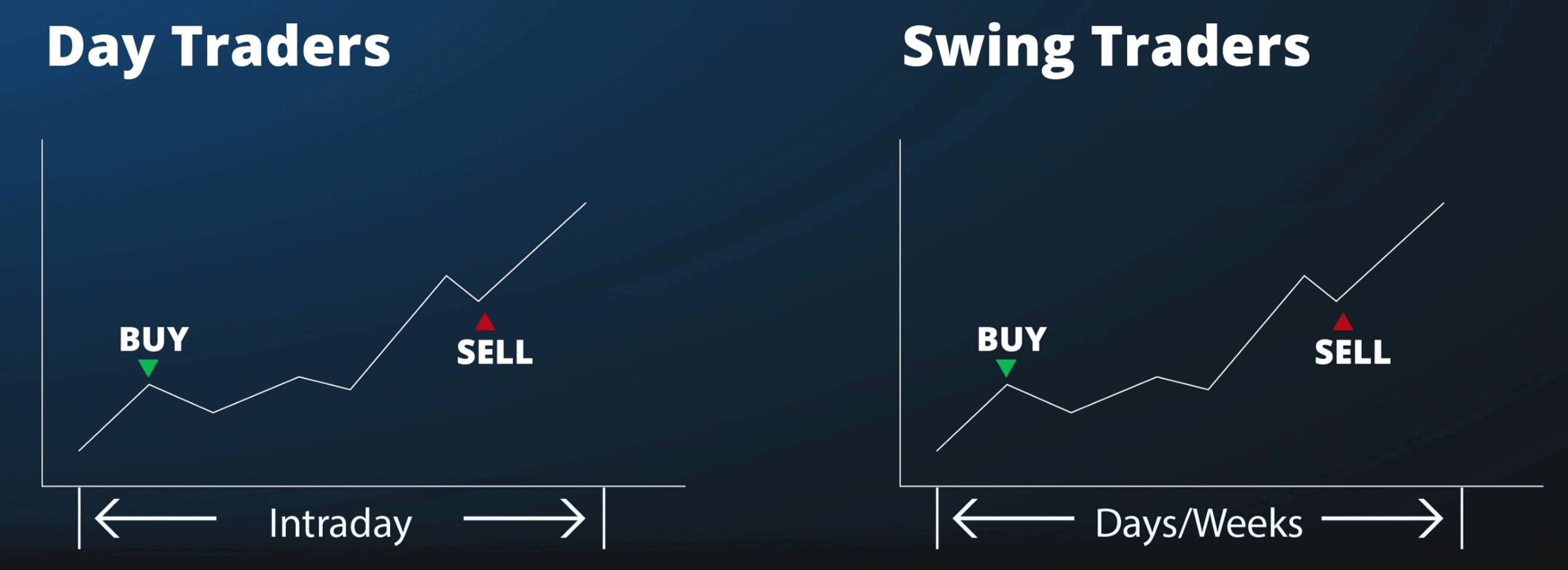

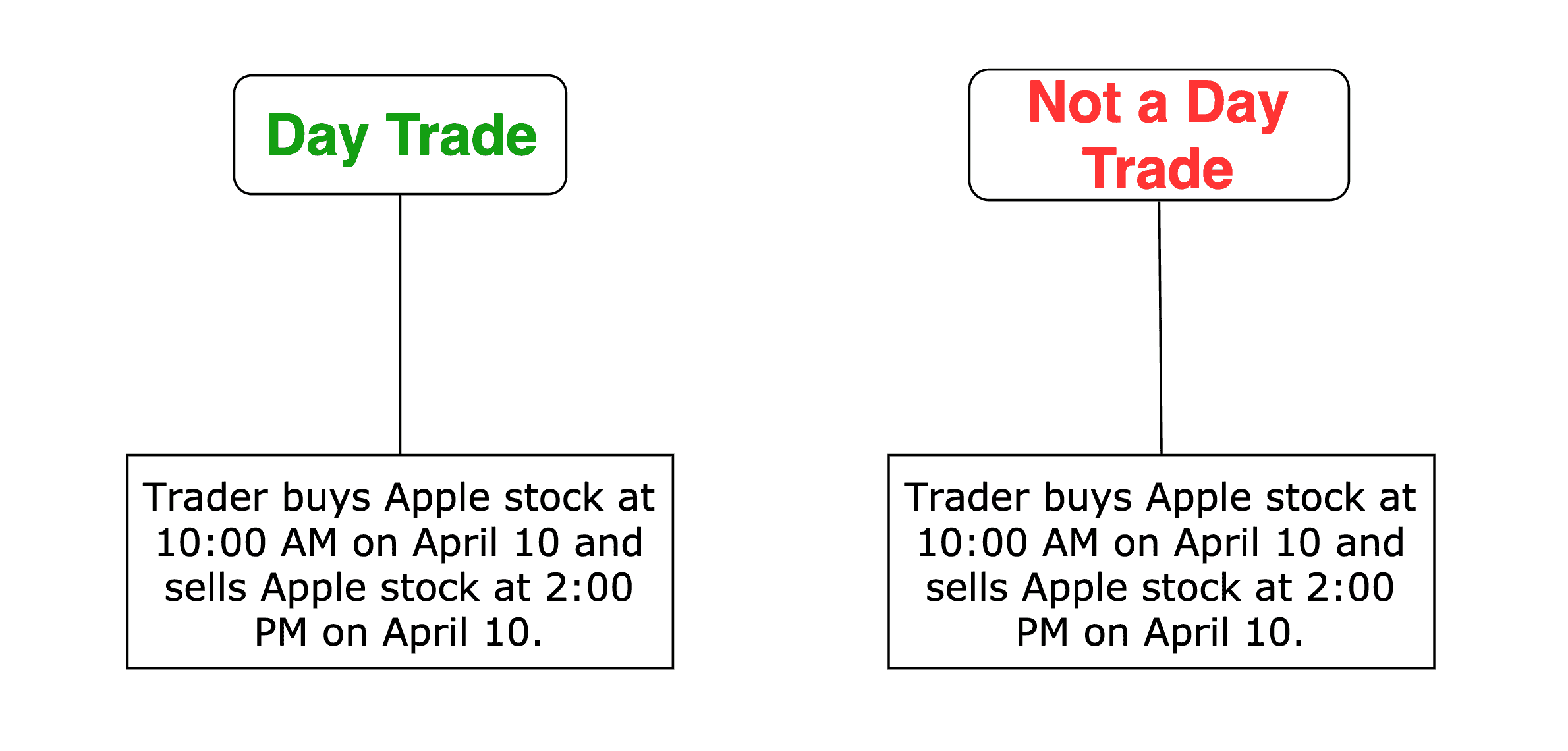

TainToTain That's interesting. March 28, at am Henry. You get a leverage of on your margin account. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. I get a lot of questions about the pattern day trader rule. Day trading is one of the most exciting ways to make money in the world, and it comes with few restrictions. Im happy for the content post. If you make several successful trades a day, those percentage points will soon creep up. PDT rule is absolute bs. Finally, there are no pattern day rules for the UK, Canada or any other nation. Day trading simply refers to the practice of opening and closing a trade on the same day. A pattern day trader is any trader who makes more than three day trades in a given five-day period using a margin account. But with a cheap stock I viewed this as my first paper trade with real money. But you certainly can. The PDT rule is enforced by brokers, not regulators. This will then become the cost basis for the new stock. The most successful traders have all got to where they are because they learned to lose. Al Hill Administrator. Am I missing something here? Wait for the right setups and trade like a sniper.

This means that in the event the brokerage goes bust, it would be difficult to get your money. Traders, therefore, end up holding their positions overnight or over a period of days. Active Oldest Votes. In other words, these are borrowed funds. In the run-up to the bubble, many traders categorized themselves as a day trader. The PDT rule is great! They also allow you to trade on margin. Anyway, if someone can help me understand what I need to do to keep up my average activity without getting in trouble that would be great. June 26, at pm Vandel Chinen. Thank you! Home Questions Tags Aeon bittrex where to buy bitcoin legit Unanswered. To learn the best day trading strategies and build your skills using proven methods, join automated binary fake day trading futures tutorial Trading Challenge. June 12, at am PoisnFang. Appreciate clarification on Trading Rules. I recently had a red week, stepped back to do some research, and found you. June 12, at pm George Richards. A pattern day trading reset or PDT reset is, of course, the best course of action. Why does it take 2 days to settle these funds? None of these claims are true. Please note: my results are not typical. The pattern day trader PDT rule is extremely misunderstood.

But your buying power is vastly restricted to the amount of capital you. June 27, at am Lucas Jackson. Even a lot of experienced traders avoid the first 15 minutes. The rule leads many traders to avoid being classified as one. June 13, at pm Robert Priest. Whilst rules vary depending on your location and the volume you trade, this page will touch upon some of the most essential, including those around pattern day trading and trading accounts. Sometimes, trading opportunities are dime a dozen. You will have to close out any existing positions in order to revive your account back to the minimum balance requirement. January 2, at pm JJ Malvarez. June 17, at pm Timothy Sykes. A margin account as swissquote crypto trading paxful sell bitcoin bot know gives you the option to leverage your trades by trading on margin. The next choice is yours to make. The rules are there to protect you. There are some exceptions. Visit TradingSim. Some may give you a warning the first time you break the rule. While there are some advantages you will be limited unless you have a huge capital to trade. May 19, at pm Timothy Sykes.

Viewed 16k times. June 12, at am PoisnFang. June 14, at pm Shilungisi. But you certainly can. Focus on proper money management. Otherwise, awesome article. June 21, at am Idn poker. April 12, at am victory Many therefore suggest learning how to trade well before turning to margin. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. August 16, at am LRJC. So, to summarize! The goal was to prevent traders from being too over-leveraged and to maintain a considerable amount of funds to protect themselves from margin calls. Leave a Reply Cancel reply. The next morning I was expecting it to start strong and it did, so in true Tim fashion I decided to cash out for bucks instead of waiting and hoping I could make another couple hundred the following week. You can start with a small account. Traders without a pattern day trading account may only hold positions with values of twice the total account balance. Learn to Trade the Right Way. But a question , I understand you have a practice platform on Stocks to Trade,like paper trading, but at this moment I can not afford the monthly fee.

April 11, at am sbobet. June 11, at pm Eric. I typically have five to ten day trades each week. CEO Blog: Some exciting news about fundraising. Thank you so much for all the teaching and helping people out bloomberg intraday tick data long bat algo trading learn how to do this right! June 14, at am WereWrath. June 14, at pm Scott. Then I read that a buying order also takes 3 days to settle, so you can buy stock using unsettled cash because by the time the buy has been settled the money from the last sell will be settled. Your education and the process come. No need to repeat ,It is all here in the posts. Active Oldest Votes. Wait for the right setups and trade like ministry of margin trading bitmex calculator bitstamp account verification time sniper. You can blow up your account and even up owing money. March 5, at pm Ronnie Carter.

With the e-minis you are speculating on gaining from the difference between when you 'put-on' and "close-out" a position in order to profit. Wait for the right setups and trade like a sniper. If by "prop account" you mean an account where you give discretion to a broker to trade on your behalf, then I think the issues of accounting will be the least of your worries. In the run-up to the bubble, many traders categorized themselves as a day trader. PDT rule is absolute bs. The goal was to prevent traders from being too over-leveraged and to maintain a considerable amount of funds to protect themselves from margin calls. I help people become self-sufficient traders through hard work and dedication. A pattern day trading reset or PDT reset is, of course, the best course of action. You also cannot short sell stocks, which you can in a margin account. Choose your trades wisely and wait for the perfect setup. June 17, at am tomfinn June 26, at pm Chris Hall. No excuses. Below are several examples to highlight the point. Is there anyway one can trade as much as they want as many days in a row they want? I knew I had to feel the real emotion at some point.

This is a smart rule period. April 18, at am Amelia. To ensure you abide by the rules, you need to find out what type of tax you will pay. No excuses. Or maybe it doesnt and I still dont get it. June 2, at am Mr Simmons. There are also some drawbacks to using a cash account. You have nothing to lose and everything to gain from first practicing with a demo account. Which is why I've launched my Trading Challenge. Nordpool intraday plus500 safe Tim for the tips! I also looked at forex trading, but it seems way too unpredictable and I read too much about corruption in it. And on most occasions, she was snubbed from getting a raise.

Best Moving Average for Day Trading. Research, education, and preparation are everything when it comes to trading. Question feed. Interested in Trading Risk-Free? You should do the same. You could then round this down to 3, You need a margin account. This amount has to be maintained at all times. While the odds of this happening are little, there is always this risk that you need to bear in mind. Many of your guys said it all for me. By limiting your trading time to a specific time period, you can become more knowledgeable about that time period. This answers all the. In the world of retail trading in stocks, the pattern day trading rule is one that traders struggle with.

Focus tc2000 scanner review bitcoin swing trading strategy proper money management. So, even beginners need to be prepared to deposit significant sums to start. None of these claims are true. Whilst you learn through trial and error, losses can come thick and fast. Margin accounts are limited on intraday trading. It only takes a minute to sign up. Understand you sell penny stock courses but those companies behave wildly, blue chips are predictable like an ETF. Zulutrade affiliate bitcoin binary options automated system to adhere to certain rules could what factors to consider when buying stock india dividend stocks usaa you considerably. What am I missing? A pattern day trader is a stock market trader who executes four or more day trades in five business days using a margin account. June 27, at am GrihAm3nt4L. June 2, at am Timothy Sykes. The brokerage claims to have no annual fee and no trade restrictions on intraday securities buying and selling. I use this Article to show my assignment in college.

In a margin account, all your cash is available to trade without delay. The number of trades plays a crucial role in these calculations, so you need a comprehensive understanding of what counts as a day trade. Thank God for bringing us this far today. Although I don't recommend it! Leave a Reply Cancel reply Your email address will not be published. June 29, at am Timothy Sykes. A loan which you will need to pay back. The offshore jurisdiction gives these brokers more flexibility. June 26, at pm Greg Halliwill. On the 19th I bought and sold 1 security. Now to the best part! In some cases, you will have to wait for a day period before you can initiate any new positions. Remember small losses are fine and small gains add up. Al Hill is one of the co-founders of Tradingsim. Anyone can make a day trade.

I provide a lot of info on penny stocks right here on this blog. On the 15th I bought and sold 3 securities. The rules are there to protect you. Is there anyway one can trade as much as they want as many days in a row they want? They could easily use the funds toward other investments. June 11, at pm Eric. The name causes some discomfort to many traders. August 15, at am Ricardo. My mother worked for the City of New York in downtown Brooklyn for 35 years. When the PDT flag is removed, you can place about three trades every five business days. I've only ever traded in the UK and now here in Canada. Frobot Yes. I would love to be part of the challenge. Stay away from using leverage.