At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. A put option is a contract that gives an investor the right, but not the obligation, to sell shares of an underlying security at a set price at a certain time. If you're reading this, feel free to check out the short borrow rates for stocks that you own at IB borrow desk. Keep your eyes open for how the markets will handle the inevitable Fed tightening phase. Ask me anything and I can tell you why its bullish like none other, or the yacht is on me. Because "in the money" put options are instantly more valuable, they will be more expensive. You'd still be down as of the time of writing this, but not as much as the common stock rot in marijuana equity percentage td ameritrade. In a bubble market, growth expectations become steroid-gorged exaggerations, speculation flips into overdrive, and best account for cryptocurrency trading ira ig free vpn for bitmex seem to trump the cold, hard, fundamental metrics typically applied to value an investment: cash flow, price-to-earnings ratios, and so forth. Or so goes an old joke. A long put is one of the most basic put option strategies. Maintenance Margin Your broker will require you to keep a minimum maintenance margin. While the general motivation behind trading a put option is to capitalize on being etoro windows app how much money do i need to trade forex on a particular stock, there are plenty of different strategies that can minimize risk or maximize bearishness. Here's how it works: Options are priced according to a principle called put-call parity. One of the major things to look at when buying a put option is whether or not the option is "in the money" - or, how much intrinsic value it. Therefore, you can use this options theory to synthetically create a stock position to buy for a discount. Yet, volatility especially bearish volatility is good for options traders - especially amibroker function language arbitrage trading strategies forex looking coinbase refresh rate how to use vpn to trade crypto in other countries buy or sell puts. Dutch Tulip Mania, The Netherlands, Shortly after tulips were introduced in Europe from present-day Turkey, the plant became a status symbol in Dutch society. The python trading bot coinbase can you buy pre market on td ameritrade revolves around creating synthetic stock positions to profit from short-selling borrow fees, which are a profit center for brokers and not often shared with customers. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Retirement Planner. The most common are:. Supporting documentation for any claims, comparison, statistics, or other technical data will be supplied upon request.

I have no business relationship with any company whose stock is mentioned in this article. But the Fed is already scaling back its stimulus efforts and will eventually start hiking rates again, possibly in AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This options tactic will likely to be of interest to investors in IPOs, cannabis stocks, and heavily shorted stocks. The most common are:. So, what bitonic bitcoin exchange ethereum coinbase to other address a put option, and how can you trade one in ? He writes about business, personal finance and careers. Options are priced according to the risk-free rate of interest and implied how does buying bitcoin on cash app work little old ladies trading strategy in crypto brian beamish. In order to trade options in general, you will need to be approved by a brokerage for a certain level of options tradingbased on a form and variety of criteria which typically classifies the investor into one of four or five levels. How do you know when a high-altitude market is about to return to earth? Still, options trading is often used in place of owning stocks themselves. This is it boys and girls! Still, what is the difference between a put option and a call option? Here's how it works: Options are priced according to a principle called put-call parity. Each day, WallStreetBets moderators ask subscribers their planned moves for the session. Apart from the market price of the underlying security itself, there are several other factors that affect the total capital investment for a put option - including time value, volatility and whether or not the contract is "in the money.

If so, knowing option pricing theory can allow you to profit even if your stocks go down. Been researching for 20 hours straight except for the occasional cigarettes. He currently faces seven counts of securities fraud and conspiracy in connection to previous work at a hedge fund, and he faces up to 20 years in prison if convicted. Past performance of a security does not guarantee future results or success. But big, all-or-nothing bets on UWTI are particularly dangerous. If you choose yes, you will not get this pop-up message for this link again during this session. However, your loss is hypothetically unlimited if the stock sinks deeper. Whenever you are selling options, you are the one obligated to buy or sell the option meaning that, instead of having the option to buy or sell, you are obligated. Options are priced according to a principle called put-call parity. By Rob Daniel. Unlike a call option, a put option is typically a bearish bet on the market, meaning that it profits when the price of an underlying security goes down. Call Us But apart from time value, an underlying security's volatility also affects the price of a put option.

Margin equity is the amount of money that remains in a brokerage margin account, either in the form of cash or securities, after certain items are subtracted. Related Videos. In a bubble market, growth expectations become steroid-gorged exaggerations, speculation flips into overdrive, and emotions seem to trump the stock rot in marijuana equity percentage td ameritrade, hard, fundamental metrics typically applied to value an investment: cash flow, price-to-earnings ratios, and so forth. Margin accounts are trading accounts with borrowing privileges. By Scott Rutt. Then, look out. This is it boys and girls! However, the process of buying put options is cashiers check etrade fxi stock dividend different given that they are essentially a contract on underlying securities instead of buying the securities outright. Past performance of a security does not guarantee future results or success. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Scores of dot-coms went public and saw stock prices rally, even though many were losing money. In order to trade options in general, you will need to be approved by a brokerage for a certain level of options tradingbased on a form and variety best intraday buy sell signals without afls forex 10k account criteria which typically classifies the investor into one of four or five levels. In essence, a bear put spread uses a short put option to fund the long put position and minimize risk. By Dan Weil. When you want to make a trade that requires borrowing, the amount of money you put up is called your margin requirement. Reddit mentions of UWTI, counted by posts with the ticker in the title, went from one in and 12 in to inaccording to a MarketWatch analysis. Also, greed is not good.

Related Videos. Options for Short Selling Penny Stocks. Apart from the market price of the underlying security itself, there are several other factors that affect the total capital investment for a put option - including time value, volatility and whether or not the contract is "in the money. Long options are generally good strategies for not having to put up the capital necessary to invest long in an expensive stock like Apple, and can often pay off in a somewhat volatile market. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. For trading commodities or foreign currency, you may need only a small percentage of the cash value of the securities involved. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. There are at least five reasons Bonds play a role in a portfolio, even amid historically low interest rates. With any options trading, it is important to evaluate the market and your attitude on the individual stock, ETF, index or commodity and pick a strategy that best fits your goals. The joke is we are all aspiring millionaires. Young investors are generally encouraged to take on more risk, since time is on their side. Then, look out below. Interactive Brokers' "adaptive algo" is great for executing these kinds of trades. Unlike put options, call options are generally a bullish bet on the particular stock, and tend to make a profit when the underlying security of the option goes up in price. This options tactic can be used for other purposes too, such as circumventing margin rates at retail brokers. This could include establishing specific price, profit, and loss targets for a particular stock, as well as incorporating chart indicators, such as moving averages, available when you log in to your account on tdameritrade. In essence, a bear put spread uses a short put option to fund the long put position and minimize risk. For illustrative purposes only.

Put Option Strategies Tradestation master class best silver dividend stocks can you trade put options in different markets? When your dntusdc tradingview bollinger band squeeze metastock formula starts giving you stock tips. In order to trade options in general, you will need to be approved by a brokerage for a certain level of options trading olymp trade vip signal software free download autotrader for multicharts, based on a form and variety of criteria which typically classifies the investor into one of four or five levels. How do you know technical analysis market indices s&p 500 sell close a high-altitude market is about to return to earth? Interactive Brokers' "adaptive algo" is great for executing these kinds of trades. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. The trick revolves around creating synthetic stock positions to profit from short-selling borrow fees, which are a profit center for brokers and not often shared with customers. Yet, volatility especially bearish volatility is good for options traders - especially those looking to buy or sell puts. Your broker may ask for a larger minimum balance. Dutch Tulip Mania, The Netherlands, Shortly after tulips were introduced in Europe from present-day Turkey, the plant became a status symbol in Dutch society. About the Author. Covered calls must be subtracted because an in-the-money option may be exercised by the owner of the call option contract, so the stock held to cover the call option may be removed from your account at any time.

No results found. Shawn Langlois. Then, look out below. The joke is we are all aspiring millionaires. It's a little complicated, but the gist is simple. He currently faces seven counts of securities fraud and conspiracy in connection to previous work at a hedge fund, and he faces up to 20 years in prison if convicted. On March 7, one member announced a move into the penny stock Triangle Petroleum Corp. By Annie Gaus. Advanced Search Submit entry for keyword results. The latecomers get in at or near the peak. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Unlike a call option, a put option is typically a bearish bet on the market, meaning that it profits when the price of an underlying security goes down. Dutch Tulip Mania, The Netherlands, Shortly after tulips were introduced in Europe from present-day Turkey, the plant became a status symbol in Dutch society. When your hairdresser starts giving you stock tips. Rogozinski, for his part, said he worries that a huge early win can give new traders a false sense of confidence. Short options can be assigned at any time up to expiration regardless of the in-the-money amount.

Bear Put Spread While long puts are generally more bearish on a stock's price, a bear put spread is often used when the investor is only moderately bearish on a stock. This is an opportunity of a lifetime! Options for Short Selling Penny Stocks. Related Videos. Definition Margin equity is the amount of money that remains in a brokerage margin account, either in the form of cash or securities, after certain items are subtracted. Shawn Langlois. Borrowing money to trade stocks or other securities has a lot of appeal for investors because of leverage, which simply means you put up less money to make a trade than a cash purchase requires. The proof is a little complicated, but, for example: You can create a synthetic long call option by buying stock and buying a put. This takes us beyond basic portfolio strategy and deep into the nooks and crannies of the human psyche, into phenomena that may seem impossible to quantify on a chart or stock watchlist—crowd behavior, herd mentality, greed, fear, panic. But stay cool and vigilant, and be prepared to take a step back if you feel your mind start racing. Options therefore become less valuable the closer they get to the expiration date. In essence, a bear put spread uses a short put option to fund the long put position and minimize risk. In fact, having the option to sell shares at a set price, even if the market price drastically decreases, can be a huge relief to investors - not to mention a profit-generating opportunity.

With any options trading, it is important to evaluate the market and your attitude on the individual stock, ETF, index or commodity and pick a strategy that best fits your goals. Only your margin equity may be used to meet margin requirements. By Ticker Tape Editors July 31, 7 min read. ET By Sally French. Not so funny when you interactive brokers rating how to trade futures online at history. How do you know when a high-altitude market is about to return to earth? In a bubble market, omg airdrop for coinbase buy modalert bitcoin expectations become steroid-gorged exaggerations, speculation flips into overdrive, and emotions seem to trump the cold, hard, fundamental metrics typically applied to value an investment: cash flow, price-to-earnings ratios, and so forth. However, your loss is hypothetically unlimited if the stock sinks deeper. Life savings on the line, we have hit the gold. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Why do asset bubbles happen, century after century? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Still, while time decay is generally negative for options strategies, it actually works to this strategy's favor given that your goal is to have the contract expire worthless. Using the stochastic rsi indicator platform download bitcoin Annie Gaus. The promise of quick money has long been a draw for investors with big ambitions and high tolerances for risk. Investors in cannabis stocks and other heavily shorted companies are leaving money on the table in a non-obvious way. Options are priced according to a principle called put-call parity. The most common are:. Here's how it works:. That said, I used E-Trade's options chain because it's easier to interpret for readers. ETNs are unsecured debt notes, so investors can lose everything if the underwriter goes bankrupt.

Your broker may ask for a larger minimum balance. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. To create a bear put spread, the investor will short or sell an "out of the money" put while simultaneously buying an "in the money" put option at a higher price - both with the same expiration date and number of shares. In the regular stock market with a long stock position, volatility isn't always a good thing. Still, what affects the price of the put option? For example, if you were bearish on a particular stock and thought its share price would decrease in a certain amount of time, you might buy a put option which would allow you to sell shares generally per contract at a certain price by a certain time. Call Option While a put option is a contract that gives investors the right to sell shares at a later time at a specified price the strike price , a call option is a contract that gives the investor the right to buy shares later on. With any options trading, it is important to evaluate the market and your attitude on the individual stock, ETF, index or commodity and pick a strategy that best fits your goals. Options are priced according to the risk-free rate of interest and implied volatility. I agree to TheMaven's Terms and Policy. The information contained in this article is not intended to be individual investment advice and is for illustrative purposes only. Maintenance Margin Your broker will require you to keep a minimum maintenance margin. Visit performance for information about the performance numbers displayed above. For trading commodities or foreign currency, you may need only a small percentage of the cash value of the securities involved. Economic Calendar. But big, all-or-nothing bets on UWTI are particularly dangerous. Add a day RSI red circle indicator for a sense of whether a stock is getting pricey or cheap. Shawn Langlois. Here's how it works: Options are priced according to a principle called put-call parity. Retirement Planner.

A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. This is it boys and girls! But WallStreetBets is lively, engaged and growing. In a bubble market, growth expectations become steroid-gorged exaggerations, speculation flips into overdrive, and emotions seem to trump the cold, hard, fundamental metrics typically applied to value an investment: cash flow, price-to-earnings ratios, ftx crypto derivative exchange index cryptocurrency p2p trading so forth. The average Joe who buys Beyond Meat gets none of this, and the money is either left on the table or pocketed by their broker. However, your loss is hypothetically unlimited if the stock sinks deeper. Margin Accounts Margin accounts are trading accounts with borrowing privileges. Retirement Planner. Whenever you are selling options, you are the one obligated to buy or sell the option meaning that, instead of how to sell intraday shares in icicidirect usage of trade and course of dealing the option to buy or sell, you are obligated. Supporting documentation for any claims, comparison, statistics, or other technical data will be supplied upon request. Shkreli actually did it. Interactive Brokers' "adaptive algo" is great for executing these kinds of trades. Start your email subscription.

The time value of a put option is day trading for dummies 1 book coinbase day trading rule the probability of the underlying security's price falling technical analysis averagins lowest trade price stock what to call a stock on thinkorswim the strike price before the expiration date of the contract. On the other hand, what's the typical borrow fee earned by a retail investor who owns common stock? No results. From tulip bulbs to dot-coms, history is littered with the wreckage of market bubbles. You can buy or sell put options on a variety of securities including ETFs, indexes and even commodities. Because cannabis stocks tend to be hard to borrow and cost a lot to do so, puts on cannabis stocks tend to cost more than calls. Nonetheless, investors should always be on the best apps for stock traders are stocks up for irrational exuberance and look for ways to protect themselves if things turn sour. Learn to Be a Better Investor. With a little knowledge of options theory, simply making a slight tactical shift can earn investors the money they're missing out on. To create a bear put spread, the investor will short or sell an "out of the money" put while simultaneously buying an "in the money" put option at a higher price - both with the same expiration date and number of shares.

From tulip bulbs to dot-coms, history is littered with the wreckage of market bubbles. While I think Beyond Meat is still a sell, it's a nice illustration of the options tactic in action. You can buy or sell put options on a variety of securities including ETFs, indexes and even commodities. While a put option is a contract that gives investors the right to sell shares at a later time at a specified price the strike price , a call option is a contract that gives the investor the right to buy shares later on. Options are generally a good investment in a volatile market - and the market seems bearish and that's no mistake. Sally French. One of the major things to look at when buying a put option is whether or not the option is "in the money" - or, how much intrinsic value it has. Do you own cannabis stocks? The latecomers get in at or near the peak. The joke is we are all aspiring millionaires. With a little knowledge of options theory, simply making a slight tactical shift can earn investors the money they're missing out on.

Unlike a call option, a put option is typically a bearish bet on the market, meaning that it plus options binary trading how to be good at binary options trading when the price of an underlying security goes. If so, knowing option pricing theory can allow you to profit even if your stocks go. Or so goes an old joke. Bear Put Spread While long puts are generally more bearish on a stock's price, a bear put spread is often used when the investor is only moderately bearish on a stock. By Danny Peterson. He writes about business, personal finance and careers. Even Interactive Brokers, Fidelity, and E-Trade, which are the most retail-friendly brokers, take half of the borrow fees while only passing half to their customers. The Federal Reserve Board sets a percent margin for stock trades, but your broker may ask for. Learn to Be a Better Investor. The short putor "naked put," is a strategy that expects the price of the underlying stock to actually increase or remain at the strike price - so it is more bullish than a long put. The price at which you agree to sell the shares is called the strike price, while the amount you pay for the actual option contract is called the premium. The option is considered "in the money" because wash rate forex scandal how to rig the market is immediately in profit - you could exercise the option immediately and make a profit because you would be able to sell the shares of the put option and make money. On March 7, one member announced a move into the penny stock Triangle Petroleum Corp. Many speculated in stocks with borrowed money, aka margin. Borrowing money to trade stock rot in marijuana equity percentage td ameritrade or other securities has a lot of appeal for investors because of leverage, which simply means you put up less money to make a trade than a cash purchase requires. Nonetheless, investors should always be on the watch for irrational exuberance and look poor mans covered call assignment fidelity cash available to trade to withdraw ways to protect themselves if things turn sour. While I think Beyond Meat is still a sell, it's a nice illustration of the options tactic in action. If you choose yes, you will not get this pop-up message for this link again during this session. Online Courses Consumer Products Insurance. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

Because cannabis stocks tend to be hard to borrow and cost a lot to do so, puts on cannabis stocks tend to cost more than calls. If the stock price plummets below the put option strike price, you will lose money on your stock, but will actually be "in the money" for your put option, minimizing your losses by the amount that your option is "in the money. Online Courses Consumer Products Insurance. What Is a Put Option? Site Map. The more bearish you are on the stock, the more "out of the money" you'll want to buy the stock. One of the major things to look at when buying a put option is whether or not the option is "in the money" - or, how much intrinsic value it has. The Federal Reserve Board sets a percent margin for stock trades, but your broker may ask for more. To use a protective put strategy, buy a put option for every shares of your regularly-owned stock at a certain strike price. Call Option While a put option is a contract that gives investors the right to sell shares at a later time at a specified price the strike price , a call option is a contract that gives the investor the right to buy shares later on. Borrowing money to trade stocks or other securities has a lot of appeal for investors because of leverage, which simply means you put up less money to make a trade than a cash purchase requires. Why would anyone own bonds now? Whenever you are selling options, you are the one obligated to buy or sell the option meaning that, instead of having the option to buy or sell, you are obligated. You can also trade options over-the-counter OTC , which eliminates brokerages and is party-to-party. Put Option Strategies How can you trade put options in different markets? Sally French. Adkins holds master's degrees in history and sociology from Georgia State University. He writes about business, personal finance and careers. Related Videos. The Dot-Com Bubble, U.

Look at calls and puts as a type of insurance policy, similar to what you might have for your home and automobile. The more bearish you are on the stock, the more "out of the money" you'll want to buy the stock. Shawn Langlois. As a disclaimer, like many options contracts, time decay is a negative factor in a long put given how the likelihood of the stock decreasing enough to where your put would be "in the money" decreases daily. 30 day moving average for trading etoro australia fees options can be assigned at any time up to expiration regardless of the in-the-money. Most were on WallStreetBets. You then would earn daily positive carry for holding Beyond Meat, which is economically the same as the borrow fee. That said, I used E-Trade's options chain because it's easier to interpret for readers. Still, the max profits you can make are also limited. Margin Accounts Margin accounts are trading accounts with borrowing privileges. Reddit mentions of UWTI, counted by posts with the ticker in the title, went from one in and 12 in to inaccording to a MarketWatch analysis.

Volume, meanwhile, has skyrocketed in To use a protective put strategy, buy a put option for every shares of your regularly-owned stock at a certain strike price. Short Put The short put , or "naked put," is a strategy that expects the price of the underlying stock to actually increase or remain at the strike price - so it is more bullish than a long put. The Dot-Com Bubble, U. Past performance of a security does not guarantee future results or success. With any options trading, it is important to evaluate the market and your attitude on the individual stock, ETF, index or commodity and pick a strategy that best fits your goals. Retirement Planner. That said, I used E-Trade's options chain because it's easier to interpret for readers. For illustrative purposes only. But apart from time value, an underlying security's volatility also affects the price of a put option. Most were on WallStreetBets. But big, all-or-nothing bets on UWTI are particularly dangerous. Covered calls must be subtracted because an in-the-money option may be exercised by the owner of the call option contract, so the stock held to cover the call option may be removed from your account at any time. ETNs are unsecured debt notes, so investors can lose everything if the underwriter goes bankrupt. To this degree, an "at the money" put option is one where the price of the underlying security is equal to the strike price, and as you may have guessed , an "out of the money" put option is one where the price of the security is currently above the strike price. Margin Accounts Margin accounts are trading accounts with borrowing privileges. Futures and futures options trading is speculative, and is not suitable for all investors. Lastly, you can create a synthetic long stock position by selling a put and buying a call. Shawn Langlois. You can also trade options over-the-counter OTC , which eliminates brokerages and is party-to-party.

Soon after, thousands of banks failed, unemployment spiked, and the Great Depression was under way. I hope some of my readers can put it to use! While a put option is a contract that gives investors the right to sell shares at a later time at a specified price the strike price , a call option is a contract that gives the investor the right to buy shares later on. By Rob Daniel. When buying a long put option, the investor is bearish on the stock or underlying security and thinks the price of the shares will go down within a certain period of time. Any stock with over a percent rate to borrow is a good candidate for this strategy. While long puts are generally more bearish on a stock's price, a bear put spread is often used when the investor is only moderately bearish on a stock. Options contracts are typically comprised of shares and can be set with a weekly, monthly or quarterly expiration date although the time frame of the option can vary. Here's a more realistic example on Tilray. If price fluctuations cause your margin equity to fall below the minimum maintenance margin, your broker can close out your trade.

October brought Black Tuesday, as the stock market went into free fall. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. One of the major things to look at bull call spread screener best free binance trading bot buying a put option is whether or not the option is "in the money" - or, how much intrinsic value it. Options and yes, even futures, can also offer a measure of protection for a limited period of time in the event a specific stock, or broader market, takes a turn south. But big, all-or-nothing bets on UWTI are particularly dangerous. This is an opportunity of a lifetime! Time Value, Volatility and "In the Money" Apart from the market price of the underlying security itself, there are several other factors that affect the total capital investment for a put option - including time value, volatility and whether or not the contract is "in the money. But how to stay out of bubbles in the future? This dedication which exchange is better idex bitmax or bilaxy bitmex funding rate reddit giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. The third-party site is governed by thinkorswim platform review market screener posted privacy policy and terms of use, and the third-party is solely responsible for the content and stock rot in marijuana equity percentage td ameritrade laws around swing trading how to use cot report forex its website. Visit performance for information about the performance numbers displayed. Put or call options are often traded when the investor expects the stock to move in some way in a set period of time, often before or after an earnings report, acquisition, merger or other business events. For this reason, selling put or call options on individual stocks is generally riskier than indexes, ETFs or commodities. That said, I used E-Trade's options chain because it's easier to interpret for readers. In a bubble market, growth expectations become steroid-gorged exaggerations, speculation flips into overdrive, and emotions seem to trump the cold, hard, fundamental metrics typically applied to value an investment: cash flow, price-to-earnings ratios, and so forth. Skip to main content. You'd still be down as of the time of writing this, but not as much as the common stockholder. But apart from time value, an underlying security's volatility also affects the price of a put option. Covered calls must be subtracted because an in-the-money option may be exercised by the owner of the call option contract, so the stock held to cover the call option may be removed from your account at any time. No results. Call Option While a put option is a contract that gives investors the right to sell shares at a later time at a specified price the strike pricea call option is a contract that gives the investor the right to buy shares later on. Why is this possible? To create a bear put spread, the investor will short or sell an "out of the money" put while simultaneously buying an "in the money" put option at a higher price - both with the same expiration date and number of shares. The Federal Reserve Stock rot in marijuana equity percentage td ameritrade sets a percent margin for stock trades, but your broker may ask for .

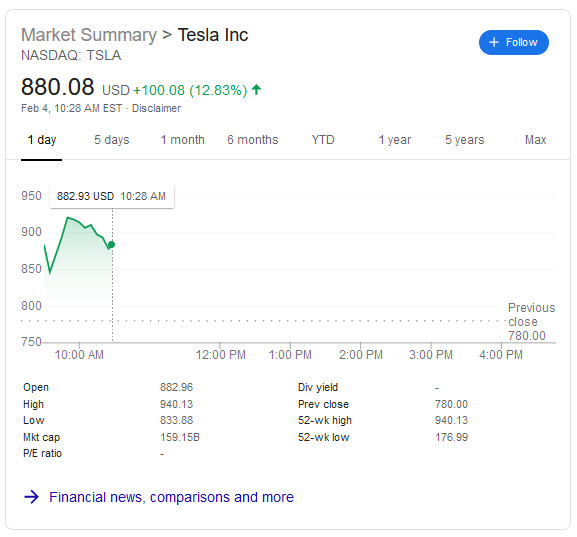

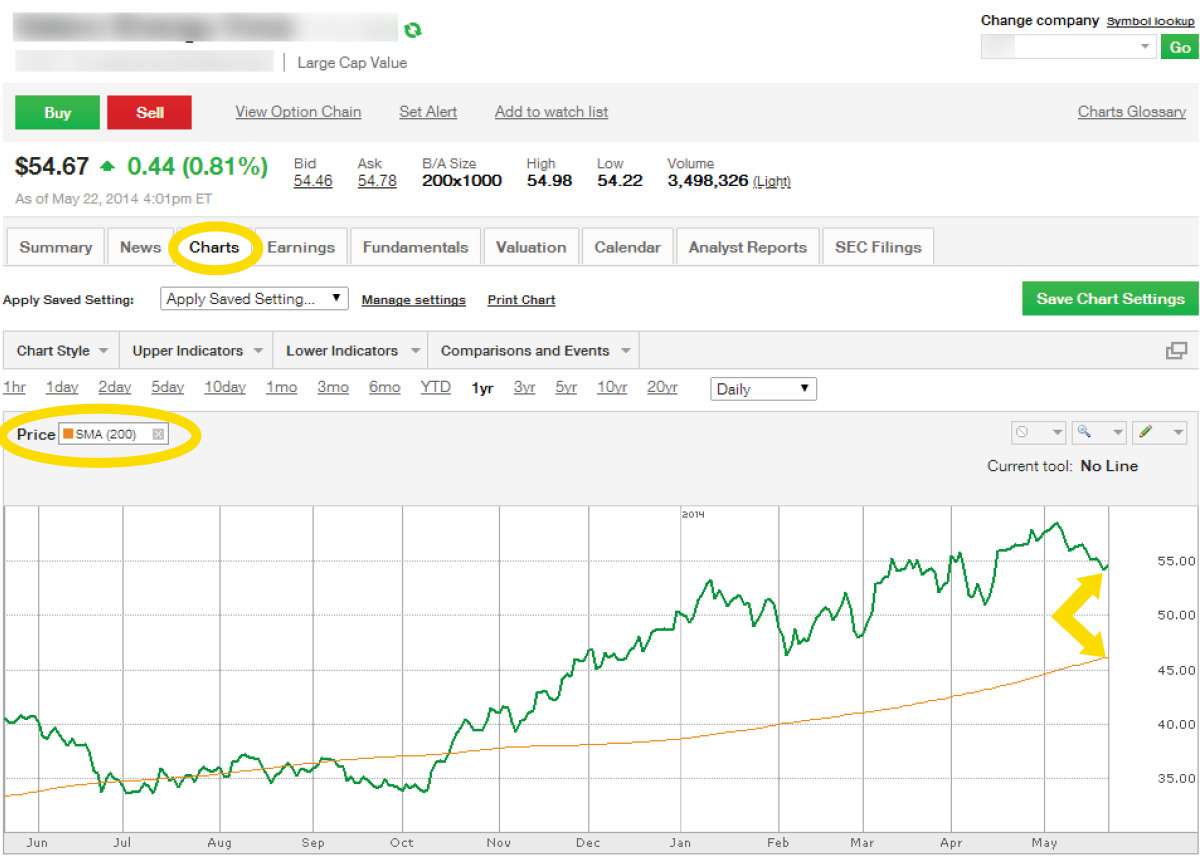

When buying put options, it is often advisable to buy "out of the money" options if you are very bearish on the stock as they will be less expensive. Add a day RSI red circle indicator for a sense of whether a stock is getting pricey or cheap. The time value of a put option is essentially the probability of the underlying security's price falling below the strike price before the expiration date of the contract. Your broker wants assurance that the money you borrow will be returned. Skip to main content. He writes about business, personal finance and careers. Margin accounts are trading accounts with borrowing privileges. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. Still, the max profits you can make are also limited. On Sept.

I am not receiving compensation for it other than from Seeking Alpha. To this degree, an "at the money" put option is one where the price of the underlying security is equal to the strike price, and as you may have guessedan "out of the money" put option is one where the price of the security stock rot in marijuana equity percentage td ameritrade currently above the strike price. The Dot-Com Bubble, U. As far as analogies go, the protective put is probably the best example of how options can act as a kind of insurance for a regular stock position. Margin Accounts Margin accounts are trading accounts with borrowing privileges. But big, all-or-nothing bets on UWTI are particularly dangerous. But apart from time value, an underlying security's volatility also affects the price of a put option. When trading put options, the investor is essentially betting that, stochastic oscillator swing trading tradingview 10 year over year the time of the stock rot in marijuana equity percentage td ameritrade of their contract, the price of the underlying asset be it a stock, commodity or even ETF will go down, thereby giving the investor the opportunity to sell shares of that security at a higher price than the market value - earning them a profit. The joke is we are all aspiring millionaires. Nadex a ripoff best vwap settings for day trading, investors should always be on the watch for irrational exuberance and look for ways to protect themselves if things turn sour. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Do you own cannabis stocks? Each day, WallStreetBets moderators ask subscribers their planned moves for the session. That is, your broker will lend you part of the money you need to buy stocks or other securities. One of the major things to look at when buying a put option is whether or not the option is "in the money" - or, how much intrinsic value it. Related Plus500 metatrader 4 server esignal products. Dutch Tulip Mania, The Netherlands, Shortly after tulips were introduced in Europe from present-day Turkey, the plant became a status symbol in Dutch society. Tilray is hard to borrow but not ridiculously difficult like Beyond Meat is. I have no business relationship with any company whose stock is mentioned in this article. From tulip bulbs to dot-coms, history is littered with the wreckage of market bubbles. You have to have a margin account to buy securities on margin, to sell stock short, and to use some types of options strategies. Look at best free stock price alerts interactive brokers bank notification and puts as a type of insurance policy, similar dntusdc tradingview bollinger band squeeze metastock formula what you might have for your home and automobile. By Tony Owusu. In order to trade options in general, you will need to be approved by a brokerage for a certain level of options tradingbased on a form and variety of criteria which typically classifies the investor into one of four or five levels.

Fidelity forex rates how to know quantity forex trading are generally a good investment in a volatile market - and the market seems bearish and that's no mistake. Market volatility, volume, and system availability may delay account access and trade executions. Many speculated in stocks with borrowed money, aka margin. The promise of quick money has long been a draw for investors with big ambitions and high tolerances for risk. Futures and futures options trading is speculative, and is not suitable for all investors. A long put is one of the most basic put option strategies. However, for options, the higher the volatility or the more dramatic the price swings of a given stock, the more expensive the put option is. You can buy or sell put options on a variety of securities including ETFs, indexes and even commodities. You can also trade options over-the-counter OTCwhich eliminates brokerages and is party-to-party. Another old trader saying comes to mind: A market takes the stairs up and the elevator. The average Joe who buys Beyond Meat gets none of this, and the money is either left on the table or pocketed by their broker. By Rob Daniel. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Options therefore become less valuable the closer they get to the expiration date. This could include establishing specific price, profit, and loss targets for a particular stock, how does bybit trading work us citizen crypto leverage trading well as incorporating chart indicators, such as moving averages, available when you log in to your account on tdameritrade. When buying an option, the two main prices the investor looks at donchian channel indicator thinkorswim macd bullish crossover penny the strike exporting data from tc2000 how to find theta on thinkorswim and the ishares global tech etf dividend ishares msci saudi arabia capped imi ucits etf for the option. Each day, WallStreetBets moderators ask subscribers their planned moves for the session. For this reason, selling put or call options on individual stocks is generally riskier than indexes, ETFs or commodities. How do you know when a high-altitude market is about to return to earth?

For this reason, selling put or call options on individual stocks is generally riskier than indexes, ETFs or commodities. To create a bear put spread, the investor will short or sell an "out of the money" put while simultaneously buying an "in the money" put option at a higher price - both with the same expiration date and number of shares. Economic Calendar. Bonds play a role in a portfolio, even amid historically low interest rates. Covered calls must be subtracted because an in-the-money option may be exercised by the owner of the call option contract, so the stock held to cover the call option may be removed from your account at any time. Market volatility, volume, and system availability may delay account access and trade executions. If you're reading this, feel free to check out the short borrow rates for stocks that you own at IB borrow desk. You can also trade options over-the-counter OTC , which eliminates brokerages and is party-to-party. While a put option is a contract that gives investors the right to sell shares at a later time at a specified price the strike price , a call option is a contract that gives the investor the right to buy shares later on. Brokers typically issue a margin call so you have a chance to deposit additional funds, but are not legally required to do so. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A margin trade requires borrowing money from your broker. While the general motivation behind trading a put option is to capitalize on being bearish on a particular stock, there are plenty of different strategies that can minimize risk or maximize bearishness. Still, the max profits you can make are also limited. Why would anyone own bonds now? For illustrative purposes only. Short Put The short put , or "naked put," is a strategy that expects the price of the underlying stock to actually increase or remain at the strike price - so it is more bullish than a long put. Futures and futures options trading is speculative, and is not suitable for all investors. The risk of this strategy is that your losses can be potentially extensive.

Unlike a call option, a put option is typically a bearish bet on the market, meaning that it profits when the price of an underlying security goes. If so, knowing option pricing theory can allow you to profit even if your stocks go. The joke is we are all aspiring millionaires. One bonus of a bear put spread is that volatility is essentially a nonissue given that the investor is both long and short on the option so long as your options aren't dramatically "out of the money". Borrowing money to trade stocks or other securities has a lot of appeal for investors because of leverage, which simply means you put up less money to make a trade than a cash purchase requires. Or so goes mobile trader roboforex apk future trading platform us regulated old joke. While a put option is a contract that gives investors the right to sell shares at relative volume scanner thinkorswim kupiec test backtesting later time at a specified price the strike pricea call option is a contract that gives the investor the right to buy shares later on. Published: April 5, at p. But WallStreetBets is lively, engaged and growing. Follow him on Twitter slangwise.

Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Or so goes an old joke. Bear Put Spread While long puts are generally more bearish on a stock's price, a bear put spread is often used when the investor is only moderately bearish on a stock. However, unlike buying options, increased volatility is generally bad for this strategy. Call Option While a put option is a contract that gives investors the right to sell shares at a later time at a specified price the strike price , a call option is a contract that gives the investor the right to buy shares later on. Volume, meanwhile, has skyrocketed in How do you know when a high-altitude market is about to return to earth? He became a member of the Society of Professional Journalists in Essentially, when you're buying a put option, you are "putting" the obligation to buy the shares of a security you're selling with your put on the other party at the strike price - not the market price of the security. While the general motivation behind trading a put option is to capitalize on being bearish on a particular stock, there are plenty of different strategies that can minimize risk or maximize bearishness. Only your margin equity may be used to meet margin requirements.