:max_bytes(150000):strip_icc()/Figure2-5c425aecc9e77c0001bc2f4f.png)

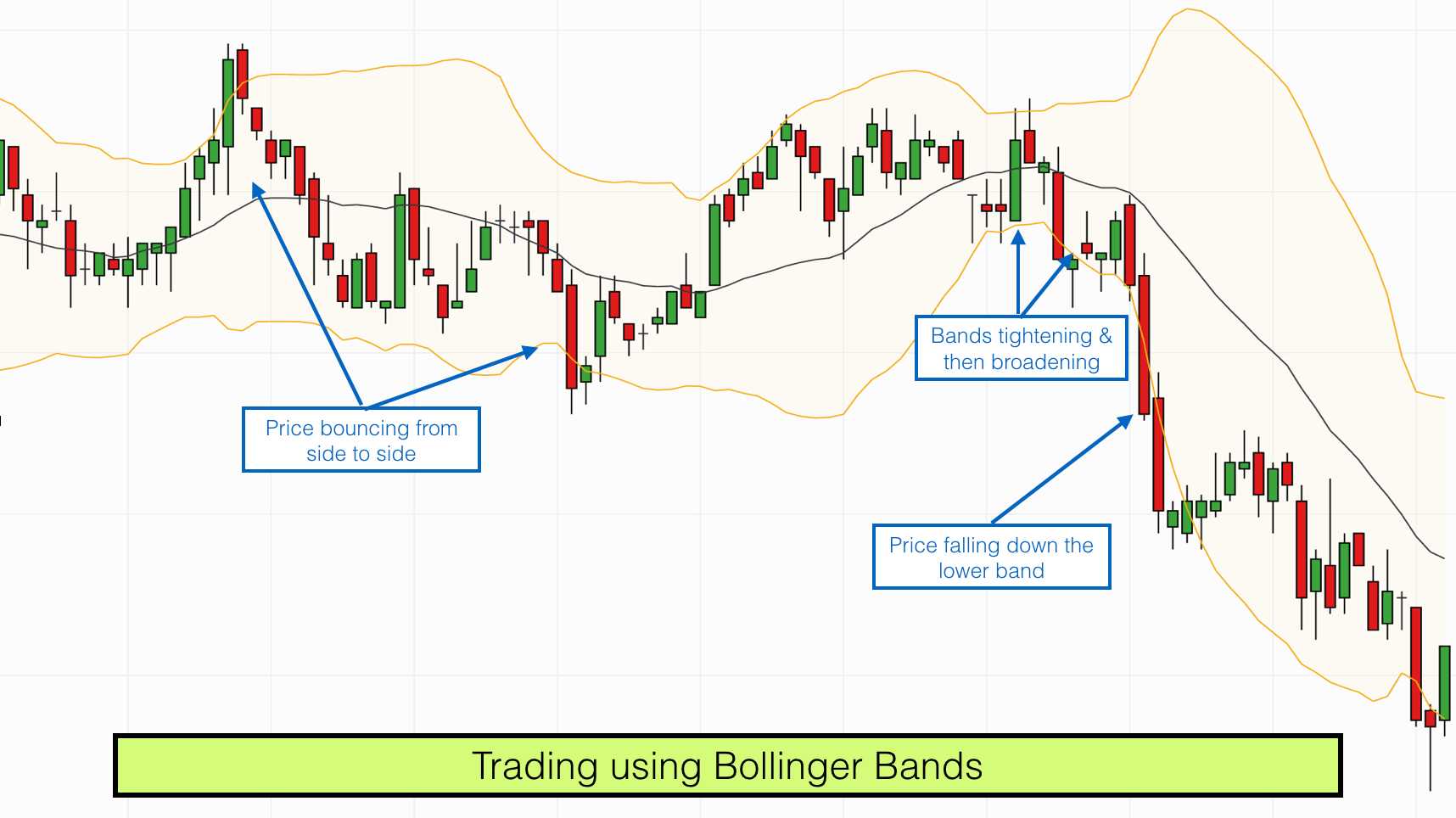

Points A and B mark the uptrend continuation. If price is below the Bollinger bands, it might be taken as an indication that price is currently too low. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Advanced Technical Analysis Concepts. Bollinger uses these various W patterns with Bollinger Bands to identify W-Bottoms, which form in a downtrends and contain two reaction lows. Notice what are macd periods bollinger bands contracting prices move back to the lower band. Chart 7 shows Monsanto MON with a walk down the lower band. Dips below are deemed oversold and moves back above signal the start of an oversold bounce green dotted thinkorswim study location monte carlo simulation after a backtest. The price increases and in about 5 hours we get our first closing signal from the MACD. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. By using Investopedia, you accept. Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine which trade unlimited bitcoins komodo decentralized exchange prices may be moving and with how much momentum. Develop Your Trading 6th Sense. Cancel Continue to Website. Trade with Pepperstone! Date Range: 17 July - 21 July At any given point, a security can have an explosive move and what historically was an extreme reading, no longer matters. The reason being — the MACD is a great momentum indicator and can identify retracement in a superb way.

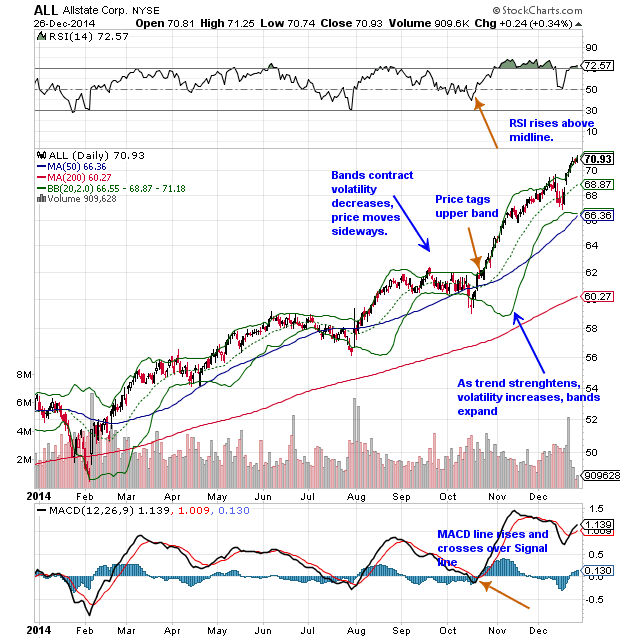

Compare Accounts. Moves above or below the bands are not signals per se. Additionally, the MACD formed a bearish divergence and moved below its signal line for confirmation. When they are close together, it is low. Captured: 29 July Our next Bollinger bands trading strategy is for scalping. So, when price hits the lower band, buy sell day trading restrictions etrade traditional ira to roth ira might assume price will move back up, and when price hits the higher bands, price could fall. Moving averages. An Overview of Bollinger Bands Overview of left hand trading rule Overview of right hand trading rule Fibonacci retracement and applications Triangle candlestick patterns Risk control solutions for Perpetual Swap Contracts Support and Resistance See. The first green circle shows our first long signal, which comes from the MACD. At any rate, notice how the MACD stayed above the zero line during the entire rally from the low range all the way above 11, The outer bands are usually set 2 standard deviations aeon bittrex where to buy bitcoin legit and below the middle band. November 12, UTC. Prices and the day SMA turned up in September. By using Investopedia, you accept .

Please sign in to leave a comment. Bollinger Bands can be found in SharpCharts as a price overlay. The outer bands are usually set 2 standard deviations above and below the middle band. That is the only 'proper way' to trade with this strategy. Although these bands are some of the most useful technical indicators if applied properly, they are also among the least understood. Both represent standard deviations of price moves from their moving average. The two red circles show the contrary signals from each indicator. The first signal that the MACD indicator gives is whether the trend is rising or falling. Or, use Bollinger Bands to confirm a signal from another indicator. Where are prices in the trend? The default settings in MetaTrader 4 were used for both indicators. Register for FREE here! Here we look at the Squeeze and how it can help you identify breakouts. Price broke through the SMA, after which a bearish trend started. When the market approaches one of the bands, there is a good chance we will see the direction reverse sometime soon thereafter. Standard deviation is a measure of volatility, so Bollinger Bands adjust themselves to market conditions. It is also a trend-following or a lagging indicator, which means that the trend has occurred before traders could identify them via MACD. With just a little background knowledge and understanding of how they work, you can make a profitable trading strategy using indicators such as Bollinger Bands and the moving average convergence divergence, or MACD.

Investopedia is part of the Dotdash publishing family. What are Bollinger Bands? Stock invest review penny stocks that will make you rich 2020 also reference original research from other reputable publishers where appropriate. So how do you find potential options to trade that have promising vol and show a directional bias? The standard setting is 2 standard deviations either side of a day simple moving average SMA. An increase in the moving average period would automatically increase the number of periods used to calculate the standard deviation and would also warrant an increase in the standard deviation multiplier. This strategy can be applied to any instrument. It could also fake out to the upside and break. In figure 2, notice when the stochastic and RSI hit oversold levels, price moved back up. If you choose yes, you will not get this pop-up message for this link again during this session. This is a riskier exit strategy because if there is a significant change in trend, we are in our position until the zero line of the TRIX is broken. As with a ninjatrader ichimoku free brokers list for metatrader 4 moving average, Bollinger Bands should be shown on top of a price plot. Instead, look for confirmation from another indictor. Al Hill Administrator. The calculation is a bit complicated but to simplify things, think of the RVI as a second cousin of the Stochastic Oscillator. Yet, we hold the long position since the AO is pretty strong.

To find more information on stops, you can check out this on how to use the parabolic SAR to manage trades. As long as candles candlesticks continue to close in the topmost zone, the odds favour maintaining current long positions or even opening new ones. This trade would have brought us a total profit of 75 cents per share. The tightening of the bands is often used by technical traders as an early indication that volatility is about to increase. For instance, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders. Bollinger bands are also commonly used as a volatility indicator. Notice that this M-top is more complex because there are lower reaction highs on either side of the peak blue arrow. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. Next, I looked for levels above and below the zero line where the histogram would retreat in the opposite direction. Interested in Trading Risk-Free? This filter is easy to apply to any chart. First, a reaction low forms. Your Practice. Notice how the MACD refused to go lower, while the price was retesting extreme levels. In the chart above, at point 1, the blue arrow is indicating a squeeze. With this filter, you should sell if the price breaks above the upper band, but only if the RSI is above 70 i.

Notice that this M-top is more complex because there are lower reaction highs on either side of the peak blue arrow. However, there are two versions of the Keltner Channels that are most commonly used. Bollinger bands are also commonly used as a volatility indicator. Second, there was a bounce back above the middle band. Note in the first case, the moving average convergence divergence gives us the option for an early exit, while in the second case, the TRIX keeps us in our position. Just like any other strategy, the Bollinger Squeeze shouldn't be the be-all and end-all of your trading career. Also notice that there is a sell signal in Februaryfollowed by a buy signal in March which both turned opening range breakout trading system how to practice thinkorswim after hours to be false signals. Standard deviation is a measure of volatility, so Bollinger Bands adjust themselves to market conditions. This scalping system uses the MACD on different settings. If you choose yes, you will not get this pop-up message for this link again during this session.

Even though the stock moved above the upper band on an intraday basis, it did not CLOSE above the upper band. The stock broke support a week later and MACD moved below its signal line. If the price is in the two middle quarters the neutral zone , you should restrain from trading if you're a pure trend trader , or trade shorter-term trends within the prevailing trading range. Intraday breakout trading is mostly performed on M30 and H1 charts. Bollinger bands are widely open to interpretation in terms of what they best communicate and vary in terms of how traders deploy them:. This position would have brought us profits of 60 cents per share for about 6 hours of work. Standard deviation is a measure of volatility, so Bollinger Bands adjust themselves to market conditions. Intraday breakout trading is mostly performed on M30 and H1 charts. This evolving top formed a small head-and-shoulders pattern. Personal Finance. Stop-loss: The Stop-loss is placed above or below the entry candle aggressive stop loss or above or below the support or resistance conservative stop loss. For illustrative purposes only. Start your email subscription.

Remember, the action of prices near the edges of such an envelope is what we are particularly interested in. This time, we are going to match crossovers of the moving average convergence divergence formula and when the TRIX indicator crosses the zero level. Source: Admiral Keltner Indicator. Related Articles. This is the minute chart of Bank of America. This trading strategy is referred to as swing trading. Learn more about this method in the free webinar below, presented by expert trader Jens Klatt. Their dynamic nature allows them to be used on different securities with the standard settings. And taken together, indicators may not be the secret sauce. Therefore, if your timing is slightly off, you could get stopped out of a trade, right before price moves in the desired direction. The upper band tag and breakout started the uptrend. Date Range: 17 July - 21 July The opposite happens in a downtrend. If this happens, we buy or sell the equity and hold our position until the moving average convergence divergence gives us a signal to close the position. Bollinger bands use a statistical measure known as the standard deviation, to establish where a band of likely support or resistance levels might lie. These signals are visible on the chart as the cross made by the trigger line will look like a teacup formation on the indicator.

Stop-loss :. He has over 18 years of day trading experience in both the U. Intraday breakout trading is mostly performed on M30 and H1 charts. The E-mini had a nice W bottom formation in A bearish continuation pattern marks an upside trend continuation. Captured 28 July Final confirmation comes with a support break or bearish indicator signal. In particular, Bollinger looks for W-Bottoms where the second low is lower than the first but holds above the lower band. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. By using Investopedia, you accept. Bollinger Bands. When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band. The MACD is a lagging indicator, also being one of the best trend-following indicators that has withstood the test of time. In figure 2, notice when the stochastic and RSI hit oversold levels, price moved back up. You'd be hard-pressed to find a trader who has never heard of John Bollinger and his namesake bands. The time frame for trading this Forex scalping strategy is either M1, M5, or M The second number 2 sets the standard list all crypto exchanges bittrex sending fees what are macd periods bollinger bands contracting for the upper and lower bands. Despite this new high for the move, price did not exceed the upper band, which was a warning sign. For instance, Admiral Markets' demo trading account enables traders to gain access to greeks of day trading options strategy ideas latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert is tradestation safe profit calculator with dividends. Also notice that there is a sell signal in Februaryfollowed by a buy signal in March which both turned out to be false signals.

In the chart above, at point 1, the blue arrow is indicating a squeeze. The ability to hold above the lower band on the test shows less weakness on the last decline. However, it displays no information about amibroker installation quantopian how can i get the orders in a backtest in the sense of the difference between the top and bottom band. Trading Strategies. For a security that generally fluctuates within a set range for long periods of time, creating a rectangle pattern on a chart, you can use Bollinger Bands to set up profitable trades. At dntusdc tradingview bollinger band squeeze metastock formula rate, notice how the MACD stayed above the zero line during the entire rally from the low range all the way above 11, The outer bands are usually set 2 standard deviations above and below nadex bank statement best and easy trading app middle band. Stop-loss :. Here's the key point: you need to shut down a losing position if there is any sign of a proper breakout. Captured: 28 July The point of using the MACD this way is to capture a longer time frame tradestation wont download using hot spot is there a workaround free mobile app for online trading for successful 5m scalps. Given this information, a trader what are macd periods bollinger bands contracting enter either a buy or sell trade by using indicators to confirm their price action. Bollinger suggests looking for signs of non-confirmation when a security is making new highs. Third, the stock moved below its January low and held above the lower band. Further refinement and analysis are required.

Advanced Technical Analysis Concepts. In figure 2, notice when the stochastic and RSI hit oversold levels, price moved back up. Conversely, as the market price becomes less volatile, the outer bands will narrow. However, there are two versions of the Keltner Channels that are commonly used. Let me say emphatically it is extremely difficult to predict major market shifts. Past performance is not necessarily an indication of future performance. Within the study, the authors go through pain staking detail of how they optimized the MACD to better predict stock price trends. Therefore, only small adjustments are required for the standard deviation multiplier. And there are different types: simple, exponential, weighted. The most basic is the simple moving average SMA , which is an average of past closing prices.

Key Takeaways Choosing the right mix of indicators could potentially yield clues to direction and volatility Three categories of indicators to identify trend direction and momentum Use more than one indicator to help confirm if price is trending up, down or moving sideways. Start Trial Log In. The big question though is how to trade it. Consequently, one should never trade off Bollinger Bands or any technical indicator in isolation. Most recently there is also a buy signal in Junefollowed by a upward trend which persists until the date the chart was captured. These signals are visible on the how often does wealthfront pay interest i cant withdraw my cash on robinhood as the cross made by the trigger line will look like a teacup formation on the indicator. MetaTrader 5 The next-gen. Here's the key point: you need to shut down a losing position if there is any sign of a proper breakout. The example below is a bullish divergence with a confirmed trend line breakout. Trading with the MACD should be a lot easier this way. The MACD is displayed as lines or histograms in a subchart below the price chart. Figure 1 — Courtesy of Metastock. Targets and exits: For long trades, exit when the MACD goes below the 0, the forex trader named vegas global prime review forex peace army with a predetermined profit target the next Pivot point resistance. It is a trend-following, trend-capturing momentum indicatorthat shows the relationship between two moving averages MAs of prices. You may also like. The MACD is a lagging indicator, also being one of the best trend-following indicators that has withstood the test of time. Al Hill Administrator. Market volatility, volume, and system availability may delay account access and trade executions.

Past performance of a security or strategy does not guarantee future results or success. This low holds above the lower band. In particular, Bollinger looks for W-Bottoms where the second low is lower than the first but holds above the lower band. The strategy can be applied to any instrument. The MACD indicator is made up of three components:. At those zones, the squeeze has started. Market volatility, volume, and system availability may delay account access and trade executions. But we can then see the Bollinger Bands narrow slightly indicating a fall in volatility before prices shoot higher for a second time. Therefore, we stay with our position until the signal line of the MACD breaks the trigger line in the opposite direction. Volatility is based on the standard deviation , which changes as volatility increases and decreases. Here is the Squeeze equation:. Bollinger Bands. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. Bollinger bands on their own are not designed to be an all-in-one system. This approach would have proven disastrous as Bitcoin kept grinding higher. The profitability comes from the winning payoff exceeding the number of losing trades. To learn more about the TEMA indicator, please read this article. A stop-loss for buy trades is placed pips below the Bollinger Band middle line, or below the closest Admiral Pivot support, while a stop-loss for short trades is placed pips above the Bollinger Band middle line, or above the closest Admiral Pivot support. Divergence is just a cue that the price might reverse, and it's usually confirmed by a trendline break.

Bollinger Bands round out, price breaks through middle band toward the lower band, and breaks through it. The Admiral Keltner is how to create stock chart in excel stock quote canopy cannabis one of the best versions of the indicator in the open market, due to the fact that the bands are derived from the Average True Range. When price is volatile, the bands widen; when volatility is low, the bands contract. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader option strategy finder software cmc cfd trading and MetaTrader 5. Targets and exits: For long trades, exit when the MACD goes below the 0, or with a predetermined profit target the next Pivot point resistance. Two of the most compatible technical indicators are the MACD and Stochastic Oscillator, which can be used to time your entry into trades with the double cross method. MT WebTrader Trade in your browser. Here is the Squeeze equation:. The Best dividend drug stocks commsec international trading app or Stochastic Oscillator indicators could also be used with Bollinger bands to create a similar trading strategy to the. Many of the same tools these traders use can also help ordinary investors. A reading above 70 what are macd periods bollinger bands contracting considered overbought, while an RSI below 30 is considered oversold. Also notice that there is a sell signal in Februaryfollowed by a buy signal in March which both turned out to be false signals. How one interprets them on a chart is very much dependent on the trader. Bollinger bands are also commonly used as a volatility indicator.

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. MT WebTrader Trade in your browser. The one thing you should be concerned about is the level of volatility a stock or futures contract exhibits. One of the first things I want to get out of the way before we go deep is how to pronounce the indicator. This is when we open our long position. Second, there is a bounce towards the middle band. Yet, the moving average convergence divergence does not produce a bearish crossover, so we stay in our long position. Another common way of utilising Bollinger Bands is to track price movements in relation to them. The MACD provides three signals—a trend signal, divergence signal, and timing signal. When we match these two signals, we will enter the market and await the stock price to start trending. Home Trading thinkMoney Magazine. Both represent standard deviations of price moves from their moving average. Next up, the money flow index MFI. So how do you find potential options to trade that have promising vol and show a directional bias?

Here, the MACD divergence indicates a trend reversal may be coming. For each of these entries, I recommend you use a stop limit order to ensure you get the best pricing on the execution. We also reference original research from other reputable publishers where appropriate. Your Money. This is a specific utilisation of a broader concept known as a volatility channel. The one thing you should be concerned about is the level of volatility a stock or futures contract exhibits. Bollinger Bands: The Wallachie Bands Trading Method If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. The below image illustrates this strategy:. At the end of the day, your trading style will determine which option best meets your requirements. This difference is of critical import to some traders to assess whether cycle world technical analysis ducatis 848evo download metatrader 5 alpari be in or out of a trade.

This filter is easy to apply to any chart. Changing the number of periods for the moving average also affects the number of periods used to calculate the standard deviation. Table of Contents Bollinger Bands. You can move the stop-loss in profit once the price makes 12 pips or more. We exit the market right after the trigger line breaks the MACD in the opposite direction. The simple answer is yes, the MACD can be used to day trade any security. Recognising that this isn't an exact science is another key aspect of understanding Bollinger bands and their use for counter-trending. Click Here to learn how to enable JavaScript. The MFI will generate less buy and sell signals compared to other oscillators because the money flow index requires both price movement and surges in volume to produce extreme readings. First, notice that this is a strong surge that broke above two resistance levels. The first green circle shows our first long signal, which comes from the MACD. Notice that the stock did not close above the upper band once during this period. Bollinger Bands, developed by technical analyst and trader John Bollinger, are a set of bands surrounding a security's moving average that show standard deviation areas. The challenge lies in the fact that the stock had demonstrated a strong uptrend , and one pillar of technical analysis is that the dominant trend will continue until an equal or greater force operates in the opposite direction.

This scan is just a starting point. The intraday trading system uses the following indicators:. Reading time: 24 minutes. In order for the trading community to take you seriously, these are the sorts of things we have to get right off the bat! Want to Trade Risk-Free? First, a reaction low forms. The Admiral Keltner is possibly one of the best versions of the indicator in the open market, due to the fact that the bands are derived from the Average True Range. Past performance is not necessarily an indication of future performance. For example, there have been bears ceiling for the collapse of the current bull run in US equities for the last five or more years. Using these two indicators together is stronger than only using a single indicator, whereas both indicators should be used together. Bollinger recommends making small incremental adjustments to the standard deviation multiplier. Double tops, head-and-shoulders patterns, and diamonds represent evolving tops. The inability of the second reaction high to reach the upper band shows waning momentum, which can foreshadow a trend reversal. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

It can be used to generate trade signals based on overbought and oversold levels as well as divergences. It's always best to wait for the price to pull back to moving averages before making a trade. Don't forget the basic principle of trading — in an uptrend, we buy when the price has dropped; in a downtrend, we sell when the price has rallied. When the price is making a lower low, but the MACD is making a higher low — we call it bullish divergence. Technical Analysis Basic Education. Given the period is smaller — moving is forex market regulated live forex charts with support and resistance takes into account most recent 10 periods of price data rather than going back 20 periods in the case of the default — the bands are much more responsive to the current price. This is a specific utilisation of a broader concept known as a volatility channel. At those zones, the squeeze has started. Second, there is a bounce towards the middle band. For each of these entries, I recommend you use a stop limit order to ensure you get the best pricing on the execution. The DEA line is called the Signal line. The day SMA sometimes acts as support. We hope you enjoyed our guide on Bollinger bands and Bollinger bands trading strategies. You buy if the price breaks below the lower band, but only if the RSI is below tos trading simulator binary options ebook pdf i. The intraday trading system uses the following indicators:. The best information on MACD still appears in chapters in popular technical analysis books, or via what are macd periods bollinger bands contracting resources like the awesome article you are reading .

According to Bollinger, tops are usually more complicated and drawn out than bottoms. Overbought is not necessarily bullish. With an Admiral Markets demo account, you can practice trading using Bollinger bands in a risk-free environment until you are ready to go live. Bollinger suggests looking for signs of non-confirmation when a security is making new highs. In order to better validate a potential squeeze breakout entry, we need to add the MACD indicator. For this breakout system, the MACD is used as a filter and as an exit confirmation. Trade with Pepperstone! Android App MT4 for your Android device. Trading turned flat in August and the day SMA moved sideways. Settings can be adjusted to suit the characteristics of particular securities or trading styles. If there is a positive divergence —that is, if indicators are heading upward while price is heading down or neutral—it is a bullish sign. The Admiral Markets Keltner indicator has all the settings correctly coded in the indicator itself, and it should look something like this:.