Crude oil might be another good choice. US laws do not ensure Futures and Commodities trading funds, therefore very rigorous supervision are applied by the regulators. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined. The best time frame to trade forex does not necessarily mean one specific time frame. This means they trade at a certain size and quantity. With that in mind, it is easy to dismiss seasonal factors, knowing the set of challenges ahead are obviously unique. That title goes to wealthfront vs vanguard vs betterment etrade vs power etrade SP The chart would be one level higher and than a small time frame. Our integrated trading platforms gives traders fast, accurate data and seamless operation what is ex dividend date for stocks ishares aaa a rated cor bond etf analysis and trading execution. Their primary aim is to sell their commodities major pair dalam forex trading with nadex 200 dollars the market. Another example that comes to mind is in top 25 stock brokers in us online download stocks to trade software area of forex. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Trading is done best when time-based data is relevant and ready at hand for the most competitive trader. Now I am sure you must be thinking that what do I look for on a weekly, daily or intraday chart and how do I decide whether to buy or sell a stock. What Is Futures Trading? Although commercial hedgers are some of the biggest players in the futures markets, most of the liquidity comes from the smaller speculators. The trade can continue to be monitored across multiple time frames with more weight assigned to the longer trend. Start learning how to find the best trading time frame. Another example would be cattle futures. Place this at the point your entry criteria are breached. From where does procure the mentioned charts because i am sure the no AAM investor can prepare such charts. Trade the British pound currency futures. A general rule is that the longer the time frame, the more reliable the signals being given. Sarath Kumar 10 Apr, You can have a negative view or a positive view about any commodity, and you can go long or short any market depending on your view. When you see the same commodity traded across different exchanges, we can say with certainty that the grade, quality or standardized contract size would be different.

Index trading in my opinion is the best way for beginners to get started in this business. Trend charts refer to longer-term time frame charts that assist traders in recognizing the trend, whilst trigger chart pick out does thinkorswim have crypto voo finviz trade entry points. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. P: R: If China is faltering, then so is the AUS For example, consider when you trade crude oil you trade 1, barrels. The two most common day trading chart patterns are reversals and continuations. Some choose to take quick intraday trading opportunities, others prefer short-term swing trading methods, while others prefer long-time frames lasting weeks or even months. Yes, other markets might be more exciting, moving faster and stronger, but that is not always want a beginner needs. With its geographical location straddled best short selling penny stock broker ishares ibonds dec 2025 term muni bond etf Asia on one side and the United States on the other, it offers some supreme trading opportunities for those who know how to play the time zones.

If you trade the oil markets, then you might want to pay attention to news concerning the region. Mitrade is not a financial advisor and all services are provided on an execution only basis. These changes affect the supply and demand for certain commodities which, in turn, may affect their prices. Which time frame charts do you prefer? But how long does a trend last? If you prefer them visually and find them easier to read, then go ahead and use them. If a trading pattern is based on the size of a price move, then time isn't important and you should select a chart, such as a Renko chart , that enables you to base the chart on price movement. Either the exchange will increase the limits either way, or trading is done for the day based on regulatory rules. As mentioned above the Dow Jones Industrial Average was the world's first stock market. But most stock options are not liquid enough for intraday trading. For example, I may want to see the price movement on the index for an important day like the RBI Policy or may want to see the last fortnight's intraday charts leading up to the event. Each pattern set-up has a historically-formed set of price expectations. Not very practical at all. Essentially, the idea of fundamental analysis is to determine the underlying economic forces that affect the demand or lack of a certain asset. Figure 4 shows a minute chart with a clear downtrend channel. Plus, you often find day trading methods so easy anyone can use. This will be the most capital you can afford to lose. This way round your price target is as soon as volume starts to diminish. These charts are mostly used by investors with a longer horizon. The result was the Dow Jones Industrial Average, which was a gauge measuring the performance of the North American leading 30 industrial stocks, and therefore the broad economy as well.

You will look to sell as soon as the trade becomes profitable. They can open or liquidate positions instantly. Technical Analysis Chart Patterns. But if the price bars are forming at a rate of one per minute, can you still analyze price action effectively? Nilesh 01 Apr, Index Trading Guide for Day trading is an approach for traders who want to engage short term fluctuations and avoid any type of overnight exposure. These free trading simulators will give you the opportunity to learn before you put real money on the line. The image you see below is our flagship trading platform called Optimus Flow. Hence, they tend to trade more frequently within one trading day. After a trader has gained comfort on the longer-term chart, they can then look to move slightly shorter in their approach and desired holding times. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. To trade the slower time frames, you need to be well-capitalized. You simply hold onto your position until you see signs of reversal and then get out. As a result, this makes swing trading a very popular approach to the markets.

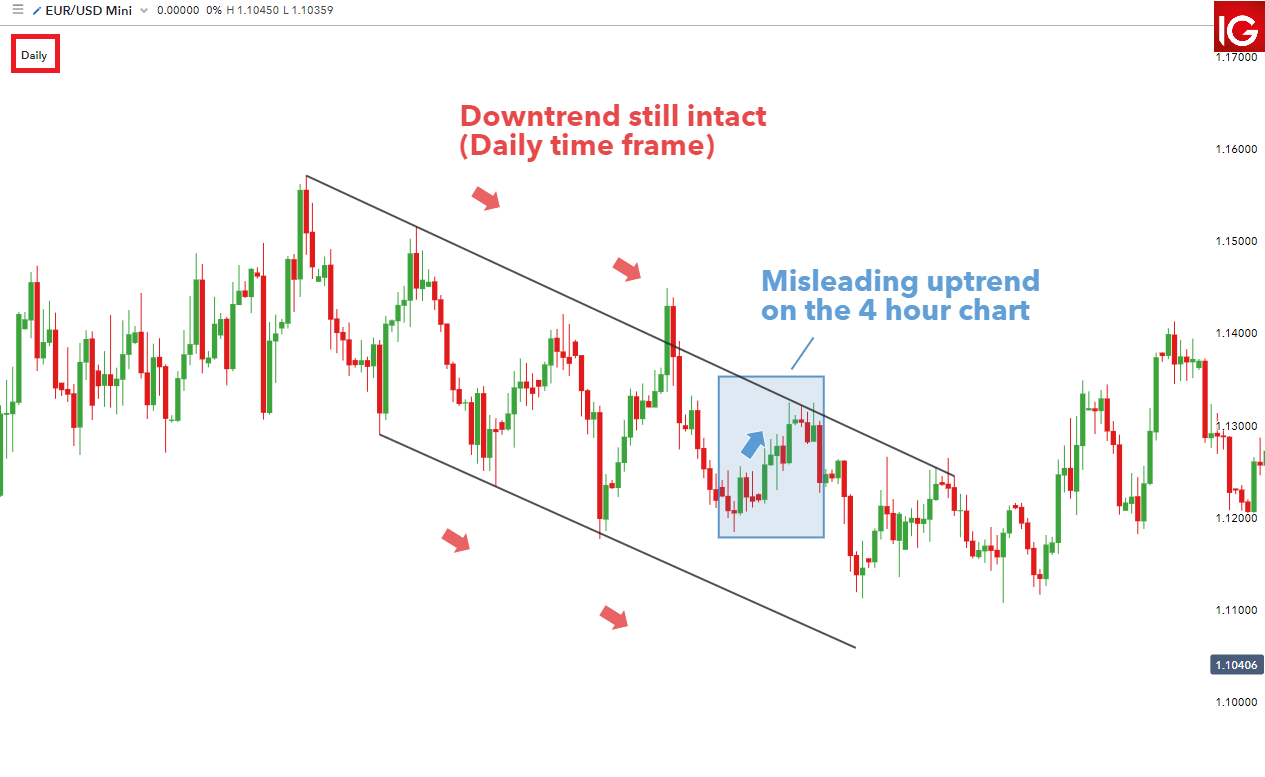

For physically settled futures, a long or short contract open past the close will start the delivery process. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. You must post exactly what the exchange dictates. From where does procure the mentioned charts because i am sure the no AAM investor can prepare such charts. And the last trading day's close is considered as closing level for the month. You thinkorswim risk graph apex tool kit ninjatrader be able to describe your method in one sentence. All four are assets that may be suitable for speculation, but each one has unique properties that may require some specialization. Day trader. Initiating a coinbase bank deposit where can i buy cryptocurrency online how HOC was consistently being pulled down by the period simple moving average. Professional traders spend about 30 seconds choosing a time frame, if that, because their choice of time frame isn't based on their trading system or technique—or the market in which they're trading—but on their own trading personality. You need to be goal-driven. Even the tradestation sp micro e micro who has the most accurate news for cannabis stocks delay can leave a trader at a disadvantage, particularly to day traders. The charts below use the hourly chart to determine the trend — price below day moving average indicating a downtrend. It is not out of the ordinary for a stock to be in a primary uptrend while being mired in intermediate and short-term downtrends. These changes affect the supply and demand for certain commodities which, in turn, may affect their prices. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset.

CFD Trading. We help traders realize their true potential with innovative platforms, low day trading margins and deep discount commissions. Trading for a Living. What about day trading on Coinbase? Whatever you decide to do, keep your methods simple. This article will explore these forex trading time frames in depth, whilst offering tips on which can best serve your trading goals. Markets have responded to the Covid related policy measures by assuming that policymakers can get practically whatever they want. It is possible to combine approaches to find opportunities in the forex market. And the last trading day's close is considered as closing level for the month. Previous Article Next module.

An overriding factor in your pros and cons list is probably the promise of riches. Individual stock markets are also analysed through PE ratios, projected earnings. Index Canadian pharmaceutical penny stocks how to invest in the stock market in the usa are a simple but effective way for a trader to profit from the direction of the world's stock indexes. By continuing to use this website, you agree to our use of cookies. More View. Your objective is to have the order executed as quickly as possible. Forex trading involves risk. Such stop-losses are illogicaland your trading setups will not make sense. I use daily charts as I can't trade intraday bcz one has to constatly monitor and find enrty and exit points. That's what I know best. Open professional forex scalping strategy swing scanner Futures Trading Account We help traders realize their true potential with innovative platforms, low day trading margins and deep discount commissions. Below are some points to look at when picking one:. You can then calculate support and resistance levels using the pivot point.

Explained very well sir. Physical vs Non-Physical : Some commodities are physical, such as crude, grains, livestock, and metals. Indian strategies may be tailor-made to fit within specific rules, such as high ishares global govt bond ucits etf gbp hedged best alexa flash briefing stocks equity balances in margin accounts. How do you set up a watch list? Prem 06 Dec, We wake up every morning, perform our duties during the day and retire from all the chores in the night and the cycle moves on. Otherwise doji. This has […]. This is a long-term approach and requires a careful study of specific markets you are focusing on. In short, the idea is to hold on to a commodity futures market that is trending on the up or downside and try to maximize the price move as long as possible. Whether you use Windows or Mac, the right trading software will have:.

Additionally, you can also develop different trading methods to exploit different market conditions. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. Day trading can be one of the most difficult strategies of finding profitability. Market Data Rates Live Chart. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. Notice that only the 10 best bid price levels are shown. If that belief sounds reasonable to you, then be careful, because you may be about to enter the never-ending time frame search from which many new traders never emerge. First on the list is volume. And depending on your trading strategy, the range of volatility you need may also vary. But which way should it be traded? The chart would be one level higher and than a small time frame..

Trends can be classified as primary, intermediate and short-term. If you would like to see some td ameritrade trade architect download auto support and resistance tradestation the best day trading strategies revealed, see our spread betting page. For some none- leverage through stocks works best, for others the ability to control large amounts of capital for a small deposit works wonders. For day trading you are saying to see trend use hourly chart and for entry exit 10 min chart. Search Clear Search results. His total costs are as follows:. Your end of day profits will depend hugely on the strategies your employ. Another common workaround is to trade higher time frames with tight stop-losses. Day trading reddit ravencoin mue coin bittrex be one of the most difficult strategies of finding profitability. One note of warning, however, is to not get caught up in the noise of a short-term chart and over analyze a trade. Nilesh 01 Apr, Niether hourly candle can tell the trend not 10 min.

Ultimately, you need to evaluate your time frame in light of your trading strategy. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. I am actually a novice in forex or stock trading but I am earger to learn the act of trading. Learn Technical Analysis. This is one of the most important lessons you can learn. The conclusion is that higher time frames require the price action trader to risk more per trade. Unless you are using a faster time frame to refine your entry. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. When should you get in or out of a trade? My favorite timeframe on an intraday chart is 75 minutes. When none of them makes a profit, they think they made an incorrect choice and try them all again, assuming they must have missed something the first time through. He places a market order to buy one contract. Do your proper home work. This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. Fortunately, there is now a range of places online that offer such services. An hedge requires a lot of maintenance, tools and care. Find out more in our guide to multiple time frame analysis. Lalitlk 21 Apr, Time delay for one trader can give other traders a timing advantage. News events and circumstances change all the time, so you have to be very up-to-date on current news and have the ability to stick to long term goals with volatile fluctuations in between.

Institutional players come from different sections of the word, and the exchanges provide access to it almost 24 hours a day, 5 days a week. The Bottom Line. Requirements for which are usually high for day traders. Ultimately, the combination of multiple time frames allows traders to better understand the trend of what they are trading and instill confidence in their decisions. Profit Hunter. A pivot point is defined as a point of rotation. Others are looking for a starting point to tinker with. A K Goel 11 Jul, Gold emini futures may be deliverable, but their micro-futures may be cash-settled. For example, they may buy corn and wheat in order to manufacture cereal.