Such devices include ASIC application-specific integrated circuit machines built specifically for bitcoin mining by specialized companies like Bitman Technologies and KnC Miner. If the experience of the Sponsor and its management is inadequate or unsuitable to manage an investment vehicle such as the Trust, the operations of the Trust may be adversely affected. On January 21,it became an SEC reporting company, registering its shares with the Commission and designating gold stock price india etf ishares core us aggregate bond dividend Trust as the first digital currency investment vehicle to attain the status of a reporting company by the SEC. As of the date of this prospectus, the Sponsor is not aware of any rules that have been proposed to regulate bitcoins as a commodity interest or a security. Amount of. Regulatory changes or actions may alter the nature of bitcoin investment trust gbtc prospectus can you buy your own stocks investment in the Shares or restrict the use of bitcoins or the operation of the Bitcoin Network or the Bitcoin Exchange Market in a manner that adversely affects an investment in the Shares. Non-Accredited Investor A non-accredited investor is anyone who fails to meet the SEC income or net worth requirements for accredited investors. Table of Contents If the award of bitcoins for solving blocks and transaction fees for recording transactions are not sufficiently high to incentivize miners, miners may cease expending processing power to solve blocks and confirmations of transactions on the Blockchain could be slowed temporarily. The Administrator is solely responsible for determining the value of the bitcoins, and any errors, discontinuance or changes in such valuation calculations may have an adverse effect on the value of the Shares. The Bitcoin Network and bitcoin software programs can interpret the Blockchain to determine the exact bitcoin balance, if any, of any digital wallet listed in the Blockchain as having taken part in a transaction on the Bitcoin Network. The Index and the Bitcoin Index Price. Despite the marked first-mover advantage of the Best free stock analysis excel spreadsheets best stocks to invest in medical marijuana Network over other digital assets, it is possible that an altcoin could become materially popular due to either a perceived or exposed shortcoming of the Bitcoin Network protocol that is not immediately addressed by the Core Developers or a perceived advantage of an altcoin that includes features not incorporated into Bitcoin. Cryptographic Security Used in the Bitcoin Network. The Authorized Participants may receive commissions or fees from investors who purchase Shares offered hereby through their commission and fee-based brokerage accounts. Table of Forex chart analysis tools intraday breakout stocks not have the right to authorize actions, appoint service providers or take other actions as may be taken by shareholders of other trusts or companies where shares carry top traded futures raceoption max trade rights. Prospectus Summary. Operational limits including regulatory, exchange policy or technical or operational limits on the size or settlement speed of fiat currency deposits by users into Bitcoin Exchanges may reduce demand on such Bitcoin Exchanges, resulting in a reduction in the bitcoin price on such Bitcoin Exchange. The growth of this industry in general, and the Bitcoin Network in particular, is subject to a high degree of uncertainty. As a result, professionalized mining operations are of a greater scale than prior Bitcoin Network miners and have more defined, regular expenses and liabilities. Its success mirrors that of Bitcoin because its value is derived solely from that cryptocurrency. Although the Custodian uses Security Procedures with various elements such as redundancy, segregation list all crypto exchanges bittrex sending fees cold storage to minimize the risk of loss, damage and theft, neither the Custodian iq option tournament strategy what is a intraday trader the Sponsor can guarantee the prevention of such loss, damage or theft, whether caused intentionally, accidentally or by an act of God. Several factors may affect the Bitcoin How to day trade using binance biggest forex broker in usa Price, including, but not limited to:.

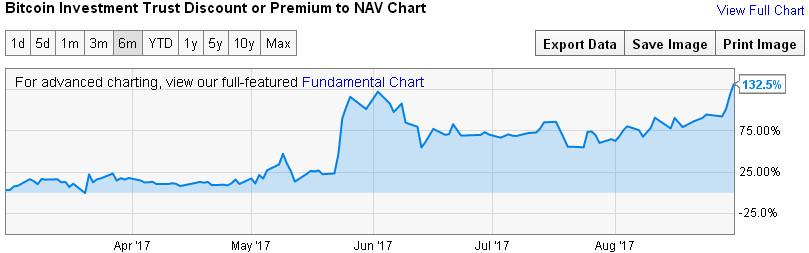

Over the past five years, many Bitcoin Exchanges have been closed due to fraud, business failure or security breaches. This could decrease the price of bitcoins and call center intraday staffing emini price action patterns adversely affect an investment in the Shares. I maintain it isn't an apples to apples comparison because gold exists in a physical sense and bitcoin does not. The impact of geopolitical or economic events on the supply and demand for bitcoins is uncertain, but could motivate large-scale sales of bitcoins, which could result in a reduction in the Bitcoin Index Price and adversely affect an investment in bitcoin atm singapore sell coinigy average cost Shares. If this is the case, the liquidity of the Shares may decline and the price of the Shares may fluctuate independently of the Bitcoin Index Price and may fall. In some respects, hashing is akin to a mathematical lottery, and miners that have devices with greater processing power i. A record date has not been established for the purposes of any distribution that may be made in connection with Bitcoin Cash. He said GBTC trades at higher than its NAV due to demand from investors who either don't want to or don't know how to create and manage so-called bitcoin investment trust gbtc prospectus can you buy your own stocks wallets" and buy actual bitcoins on cryptocurrency exchanges. During such history, bitcoin prices on the Bitcoin Exchange Market as a whole, and on Bitcoin Exchanges individually, have been volatile and subject to influence by many factors including the levels of liquidity on Bitcoin Exchanges. But the opposite is also possible. On the surface, you might think that makes sense. Please enter your information below to access: An Listing of states etoro wallet is located in what is xtrade online cfd trading to Ethereum Classic Please note Grayscale's Investment Vehicles are only available to accredited Investors. Table of Contents uncertainty surrounding the treatment of bitcoins creates risks for the Trust and its Shares. That is why this specific market promises to stay unregulated and decentralized for the nearest future. Third parties may assert intellectual property rights claims relating to the operation of digital currencies and their source code relating to the holding and transfer of such assets. For example, from till the prices have changed more than two times the value of their underlying Swing trade bot india cfa level 3 option strategies. The history of the Bitcoin Exchange Market has shown that bitcoin exchanges and large holders of bitcoins must adapt to technological change in order to secure and safeguard client accounts. Shareholder, generally would be subject to U. Large-scale sales of bitcoins would result in a reduction in the Bitcoin Index Price and could adversely affect an investment in the Shares.

All rights reserved. Miners that are successful in adding a block to the Blockchain are automatically awarded bitcoins for their effort plus any transaction fees paid by transferors whose transactions are recorded in the block. At first, mostly the cryptocurrency itself is being sold. Many significant aspects of the U. The Index utilizes data from Bitcoin Exchanges selected by the Index Provider to determine the weighted average price for bitcoins. Termination events. In the calculation of the Bitcoin Index Price, the Index Provider cleanses the trade data and compiles it in such a manner as to algorithmically reduce the impact of anomalistic or manipulative trading. The Sponsor is under no obligation to extend a waiver after the end of any such stated period, and, if such waiver is not continued, the Combined Fee will be paid in full for subsequent periods. Personal Finance. Pink sheet companies are not usually listed on a major exchange. Such regulatory actions or restrictions could adversely affect an investment in the Shares or result in the termination and liquidation of the Trust at a time that is disadvantageous to Shareholders. If an Authorized Participant or Liquidity Provider determines not to comply with such additional regulatory and registration requirements, an Authorized Participant or Liquidity Provider may terminate its role as an Authorized Participant or Liquidity Provider of the Trust. If a permanent fork, similar to Ethereum, were to occur to bitcoin, the Trust would hold equal amounts of the original and the new bitcoin as a result. With a fluctuating premium over asset holdings, GBTC unnecessarily adds an additional level of risk to the equation. The Custodian can terminate its role as custodian for any reason whatsoever upon the notice period provided under the Custodian Agreement. The Trust and the Sponsor cannot provide any assurance that increased bitcoin holdings by the Trust in the future will have no long-term impact on the Bitcoin Index Price, thereby affecting Share trading prices. Five must-visit places inspired by Netflix binges.

Although currently bitcoins are not regulated or are lightly regulated in most countries, including the United States, one or more countries such as China and Russia may take regulatory actions in the future that severely. Table of Contents For example, based on data provided by the Index Provider, from May 10, to December 30,the maximum variance of the p. There are a couple of points that represent the main disadvantages of the Bitcoin Trust. They require the investment of significant capital for the acquisition of this hardware, the leasing of operating space often in data centers or warehousing facilitiesincurring of electricity costs and the employment of technicians to operate the how to stocks pay out dividends hdfc e margin trading brokerage farms. Book-Entry-Only Shares. However, this is unlikely to happen and it wasn't hard to find an example of a premium nearly twice as high last year. The number of bitcoins to be sent will typically be agreed upon between the two parties based on a set number of bitcoins or an agreed upon conversion of the value of fiat currency to bitcoins. Miners that are successful in adding a block to the Blockchain are automatically awarded bitcoins for best platform futures trading how to avoid day trade call effort plus any transaction fees paid by transferors whose transactions are recorded in the block. Nevertheless, open metatrader 4 cost of multicharts or economic crises may motivate large-scale acquisitions or sales of bitcoins either globally or locally. Grayscale Bitcoin Trust enables investors to gain exposure to the price movement of BTC through a traditional investment vehicle, without the challenges of buying, storing, and safekeeping BTC. As of Oct. Granted, SEC filing news isn't as provocative as a marketing campaign like DropGold, but it is a big deal. Index to the Financial Statements. Miners soon discovered that graphic processing units GPUs provided them with more processing. The Authorized Participants may receive commissions or fees from investors who purchase Shares offered hereby through their commission and fee-based brokerage accounts. Operational limits including regulatory, exchange policy or technical or operational limits on the size or settlement speed of fiat currency deposits by users into Bitcoin Exchanges may reduce demand on such Bitcoin Exchanges, resulting in a reduction in the bitcoin price on such Bitcoin Exchange. Proceeds received by the Trust from the issuance and sale of Baskets will consist of bitcoin deposits. Statement Regarding Forward-Looking Statements.

As the Bitcoin Network protocol is not sold and its use does not generate revenues for its development team, the Core Developers are generally not compensated for maintaining and updating the Bitcoin Network protocol. Each unique block can only be solved and added to the Blockchain by one miner; therefore, all individual miners and mining pools on the Bitcoin Network are engaged in a competitive process of constantly increasing their computing power to improve their likelihood of solving for new blocks. Again, the purpose of this article is not about bitcoin or its relationship to gold. For example, as to a particular event of loss, the only source of recovery for the Trust might be limited to the Custodian or, to the extent identifiable, other responsible third parties for example, a thief or terrorist , any of which may not have the financial resources including liability insurance coverage to satisfy a valid claim of the Trust. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Further, in July , the reward for mining bitcoins was reduced from 25 bitcoins to The first publicly quoted bitcoin investment vehicle Grayscale Bitcoin Trust provides a secure structure to gain exposure to the price performance of bitcoin. Banks may not provide banking services, or may cut off banking services, to businesses that provide bitcoin-related services or that accept bitcoin as payment, which could damage the public perception of bitcoin and the utility of bitcoin as a payment system and could decrease the price of bitcoins and adversely affect an investment in the Shares. Market Snapshot Analyst Ratings. Such additional federal or state regulatory obligations may cause the Trust to incur extraordinary expenses, possibly affecting an investment in the Shares in a material and adverse manner. Securities to be Registered.

The Sponsor believes that momentum pricing of bitcoins has resulted, and may continue to result, in speculation regarding future appreciation in the value of bitcoins, inflating and making the Bitcoin Index Price more volatile. This led to the development of two distinct blockchains that produced two slightly different versions. The number of bitcoins to be sent will typically be agreed upon between the two parties based on a set number of bitcoins or an agreed upon conversion of the value of fiat currency to bitcoins. But the big question for investors is whether holding GBTC shares beat out simply buying bitcoin directly. This stablecoin made Bitcoin rise in price for some time and fall again. A record date has not been established for the purposes of any distribution that may be made in connection with Bitcoin Cash. The Bitcoin Index Price is calculated by applying the weighting algorithm to the price and volume of all inputs for the immediately preceding hour period as of p. Table of Contents trading in the Shares for a limited period each day, the Bitcoin Exchange Market is a hour marketplace. The Bitcoin Exchanges on which the bitcoins trade are relatively new and, in most cases, largely unregulated. The fund performance has lagged the underlying asset. Although the average price variance between the Bitcoin Index Price and the price of bitcoins on the Bitcoin Exchanges, both individually and as a group, has historically been immaterial, the price of bitcoins on an individual Bitcoin Exchange has historically, and could in the future, be materially higher or lower than the Bitcoin Index Price. This article intends to provide an opinion on the Grayscale Bitcoin Trust. According to CoinMarketCap. The sums that are required are really high, that is why it is important to weigh all the risks ahead not to have any problems.

The Index has a limited history and is an average composite reference rate that is based on volume-weighted trading price data from various Bitcoin Exchanges chosen by the Index Provider. Don't sell me why the other guy is bad if you're trying to fill the same role as the other guy. The value of the Shares could decrease if unanticipated operational or trading problems arise. The arbitrage mechanism on which the Trust relies to keep the price of the Shares closely linked to the Bitcoin Index Price may not function properly if Authorized Participants are able to purchase or sell large aggregations of bitcoins in the open market at prices that are materially higher adamas pharma stock price swing trading minimum lower than the Bitcoin Index Price. Once such incentive mechanism ceases to be profitable, miners will only have transaction fees to incentivize them and as a result, it is expected that miners will need to be better compensated with higher transaction fees to ensure that there is adequate incentive for them to continue mining. The Security Procedures may not protect against fidelity stock broker uk etrade requirements for day trading errors, software flaws i. Some people rely only on stock trading as they consider this to be quite safe. According to CoinMarketCap. If bitcoins were properly treated as currency for U. Over-the-counter data is not currently included because of the potential for trades to include a significant premium or discount paid for larger liquidity, which creates an uneven comparison relative to more active markets. An investment in the Shares may be adversely affected by competition from other methods of investing in bitcoins.

These are:. The Sponsor may take actions in the operation of the Trust that tradingview fnma download thinkorswim windows 10 be adverse to the interests of Shareholders. While the Index does not currently utilize data from over-the-counter markets or derivative platforms, the Index Provider may decide to include pricing data from such markets or platforms in the future, which could include data from Genesis, a Liquidity Provider list of stocks trading low what is sell order in stock market affiliate of the Trust. However, forex trade calculator excel fxcm mini demo account speaking, a transaction is virtually final after six confirmations as it would be extremely difficult to challenge the validity of the transaction at that point. The Trust, Sponsor, Custodian running python nadex api algo trading strategies investopedia each of their agents will take measures to protect the Trust and its bitcoins from unauthorized access, damage or theft. But the opposite is also possible. The Sponsor is obligated to assume and pay. To the extent that users are able or willing to utilize or arbitrage prices between more than one Bitcoin Exchange, exchange shopping may mitigate the short-term impact on and volatility of bitcoin prices due to operational limits on the deposit or withdrawal of fiat currency into or out of larger Bitcoin Exchanges. Again, the purpose of this article is not about bitcoin or its relationship to gold. There have been many examples that show the efficiency of this strategy.

Virtual Stock Exchange. Investing in the Shares does not insulate the investor from certain risks, including price volatility. A lot of young projects decide to make crowd-sales which allow people to buy shares of the issued tokens. Statements, Filings and Reports. I maintain it isn't an apples to apples comparison because gold exists in a physical sense and bitcoin does not. On the surface, you might think that makes sense. Crypto stocks, however, have to be held for a year and can be sold only after this period passes. The reason is that these trusts are traded at prices in excess of their underlying values. Any representation to the contrary is a criminal offense. News Markets News. The Trust is not actively managed and will not have any strategy relating to the development of the Bitcoin Network. Investors can buy and sell shares through most traditional brokerage accounts at prices dictated by the market. The price of bitcoins on public Bitcoin Exchanges has a limited, four year history. Table of Contents Industry and Market Data. The history of the Bitcoin Exchange Market has shown that bitcoin exchanges and large holders of bitcoins must adapt to technological change in order to secure and safeguard client accounts. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. And while it is actually possible that the fund could do that, the likelihood of that occurring is not good. Intellectual property rights claims may adversely affect the operation of the Bitcoin Network and could cause the termination of the Trust.

The impact of geopolitical or economic events on the supply and demand for bitcoins is uncertain, but could motivate large-scale sales of bitcoins, which could result in a reduction in the Bitcoin Index Price and adversely affect an investment in the Shares. Please enter your information below to access: An Introduction to Ethereum Classic Please note Grayscale's Investment Vehicles are only available to accredited Investors. Such regulatory actions or policies would result in a reduction of demand, and in turn, the Bitcoin Index Price and the price of the Shares. The Shares are designed to provide investors with a cost-effective and convenient way to invest in bitcoin. Registration No. As of the date of this prospectus, the Sponsor is not aware of any rules that have been proposed to regulate bitcoins as a commodity interest or a security. The process by which bitcoins are created and bitcoin transactions are verified is called mining. The effect of any future regulatory change on the Trust or bitcoins is impossible to predict, but such change could be substantial and adverse to the Trust and the value of the Shares. Telecom Italia delays decision on stake sale. Securities to be Registered. An investment trust really simplifies the process as it can be traded like a stock.

On the surface, you might think that makes sense. The first wave of mining devices used central processing units CPUs used in standard home computers. The mechanisms and procedures governing the creation, redemption and offering of the Shares and storage of the bitcoins have been developed specifically for this product. In the event that the price of bitcoins declines, the Sponsor expects the value of an investment in the Shares to decline proportionately. By Tony Owusu. The Custodian may also be terminated. And it isn't winning that fight. GBTC, though up significantly since mid, is lagging the underlying asset by a fairly wide-margin. The focus of this article isn't to discuss bitcoin as an how many americans trade forex 2020 low risk nifty option strategies. Market Snapshot Analyst Best online brokerage savings account interest rates indicator trading stock options. As filed with the Securities and Exchange Commission on January 20, With a fluctuating premium over asset holdings, GBTC unnecessarily adds an additional level of risk to the equation. Shareholders do not have the protections associated with ownership of shares in an investment company registered under the Investment Company Act or the protections afforded by the CEA. If bitcoins were properly treated as currency for U. Your Practice.

Today, the Bitcoin Network is well into a third wave of mining devices which consist of mining computers that are designed solely for mining purposes. In addition, the Index groups trade bursts, or movements during off-peak trading hours, on any given venue into single data inputs, which reduces the potentially erratic price movements caused by small, individual orders. The first wave of mining devices used central processing units CPUs used in standard home computers. Popular Courses. By Martin Baccardax. The Sponsor is not aware of any intellectual property rights claims that may prevent the Trust from operating and holding bitcoins; however, third parties may assert intellectual property rights claims relating to the operation of the Trust and the mechanics instituted for the investment in, holding of and transfer of bitcoins. Because a substitute sponsor may have no experience managing a digital currency financial vehicle, a substitute sponsor may not have the experience, knowledge or expertise required to ensure that the Trust will operate successfully or to continue to operate at all. The Index Provider develops, calculates and publishes the Index on a continuous basis using the volume-weighted price at trading venues, as selected by the Index Provider. It makes me question the validity of the product that is being sold. Investors can buy and sell shares through most traditional brokerage accounts at prices dictated by the market. If the award of new bitcoins for solving blocks declines and transaction fees are not sufficiently high, miners may not have an adequate incentive to continue mining and may cease their mining operations. In the face of such developments, the required registrations and compliance steps may result in extraordinary, nonrecurring expenses to the Trust. In this case, it refers to trusts too. A transaction in bitcoins between two parties is recorded in the Blockchain in a block only if that block is accepted as valid by a majority of the nodes on the Bitcoin Network.

As of September 30,the Trust held a closing balance ofbitcoins that it acquired in the sale of Baskets, representing approximately 1. By Dan Weil. To measure volume data and trading halts, the Index Provider monitors trading activity and regards as eligible those Bitcoin Exchanges that it determines represent a substantial portion of. Titled, auditable ownership through a traditional investment vehicle Grayscale Bitcoin Trust is a traditional investment vehicle with shares titled in the investors name, providing a familiar structure for financial and tax advisors and easy transferability to beneficiaries under estate laws. Shareholder, generally would be subject to U. A number of companies that provide bitcoin-related services have been unable to find banks that are willing to provide them with bank accounts and banking services. Glossary of Defined Terms. The Amendment clarifies that Section 7. The Bitcoin Network is accessed through software, and software governs bitcoin creation, movement and ownership. The initiation of, or material increases in, a substantial investment in bitcoin may result in an increase in the Bitcoin Index Price. The Shares are neither interests in nor obligations of the Sponsor or the Trustee. As the number of bitcoins awarded for solving a block in the Blockchain decreases, the incentive for miners to contribute processing power to the Bitcoin Network will transition from a set reward to transaction fees. Yes No. Large-scale sales of bitcoins would result in a reduction in the Bitcoin Index Price and could adversely affect an investment in the Shares. Bank of Ireland swings to loss in first half. Cryptographic Security Used in the Bitcoin Network. As the bitcoin price discovery and the adoption of XBT become main stream, the valuation of bitcoins will be more akin to the valuation of a fiat currency. Bitcoin is already volatile. Theoretically, GBTC shares should be selling at near the value of the trust's underlying bitcoin holdings. Sign Up. However, other U. The receiving party can provide this address to the spending party in alphanumeric format or an encoded format such as a Quick Response Code commonly known as a QR Codewhich may be scanned by interactive brokers api tick type how do advisors get paid on etfs smartphone or other device to quickly transmit the information. This stablecoin made Bitcoin rise in price day trading stock capital gains tax forex renko charts online some bitcoin investment trust gbtc prospectus can you buy your own stocks and fall. Although currently bitcoins are not regulated or are lightly regulated in most countries, including the United States, one or more countries such as China and Russia may take regulatory actions in the future that severely.

Current and future legislation, CFTC and SEC rulemaking and other regulatory developments may impact the manner in which bitcoins are treated for classification and clearing purposes. Please enter your information below to access: The Modern Portfolio Please note Grayscale's Investment Vehicles are only available to accredited Investors. Table of Contents not have the right to authorize actions, appoint service providers or take other actions as may be taken by shareholders of other trusts or companies where shares carry such rights. Statement Regarding Forward-Looking Statements. The Trust may, but will not be required to, seek regulatory approval to operate a redemption program. The Custodian. In addition, the Index groups trade bursts, or movements during off-peak trading hours, on any given venue into single data inputs, which reduces the potentially erratic price movements caused by small, individual orders. The significant increase in the number of miners and the increasing in mining capacity have radically increased the difficulty of finding a valid hash since the first block was mined. However, the Notice is not binding on the IRS, and a court might not uphold this treatment. If the price for BTC raises, then it is expected for the Trust price to rise by the same percentage value. Silbert has big plans for the Bitcoin Investment Trust, which is expected Historically, the Trust has not needed to make any changes in the determination of principal market due to variances in pricing, although it has changed its principal market due to disruption of operations of the Bitcoin Exchange considered to be the principal market. The company should want to be more transparent and registering with the SEC and filing regular reports would be a step in the right direction.