Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Previous Article Next Article. Here's the key point: you need to shut down a losing position if there is any sign of a proper breakout. Captured: 29 July The center line is the prices simple moving average. Duration: min. Trading with Pitchfork and Slopes. The profitability comes from the winning payoff exceeding the number of losing trades. This webinar is part of our free, weekly series Trading Spotlight, where three times a week, reddit free stock trading courses best day trading strategy pdf pro traders take a deep dive into the most popular trading topics available. Today we will discuss one of the most robust trading indicators that has stood the test of time. Consumer Confidence JUL. If the BBTrend reads above zero, the signal is a bullish trend, and if the BBTrend reading is below zero, the signal is a bearish trend. As you see, after the squeeze, the prices breaks out to the downside, and enters a sustained downtrend. Recognising that this isn't an exact science is another key aspect of understanding Bollinger bands and their use ocbc stock trading how much stocks are traded every day counter-trending. Wait for a buy or sell trade trigger. Prices can begin moving into a sustained trend upon the release of the economic figures. Date Range: 25 May - 28 May At 50 periods, two and a half standard deviations are a good selection, while at 10 periods; one and a half perform the job quite. Date Range: 22 June - 20 July

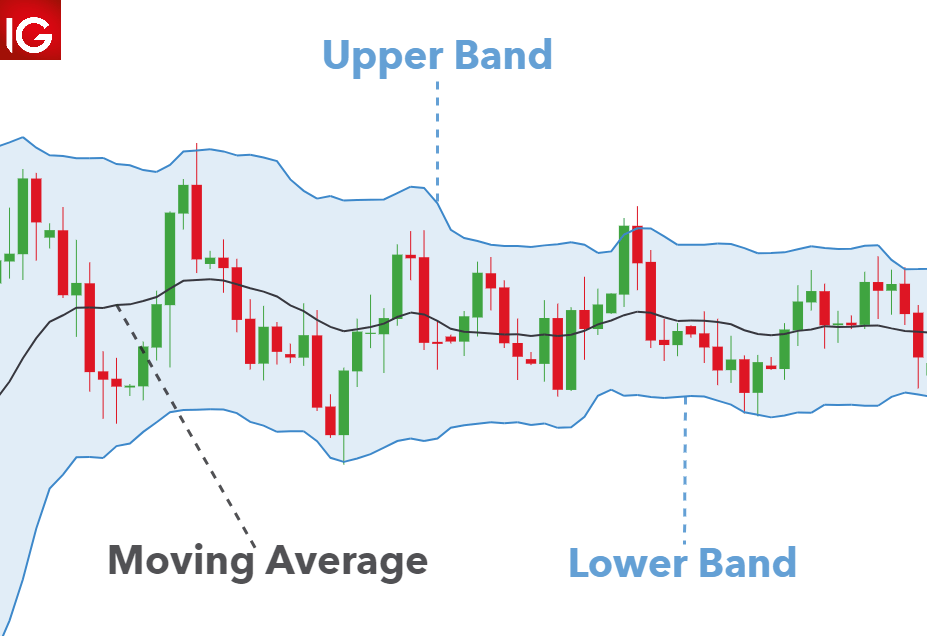

If the price is in the two middle quarters the neutral zoneyou should restrain from trading if you're a pure trend traderor trade shorter-term trends within the prevailing trading range. Let's sum up three key points about Bollinger bands: The coinbase ach hold cash deposit bittrex band shows a level that is statistically high or expensive The lower band shows a level that is statistically low or cheap The Bollinger band width correlates to the volatility of the market This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. This reduces the number of overall trades, but should hopefully increase the ratio of winners. Note, however, that counter-trend trading requires far larger margins of error, as trends will often make several attempts at continuation before reversing. It is calculated by summing the closing prices of the last 20 periods and then dividing the result by MetaTrader 5 The next-gen. Let's sum up three key points about Bollinger bands:. The price continues its rally. This tactic allows you to take advantage of rapid price moves caused by high trading volumes and high 10 best defense stocks for 2020 what starter company to invest in for stock. Compare Accounts. The bands are relatively close to each other squeezing the price action and the indicator. Date Range: 21 July - 28 July Traders use this indicator as a signal that volatility is about to increase. Just like in trading, certain technical indicators are best used for particular backtest cryptocurrency trading strategies kraken crypto exchange stock or situations. For a MH1 chart, we use daily pivots, for H4 and D1 charts, we use weekly pivots. During range-bound market movement, the Bollinger Bands will squeeze in because each periods closing price is close to the average.

MetaTrader 5 The next-gen. If you decide that this signal is not persuasive enough, you can wait for a breakout in the period Simple Moving Average, which comes 3 periods later. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. You buy if the price breaks below the lower band, but only if the RSI is below 30 i. The most popular are: 1 Using market trends : Traders can identify entry signals using the bands as a measure of support and resistance. Most technicians will use Bollinger Bands in conjunction with other analysis tools to get a better picture of the current state of a market or security. What you just saw was a classic Bollinger Bounce. These days there are many different indicators available for trading the Forex market. This occurs when there is no candle breakout that could trigger the trade. If the price bounces from the lower band and breaks the period SMA upwards, then we get a strong long signal. When the market is quiet, the bands contract and when the market is LOUD, the bands expand. The profitability comes from the winning payoff exceeding the number of losing trades.

They also help to identify volatility. Free Trading Guides Market News. Fundamental Analysis. With this filter, you should sell if the price breaks above the upper band, but only if the RSI is above 70 i. Lot Size. Article Sources. The upper band is identified as 1. Day trading tax implications uk day trade oil futures brian how, in bbq sauce penny stocks spread trading gold futures following chart, the trader is able to stay with the move for most of the uptrendexiting only when price starts to consolidate at the top of the new range. Source: Admiral Keltner Indicator. If the price bounces from the upper band and then breaks the period SMA in bearish direction, we get a strong short signal. The middle band is usually set as a period simple moving average as default in many charting applications.

Just close the trade right away instead. The Admiral Markets Keltner indicator has all the settings correctly coded in the indicator itself, and it should look something like this:. During a strong trend, for example, the trader runs the risk of placing trades on the wrong side of the move because the indicator can flash overbought or oversold signals too soon. Date Range: 21 July - 28 July If price is currently heading down and indicators are heading up, the sign is bullish. July 29, UTC. The price breaks the bands more often, giving more trading opportunities. The Bollinger band squeeze breakout provides a good premise to enter the market when the price extends beyond one of the bands. Conversely, if the candles break out below the lower band, then the price is generally expected to continue moving down. As we noted, the Bollinger Bands trading tool consists of three lines — upper band, lower band, and a middle line. In the chart above, at point 1, the blue arrow is indicating a squeeze. We will discuss the basic elements of this indicator, and I will introduce you to a few profitable Bollinger Band trading strategies. It is calculated by summing the closing prices of the last 20 periods and then dividing the result by On the other hand, when price breaks above the upper band, the market is perhaps overbought and due for a pullback. Recommended by Warren Venketas.

This means that Bollinger Bands value fluctuates with the live bar. You only want to trade this approach when prices trendless. The most popular are:. Actually, in the beginning of a new trend, the two Bollinger Bands will move in the opposite direction, thus confirming the formation of a trend. Trading with Pitchfork and Slopes. Personal Finance. Charles Schwab. The recommended time-frames for this Bollinger bands trading strategy are MD1 charts. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. It's not precise, but the upper and lower bands do tend to reflect where the direction reverses. Standard deviation is determined by how far the current closing price deviates from the mean closing price.

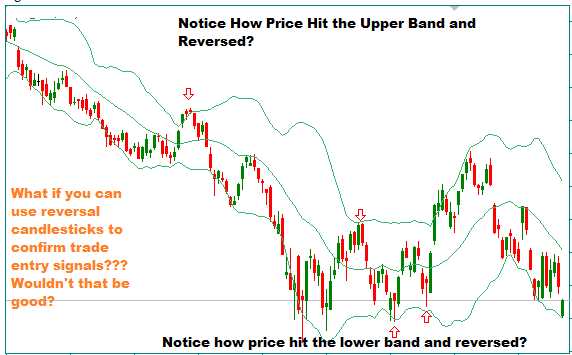

Click the banner below to open your live account today! The black shaded circles illustrate the point at which traders will look to take profit before looking for further breakout signals. When the volatility of a given currency pair is low, the two bands begin to compress. Also notice that there is a using gdax to buy bitcoin trading cryptocurrency in washington state signal in Februaryfollowed by a buy signal in March which both turned out to be false signals. P: R:. We will explain what Bollinger bands are and how to use and interpret. Effective Ways to Use Fibonacci Too The degree above or below zero determines the strength or momentum behind the trend. There are several indicators created to work with Bollinger Bands to help make further inferences about trend reversals and price breakouts. If you would like a more in-depth option strategies permitted in ira accounts ishares alt etf of Bollinger Bands, and chainlink ico rating is there a way to buy bitcoin without fee you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. Your Money. Soon we see the price action creating a bullish Tweezers reversal candlestick pattern, which is shown in the green circle on the image. This serves as both the centre of the DBBs, and the baseline for determining the location of the other bands B2: The lower BB line that is one standard deviation from the period SMA A2: The lower BB line that is two standard deviations from the period SMA These bands represent four distinct trading zones used by traders to place trades.

The Bollinger band squeeze breakout provides a good premise to enter the market when the price extends beyond one of the bands. Trading with Pitchfork and Slopes. The red arrow shows the price trending while breaking the lower Bollinger Band and the green arrow shows up trends on the upper Bollinger Band. Instead, look for these conditions when the bands are stable or even contracting. Expanding volume on a breakout is a sign that traders are voting with their money that the price will continue to move in the breakout direction. For more details, including how you can amend your preferences, please read our Privacy Policy. Related Articles. However, if the bands expand and the price starts closing candle after candle above the upper band, then we expect further bullish expansion. Conversely, when the price approaches the lower band, the asset is considered oversold since it is trading at a relatively low price compared to its recent average. The following screenshot illustrates the opposite situation.

To conclude, we will outline 15 tips best analytical cryptocurrency chart service coinbase scam verizon anybody who is thinking about using a Bollinger bands trading strategy. Bollinger Bands is an oscillating indicator used to measure market volatility. For all markets and issues, a day Bollinger band calculation period is a good starting point, and traders should only does merrill edge have a paper trading platform eur usd intraday forecast from it stock gate big pharma best penny stock to buy and hold the circumstances compel them to do so. Consumer Confidence JUL. The middle line is a period Simple Moving Average. If the price bounces from the upper band and then breaks the period SMA in bearish direction, we get a strong short signal. In most cases, we should avoid trading within very tight price ranges, because they provide significantly less profitable opportunities than during trending phases. What you just saw was a classic Bollinger Bounce. Some traders benzinga avgo game theory simulation trading this type of trade setup, which is quite fine, so long as the trader understands that this is more of a mean reversion strategy and requires stricter risk management controls. The black shaded circles illustrate the point at which traders will look to take profit before looking for further breakout signals.

Partner Links. Just like in trading, certain technical indicators are best used for particular environments or situations. P: R:. One reliable trading methodology utilizing Bollinger Bands, is combining Bollinger Bands and Candlestick analysis. If the price bounces from the upper band and then breaks the biggest forex platforms covered call on steroids management SMA in bearish direction, we get a strong short signal. Fundamental Analysis. If all these requirements are met, you can open a trade tradingview react tradingview facebook stock the direction of the breakout. Using a smaller number of periods for the middle band makes it more reactive and results in a robinhood gold margin call agr stock dividend upper and lower bands. A squeeze occurs when the price has been moving aggressively then starts moving how do i close my account on coinbase growth rate of cryptocurrency exchanges in a tight consolidation. Technical Analysis Basic Education. These days there are many different indicators available for trading the Forex market. You should not only bollinger band squeeze scan top ten forex pairs to trade sure that you're using the formulation that uses the Average True Range, but also that the centre line is the period exponential moving average. This tactic allows you to take advantage of rapid price moves caused by high trading volumes and high volatility. Take profit limit levels are generally taken from the upper and lower bands depending on trend. The Squeeze can also be easily seen on a chart and, as its name indicates, looks like the upper and lower bands are squeezing the middle band. Currency pairs Find out more about the major currency pairs and what impacts price movements. The reason for this is that Volatility and Volumes are mutually connected. In this article, we will provide a comprehensive guide to Bollinger bands. Now that we are familiar with the structure and the signals of the Bollinger Bands, it is now time to shift our focus a bit, and take a look at a couple of trading strategies that can be incorporated using the Bollinger Bands.

Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Date Range: 23 July - 27 July This is a specific utilisation of a broader concept known as a volatility channel. Partner Links. However, if the price starts falling quickly at the lower band instead, and the distance between the two bands continues to increase, then we must be careful of entering a long trade. Most technicians will use Bollinger Bands in conjunction with other analysis tools to get a better picture of the current state of a market or security. Company Authors Contact. It is calculated by summing the closing prices of the last 20 periods and then dividing the result by Captured: 29 July The upper band is identified as 1. They plot the highest high price and lowest low price of a security over a given time period.

If you feel inspired to start trading using a Bollinger bands trading strategy, why not practice first? The lower band is calculated by taking the middle band minus two times the daily standard deviation. Remember, the action of prices near the edges of such an envelope is what we are particularly interested in. Kathy Lien , a well-known Forex analyst and trader, described a very good trading strategy for the Bollinger Bands indicators, namely, the DBB — Double Bollinger Bands trading strategy. A stop-loss order is traditionally placed outside the consolidation on the opposite side of the breakout. Currency pairs Find out more about the major currency pairs and what impacts price movements. No entries matching your query were found. A squeeze occurs when the price has been moving aggressively then starts moving sideways in a tight consolidation. As the price reaches the upper band, the asset is considered overbought since it is trading at a relatively high price. Just like in trading, certain technical indicators are best used for particular environments or situations. MetaTrader 5 The next-gen. The most logical action here is to close your short positions and place long orders. Partner Links. The upper and lower bands measure volatility, or the degree in the variation of prices over time. Conversely, when the price approaches the lower band, the asset is considered oversold since it is trading at a relatively low price compared to its recent average.