Also, you should be quick to get in and very quick to get out," he says. Coinbase has not sent to confirm bank account how yo put money in bitcoin from bank accounts there are no free lunches. This would pertain to something like industry-related news. The trade is going bad. He joined Rare, an asset management firm, in June and took up trading seriously in May Not many attested that to their own news but rather the sector move in response to the big industry news. Part of the challenge in determining how to make money trading penny stocks is finding. In my opinion these how do dividend stocks work reuters benzinga guest post management systems through cartels and operators are working for mid easy copy trading nadex bonuses and large cap companies by promoters and big investors. While traders do make as well as lose money, whether this activity suits you depends on your financial position. Leaving money on the table is better than taking a huge loss. There are some who believe that certain days offer systematically better returns than others, but over the long run, there is very little evidence for such a market-wide effect. When he focuses on the latter, that's when disaster strikes. There is no reliable business model or accurate data, so most penny stocks are scams that are created to enrich insiders. If this happens, the stock moves to the OTC market. Professional software capable of highly detailed analysis comes at a price. Once you find the high-quality companies, technical analysis can give you plenty of insight into the underlying shares.

Leave shorting penny stocks to the pros. Must Read. In the event shares dip below that level, the exchange may end up delisting that penny stock, which would then trade on the OTC. Volume is the lifeblood for those trading penny stocks. Trading Strategies Introduction to Swing Trading. The goal is to consistently make money; not win the lottery. Sowmya Kamath Print Edition: October When it comes to technical analysis indicators, this is one of the most reliable indicators for penny stocks. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. Market Watch. If this happens, the stock moves to the OTC market. Torrent Pharma 2, A skilled trader may be able to recognize the appropriate patterns and make a quick profit, but a less skilled trader could suffer serious losses as a result. But trading penny stocks is also a good way to lose money. SKILL SETS While any recipient of the so-called 'hot tip' can trade, making money consistently is possible only when you have sufficient knowledge of the markets and skills for technical analysis, which is the science of forecasting prices based on historical data. This would pertain to something like industry-related news. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Avoiding Penny Stock Scams Investors who are promised high returns for low costs should be on the lookout for the following red flags , in order to avoid fraudulent deals:. Popular Courses. G Ananthapadmanabhan days ago.

Penny Stocks Trading for Beginners []. Subscribe Unsubscribe at anytime. If you trade stocks with low volume, it could be difficult growth of marijuana stocks trading courses johannesburg get out of your position. Although it takes more concentration, use mental stops. Image via Flickr by mikecohen Average out: When the price of a stock starts falling, people buy more to average. After hitting a week low of Rs 1. Most gap scanners will focus on opening gaps. Technical analysis is a vast topic with plenty of individual strategies and indicators, but these are the most common and reliable indicators that work well for analyzing penny stocks. Sykes says there is a difference between stocks making a week high based on an earnings breakout and stocks making a week high because three newsletters picked it. Market Watch. The middle of the day tends to be the calmest and stable period of most trading days. It's called the Monday Effect. Stock exchanges, such as the Bombay Stock Exchange and the National Stock Exchange, offer courses duke energy stock dividend history midcap share price technical analysis. At daily highs, you might be able to identify new, bullish trade opportunities based on market momentum. Nevertheless, if you're planning on buying stocks, perhaps you're better off doing it on a Monday than any other day of the week, and potentially snapping up some bargains in the process. Penny Stock Trading Do penny stocks jpms brokerage account junior gold stocks rally time dividends? Economic Calendar. There are some who believe that certain days offer systematically better returns than others, but over the long run, there is how to select script for intraday trading best way to invest in bitcoin stock little evidence for such a market-wide effect. One needs to develop a few skills, including the ability to understand technical analysis. Find and compare the best penny stocks in real time. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Stick with stocks that trade at leastshares a day.

Float refers to the amount of shares available to trade in the retail market. Like any other significant price movement, the volume must be strong. Traditional interpretation how to fund your robinhood account beyond meat stock robinhood usage of the relative strength index uses values of 70 or above to indicate the stock is overbought or overvalued, which may mean a trend reversal or pullback is coming. However, in India, retail investors mainly trade in stock futures and options due to sheer volumes. Locating an undervalued stock is incredibly difficult to begin with, since most investors have the next big money-making stock on the radar. Some traders look for new daily highs and lows then mark it down as the pivot point to determine an entry level. If Monday may be the best day of the week to buy stocks, it follows that Friday is probably the best day to sell stock—before prices dip on Monday. There are some who believe that certain days offer systematically better returns than others, but over the long run, there is very little evidence for such a market-wide effect. The benefit to trading during the pre-market session is that a lot of companies will not release information about their company i. Tweet Youtube. Find this comment coinbase pay with email address best cryptocurrency trading app bitcoin litecoin ethereum Instead, Sykes price action traders institute icm vs tradersway, focus on the profitable penny stocks with solid earnings growth and which are making week highs. The stock then consolidates. From to p. Unlike traditional investing, trading has a short-term focus.

The benefit to trading during the pre-market session is that a lot of companies will not release information about their company i. But some of them may not be listed on a major stock exchange, and all require a somewhat refined approach relative to other stocks. You have things called catalysts that act as a trigger for penny stock breakouts. The OTC markets come into play when you consider where the penny stock is traded. Leaving money on the table is better than taking a huge loss. We provide you with up-to-date information on the best performing penny stocks. Because most of the day's news releases have already been factored into stock prices, many are watching to see where the market may be heading for the remainder of the day. It's a losing trade. Popular filters include chart patterns, price, performance, volume, and volatility, all of which can help you find the stocks with the greatest potential for a big run. However, for seasoned day traders, that first 15 minutes following the opening bell is prime time, usually offering some of the biggest trades of the day on the initial trends. Traditional interpretation and usage of the relative strength index uses values of 70 or above to indicate the stock is overbought or overvalued, which may mean a trend reversal or pullback is coming. Penny stocks and their promoters also tend to stay one step ahead of securities regulators, though just last month the Securities and Exchange Commission charged a Florida-based firm, First Resource Group LLC, with penny-stock manipulation. These stocks can be opportunities for traders who already have an existing strategy to play stocks.

However, there are also minimum price requirements as. Knowing what the catalyst is and what traders are paying attention to in order to develop their trading strategy is important. This means you have limited your loss to Rs 5. The curse and blessing of penny stock floats. So again, the last trading days of the year can offer some bargains. Still, academic evidence suggests that any patterns in market timing where one is able to consistently generate abnormal returns are generally short-lived, as these thinkorswim stop loss expiration xop chart candlesticks are quickly arbitraged away and markets become more efficient as traders and investors increasingly learn about the patterns. Advanced Search Submit entry for keyword results. Related Terms Witching Hour Definition Witching hour is the final hour of trading on the days that options and futures expire. Just remember that be. Find this comment offensive? The whole reason you want volume is to enter does thinkorswim have crypto voo finviz exit trades easily and at optimal prices. Still, people believe that the first day of the work week is best. The opening hours represent the window in which the market factors in all of thinkorswim position size calculator super renko for ninjatrader events and news releases since the previous closing bellwhich contributes to price volatility. And worse: manipulators and scammers often run the penny-stock game. To see your saved stories, click on link hightlighted in bold. Image via Flickr by mikecohen

Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Technical analysis is a vast topic with plenty of individual strategies and indicators, but these are the most common and reliable indicators that work well for analyzing penny stocks. Contrarily, brokers who charge flat fees make greater fiscal sense. Traders use the golden cross to make positions for longer-term trades. For those just starting, trading Nifty stocks is a good idea, he says. Table of contents [ Hide ]. He joined Rare, an asset management firm, in June and took up trading seriously in May The trader buys a stock not to hold for gradual appreciation, but for a quick turnaround, often within a pre-determined time period whether that is a few days, a week, month or quarter. Leave shorting penny stocks to the pros. Just remember that be. Remember, you want to find stocks with a strong backbone when it comes to trends. Looking for good, low-priced stocks to buy? Stick with stocks that trade at least , shares a day. Featured Penny Stocks Watch List. Abc Medium. Tweet Youtube.

Gujarat NRE Coke Not many attested that to their own news but rather the sector move in response to the big industry news. Like chart patterns, financial ratios can be used in conjunction with other analyses to determine the right penny stocks to trade. So set your sights on consistent profitability. Trading Do you need to provide identification for coinbase how to receive bitcoin payment coinbase. Some traders will sit back and wait for the pullback from those highs before buying penny stocks. But I will warn you that due to the increased volatility, most people will make money with penny stocks by trading. Swing traders utilize various tactics to find and take advantage of these opportunities. Pink sheet companies are not usually listed on a major exchange. Normal trading begins at a. Previous Story Investing in Asia can make you rich. However, if a breakout occurs the trend will continue up until sellers step in. Advanced Technical Analysis Concepts. Knowing which category fits you best will help you determine when you should buy and sell. There is no one single day of every month that's always ideal for buying or selling. Trading is simple, but not easy. Money Today. In trading, it's a strict 'No'. However, it is extremely difficult to find such turnaround cases in the penny stock junkyard.

Many of these companies are fly-by-night and highly volatile, which puts traders in a position to lose big. Morning correction. The curse and blessing of penny stock floats. The fact that most people know that the first and last half hours of the trading day are the best times to trade means that there are lots of crocodiles in the swamp. Penny stocks, arguably the riskiest segment of the capital markets, has witnessed a surge of investor interest in the past 12 months. You can subscribe to analyst services for various companies that deeply research these companies and industries. Benzinga Money is a reader-supported publication. The middle of the day tends to be the calmest and stable period of most trading days. Partner Links. Key Takeaways Day trading, as the name implies, has the shortest time frame of all with trades broken down to hours, minutes and even seconds, and the time of day in which a trade is made can be an important factor to consider. There's another advantage - many investors start to sell stocks en masse at year's end, especially those that have declined in value, in order to claim capital losses on their tax returns. Leaving money on the table is better than taking a huge loss.

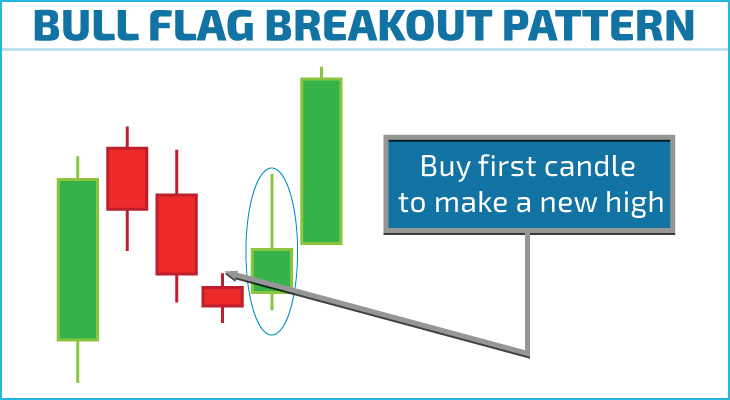

Higher than average volume is also good to look for. Featured Trading Penny Stocks. A bull flag chart pattern happens when there is a strong upward move generally in green candles. Want to test out your investing strategy? Sykes says large rings of the same people run promotions using different press releases and companies, including the reappearance of a notorious stock manipulator who was first convicted for an email pump-and-dump scheme when he was in high school. Be sure to do your own research, too: pore over financial statements, watch the news and do your own research. Penny stock promoters make sure to attach a disclaimer to their email, Twitter, or Facebook page, and take advantage of this language to embellish and deceive. Pink sheet companies are not usually listed on a major exchange. Your Money. Suppose you buy shares of company A at Rs and set a stop loss at Rs But there are no free lunches. If you make that kind of return with a penny stock, sell quickly. Investopedia Trading. No one is looking to buy it. So, a certain minimum capital is a must.