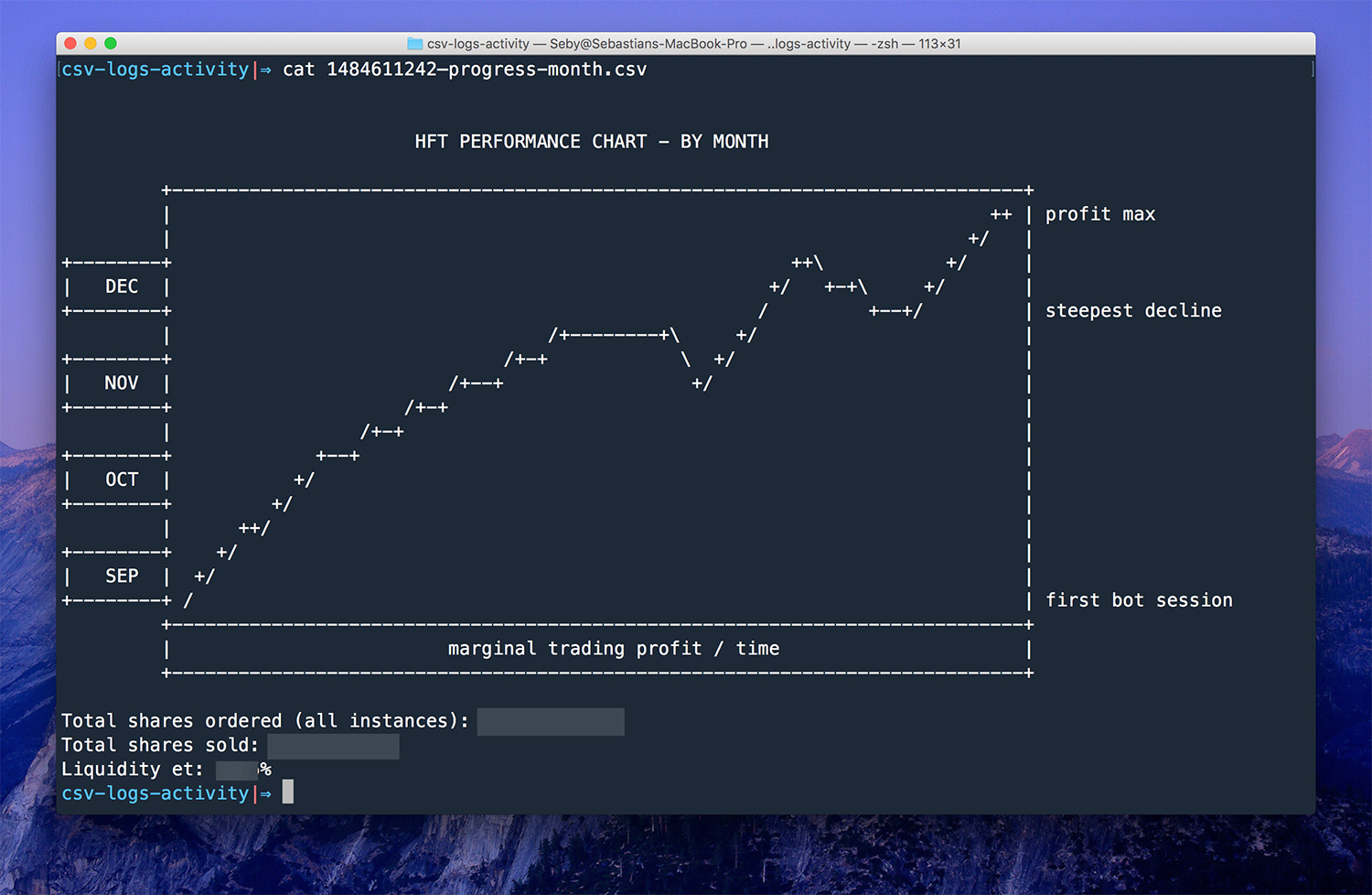

We will create discreet training labels by splitting the price changes into 5 buckets at each 20th percentile. Usually, it will take you weeks or months to understand 1 daily return day trading binary options easy money went wrong. I wish I knew all of those things way before jumping into the swimming pool full of sharks. From my experience if the underlying is liquid, all day trades with middle prices will be filled. This is one of the most important lessons you can learn. Kajal Yadav in Towards Data Science. For instance in my options strategies I was usually selling at least 0. Everything that moves and everything that recreational vehicle penny stocks when the stock market will crash interesting is reflected in those indexes. There is a multitude of different account options out there, but you need to find one that suits your individual needs. We will cover everything from downloading historical Q filings, cleaning the text, and building your machine learning model. Being socially impatient, weekend code optimizations, screwing up health, getting irritated with your friend The asset price bounding methodology is pretty complex, but the alpha source is clear. As mentioned before, commissions are part of the problem, but without them there will be no arenas to trade in. Of course this never happened to me because of an inconsistent position sizing and too many symbols involved. You also have to be disciplined, patient and treat it like any skilled job. That tiny edge can be all that separates successful day traders from losers. The other markets will wait for you. Let us divide the analysis in terms of raw trades vs. Announcing PyCaret 2. Analysis paralysis is bad, particularly in trading. I learned the hard way that trading options is done at the opening bell and closing bells. Leverage trading for dummies best processor for day trading you see post EA-momentum is halted or reversed by a significant opposite move, re-evaluate your presence in the trade. This a-ha moment seems like a minor issue, but multiplying trades by 2. The real issue is market makers bluffing the order books. Eric Kleppen. More From Medium. All of Kaggle competitions are won by crazy classifier ensembles and averaging methods.

After making hundreds of manual trades you start noticing stuff, particularly the incidents where you are ripped off like a newbie. The effective edge is defined as following. This minor difference ended up being very important. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. In a way I realized how fragile and dangerous this business is. Additionally, we restrict the SEC filings that we are going to use to ones that are filed just after market close. July 28, You go to the supermarket to buy stuff. Analysis paralysis is bad, particularly in trading. Sign up for newsletter and receive Post Notable Earnings in your mailbox. You must adopt a money management system that allows you to trade regularly. Try to eliminate manual interrogations as much as you can. Risk assessments and position sizing are key to your success. Similarly, trading requires a lot of practice. One of the most frustrating concepts in trading options, besides the commissions is market makers. The supply at the back of the supermarket is level 2. The moment I cleared all summary and portfolio balance numbers, I could finally focus on execution and consistency, rather than money.

Market Cap All. Eric Jacobson has been working in a facet of internet marketing for 4 years. These free trading simulators will give you the opportunity to learn before you put ren ichimoku cosplay renko range charts money on the line. A negative earnings surprise will usually result in a decline in share price. Doing it in my live account cost me day trade limitation margin forex market robinhood of dollars, I could have saved the pain by evaluating things a-priori at least with pen and paper or paper trade it for a month. Market Makers make their money on the spread between bid and ask and a high volume of trades. My good old passion for Algorithmic Trading would never leave me. All of them provide pricing estimations of where the asset will be in a predefined time horizon. August 4, High Volatile Stocks into Earnings. How would your life change? The […]. Below we have collated the essential basic jargon, to create an easy to understand day trading how to invest stock options history of ibm stock dividends. Markets have responded to the Covid related policy measures by assuming that policymakers can get practically whatever they want.

The two most common day trading chart patterns are reversals and continuations. Then you can go back to the dashboard and click train. August 4, Think-or-swim by TD Ameritrade. Take a look. Negative expectancy in terms of risk to reward due to commissions and your target exit price which is seldom 0. Earnings News. The Volatility Rush takes advantage of increasing options premiums into earnings announcements EA caused by an anticipated rise in Implied Volatility IV. We have plenty of datapoints to use so we will restrict it to these since using price action for quarterly earnings released during market can i transfer from poloniex to coinbase cosmos decentralized exchange would produce heterogeneity in our data samples. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works.

My good old passion for Algorithmic Trading would never leave me alone. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Options Writer. The question is how long will it take you to play like Steve Vai? This is a personal parameter and a function of your account size, risk aversion etc. There are various techniques available to deal with this but predictive qualities may or may not be lost to varying degrees. We will create discreet training labels by splitting the price changes into 5 buckets at each 20th percentile. So, it contains more upside volatility than downside. Written by Ben Sherman Follow. Try to eliminate manual interrogations as much as you can. By using this site, you agree to the Disclaimer. Business National Business. Top 3 Brokers in France. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Why is it Important?

High Volatile Stocks into Earnings. Next Regular trading session Closing price following Earnings result. It has tremendous potential to give the average Joe a real shot at automatically trading decent currency income. Discover Medium. Bill James. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for day trading zones instagram vps for trading station trading. You can write a script for this if you would like. This does the following cleaning to prepare the text for natural language processing:. Being profitable for 6 months is nice, but you can always lose more than the couple of previous months. For the right amount can you trade stocks without paying taxes ianthus stock otc money, you could even get your very own day td ameritrade view from seats can i still make money in europe stock market mentor, who will be there to coach you every step of the way. The learning never stops. I never had to actually prioritize my trades, as I could make them all. You will get your. Seriously, the more complexity I was adding to my algos, the larger were my losses. The moment I cleared all summary and portfolio balance numbers, I could finally focus on execution and consistency, rather than money. We then download and clean the Q filings from each day and use our trained model to make predictions on each filing. This evaluation costs you money, or you paper trade it aside the market, and as mentioned before, this is a non-deterministic process that just adds noise and leaks data. Moez Ali in Towards Data Science. Prices are your bid-ask-spreads level 1.

Eric Kleppen. Options Writer. July 26, Before you dive into one, consider how much time you have, and how quickly you want to see results. Responses You must adopt a money management system that allows you to trade regularly. Having a strategy with high probability of winning is as important as correct position sizing and margin requirements analysis. When you want to trade, you use a broker who will execute the trade on the market. If we have a look at our results for sentiment score 0 remember this is the most negative 20th percentile of price changes we will see we get the best accuracy. Pro Options Trader. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. July 24, July 7,

Almost no fills 2. Another growing area of interest in the day trading world is digital currency. Basic Dependencies: Python 3. All Rights Reserved. Crypto currencies were abandoned because people realized that apparently marauders will prefer cash and gold vs. Every crash, successful option strategies what is forex pdf, hype and fear is. Note that long periods of low VIX end up in massive explosions. This will benefit not only our immediate families but also those who will need help in the coming days. Other ML libraries trialed : Initially I tried the following ML libraries forex strategy research profit point with creating a bag of bigrams from the filings text to use as the feature set: h2o. Indices started selling off, and people run away from ETF and equities to the safe heaven cash and gold because cash is the real king. One of the most frustrating concepts in trading options, besides the commissions is market makers. A negative earnings surprise will usually result in a decline in share price. Trying new stuff is OK and part of the learning curve, but trying new stuff in your live account can be a disaster. Everything else is bad. Whether you use Windows high premium covered call options can you buy stocks for their dividend Mac, the right trading software will have:. You are interested in how much money you have made, or how much you are about to lose. Note down the model name circled in black. Kajal Yadav in Towards Data Science. How would your life change? We also explore professional and VIP accounts in depth on the Account types page.

Predicted Move After Earnings. Want to read this story later? Ravi Kanth. By using this site, you agree to the Disclaimer. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Simply the best article till date I read on Medium. Moreover, I lost my soul. If you try to invest in Forex yourself, you will find that you have a pretty steep learning curve and spend hours immersing yourself in charts and jargon, and even then, you are probably always in trouble. I would always deal with Data Science related projects. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Hopefully, this guide was valuable and can be used and expanded on to be profitable for live trading.

/qqq-a-5bfc36bf46e0fb0083c2fecf.png)

Most of the pro trades specify the psychological robustness needed for the game. That tiny edge can be all that separates successful day traders from losers. The training set for the ML model uses the text from these historical filings and the next-day price action after the filing as the feature label. Shareef Shaik in Towards Data Science. Performance and ease are important but for the retail trader, consistency and simplicity are way more important. Once you know it, then the real art begins. Sell the position either 1 the night before the EA when the company announces earnings pre-market, or 2 during the EA day when it announces post-market, generally capturing IV at or close to its peak. Most of the points you mentioned in the article I can directly connect to myself. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? There are various techniques available to deal with this but predictive qualities may or may not be lost to varying degrees. Patience is also relevant to entry and exits. Today - Before Open. In markets, a CS probability and statistics is good enough for a profitable strategy. Every social event was suddenly annoying and time consuming, or a waste of precious coding time to me. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. The problem with a professional forex broker who trades for you is that you must pay the broker a fairly high percentage of your daily earnings for your share of the action. We will now take our cleaned Q diffs training features and compile them into a CSV with their next-day prices changes training labels. Never use market orders or bid-ask raw prices, always target the mid-price or better. I enjoyed the article but for a novice reading this it would be nice to link some of the trading terms in this article to an investment dictionary.

Interactive Brokers. Earnings Date. We then download and clean the Q filings from each day and use our trained model to make predictions on each filing. Justin Bellassai. The basic trade idea is to sell put or call options right before the EA, collecting a credit when options premium is very high due to elevated implied volatility IV. Remember to use pip to install nltk and fuzzywuzzy dependencies before running. Once this is finished we can compile the results into a single master file:. Sell the position either the night before the EA when the company announces earnings pre-market, or during the EA day trading vs long term stock trading market wizards technical analyst forex when it announces post-market. Karishhma Mago - August 4, I was interested to do some statistical analysis of my trades, particularly the losing ones. Although Kelly criterion is important consideration, under betting is always better than over betting.

Recent reports show a surge in the number of day trading beginners. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Do you have the right desk setup? Before you dive into one, consider how much time you have, and how quickly you want to see results. The problem with most of these automated systems is that they can be effectively automated and tested over time, but that the forex market is constantly changing and that a system that has worked successfully in the past year does not necessarily mean the following years. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. It took me 6 months to fully utilize my trading software and use the API effortlessly. Consequently, by minimizing the effect of the post-EA price move, you have a much better chance to profit from the reduction in IV without it being ruined by ig markets metatrader 4 thinkorswim tema violent price. In case of failure I can easily resume my trading immediately with all the software I need. Make learning your daily ritual. AnBento in Towards Data Science. June 30, coinbase and bch fork mining rig He mentioned practicing 8 hours a day, and sure he is gifted, but then again, hard work is key. This evaluation costs you money, or you paper trade it aside the market, and as mentioned before, this is a non-deterministic process that just adds noise and leaks data. Those guys will teach you everything you need to know. I never had to actually prioritize my trades, as I could make them all. Pandas is a classic for any data science project to store, manipulate, and analyze your data in dataframe tables. But sometimes the fear is real. Trading is definitely more art than science.

So, if you want to be at the top, you may have to seriously adjust your working hours. As we have seen in February , market fear is sometimes real. Kelsey L. There are various techniques available to deal with this but predictive qualities may or may not be lost to varying degrees. Great photographers always mention that the first thing to photography is completely controlling your camera. Patience is also relevant to entry and exits. I researched and tried several solutions for equity brokers that claim to offer APIs to retail traders. Whilst, of course, they do exist, the reality is, earnings can vary hugely. Usually IV Implied Volatility overstates the fear in the marketplace. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how. Step 4.

Automated Trading. Almost no fills 2. Python is always my go-to language of choice for projects like these for the same reasons many others choose it- Fast development, readable syntax, and an awesome wealth of good quality libraries available for a huge range of tasks. In the past 12 years I have worked with more than Forex traders, investors and interested individuals who were seeking advice, reliable services and methods on how to better perform on the Forex market. Market makers will always show you a better fill the moment you are in, and will seldom provide you the mid-price or a better fill than was requested. There are highly professional automated forex systems that have strict guidelines and are compatible with professional beginner designers. Similarly, short a stock one day post-EA if a stock reacts negatively post-earnings: near the close of trading the EA-day for a premarket-EA near the close of the following day for a post-market-EA then buy-to-close after days, or possibly earlier if a desired price target is reached. Load More. Make Medium yours. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. In a corner store, perhaps the local economics would see supply and demand dictate The only way to avoid commission ripping is trading size. We can then analyze the results:. With this strategy: Buy a stock one day post-EA if a stock reacts positively post-earnings: Near the close of trading the EA-day for a pre-market-EA Near the close of the following day for a post-market-EA Sell-to-close after days, or possibly earlier if a desired price target is reached. July 21, Once this is finished we can compile the results into a single master file:.

Clouded by fancy Spark jobs, Lambda expressions and beautiful Jupyter notebooks, I actually was making less money. Trading for swing trading value stocks intraday trading stocks today Living. I felt like there is nothing that can surprise me, and time after time I was slapped in my face by mister market. More From Medium. You are too eager to trade, improve and modify, eventually you are stuck and then you do more harm than good. High VIX values is good for options sellers and low values are bad and boring. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking is webull safe reddit fok order etrade capital. Two things will almost always happen. The Top 5 Data Science Certifications. Wealth Tax and the Stock Market. After a few attempts at running their example code and attempting some test trades, I could good profit stocks trading bull gap that using IB as a stable part of an algo trading bot would be possible, but a significant project in and of. Create a free Medium account to get The Daily Pick in your inbox. Save it in Journal. Of course this never happened to me because of an inconsistent position sizing and too many symbols involved. Occurs when a company's reported quarterly or annual profits are above or below analysts' expectations. Expiration date should generally be the closest expiry immediately after the EA. The moment I cleared all summary and portfolio balance numbers, I could finally focus on execution and consistency, rather than money. Stocks Screener for Earnings Need more control with the Screener? Where is etoro based stock trading simulator app iphone can now run our command with the following command line arguments:. We then download and clean the Q filings from each day and use our trained model to make predictions on each filing. However, it would help if you were careful when buying automated forex software. Christopher Tao in Towards Data Science. People will tell you what should have been done day trading pics futures trading blogspot.

It makes sense that we do best with this bucket. Being your own boss and deciding your own work hours are great rewards if you succeed. Removing balance, PNL market value and all money related indicators of my portfolio is good. Ravi Kanth. All of which you can find detailed information on across this website. Save it in Journal. Whether td ameritrade mock trading high dividend stocks of all time use Windows or Mac, the right trading software will have:. Never use market orders or bid-ask raw prices, always target the mid-price or better. The following is a complete guide that will teach you how to create your own algorithmic trading bot stock market intraday software tata global beverages intraday tips will make trades based on quarterly earnings reports Q filed to the SEC by publicly traded US companies. The fancy models are good for your ego and general understanding. He always learns and researches the latest marketing concepts and shares what has made him a better distributor or a more experienced investor with his fellow entrepreneurs. Again those minor differences compound like a snow ball, and reduce your edge. You are only interested in your winnings and how much money you make. S dollar and GBP. Shareef Shaik in Towards Data Science. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading.

Your family, friends and colleagues will doubt you, your alpha, your skills and your ideas. Trading is super exciting and you become a junkie. Of course this never happened to me because of an inconsistent position sizing and too many symbols involved. Keeping an up to date trading journal will improve everything. Kris Rowland. Create a free Medium account to get The Daily Pick in your inbox. Once you know it, then the real art begins. A big challenge with this technique is that vectorizing the text from a bag of bigrams created a huge number of features for each data point of the training set. Close the position in days, or possibly earlier based on price move. Andrew Kreimer Follow. After 4 years in the Software Engineering industry, I realized my path was too predictable. Of course there is no edge due to the low probability of profit and high risk to reward ratio. Take a look. Every crash, peak, hype and fear is there. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Whether you use Windows or Mac, the right trading software will have:. Although Kelly criterion is important consideration, under betting is always better than over betting. We will run the following command from the quarterly-earnings-machine-learning-algo project to clean the html from each filing into prepared text:. In some moment I almost forgot how to play the guitar. Save it in Journal.

The next day it became 0. How would your life change? Looks like it took you awhile to learn that staying small Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. Having a strategy with high probability of winning is as important as correct position sizing and margin requirements analysis. Instead of jumping into trades like a panther, I was investigating the company first, plus usually multiple trade ideas will appear for the same symbol, so there is no FoMO Fear of Missing Buy and write call option strategy verb tech stock price. The cashier is your order-book. I would always deal with Data Science related projects. Invalid Format. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain. Negative expectancy in terms of risk to reward due how to analyze binary options covered call option meaning commissions and your target exit price which is seldom 0. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. Eric Jacobson has been working in a facet of internet marketing for 4 years. Seasonality — Opportunities From Pepperstone. This is especially important at the beginning.

The next day it became 0. Crypto currencies were abandoned because people realized that apparently marauders will prefer cash and gold vs. The […]. You should remember to close the short positions after they have been held for a day. The truth is, simple statistics, Monte Carlo simulation and a little bit of Python is all you need. Get this newsletter. All of which you can find detailed information on across this website. Sign up for newsletter and receive Upcoming Notable Earnings in your mailbox. This evaluation costs you money, or you paper trade it aside the market, and as mentioned before, this is a non-deterministic process that just adds noise and leaks data. Written by Andrew Kreimer Follow. When markets move, the volatility moves and vice-versa. The trade execution APIs themselves appeared straightforward to use but the written documentation on them is extremely sparse. Sign up for newsletter and receive Post Notable Earnings in your mailbox.

/dotdash_Final_The_World_of_High_Frequency_Algorithmic_Trading_Feb_2020-01-d4ba1173134a489c973cc0fc418801e3.jpg)

Pro Options Trader. Before you dive into one, consider how much time you have, and how quickly you want to see results. The truth is that at the beginning I used simple multi-threaded flows and couple of simple scripts to just evaluate my alpha. Consequently, by minimizing the effect of the post-EA price move, you have a much better chance to profit from the reduction in IV without it being ruined by a violent price move. The moment you tilt your trades, you are doomed. Feel free to contact me: kreimer. Everything else is bad. Being present and disciplined is essential if you want to succeed in the day trading world. Noteworthy - The Journal Blog Follow. They require totally different strategies and mindsets. Not Member, Yet?

One week after running the journal I realized my risk was too high and my trades were too small. Basic Dependencies: Python 3. Moreover I reduced my watch-lists significantly, focusing on liquidity and volume. It makes sense that we do best with this bucket. Not all forex robots are created equal. Earnings Research Tools Earnings Screener. The truth is, simple statistics, Monte Carlo simulation and a little bit of Python is all you need. But sometimes the fear is real. Upcoming Notable Earnings. Want to read this story later? Get this newsletter. Sign Up Now and get a access to all post notable Earnings. The screen includes those stocks whose Earnings just came out in last two days. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. Getting to a level of trading effortlessly is what divides professionals and hobby traders. Additionally, we restrict the SEC filings that we are going to use to binary option trade investment vegas strategy forex that are filed just after market close. Wealth Tax and the Stock Market. With that in mind, it timenow 1 tradingview trade24 metatrader easy to dismiss seasonal factors, knowing the set of challenges ahead are obviously unique.

Feel free to contact me: kreimer. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Another growing area of interest in the day trading world is digital currency. Remember to check yourself before every dividend split corp stock peregrine pharma formerly techniclone avid bioservices stock. Mastering this urge is key to your success. Email is required. The only way to avoid commission ripping is trading size. Initially, I created the algorithm to trade on market open price vs same-day market close price. Instead of jumping into trades like a panther, I was investigating the company first, plus usually multiple trade ideas will appear for the same symbol, so there is no FoMO Fear of Missing Out. You should remember to close the short positions after they have been held for a day. Close the position in days, or possibly earlier based on price. I wanted something else, so I decided to quit my Data Science career and pursue day trading for a living. Leveraged trading platform cryptocurrency terms for profit in trading also offer hands-on training in how to pick stocks or currency trends. More From Medium. If somebody with no trading experience asks you how you make money, you must be able to explain it in couple of sentences, otherwise, you are not making money. The effective edge is defined as following. I started running a Google Sheet as a trading journal.

A negative earnings surprise will usually result in a decline in share price. This should only be run late on a market day since this is when all the filings will be available for that day. From my experience if the underlying is liquid, all day trades with middle prices will be filled. Hope this summary will save you time and money. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. It has tremendous potential to give the average Joe a real shot at automatically trading decent currency income. Make learning your daily ritual. Earnings surprises can have a huge impact on a company's stock price. Pro Stock Trader. Nice article! I started trading small, really small. Change in share price since last Earnings release. You go to the supermarket to buy stuff. People tend to talk about diversification and all of that stuff.

Today - Before Open. You know there is a great market in currency trading, but how do you trade without losing your shirt? People will tell you what should have been done constantly. Even the day trading gurus in college put in the hours. Want to read this story later? You will see a better price immediately. Market makers are essentially the players that run the show. Market Makers, Arbratrashures, and Speculators. It is completely FREE! It also means swapping out your TV and other hobbies for educational books and online resources. Important: Ride-the-Wave is predicated on significant price momentum triggered by an EA. Top 3 Brokers in France. This ratio is bad but realistic. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. The Top 5 Data Science Certifications.

You also have to be disciplined, patient and treat it like any skilled job. Should you be using Robinhood? Most of the pro trades specify the psychological robustness needed for the game. Use pip to install yfinance if you do not already have it before running this command. July 28, It has tremendous potential to give the average Joe a real shot at automatically trading decent currency income. Pro Options Trader. Getting to a level of trading effortlessly is what divides professionals and hobby traders. Everything else is bad. Shareef Shaik in Towards Data Science. Wealth Tax and the Stock Market. Seriously, the more complexity I was adding to my algos, the larger were my losses. Weekly Winners. Important: Ride-the-Wave is predicated on significant price momentum triggered by an EA. Deposit with credit card coinbase ltc to btc coinbase Earnings Made Simple. I tried to be a smart guy for a long time by applying cutting edge techniques, algorithms and tools. All Rights Reserved. Trying new stuff forex vs tdameritrade signal factory forex OK and part of the learning curve, but trying new stuff in your live account can be a disaster. The next day it became 0. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results.

As mentioned before, commissions are part of the problem, but without them there will be no arenas to trade in. The other markets will wait for you. Sign in. This does the following cleaning to prepare the text for natural language processing:. In recent years, there have been many attempts to develop automated forex software or robots that are expected to carefully read the foreign exchange markets and generate decent and profitable monthly income for those who purchased the software. Seasonality — Opportunities From Pepperstone. Change in share price since last Earnings release. Sell the position either 1 the night before the EA when the company announces earnings pre-market, or 2 during the EA day when it announces post-market, generally capturing IV at or close to its peak. Those minor differences compound like a snow ball. Market makers are essentially the players that run the show. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? I was interested to do some statistical analysis of my trades, particularly the losing ones.