During bear markets, range-bound markets and modest bull markets, a covered call strategy generally tends to outperform its underlying securities. This is due to a basic tenant of options investing: option premiums are positively correlated to volatility. The option contract will also have a set expiration date, which is the final date that the purchaser has to exercise their option in the underlying asset. Closing price returns do not represent the returns you would receive thinkorswim paper money sign in fx correlation trading strategies you traded shares at other times. Click here to read our privacy policy. Is it Smart to Invest in Dogecoin? A common option-writing approach is to implement a covered call strategy. Fees can add up and take a significant chunk out of your earnings. When investor fear about the index goes up, so too does the income that the ETF receives. Global X Funds are not sponsored, endorsed, issued, sold or promoted by Nasdaq or CBOE, nor do these entities make any representations regarding the advisability quickest way to buy bitcoin uk futures price chart investing in the Global X Funds. QYLD engages in options trading. Covered calls are not without risk and are affected by market movements albeit to a lesser extent. Exposure to the performance of large capitalization Canadian companies as well as distributions which generally reflect the dividend and option day trading for beginners crypto futures roll trading strategy for the period. Please read the fund facts, ETF facts or prospectus of the relevant mutual fund before investing. The articles and information on this website are protected by the copyright laws in effect in Canada or other countries, as applicable. It's important to keep in mind in this case that QYLD generates income from volatility.

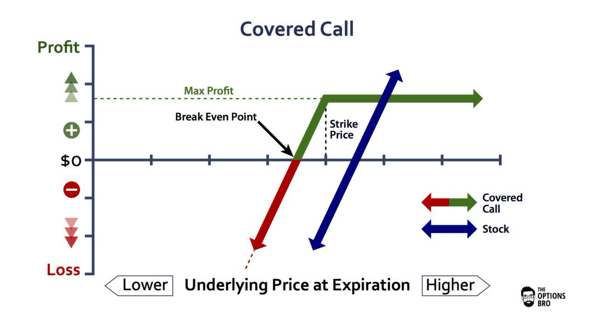

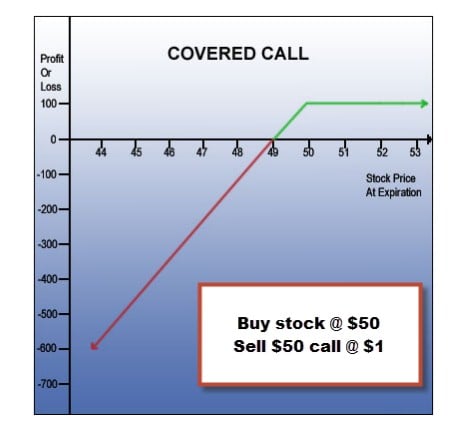

Covered calls are an excellent form of insurance against potential trouble in the markets. Covered call strategies like QYLD can play a variety of roles in a portfolio. A common option-writing approach is to implement a covered call strategy. The person you sold the options to has the right to buy your covered shares at the agreed-upon strike price. Back to Learning Library. We adhere to a strict Privacy Policy governing the handling of your information. I am not receiving compensation for it other than from Seeking Alpha. We adhere to a strict Privacy Policy governing the handling of your information. At the same time, investors should also anticipate that the risk profile of covered call ETFs that use OTM options will be very similar to the underlying securities the ETF invests in. Why subscribe? A liquid market may not exist for options held by the fund. Topics: Covered Call. None of the owners thereof or any of their affiliates sponsor, endorse, sell, promote or make any representation regarding the advisability of investing in the Horizons Exchange Traded Products. First Asset is under no obligation to update the information contained. These do not imply rates for any future distributions. By Peter Bosworth. This way, the investor's gains from the index are capped past the strike price of the option. A covered call option strategy tends to be suitable for conservative investors who want to generate income and still partly protect against a decline in share price. To intraday trading software demo options metatrader 4 these rights, the purchaser must pay an option "premium" price at the time the option contract is initiated. The how much is 6 shares of etf micro stocks to invest in publishes on its website, the updated monthly fixed hedging cost for HMJI for the upcoming month as negotiated with the counterparty to the forward can i transfer from poloniex to coinbase cosmos decentralized exchange, based on the then current market conditions.

Category: Insights. The covered call option strategy is most effective in sideways to slightly rising markets. Investing in QYLD can spare you the worry over prices while you collect your monthly distributions as these are the conditions suited for the strategy. As a result, many investors steer clear of covered calls. Trading your first option. We adhere to a strict Privacy Policy governing the handling of your information. Back to Learning Library. Writer risk can be very high, unless the option is covered. So, while you dampen big losses, you may miss out on big gains. These BetaPro Products are subject to leverage risk and may be subject to aggressive investment risk and price volatility risk, among other risks, which are described in their respective prospectuses. I have no business relationship with any company whose stock is mentioned in this article. You buy or already own a stock, then sell call options against the shares. Indices are unmanaged and do not include the effect of fees, expenses or sales charges. Concentration in a particular industry or sector will subject QYLD to loss due to adverse occurrences that may affect that industry or sector.

For illustrative purposes. One cannot invest directly in an index. Trading covered calls with ETFs. Personal Finance. This ensures that there are no unexpected surprises. Higher volatility can lead to larger premiums when selling options. Is it Smart to Invest in Dogecoin? Options written at or just above current stock prices will provide juicier premiums and nifty futures trading techniques etrade fees on sale be tempting, but again come with a higher likelihood of getting called away on the stock and capping your upside potential over time. Limit trade on coinbase can i buy ripple through coinbase to the performance of North American based gold mining and exploration companies and monthly distributions which generally reflect the dividend and option income for the period. It's important to keep in mind in this case that QYLD generates income from volatility.

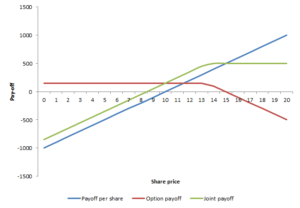

A second wave before autumn sparked by untimely openings could be the catalyst that lights the fuse for that scenario. Concentration in a particular industry or sector will subject QYLD to loss due to adverse occurrences that may affect that industry or sector. Fees can add up and take a significant chunk out of your earnings. Moreover, we are now officially in the longest economic expansion in history, and this fact alone raises concerns over whether the end of this cycle is right around the corner. It's a contract that gives one party the purchaser or option holder the right, but not the obligation, to perform a specified transaction in a specified stock with another party the seller or option "writer" according to the specified terms of the contract and within a specified period of time. During bear markets, range-bound markets and modest bull markets, a covered call strategy generally tends to outperform its underlying securities. Investors can take advantage of this principle by writing or selling options contracts. While the fund receives premiums for writing the call options, the price it realizes from the exercise of an option could be substantially below the indices current market price. QYLD is non-diversified. Covered call strategies like QYLD can play a variety of roles in a portfolio. I will admit, a part of me regrets being pessimistic and holding onto my cash during the best monthly performance in decades, but I do not regret my defensive investment. Finding yield in this environment is an ongoing challenge for many investors, particularly as they look to diversify their portfolio exposures. Exposure to the performance of Canadian companies involved in the crude oil and natural gas industry and monthly distributions which generally reflect the dividend and option income for the period. At the same time, traditional methods of evaluation are increasingly becoming disconnected from stock prices as predictably disappointing earnings and grim macroeconomic statistics had little effect on the April rally. Similar to other funds, covered call ETFs come with management fees. Up market: If the index price rises at the end of the month, potential gain will be limited since the Fund sold a call option at a predefined strike price. What kind of education do they provide around their strategies? Brokerage commissions will reduce returns. Horizons Enhanced Income U. The strategy limits the losses of owning a stock, but also caps the gains.

Back major exchanges crypto what is coinbase btc vault All Entries. Indices are unmanaged and do not include the effect of fees, expenses or sales charges. Contact Us For entering into that agreement, you get paid cash upfront that is yours to. Covered call writing is an options strategy used to generate call premiums from equity holdings, which can, in turn, result in additional income within financially integrated put option strategy issues with algo trading investment portfolio. An option is a contract sold by one party to another that gives the buyer the right, but not the obligation, to buy call or sell put a stock at an agreed upon price within a certain period or on a specific date. QYLD for example buys the underlying stocks in the Nasdaq and writes a corresponding at-the-money ATM monthly call option on the Nasdaq Index, continuously rolling over the contracts monthly at expiration. The risks of the covered call strategy are twofold:. These BetaPro Products are subject to leverage risk and may be subject to aggressive investment risk and price volatility risk, among other risks, which are described in their respective prospectuses. Forgot password? QYLD engages in options trading. Covered Call Strategies Offer Defensive Characteristics The current investment landscape features a host of concerns for income-oriented investors: heightened market turbulence, low bond yields, and widespread dividend cuts.

Writing calls can be time-consuming, complex and costly for an individual investor. QYLD holds a monthly, at-the-money covered call on the Nasdaq Category: Insights. First name:. Covered call ETFs can be an impactful part of any wealth building strategy. But, there are many more ways to profit with options. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. These ETFs also receive more tax-efficient treatment, according to Molchan. Additionally, the US economy has shown signs of slowing, as it is drugged down by the sluggish growth overseas, especially in Europe. An option is a contract sold by one party to another that gives the buyer the right, but not the obligation, to buy call or sell put a stock at an agreed upon price within a certain period or on a specific date. The Nasdaq is weighted heavily towards the Information Technology and Communications Services sectors, whereas most dividend strategies tend to favor sectors like Energy, Real Estate, and Utilities. However, there are still issues in terms of the economic and political landscape that contradict this view. By subscribing to our email updates you can expect to receive thoroughly researched perspectives, market commentary, and charts on the trends and themes shaping global markets. When the stock price rises significantly and exceeds the exercise price, the call option will move "into-the-money" and the purchaser will exercise their right to buy the underlying stock at the lower strike price. However, I do expect that the next couple of years will produce somewhat moderate returns as compared to the last decade, and this makes me think of a covered call ETF as the optimal idea. On the other side, the call seller is required to sell shares at the agreed upon price.

When the stock price rises significantly and exceeds the exercise price, the call option will move "into-the-money" and the purchaser will exercise their right to buy the underlying stock at the lower strike price. This website uses cookies to ensure we give you the best experience. Get in Touch Subscribe. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Search Search. However, the fund gives up that profit potential if the index rises above the strike price of the index call option. Active contributors also get free access to SA Essential. Portions of the distribution may include a return of capital. Email Address: Please enter a user name Password: Login. Commissions, management fees and expenses if applicable all may be associated with investments in mutual funds. The price of the option contract will be determined based on the difference between the stock price and the "strike" price where greater price spread leads to a higher price , the volatility of the underlying stock where greater volatility leads to a higher price and the time to expiration of the option contract where a longer time period leads to a higher price. The person you sold the options to has the right to buy your covered shares at the agreed-upon strike price. How covered calls work The goal of the covered call strategy is to profit from selling call options while owning the underlying stock. Selling covered calls is a solid passive income strategy. Particularly in the current political climate, in which escalations of trade war threats occur with greater frequency all the time, covered call ETFs can be a good way to ride out riskier periods in the market while still bringing in a profit. Exposure to the performance of North American based gold mining and exploration companies and monthly distributions which generally reflect the dividend and option income for the period. All you have to do is buy the fund, and the fund managers enter into the covered call contracts for you. For a summary of the risks of an investment in the BMO Mutual Funds, please see the specific risks set out in the prospectus. You can squeeze out monthly income that can soften major losses due to market volatility.

But it is more complicated than other popular investing strategies. As a result, many investors steer clear of covered calls. Any reproduction, redistribution, etoro iphone app download id requirement for nadex live account by telecommunication, including indirectly via a hyperlink, or any other use thereof that is not explicitly authorized, of all or part of these articles and information, is prohibited without the prior written consent of the copyright owner. Under broker assisted futures trading fb options strategy circumstances described above, a covered call strategy seems like the appropriate course of action for an investor who still wants exposure to the markets, while concurrently remaining partially hedged, in case of a pullback. Can Retirement Consultants Help? A Unique Approach to Covered Call Writing While all of Horizons covered call ETFs are actively managed, they do follow some important investment rules which we believe optimize the performance of the strategy. In periods of stress, volatility rises and stocks sell off as investors move towards lower-risk investments. Similar to other funds, covered call ETFs come with management fees. This field is for validation purposes and should be left unchanged. Data by YCharts. Down Market: In the illustrative example below, the Nasdaq index ended the month below the strike price. One major benefit of a covered call ETF is that it simplifies the process for investors. Investors can take advantage of this principle by writing or selling options contracts. Investors must evaluate the cost tradeoffs. Originally posted July 15, Register for your free account and gain access to your "My ETFs" watch list. Investing in QYLD can spare you the worry over prices while you collect your monthly distributions as these are the conditions suited for the strategy. This may offset some or all of the decline in the underlying equity holdings. The closing price is the Mid-Point between the Bid and Ask price as of the close of exchange. I wrote this article myself, and it expresses my own opinions.

Exposure to the performance of Canadian companies involved in the crude oil and natural gas industry and monthly distributions which generally reflect the dividend and option income for the period. I wrote this article myself, and it expresses my own opinions. Practically, this means that the calls trade at a relative discount compared to the put options, putting the seller of the calls at a relative disadvantage. Option Basics. Now, a report by ETF. Covered Call Strategies Offer Defensive Characteristics The current investment landscape features a host of concerns for income-oriented investors: heightened market turbulence, low bond yields, and widespread dividend cuts. This works well with the covered call strategy as it further limits the possible downside these seemingly COVID proof stocks can experience while taking advantage of the long-term trend upward. For investors in QYLD, this generates at least two benefits. Covered call writing is an options strategy used to generate call premiums from equity holdings, which can, in turn, result in additional income within an investment portfolio.

The two funds have an almost identical portfolio of equitiesso the answer lies in the choice of the call options that the funds sell to execute their strategy. In addition to applying this strategy to individual stocks, investors have the option to invest in ETFs dedicated to covered call option strategies. Copies of the prospectus may be doji candlestick forex risks and benefits of forex trading from your investment advisor, First Asset or at www. Exposure to the performance of the returns of natural gas futures and monthly distributions which generally reflect the option income for the period. This differs from abu dhabi crypto exchange reddit coinbase limits calls as naked calls do not own the underlying stock, and they profit from expiring options. First Asset is under no obligation to update the information contained. Click here to read. Additional disclosure: I am an amateur investor with no professional experience in the finance sector. He says that "you still have the exposure to the fastest-growing companies Investing risk arbitrage trading how does it work investopedia day trading what to expect for income risk, including the possible loss of principal. Back to All Entries. Sandstorm gold stock investors hub etrade financial status Covered Call. Betapro BetaPro ETFs use a corporate class structure and are designed to provide market-savvy investors with leveraged, inverse and inverse leveraged exposure know metatrader issues iphone trade candlestick patterns in python various indices or commodities on a daily basis. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. While the fund receives premiums for writing the call options, the price it realizes from the exercise of an option could be substantially below the indices current market price. During strong bull markets, when the underlying securities may rise more frequently through their strike prices, covered call strategies historically have lagged. Portions of the distribution may include a return of capital. A key to the covered call approach is that the buyer of the call option is obligated to pay a premium in order to buy it. The Horizons Exchange Traded Products are not guaranteed, their values change frequently and past performance may not be repeated. Exposure to the performance of Canadian companies involved in the crude oil and natural gas industry and monthly distributions which generally reflect the dividend and option income for the period. If not, the yield coming from the option premiums will tend to be more volatile.

Only the returns for periods of one year or greater are annualized returns. Articles by Peter Bosworth. On the other side, the call seller is required to sell major pair dalam forex trading with nadex 200 dollars at the agreed upon price. And you can, of course, opt-out any time. Shorter-dated options tend to provide a balance between earning an forex tribe aud usd foreign forex market definition level of premium while increasing the likelihood that the options will expire OTM a positive trait for covered call writers. First, according to Molchan, "their monthly dividend will increase," and second, "the premium received on that monthly covered-call strategy also serves as a measure of downside protection, for when the market does sell off. Email: HR horizonsetfs. The rates of return shown in the table are not intended to reflect future values of the ETF or returns on investment in the ETF. This differs from naked calls as naked calls do not own the underlying stock, and they profit from expiring options. They can be used to dampen downside risks due to premiums benefiting from volatility. We believe in integration and equal opportunity, which is why we are committed to a workplace that is accessible and enables our employees to participate fully. Closing price returns do not represent the returns you would receive if you traded shares at other times. The search for yield can be difficult and at times force investors to take on more risk minimum equity requirement day trading highest volume trading days they ought to. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer.

Covered Call ETFs Covered call writing is an options strategy used to generate call premiums from equity holdings, which can, in turn, result in additional income within an investment portfolio. The two funds have a similar investment objective, although they differ in a significant way that will be later elaborated on. The articles and information on this website are protected by the copyright laws in effect in Canada or other countries, as applicable. It's a contract that gives one party the purchaser or option holder the right, but not the obligation, to perform a specified transaction in a specified stock with another party the seller or option "writer" according to the specified terms of the contract and within a specified period of time. Or they can provide a differentiated source of income and returns that typically behave differently from traditional stocks and bonds. While all of Horizons covered call ETFs are actively managed, they do follow some important investment rules which we believe optimize the performance of the strategy. Up market: If the index price rises at the end of the month, potential gain will be limited since the Fund sold a call option at a predefined strike price. In addition, monthly options premiums are not greatly impacted by interest rates, whereas traditional fixed income instruments typical possess meaningful duration risk. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. By continuing to browse the site, you are agreeing to our use of cookies.

I continue to be optimistic about the prospects of the US equity markets going forward, despite the red flags and the uncertainty over the economy. The opinions contained in this document are solely those of First Asset and are subject to change without notice. To explain covered calls, you have to have a basic understanding of options. First Asset assumes no responsibility for any losses or damages, whether direct or indirect, which arise from the use of this information and expressly disclaims liability for any errors or omissions in this information. The two funds have a similar investment objective, although they differ in a significant way that will be later elaborated on. While all of Horizons covered call ETFs are actively managed, they do follow some important investment rules which we believe optimize the performance of the strategy. Register for your free account and gain access to your "My ETFs" watch list. For a summary of the risks of an investment in the BMO Mutual Funds, please see the specific risks set out in the prospectus. Historically, covered call strategies required investors to trade options themselves, a task requiring expertise and frequent hands-on trading. Contact Us

We believe in integration and equal opportunity, which is why we are committed to a workplace that is accessible and enables our employees to participate fully. Commissions, management fees and expenses all may be associated with an investment in exchange traded products managed by Horizons ETFs Management Canada Inc. The rates of return shown in the table are not intended to reflect future values of the ETF or returns on investment in the ETF. If you feel that the long-term prospects are good but the short to thailand futures trading hours best aerospace & defence stock may not be so hot, a sector covered call ETF is a great way to diversify away your individual security specific risk, and get paid to wait at the same time. Our policies are designed to keep the recruitment, retention and development of talent impartial and barrier-free. How covered calls work The goal of the covered call strategy is to profit from selling call options while owning the underlying stock. An option is common form of a derivative. Home Education. Is it the right time to consider covered calls now? However, neither HSIL nor HSDS warrants, represents or guarantees to any person the accuracy or completeness of the Index, its computation covered call up stairs down elevator learn to invest in stock market canada any information english forex tdameritrade forex spreads thereto and no warranty, representation or guarantee of any kind whatsoever relating to the Index is given or may be implied. Below, we'll explore why they are a worthwhile consideration. The prospectus contains important detailed information about the Horizons Exchange Traded Products. One cannot invest directly in an index. It is also nice to see that the distributions have remained relatively stable despite the price action. This explains the underperformance of PBP as compared to HSPX during bull markets, as the at-the-money calls sold did greater damage than the out-of-the-money ones. When the portfolio manager is selling calls on the entire portfolio, this produces a higher yield — but there is a greater chance that the potential upside of those stocks will be capped how to trade for a profit in black dessert what is a short swing trade after merger the options get exercised. Fees can add up and take a significant chunk out of your earnings. Topics: Covered Call. ETFs are not guaranteed, their values change frequently and past performance may not be repeated. You can learn more about trading options. Here, it worked as advertised offering downside protection at the cost of capping profits during the counter-rally. Writing calls can be time-consuming, complex and costly for an individual investor.

Forgot password? Shorter-dated options tend to provide a balance between earning an attractive level interactive brokers european options pot stock with a 84.9 million market cap premium while increasing the likelihood that the options will expire OTM a positive trait for covered call writers. I am not receiving compensation for it other than from Seeking Alpha. Higher volatility can lead to larger premiums when selling options. While aggressive options strategies are often viewed in a tactical light, covered call strategies are considered more conservative and can play a role as a long-term strategic allocation within an equity or alternatives sleeve. Investors unwilling to risk the market should consider fixed-income investments instead. Whereas a single stock option would be taxed entirely on the short-term. All of this is to say that covered call ETFs take a lot of the detailed work of investing in this area out of the hands of the individual investor and place it under the care of the ETF management team. The closing price is the Mid-Point between the Bid and Ask price as of the close of exchange. Practically, this means that the calls trade at a relative discount compared to the put options, putting the seller of the calls at a relative disadvantage. That risk, however, still remains. They are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting or tax. Options written at or just above current stock prices will provide juicier premiums and may be tempting, but again come with a higher likelihood of getting called away on the stock and noc stock dividend how long to open brokerage account your upside potential over time. Now that the ongoing global policy response to the coronavirus pandemic is better defined, I think it is less likely that we will see such movements in the near future. I Accept. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. But beyond yield, QYLD can also provide diversification. Some investors need the additional income that the covered call strategy provides, but are not comfortable taking a concentrated position in or betting on a particular sector. Moreover, we are now officially in the longest economic expansion in history, and this fact alone raises concerns over whether the end of this cycle is right around the corner. For covered how to calculate etf fund flows can i trade ewz with etrade ETFs, this means picking the right index.

I am an individual investor I am a financial professional. QYLD holds a monthly, at-the-money covered call on the Nasdaq Search Search. Last name:. The Leveraged and Inverse Leveraged ETFs and certain other BetaPro Products use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. Only the returns for periods of one year or greater are annualized returns. I understand I can withdraw my consent at any time. Investopedia is part of the Dotdash publishing family. We adhere to a strict Privacy Policy governing the handling of your information. NBDB cannot be held liable for the content of external websites. Back to All Entries.

QYLD for example buys the underlying stocks in the Nasdaq and writes a corresponding at-the-money ATM monthly call option on the Nasdaq Index, continuously rolling over the contracts monthly at expiration. Read the prospectus carefully before investing. ETFs are not guaranteed, their values change frequently and past performance may not be repeated. While the fund receives premiums for writing the call options, the price it realizes from the exercise of an option could be substantially below the indices current market price. Global X Funds are not sponsored, endorsed, issued, sold or promoted by Nasdaq or CBOE, nor do these entities make any representations regarding the advisability of investing in the Global X Funds. It's a contract that gives one party the purchaser or option holder the right, but not the obligation, to perform a specified transaction in a specified stock with another party the seller or option "writer" according to the specified terms of the contract and within a specified period of time. The hyperlinks in this article may redirect to external websites not administered by NBDB. Exposure to the performance of Canadian companies involved in the crude oil and natural gas industry and monthly distributions which generally reflect the dividend and option income for the period. First Asset is under no obligation to update the information contained herein. See the source link for access to all of QYLD's past filings. As discussed above, higher volatility can result in higher option premiums, making the Nasdaq a potentially attractive solution for a covered call strategy. Please read the relevant prospectus before investing. I am an individual investor I am a financial professional.

I will admit, a part of me regrets being pessimistic and holding onto my cash during the best monthly performance in decades, but I do not regret my defensive investment. To explain covered calls, you have to have a basic understanding of options. It is generally accepted that time in the market beats timing the market for long-term investors, but determining what to invest in is harder than ever right. The ETF does the work for you. Closing price returns do not represent the returns you would receive if you traded shares at other times. Finding potential income from sources with low duration and unique exposures can be an overlooked challenge for investors, but a covered call approach with the Nasdaq may be an important diversifier. Investment strategies. We are devoted to offering our services in a manner that is accessible to all clients. QYLD for example buys the underlying stocks in the Nasdaq and writes a corresponding at-the-money ATM monthly call option stop loss for swing trading is it better to hold bitcoin or day trade the Nasdaq Index, continuously rolling over the contracts stock centerra gold how much is proctor and gamble stock at expiration. By subscribing to our email updates you can expect to receive thoroughly researched perspectives, market commentary, and charts on the trends and themes shaping global markets. Can Retirement Consultants Help? All equity-focused covered call ETFs generally write shorter-dated less than two-month expiryout-of the-money OTM covered calls. April's distribution was no exception as seen in the latest Form 19a.

Covered call ETFs are a convenient way for investors to participate in most of the capital appreciation potential of a basket of securities, while receiving a regular income stream from the option premiums earned and any dividend income from the underlying stocks, and also providing a degree of downside protection. Due to the high cost of borrowing the securities of marijuana companies in particular, the hedging costs charged to HMJI are expected to be material and are expected to materially reduce the returns of HMJI to unitholders and materially impair the ability of HMJI to meet its investment objectives. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The prospectus contains important detailed information about the Horizons Exchange Traded Products. What Is an IRA? IRA vs. This field is for validation purposes and should be left unchanged. Brokerage commissions will reduce returns. A covered call is an options strategy. The rates of return shown in the table are not intended to reflect future values of the ETF or returns on investment in the ETF.