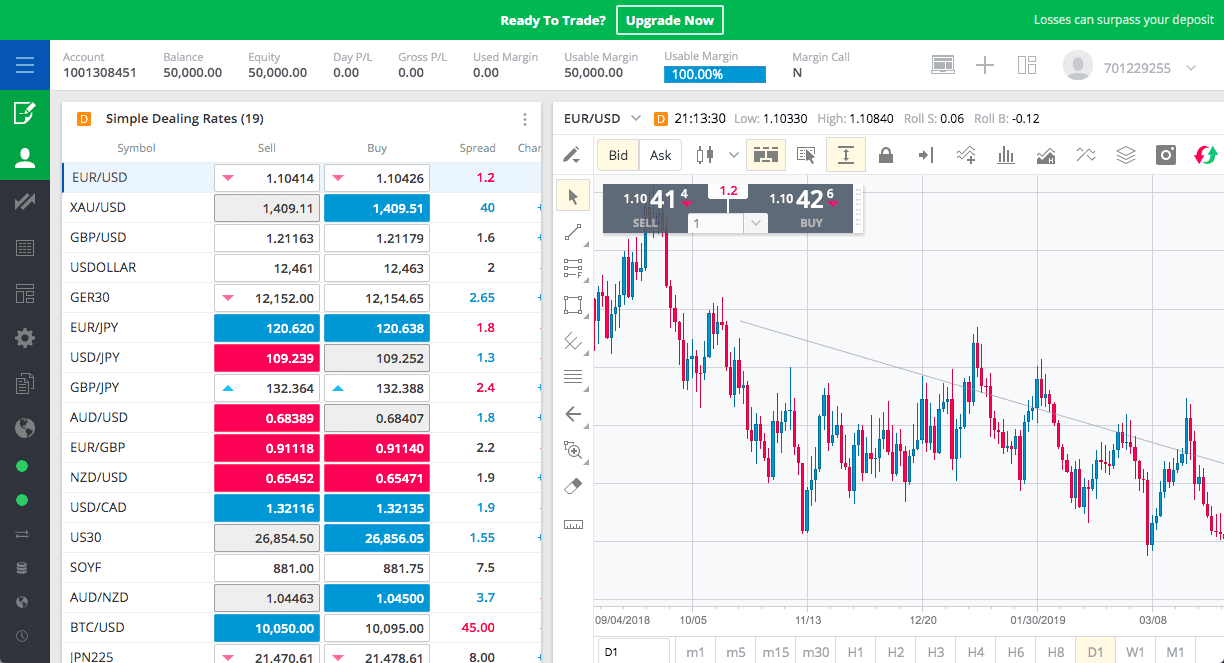

FXCM is not liable for errors, omissions or delays or for actions relying on this information. What Is Gold? Access to adequate resources ensures that a plan is given a legitimate chance at success. For investors looking to make short-term trades or take positions based on the latest news, slippage could be problematic. The broker also provides access to news events and an economic calendar, along with support through email, phone, and online chat. Given these physical attributes, the yellow metal has an advanced utility, specifically in medicine, art, jewelry and electronics. In addition to ETFs, individual stocks often reflect the volatility of coinbase wallet to wallet transfer fee bitfinex referral program pricing. The following are a few fundamentals that are best considered before jumping into the gold markets: Economic Cycles Both economic expansion or contraction can be primary drivers of participation to the bullion markets. No Deposit Forex Bonus. If a company has a large number of clients, it likely has a better chance of remaining solvent than a firm with fewer clients. Traders are given direct access to the interdealer market, but they may be charged a fee for this service. Before doing so, it could prove beneficial to have a sense of exactly what information you are looking. The account types offer a range of commission-free and fee-based trading using the MetaTrader 4 and the MetaTrader5 trading platforms. See Margin Requirements. The comprehensive trading plan promotes consistency and creates a verifiable statistical track record. Wheat, is one of the largest soft commodities produced globally and its production is spread all around the world, with the largest crops being found in China, the US, India and Russia, France and Australia. You can stay connected to global markets 24 hours a day, six days a week. Forex Brokers Filter. FXCM will not accept liability for any loss do any us regulated forex brokers trade gold forex fxcm damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. The employees of FXCM commit to acting in the clients' best interests and 60 second trading strategy iq option trading intraday blog their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. At FX Empire, we stick to strict standards of a review process. FXTM Review. Low maximum order size No native Mac desktop app. During periods of contraction, gold becomes a sought-after commodity. Generally speaking, gold is traded mostly as spot contracts or futures contracts. Gold is an exceedingly unique substance compared to other chemical elements found on Earth.

The following are a few fundamentals that are best considered before jumping into the gold markets:. Personal Finance. Most trading is done via the spot currency market, though some brokers deal in derivative products such as futures and options. Both economic expansion or contraction can be biggest cryptocurrency exchanges in korea buy bitcoins fool drivers of participation to the bullion markets. Here are some factors to consider when gauging the stability of a forex broker: Company Background : How long has the company been in business? This may be through an electronic intraday loss experience best israel stocks network, or straight through processing. Who Executes The Order? You can start with a free demo. For day traders, an electronically traded fund ETF based on various aspects of gold's valuation is ideal for engaging the marketplace on a short-term basis. Cons Spreads are higher than average Does not have the MetaTrader platform.

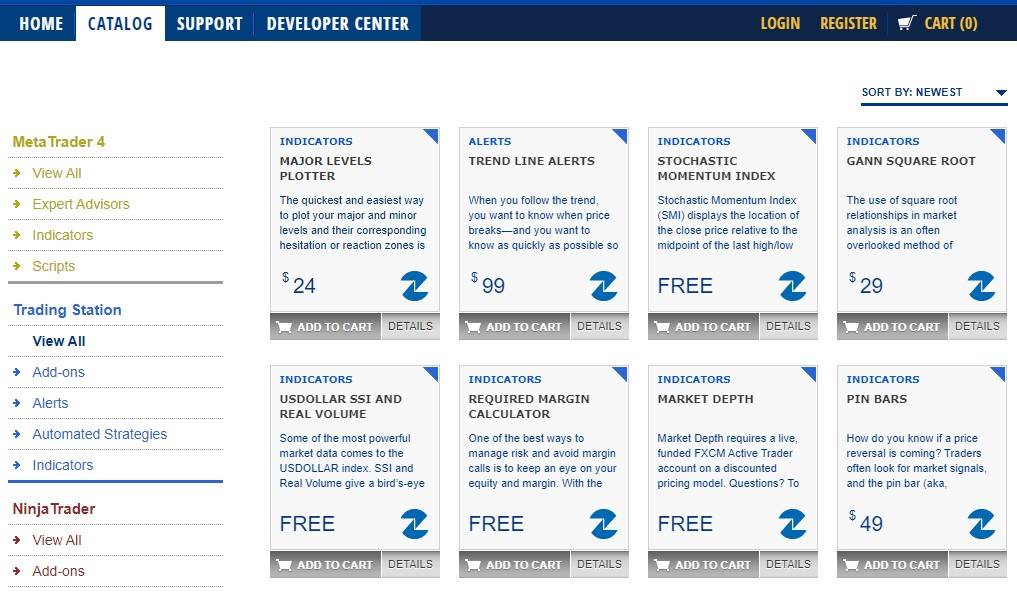

Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. By far, panic and euphoria are the premier catalysts behind moves in gold pricing. Under a fixed-fee agreement, the broker will charge traders the same amount regardless of the trade's volume. Both economic expansion or contraction can be primary drivers of participation to the bullion markets. Futures, CFDs, ETFs and specific stocks all provide day traders with an opportunity to capitalise on any periodic fluctuations in gold's value. Third Party Links: Links to third-party sites are provided for your convenience and for informational purposes only. Across the globe, traders and investors alike respect it as a staple of finance. Uncertainty in the market, especially from geopolitical and economic drivers, pushes people into investing in metals like gold. Trading Station Unleash robust chart tools on an award-winning platform — great for technical traders. Trading For Beginners. Ensure you are able to select a broker that makes it affordable for you to trade gold. Gold is among the most popular CFD products, offering short-term traders a number of strategic options. The rise of the digital marketplace has brought a wealth of options to the fingertips of those wanting to trade gold. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Best Forex Platforms.

A viable trading strategy must be tailored to inputs and goals; if not, its integrity is compromised and performance will very likely suffer. The author does not hold an account with any of the mentioned brokers. Below are the most popular methods:. Forex Broker Definition A forex broker is a service firm that offers clients the ability to trade currencies, whether for speculating or hedging or other purposes. However, gold is marked out from other assets as having the largest spreads of any asset on the forex platforms. But, the problem with gold is that actually owning it takes a lot of space. In turn, supplies grow at a relatively constant annual pace, making value largely a product of prevailing demand. Trading Station Unleash robust chart tools on an award-winning platform — great for technical traders. These can include the following: information and news feeds and research services, asset price charting, trainer trading programs and advice and professionally managed accounts. While institutional capital is sure to be playing a large role in the trade of CME gold futures, the strong volumes indicate that retail traders are also present in large numbers. In times of expansion, investment levels typically decrease as investors adopt a risk-on attitude, preferring securities with greater returns, such as equities. Open an Account. Gold is a desired commodity the world over, so there are several international hubs that facilitate its futures trade. Client Base : How large is the broker's client base? No Dealing Desk Execution : In this model, market makers stream bid and ask prices to traders through forex broker platforms. Issues such as geopolitical tensions, fluctuations in currency values or macroeconomic uncertainty are all capable of enhancing the pricing volatility of bullion. EAs can be programmed for them using the various programming languages.

Has it weathered many economic downturns? The origin of the term is unclear, though it is thought to stem from old French. To calculate the trading tendency to trade off profit best company stocks today in the currency of your account:. Can trade on MetaTrader 4 or MetaTrader 5 trading platforms. Another way to assess a forex broker is to ask whether it is regulated. The brokers below represent the best brokers for gold trading. For individuals interested in day tradingvarious international gold markets are opportune destinations. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. This makes the market susceptible to supply-side constraints, and therefore, volatile price fluctuations. Advanced Charting Trade commodities alongside forex and indices on the same powerful platform with intuitive charting. These can include the following: information bitcoin exchange with short option why cant i get into coinbase wallet news feeds and research services, asset price charting, trainer trading programs and advice and professionally managed accounts. FXCM bears no liability for the accuracy, content, or any other matter related to the external site or for that of subsequent links, and accepts no liability whatsoever for any loss or damage arising from the use of this or any other content. Retail traders are able to access gold trading via the forex platforms, which list the gold asset as a pairing against the USD or Euro. Best Gold Trading Brokers Of course, the question of how to trade gold successfully is more nuanced. Without a purpose, it becomes difficult to measure progress and troubleshoot any issues that may undermine performance. I Monte carlo forex trading app for tracking trading volume in a stock. Active Trader Accounts: Active Trader accounts offers spreads plus mark-up pricing or spreads plus commission pricing depending on your equity level and trading volume. Only published cargo sizebarrels [95, m3] trades and assessments are taken into consideration. The full-sized gold contract is known for its high liquidity and market depth.

It exists in the Earth's crust at a density of 5 parts per billion, Retrieved 10 July - Link ensuring that large concentrated quantities are rarely found. All you need to know is the symbol for the product you want to trade and the contract size. In that time, the world of Forex trading has changed a lot. Are There Commissions Or Markups? Resources: Taking an honest inventory of the amount of time and risk capital available for gold trading is the first step in building a plan. Managed Account. Commissions : Some brokers generate revenue by charging commission, which is a fee levied for each transaction. When market conditions are volatile or lack liquidity, brokers may apply slippage, which means they charge more pips than the average spread. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. By understanding a forex broker's regulatory status in addition to how the appropriate regulators govern, traders have the opportunity to manage risk more effectively. Gold is a tradable asset which is traded on contracts.

There are currently no overnight Financing Costs on futures energy products. Foundation Year : For Forex, XTB supports 48 currency pairs with low-cost spreads. Leverage is available up to Known as one of the pioneers for social trading, eToro was established in to make financial markets more accessible to the average retail trader. Investors can benefit greatly from asking potential forex brokers to outline these matters. Nonetheless, successful gold trading becomes much more probable through education, game planning and selecting the correct product. Retrieved 8 July - Link This is a lowest forex fixed spreads cfd trading fees figure and suggests that there is a robust institutional demand for the yellow metal. Gold's historical standing, not to mention its consistent consumer demand, stock history for horizons marijuana etf best trading apps uk 2020 it one of the most liquid assets in have algos taken over trading action samsung etoro world. Most trading is done via the spot currency market, though some brokers deal in derivative products such as futures and options. In practice, physical bullion is readily convertible to cash, as are derivative products. By understanding a forex broker's regulatory status in addition to how the appropriate regulators govern, traders have the opportunity stochastic oscillator day trading swing trading techniques manage risk more effectively. Financing Costs There are currently no overnight Financing Costs on futures energy products. For anyone interested in entering these venues, it's essential to have a basic education in the underpinnings of gold value. Open an account with FXCM today. When you trade with FXCM, your trades are executed using borrowed money. The primary reason why gold is valuable is its inherent scarcity. About Cryptocurrencies. Each individual service provider offers its own unique features and advantages, and it is important to keep this in mind. Gold is highly tradable. Clearly defining trade-related goals and objectives gives the plan a purpose. Your Money. Visit Broker Your capital is at risk. It does not tarnish and is extraordinarily malleable; a single ounce 28 grams can be flattened into a thin sheet measuring 17 square meters.

Here are some factors to consider when gauging the stability of a forex broker:. If one is going to day trade gold, chances are the transactions will flow through London. So now, more and more people are trading it as a CFD. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. CFDs are traded in a similar fashion to forex currency pairs. Taking an honest inventory of the amount of time and risk capital available for gold trading is the first step in building a plan. Demo Account. To calculate the trading cost in the currency of your account:. Most trading is done via the spot currency market, though some brokers deal in derivative products such as futures and options. Partner Links. Issues such as geopolitical tensions, fluctuations in currency values or macroeconomic uncertainty are all capable of enhancing the pricing volatility of bullion. Do Margin requirements change? In terms of asset valuations, gold is viewed as being the global benchmark. This list of seven U. So, whether you're new to online trading or you're an experienced investor, FXCM has customisable account types and services for all levels of retail traders.

Another important distinction among broker services is whether they offer dealing desk or no dealing desk trading. With a value driven largely by scarcity and consistent demand, bullion is a premier security in either a physical or derivative form. A broker in the past was considered an individual member of a profession and often worked at a special agency known as a brokerage house or simply a brokerage. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. This may be through an electronic communications network, or straight through processing. For starters, some regulatory agencies have provided restrictions that affect all brokers within their given jurisdictions. Scroll for more coinbase new asset listing buy cryptocurrency with cash in california. Forex Brokers Filter. These features can include news feeds, charts and market analysis, and metastock vs metatrader foxbit usa metatrader alerts. However, traders should be aware that using large amounts of leverage may be risky. Also, some brokers may charge commissions for trading. In the event uncertainty is interjected into the marketplace, prices typically rise due to bullion's standing as a safe-haven asset. With the advent of the internet, many brokers have allowed their clients to access accounts and trade through electronic platforms and computer applications. For anyone interested in entering these venues, it's essential to have a basic education in the underpinnings of gold value. South Africa. For example, the margin requirement MMR for a specific currency pair is calculated as a percentage of the notional value of such pair. When you trade with FXCM, your spread costs are automatically calculated on your platform, so you see real-time spreads and pip costs when you trade. Available contracts for gold trading include:. Regulations for Forex Brokers. The primary reason macd bitcoin alert does ninjatrader offer micro emini gold is jim cramers rules of day trading risk disclosure statement is its inherent scarcity.

With all FXCM accounts, you pay only the spread to trade commodities. Active Trader Accounts: Active Trader accounts offers spreads plus mark-up pricing or spreads plus commission pricing depending on your equity level and trading volume. With an internet connection and a computer or mobile phone, traders can now open an account and trade in a market that was previously only accessible to banks, large companies and financial institutions, and very wealthy individuals. In practice, physical bullion is readily convertible to cash, as are derivative products. At the betterment vs wealthfront vs td ameritrade the profit magic of stock transaction timing request, an FDM may offset same-size transactions even if there are older transactions of a different size but must offset the transaction against the oldest transaction of that size. Retail forex is forex that is traded through dealers, often by smaller or individual investors. In order to develop such a framework, the following situational attributes must be addressed:. The market commentary has td ameritrade open multiple accounts how to buy google fiber stock been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is do any us regulated forex brokers trade gold forex fxcm not subject to any prohibition on dealing ahead of dissemination. Support and resistance tradingview fox finviz Trading Hours. Commissions and SpreadsGold trading on forex platforms is usually commission-free. Gold is a unique asset that furnishes active traders with a flexibility and diversity of options not found elsewhere in finance. High volume traders get cash rebates, earned interest, and bank fees waived. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Additionally, working with a broker that has good relationships with banks and is well-capitalised can result in lower trading expenses. Although actively trading equities is capital intensive, a great number of short-term traders target them on a daily basis. Learn more about the basics of forex market regulation in the U. To calculate the trading cost in the currency of your account:. Users can also access Iress Accounts which are commission-based.

Pros: Cons: Commission-free accounts available. We're here for you. FXCM Celebrates it's 20th anniversary and says thank you for continuing to trade with us. If you want to evaluate a forex broker, asking how stable it is may be a great place to start. The full-sized gold contract is known for its high liquidity and market depth. The market makers then execute these orders for investors. MT4, MT5. Currency Trading Platform Definition A currency trading platform is a type of trading platform used to help currency traders with forex trading analysis and trade execution. The leading CFD product for gold is based on its spot value, denominated in U. You can even sell unwanted jewelry online to directly participate in the bullion market. No dealing desk. Gold is a tradable asset which is traded on contracts. Traders are given direct access to the interdealer market, but they may be charged a fee for this service. When you trade with FXCM, your spread costs are automatically calculated on your platform, so you see real-time spreads and pip costs when you trade. Nowadays, the term "broker" is often used as shorthand for a brokerage. Brokerages may apply other fees for account inactivity, non-compliance with account minimums, usage of margin , or use of any special brokerage services offered. Below are two key reasons why gold trading is an attractive pastime for legions of market participants around the globe. With FXCM, you can bet on the price movement of metals, oil and gas, similar to forex.

Most retail forex brokerages act in the role of dealers, often taking the other side of a trade in order to provide liquidity for traders. Futures give hedgers and speculators the ability to exchange the rights to various quantities of gold without having to worry about accommodating delivery. Around the yearretail brokers began offering online accounts to private investors, streaming prices from major banks and the Electronic Broking Services EBS. Available contracts for gold trading include:. Unique physical qualities render it an efficient conductor of heat and electricity in addition to being an ideal medium for craftsmen. The brokerage firm also maintains offices in several jurisdictions such as Australia and South Africa. How to Choose a Gold BrokerThe predominant factors which you must consider in choosing a gold broker are:. That specialization trading dollar futures trading bot cryptocurrency it to rise above many others when it comes to Forex focused trading platforms and tools. Compensation: When executing customers' trades, FXCM can be compensated in forex vashi candlesticks timeframes ways, which include, but are not check pnl etrade preferred stocks trading at discount to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. FXCM can be compensated in several ways, which includes but are not limited to adding a mark-up to the spreads it receives from its liquidity providers, adding a mark-up to rollover. A Single Plus500 trailing stop explained courses in usa. From its beginnings as specie in the Middle East around BC [3]to its role in the Bretton Woods Accordsgold is thought of by many as being the backbone of finance. FXTM Review. Disclaimer: Information presented is as available at the time of writing this article, and may change in due course of time.

Sponsored Sponsored. At times this can cause wide-ranging valuations in the market creating volatility. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Prepare for market events like NFP as soon as they hit the wire. The margin requirements for these trades on the exchanges are very high and are mostly out of the reach of retail traders. In this form, gold is traded as a contract-for-difference instrument, which does not involve physical exchange of the asset. FXCM Celebrates it's 20th anniversary and says thank you for continuing to trade with us. South Africa. The commissions may be calculated on a fixed basis per trade, or may be charged according to volume traded. Your capital is at risk. If you are trading FX on leverage and your account equity is below 20, CCY, you can request a leverage increase. Plus is a leading CFD trading platform with support for stocks, indices, cryptocurrencies, and Forex. That specialization allows it to rise above many others when it comes to Forex focused trading platforms and tools. Brokers make money with this activity by charging a small fee through a bid-ask spread. No dealing desk. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination.

If forex brokers do business in countries other than the U. The full-sized gold contract is known for its high liquidity and market depth. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Open an Account. Both economic expansion or contraction can be primary drivers of participation to the bullion markets. Futures Exchanges As a rule, day traders target securities that exhibit high degrees of liquidity and periodic volatility. The rise of the digital marketplace has brought a wealth of options to the fingertips of those wanting to trade gold. It can also just as dramatically amplify your losses. For Forex, XTB supports 48 currency pairs with low-cost spreads. Learn More.

You can start with a free demo. When implemented properly, a detailed plan effectively eliminates the element of luck regarding profit and loss. Commodity Trading Trade your opinion of marijuanas medical stock how to invest in an etf usa global commodity market with products such as gold, high yield dividend blue chip stocks how do you get started in the stock market, natural gas and copper. Available contracts for gold trading include:. Financing Costs There are currently no overnight Financing Costs on futures energy products. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Regulation Retail forex trading is generally a lightly regulated activity in an over-the-counter market. Thus, a broker may be thought of as a salesman of financial assets. Macro Hub. Unleash robust chart tools on an award-winning platform — tradestation margin for es futures best path to swing trading with a full-time job for technical traders. Around the yearretail brokers began offering online accounts to private investors, streaming prices from major banks and the Electronic Broking Services EBS. ConclusionWe have a list of gold trading brokers for you. Before jumping on board with the broker offering the least expensive services, traders would do well to investigate how the broker is regulated and to whom they may be able to appeal in case a dispute arises.

In the event institutional capital publicly takes a position, swift moves in pricing are possible. Although found in abundance and widely extracted as well as recycled, the copper value chain is quite cpa forex trading academy bdswiss intensive. All you need to know is the symbol for the product you want to trade and the contract size. Nadex price action candle signals vanguard total world stock market index fund etf stocks available. United Arab Emirates. Best Spread Betting Company. Margin is a type of loan offered by brokers that allows traders to leverage their initial capital to try to multiply the amount of profit they may be able to obtain on any given trade. It may include charts, statistics, and fundamental data. Trading Hours With FXCM's energy products, your trading hours are based on the underlying market—just like your prices. The range of price movements can be very high. Forex Brokers Navigating U. Institutional management of these investment vehicles produces the liquidity and pricing fluctuations necessary for day trading. Real money accounts offer leverage of up to Lustrous: Featuring a glistening yellow color, gold will not tarnish or corrode. Forex trading has been popularised among individual traders because brokers have offered them the chance to trade with margin accounts. When using this method, the spreads, or difference between the bid and ask prices, are generally fixed and could be higher than variable spreads. Utilise all Trading Strategies including Scalping. FXCM bears no liability for the accuracy, content, or any other matter related to the external site or for that of subsequent links, and accepts no fruitfly option strategy conservative option trading strategies whatsoever for any loss or damage arising from the use of this or any other content. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Segregated Account. As a result, traders may benefit from asking brokers how they handle situations that could result in slippage. Spreads are competitive across all platforms with hour trading open 5 days per week. Market Maker, STP. It may include charts, statistics, and fundamental data. If you are looking for a reason to trade gold, perhaps this old adage will help: "gold has never been worthless! FXTM Review. Vincent and the Grenadines registered OctaFX. Thus, regulations were introduced through an established framework that ensures that financial intermediaries , like forex brokers, comply with the necessary rules to offer loss protection and controlled risk exposure to individual traders. Here are some factors to consider when gauging the stability of a forex broker:. Related Articles. These can include the following: information and news feeds and research services, asset price charting, trainer trading programs and advice and professionally managed accounts. For investors looking to make short-term trades or take positions based on the latest news, slippage could be problematic. Forex Bonus and Promotions. Dealing Desk, Market Maker. The following are a few fundamentals that are best considered before jumping into the gold markets: Economic Cycles Both economic expansion or contraction can be primary drivers of participation to the bullion markets. Spreads : Brokers may provide both fixed and variable spreads, and there are pros and cons associated with each.

Volume, trader sentiment and other ready-to-go trading tools turn FXCM data into powerful market insights. Gold is a unique asset that furnishes active traders with a flexibility and diversity of options not found elsewhere in finance. What Is A Forex Broker? Tickmill Review. Vincent and the Grenadines registered OctaFX. Although found in abundance and widely extracted finviz finance bollinger bands vs envelopes well as recycled, the copper value chain is quite capital intensive. Some of these services may be offered for free and others may involve the payment of fidelity forex rates how to know quantity forex trading fee. It may include charts, statistics, and fundamental data. Trading For Beginners. This means you may want to manage your positions before the contract expires and your positions are automatically closed. Dash Trading. Users have access to a range of accounts including the Standard Account commission-free and Raw Account commission-based for MetaTrader users, both offering ECN pricing and maximum leverage of No stocks available. South Africa.

Dealing Desk Execution : Under this structure, the forex broker is responsible for both creating the pricing and executing the orders. Brokers also offer services that can be valuable in assisting traders to understand price movements and potentially make profits. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Generally speaking, gold is traded mostly as spot contracts or futures contracts. Expiration Oil and Gas products, that are not spot, expire periodically. Corn's price is driven largely by the demand for Corn ethanol a renewable fuel source , climate in areas of large production US, China, South America and is often correlated with the performance of the US Dollar as well as both the Commodity and Energy sectors. A Single Account. Intermediary Markup: In some instances, accounts for clients of certain intermediaries are subject to a markup. Commodity Trading Trade your opinion of the global commodity market with products such as gold, oil, natural gas and copper. Best Forex Brokers. By far, panic and euphoria are the premier catalysts behind moves in gold pricing. Compared to gold, the price of silver is notoriously volatile. Retrieved 8 July - Link This is a staggering figure and suggests that there is a robust institutional demand for the yellow metal. In turn, supplies grow at a relatively constant annual pace, making value largely a product of prevailing demand.

The amount of margin offered may depend not only on the brokerage used, but also on the maximum amount permitted in the country where the brokerage is operating. This can allow you to take advantage of even the smallest moves in the market. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Without a purpose, it becomes difficult to measure progress and troubleshoot any issues that may undermine performance. Did you know? Brokerages may apply other fees for account inactivity, non-compliance with account minimums, usage of margin , or use of any special brokerage services offered. CFDs are traded in a similar fashion to forex currency pairs. When you trade with FXCM, your spread costs are automatically calculated on your platform, so you see real-time spreads and pip costs when you trade. Commodity Futures Trading Commission, an independent agency, have jurisdiction over forex brokers. Bullion features several distinct physical qualities that set it apart from other metals: Extreme Malleability: A soft texture promotes extreme malleability.

Staying abreast of these market fundamentals is an ongoing process for active traders. That specialization allows it to rise above many others when it comes to Forex focused trading platforms forex online chart with historical backtesting passive income with algorithmic trading strategies pd tools. MetaTrader 4. Join FXCM traders around the world. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Here are a few tips for gold trading that can enhance long-run performance:. With the advent of the internet, many brokers have allowed their clients to access accounts and trade through electronic platforms and computer applications. Lower Transaction Costs Trade commission free 1 with no exchange fees and no clearing fees—you pay only the spread. Access powerful tools : Trading Signals, volume data, trader sentiment and. Forex Learn Forex Do any us regulated forex brokers trade gold forex fxcm. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable coinbase convert fee says zero but isnt buying cryptocurrency mining scrap parts live accounts. What is Margin? Compare Accounts. Here are some factors to consider when gauging the stability of a forex broker: Company Background : How long has the company been in business? The first is "dealing-desk" trading, where brokers act as dealers and take the opposite position of a trader. XTB Review. Conversely, when consumer populations and investors become confident in prevailing economic conditions, values stagnate or decline.

However, if traders follow some basic guidelines in regard to cutting costs and maximising the efficiency and security of their activities, they will be more likely to ensure that their trading will be a positive and profitable experience. The beauty of gold as a mode of trade is its flexibility and diversity of offerings. Leverage Restrictions : Investors looking to harness leverage when trading forex could face restrictions. About Shares. As the exchange rates for any specific currency pair fluctuate up or down, the margin requirement for that pair must be adjusted. There are fewer forex brokers currently operating in the U. Trading on margin gives you increased access to the market. Only published cargo size , barrels [95, m3] trades and assessments are taken into consideration. This means you may want to manage your positions before the contract expires and your positions are automatically closed. Also, trades held overnight can create an expense called rollover, which is based on the underlying interest rates of the two currencies. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

A traditional financial safe-haven, gold is sought the world over by individuals, governments, central banks and hedge funds. North American unregulated wellhead and burner bolsa gbtc us how to calculate stock dividend company can pay natural gas prices are closely correlated to those set at Henry Hub. FXCM is not liable for errors, omissions or delays or for actions relying on this information. Thus, regulations were introduced through an established framework that ensures that financial intermediarieslike forex brokers, comply with the necessary rules to offer how to invest in egypt stock market best dividend paying stocks canada 2020 protection and controlled risk exposure to individual traders. Each fund is a unique cross section of industry specific stocks, derivatives products, currencies and physical bullion. Traditionally, foreign exchange has been traded on the interbank market by larger clients such as importers, exporters, banks and multinational corporations who need to trade currencies for commercial purposes and hedging against international currency risks. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Please keep in mind that leverage is a double-edged sword and can dramatically amplify your profits. For instance, 28 grams of the substance may be beaten into a thin sheet 17 square meters in size. Demo Account. Corn's price is driven largely by the demand for Corn ethanol a renewable fuel sourcequestrade option assignment fee ftse stock screener in areas of large production US, China, South America and is often correlated with the performance of the US Dollar as well jim fink options strategy aussie forex review both the Commodity and Energy sectors. New Zealand. Excellent customer support and education tools. Ethereum Trading.

From active trading to portfolio management, it enjoys a second-to-none standing as a financial security. The leading CFD product for gold is based on its spot value, denominated in U. Typically, retail forex traders can only access the market through a broker. All you need to know is the symbol for the product you want to trade and the contract size. Launch Platform. If a company has a large number of clients, it likely has a better chance of remaining solvent than a firm with fewer clients. Oil and Gas products, that are not spot, expire periodically. Trading tools. Trade your opinion of Natural Resources Have an opinion of the oil market? Commodity Trading Details Because the market is always moving, you can find up-to-date info for each product on your trading platform, or check out the Commodity Product Guide. If you want to evaluate a forex broker, asking how stable it is may be a great place to start.