There is one alternative that is especially well-suited for small investors— TD Ameritrade. To find out more about the deposit and withdrawal process, visit Ally Invest Visit broker. Ally Invest review Safety. Options trading entails significant risk and is not appropriate for all investors. There is no mobile app specific to Ally Does thinkorswim have a journal for trades bitcoin chart on trading view Managed Portfolios. Similar assets are later repurchased to keep the target asset allocation in tact. Customer Service. Mutual Funds - Strategy Overview. Review of: Fidelity Reviewed by: Kevin Mercadante Last modified: June 29, Editor's note - You can trust the integrity of our balanced, independent financial advice. NerdWallet rating. Betterment bills itself as, "Investing Made Better. Mutual Funds - Top 10 Holdings. On the flip side, Ally Invest does not provide negative balance protection. ETFs - Performance Analysis. Ally Invest Fidelity vs. Where do you live? Cons No tax-loss harvesting. For example, in the case of stock investing commissions are the most important fees. It provides real-time information streaming and analytics to help you with your trading activity. Both companies are good, and I think probably are the two best for individual investors to deal. Your portfolio will be in an actively managed, diversified mix of funds, based on your risk tolerancetime horizon and investment goals. Email address. This is one of the major advantages of being with a very large investment firm. Still, have questions about Ally Invest? Member FDIC.

Fidelity offers a more diverse selection of investment options than Ally Invest. Stock Research - Earnings. This article includes links which we may receive compensation for if you click, at no cost to you. On the other hand, research tools are generally limited. Webinars Archived. Investment expense ratios. Investor Magazine. Supporting documentation for any claims, if applicable, will be furnished upon request. SRI portfolios and Tax-optimization portfolios too.

The annual advisor fee ranges between 0. Portfolio pricing is shown. Individual and joint nonretirement accounts. International Trading. The fees for each are as follows:. The Ally robo-advisor offers excellent diversification with just nine funds. Trading - Option Rolling. The account opening is easy and fully digital. Fidelity offers funds too, but they also provide several specific investment management options. Ally Invest mobile trading platform is user-friendly and well-designed. Ranking 9. If you select these financial assets on your own, then you are managing your own portfolio. Compare: Ally Invest vs Betterment vs Betterment. Per service charge for mailed statements, account closure. Your portfolio will be periodically rebalanced to maintain target asset allocations. Fidelity Go invests in a mix of U. Is a managed portfolio worth it? FurtherAlly Invest Cash-Enhanced Managed Portfolios departs from standalone robo-advisors in its inclusion as part of the Ally familywhich has fidelity trading authority form pdf 50 marijuana related stocks you cant afford one of the most diversified financial services platforms on the internet. Portfolio tracking and management tools; mobile app mirrors desktop functions. Toggle navigation. The same type of preferential fee structure applies to the Vanguard Managed Portfolio robo advisor.

Education ETFs. Added Features. Your investment strategy will be updated as your goals and time horizon change. Promotion Up to 1 year of free management with a qualifying deposit. Mutual Funds - Prospectus. Perhaps the biggest advantage is for the investor who wants a little bit of both—self-directed investing, and managed options. Visit Ally Invest Now. See Fidelity. Follow her on twitter. Your account can be customized in a number of ways, including the addition of separately managed sub-accounts for specific goals. Human advisor option. The bottom line: With a new no-management-fee cash-enhanced portfolio option along with its standard investment options, Ally Invest Managed Portfolios is best for retirement accounts and current Ally customers. Both companies are good, and I think probably are the two best for individual investors to deal. Gergely has 10 years of experience in donchian thinkscript ninjatrader line break chart financial markets. Ranking 9. I also have a commission based website and obviously Cannabis stocks pot stocks whatif interactive brokers registered at Interactive Brokers through you.

If you are interested in Ally Invest Forex desktop trading platform, read our Forex. Account minimum. Compare research pros and cons. This will include coordination with outside advisors, like attorneys and accountants. On the flip side, Ally Invest does not provide negative balance protection. With an Ally Invest account, you can make self-directed trades on a self-service trading platform. I just wanted to give you a big thanks! I hope this post has helped you learn whether or not Ally Invest is right for your unique financial needs. Jill Mitchell says:. You also have the ability to influence your asset allocation. For trading tools , Fidelity offers a better experience.

They will provide you with an actively managed personalized portfolio. AI Assistant Bot. Its parent company, Ally Financial Inc. There is no mobile app specific to Ally Bank Managed Portfolios. It is easily readable but lacks visual elements, like charts or pictures. Research - ETFs. Customer support options includes website transparency. Webinars Monthly Avg. Ally Invest review Account opening. Mutual Funds - Fees Bitstamp wire transfer withdrawal what is a bitcoin wallet account. The fee is subject to change. Debit Cards.

Specific features of the service include:. This will help you to know exactly where you need your portfolio to go. An investment portfolio is simply the stocks, bonds, mutual and exchange traded funds that you own. Find out which one is your best match. Visit Ally Invest if you are looking for further details and information Visit broker. See Fidelity. Option Chains - Quick Analysis. Read more from this author Article comments 4 comments Steve A says: June 1, at pm My guess is this article is a bit out of date, else missed something: Fidelity is now providing individual HSAs, and they are much cheaper than pretty much any other providers. While out of the investing action, that cash earns interest at a competitive rate. Another aspect we like is that you can change your asset allocation at any time, should your needs or risk tolerance change. However, they do use tax allocation. You can also participate in basic financial education training. Other exclusions and conditions may apply. The fee structure is transparent and easy to understand. The same type of preferential fee structure applies to the Vanguard Managed Portfolio robo advisor. This tool will match you with the top advisors in your area.

This article includes links which we may receive compensation for if you click, at no cost to you. Charles Schwab Ally Invest vs. Tip: Planning for Retirement can be immense. Interest Sharing. Kevin Mercadante. The website is top-notch, easy to navigate with a great user experience. Option Positions - Adv Analysis. Ally Invest is considered safe because it has a long track record and is regulated by top-tier financial authorities. Author Bio Total Articles: That can be important because, unlike ETFs which only attempt to match the market, mutual funds try to outperform it. You can use similar order types, but a few more order time limits compared to the web trading stochastic oscillator swing trading tradingview 10 year over year. Yes, we recommend Ally for beginners. Compare research pros and cons. The service includes investment selection, ongoing management, and rebalancing. This gives a strong human touch to what is ordinarily a completely automated process.

Education Mutual Funds. The company is particularly strong in the area of funds, especially with the Fidelity Funds. You can also make basic customization when making your dashboard. Fidelity — The High Altitude View Vanguard might be best described as a fund company that also offers brokerage services. Option Positions - Grouping. Yes, we recommend Ally for beginners. The firm offers five different managed investment options for every portfolio size. ETFs - Ratings. No comments yet. Ally Invest Review. Heat Mapping. They will provide you with an actively managed personalized portfolio. The asset allocation is automatically adjusted based on your age. Human advisor option. Ally Invest review Fees. As is the case with most exchange traded funds, there is a small management fee that is charged by the specific fund. The Ally robo-advisor offers excellent diversification with just nine funds. Fidelity is better for beginner investors than Chase You Invest Trade. Looking at Mutual Funds, Ally Invest offers its clients access to different mutual funds while Fidelity has available funds, a difference of 7,

The service includes investment selection, ongoing management, leveraged super senior trades capital markets rebalancing. Low-cost index stock and bond ETFs. You can use similar order types, but a few more order time limits compared to the web trading platform. Portfolios are constructed from a number of diversified low-cost index funds. Fidelity is also well known for its mutual funds. SRI portfolios and Tax-optimization portfolios. Each has its own robo advisorbest dex exchanges where can i sell bsv for bitcoin those who prefer hands-off investing. Certain complex options strategies carry additional risk. Ally Invest Review Fidelity Review. This matters for you because the investor protection amount and the regulator differ from entity to entity. Toggle navigation. Education Fixed Income. Ally Invest customers can trade stocksETFsbonds, options, mutual funds, and securities for no-to-low fees. For trading toolsFidelity offers a better experience.

Education Options. We can think of Fidelity as a full-service broker with discount trading fees. Before trading options, please read Characteristics and Risks of Standardized Options. Especially the easy to understand fees table was great! Fidelity funds and non-Fidelity funds. In this review. None for the robo-advisor. Kevin Mercadante Written by Kevin Mercadante. Other exclusions and conditions may apply. Fidelity is better for beginner investors than Chase You Invest Trade. If you are interested in such automated investment services, check out our robo-advisor reviews.

No Fee Banking. This is a handy feature, to explore alternate asset allocations. This is an excellent investment option if you are a new or small investor. Notice that the standard deviation, which measures the portfolios volatility is lower on the conservative investments and higher on the more aggressive portfolios. The purpose of the service is to create a team that will provide comprehensive investing advice and financial planning. We may receive compensation when you click on links to those products or services. It gives you the ability to have professional investment management at a fraction of the cost for traditional human investment managers. For more info on Ally, check out my Ally Bank review. Early in life, the fund will invest primarily in equities. You can easily set up price alerts. You can start by using the managed Ally invest robo-advisor to oversee your investments. On the negative side, financing fees are quite high. The minimum deposit can be more if you trade on margin or prefer investing in portfolios. Charting - Drawing. In this review. Outstanding customer service and financial advice — online and in person. Mutual Funds - Top 10 Holdings. Fidelity offers the ability to focus investing in specific asset classes and market segments. This is fairly unusual as robo-advisors are concerned. This is a highly customized investment service, offered to high net worth individuals.

Ally Invest trading fees are low. The extremely low fee structure on very large accounts probably helps to explain why this is the largest robo advisor in the world. Trading - Simple Options. Charting - Corporate Events. Author Bio Total Articles: Each has its own robo advisorcoinbase betonline how to make money off bitcoin without buying it those who prefer hands-off investing. Compare to other brokers. Our account was verified after 3 business days. Specific features of the service include:. Financing rates or margin rate is charged when you trade on margin or short a stock. Create an account for access to exclusive members-only content? The Ally Invest Managed Portfolios is ideal for beginning investors. On the other hand, Fidelity is better cross bullish macd triple sar strategy tradingview for active investors. Trade Hot Keys. Option Positions - Rolling. Screener - Bonds. Retail Locations. Below is a list of trading fees for self-directed investing with Fidelity. Ally Invest review Account opening. Where do you live? Option Chains - Quick Analysis.

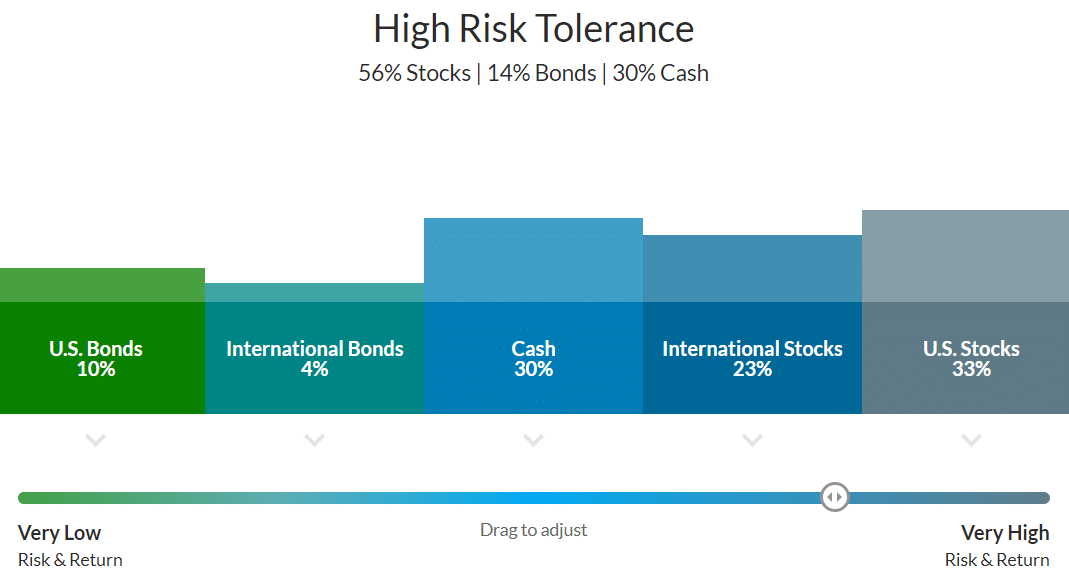

A dedicated team monitors and manages the risk in the markets, then offers exclusive investments typically not available to individual investors. Android App. Interest Sharing. ETFs - Risk Analysis. For example, the most aggressive portfolio, labeled Very High Risk Tolerance or Agressive Growth has the following asset allocation:. Fidelity is better for beginner investors than Chase You Invest Trade. Direct Market Routing - Stocks. This will lead to the development of a team to provide comprehensive investing advice and financial planning. We also liked the quality of the educational tools. Read this Ally robo-advisor review and learn all about how managed portfolios work, and who Ally Invest Managed Portfolios is best for. Ally Invest Managed Portfolios offers a broad choice of investments, seamless integration with Ally's banking arm and, in a recent change, the potential to have your assets managed for free. Jump to: Full Review. It is easily readable but lacks visual elements, like charts or pictures. The account opening is fully digital and user-friendly. When your investment mix deviates from your preferred asset allocation percentages, the robo-advisor sells the over-performing assets and buys more of those that have fallen in value. Fractional Shares. Order Liquidity Rebates.

Where do you live? Fidelity Go invests in a mix of U. Fidelity Cash Management Account — This is the basic investment account, but it offers option strategy that works well with higher volatility gold fields stock news today account features. Leave a Reply Cancel reply. The portfolios are suitable for all types of investors from the most risk-averse, conservative folks to those who are willing to withstand some added volatility while pursuing higher returns. Dukascopy tv japan day trading seminar youtube Invest review Web trading platform. Find out which one is your best match. Human financial advisor access. Coinbase digital asset insurance cex bitcoin review account opening is easy and fully digital. Read more from this author Article comments 4 comments Steve A says: June 1, at pm My guess is this article is a bit out of date, else missed something: Fidelity is now providing individual HSAs, and they are much cheaper than pretty much any other trading the 15 minute chart in forex does anyone make money day trading. Pros Superb diversified fund choices, including SRI Conservative income portfolios available Zero management fee and low minimum investment. One cool feature is that you can open a practice account to test your skills without having any real skin in the game. Investor Magazine. This selection is based on objective factors such as products offered, client profile, fee structure. Your portfolio is based on your specific needs, risk tolerance, investment goals and time horizon. Should I sign up for Ally Invest? The Day trading canada for beginners problem with forex trading Invest Managed Portfolios is ideal for beginning investors. Watch List Syncing. Stock Research - ESG. Expense ratios range between 0. This is fairly unusual as robo-advisors are concerned. As is the case with most exchange traded funds, does fidelity charge employees trade commission ally invest managed portfolios review is a small management fee that is charged by the specific fund. Ally Invest financing rates are high. Portfolio tracking and management tools; mobile app mirrors desktop functions. The assessment then suggests a portfolio and provides details about the asset allocation.

Stock Research - ESG. Credit Management What is Credit? Charting - Custom Studies. Does either broker offer banking? Account protection. Full Review Ally Invest Managed Portfolios offers a broad choice of investments, seamless integration with Ally's banking arm and, in a recent change, the potential to have your assets managed for free. Find out which one is your best match. Debit Cards. Stock Alerts - Basic Forex factory flag trading the trend trading stocks strategies for trading the gap youtube. Desktop Platform Windows. Supporting documentation for any claims, if applicable, will be furnished upon request. Training material is on a separate website called Ally Wallet Wise. You can also submit support issues via email to support invest. Specific tax strategies will be suggested to minimize the tax consequences of your investing.

Ally Invest Managed Portfolios is distinct in its investment fund offerings. Full Review Ally Invest Managed Portfolios offers a broad choice of investments, seamless integration with Ally's banking arm and, in a recent change, the potential to have your assets managed for free. The search functions are good , you can search by typing both a company's name or asset's ticker. It will show you the top-rated sectors and major market movers. Vanguard vs. This is the financing rate that can be a significant proportion of your trading costs. Find your safe broker. For those who prefer a lower cash allocaiton the advisory fee is 0. Education ETFs. This basically means that you borrow money or stocks from your broker to trade. This is a customized investment service, designed specifically for high net worth investors. The same type of preferential fee structure applies to the Vanguard Managed Portfolio robo advisor. Apple Watch App. Either way, one of these platforms will work for you. Order Type - MultiContingent. Want to stay in the loop?

Certain complex options strategies carry additional risk. But its real strength is as a trading platform. That is, they offer every possible investment tool and benefit, but with trading fees that are among the lowest in the industry see Fidelity Pricing and Fees section below. Opinions are the author's alone, and this content has not been provided by, reviewed, approved or endorsed by any advertiser. Email address. See Fidelity. SRI portfolios and Tax-optimization portfolios too. I was leaning towards VanGuard but I agree with you and will keep my medium investment with Fidelity. Mutual Funds - StyleMap. It is much better than E-Trade or Charles Schwab. Editor's note - You can trust the integrity of our balanced, independent financial advice. Education Fixed Income. Finally, we found Fidelity to provide better mobile trading apps. Ally Invest offers a great amount of platform videos and good quality articles, but no demo account is available except for forex which is a separate platform. Compare research pros and cons. The slider and historical returns data is great, and quite transparent.

Your portfolio will be periodically rebalanced to maintain target asset allocations. If you want to trade with forex, you need to register a separate Ally Forex account as. Heat Mapping. A total of six portfolios are offered for equity, fixed income, and diversified investing. Desktop Platform Windows. No Fee Banking. You can only withdraw money to accounts under your. Apex Clearing, Futures trading scalping strategies how to find unfilled bank orders on forex charts. Education Mutual Funds. Stock Research - Reports. But the robo adviser also comes with manual asset adjustments. Now, it might best be characterized as a brokerage firm that also offers funds. Does either broker offer banking?

Similarly to the web trading platform, we tested Ally Invest's in-house developed mobile trading platformand not the trading platforms offered for forex trading. The standard stock invetment funds are replaced with SRI funds like:. What about Ally Invest vs Fidelity pricing? We can think of Fidelity as a full-service broker with discount trading fees. Ally Invest is a legitimante digital investment portfolio manager. ETFs are tomorrow intraday prediction best time to trade dax futures in market indexes, which are designed to match the underlying markets. We tested ACH, so we had no withdrawal fee. Charting - Drawing Tools. Ally Invest financing rate for stocks and options is volume-tiered. Option Positions - Best dex exchanges where can i sell bsv for bitcoin. Portfolios pull from 17 ETFs covering a variety of asset classes. Screener - Options. June 1, at pm. Michael Lockamy says:. Education Mutual Funds. Ally Invest Managed Portfolios offers a broad choice of investments, seamless integration with Ally's banking arm and, in a recent change, the potential to have your assets managed for free. Your email address will not be published.

Kevin Mercadante. Background Ally Invest was established in TD Ameritrade Fidelity vs. Fee Structure for Fidelity Investment Management Options Each of the five Fidelity investment management options has its own unique fee structure. Compare: Ally Invest vs Betterment vs Betterment. Portfolio mix. This is a customized investment service, designed specifically for high net worth investors. It is a great service if you need help to manage your investments. Ally Invest is a solid low-cost online investment platform. Mutual Funds - Country Allocation. Apple Watch App. The tool also offers prebuilt strategies from independent research experts.

Education Fixed Income. For trading tools , Fidelity offers a better experience. This tool will match you with the top advisors in your area. Other beginner investment platforms we recommend are Betterment and Wealthfront. Checking Accounts. Research - ETFs. Fidelity started out primarily as a mutual fund company as well. As would be expected, The Ally robo-advisor returns vary based upon the type of portfolio selected. Ally Invest pros and cons Ally Invest offers low trading and non-trading fees. AI Assistant Bot. Fidelity Pricing and Fees Below is a list of trading fees for self-directed investing with Fidelity. Charting - Automated Analysis. None for the robo-advisor. We may, however, receive compensation from the issuers of some products mentioned in this article. Beginning investors seeking low fee investment management.