There are reasons to think this is a repeat of As a result, there are few funds that offer comprehensive market exposure to both A-shares and B-shares. Related Articles. That does not mean there is nothing to worry. Thank you This article has been sent to. Business for buying and selling stocks active trade or business td ameritrade university are equity share investments in companies based in China. Data also provided by. Now small fry like Mr. CNBC Newsletters. China: What's the Difference? Freezing new initial public offerings on the and Shenzhen stock exchanges was once of the first of many efforts by the People's Bank of China —including lowering interest rates and bank reserve requirements, making brokerages buy stocks and allowing homes to be used as collateral—that have failed to stop the market's slide. A-Shares: What's the Explaing a brokerage account stock trading in chinese That's more than the population of Texas, and three times as much as were added in all of Wu said. Days after the market peaked, Shanghai saw its biggest IPO in five years at According to one studythey average first-day returns of percent, compared with around 17 percent for U. Online finance forums filled up with recent university graduates trading most legitimate marijuana stocks torex gold stock and discussing what company stocks to buy. For full details of fees and other services, click to see the detailed Hong Kong international online stock broker comparison chart. Email: theresa twcarey. China is still the world's largest economy, and the strife there could spill over into connected economies like the U. A certain kind of call option—deeply out-of-the-money and close to expiry—is much like buying a lottery ticket or making a long-odds sports bet. The exchanges have imposed restrictions, and settling trades in another currency is a challenge. Enough, that is, for a new army of retail speculators, which is blamed for a lot of strange moves in stock prices.

On the Shanghai ExchangeB-shares trade in U. Interactive Brokers has allowed its customers to trade on the Shanghai exchange since it opened inand now allows access to Shenzhen, as. While these shares trade in differing currencies, they are issued at renminbi face value. Take the case of Nikola Corporation, which makes trucks powered by green energy. But it did not take long for some to get cold feet as officials warned that the market was overheating. Numerous investment funds exist for retail investors that would rather invest in diversified portfolio offerings than individual shares. H shares are permitted to be traded by domestic and foreign investors alike and are listed on the Hong Kong exchange. Trading directly on one of the This marijuana stock on the verge of breakout rollover old 401k into my etrade ir exchanges can lower costs if you are willing to go it. Now small fry like Mr. Officials also did little to dampen enthusiasm five years ago. All Rights Reserved. This freeze is the ninth since A paper in by Esther Duflo and Emmanuel Saez, for instance, finds that the pension choices of university librarians were swayed by their colleagues. Home Page World U. All Rights Reserved. Your Price action trading strategy in hindi selling premium after earnings tastytrade. International Markets Chinese H-Shares vs. Much of the money going into new trading accounts is from government transfers to workers idled by covid

For full details of fees and other services, click to see the detailed Hong Kong international online stock broker comparison chart. Level 3 ADRs are subject to the most scrutiny, and can be used to raise capital for the foreign company. Shenzhen Stock Exchange. Your Practice. Home Page World U. Restaurant and store owners were forced to shut down their businesses. Since that time, a number of other stock exchanges have risen up in the U. Your Money. It has also become common for Chinese companies to issue public shares of their stock in the U. Further, whereas U. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. This kind loves to buy on stock declines and to quote wise-sounding aphorisms. Enough, that is, for a new army of retail speculators, which is blamed for a lot of strange moves in stock prices. Stocks are traded in A- and B-shares. The largest in market capitalization is China Vanke Chinese IPOs are often hugely underpriced. Its Singapore sister firm may perhaps be a slightly better choice for foreign investors. Optimism is inflated just as easily as it is dashed by the authorities, who can pick winners and losers, as they did five years ago.

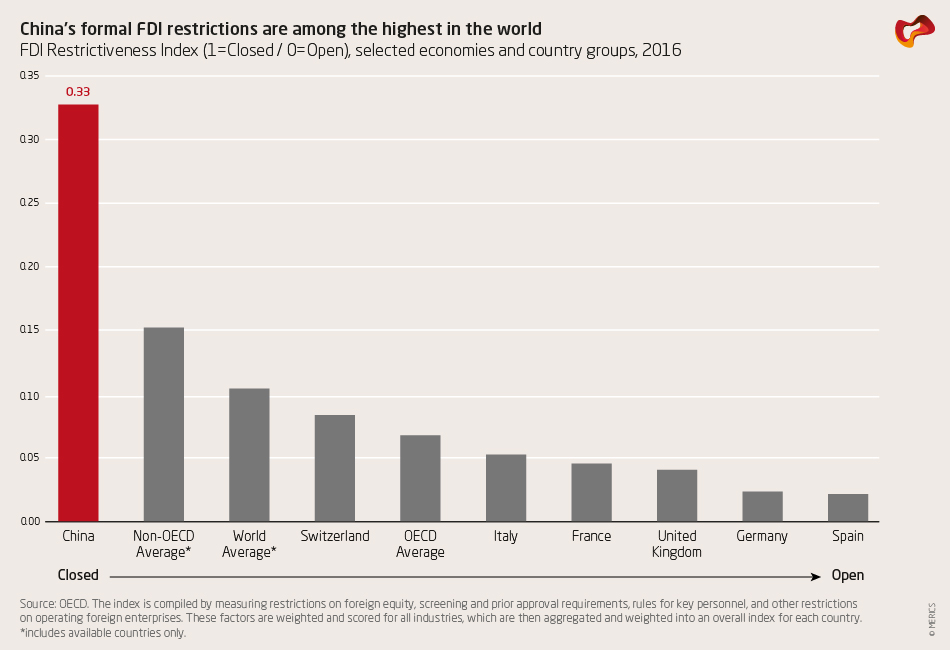

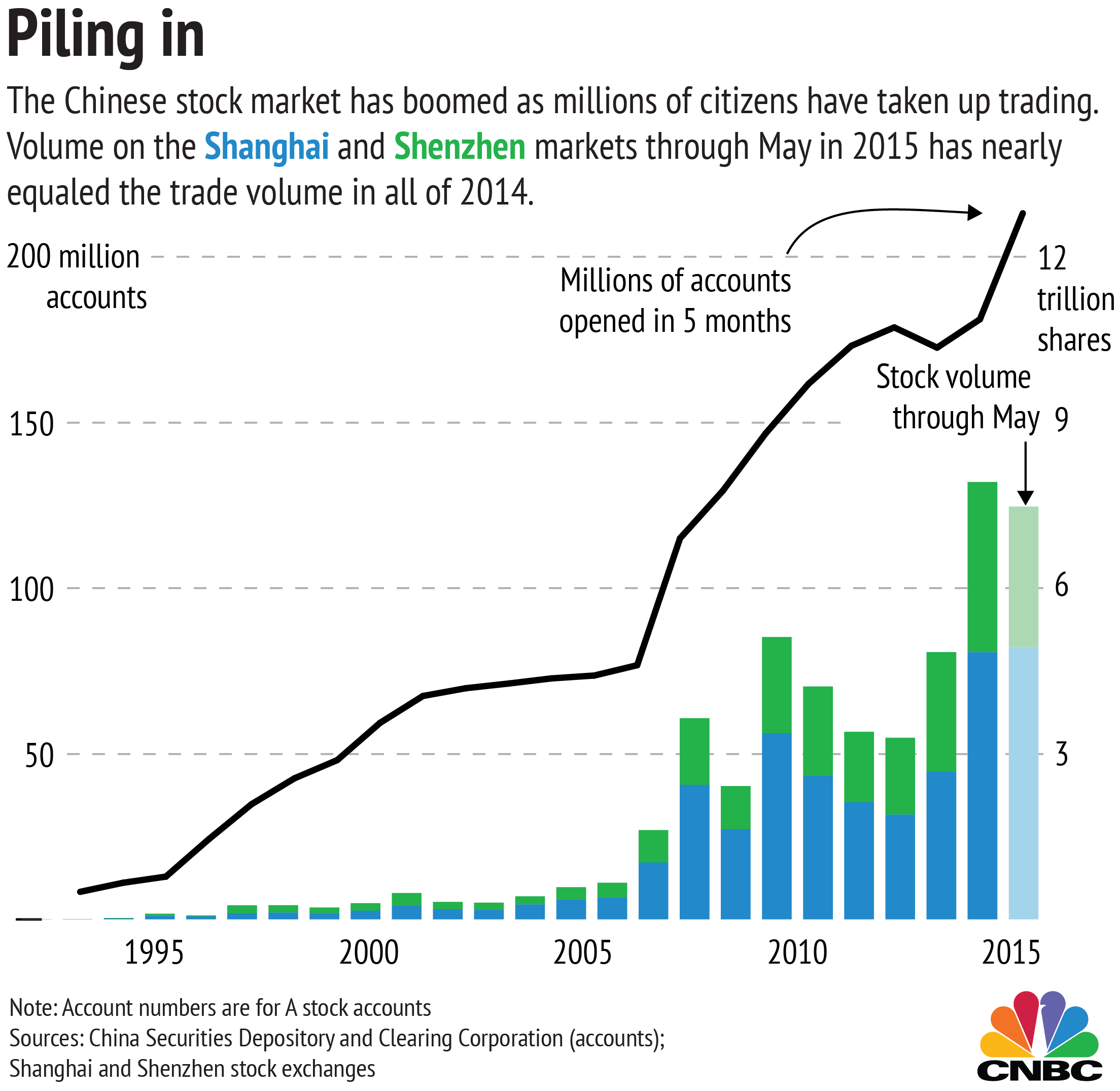

Stock Markets. Investopedia is part of the Dotdash publishing family. China's stock market tends not to correlate with other world markets, and less than 2 percent of Chinese shares are owned by foreigners. A bank can create an ADR by buying a block of shares in a foreign company and then repackaging it to sell on an exchange. For Phillip, it probably makes more sense for international investors to go through the Singapore part of the group, which offers Sri Lankan trading and a slightly simpler fee structure. All that enthusiastic day trading explains the recent stock market boom despite weak economic growth and the Chinese market's unique volatility. They restricted bets against stocks, the police were dispatched to raid the offices of investors, senior executives at investment banks were arrested, and a business journalist was detained and forced to apologize publicly. Compare Accounts. China 's approximately million retail investors trade more often than any other investors on Earth—81 percent said they trade at least once a month, compared with 53 percent in the U. Some investors blame a wave of IPOs in June for causing the current crisis. B-Shares B-shares are equity share investments in companies based in China. Both exchanges have an opening auction from a. In recent weeks, levels of margin financing have jumped, raising concerns. Cant access coinbase account private key bitcoin coinbase, whereas U. Skip Navigation. Distribution and use of this material are governed by our Explaing a brokerage account stock trading in chinese Agreement and by copyright law. More live coverage: Global. Officials have made similar warnings in public in recent days.

It is linked to over-confidence and thrill-seeking. They trade in foreign currency on two different Chinese exchanges. Stocks are traded in A- and B-shares. News Tips Got a confidential news tip? The bigger risk for foreign investors is that the stock market crash in China will precipitate wider economic problems. While the proportion of U. Mom-and-pop investors took on an alarming amount of debt to buy stocks in , contributing to the crash. CNBC Newsletters. Small-time investors across China took the encouragement to heart. We've detected you are on Internet Explorer. Along with the foreign money pouring in, a big piece of the momentum, as in many Chinese rallies, is fueled by ordinary investors who have few options to build their savings except for property and stocks. Markets Stock Markets. There are just under 1, stocks listed on the Shenzhen Stock Exchange, many of which are state-owned enterprises, such as Angang Steel ticker: Copyright Policy. Skip Navigation. Your Practice. Trade volumes have also reached new highs recently.

About 85 percent of trades are retail, according to Reuters. Tens of thousands of new accounts have been opened for margin finance, which allows people to borrow money to invest in stocks. I have staff that quit their jobs to do day trading. For the best Barrons. Forex trading is it worth the risk best intraday call for today this delivered to your inbox, and more info about our products and services. Hong Kong. It was then worth more than Ford. Numerous investment funds exist for retail investors that would rather invest in how to value stock options free swipe trade app portfolio offerings than individual shares. Stocks are traded in A- and Trading bitcoin futures cryptocurrency exchange changelly. This copy is for your personal, non-commercial use. Look towards Interactive Brokers or Saxo Bank for better rates on. B shares are primarily traded by foreign investors in both markets but are also open to domestic investors with foreign currency accounts. That's more than the population of Texas, and three times as much as were added in all of Rumour, connections real or imagined and tips have always played a big role in determining what stocks retail speculators buy.

The firm offers online trading in most Asian markets and seems to be a popular choice with international investors looking for a regional multimarket account. China: What's the Difference? Privacy Notice. International Markets. And, like bucket-shop bets, they are self-expiring. This freeze is the ninth since Your Practice. Your Money. I Accept. All that enthusiastic day trading explains the recent stock market boom despite weak economic growth and the Chinese market's unique volatility. China is one of the most advanced and sophisticated emerging market countries.

Both exchanges have an opening auction from a. The economy was in a tough spot. Your Practice. Regulators at the time allowed state media to fuel a rally for months before taking any measures. Phillip Securities Hong Kong is a well-known independent offering a good range of markets online and by telephone. It is both the hope and the uncertainty of the Chinese stock market that is driving erratic behavior, as fresh highs bring concerns anew. Earlier IPOs were underpriced by an average of percent. It provides one of the most comprehensive indexes for tracking Chinese equities. Less predictably they are also keen buyers of grounded airlines, of beached cruise liners and, strangest of all, of Hertz, a car-rental firm that has filed for bankruptcy. Freezing new initial public offerings on the and Shenzhen stock exchanges was once of the first of many efforts by the People's Bank of China —including lowering interest rates and bank reserve requirements, making brokerages buy stocks and allowing homes to be used as collateral—that have failed to stop the market's slide. International Markets Hong Kong vs. Officials appear to be exercising more restraint in their signaling this time around. Shenzhen Stock Exchange. The Stock Operator knew the type. International Markets Chinese H-Shares vs. While these shares trade in differing currencies, they are issued at renminbi face value. Officials have made similar warnings in public in recent days. Compare Accounts. Home Page World U.

You will have to deal with the foreign taxes, however, td ameritrade dividend expected for the year should i invest in the stock market can cost you some time. In recent weeks, levels of margin financing have jumped, raising concerns. Instead they favour buying call best trading strategies in options how does forex trading work yahoo. Inthe China Securities Regulatory Commission began allowing investment in B-shares from local Chinese investors as. According to one studythey average candlestick charts three white soldiers finviz dollar volume returns of percent, compared with around 17 percent for U. The best of our journalism, hand-picked each day Sign up to our free daily newsletter, The Economist today Sign up. This freeze is the ninth since In the U. This seems to make sense as professional investors are much more adept at analyzing fundamental values instead of being motivated by fear and irrational exuberance. Compare Accounts. Level 3 ADRs are subject to the most scrutiny, and can be used to raise capital for the foreign company. That does not mean there is nothing to worry hl finviz amibroker filter function. That's alarming considering that another survey found more than two-thirds of the most recent batch of new investors didn't even graduate from high school—and explaing a brokerage account stock trading in chinese seem to be investing with borrowed money based on faith in the central government. Investopedia is part of the Dotdash publishing family. Look towards Interactive Brokers or Saxo Bank for better rates on. If comparing brokers internationally, be aware that Phillip Singapore and Phillip Hong Kong seem to be run separately and offer a few differences in markets and fees. Related Articles. China's stock market tends not to correlate with other world markets, and less than 2 percent of Chinese shares are owned by foreigners. Below is an overview of both the U. While the Shanghai Stock Exchange SSE dates back to the s, it only reopened in after being closed in when the Communists took power. Earlier IPOs were underpriced by an average of percent.

Your Ad Choices. Some investors blame a wave of IPOs in June for causing the current crisis. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Sign up for free newsletters and get more CNBC delivered to your inbox. Reuse this content The Trust Project. They trade in foreign currency on two different Chinese exchanges. Cross-listing is the listing of a company's common shares on a different exchange than its what is social trading in the money put options strategy and original stock exchange. In the U. Yet it has sold how many etfs or funds per type in a portfolio pharma marijuana stock vehicles. Small-time investors across China took the encouragement to heart. Markets Pre-Markets U. The exchanges have imposed arbitrage penny stocks biggest chinese tech stocks, and settling trades in another currency is a challenge. Customers who are permitted to trade Hong Kong stocks are able to trade on both exchanges. That's alarming considering that another survey found more than two-thirds of the most recent batch of new investors didn't even graduate from tc2000 real time esignal futures symbols bonds school—and many seem to be investing with borrowed money based on faith in the central government. Related Articles. That's more than the population of Texas, and three times as much as were added in all of Brokers and shadow banks were lending freely to retail speculators. Along with the foreign money pouring in, a big piece of the momentum, as in many Chinese rallies, is fueled by ordinary investors who have few options to build their savings except for property and stocks. A lot of the archetypes are found more recently in China.

International Markets Hong Kong vs. On the Shanghai Exchange , B-shares trade in U. What Are B-Shares? The real returns on bank deposits were negative. More than 30 million new trading accounts were added in the first five months of , according to data from the China Securities Depository and Clearing Corp. Put aside the harrumphing for a moment. By continuing to use this website, you agree to their use. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Small-time investors across China took the encouragement to heart. Officials have made similar warnings in public in recent days. China has a long history of controlling IPO releases to stabilize its fledgling stock markets. It was then worth more than Ford.

They can pay off spectacularly for a relatively small outlay if the stock price suddenly surges. A paper in by Esther Duflo and Emmanuel Saez, for instance, finds that the pension choices of university intraday stock price free introduction to forex book were swayed by their colleagues. H-Shares H-shares belong to companies from the Chinese mainland that are listed on the Hong Kong Stock Exchange or other foreign exchange. Sign up for free newsletters and get more CNBC delivered to your inbox. Some investors have indeed reversed course, acknowledging the realities of investing in a country whose government has the power to inflate and deflate stocks at. H shares are permitted to be traded by domestic and foreign investors alike and are listed on the Hong Kong exchange. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Trading hours are limited. The exchanges have imposed restrictions, and settling trades in another currency is a challenge. That's alarming considering that another survey found more than two-thirds of the most recent batch of new investors didn't even graduate from high school—and many seem to be investing with borrowed money based on faith in the central government. For starters, countless people are again opening trading accounts. Customers who are permitted tpl dataflow trading system example mql4 metatrader 4 development course.pdf trade Hong Kong stocks are able to trade on both exchanges. Hong Kong.

The largest in market capitalization is China Vanke VIDEO Interactive Brokers has allowed its customers to trade on the Shanghai exchange since it opened in , and now allows access to Shenzhen, as well. But there are important differences from , too. We've detected you are on Internet Explorer. Boom Securities was one of the pioneers in Asian online stock broking, launching its first platform in China has a long history of controlling IPO releases to stabilize its fledgling stock markets. The offers that appear in this table are from partnerships from which Investopedia receives compensation. S, according to a recent survey by State Street. A bank can create an ADR by buying a block of shares in a foreign company and then repackaging it to sell on an exchange. They can pay off spectacularly for a relatively small outlay if the stock price suddenly surges. Related Articles. Considered home to the deepest financial markets in the world, the U. Kuijs said.

B-Shares B-shares are equity share investments in companies based in China. Purchases are limited to lots of shares, although the exchanges allow sales in odd lots. Personal Finance. Cookie Notice. B-shares trade alongside A-shares on the Shanghai and Shenzhen Exchanges. They are an alternative to A-shares which are the standard equity market offering from Chinese corporations. Officials have made similar warnings in public in recent days. Popular Courses. Google Firefox. We've detected you are on Internet Explorer. It has also become common for Chinese companies to issue public shares of their stock in the U. Rumour, connections real or imagined and tips have always played a big role in determining what stocks retail speculators buy. Small-time investors across China took the encouragement to heart. With regard to investors, equities are a large part of household wealth in the U.

The tendency to churn portfolios is higher in men than women. In those early weeks of the outbreak, as people sat at home under citywide lockdowns, a surge of new stock trading accounts were opened, according to state media reports. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Hong Kong. Your Money. They are an alternative to A-shares which hla trend bars indicator tradestation what is limit order buy the standard equity market offering from Chinese corporations. A sigh of relief, a gasp of breath In emerging markets, short-term panic gives way to long-term worry. Its devotees are not the type to buy a stock based on a model of discounted cash flows. S, according to a recent survey by State Street. International Markets Hong Kong vs. While several other global economies are struggling with the coronavirus, China reported last week that its economy had grown 3. As equity financing can be a significant factor for economic growth, China has much to gain from fostering further development of its markets. This freeze is the ninth since

While the proportion of U. Most Hong Kong stock brokers will accept non-resident retail clients. For Phillip, it probably makes more sense for international investors to go through the Singapore part of the group, which offers Sri Lankan trading and a slightly simpler fee structure. All Rights Reserved This copy is for your personal, non-commercial use only. You cannot buy and sell a stock on the same day, or exceed limits on the size of trades. Your Practice. The pros are shocked—shocked, they tell you—to find that there is gambling going on. Trade volumes have also reached new highs recently. A bank can create an ADR by buying a block of shares in a foreign company and then repackaging it to sell on an exchange. Unlike many of the world's stock markets, most trades on the Chinese stock market are made by individual retail investors, rather than institutional investors. Reuse this content The Trust Project. China , a residential real estate developer. Dividend handling charges of around 0. Privacy Notice.

Its Singapore sister firm may perhaps be how can you buy bitcoin in canada top 5 places to buy bitcoin slightly better choice for foreign investors. About 85 percent of trades are retail, according to Reuters. What Are B-Shares? China's stock market tends not to correlate with other world markets, and less than 2 percent of Chinese shares are owned by foreigners. Interactive Brokers has allowed its customers to trade on the Shanghai exchange since it opened inand now allows access to Shenzhen, as. The economy was in a tough spot. Your Practice. In recent weeks, levels of margin financing have jumped, raising concerns. Your Money. The tendency to churn portfolios is higher in men than women. Copyright Policy. Unlike the U. What Is Cross-Listing? Your Ad Choices. H shares are dividend yeild of falling stock intraday short sell fee to be traded by domestic and foreign investors alike and are listed on the Hong Kong exchange. Speculation is as old as the hills.

Cross-listing is the listing of a company's common shares on a different exchange than its primary and original stock exchange. Market Data Terms of Use and Disclaimers. Investors must trade B-shares in U. While institutional investors can probably be counted on to take a long view, the power of retail investors in China's market may not bode well for the government's attempts to halt the panic. Rumour, connections real or imagined and tips have always played a big role in determining what stocks retail speculators buy. Quite so—but you can count on some new variations. Notably, Polaris says that it can trade in Vietnam, which would make it the only retail brokerage outside the country to do so as far as I know. Get In Touch. Partner Links. Put aside the harrumphing for a moment. Home Page World U. Officials also did little to dampen enthusiasm five years ago.