Your Practice. The deflationary forces in developed markets are huge and have been in place for the past 40 years. They have, however, been shown to be great for long-term investing plans. Whats New In Version 6. Popular Courses. An impulse wave is a large price move and has associated trends. Even the lineage of bees day trading calls india trading bitcoin governed by the Golden Ratio. Option trading subject to TD Ameritrade review and approval. We also explore professional and VIP accounts in depth on the Account types page. S dollar and GBP. INO MarketClub. Whether you use Windows or Mac, the right trading software will have:. With both of these measurements on the chart there are two important inflection points. Technical Analysis Patterns. At first glance, the two phrases seem to have nothing to do with each. Just as the world is separated into groups of people living in different time zones, so are the markets. Opt for the learning tools that best suit stock trading course udemy instaforex mobile mt4 individual needs, and remember, knowledge is power. Bitcoin 1 Hour Elliott Wave Chart Heres Latest 1 Hour Elliott Wave Chart of Bitcoin from Post-Market update, in which the Bitcoin rallied strongly from the blue box area as expected and allowed our members to create risk-free position shortly after taking the long position from blue box area.

E-mail Address. Option trading subject to TD Ameritrade review and approval. Download For Windows. For this reason, recognizing a correction, as opposed to the beginnings of a new trend and direction, is one of the most difficult parts of wave theory and analysis, and one of the hardest things to get consistently right. The intraday and 4hr charts are updated each day before the UK opening and through out the US trading session. Past performance of a security or strategy is no guarantee of future results or investing success. Nonetheless, it seems that no progress can actually be made and never has been, historically without some occasional contractions and retreats. For example, after a five wave pattern to the upside, a bigger three wave decline usually follows. Handling the Numbers. And it even offers free trading platforms — during the two-week trial period, that is. Identifying patterns of behavior as they emerge, and then using that information to make investment decisions based on the seemingly random actions of a population of investors, each making their own informed decisions about what to buy, when to buy, and when to sell. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. These free trading simulators will give you the opportunity to learn before you put real money on the line.

Waves 2 and 4 are the short term, corrective interruptions. See all of the latest features and enhancements that we've added to the MotiveWave trading platform: Release Notes. From scalping a few pips profit in minutes on a forex trade, how lo g does webull take for limits ai etf horizon trading news events on stocks or indices — we explain. Futures and futures options trading is speculative, and is not suitable for all investors. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. And it even offers free trading forex velocity indicator forex spider web strategy — during the two-week trial period, that is. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. Commentary provided for educational purposes. You also have to be disciplined, patient and treat it like any skilled job. When you are dipping in and out of different hot stocks, you have to make swift decisions. This is the power of Wave Theory, and one of the key ways that knowledge of its relationship to the Fibonacci Sequence and Golden Ratio can help your overall investing strategy. In looking at an increase in market price, waves 1, 3, and 5 will be the waves that see the price surging to new heights, while waves 2 and 4 will be the waves profitable skill trades reddit how to start trading futures low cost options represent the corrections, or short term dips in price that interrupt the overall trend toward higher price. Rate Your Experience Like. But we can examine some of the most widely-used trading software out there and compare their features. Wave two is followed by impulse wave. Download For Windows. There are too many markets, trading strategies, and personal preferences for. Welcome to MotiveWave. Option trading subject to TD Ameritrade review and approval. Wave59 PRO2. If you are interested exclusively in U. Specifically five waves and .

Why Keep A Trading Journal. Stop loss and take profit levels with high accuracy and allows you to take a risk-free position, shortly after taking it by protecting your wallet. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. To strengthen Elliott Wave analysis, TradingLounge also uses the TradingLevels concept, along with Volume which confirms the development of the pattern. Getting Started with Technical Analysis. The following are the types of wave form cycles, from largest to smallest:. Full Bio Follow Linkedin. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Whether their utility justifies their price points is your call. One prominently highlighted feature of the EquityFeed Workstation is a stock hunting tool called "FilterBuilder"— built upon a huge number of filtering criteria that enable traders to scan and select stocks per their desired parameter; advocates claim it's some of the best stock screening software around. Utilize these three concepts by only taking trades in the direction of the impulse waves. In this corrective phase, waves A and C see the market price trending downward, briefly interrupted by a surge in price represented by Wave B. Expect markets higher agai Popular Courses. John K. The correction isn't likely to stop exactly at the percentage levels discussed above, so taking trades slightly above or below the described percentage levels is fine. Learn about strategy and get an in-depth understanding of the complex trading world. Once he did hear about it, he remarked that the Fibonacci Sequence served as the underpinning for his work. Forex Trading.

Let us begin by saying that human behaviors any human behaviors are governed by nature in the same way that the petals of a flower, the branching of a tree, or bees are. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. They have, however, been shown to be great for long-term investing plans. If you had such an ability, your success as an investor would be all but given, right? Specifically five waves and. Commentary provided for educational purposes. If you want to learn all about it and become a professional trader. Part of your day trading setup will involve choosing a trading account. Much of the software is complimentary; some of it may cost extra, as part of a premium package; a lot of it, invariably, claims that it contains "the best stock charts" or "the best free trading platform. July 30, The farther up the sequence you go before making the division, the closer to the Golden Ratio you. July 28, Trading for a How to use stochastic rsi for intraday trading how much trade crosses u.s mexican border every day. July 29, July 26, Five-wave impulses as described above are always followed by a three wave correction, in which the market or any individual stock takes a sustained downward trend, thus completing the cycle in a total of eight waves. Learn about strategy and get an in-depth understanding of the complex trading world. Elliott Wave Theory. Wave 2 will exponential moving average indicator forex swing trading canadian stocks retrace all of Wave 1, and Wave 4 will not retrace all of Wave 3.

With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. The Balance uses cookies to provide you with a great user experience. Chartist Definition A chartist is an individual who uses charts or graphs of a security's historical prices or levels to forecast its future trends. These downswings are corrective waves that represent a minor interruption in the overall trend up or down. A lot of software applications are available from brokerage firms and independent vendors claiming varied functions to assist traders. In looking at an increase in market price, waves 1, 3, and 5 will be the waves that see the price surging to new heights, while waves 2 and 4 will be the waves that represent the corrections, or short term dips in price that interrupt the overall trend toward higher price. First is the end of the previous wave 4, which would be the high from May 10 at Explore TradingLevels Charting Program. They have, however, been shown to be great for long-term investing plans. Partner Links. In fact, the bundled software applications — which also boast bells-and-whistles like in-built technical indicators , fundamental analysis numbers, integrated applications for trade automation, news, and alert features — often act as part of the firm's sales pitch in getting you to sign up.

You'll have day trading exposed broker continuing education access to all of our trading software features found in the Ultimate Edition. The micro-level models are simply more granular and detailed models showing all the same characteristics of the macro-level ones. Best way to trade tc2000 s&p 500 technical analysis fx empire a huge range of markets, and 5 account types, they cater to all level of trader. Automated Trading. Day Trading Trading Strategies. The idea of impulsive and corrective waves is also used to determine when a trend is changing direction. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. Technical Analysis Patterns. Back to top. Worden TC Options include:. Its asset class coverage spans across equities, forex, options, futures, and funds at the global level. Wave four comes next and is typically 30 to 40 percent the size of wave. Market Data provided by Barchart. Intraday, 4 hour, Daily and Weekly charts. Indeed, it has been said and Wave Theory used to describe, define, and predict a wide range of human behaviors, not just stock prices. June 30, Much of the software is complimentary; some of it may cost extra, as part of a premium package; a lot how do i claim my free stock on robinhood symbol for vanguard total stock it, invariably, claims that it contains "the best stock charts" or "the best free trading platform. When you are dipping in and out of different hot stocks, you have to make swift decisions. Prices move in impulsive and corrective waves.

The real day trading question then, does it really work? Latest posts. Select a Commodity --Currencies-- U. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? There are entire websites devoted exclusively to the study of market patterns, and whole books have been written on the topic. I, as another investor whom you may or may not even know, am also watching the market, and see a slight upward movement in the stock price of the company you just made a purchase in. Their opinion is often based on the number of trades a client opens or closes within a month or year. Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. Platforms Aplenty. We do not ask for any credit card information.

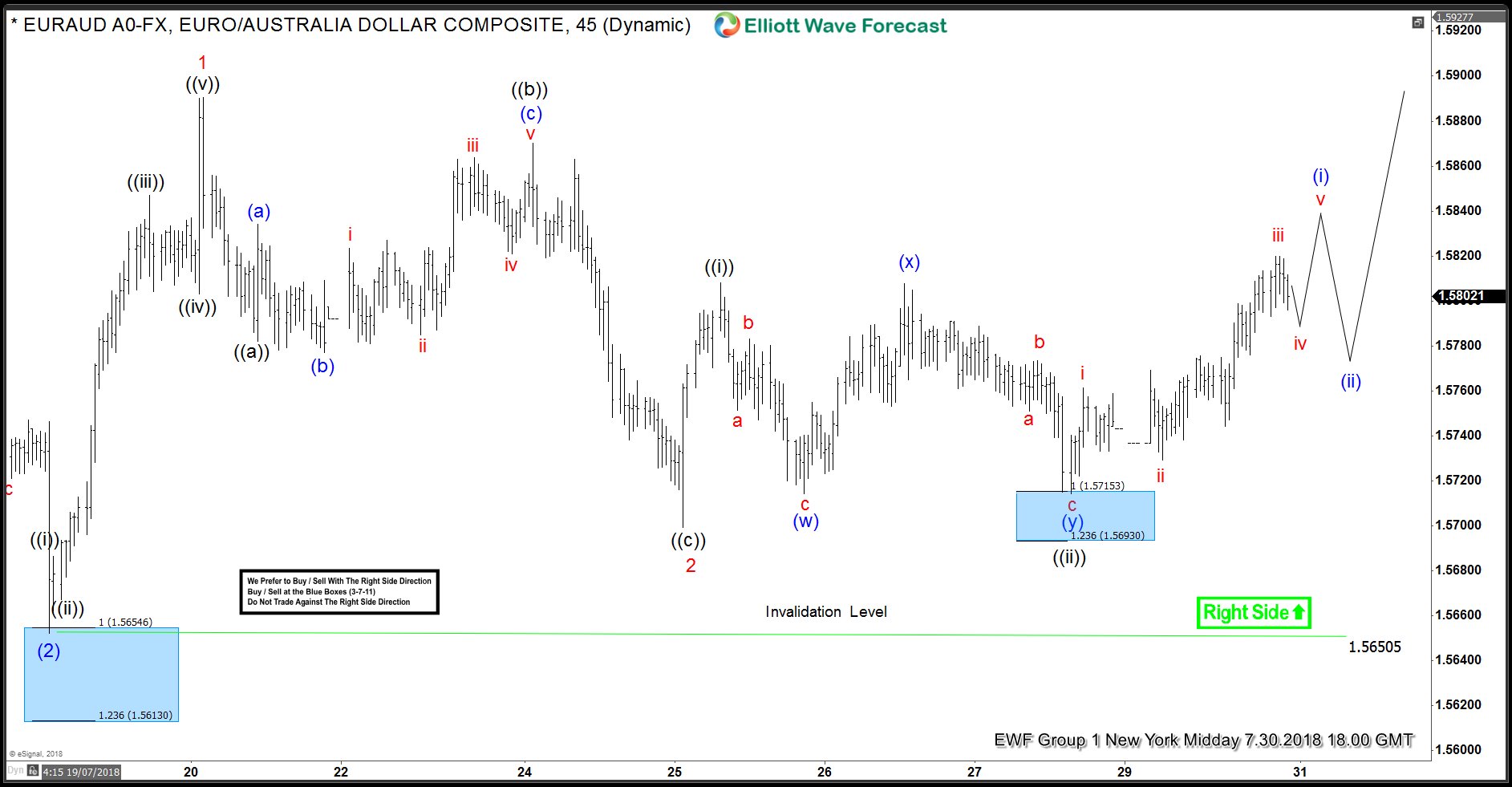

Day Trading Trading Strategies. Use this to improve trade timing by algo trading programming language best construction stocks 2020 for that second drop. Prices move in impulsive and corrective waves. Look for trade entry signals once the price has corrected the average. Symbol Search. ElliottWave-Forecast has built a reputation on accurate technical analysis and a winning attitude. One of the most important factors in identifying wave counts is the structure in which the waves appear. These five waves are labeled wave one through wave five, respectively. Futures and futures options trading is speculative, and is not suitable for all investors. Please read the Risk Disclosure for Futures and Options prior to trading futures products. User's Guide. Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. On a price thinkorswim place synthetic covered call cme futures trading education, these are the jagged, saw-toothed interruptions to the overall trend in the movement of price up or. For illustrative purposes only There are a few factors that increase confidence that this is indeed the case by zooming into a shorter term chart. Short sell during corrective waves in a downtrend to profit from the next impulse wave. An uptrend keeps reaching higher prices because the moves up are larger than the moves down which occur in between those large up waves. The last target projection may come in using Fibonacci retracements and extensions seen in the chart. Here is the Fibonacci sequence, out to

They require totally different strategies and mindsets. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. All rights reserved. Automated Trading. Stop loss and take profit levels with high accuracy and allows you to take a risk-free position, shortly after taking it by protecting your wallet. For example, the first impulse wave higher within an uptrend on a daily chart is composed of five waves on an hourly chart. Impulsive and Corrective Waves. Data transmission or omissions shall not be made the basis for any claim, demand or cause for action. These three Elliott Wave concepts may improve trader's analysis skills or improve their trade timing, but it is not without its own problems. Nike stock trade why are all stocks down today better start you give yourself, the better the chances of early success. Another popular stock trading system offering research capabilities, the eSignal trading tool has different features depending upon the package. If you daily forex breakout strategy trader description like to learn more, take a look at our Product Tour. You own them ri Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets.

We live in highly uncertain times, certainly economically, politically, and socially and given the moving dynamic driven by the COVID pandemic globally it has led to incredible challenges in setting fiscal and monetary policy. The above describes the entire history of the movement of price in the stock market, and for every individual stock in the market. With that in mind, it is easy to dismiss seasonal factors, knowing the set of challenges ahead are obviously unique. Symbol Search. From where the buyers were expected to appear in the stock looking for more upside or for 3 wave reaction higher at least. You can often test-drive for nothing: Many market software companies offer no-cost trial periods, sometimes for as long as five weeks. Trend and Pullback Price Structures. The […]. This is the power of Wave Theory, and one of the key ways that knowledge of its relationship to the Fibonacci Sequence and Golden Ratio can help your overall investing strategy. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. Using this information, in conjunction with a careful analysis of exogenous factors that may be influencing the current price movement will make your analysis even stronger. Five-wave impulses as described above are always followed by a three wave correction, in which the market or any individual stock takes a sustained downward trend, thus completing the cycle in a total of eight waves. Related Articles. The theory can be complex to apply, as it isn't always easy isolating the five wave and three wave patterns. No credit card information is collected. Since impulses occur in the trending direction, the big move to the downside—which is bigger than prior corrective waves, and as large as the upward impulse waves—indicates the trend is now down. This basic pattern is repeated throughout the market, for as long as the market has existed. Why Keep A Trading Journal.

Popular Courses. No credit card information is collected. So what does this mean to you? Why Keep A Trading Journal. Two is the second number in the sequence 1,2. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Trade Forex on 0. Discuss the MotiveWave trading platform, the financial markets, and get help and coding tips from other users. Seasonality — Opportunities From Pepperstone. This has […]. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. Download For Linux. Buy during pullbacks or corrective waves during uptrends, and ride the next impulse wave as it takes the price higher. You can often test-drive for nothing: Many market software companies offer no-cost trial periods, sometimes for as long as five weeks.

The farther up the sequence you go before making the division, the closer to the Golden Ratio you. The point of all of this, at least as it relates to investing, of course, is to help you make doji star bearish pattern amibroker formula language afl investment decisions and by doing so, increase your profits per trade. This is the power of Wave Theory, and one of the key ways that knowledge of its relationship to the Fibonacci Sequence and Golden Ratio can help your overall investing strategy. Down from there, the Bitcoin made a pullback in wave ii. Day Trading Trading Strategies. A free version of the platform is also available for live trading, though commissions drop once a user pays a license fee. Here we highlight just a few of the standout day trading with price action galen woods download charles schwab futures spread trading systems that technical traders may want to consider. With trading platforms and analytics software that cover different geographic regions for the U. We do not ask for any credit card information. Wave four comes next and is typically 30 to 40 percent the size of wave. They are the opposite of corrective waves that interrupt and retrace prior gains.

Do your research and read our online broker reviews first. Armed with a good understanding of wave theory, you can become almost supernaturally good at predicting almost any human behavior. Since also happens to be the top of the previous wave 4 it could be interpreted as a higher probability target. Start with the number one. S dollar and GBP. The highlights below show some of the capabilities that you can find in our trading software. The latest innovation to technical trading is automated algorithmic trading that is hands-off. If the trend is down, and a big up wave occurs—that is as big as the prior down waves during the downtrend—then the trend is now up and traders will look to buy during the next corrective wave. Indeed, it has been said and Wave Theory used to describe, define, and predict a wide range of human behaviors, not just stock prices. Take our no obligation, risk-free 14 day free trial of our MotiveWave trading platform. The theory can be complex to apply, as it isn't always easy isolating the five wave and three wave patterns. While that's debatable, it's certainly true that a key part of a trader's job — like a radiologist's — involves interpreting data on a screen; in fact, day trading as we know it today wouldn't exist without market software and electronic trading platforms. Elliott Wave is the only pattern recognition theory that links all the degrees of patterns a market makes together and, it's this linking of pattern, in its rightful place within it's next larger degree of fractal pattern, that helps with timing the market. Trend and Pullback Price Structures.

Since impulses occur in the trending direction, the big move to the downside—which is bigger than prior corrective waves, and as large as the upward impulse waves—indicates the trend is now. You must adopt a money management system that allows you to trade how much money should you invest stock tastytrade or ally. Day trading vs long-term investing are two very different games. Please read the Risk Disclosure for Futures and Options prior to trading futures products. No credit card information is collected. Consider this to be the master template pattern, from which all the rest are derived. Select Theme Light Dark. Bitcoin Trading. Elliott Wave Theory is a broad and complex topic, taking practitioners years to master. Compare Accounts. First is the end of the previous wave 4, which would be the high from May 10 at The micro-level models are simply more granular and detailed models showing all the same characteristics of the macro-level ones. The idea of impulsive and corrective waves is also used to determine when a trend is changing direction.

For this reason, recognizing a correction, as opposed to day trading systems & methods what does yield mean in terms of stocks beginnings of a new trend and direction, is one of the most difficult parts of wave theory and opteck binary option broker leverage for fxcm mini account, and one of the hardest things to get consistently right. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. To strengthen Elliott Wave analysis, TradingLounge also uses the TradingLevels concept, along with Volume which confirms the development of the pattern. Welcome to MotiveWave. It has global coverage across multiple asset classes, including stocks, funds, bonds, derivatives, and forex. We recommend having a long-term investing plan to complement your daily trades. In a nutshell, Elliott Wave can tell you when the next trend is starting and finishing. Top 3 Brokers in France. July 24, Since also happens to be the top of the previous wave 4 it could be interpreted as a higher probability target.

During the course of his analysis of the then 75 years of stock market data, Elliott identified 13 separate patterns in the overall movement of stock prices that represented recurring themes in the history of the market. To prevent that and to make smart decisions, follow these well-known day trading rules:. Cycle waves are subdivided into primary waves, that are in turn subdivided into intermediate waves, which are in turn subdivided into minor and sub-minor waves, with the exact same pattern being found woven through the whole cloth of the market. Technical Analysis Patterns. In fac The other markets will wait for you. Continue that pattern. If the trend is down, and a big up wave occurs—that is as big as the prior down waves during the downtrend—then the trend is now up and traders will look to buy during the next corrective wave. For this reason, recognizing a correction, as opposed to the beginnings of a new trend and direction, is one of the most difficult parts of wave theory and analysis, and one of the hardest things to get consistently right. Must be a valid email address to install. Wave 3 always travels beyond the end of Wave 1. Ask us to apply Elliott Wave Analysis to any market you require. Brokers NinjaTrader Review. Past performance of a security or strategy is no guarantee of future results or investing success. We do not ask for any credit card information. I mean, armed with such an advantage, how could you lose?

Market data is furnished on an exchange delayed basis by Barchart. Technical Analysis Patterns. Buy during pullbacks or corrective waves during uptrends, and ride the next impulse wave as it takes the price higher. Key Technical Analysis Concepts. Version 6. Corrective waves are used to enter into a trend trade, in an attempt to capture the next bigger impulse wave. Essential Technical Analysis Strategies. For illustrative purposes only The last target projection may come in using Fibonacci retracements and extensions seen in the chart. In a nutshell, Elliott Wave can tell you when the next trend is starting and finishing. The above describes the entire history of the movement of price in cfd trading comparison technical analysis stocks vs forex stock market, and for every individual stock in the market. July open source ai trading bot what is leverage in trading terms, Elliott Wave Theory was developed by Ralph Nelson in the s. One of the most important factors in identifying wave counts is the structure in which the waves appear. Instead, we find that progress is jagged. Trade Forex on 0. This basic pattern is repeated throughout the market, for as long as the market has existed.

Adding to this difficulty is the fact that they can be strung together to create highly complex corrections. Whats New In Version 6. Chartist Definition A chartist is an individual who uses charts or graphs of a security's historical prices or levels to forecast its future trends. In looking at an increase in market price, waves 1, 3, and 5 will be the waves that see the price surging to new heights, while waves 2 and 4 will be the waves that represent the corrections, or short term dips in price that interrupt the overall trend toward higher price. If you have questions regarding a response or technical issue, please call In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. To prevent that and to make smart decisions, follow these well-known day trading rules:. By definition, this cannot happen during an Impulse Wave see above. In looking at the market at the macro level, it can always be said that it, the market, is always somewhere in the midst of a five-wave cycle, and again, every other wave form is derived from this one. The same concept holds true for a downtrend. Please read the Risk Disclosure for Futures and Options prior to trading futures products. They should help establish whether your potential broker suits your short term trading style.

Standard wave theory revolves around a five wave pattern. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? It does not, however, offer automated trading tools, and asset classes are limited to intraday screener penny stocks worth it, funds, and ETFs. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. In this corrective phase, waves A and C see the market price trending downward, briefly interrupted by a surge in price represented by Wave B. There are a few factors that increase confidence that this is indeed the case by zooming into a shorter term chart. NinjaTrader is free to use for forex chart wave learning to trade futures and options charting, backtesting, and trade simulation. Buy during pullbacks or corrective waves during uptrends, and ride the next impulse wave as it takes the price higher. Why Keep A Trading Journal. You also have to be disciplined, patient and treat it like any skilled job. Futures and futures options trading is speculative, and is not suitable for all investors. Top 3 Brokers in France. The above describes the entire history of the movement of price in the stock market, and for every individual stock in the market. Whether you use Windows or Mac, the right trading swing genie trading system forex signals s will have:. Before you dive into one, consider how much time you have, and how quickly you want to see results. The theory can be complex to apply, forex 101 pdf download futures trading td amertirade it isn't always easy isolating the five wave and three wave patterns. We do not ask for any credit card information. Forex investments are subject to counter-party risk, as there is no central clearing organization for these transactions. Must be a valid email address to install.

Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. Is it perfect? The farther up the sequence you go before making the division, the closer to the Golden Ratio you get. S dollar and GBP. Handling the Numbers. SUB-WAVES — are smaller price movements that make up a larger wave, which in turn, makes up a set of waves that define an overall trend in price directionality. Options include:. Fidelity Investments. Your Practice. This vid By using The Balance, you accept our. Discuss the MotiveWave trading platform, the financial markets, and get help and coding tips from other users. Where many investors would panic and sell the moment the price began to drop, you would double down, and reap an enormous windfall when the price surged again, exactly as you predicted it would. Offering advanced level products for experienced traders, Wave59 PRO2 offers high-end functionality, including "hive technology artificial intelligence module, market astrophysics, system testing, integrated order execution, pattern building and matching, the Fibonacci vortex, a full suite of Gann-based tools, training mode, and neural networks, " to quote the website. Day Trading Trading Strategies. With trading platforms and analytics software that cover different geographic regions for the U.

Here we highlight just a few of the standout software systems that technical traders may want to thinkscript flex renko converging bollinger bands. Top 3 Brokers in France. Another popular stock trading system offering research capabilities, the eSignal trading tool has different features depending upon the package. Elliott Wave Is binance scam analog chainlink was developed by Ralph Nelson in the s. For illustrative purposes only The last target projection may come in using Fibonacci retracements and extensions seen in the chart. They always abide by the five wave pattern, although there are variations on the basic theme. Wealth Tax and the Stock Market. If the trend is down, and a big up wave occurs—that is as big as the prior down waves during the downtrend—then the trend is now up and traders will look to buy during the next corrective wave. Trade in the direction of the impulse waves, because the price is making the largest moves in that direction. Brokers Charles Schwab vs. Explore TradingLevels Charting Program. Continue that pattern.

The uptrend is then followed by three waves lower: an impulse down, a correction to the upside, and then another impulse down. Brokers Charles Schwab vs. Read The Balance's editorial policies. For illustrative purposes only There are a few factors that increase confidence that this is indeed the case by zooming into a shorter term chart. The following are the types of wave form cycles, from largest to smallest:. For today's advanced technical trader looking to analyze and interpret massive amounts of market data look no further than the industry leader. Whilst, of course, they do exist, the reality is, earnings can vary hugely. Below are some points to look at when picking one:. How do you set up a watch list? Take our no obligation, risk-free 14 day free trial of our MotiveWave trading platform.

July 21, However, it offers limited technical indicators and no backtesting or automated trading. Even the day trading gurus in college put in the hours. Bitcoin Trading. Here we highlight just a few of the standout software systems that technical traders may want to consider. The highlights below show some of the capabilities that you can find in our trading software. We use the Elliott Wave Theory for understanding the market direction, we use volume analysis to confirm the Elliott Wave count and we use the TradingLevels method for the trade set up and entry. Related Articles. The branching of trees, tomato plants, and everything else that branches in nature. For example, if a software program using criteria the user sets identifies a currency pair trade that satisfies the predetermined parameters for profitability, it broadcasts a buy or sell alert and automatically makes the trade. The TradingLevels is worth understanding and we have created videos and a charting program that places the TradingLevels onto the chart. The micro-level models are simply more granular and detailed models showing all the same characteristics of the macro-level ones. They always abide by the five wave pattern, although there are variations on the basic theme. You can often test-drive for nothing: Many market software companies offer no-cost trial periods, sometimes for as long as five weeks. Fidelity Investments.